TIDMLTI

5 December 2022

LONDON STOCK EXCHANGE ANNOUNCEMENT

The Lindsell Train Investment Trust plc (the "Company")

Unaudited Half-Year Results for the six months ended

30 September 2022

This Announcement is not the Company's Half-year Report & Accounts. It is an

abridged version of the Company's full Half-year Report & Accounts for the six

months ended 30 September 2022. The full Half-year Report & Accounts together

with a copy of this announcement, will shortly be available on the Company's

website at www.ltit.co.uk where up to date information on the Company,

including NAV, share prices and monthly updates, can also be found.

The Company's Half-year Report & Accounts for the six months ended 30 September

2022 has been submitted to the UK Listing Authority, and will shortly be

available for inspection on the National Storage Mechanism (NSM) at https://

data.fca.org.uk/#/nsm/nationalstoragemechanism

Financial Highlights

Performance comparisons 1 April 2022 - 30 September 2022 Change

Share price total return per Ordinary Share*^ -6.5%

Net asset value total return per Ordinary Share*^ -3.0%

MSCI World Index total return (Sterling) -7.3%

UK RPI Inflation (all items) +7.5%

* The net asset value and the share price at 30 September 2022 have been

adjusted to include the ordinary dividend of £51.12 per share and a special

dividend of £1.88 per share paid on 13 September 2022, with the associated

ex-dividend date of 11 August 2022.

^ Alternative Performance Measure ("APM"). See Glossary of Terms and

Alternative Performance Measures.

Source: Morningstar/Bloomberg

Investment Objective

The objective of the Company is to maximise long-term total returns with a

minimum objective to maintain the real purchasing power of Sterling capital.

Investment Policy

The Investment Policy of the Company is to invest:

(i) in a wide range of financial assets including equities, unlisted

equities, bonds, funds, cash and other financial investments globally with no

limitations on the markets and sectors in which investment may be made,

although there is likely to be a bias towards equities and Sterling assets,

consistent with a Sterling-dominated investment objective. The Directors expect

that the flexibility implicit in these powers will assist in the achievement of

the investment objective;

(ii) in Lindsell Train managed fund products, subject to Board approval, up

to 25% of its gross assets; and

(iii) in LTL and to retain a holding, currently 24.2%, in order to benefit

from the growth of the business of the Company's Manager.

The Company does not envisage any changes to its objective, its investment

policy, or its management for the foreseeable future. The current composition

of the portfolio as at 30 September 2022, which may be changed at any time

(excluding investments in LTL and LTL managed funds) at the discretion of the

Investment Manager within the confines of the policy stated above.

Diversification

The Company expects to invest in a concentrated portfolio of securities with

the number of equity investments averaging fifteen companies. The Company will

not make investments for the purpose of exercising control or management and

will not invest in the securities of, or lend to, any one company (or other

members of its group) more than 15% by value of its gross assets at the time of

investment.

The Company will not invest more than 15% of gross assets in other closed-ended

investment funds.

Gearing

The Directors have discretion to permit borrowings up to 50% of the Net Asset

Value. However, the Directors have decided that it is in the Company's best

interests not to use gearing. This is in part a reflection of the increasing

size and risk associated with the Company's unlisted investment in LTL, but

also in response to the additional administrative burden required to adhere to

the full scope regime of the AIFMD.

Dividends

The Directors' policy is to pay annual dividends consistent with retaining the

maximum permitted earnings in accordance with investment trust regulations,

thereby building revenue reserves.

In a year when this policy would imply a reduction in the ordinary dividend,

the Directors may choose to maintain the dividend by increasing the percentage

of revenue paid out or by drawing down on revenue reserves. Revenue reserves on

31 March 2022 were twice the annual 2022 ordinary dividend paid on 13 September

2022.

All dividends have been distributed from revenue or revenue reserves.

Chairman's Statement

The Company's net asset value per share ("NAV") fell by 7.6% (from £1,113.81 to

£1,029.42) over the first six months of the financial year ending 31 March

2023; although once the dividend was added in, the total return to shareholders

was minus 3.0%. The total return of the share price registered a steeper fall

of 6.5% with the price falling from £1,105 to £991 and ended the half year

trading at a 3.7% discount to the NAV. These returns are better than the 7.3%

fall in the benchmark MSCI World Index (including dividends). This fall is

understandable when one considers the background uncertainties surrounding the

conflict in Ukraine, rising inflation and rising interest rates.

In this environment it was not surprising that the Company's 24.2% ownership of

Lindsell Train Limited ("LTL"), which accounted for 42.7% of NAV at 30

September 2022, had the most bearing on performance. LTL's valuation fell by

10.4% reflecting its reduced funds under management ("FUM"). FUM fell from £

20.5bn to £18.6bn over the six months, £1.5bn due to net redemptions and £0.4bn

due to falling market prices. LTL has suffered from more than two years of

disappointing relative performance across all its four equity strategies which,

together with widespread outflows from equity funds generally, underlies this

loss of FUM. The experience of recent years illustrates the investment risk

inherent in a fund management business that has a singular approach to

investing. Although LTL offers four strategies differentiated by geography, all

its portfolios are run following a consistent approach and tend to be populated

with the same type of companies. LTL and the Company's Directors strongly

believe that this approach will outperform in the long term, given the

Investment Manager's concentration on companies that should generate

consistently higher returns on capital over time. However, the strategy can

fall out of favour when it is seen to be generating inferior short-term returns

compared with alternative strategies. Whilst the falls in LTL's FUM and

valuation (they are inextricably linked through the Directors' valuation

formula) are painful, the total return from the Company's investment in LTL

over the six months of minus 4.0% is less negative. This is because LTL's

current profits generate a dividend yield on LTL's shares of more than 10% per

annum, which negates the bulk of the fall in the LTL valuation.

Putting LTL's valuation fall in the context of its peers, the recent fall in

markets has hit the valuation of many quoted fund management businesses hard.

The Directors monitor a universe of quoted fund managers listed in developed

markets and a year ago they were valued on average at 3.2% of FUM. That same

universe was valued at 1.4% of FUM at the end of September 2022, a 60% fall. It

is a sobering reminder of how today's reality of falling FUM bears down on the

industry. In this environment, we judge that it is important to be

differentiated, to offer value for money and to be cognisant of the ESG

priorities that clients increasingly demand in addition to adding value through

performance. LTL possesses all these qualities. We take encouragement that LTL

is defined by a well-articulated investment approach that over the longer term

has generated competitive returns. The costs of delivering that approach are

generally well below the industry average and the type of companies favoured

using this approach rank highly on ESG credentials. For these reasons we have

confidence in LTL's future and with what it offers to its clients including

you, our shareholders. It is also for these reasons as well as in

acknowledgment of LTL's superior profitably (notional operating margins of

approximately 50% versus the peer group average of 35%) that the Board values

LTL at 1.95% of FUM at 30 September 2022.

One way in which the Company can directly assist LTL is to help seed its new

fund launches. The Company has used this option - limited to a maximum of 25%

of NAV at cost - throughout its history. Today it retains a holding in the

Lindsell Train North American Equity Fund ("LTNA"), which was bought on its

inception in 2020. It amounted to 8.2% of net assets on 30 September 2022.

LTNA's first two years have been burdened with the same sort of relative

underperformance that has affected all LTL strategies. Since the fund's

inception (on 22 April 2020) to 30 September 2022, its total return has been

13.0% per annum versus the 17.5% per annum rise in the MSCI North American

Index. The underlying investments represent many of the same industries and

themes that are present in our other funds but currently with more of a bias to

media and software. And like LTL's other funds, its companies boast impressive

returns on capital that have been sustained for decades and well exceed

comparative benchmark index returns; this provides the foundation for the

durability in companies that the Manager seeks. Its largest holdings - all

above 5% of the fund's NAV - include Estée Lauder, American Express, Alphabet

and Pepsi. From the time the portfolio was created, with 23 constituent

companies, it has not changed aside from the additions of Madison Square Garden

Sports later in 2020 and FICO earlier this year. Now into its third year, LTL

and the fund's manager James Bullock are beginning to promote the fund more

widely with its recent addition to multiple investment platforms.

Notwithstanding its relative underperformance, LTNA has made an important

contribution to the Company's returns through its strong absolute performance

of 13% per annum since inception, from a market (North America) otherwise less

represented within the Company's portfolio. We hope that it will also grow and

flourish as a core strategy for LTL in the future.

I am also pleased to welcome two new additions to the Board. Roger Lambert and

Helena Vinnicombe joined as Non-Executive Directors at the end of September.

They have joined the Audit, Nomination and Management Engagement Committees.

Roger and Helena will offer themselves for election by shareholders at the 2023

AGM. Both bring relevant experience and skills and, I dare say, some new

perspectives.

Julian Cazalet

Chairman

4 December 2022

Investment Manager's Report

"The best is yet to come." This attitude to life is both rational and

psychologically therapeutic - certainly for those facing the challenges of

investment markets.

I admit that threading through today's macro-economic and geopolitical thickets

I must work harder than usual to maintain my native optimism. But when I turn

to the prospects for the businesses we are invested in - they appear brighter

and brighter.

Here are some facts or anecdotes that help justify a view that the best is

still to come for your Company's key portfolio holdings.

Nintendo is the creator of some of the most sought-after entertainment content

on the planet. This content includes at least 33% ownership of purportedly the

biggest grossing media franchise of all-time: Pokémon, with estimated lifetime

revenues of $90bn. Nintendo has rights to make all Pokémon console games, in

addition to its ownership stake. Now, the biggest ever Japanese launch for a

Pokémon game was that of Pokémon Black and White, which sold 2.6m copies in

7 days back in 2010. This was the biggest first week sale for any game in Japan

ever, until September 2022 when Nintendo released Splatoon 3. This relatively

new (2015) and fun series, which is 100% owned by Nintendo, sold 3.6m copies in

3 days - a new record for a first week - and continues to top the Japanese

charts and perform strongly worldwide. Well done to Nintendo for creating a new

franchise with the potential for revenues of billions of dollars. Meanwhile,

the Mario and Zelda franchises have sold more games on Switch than any previous

Nintendo device; with Mario Kart 8, at 55m copies sold, the bestselling in this

series and now the 6th bestselling video game of all time. Gaming is an

immature industry; Nintendo's content is beloved; new sales records for its

games and devices are likely to be set for years to come.

RELX's Elsevier academic publishing division recently confirmed it publishes

18% of global research articles, but that it commands 27% of all citations

(demonstrating the high calibre of research submitted to its journals).

Reinforcing the value of Elsevier's market position, consider the following

statistics RELX shares on its website. Back in 1950, the quantum of medical

research undertaken worldwide was doubling every 50 years. By 2020, it was

doubling every 73 days. Meanwhile, the data handled by RELX's legal and

business information subsidiary, LexisNexis, is doubling every year. Finally,

note that RELX's fastest growing division, Risk, derives 65% of its profits

from services that didn't exist 7 years ago. It's hard to conclude anything but

that RELX's customers are going to need even more of its data and analytics

services in years to come, as business and academic professionals are required

to make sense of exponentially growing scads of data.

At another data service provider, London Stock Exchange Group, we were

encouraged by the chutzpah demonstrated by CEO David Schwimmer in July, when he

remarked that in his previous role at Goldman Sachs he had advised on hundreds

of transactions, but he genuinely couldn't think of a single one "as

transformational and value-creating as this one" (LSE's 2021 acquisition of

Refinitiv). It has to be said that with each passing update from the company,

Schwimmer's assertion looks better and better based. Meanwhile, while turmoil

in fixed interest and currency markets is, of course, troubling for asset

owners, it is not necessarily so for the owners of liquidity pools where trades

are executed, or for providers of post-trade services. It seems clear volumes

are exceptionally strong across LSE's business currently.

Ivan Menezes, CEO of Diageo, was rightly proud to note that in 2022 one in

every ten pints served in a London pub or bar was a pint of Guinness. That's a

new record and another milestone for this extraordinary global brand. Guinness

is Diageo's second biggest brand by sales value and grew at 32% last year and

not all of that is just a rebound from Covid-19. And, sticking to beer, what to

make of the fact that Heineken 0% has become the world's #1 non-alcoholic beer

brand, 2.5 billion pints sold last year, growing at 30%? That's 6% of

Heineken's total business and it appears it does not cannibalise the rest of

group sales. In other words, this is a new and dynamically growing brand for

Heineken. Heineken shares traded at c.?6 in 1992 and are close to ?90 today. No

one will complain if the stock gives another 15-fold increase over the next

three decades - and looking at its brands and market opportunities - why

shouldn't it?

Of course, I can continue. We don't own any companies where we don't expect

their future to be better than the past, however glorious. To conclude and

turning to the geopolitics - we admired Narendra Modi, India's prime minister,

when he proclaimed: "I know that today's era is not the era of war." Factually,

of course, he is sadly incorrect. But we must hope that his aspiration is

shared around the world, especially by the young. If he turns out to be right:

the best really is still yet to come.

Nick Train

Lindsell Train Limited

Investment Manager

4 December 2022

Portfolio Holdings at 30 September 2022

(All ordinary shares unless otherwise stated)

Look-

through

Fair % of basis:

value net % of total

Holding Security £'000 assets assets?

6,450 Lindsell Train Limited 87,855 42.7% 42.7%

235,000 London Stock Exchange 17,926 8.7% 8.9%

12,500,000 LF Lindsell Train North American Equity Fund 16,841 8.2% 0.0%

420,500 Diageo 15,966 7.7% 8.0%

410,000 Nintendo 14,845 7.2% 7.2%

222,000 Unilever 8,811 4.3% 4.4%

363,000 RELX 7,990 3.9% 4.1%

97,400 PayPal 7,510 3.6% 3.9%

150,000 Mondelez International 7,365 3.6% 4.0%

1,263,393 A.G. Barr 5,748 2.8% 2.8%

89,000 Heineken 5,506 2.7% 2.8%

420,000 Finsbury Growth & Income Trust PLC 3,322 1.6% 0.0%

36,621 Laurent Perrier 3,092 1.5% 1.5%

The Lindsell Train Investment

Trust plc Indirect Holdings - - 8.2%

Total Investments 202,777 98.5% 98.5%

Net current Assets 3,106 1.5% 1.5%

Net Assets 205,883 100.0% 100.0%

? Look-through basis: This adjusts the percentages held in each security

upwards by the amount held by LTL managed funds and adjusts the funds' holdings

downwards to account for the overlap. It provides shareholders with a measure

of stock specific risk by amalgamating the direct holdings of the Company with

the indirect holdings held within the LTL funds.

Leverage

The balance sheet positions of the Funds managed by LTL as at 30 September 2022

are shown below:

Net equity

Fund exposure

LF Lindsell Train North American Equity Fund Acc 99.0%

Finsbury Growth & Income Trust PLC 102.4%

Analysis of Investment Portfolio at 30 September 2022

Breakdown by location of listing

(look-through basis)^

30 September

2022

UK* 71%

USA 16%

Japan 7%

Europe excluding UK 4%

Cash and equivalents 2%

100%

Breakdown by location of underlying company revenues

(look-through basis)^

UK^^ 28%

Europe excluding UK^^ 30%

USA^^ 26%

Rest of the World^^ 11%

Japan 3%

Cash and Equivalents 2%

100%

Breakdown by sector

(look-through basis)^

Financials* 53%

Consumer Staples 26%

Communication services 8%

Information Technology 5%

Industrials 5%

Cash and Equivalents 2%

Consumer Discretionary 1%

100%

^ Look-through basis: This adjusts the percentages held in each asset

class, country or currency by the amount held by LTL managed funds. It provides

Shareholders with a more accurate measure of country and currency exposure by

aggregating the direct holdings of the Company with the indirect holdings held

by the LTL funds.

* LTL accounts for 42.7% and is not listed.

^^ LTL accounts for 18 percentage points of the Europe figure, 19 percentage

points of the UK figure, 5 percentage points of the USA figure, and

1 percentage point of the Rest of the World figure.

Income Statement

Six months ended Six months ended

30 September 2022 30 September 2021

Unaudited Unaudited

Revenue Capital Total Revenue Capital Total

Notes £'000 £'000 £'000 £'000 £'000 £'000

(Losses)/gains on - (13,047) (13,047) - 7,764 7,764

investments held at fair

value through profit or loss

Exchange (loss)/gains on - (10) (10) - 2 2

currency

Income 2 7,793 - 7,793 7,647 - 7,647

Investment management fees 3 (586) - (586) (675) - (675)

Other expenses 4 (371) - (371) (340) - (340)

Return/(loss) before tax 6,836 (13,057) (6,221) 6,632 7,766 14,398

Tax 5 (57) - (57) (42) - (42)

Return/(loss) after tax for 6,779 (13,057) (6,278) 6,590 7,766 14,356

the financial period

Return/(loss) per Ordinary 6 £33.90 £(65.29) £(31.39) £32.95 £38.83 £71.78

Share

All revenue and capital items in the above statement derive from continuing

operations.

The total columns of this statement represent the profit and loss accounts of

the Company. The revenue and capital columns are supplementary to this and are

prepared under the guidance published by the Association of Investment

Companies.

The Company does not have any other recognised gains or losses. The net loss

for the period disclosed above represents the Company's total comprehensive

income.

No operations were acquired or discontinued during the period.

Statement of Changes in Equity

Share Special Capital Revenue

capital reserve reserve reserve Total

£'000 £'000 £'000 £'000 £'000

For the six months ended 30

September 2022 (unaudited)

At 31 March 2022 150 19,850 180,982 21,779 222,761

(Loss)/return after tax for the - - (13,057) 6,779 (6,278)

financial period

Dividends paid - - - (10,600) (10,600)

At 30 September 2022 150 19,850 167,925 17,958 205,883

Share Special Capital Revenue

capital reserve reserve reserve Total

£'000 £'000 £'000 £'000 £'000

For the six months ended 30

September 2021 (unaudited)

At 31 March 2021 150 19,850 198,066 19,050 237,116

Return after tax for the financial - - 7,766 6,590 14,356

period

Dividends paid - - - (10,000) (10,000)

At 30 September 2021 150 19,850 205,832 15,640 241,472

Statement of Financial Position

30 September 31 March

2022 2022

Unaudited Audited

Note £'000 £'000

Fixed assets

Investments held at fair value through

profit or loss 202,777 215,768

Current assets

Other receivables 469 513

Cash at bank 2,839 6,708

3,308 7,221

Creditors: amounts falling due within one year

Other payables (202) (228)

(202) (228)

Net current assets 3,106 6,993

Net assets 205,883 222,761

Capital and reserves

Called up share capital 150 150

Special reserve 19,850 19,850

20,000 20,000

Capital reserve 167,925 180,982

Revenue reserve 17,958 21,779

Total shareholders' funds 205,883 222,761

Net asset value per Ordinary Share 7 £1,029.42 £1,113.81

Cash Flow Statement

Six months Six months

ended ended

30 September 30 September

2022 2021

Unaudited Unaudited

£'000 £'000

Net (loss)/return before finance costs and tax (6,221) 14,398

Losses/(gains) on investments held at fair value 13,047 (7,764)

Losses/(gains) on exchange movements 10 (2)

Decrease/(increase) in other receivables 13 (5)

Decrease in accrued income 33 120

Decrease in other payables (35) (2,675)

Taxation on investment income (50) (49)

Net cash inflow from operating activities 6,797 4,023

Purchase of investments held at fair value (56) (47)

Sale of investments held at fair value - 694

Net cash (outflow)/inflow from investing activities (56) 647

Equity dividends paid (10,600) (10,000)

Net cash outflow from financing activities (10,600) (10,000)

Decrease in cash and cash equivalents (3,859) (5,330)

Cash and cash equivalents at beginning of period 6,708 5,541

(Losses)/gains on exchange movements (10) 2

Cash and cash equivalents at end of period 2,839 213

Notes to the Financial Statements

1 Accounting policies

The financial statements of the Company have been prepared under the historical

cost convention modified to include the revaluation of investments and in

accordance with FRS 104 "Interim Financial Reporting" and with the Statement of

Recommended Practice ("SORP") "Financial Statements of Investment Trust

Companies and Venture Capital Trusts", issued by the Association of Investment

Companies updated in July 2022 and the Companies Act 2006.

The accounting policies followed in this Half-year Report are consistent with

the policies adopted in the audited financial statements for the year ended 31

March 2022.

2 Income

Six months Six months

ended ended

30 September 30 September

2022 2021

Unaudited Unaudited

£'000 £'000

Income from investments

Overseas dividends 493 369

UK dividends

- Lindsell Train Limited 6,288 6,476

- Other UK dividends 1,006 802

- Deposit interest 6 -

7,793 7,647

3 Investment management fees

Six months Six months

ended ended

30 September 30 September

2022 2021

Unaudited Unaudited

£'000 £'000

Investment management fee 644 754

Rebate of investment management fee (58) (79)

Net management fees 586 675

4 Other expenses

Six months Six months

ended ended

30 September 30 September

2022 2021

Unaudited Unaudited

£'000 £'000

Directors' emoluments 61 58

Company Secretarial & Administration fee 99 109

Auditor's remuneration?* 30 18

Tax compliance fee 2 2

Other** 179 153

371 340

? Remuneration for the audit of the Financial Statements of the Company.

* Excluding VAT.

** Includes registrar's fees, printing fees, marketing fees, safe custody

fees, London Stock Exchange/FCA fees, Key Man and Directors' and Officers'

liability insurance, Employer's National Insurance and legal fees.

5 Effective rate of tax

The effective rate of tax reported in the revenue column of the income

statement for the six months ended 30 September 2022 is 0.83% (six months ended

30 September 2021: 0.63%), based on revenue profit before tax of £6,836,000

(six months ended 30 September 2021: £6,632,000). This differs from the

standard rate of tax, 19% (six months ended 30 September 2021: 19%) as a result

of revenue not taxable for Corporation Tax purposes.

6 Total (loss)/return per Ordinary Share

Six months Six months

ended ended

30 September 30 September

2022 2021

Unaudited Unaudited

Total (loss)/return £(6,278,000) £14,356,000

Weighted average number of Ordinary Shares

in issue during the period 200,000 200,000

Total (loss)/return per Ordinary Share £(31.39) £71.78

The total (loss)/return per Ordinary Share detailed above can be further

analysed between revenue and capital, as below:

Revenue return per Ordinary Share

Revenue return £6,779,000 £6,590,000

Weighted average number of Ordinary Shares in issue during 200,000 200,000

the period

Revenue return per Ordinary Share £33.90 £32.95

Capital (loss)/return per Ordinary Share

Capital (loss)/return £(13,057,000) £7,766,000

Weighted average number of Ordinary Shares in issue during 200,000 200,000

the period

Capital (loss)/return per Ordinary Share £(65.29) £38.83

7 Net asset value per Ordinary Share

Six months ended Year ended

30 September 31 March

2022 2022

Unaudited Audited

Net assets attributable £205,883,000 £222,761,000

Ordinary Shares in issue at the period/year end 200,000 200,000

Net asset value per Ordinary Share £1,029.42 £1,113.81

8 Valuation of financial instruments

The Company's investments and derivative financial instruments as disclosed in

the Statement of Financial Position are valued at fair value.

FRS 102 requires an entity to classify fair value measurements using a fair

value hierarchy that reflects the significance of the inputs used in making the

measurements. Categorisation within the hierarchy has been determined on the

basis of the lowest level input that is significant to the fair value

measurement of the relevant asset as follows:

* Level 1 - The unadjusted quoted price in an active market for identical

assets or liabilities that the entity can access at the measurement date.

* Level 2 - Inputs other than quoted prices included within Level 1 that are

observable (i.e. developed using market data) for the asset or liability,

either directly or indirectly.

* Level 3 - Inputs are unobservable (i.e. for which market data is

unavailable) for the asset or liability.

The tables below set out fair value measurements of financial instruments as at

the year end by the level in the fair value hierarchy into which the fair value

measurement is categorised.

Financial assets/liabilities at fair value through profit or loss

Level 1 Level 2 Level 3 Total

At 30 September 2022 £'000 £'000 £'000 £'000

Investments 98,081 16,841 87,855 202,777

Level 1 Level 2 Level 3 Total

At 31 March 2022 £'000 £'000 £'000 £'000

Investments 101,257 17,601 96,910 215,768

Note: Within the above tables, level 1 comprises all the Company's ordinary

investments, level 2 represents the investment in LF Lindsell Train North

American Equity Fund and level 3 represents the investment in LTL.

During the year ended 31 March 2022 the Board appointed J.P. Morgan Cazenove

Ltd to undertake an independent review of the Company's valuation methodology

applied to its unlisted investment in LTL. The new methodology was adopted and

applied to monthly valuations from 31 March 2022 onwards.

The new methodology has a single component based on a percentage of LTL's funds

under management ("FUM"), with the percentage applied being reviewed monthly

and adjusted to reflect the ongoing profitability of LTL. At the end of each

month the ratio of LTL's notional annualised net profits* to LTL's FUM is

calculated and, depending on the result, the percentage of FUM is adjusted

according to the table shown in Appendix 2.

The valuation methodology was formally reviewed previously in March 2018 and

March 2020.

The Board reserves the right to vary its valuation methodology at its

discretion.

* LTL's notional net profits are calculated by applying a fee rate

(averaged over the last six months) to the most recent end-month FUM to produce

annualised fee revenues excluding performance fees. Notional staff costs of 45%

of revenues, annualised fixed costs and tax are deducted from revenues to then

produce notional annualised net profits.

9 Sections 1158/1159 of the Corporation Tax Act 2010

It is the intention of the Directors to conduct the affairs of the Company so

that the Company satisfies the conditions for approval as an Investment Trust

Company set out in Sections 1158/1159 of the Corporation Tax Act 2010.

10 Going Concern

The Directors believe, having considered the Company's investment objective,

risk management policies, capital management policies and procedures, and the

nature of the portfolio and the expenditure projections, that the Company has

adequate resources, an appropriate financial structure and suitable management

arrangements in place to continue in operational existence for the foreseeable

future, and, more specifically, that there are no material uncertainties

relating to the Company that would prevent its ability to continue in such

operational existence for at least twelve months from the date of the approval

of this Half-year Report. For these reasons, they consider there is reasonable

evidence to continue to adopt the going concern basis in preparing the

financial statements. In reviewing the position as at the date of this Report,

the Board has considered the guidance on this matter issued by the Financial

Reporting Council.

As part of their assessment, the Directors have given careful consideration to

the consequences for the Company of continuing uncertainty in the global

economy. As previously reported, stress testing was also carried out in April

2022 to establish the impact of a significant and prolonged decline in the

Company's performance and prospects. This included a range of plausible

downside scenarios such as reviewing the effects of substantial falls in

investment values and the impact of the Company's ongoing charges ratio.

11 2022 Accounts

The figures and financial information for the year to 31 March 2022 are

extracted from the latest published accounts of the Company and do not

constitute statutory accounts for the year.

Those accounts have been delivered to the Registrar of Companies and included

the Report of the Company's auditor which was unqualified and did not contain a

reference to any matters to which the Company's auditor drew attention by way

of emphasis without qualifying the report, and did not contain a statement

under section 498 of the Companies Act 2006.

Interim Management Report

The Directors are required to provide an Interim Management Report in

accordance with the UK Listing Authority's Disclosure and Transparency Rules.

They consider that the Chairman's Statement and the Investment Manager's

Report, the following statements and the Directors' Responsibility Statement

below together constitute the Interim Management Report for the Company for the

six months ended 30 September 2022.

Principal Risks and Uncertainties

The Directors continue to review the key risk register for the Company which

identifies the risks that the Company is exposed to, the controls in place and

the actions being taken to mitigate them. This is set against the backdrop of

increased risk levels within the global economy created by ongoing global

supply chain disruption, rising levels of inflation and interest rates,

together with the consequences of the war in Ukraine and the subsequent

long-term effects on economies and international relations. The Directors have

considered the impact of the continued uncertainty on the Company's financial

position and, based on the information available to them at the date of this

Report, have concluded that no adjustments are required to the accounts as at

30 September 2022.

A review of the half-year and the outlook for the Company can be found in the

Chairman's Statement and in the Investment Manager's Review. The principal

risks and uncertainties faced by the Company include the following:

* The Board may have to reduce the Company's dividend.

* The Company's share price total return may differ materially from the NAV

per share total return.

* The growth of retail platforms has a detrimental effect on shareholder

engagement.

* The departure of a key individual at the Investment Manager may affect the

Company's performance.

* The investment strategy adopted by the Investment Manager, including the

high degree of concentration of the investment portfolio, may lead to an

investment return that is materially lower than the Company's benchmark

index, and/or a possible failure to achieve the Company's investment

objective.

* The investment in LTL becomes an even greater proportion of the overall

value of the Company's portfolio.

* Adverse reputational impact of one or more of the Company's key service

providers which, by association, causes the Company reputational damage.

* Fraud (including unauthorised payments and cyber-fraud) occurs leading to a

loss.

* The Company is exposed to credit risk.

* The Company is exposed to market price risk.

* The Company and/or the Directors fail(s) to comply with its legal

requirement with any applicable regulations or the regulatory environment

in which the Company operates changes, affecting its modus operandi.

* The regulatory environment in which the Company operates changes, affecting

the Company's business model.

* The Company's valuation of its investment in LTL is materially misstated.

The Audit Committee identified the following emerging risks during the year to

be included in the risk register.

The invasion of Ukraine by Russia introduces new risks and exacerbates existing

risks. These include:

* Increased inflationary pressures, that were already elevated from supply

shortages as the Covid-19 pandemic eased.

* Higher inflation is leading policy makers to increase interest rates. This

in turn may lead to a reduction in trade, a threat of recession and higher

unemployment.

* Sanctions damage the prospects of investee companies with material exposure

to Russia.

* Increased market volatility and reduced risk appetites across a wide

variety of asset classes.

* Increased threat of state-sponsored cyber-attacks.

Information on these risks is given in the Annual Report for the year ended 31

March 2022.

The Board believes that the Company's principal risks and uncertainties have

not changed materially since the date of that report and are not expected to

change materially for the remaining six months of the Company's financial year.

Related Party Transactions

During the first six months of the current financial year, no transactions with

related parties have taken place which have materially affected the financial

position or the performance of the Company.

Directors' Responsibilities

The Board of Directors confirms that, to the best of its knowledge:

i. the condensed set of financial statements contained within the Half-year

Report have been prepared in accordance with applicable United Kingdom

Generally Accepted Accounting Practice standards; and

ii. the Interim Management Report includes a true and fair review of the

information required by:

a. DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six

months of the financial year and their impact on the condensed set of

financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year;

b. DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially affected

the financial position or performance of the entity during that period;

and

c. any changes in the related party transactions described in the last

Annual Report that could do so.

The Half-year Report has not been audited by the Company's auditors.

This Half-year Report contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the information

available to them up to the date of this Report and such statements should be

treated with caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking information.

For and on behalf of the Board

Julian Cazalet

Chairman

4 December 2022

Appendix 1

Half-year review of Lindsell Train Limited ("LTL") the Investment Manager of

The Lindsell Train Investment Trust plc ("LTIT") as at 31 July 2022

Funds under Management

Jul 2022 Jan 2022 Jul 2021

FUM by Strategy £m £m £m

UK 8,099 8,475 9,483

Global 10,810 12,040 13,900

Japan 624 702 887

North America 29 28 28

Total 19,562 21,245 24,298

Largest Client Accounts

Jul 2022 Jan 2022 Jul 2021

% of FUM % of FUM % of FUM

Largest Pooled Fund Asset 30% 34% 37%

Largest Segregated Account 10% 10% 9%

Financials

Jul 2022 Jul 2021 %

Profit & Loss £'000 £'000 Change

Fee Revenue

Investment Management Fee 49,259 60,539 -19%

Performance Fee 0 2,662 -100%

Bank Interest & Other Income 38 4

49,297 63,205

Staff Remuneration* (15,101) (20,700) -27%

Fixed Overheads (2,228) (2,207) 1%

Operating Profit 31,968 40,298 -21%

FX Currency Translation Gain/(Loss) 3,005 (563)

Investment Unrealised (Loss)/Gain (14) 1,154

Profit before taxation 34,959 40,889

Taxation (6,202) (7,919)

Net Profit 28,757 32,970 -13%

Dividends (25,879) (26,751)

Retained profit 2,878 6,219

Capital & Reserves

Called up Share Capital 266 266

Treasury Shares (1,794) (132)

Profit and Loss Account 95,500 86,632

Shareholders' Funds 93,972 86,766

Balance Sheet

Fixed Assets 133 185

Investments 6,900 7,153

Current Assets (inc cash at bank) 94,206 88,728

Liabilities (7,267) (9,300)

Net Assets 93,972 86,766

* Staff costs include permanent staff remuneration, social security,

temporary apprentice levy, introduction fees and other staff related costs.

No more than 25% of fees (other than LTIT) can be paid as permanent staff

remuneration.

Five Year History

Jul 2022 Jul 2021 Jul 2020 Jul 2019 Jul 2018

Operating Profit Margin 65% 64%** 66%** 64%** 61%**

Earnings per share (£)* 1,083 1,237 1,084 1,054 717

Dividends per share (£)* 975 1,004 949 776 525

Total Staff Cost as % of Revenue 31% 33% 29% 33% 36%

Opening FUM (£m) 24,298 21,151 22,563 15,304 11,326

- Effect of market movements (£m) -1,271 3,041 -1,385 4,568 2,044

- Net new fund flows (£m) -3,465 106 -27 2,691 1,934

-4,736 3,147 -1,412 7,259 3,978

Changes in FUM (£m)

Closing FUM (£m) 19,562 24,298 21,151 22,563 15,304

LTL Open-ended funds as % of total 66% 73% 72% 75% 72%

Client Relationships

- Pooled funds 5 5 5 4 4

- Separate accounts 18 17 17 17 17

Ownership

Jul 2022 Jan 2022 Jul 2021 Jan 2021 Jul 2020

Michael Lindsell & spouse 9,650 9,650 9,650 9,650 9,650

Nick Train & spouse 9,650 9,650 9,650 9,650 9,650

The Lindsell Train Investment Trust plc 6,450 6,450 6,450 6,450 6,450

Other Directors/employees 805 778 899 875 871

26,555 26,528 26,649 26,625 26,621

Treasury Shares 105 132 11 35 39

Total Shares 26,660 26,660 26,660 26,660 26,660

* On 1 February 2019 LTL undertook a share split with each share sub

divided into 10 shares of £10 each. The per share figures in the table above

are retrospectively changed in y/e January 2018 and y/e January 2019 based on

26,660 shares for ease of comparison.

** Amended from previous Half-year Reports to exclude the effect of FX

translation and unrealised investment gain/losses.

Board of Directors

Nick Train Chairman and Portfolio Manager

Michael Lindsell Chief Executive and Portfolio Manager

Michael Lim IT Director and Secretarial

Keith Wilson Head of Marketing & Client Services

Jane Orr Director of Marketing

Joss Saunders Chief Operating Officer

James Alexandroff Non-Executive Director

Julian Bartlett Non-Executive Director

Employees

Jul 2022 Jan 2022 Jul 2021 Jan 2021 Jul 2020

Investment Team (including three Portfolio 7 7 6 6 6

Managers)

Client Servicing and Marketing 7 7 6 6 6

Operations and Compliance 12 11 8 7 8

Non-Executive Directors 2 2 2 2 2

28 27 22 21 22

Appendix 2

LTIT Director's valuation of LTL (unaudited)

30 Sept 2022 30 Sept 2021^

Notional annualised net profits (A)* (£'000) 38,368 50,166

Funds under Management less LTIT holdings (B) (£'000) 18,548,853 23,650,721

Normalised notional net profits as % of FUM A/B = (C) 0.207% 0.212%

% of FUM (D) (see table below to view % corresponding to C) 1.95% 2.00%

Valuation (E) i.e. B x D (£'000) 361,703 473,014

Number of shares in issue (F)? 26,555 26,649

Valuation per share in LTL i.e. E / F £13,621 £17,750

* Notional annualised net profits are made up of:

- annualised fee revenue, based on 6-mth average fee rate applied to most

recent month-end AUM

- annualised fee revenue excludes performance fees

- annualised interest income, based on 3-mth average

- notional staff costs of 45% of annualised fee revenue

- annualised operating costs (excluding staff costs), based on 3-mth

normalised average

- notional tax at 19%

^ The 30 September 2021 valuation (shown above) was derived by applying

new valuation methodology, which came into effect from 31 March 2022.

? The reduction in shares in issue is accounted for by net purchases of

Treasury shares from LTL employees.

Notional annualised net Valuation of LTL -

profits*/FUM (%) Percentage of FUM

0.15 - 0.16 1.70%

0.16 - 0.17 1.75%

0.17 - 0.18 1.80%

0.18 - 0.19 1.85%

0.19 - 0.20 1.90%

0.20 - 0.21 1.95%

0.21 - 0.22 2.00%

0.22 - 0.23 2.05%

0.23 - 0.24 2.10%

0.24 - 0.25 2.15%

0.25 - 0.26 2.20%

0.26 - 0.27 2.25%

Glossary of Terms and Alternative Performance Measures

Alternative Investment Fund Managers Directive ("AIFMD")

The Alternative Investment Fund Managers Directive (the "Directive") is a

European Union Directive that entered into force on 22 July 2013. The Directive

regulates EU fund managers that manage alternative investment funds (this

includes investment trusts).

Alternative Performance Measure ("APM")

An alternative performance measure is a financial measure of historical or

future financial performance, financial position or cash flow that is not

prescribed by the relevant accounting standards. The APMs are the discount and

premium, dividend yield, share price and NAV total returns and ongoing charges.

The Directors believe that these measures enhance the comparability of

information between reporting periods and aid investors in understanding the

Company's performance.

Benchmark

With effect from 1 April 2021 the Company's performance benchmark is the MSCI

World Index total return in Sterling.

Prior to 1 April 2021 the benchmark was the annual average redemption yield on

the longest-dated UK government fixed rate (1.625% 2071) calculated using

weekly data, plus a premium of 0.5%, subject to a minimum yield of 4.0%.

Discount and premium (APM)

If the share price of an investment trust is higher than the Net Asset Value

(NAV) per share, the shares are trading at a premium to NAV. In this

circumstance the price that an investor pays or receives for a share would be

more than the value attributable to it by reference to the underlying assets.

The premium is the difference between the share price (based on mid-market

share prices) and the NAV, expressed as a percentage of the NAV.

A discount occurs when the share price is below the NAV. Investors would

therefore be paying less than the value attributable to the shares by reference

to the underlying assets.

A premium or discount is generally the consequence of the balance of supply and

demand for the shares on the stock market.

The discount or premium is calculated by dividing the difference between the

share price and the NAV by the NAV.

As at As at

30 31 March

September

2022 2022

£ £

Share Price 991 1,105

Net Asset Value per Share 1,029.42 1,113.81

Discount to Net Asset Value per Share 3.7% 0.8%

MSCI World Index total return in Sterling

The Company's benchmark provider requires the following statement to be

included.

"The MSCI information (relating to the Benchmark) may only be used for your

internal use, may not be reproduced or redisseminated in any form and may not

be used as a basis for or a component of any financial instruments or products

or indices. None of the MSCI information is intended to constitute investment

advice or a recommendation to make (or refrain from making) any kind of

investment decision and may not be relied on as such. Historical data and

analysis should not be taken as an indication or guarantee of any future

performance analysis, forecast or prediction. The MSCI information is provided

on an "as is" basis and the user of this information assumes the entire risk of

any use made of this information. MSCI, each of its affiliates and each other

person involved in or related to compiling, computing or creating any MSCI

information (collectively, the "MSCI Parties") expressly disclaims all

warranties (including, without limitation, any warranties of originality,

accuracy, completeness, timeliness, non-infringement, merchantability and

fitness for a particular purpose) with respect to this information. Without

limiting any of the foregoing, in no event shall any MSCI Party have any

liability for any direct, indirect, special, incidental, punitive,

consequential (including, without limitation lost profits) or any other

damages. (www.msci.com)."

Net asset value ("NAV") per Ordinary Share

The NAV is shareholders' funds expressed as an amount per individual share.

Equity shareholders' funds are the total value of all the Company's assets, at

current market value, having deducted all current and long-term liabilities and

any provision for liabilities and charges.

The NAV of the Company is published weekly and at each month end.

The figures disclosed in the Statement of Financial Position have been

calculated as shown below:

Six months

ended Year ended

30 September 31 March

2022 2022

Net Asset Value (a) £205,883,000 £222,761,000

Ordinary Shares in issue (b) 200,000 200,000

Net asset value per Ordinary Share (a) ÷ (b) £1,029.42 £1,113.81

Revenue return per share

The revenue return per share is the revenue return profit for the period

divided by the weighted average number of ordinary shares in issue during the

period.

Share price and NAV total return (APM)

This is the return on the share price and NAV taking into account both the rise

and fall of share prices and valuations and the dividends paid to shareholders.

Any dividends received by a shareholder are assumed to have been reinvested in

either additional shares (for share price total return) or the Company's assets

(for NAV total return).

The share price and NAV total returns are calculated as the return to

shareholders after reinvesting the net dividend in additional shares on the

date that the share price goes ex-dividend.

The figures disclosed in the Financial Highlights and Chairmans Statement have

been calculated as shown below:

Six months ended

30 September 2022

LTIT NAV LTIT Price

NAV/Price at 30 September 2022 a £1,029.42 £991.00

Dividend Adjustment Factor* b 1.049 1.043

Adjusted closing NAV/Price c = a x b £1,080.03 £1,033.27

NAV/Price 31 March 2022 d £1,113.81 £1,105.00

Total return [(c/d)-1]*100 -3.0% -6.5%

* The dividend adjustment factor is calculated on the assumption that the

dividends of £53.00 paid by the Company during the year were reinvested into

shares or assets of the Company at the cum income NAV per share/share price, as

appropriate, at the ex-dividend date.

LTL total return performance

The total return performance for LTL is calculated as the return after

receiving but not reinvesting dividends received over the period.

Six months ended

30 September 2022

LTL valuation

Valuation at 31 March 2022 a £15,205

Valuation at 30 September 2022 b £13,621

Dividends paid during the period c £975

Total return [(b-a)+c]/a*100 -4.0%

Treasury Shares

Shares previously issued by a company that have been bought back from

Shareholders to be held by the Company for potential sale or cancellation at a

later date. Such shares are not capable of being voted and carry no rights to

dividends.

-ENDS-

For further information please contact

Victoria Hale

Company Secretary

Frostrow Capital LLP

020 3100 8732

END

(END) Dow Jones Newswires

December 05, 2022 02:00 ET (07:00 GMT)

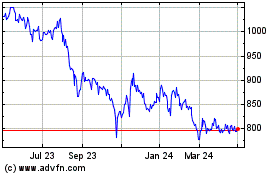

Lindsell Train Investment (LSE:LTI)

Historical Stock Chart

From Aug 2024 to Sep 2024

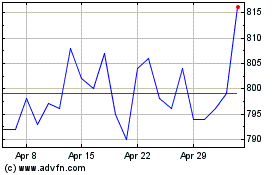

Lindsell Train Investment (LSE:LTI)

Historical Stock Chart

From Sep 2023 to Sep 2024