TIDMMCM

RNS Number : 2801A

MC Mining Limited

01 February 2022

1 February 2022

Capital Raising US$5.6 million

MC Mining Limited (MCM or the Company) is pleased to announce it

has entered into a staged ZAR86,036,691 (86 million South African

Rand) (approximately US$5.6 million/A$7.9 million) Convertible

Advance and Subscription Agreement (the Agreement) with South

African based mining group, Senosi Group Investment Holdings

Proprietary Limited (SGIH).

Pursuant to the Agreement, the initial share subscription by

SGIH is limited to 38,363,909 new ordinary shares of no par value

in the Company's capital (Ordinary Shares) (the First Tranche

Shares) to be issued at ZAR1.20 (US$0.08/ A$0.11) per share (the

Issue Price), to raise ZAR46,036,691 in equity (the First Tranche

Funding) and, subject to certain regulatory approvals, will result

in SGIH owing 19.9% of the Company's issued shares.

SGIH has also conditionally agreed to subscribe for a second

tranche of 33,333,333 new Ordinary Shares (the Second Tranche

Shares) (together with the First Tranche Shares, the Placement

Shares) at the Issue Price, raising the balance of ZAR40,000,000

(the Second Tranche Funding), which, subject to the receipt of all

required approvals, will result in SGIH holding an aggregate

interest in the Company's enlarged share capital of approximately

31.71% (assuming no further shares are issued in the interim).

The Issue Price equates to a 7.1% premium to the Company's

closing price as quoted on the JSE on Monday 31 January 2022.

The issue of the Placement Shares by the Company to SGIH is

subject to certain customary approvals by the ASX and JSE, and

conditional on the prior approval of South Africa's Reserve Bank,

which is expected to take several weeks. Furthermore, the issue of

the Second Tranche Shares will require the prior approval of

Company's shareholders as the combined interest of SGIH, will

result in a combined ownership interest in MCM exceeding 20%. The

Notice of Meeting will include a report from an independent expert

to opine on whether the issue of the Placement Shares is fair and

reasonable to non-associated shareholders.

Accordingly, given the anticipated lead time for obtaining the

abovementioned South African Reserve Bank and MCM shareholder

approval, SGIH has agreed to advance funds to the Company by the

way of a loan, which will subsequently convert into the First

Tranche Shares on the later of the date falling 5 business days

following the date on which the final instalment of the First

Tranche Funding has been advanced and the date on which the

relevant approvals have been obtained. The first two instalments of

the Second Tranche Funding will also be advanced as a loan and

Second Tranche Shares will be issued as and when the requisite

approvals have been obtained. If the relevant approvals have not

been obtained on or before 29 June 2022, the final 2 instalments of

the Second Tranche Funding will not be advanced, and the loans will

become repayable as set out below. The timing and amount of loan

funds to be provided by SGIH is as set out below:

First Tranche Funding:

Date ZAR

The first business day following the effective date

of the Agreement (anticipated to be the first week

of February 2022) 10,000,000

-----------

23 February 2022 30,000,000

-----------

31 March 2022 6,036,691

-----------

Total 46,036,691

-----------

As stated above the total ZAR46,036,691 SGIH loan will convert

to the First Tranche Shares once the total First Tranche Funding

has been advanced, provided that South African Reserve Bank

approval has been obtained. The First Tranche Funding is secured

against shares in MCM's wholly owned subsidiaries, Limpopo Coal

Company (Pty) Ltd and Harissa Investment Holdings (Pty) Ltd . This

security will be released when the First Tranche Funding is repaid

or the First Tranche Shares are issued. The Second Tranche Funding

will not be secured.

Second Tranche Funding:

Date ZAR

30 April 2022 10,000,000

-----------

31 May 2022 10,000,000

-----------

30 June 2022 10,000,000

-----------

31 July 2022 10,000,000

-----------

Total 40,000,000

-----------

As stated above, the total ZAR40,000,000 Second Tranche Funding

will convert to the Second Tranche Shares as and when South African

Reserve Bank approval is obtained and the necessary shareholder

approval is received. To the extent that the aforementioned

approvals are obtained prior to the abovementioned dates, the

relevant Placement Shares will be issued in tranches directly to

SGIH against payment of the subscription amounts at the Issue

Price.

The First Tranche Funding will be used to settle the balance

owing to the vendors of the Lukin and Salaita properties, due by 28

February 2022, as announced on 11 January 2022, and to supplement

the MCM group working capital requirements.

The Second Tranche Funding will be used to advance development

of the Makhado hard coking coal project and to supplement the MCM

group's working capital requirements. Based on prevailing forward

API4 coal prices and management of Group facilities, the funding

from SGIH is expected to extend the cash runway to at least August

2022.

It is important to note that the conversion of the Second

Tranche Funding is expressly subject to shareholder approval,

including under the ASX Listing Rules and item 7 of section 611 of

the Corporations Act 2001.

SGIH is a substantial mining house with investments in coal

mining, contract mining, commodity trading, gold mining, energy,

engineering and property.

SGIH 's coal mining interests are held through its wholly owned

subsidiaries, which produce over eight million tons of run of mine

(ROM) coal per year and are targeting to increase ROM production to

12 million tons in 2022. SGIH's group companies supply

approximately 4 million tonnes of coal per annum to the local

electricity utility Eskom and exports 3.5 million tonnes of coal

per annum through the Richards Bay Coal Terminal. SGIH controls

over 300 million tonnes of coal Resources and Reserves through its

coal mining subsidiaries. All SGIH 's collieries are located in the

Highveld and Witbank Coalfields of the Mpumalanga Province of South

Africa.

The SGIH group chief executive officer and controlling

shareholder is Mr Ontiretse Mathews Senosi. Mr Senosi is, subject

to completion of the relevant regulatory and customary due

diligence processes, to be appointed a director of the Company on

completion of the issue of the First Tranche Shares. A further

announcement will be made in this regard in due course.

Mr Senosi is a mining engineer having completed his degree and

also a Graduate Diploma in Engineering at the University of the

Witwatersrand in South Africa. He gained experience at Anglo Coal

before pursuing his own business interests. He has substantial

experience in mining engineering consulting, feasibility studies,

mine optimisation projects and several civil, building and

construction contracts for over 20 years. Since 2008, Mr Senosi is

also an experienced company director of various companies including

underground mine contractors.

Mr Bernard Pryor, MC Mining's Chairman, commented :

"We are very pleased Mr Senosi has agreed to invest in our

Company and to also join our board of directors. His successful

track record of developing and operating coal mines in South Africa

will be invaluable as we move closer to finalising the funding

requirements to develop our flagship Makhado project."

The more detailed terms of the Convertible Advance and

Subscription Agreement are as follows:

material terms of Convertible Advance and Subscription

Agreement

Name of Contract Convertible Advance and Subscription Agreement

Parties MC Mining Limited (MCM) as Guarantor,

MCM's subsidiaries, Limpopo Coal Company

Proprietary Limited as borrower (Borrower)

and Harrisia Investment Holdings Proprietary

Limited, and Senosi Group Investment Holdings

Proprietary Limited as lender and subscriber

-----------------------------------------------------------

Execution On or around 31 January 2022

-----------------------------------------------------------

Loan ZAR86,036,691 or approximately A$7.9 million

-----------------------------------------------------------

Use of Loan The ZAR46,036,691 first tranche: Principally

required for MCM to make payment of the

sum of ZAR35,000,000 under a deferred

payment arrangement for land acquired

under a sale and purchase agreement due

on 28 February 2022. The balance of ZAR11,036,691

will be used for working capital; and

The ZAR40,000,000 second tranche: Principally

required to advance development of the

Makhado hard coking and thermal coal project

and for working capital.

-----------------------------------------------------------

Interest The Loan is interest free, unless the

relevant approvals required in order to

issue the Placement Shares are not obtained

in which event the loans will bear interests

at the South African prime rate.

-----------------------------------------------------------

Condition of Conversion The first tranche of ZA46,031,691 is to

convert into shares in the Company, subject

to ASX, AIM and JSE approval, only after

South Africa's Reserve Bank approval has

been obtained and the full amount of the

first tranche has been advanced to the

Borrower. The second tranche of ZAR40,000,000

is to convert into shares in the Company

only after South Africa's Reserve Bank

and all other required shareholder and

regulatory approvals, including under

the ASX Listing Rules and section 611

of the Corporations Act 2001, have been

obtained.

-----------------------------------------------------------

Conversion Subject to all applicable laws and required

approvals, and except as otherwise provided,

providing the Loans remain outstanding,

the Loans shall convert into MCM Shares

as soon as reasonably practicable following

the date on which the applicable conditions

are satisfied and the number of MCM Shares

to be issued shall be determined by dividing

the principal amount of the Loan outstanding

to be converted by ZAR1.20.

-----------------------------------------------------------

Conversion/ Repayment The Loans will convert when the respective

Date conditions for conversion have been satisfied

as set out above, provided that;

(a) If the first tranche conversion condition

has not been satisfied on or before 29

June 2022 or such later date agreed by

the parties, that loan plus interest shall

be repaid 30 calendar days thereafter;

and

(b) If the second tranche conversion conditions

have not been satisfied on or before 29

June 2022 , or such later date agreed

by the parties, that loan plus interest

shall be repaid 30 calendar days thereafter.

-----------------------------------------------------------

Placement To the extent that the required approvals

for the issue of the Placement Shares

are obtained prior to the date on which

any portion of Loan is the be advanced

by SGIH, SGIH has agreed to directly subscribe

for the Placement Shares in tranches on

the same basis as the Loans were to be

advanced.

-----------------------------------------------------------

Security As security for the repayment of the first

tranche, the Company has agreed:

(a) to pledge and cede in security all

of its right title and interest in and

to its shares in the Borrower and its

wholly owned group company, Harissa Investment

Holdings (Pty) Ltd. Enforcement by SGIH

will be subject to compliance with the

requirements of the Mineral and Petroleum

Resources Development Act or other regulatory

approvals, as applicable; and

(b) to subordinate the intercompany loans

in the Borrower and Harrisia in favour

of SGIH.

The security will be released as soon

as the first tranche is repaid or converted.

The second tranche will not be secured.

-----------------------------------------------------------

Note:

Exchanged rates used in this announcement are:

US$1.00 = ZAR15.24

A$1.00 = ZAR10.90

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014 as amended by the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

This announcement has been approved by the Company's disclosure

committee.

ASX: MCM / AIM: MCM.L / JSE: MCZ

For more information contact:

Sam Randazzo Interim Chief Executive Officer MC Mining Limited +61 408 945010

Tony Bevan Company Secretary Endeavour Corporate Services +618 9316 9100

Company advisors:

James Harris / James Dance Nominated Adviser Strand Hanson Limited +44 20 7409 3494

Rory Scott Broker (AIM) Tennyson Securities +44 20 7186 9031

James Duncan Financial PR (South Africa) R&A Strategic Communications +27 11 880 3924

Investec Bank Limited is the nominated JSE Sponsor

About MC Mining Limited

MC Mining is an AIM/ASX/JSE-listed coal exploration, development

and mining company operating in South Africa. MC Mining's key

projects include the Uitkomst Colliery (metallurgical and thermal

coal), Makhado Project (hard coking coal). Vele Colliery (semi-soft

coking and thermal coal), and the Greater Soutpansberg Projects

(coking and thermal coal).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEKZGGZVMDGZZG

(END) Dow Jones Newswires

February 01, 2022 01:59 ET (06:59 GMT)

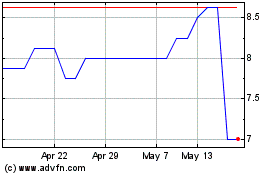

Mc Mining (LSE:MCM)

Historical Stock Chart

From May 2024 to Jun 2024

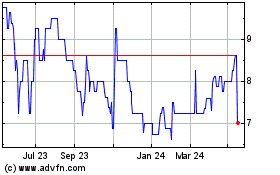

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2023 to Jun 2024