TIDMLWDB

ANNUAL FINANCIAL REPORT for the year ended 31 December 2012(audited)

This is a corrected version of the Report originally published at 7.30am on

1 March 2013, amending only the table headed "Financial Summary" to correctly state

the NAV.

This is the Annual Financial Report of The Law Debenture Corporation p.l.c. as

required to be published under DTR 4 of the UKLA Listing Rules.

The directors recommend a final dividend of 9.75p per share making a total for

the year of 14.25p. Subject to the approval of shareholders, the final dividend

will be paid on 18 April 2013 to holders on the register on the record date of 22

March 2013. The annual financial report has been prepared in accordance with

International Financial Reporting Standards.

The Corporation has for the first time, included in its financial summary at 31

December 2012 a figure for NAV after the final dividend with long term debt

stated at fair value. On this basis the long term debt would be valued at GBP47.3m

rather than book value of GBP39.4m representing a reduction in the year end NAV

of 6.69 pence per share.

Group income statement

for the year ended 31 December

2012 2011

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

UK dividends 11,431 - 11,431 11,643 - 11,643

UK special 457 - 457 140 - 140

dividends

Overseas dividends 1,792 - 1,792 1,755 - 1,755

Overseas special 51 - 51 64 - 64

dividends

Interest from 661 - 661 524 - 524

securities

14,392 - 14,392 14,126 - 14,126

Interest income 140 - 140 446 - 446

Independent 29,760 - 29,760 30,948 - 30,948

fiduciary services

fees

Other income 105 105 94 - 94

Total income 44,397 - 44,397 45,614 - 45,614

Net gain/(loss) on - 59,259 59,259 - (22,175) (22,175)

investments held at

fair value through

profit or loss

Gross income and 44,397 59,259 103,656 45,614 (22,175) 23,439

capital gains/

(losses)

Cost of sales (3,761) - (3,761) (4,313) - (4,313)

Administrative (18,638) (193) (18,831) (18,643) (223) (18,866)

expenses

Operating profit 21,998 59,066 81,064 22,658 (22,398) 260

Finance costs

Interest payable (2,450) - (2,450) (2,450) - (2,450)

Profit/(loss)before 19,548 59,066 78,614 20,208 (22,398) (2,190)

taxation

Taxation (1,753) - (1,753) (1,977) - (1,977)

Profit/(loss) for 17,795 59,066 76,861 18,231 (22,398) (4,167)

year

Return/(loss) per 15.14 50.24 65.38 15.52 (19.07) (3.55)

ordinary share

(pence)

Diluted return/ 15.13 50.21 65.34 15.52 (19.07) (3.55)

(loss) per ordinary

share (pence)

Statement of comprehensive income

for the year ended 31 December

Revenue Capital Total Revenue Capital Total

2012 2012 2012 2011 2011 2011

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Group

Profit/(loss) for the 17,795 59,066 76,861 18,231 (22,398) (4,167)

year

Foreign exchange on - (204) (204) - (9) (9)

translation of foreign

operations

Pension actuarial gains/ 336 - 336 (3,145) - (3,145)

(losses)

Taxation on pension (104) - (104) 800 - 800

Total comprehensive 18,027 58,862 76,889 15,886 (22,407) (6,521)

income/(loss)for the year

Financial summary and performance

Financial summary

31 December 31 December

2012 2011

pence pence

Share price 425.00 333.50

NAV per share after proposed 374.55 323.75

final dividend

NAV per share after proposed 367.86 323.75

final dividend with debt at

fair value*

Revenue return per share

- Investment trust 8.47 8.27

- Independent fiduciary 6.67 7.25

services

Group revenue return per share 15.14 15.52

Capital return/(loss) per 50.24 (19.07)

share

Dividends per share 14.25 13.50

* The estimated fair value of the debt at 31 December 2012 has been based upon

the redemption yield of the reference gilt plus a margin derived from the

spread of BBB UK corporate bond yields over UK gilt yields.

2012

%

Ongoing charges 0.47

Gearing 100

Ongoing charges are based on the cost of the investment trust and include the

Henderson management fee of 0.30% of the NAV of the investment trust. There is

no performance related element to the fee.

Performance

2012 2011

% %

Share price total return¹ 32.0 (2.9)

NAV total return¹ 19.7 (1.6)

FTSE Actuaries All-Share Index 12.3 (3.5)

total return

¹ Source AIC.

Chairman's statement and review of 2012

Performance

Our net asset value total return for the year to 31 December 2012 was 19.7%,

compared to a total return of 12.3% for the FTSE Actuaries All-Share Index. Net

revenue return per share was 15.14p, a decrease of 2.4% over the previous year,

as a result of a 2.4% increase in the investment trust and an 8.0% decrease in

independent fiduciary services.

Dividend

The board is recommending a final dividend of 9.75p per ordinary share (2011:

9.0p), which together with the interim dividend of 4.5p (2011: 4.5p) gives a

total dividend of 14.25p (2011: 13.5p).

The final dividend will be paid, subject to shareholder approval, on 18 April

2013 to holders on the register on the record date of 22 March 2013.

The Corporation's policy continues to be to seek growth in both capital and

income. We attach considerable importance to the dividend, which we aim to

increase over a period, if not every year, at a rate which is covered by

earnings and which does not inhibit the flexibility of our investment strategy.

Our basis for reporting earnings is more conservative than that of many

investment trusts, in that all our expenses, including interest costs, are

charged fully to the revenue account.

Investment trust

Equity markets rose and good corporate performance led to increased dividends.

However, uncertainty remained as a result of persistent fiscal deficits,

uncertainty over the euro and disappointing rates of recovery following the

financial crisis.

We remained fully invested in equities in the investment portfolio, but the

board has not been convinced that the macroeconomic uncertainty of recent years

is over and has therefore not deployed our gearing. Our exposure to industrial

companies has remained high. For a discussion of the portfolio, see the

investment manager's review.

Independent fiduciary services

The business continued to deliver a good return for shareholders, against a

background of difficult market conditions.

For a discussion on the independent fiduciary services business please see the

managing director's report.

Regulatory environment

The introduction of the Retail Distribution Review at the end of 2012 has

changed the way that retail investors receive and pay for independent financial

advice. This might lead to an increased awareness of investment trust shares

generally, but also means that those who advise retail investors may require

greater detail about individual trusts in order to recommend them or include

them on execution only platforms. With that in mind, the Corporation has

introduced a new section in this year's annual report.

During 2013, the board will be taking decisions on how the Corporation should

best organise itself to comply with the latest iteration of the Combined Code,

the Foreign Account Tax Compliant Act ("FATCA") and the Alternative Investment

Fund Manager's Directive. Neither of these last two developments is welcome and

both may impose significant costs for little or no benefit to shareholders.

Board

Mark Bridgeman will be appointed to the board on 15 March 2013 and comes up for

election at the annual general meeting. He has a strong background in

investment management, having been Global Head of Research at Schroder plc, and

experience of investment trusts. I am confident that he will make a valuable

contribution and encourage you to support his election.

I shall retire from the board at the conclusion of the annual general meeting.

In my period of office I have been fortunate to work with two outstanding

investment managers, first Michael Moule and latterly James Henderson, and with

Caroline Banszky, who with her team, has vigorously enhanced the profitability

of the independent fiduciary services business. Christopher Smith, who takes

over from me, has a deep understanding of both sides of this unique and

successful company, and I am confident of its future in the hands of him and

his colleagues.

The annual general meeting will be held at the Brewers Hall, Aldermanbury

Square, London EC2V 7HR on 10 April 2013, and I look forward to seeing as many

as possible of you there.

Douglas McDougall

Investment manager's review

Review

The global economy did not grow in 2012 as fast as had been hoped but this did

not stop equity markets performing well. Markets were driven by decent

corporate profit and dividend growth at a time when investor expectations were

low. The best performing area was the Far East, while the US stocks lagged

after a few years of strong performance. The majority of our investments are in

the UK, where small and medium sized companies significantly outperformed

larger companies. The four biggest detractors of value from the portfolio, as

can be seen from the table below, were large blue chips involved in the oil,

gas and pharmaceutical industries, while the fifth largest detractor was Cape,

where accounting irregularities were discovered. The five largest contributors

all came from different business sectors. Among these, IP Group works with

start-up companies to commercialise their intellectual property, International

Personal Finance provides home credit to customers in emerging markets and Hill

& Smith manufactures infrastructure products.

Biggest rises by value

GBP000

1. IP Group 3,386

2. Smith (DS) 2,788

3. Hill & Smith 2,713

4. International Personal Finance 2,519

5. Senior 2,253

Biggest falls by value

GBP000

1. Royal Dutch Shell (1,400)

2. BG (1,061)

3. GlaxoSmithKline (1,028)

4. BP (929)

5. Cape (851)

The equity market advanced across most business sectors during the year,

suggesting - encouragingly - that the operating improvements in UK companies

achieved in recent years are not confined to a narrow part of the economy. Some

commentators claim that the UK economy is in a poor state, but if they were to

visit companies they would take a different view. I continue regularly to have

face-to-face meetings with the senior managements of UK companies, as I have

been doing for over twenty five years, and believe that companies have never

been financially stronger or operationally more motivated than they are at

present.

Investment Approach

The focus is on individual companies with the intention of buying them when

their prospects for growth are being underestimated and selling them when the

valuations reach or exceed a level that more accurately reflects the potential.

The frequent mispricing of individual stocks affords opportunities to the

investor who pays close attention to the monitoring of stocks. The approach is

to have a relatively low portfolio turnover, with purchases and sales being

determined by the company fundamentals rather than based on a wider

macroeconomic view, which is subjective and notoriously difficult to get right.

I do not believe that we can add long term value to the portfolio simply by

switching between different geographic areas, nor do I believe that taking a

view on currencies, say by hedging the currency exposure, would bring any

benefit or value in the long term. The object is to play to the strengths in

the team at Henderson and to recognise the weaknesses. We will use other fund

managers' vehicles to obtain their expertise if Henderson does not have it. For

example, we have a holding in Herald Investment Trust as this gives us access

to smaller technology companies; and we spread our exposure to the Far East

between three different investment houses.

Portfolio activity

We remained fully invested throughout the year aside from our gearing. Rather

than employing gearing to make new purchases, we reduced some holdings when it

was deemed that they had become overweight in the overall portfolio. An example

of this was Senior, the aerospace and automotive supplier, which is

operationally performing well and continues to be our largest individual

holding, and about which we remain positive.

We profitably bought and sold Apple; it is unusual for a company to come in and

out of the portfolio so fast but consumer electronics is a fluid industry

undergoing rapid change and the sale subsequently proved to have been timely.

We will consider investing in companies of any size so long as they can add

value. For example, we took a holding in Oxford Catalysts, a small AIM listed

company whose technology in the production of clean synthetic fuels could lead

to substantial growth in business over coming years.

The exposure to manufacturing businesses in the portfolio remains large. In the

USA and UK they are experiencing a period of renewed dynamic growth, as they

apply advanced technologies to new products. The aerospace sector is a good

example.

The overall turnover in the portfolio during the year was approximately 10%.

Outlook

Companies are stronger. Corporate debt has fallen substantially and many of our

holdings have net cash. Corporate margins may surprise many commentators over

the coming year by increasing as management teams continue to drive operational

efficiencies at a time when the economy is stable but dull. There is no

complacency from managements, even though the upswing in valuation is now into

its fourth year. The memories of 2008 still exert a discipline, but we believe

the equity market may make further advances.

James Henderson

Henderson Global Investors Limited

Management review - independent fiduciary services

Results

Independent fiduciary services profit before tax decreased by 8.5% from

GBP10.49 million to GBP9.60 million. Revenue return per share decreased by 8.0% from

7.25p to 6.67p.

Independent fiduciary services businesses

Law Debenture is a leading provider of independent third party fiduciary

services, including corporate and pension trusts, service of process, treasury

and agency solutions, corporate services, board effectiveness and whistle

blowing. The businesses are monitored and overseen by a board comprising the

heads of the relevant business areas, chaired by a non-executive independent

director, currently Christopher Smith.

Review of 2012

The independent fiduciary businesses performed reasonably well in the face of

continuing macroeconomic negativity, particularly in the first half of the

year. The dip back into recession, further pressure on the banking sector and

Eurozone difficulties all contributed to uncertainty in the markets where we

operate. However, some sectors, such as service of process, were very lively as

corporate activity overseas was maintained at 2011 levels. Market share

remained satisfactory across all of the businesses and activity levels in

pre-existing transactions remained high, caused by the continuing need for

transactions to be amended as a result of strains incurred since 2007. In a

number of these cases, we were able to generate additional fees for time spent.

Some features of the year are set out below.

Corporate trusts

Corporate trusts had a reasonable year, with signs of greater activity in the

bond market in the second half. We were selected to act as trustee by a wide

range of companies including Aviva, BG Energy, Friends Life, First Group,

GlaxoSmithKline, National Grid, Severn Trent and The Housing Finance

Corporation.

We took on an increasing amount of security trustee work, including on two

major international project financings with the International Finance

Corporation.

Our recognised independence as an impartial third party was instrumental in

securing a growing number of escrow agent appointments, holding a variety of

assets.

We remained busy on post-issuance work including restructurings and transaction

amendments arising from, for example, ratings downgrades of transaction

parties.

Pension trusts

Our pension scheme trusteeship service continued to be busy and demanding,

reflecting the challenges which pension schemes face. We were appointed to 11

new schemes ranging in size from GBP5 million to over GBP8 billion and new clients

included IBM and Santander. Michael Chatterton and Simone Lavelle were

appointed as joint Managing Directors to manage our practice and Mark Ashworth

took on the role of Chairman. John Nestor joined the team. His expertise is in

investment management.

Reflecting the ever changing nature of the pensions sector, we now offer sole

trusteeship services, where we act as the sole trustee of a pension scheme to

deliver extra governance where people, time or knowledge are lacking. We are

also developing on-line trustee assessment and board effectiveness survey

tools.

Corporate services

Our long established and highly regarded service of process business had

another solid year with an increase in new appointments.

The corporate services business (provision of corporate directors, company

secretary, accounting and administration of special purpose vehicles) was

steady. While the market for new structured finance transactions was slow, new

securitisations were secured originated by Virgin Money and Apollo European

Principal Finance. We also continued to win business from other markets,

including a number of new company secretarial appointments and specialised

roles providing administration support to companies in distress.

Treasury and agency solutions

We successfully developed and launched our advanced on-line Dynamic Analytical

Reporting Tool system (`DARTS') during the course of the year. DARTS delivers

superior real time client reporting, accessible directly by borrowers,

investors and other parties on structured, loan facility and treasury

transactions. We continue to service our cash escrow, security trust and

project finance business, as well as providing other customised solutions

including data verification and data room services.

Safecall

It was another good year for our external whistleblowing service with a

significant increase in the customer base. Recent legislation including The

Bribery Act continues to result in a number of organisations reviewing their

policies and procedures and deciding to contract with Safecall. Notable

appointments in 2012 include Michelin, NXP Semiconductors, 3663, CHEP and

Bright Horizons.

Governance services

Our governance services business completed its second year in what remains a

fragmented and competitive market. We won a number of assignments in board

effectiveness in the listed, public and voluntary sectors and expect this to

continue in 2013. We have developed sector specific approaches, for example for

investment companies and the insurance market, where we have found that

modifications have been necessary. Our ancillary products - tools for use in

decision making and risk management - have been positively received by boards,

management teams and operating committees alike.

Overseas

United States

The US corporate trust business held its own. Its core successor trustee

business (which derives from bankruptcies) faced challenges in an improving

domestic economy and a continued low interest rate environment. However, new

roles, including acting as a "separate trustee" to pursue remedial rights in

residential mortgage securitisations, generated a healthy number of new

appointments. This business should continue to offer growth prospects in the

year ahead. The corporate services business, including Delaware Corporate

Services, continued to generate excellent returns.

Hong Kong

General business levels remained strong until the third quarter, when both the

Hong Kong and the Chinese markets became less active. However, we saw continued

firm demand for employee share trust and escrow services and our service of

process team had another good year in respect of appointments under local law

and particularly on behalf of the US and UK offices.

Channel Islands

There was an overall increase in transactional activity during the year from

our existing client base, although this was largely offset by the loss of

several transactions coming to the end of their natural life. New business

remains difficult to come by, although there were several new service of

process appointments taken on in the year.

Outlook

The recent rally in stock market values may indicate that investor confidence

is returning, possibly leading to an increase in activity in the capital

markets. Similarly, governmental initiatives to stimulate lending could

possibly lead to an increase in debt market activities and the crisis in the

Eurozone seems to have abated, at least for the time being, removing some

uncertainty. While prospects for a possible upturn in activity may exist,

caution remains the watchword as growth prospects remain largely dependent on

wider macroeconomic factors. We are well positioned to take advantage of

opportunities as they arise, including being willing to expand our fiduciary

services into areas where there is a need for an established, trusted,

independent third party.

Caroline Banszky

Statement of financial position

as at 31 December

2012 2011

GBP000 GBP000

Assets

Non current assets

Goodwill 2,182 2,218

Property, plant and equipment 254 320

Other intangible assets 363 199

Investments held at fair value 479,521 423,044

through profit or loss

Deferred tax assets 1,126 1,416

Total non current assets 483,446 427,197

Current assets

Trade and other receivables 4,244 4,940

Other accrued income and prepaid 5,980 6,246

expenses

Cash and cash equivalents 22,201 18,063

Total current assets 32,425 29,249

Total assets 515,871 456,446

Current liabilities

Trade and other payables 10,745 11,674

Corporation tax payable 1,005 1,293

Other taxation including social 629 559

security

Deferred income 3,948 3,902

Total current liabilities 16,327 17,428

Non current liabilities and deferred

income

Long term borrowings 39,418 39,391

Retirement benefit obligations 2,227 3,138

Deferred income 6,035 5,563

Total non current liabilities 47,680 48,092

Total net assets 451,864 390,926

Equity

Called up share capital 5,905 5,905

Share premium 8,122 8,106

Capital redemption 8 8

Shared based payments - 201

Own shares (1,778) (1,684)

Capital reserves 405,334 346,268

Retained earnings 33,964 31,609

Translation reserve 309 513

Total equity 451,864 390,926

Statement of cash flows

for the year ended 31 December

2012 2011

GBP000 GBP000

Operating activities

Operating profit before interest payable and 81,064 260

taxation

(Gains)/losses on investments (59,066) 22,398

Foreign exchange 39 (12)

Depreciation of property, plant and equipment 149 164

Amortisation of intangible assets 214 76

Decrease/(increase) in receivables 962 (658)

(Decrease)/increase in payables (314) 442

Transfer to capital reserves 772 126

Normal pension contributions in excess of cost (575) (883)

Cash generated from operating activities 23,245 21,913

Taxation (1,855) (1,548)

Interest paid (2,450) (2,450)

Operating cash flow 18,940 17,915

Investing activities

Acquisition of property, plant and equipment (89) (289)

Expenditure on intangible assets (375) (157)

Purchase of investments (48,376) (96,508)

Sale of investments 50,193 92,275

Cash flow from investing activities 1,353 (4,679)

Financing activities

Dividends paid (15,873) (15,270)

Proceeds of increase in share capital 16 41

Purchase of own shares (94) 110

Net cash flow from financing activities (15,951) (15,119)

Net increase/(decrease) in cash and cash 4,342 (1,883)

equivalents

Cash and cash equivalents at beginning of 18,063 19,953

period

Foreign exchange (losses) on cash and cash (204) (7)

equivalents

Cash and cash equivalents at end of period 22,201 18,063

Statement of changes in equity

Share Share Own Capital Share Translation Capital Retained Total

Capital Premium Shares Redemption based Reserve Reserve Earnings

payment

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Equity 1 5,905 8,106 (1,684) 8 201 513 346,268 31,609 390,926

January 2012

Profit - - - - - - 59,066 17,795 76,861

Foreign - - - - - (204) - - (204)

exchange

Actuarial - - - - - - 232 232

gain on

pension

scheme (net

of tax)

Total - - - - - (204) 59,066 18,027 76,889

comprehensive

income

Issue of - 16 - - - - - - 16

shares

Dividend - - - - - - - (10,582) (10,582)

relating to

2011

Dividend - - - - - - - (5,291) (5,291)

relating to

2012

Movement in - - (94) - - - - - (94)

own shares

Transfer - - - - (201) - - 201 -

Total equity 5,905 8,122 (1,778) 8 - 309 405,334 33,964 451,864

31 December

2012

Equity 1 5,904 8,066 (1,794) 8 201 522 368,666 30,993 412,566

January 2011

Net (loss) - - - - - - (22,398) 18,231 (4,167)

Foreign - - - - - (9) - - (9)

exchange

Actuarial - - - - - - - (2,345) (2,345)

(loss) on

pension

scheme (net

of tax)

Total - - - - - (9) (22,398) 15,886 (6,521)

comprehensive

(loss)

Issue of 1 40 - - - - - - 41

shares

Dividend - - - - - - - (9,984) (9,984)

relating to

2010

Dividend - - - - - - - (5,286) (5,286)

relating to

2011

Movement in - - 110 - - - - - 110

own shares

Total equity 5,905 8,106 (1,684) 8 201 513 (346,268) 31,609 390,926

31 December

2011

Segmental analysis

Investment trust Independent Total

fiduciary services

2012 2011 2012 2011 2012 2011

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Segment income 14,392 14,126 29,760 30,948 44,152 45,074

Other income 12 76 93 18 105 94

Cost of sales - - (3,761) (4,313) (3,761) (4,313)

Administration costs (1,917) (1,915) (16,721) (16,728) (18,638) (18,643)

12,487 12,287 9,371 9,925 21,858 22,212

Interest (net) (2,534) (2,566) 224 562 (2,310) (2,004)

Return, including 9,953 9,721 9,595 10,487 19,548 20,208

profit on

ordinary activities

before taxation

Taxation - - (1,753) (1,977) (1,753) (1,977)

Return, including 9,953 9,721 7,842 8,510 17,795 18,231

profit attributable

to shareholders

Revenue return per 8.47 8.27 6.67 7.25 15.14 15.52

ordinary share

Assets 491,643 434,325 24,228 22,121 515,871 456,446

Liabilities (54,915) (57,233) (9,092) (8,287) (64,007) (65,520)

Total net assets 436,728 377,092 15,136 13,834 451,864 390,926

The capital element of the income statement is wholly attributable to the

investment trust.

Portfolio changes in geographical distribution

Valuation Purchases Costs of Sales Appreciation/ Valuation

31 December acquisition proceeds (depreciation) 31 December

2011 2012

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

United Kingdom 274,705 36,240 (173) (26,858) 46,383 330,297

North America 27,859 5,375 (8) (4,096) 2,310 31,440

Europe 31,263 6,761 (12) (4,049) 4,240 38,203

Japan 12,753 - - - 421 13,174

Other Pacific 31,973 - - (6,388) 6,352 31,937

UK Gilts 44,491 - - (8,802) (1,219) 34,470

423,044 48,376 (193) (50,193) 58,487 479,521

The financial information set out above does not constitute the Corporation's

statutory accounts for 2011 or 2012. Statutory accounts for the years ended 31

December 2011 and 31 December 2012 have been reported on by the Independent

Auditor. The Independent Auditor's Reports on the Annual Report and Financial

Statements for 2011 and 2012 were unqualified, did not draw attention to any

matters by way of emphasis, and did not contain a statement under 498(2) or 498

(3) of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2011 have been filed with the

Registrar of Companies. The statutory accounts for the year ended 31 December

2012 will be delivered to the Registrar in due course.

The financial information in this Annual Financial Report has been prepared

using the recognition and measurement principles of International Accounting

Standards, International Financial Reporting Standards and Interpretations

adopted for use in the European Union (collectively Adopted IFRSs). The

accounting policies adopted in this Annual Financial Report have been

consistently applied to all the years presented and are consistent with the

policies used in the preparation of the statutory accounts for the year ended

31 December 2012. The principal accounting policies adopted are unchanged from

those used in the preparation of the statutory accounts for the year ended 31

December 2011.

Group summary

From its origins in 1889 Law Debenture has diversified to become a group with a

unique range of activities in the financial and professional services sector.

The group divides into two distinct complementary areas of business.

The investment trust and its management

We are a global growth investment trust, listed on the London Stock Exchange.

The Corporation carries on its business as a global growth investment trust.

Its objective is set out in the chairman's review. The aim is to achieve a

higher rate of total return than the FTSE Actuaries All-Share Index through

investing in a portfolio diversified both geographically and by industry.

Henderson Global Investors Limited (Henderson) is responsible for the

management of the investment portfolio. Henderson is fully aware of the

Corporation's investment strategy and provides a cost competitive service.

Consequently the directors believe that the continuing appointment of Henderson

is in the best interests of shareholders. The agreement does not cover custody

or the preparation of data associated with investment performance, which are

outsourced, or record keeping, which is maintained by the Corporation. Fees

paid to Henderson in the year amounted to GBP1,208,000 (2011: GBP1,150,000). Fees

are charged at 0.30% of the value,of the net assets of the group (excluding the

net assets of the independent fiduciary services business), calculated on the

basis adopted in the audited financial statements. This means that the

Corporation continues to maintain one of the most competitive fee structures in

the investment trust sector. The underlying management fee of 1% on the

Corporation's holdings in the Henderson Japanese and Pacific OEICs continues to

be rebated.

The investment trust - investment strategy and implementation

The Corporation's investment strategy is as follows:

The Corporation carries on its business as a global growth investment trust.

Its objective is set out in the business review. The aim is to achieve a higher

rate of total return than the FTSE actuaries All-Share index through investing

in a portfolio diversified both geographically and by industry.

To achieve this, investments are selected on the basis of what appears most

attractive in the conditions of the time. This approach means that there is no

obligation to hold shares in any particular type of company, industry or

geographical location. The independent fiduciary services businesses do not

form part of the investment portfolio and are outwith this strategy.

The Corporation's portfolio will typically contain between 70 and 150 listed

investments. The portfolio is widely diversified both by industrial sector and

geographic location of investments in order to spread investment risk.

Whilst performance is measured against local and UK indices, the composition of

these indices does not influence the construction of the portfolio. As a

consequence, it is expected that the Corporation's investment portfolio and

performance will deviate from the comparator indices.

Because the Corporation's assets are invested internationally and without

regard to the composition of indices, there are no restrictions on maximum or

minimum stakes in particular regions or industry sectors. However, such stakes

are monitored in detail by the board at each board meeting in order to ensure

that sufficient diversification is maintained.

Liquidity and long-term borrowings are managed with the aim of improving

returns to shareholders. The policy on gearing is to assume only that level of

gearing which balances risk with the objective of increasing the return to

shareholders. In pursuit of its investment objective, investments may be held

in, inter alia, equity shares, fixed interest securities, interests in limited

liability partnerships, cash and liquid assets. Derivatives may be used but

only with the prior authorisation of the board. Investment in such instruments

for trading purposes is proscribed.

It is permissible to hedge against currency movements on capital and income

account, subject again to prior authorisation of the board. Stock lending,

trading in suspended shares and short positions are not permitted.

The Corporation's investment activities are subject to the following

limitations and restrictions:

* No investment may be made which raises the aggregate value of the largest 20

holdings, excluding investments in OEICs, Baillie Gifford Pacific, First State

Asia Pacific and UK gilts, to more than 40% of the Corporation's portfolio,

including cash. The value of a new acquisition in any one company may not

exceed 5% of total portfolio value (including cash) at the time the investment

is made, further additions shall not cause a single holding to exceed 5%, and

board approval must be sought to retain a holding, should its value increase

above the 5% limit.

* The Corporation applies a ceiling on effective gearing of 150%. While

effective gearing will be employed in a typical range of 90% to 120%, the board

retains the ability to reduce equity exposure to below 90% if deemed

appropriate.

* The Corporation may not make investments in respect of which there is

unlimited liability.

* Board approval must be sought for any proposed direct investments in certain

jurisdictions.

* The Corporation has a policy not to invest more than 15% of gross assets in

other UK listed investment companies.

Investment strategy - implementation

During the year, the assets of the Corporation were invested in accordance with

the investment strategy.

At 31 December 2012 the top 20 holdings (excluding the Henderson OEICs)

comprised 33% of the total portfolio (2011: 33%).

The extent to which the Corporation's objective has been achieved, and how the

investment strategy was implemented, are described in the chairman's statement

and the investment manager's review.

The most recently published high level portfolio information at 31 January 2013

is:

Top 10 Holdings

Rank Name of Holding % of

portfolio

(excl. cash)

1. UK Treasury 4.5% 07/03/13 3.83

2. Senior 2.96

3. UK Treasury 2.25% 07/03/14 2.89

4. BP 2.65

5. Henderson Asia Pacific Capital 2.48

Growth

6. Henderson Japan Capital Growth 2.38

7. Royal Dutch Shell 2.24

8. GKN 2.18

9. GlaxoSmithKline 2.12

10. Baillie Gifford Pacific 2.10

Geographical Split

Region % of

portfolio

UK 67

Europe 8

North America 7

Japan 3

Other Pacific 6

Other -

Cash and Fixed Interest 9

TOTAL 100

Independent fiduciary services

We are a leading provider of independent fiduciary services. Our activities are

corporate trusts, treasury and agency solutions, pension trusts, corporate

services (including agent for service of process), whistle blowing services and

board effectiveness services. We have offices in London, Sunderland, New York,

Delaware, Hong Kong, the Channel Islands and the Cayman Islands.

Companies, agencies, organisations and individuals throughout the world rely

upon Law Debenture to carry out its duties with the independence and

professionalism upon which its reputation is built.

Principal risks and uncertainties

The principal risks of the Corporation relate to its investment activities and

include market price risk, foreign currency risk, liquidity risk, interest rate

risk and credit risk:

* market price risk, arising from uncertainty in the future value of

financial instruments. The board maintains strategy guidelines whereby risk

is spread over a range of investments, the number of holdings normally

being between 70 and 150. In addition, the stock selections and

transactions are actively monitored throughout the year by the investment

manager, who reports to the board on a regular basis to review past

performance and develop future strategy. The investment portfolio is

exposed to market price fluctuation: if the valuation at 31 December 2012

fell or rose by 10%, the impact on the group's total profit or loss for the

year would have been GBP48.0 million (2011: GBP42.3 million).

* foreign currency risk, arising from movements in currency rates applicable

to the group's investment in equities and fixed interest securities and the

net assets of the group's overseas subsidiaries denominated in currencies

other than sterling. The group's financial assets denominated in currencies

other than sterling were:

2012 2011

Net Total Net Total

Investments monetary currency Investments monetary currency

assets exposure assets exposure

GBPm GBPm GBPm GBPm GBPm GBPm

Group

US Dollar 26.8 3.7 30.5 24.1 3.3 27.4

Canadian 4.7 - 4.7 3.8 - 3.8

Dollar

Euro 24.1 0.3 24.4 18.4 0.4 18.8

Danish 0.7 - 0.7 - - -

Krone

Swedish 2.1 - 2.1 1.8 - 1.8

Krona

Swiss Franc 11.6 - 11.6 11.0 - 11.0

Hong Kong - 0.6 0.6 - 0.4 0.4

Dollar

Japanese 1.9 - 1.9 1.5 - 1.5

Yen

Total 71.9 4.6 76.5 60.6 4.1 64.7

The holdings in the Henderson Japan Capital Growth, Henderson Pacific Capital

Growth, Baillie Gifford Pacific and First Asia Pacific, OEICs and Scottish

Oriental Smaller Companies Trust are denominated in sterling but have

underlying assets in foreign currencies equivalent to GBP43.2 million

(2011: GBP43.3 million). Investments made in the UK and overseas have underlying

assets and income streams in foreign currencies which cannot be determined and this

has not been included in the sensitivity analysis. If the value of all other

currencies at 31 December 2012 rose or fell by 10% against sterling, the impact

on the group's total profit or loss for the year would have been GBP11.5 million

(2011: GBP10.4 million). The calculations are based on the investment portfolio

at the respective year end dates and are not representative of the year as a

whole.

* liquidity risk, arising from any difficulty in realising assets or raising

funds to meet commitments associated with any of the above financial

instruments. To minimise this risk, the board's strategy guidelines only

permit investment in equities and fixed interest securities quoted in major

financial markets. In addition, cash balances and overdraft facilities are

maintained commensurate with likely future settlements.

* interest rate risk, arising from movements in interest rates on borrowing,

deposits and short term investments. The board reviews the mix of fixed and

floating rate exposures and ensures that gearing levels are appropriate to

the current and anticipated market environment. The group's interest rate

profile at 31 December 2012 was:

Group

Sterling HK Dollars US Dollars Euro

GBPm GBPm GBPm GBPm

Floating rate assets 17.6 0.6 3.7 0.3

Fixed rate assets

Bonds

SSE 5.75% 05/02/14 2.4

National Grid 6.125% 15/04 5.7

/14

8.1

Gilts

UK Treasury 4.5% 07/03/13 19.7

UK Treasury 2.25% 07/03/14 14.8

34.5

Total 42.6

Weighted average fixed 1.53%

rate to maturity based on

fair value

Fixed rate liabilities* 39.4

Weighted average fixed 6.125%

rate

*Fixed until 2034.

The group holds cash and cash equivalents on short term bank deposits and money

market funds. Interest rates tend to vary with bank base rates. The investment

portfolio is not directly exposed to interest rate risk.

If interest rates during the year were 1.0% higher the impact on the group's

total profit or loss for the year would have been GBP152,000 (2011: GBP140,000). It

is assumed that interest rates are unlikely to fall below the current level.

* credit risk, arising from the failure of another party to perform according

to the terms of their contract. The group minimises credit risk through

policies which restrict deposits to highly rated financial institutions and

restrict the maximum exposure to any individual financial institution. The

group's maximum exposure to credit risk arising from financial assets is

GBP26.4 million (2011: GBP23.0 million).

The principal risks of the independent fiduciary services business arise during

the course of defaults, potential defaults and restructurings where we have

been appointed to provide services. To mitigate these risks we work closely

with our legal advisers and, where appropriate, financial advisers, both in the

set up phase to ensure that we have as many protections as practicable, and at

all other stages whether or not there is a danger of default.

Capital management

The Corporation is not allowed to retain more than 15% of its income from

shares and securities each year and has a policy to increase dividends, however

revenue profits are calculated after all expenses and distributions will not be

made if they inhibit the investment strategy.

The investment strategy of the Corporation includes a ceiling on effective

gearing of 150%, with a typical range of 90% to 120%.

Related party transactions

There have been no related party transactions during the period which have

materially affected the financial position or performance of the group. During

the period transactions between the Corporation and its subsidiaries have been

eliminated on consolidation.

Acquisition of own shares

A subsidiary of the Corporation made one purchase of shares in 2012 in

connection with the Deferred Share Plan for senior staff. On 15 March 2012,

166,889 shares were purchased in the market at 395.2 pence per share. These

shares will be held in trust by the subsidiary and released to eligible staff

if and when the release conditions (as prescribed under the Plan rules) are met

in 2015.

Total voting rights

The Corporation has an issued share capital at 1 March 2013 of 118,101,503

ordinary shares with voting rights and no restrictions and no special rights

with regard to control of the Corporation. There are no other classes of share

capital and none of the Corporation's issued shares are held in treasury.

Therefore the total number of voting rights in The Law Debenture Corporation

p.l.c. is currently 118,101,503.

Directors' responsibility statement pursuant to DTR4

The directors confirm that to the best of their knowledge:

* The group financial statements have been prepared in accordance with

International Financial Reporting Standards as adopted by the European

Union (IFRSs) and Article 4 of the IAS Regulation and give a true and fair

view of the assets, liabilities, financial position and profit or loss of

the group;

* The annual report includes a fair review of the development and performance

of the business and the position of the group and parent company, together

with a description of the principal risks and uncertainties that they face.

Copies of this Annual Financial Report are available on www.lawdeb.com/

investment-trust/financial-statements

Copies of the annual report will be available from the Corporation's registered

office or on the above website link once published on 5 March 2013.

By order of the board

Law Debenture Corporate Services Limited

Secretary

1 March 2013

END

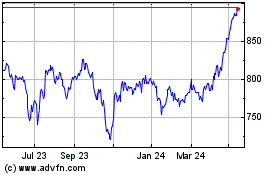

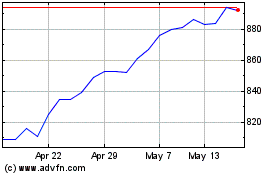

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024