TIDMLLAI

RNS Number : 1446G

LungLife AI, INC

28 March 2022

LungLife AI, Inc.

(the "Company" or "LungLife")

Preliminary results

LungLife AI (AIM: LLAI), a developer of clinical diagnostic

solutions for lung cancer, announces its maiden audited preliminary

results for the year ended 31 December 2021, following admission to

trading on AIM on 8 July 2021.

Summary and Highlights for the year:

-- Revenues of $196k (2020: $205k) of which $88k (2020: $Nil)

represented first royalty income from sales under our sub license

in China

-- Loss before tax of $7.43m, after charging IPO costs of $1.1m.

Adjusted EBITDA(1) loss of $5.8m

-- Admission to AIM and successful GBP17m (gross) fundraising at

an issue price of 176p on 8 July 2021

-- Cash as of 31 December 2021 of $14.62m

-- The Company's clinical laboratory in Thousand Oaks,

California awarded accreditation by the College of American

Pathologists (CAP)

Post-period end:

-- CPT(R) Proprietary Laboratory Analyses (PLA code), a key

component towards reimbursement in the US market, awarded and

scheduled to become effective on 1 April 2022

-- In February 2022, enrolled first participant into

multi-centre clinical validation study for those with indeterminant

lung nodules. The study will be used to validate the LungLB(R) test

performance, enrolling 425 participants from sites across the US,

with the study expected to complete by Q1 2023

-- Veterans Affairs (VA) sites added to validation study in

March 2022, and first participant enrolled from the Bay Pines VA in

Florida

-- Appointment of Dr Drew Moghanaki, an internationally

recognised lung cancer specialist, to the Company's Scientific

Advisory Board

Commenting, Paul Pagano, Chief Executive Officer of LungLife,

said : "Since IPO, we have achieved several milestones which has

kept us on track with our strategic vision. During the year, we

laid the groundwork towards commencing our multi-centre validation

study, and post-period end we enrolled our first participants. Our

clinical laboratory in Thousand Oaks also achieved CAP

accreditation in November 2021, confirming that we are maintaining

the highest standards of excellence in laboratory testing for

patients.

"Throughout the rest of the year we will continue with our

validation study which we expect to complete in Q1 2023, as well as

work towards regulatory authorisation and commercial reimbursement,

which we made our first step towards post-period end when we were

granted a CPT(R) PLA code. We remain focused on bringing early

detection solutions to those who need them most, which will lead to

better outcomes for people with lung cancer."

For further information please contact:

LungLife AI, Inc. www.lunglifeai.com

Paul Pagano, CEO Via Walbrook PR

David Anderson, CFO

Investec Bank plc (Nominated Adviser Tel: +44 (0)20 7597 5970

& Broker)

Daniel Adams / Virginia Bull / Cameron

MacRitchie

Walbrook PR Limited Tel: +44 (0)20 7933 8780 or LungLifeAI@walbrookpr.com

Paul McManus / Alice Woodings / Phillip Mob: 07980 541 893 / 07407 804 654 /

Marriage 07867 984 082

(1) Earnings before income tax, depreciation and amortisation,

adjusted to exclude exceptional items and other operating

income

About LungLife

LungLife AI is a developer of clinical diagnostic solutions

designed to make a significant impact in the early detection of

lung cancer, the deadliest cancer globally. Using a minimally

invasive blood draw, the Company's LungLB(R) test is designed to

deliver additional information to clinicians who are evaluating

indeterminate lung nodules. For more information visit

www.lunglifeai.com

Our Purpose is to be a driving force in the early detection to

lung cancer. And our Vision is to invert the 20:80 ratio such that

in years to come at least 80% of lung cancer is detected early.

Chairman's Statement

I am delighted to report on the first annual results for

LungLife AI, Inc. since our admission to trading on AIM in July

2021. We have continued to deliver on the Company's objectives and

remain committed to creating shareholder value as we proceed with

the aim of being a driving force in the early detection of lung

cancer through the completion of our LungLB(R) test multi-centre

clinical validation study.

LungLB(R) test

According to the World Health Organization, over 2.2 million new

cases of lung cancer were diagnosed in 2020 and approximately 1.8

million deaths from lung cancer were recorded in 2020 globally.

Nearly 80% of all lung cancers in the United States are diagnosed

in later stages when survival rates are low because the options for

curative treatment are then limited. This is in part due to the

lack of effective early detection solutions and the fact that lung

cancer largely develops asymptomatically.

LungLB(R) is a blood-based test that uses circulating tumour

cells ("CTC") to stratify indeterminant lung nodules as either

cancerous or benign following their identification by CT scan.

Biopsy is currently part of the standard care pathway for lung

nodules and the LungLB(R) test is designed to support the

physician's decision to biopsy only when necessary, or to monitor

non-invasively using additional imaging. There are estimated to be

over 1.5 million indeterminant lung nodules identified each year in

the United States(1) and LungLife's estimated 1 week turnaround

from receipt of the blood sample to results can save a significant

amount of stressful waiting time for the patient as well as

unnecessary costly and often dangerous procedures. In 2021, we

completed a 149 participant pilot study in subjects with

indeterminate lung nodules which showed a well-balanced performance

and a Positive Predictive Value of 89 per cent which we believe

will support physician decision making.

Progress

We enrolled our first participant in February 2022 in our

multi-centre clinical validation study. The multi-centre clinical

study will be used to validate the LungLB(R) test performance,

looking to repeat the high performance already observed in the

pilot study completed earlier in the year. The study will enrol 425

participants across multiple US sites, including MD Anderson Cancer

Center, Mount Sinai Hospital in New York City and multiple medical

centres of the Veterans Affairs, which we recently announced,

involving participants who present with indeterminate lung nodules

that would otherwise be scheduled for needle biopsy. This first

participant enrolment confirms that the Company is on track to

enrol participants over the next 12 months, with study completion

expected in Q1 2023.

In November 2021, our clinical laboratory in Thousand Oaks,

California was awarded accreditation by the College of American

Pathologists (CAP), a significant further independent validation of

the quality of our laboratory procedures.

The successful granting of a CPT(R) code marks the first step on

the path for commercial reimbursement. In October 2021 we applied

to the American Medical Association for a CPT(R) Proprietary

Laboratory Analyses (PLA) code and this was granted post year end

and is scheduled to become effective on 1 April 2022.

Reimbursement in the US is comprised of three components: code,

price, and coverage. CPT(R) codes offer health care professionals a

uniform language for coding medical services and procedures, and

the CPT(R) code allows clinical laboratories to more specifically

identify their tests when billing Medicare and commercial

insurers.

AIM IPO

In July 2021 we successfully raised gross proceeds of GBP17

million as part of the Company's admission to trading on AIM. Since

then we have already fulfilled several of the aims that we set out

to achieve including commencement of the clinical validation study

and obtaining a CPT(R) code for Medicare reimbursement for the

LungLB(R) test.

We anticipate that the net proceeds of the fundraise will be

sufficient to complete the multi-centre validation study and

commence the utility study of the LungLB(R) test for indeterminate

lung nodules, commence the post-surgical monitoring validation

study for the LungLB(R) test, and take the Company to early

revenues in 2023.

We are hugely grateful to the support received from new

shareholders who participated in our 2021 fundraise and prior

shareholders who had supported the company to that point, and I

would like to thank all of our shareholders for their continued

support.

People

On admission to trading on AIM, David Anderson formally joined

the Company as CFO after serving as a consultant since the

beginning of 2020.

Paul and David have done a great job of bringing the Company to

market and delivering on the aims set out at the Company's IPO. I

would like to thank them for their excellent leadership during this

dynamic time for the Company.

We also made senior hires in Clinical Trials, Quality, Research

and Development and Project Management in the year and post year

end bringing the team up to 13 full time, and 2 part time

employees.

We also recently announced the appointment of Dr Drew Moghanaki

to our Scientific Advisory Board.

On behalf of the Board, I would like to thank our employees,

clinical partners, study participants, professional advisors,

suppliers and shareholders for their support, and we look forward

to providing further updates on progress throughout the current

year.

Outlook

In addition to the continued enrolment of participants into our

validation study, our focus this year is on reimbursement. The

three constituent parts are code, price and coverage. We have

received our code, the next stage is the pricing process and

determining whether we fall under "cross-walk" or "gap fill". We

have submitted our application for the New York Clinical Laboratory

Evaluation Program ("CLEP") permit. We will submit our Breakthrough

Device application to the FDA when our advisors indicate the timing

is right.

The next two years are incredibly exciting for LungLife and we

look forward to updating shareholders on our progress during that

time.

Roy Davis

Non-Executive Chairman

28 March 2022

(1) Gould MK et al. Am J Respir Crit Care Med. 2015 PMID:

26214244.

Financial Review

The financial performance of the Company in the year to 31

December 2021 reflects the IPO which took place on 8 July 2021 and

involved the conversion of Convertible Loan Notes and existing

shares prior to the Admission of the new common shares onto

AIM.

Statement of Comprehensive Income

The loss for the year of $7,444,188 is after charging a portion

of the expenses incurred on the share issue of $1,101,370,

disclosed as exceptional, with the balance of expenses of the share

issue of $1,000,354 charged directly to reserves. The loss

excluding this exceptional item was $6,342,818.

The Company generated revenues of $195,566 comprising royalty

income from its sub licensee in China of $88,553 and consumable

sales of fluorescent in situ hybridisation (FISH) probes of

$107,013 to the same sub-licensee. The royalty income represents

the first such income under the sub licence calculated at 6% of

underlying sales. In turn the Company pays a 6% royalty on this

income to MD Anderson Cancer Center.

The largest cost incurred in the year was employee expenses

($1,760,012) followed by research and development costs

($1,343,132), being those external costs incurred in the

development of our LungLB(R) test and AI algorithm.

Other operating income relates to payment received under the US

Government Paycheck Protection Program, akin to the UK furlough

scheme. This represented a one-time loan which was subsequently

forgiven in full. Finance expense of $309,327 related to interest

charged on the Convertible Loan Notes, which formed part of the

balance on the Notes subsequently converted into new common shares

at the time of IPO. The balance of $107,601 reflects the charge for

lease liabilities, being leases for certain tangible assets and the

leasehold premises occupied by the Company.

Statement of Financial Position

Cash at the end of the year was $14,628,351, reflecting the net

proceeds of the AIM admission of $21,342,405, payment of $1,800,000

to the Icahn School of Medicine of Mount Sinai ("Mount Sinai")

under the terms of the License Agreement with Mount Sinai, and

working capital for the year. The payment of $1,800,000 together

with the 1,656,888 consideration shares issued to Mount Sinai at

issue price of 176p constitutes the intangible asset of $5,818,359.

The option fee gives the Company access in the future to the

de-identified patient records held by Mount Sinai to assist in the

development of future products. As this asset is therefore not

currently being utilised no amortisation has been charged to

date.

Extension to the lease on the Company's premises and financing

of a further microscope gave rise to movement on right of use

assets and lease liabilities.

Statement of Cash Flows

The net outflow from operating activities was $7,538,876, funded

in part by the gross proceeds from the AIM admission of $23,444,129

and in the period before the AIM admission $1,612,421 of new

Convertible Loan Notes. These Notes were converted in full as part

of the Company's reorganisation prior to the AIM admission. The net

inflow of cash in the year was $14,500,723 contributing to the

closing cash balance of $14,628,351.

David Anderson

Chief Financial Officer

28 March 2022

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2021

Year to Year to

31 December 31 December

Note 2021 2020

US$ US$

Revenue 4 195,566 205,180

Cost of sales (96,269) (188,178)

_________ _________

Gross margin 99,297 17,002

Administrative expenses 6 (5,903,738) (3,458,984)

Depreciation 6 (323,758) (282,654)

Exceptional expense - costs of listing (1,101,370) (337,201)

_________ _________

Loss from operations (7,229,569) (4,061,837)

Other operating income 6 206,164 -

Finance income 9 12,017 -

Finance expense 9 (416,928) (777,186)

_________ _________

Loss before tax (7,428,316) (4,839,023)

Tax expense 10 (15,872) -

_________ _________

Loss from continuing operations (7,444,188) (4,839,023)

Other comprehensive income - -

_________ _________

Loss and total comprehensive income attributable

to the owners of the Company (7,444,188) (4,839,023)

_________ _________

Earnings per share attributable to the

ordinary equity holders of the parent 11

Loss per share

Basic and diluted (US$ cents) ($0.469) ($0.743)

_________ _________

The results reflected above relate to continuing operations

STATEMENT OF FINANCIAL POSITION

As at 31 December 2021

Note 2021 2020

US$ US$

Assets

Current assets

Trade and other receivables 14 740,865 169,801

Cash and cash equivalents 14,628,351 127,628

_________ _________

15,369,216 297,429

_________ _________

Non-current assets

Property, plant and equipment 12 765,983 463,437

Intangible assets 13 5,818,359 -

Other receivables 14 13,235 13,235

_________ _________

6,597,577 476,672

_________ _________

Total assets 21,966,793 774,101

_________ _________

Liabilities

Current liabilities

Trade and other payables 15 803,738 1,225,836

Lease liabilities 17 207,280 169,955

Discontinued operations 174,057 174,057

Convertible notes 18 - 10,086,616

Borrowings and loans 16 - 206,164

_________ _________

1,185,075 11,862,628

Non-current liabilities

Lease liabilities 17 601,622 167,488

Provisions 19 50,000 50,000

_________ _________

Total liabilities 1,836,697 12,080,116

_________ _________

NET ASSETS 20,130,096 (11,306,015)

_________ _________

Issued capital and reserves attributable

to

owners of the parent

Share capital 21 2,548 8,665

Share premium reserve 22 91,264,305 52,194,390

Other equity 22 - 843,137

Share based payment reserve 960,312 550,511

Accumulated losses (72,097,069) (64,902,718)

_________ _________

TOTAL EQUITY 20,130,096 (11,306,015)

_________ _________

STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2021

Total

attributable

Share-based to equity

Share Share payment Accumulated holders of Total

capital premium reserve Other equity losses parent equity

US$ US$ US$ US$ US$ US$ US$

1 January 2020 8,483 52,104,062 324,876 828,318 (60,063,695) (6,797,956) (6,797,956)

Comprehensive

income for

the year

Loss - - - - (4,839,023) (4,839,023) (4,839,023)

Other

comprehensive

Income - - - - - - -

_________ _________ _________ _________ _________ _________ _________

Total

comprehensive

Income

for the year - - - - (4,839,023) (4,839,023) (4,839,023)

_________ _________ _________ _________ _________ _________ _________

Contributions

by and

distributions

to owners

Issue of common

stock 182 90,328 - - - 90,510 90,510

Issue of

Convertible

Loan

Note - - - 14,819 - 14,819 14,819

Share-based

payment - - 225,635 - - 225,635 225,635

_________ _________ _________ _________ _________ _________ _________

Total

contributions

by

and

distributions

to owners 182 90,328 225,635 14,819 - 330,964 330,964

_________ _________ _________ _________ _________ _________ _________

31 December

2020 8,665 52,194,390 550,511 843,137 (64,902,718) (11,306,015) (11,306,015)

_________ _________ _________ _________ _________ _________ _________

STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2021 (continued)

Total

attributable

Share-based to equity

Share Share payment Accumulated holders of Total

capital premium reserve Other equity losses parent equity

US$ US$ US$ US$ US$ US$ US$

1 January 2021 8,665 52,194,390 550,511 843,137 (64,902,718) (11,306,015) (11,306,015)

Comprehensive

income for

the year

Loss - - - - (7,444,188) (7,444,188) (7,444,188)

Other

comprehensive

Income - - - -

_________ _________ _________ _________ _________ _________ _________

Total

comprehensive

Income

for the year - - - - (7,444,188) (7,444,188) (7,444,188)

_________ _________ _________ _________ _________ _________ _________

Contributions

by and

distributions

to owners

Issue of

Convertible

Loan

Notes - - - 99,263 - 99,263 99,263

Reverse split (8,184) 8,184 - - - - -

Issue of common

shares

on conversion

of preference

shares and

Convertible

Loan Notes 935 12,600,730 - - - 12,601,665 12,601,665

Issue of share

capital 1,132 27,461,355 - - - 27,462,487 27,462,487

Transfer of

balance

following

conversion of

Convertible

Loan Note - - - (942,400) 249,837 (692,563) (692,563)

Share issue

costs - (1,000,354) - - - (1,000,354) (1,000,354)

Share-based

payments - - 409,801 - - 409,801 409,801

_________ _________ _________ _________ _________ _________ _________

Total

contributions

by

and

distributions

to owners (6,117) 39,069,915 409,801 (843,137) 249,837 38,880,299 38,880,299

_________ _________ _________ _________ _________ _________ _________

31 December

2021 2,548 91,264,305 960,312 - (72,097,069) 20,130,096 20,130,096

_________ _________ _________ _________ _________ _________ ________

STATEMENT OF CASH FLOWS

For the year ended 31 December 2021

Year to Year to

31 December 31 December

Note 2021 2020

US$ US$

Cash flows from operating activities

Loss for the year (7,444,188) (4,839,023)

Adjustments for:

Depreciation of property, plant and equipment 323,758 282,654

Forgiveness of Paycheck Protection Program (206,164) -

Loan

Gain on sale of tangible assets (35,752) -

Finance income (12,017) -

Finance expense 416,928 777,186

Taxation 15,872 -

Share-based payments expense 409,801 225,635

_________ _________

(6,531,762) (3,553,548)

(Increase) / decrease in trade and other

receivables (569,143) 82,127

(Decrease) / increase in trade and other

payables (422,097) 597,396

Income taxes paid (15,872) -

_________ _________

Net cash outflow from operating activities (7,538,876) (2,874,025)

_________ _________

Cash flows from investing activities

Purchases of tangible assets (47,365) (5,328)

Proceeds from sale of tangible assets 35,752 -

Landlord improvement contribution 15,588 -

Purchase of intangibles (1,800,000) -

_________ _________

Net cash used in investing activities (1,796,025) (5,328)

_________ _________

Cash flows from financing activities

Issue of Convertible Notes 1,612,421 2,290,899

Issue of Common Stock 23,444,129 90,510

Expenses of issue of Common Stock (1,000,354) -

Interest received 10,097 -

Interest paid (107,601) (6,297)

Paycheck Protection Program loan - 205,822

Repayment of loans - (120,368)

Repayment of lease liabilities (123,068) (180,379)

_________ _________

Net cash from financing activities 23,835,624 2,280,187

Net increase / (decrease) in cash and

cash equivalents 14,500,723 (599,166)

Cash and cash equivalents at beginning

of year 127,628 726,794

_________ _________

Cash and cash equivalents at end of year 5 14,628,351 127,628

_________ _________

LungLife AI, Inc.

Notes forming part of the financial statements

for the year ended 31 December 2021

1 General Information

LungLife AI, Inc, (the "Company") is a company based in Thousand

Oaks, California which is developing a diagnostic test for the

early detection of lung cancer. The Company was incorporated under

the laws of the state of Delaware, USA on 30 December 2009.

The Company's costs associated with developing and

commercialising its test include costs associated with the

development of intellectual property, optimising the technology,

and obtaining regulatory approval. To complete clinical trials the

Company will continue to require additional operating funds. The

Company has raised funds through offerings of debt, common stock

and Series A Preferred Shares.

There are no restrictions on the Company's ability to access or

use its assets and settle its liabilities.

2 Basis of preparation

The financial statements have been prepared in accordance with

UK adopted International Accounting Standards ("UK IFRS").

These financial statements are prepared in accordance with UK

IFRS under the historical cost convention, as modified by the use

of fair value for financial instruments measured at fair value. The

historical financial information is presented in United States

Dollars ("US$") except where otherwise indicated.

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated.

(a) Going concern

These financial statements have been prepared on the going

concern basis.

The directors of the Company have a reasonable expectation that

the Company has adequate resources,to continue in operational

existence for the foreseeable future and for at least one year from

the date of the financial statements. For that reason, they

continue to adopt the going concern basis in preparing the

Company's financial statements.

(b) New standards, amendments and interpretations

New standards are not expected to impact the Company as they are

either not relevant to the Company's activities or require

accounting which is consistent with the Company's current

accounting policies.

The Directors have considered those standards and

interpretations which have not been applied in these financial

statements but which are relevant to the Company's operations that

are in issue but not yet effective and do not consider that they

will have a material effect on the future results of the

Company.

2 Basis of preparation (continued)

(c) Revenue recognition

Sale of goods

Revenue comprises the fair value of the sale of FISH probes used

to identify the properties of blood samples under the terms of a

sub license agreement with a third party, net of applicable sales

taxes. Revenue is recognised on the sale of goods when the

significant risks and rewards of ownership of the goods have passed

to the buyer and the amount of revenue can be measured reliably.

Revenue on goods delivered is recognised when the customer accepts

delivery and on services when those services have been

rendered.

Royalty income

Under the terms of a patent and technology sub license agreement

the company is entitled to receive royalty income at 6% of the

quarterly net sales invoiced by the sub licensee in the relevant

quarter. Income is recognized in the period in which the underlying

net sales are generated.

Cash is received from revenues recognised according to terms of

trade within the relevant contractual relationship, usually in

accordance with agreed events such as placing of order, fulfilment

of order and delivery.

(d) Intangible assets

Research expenditure is recognised as an expense when incurred.

Development expenditure is recognized as an expense except those

costs incurred on development projects are capitalised as long term

assets to the extent that such expenditure is expected to generate

future economic benefits. Development expenditure is capitalised

only if it meets the criteria for capitalisation under IAS 38.

Capitalised development expenditure is measured at cost less

accumulated amortisation and impairment losses, if any. Development

expenditure initially recognised as an expense is not recognised as

an asset in future years. Capitalised development expenditure is

amortised on a straight-line basis over the estimated useful life

of the asset when the asset is available for use.

(e) Property, plant and equipment

Owned assets

Items of property, plant and equipment are stated at cost or

deemed cost less accumulated depreciation and impairment losses.

Cost includes the original purchase price of the asset and the

costs attributable to bringing the asset to its working condition

for its intended use. When parts of an item of property, plant and

equipment have different useful lives, those components are

accounted for as separate items of property, plant and

equipment.

Subsequent costs are included in the asset's carrying amount or

recognised as a separate asset, as appropriate, only when it is

probable that future economic benefits associated with the item

will flow to the Company and the cost of the item can be measured

reliably.

Gains and losses on disposals are determined by comparing the

proceeds with the carrying amount and are recognised in the income

statement.

2 Basis of preparation (continued)

(e) Property, plant and equipment (continued)

Depreciation

Depreciation is charged to profit or loss on a straight-line

basis over the estimated useful lives of each part of an item of

property, plant and equipment. The estimated useful lives are as

follows:

-- computer and IT equipment - 33 per cent. straight line

-- leasehold improvements - shorter of lease term and useful life

-- plant and machinery - 20 per cent. straight line

-- laboratory equipment - 20 per cent. straight line

The residual values, useful lives and depreciation methods are

reviewed, and adjusted if appropriate, or if there is an indication

of a significant change since the last reporting date.

Gains and losses on disposals are determined by comparing the

proceeds with the carrying amount and are recognised within "other

operating income" in the statement of income.

(f) Impairment of non-financial assets

Non-financial assets are reviewed for impairment whenever events

or changes in circumstances indicate that the carrying amount may

not be recoverable. An impairment loss is recognised for the amount

by which the asset's carrying amount exceeds its recoverable

amount. The recoverable amount is the higher of an asset's fair

value less costs to sell and value in use. For the purposes of

assessing impairment, assets are considered at the lowest levels

for which there are separately identifiable cash flows (cash-

generating units).

Non-financial assets other than goodwill that suffered

impairment are reviewed for possible reversal of the impairment at

each reporting date.

(g) Financial assets

Classification

The Company classifies its financial assets as loans and

receivables. The classification depends on the purpose for which

the investments were acquired. Management determines the

classification of its investments at initial recognition.

Loans and receivables

Loans and receivables are non-derivative financial assets with

fixed or determinable payments. They are initially recognised at

fair value and are subsequently stated at amortised cost using the

effective interest method.

Impairment of financial assets

Impairment provisions are recognised when there is objective

evidence (such as significant financial difficulties on the part of

the counterparty or default or significant delay in payment) that

the Company will be unable to collect all of the amounts due under

the term's receivable, the amount of such a provision being the

difference between the net carrying amount and the present value of

the future expected cash flows associated with the impaired

asset.

(h) Cash and cash equivalents

Cash and cash equivalents comprise cash balances and call

deposits with an original maturity of three months or less.

2 Basis of preparation (continued)

(i) Financial liabilities

Trade and other payables

Trade and other payables are initially recognised at fair value

and subsequently measured at amortised cost. Accounts payable are

classified as current liabilities if payment is due within one year

or less. If not, they are presented as non-current liabilities.

Convertible debt

The proceeds received on issue of the Company's convertible debt

are allocated into their liability and equity components. The

amount initially attributed to the debt component equals the

discounted cash flows using a market rate of interest that would be

payable on a similar debt instrument that does not include an

option to convert. Subsequently, the debt component is accounted

for as a financial liability measured at amortised cost until

extinguished on conversion or maturity of the bond. The remainder

of the proceeds is allocated to the conversion option and is

recognised in the "Other equity" within shareholders' equity, net

of income tax effects.

(j) Borrowings

Borrowings are recognised initially at fair value, net of

transaction costs incurred. Borrowings are subsequently carried at

amortised cost; any difference between the proceeds (net of

transaction costs) and the redemption value is recognised in the

income statement over the period of the borrowings using the

effective interest method.

Borrowings are de-recognised from the statement of financial

position when the obligation specified in the contract is

discharged, is cancelled or expires. The difference between the

carrying amount of a financial liability that has been extinguished

or transferred to another party and the consideration paid,

including any non-cash assets transferred or liabilities assumed,

is recognised in the income statement as other operating income or

finance costs.

Borrowings are classified as current liabilities unless the

Company has an unconditional right to defer settlement of the

liability for at least 12 months after the reporting period.

(k) Provisions

A provision is recognised in the statement of financial position

when the Company has a present legal or constructive obligation as

a result of a past event, and it is probable that an outflow of

economic benefits will be required to settle the obligation. If the

effect is material, provisions are determined by discounting the

expected future cash flows at a pre- tax rate that reflects current

market assessments of the time value of money and, when

appropriate, the risks specific to the liability. The increase in

the provision due to the passage of time is recognised in finance

costs.

(l) Share capital

Ordinary shares are classified as equity. There are various

classes of ordinary shares in issue, as detailed in note 21.

Incremental costs directly attributable to the issue of new shares

are shown in share premium as a deduction from the proceeds.

2 Basis of preparation (continued)

(m) Net finance costs

Finance costs

Finance costs comprise interest payable on borrowings, direct

issue costs, dividends on preference shares and foreign exchange

losses, and are expensed in the period in which they are

incurred.

Finance income

Finance income comprises interest receivable on funds invested,

and foreign exchange gains.

Interest income is recognised in the income statement as it

accrues using the effective interest method.

(n) Leases

All leases are accounted for by recognising a right-of-use asset

and a lease liability except for:

-- Leases of low value assets; and

-- Leases with a duration of 12 months or less.

Lease liabilities are measured at the present value of the

contractual payments due to the lessor over the lease term, with

the discount rate determined by reference to the rate inherent in

the lease unless (as is typically the case) this is not readily

determinable, in which case the Company's incremental borrowing

rate on commencement of the lease is used. Variable lease payments

are only included in the measurement of the lease liability if they

depend on an index or rate. In such cases, the initial measurement

of the lease liability assumes the variable element will remain

unchanged throughout the lease term. Other variable lease payments

are expensed in the period to which they relate.

On initial recognition, the carrying value of the lease

liability also includes:

-- amounts expected to be payable under any residual value guarantee

-- the exercise price of any purchase option granted in favour

of the Company if it is reasonably certain to assess that

option

-- any penalties payable for terminating the lease, if the term

of the lease has been estimated on the basis of termination option

being exercised.

Right of use assets are initially measured at the amount of the

lease liability, reduced for any lease incentives received, and

increased for:

-- lease payments made at or before commencement of the lease

-- initial direct costs incurred; and

-- the amount of any provision recognised where the Company is

contractually required to dismantle, remove or restore the leased

asset (typically leasehold dilapidations - see note 19).

Subsequent to initial measurement lease liabilities increase as

a result of interest charged at a constant rate on the balance

outstanding and are reduced for lease payments made. Right-of-use

assets are amortised on a straight-line basis over the remaining

term of the lease or over the remaining economic life of the asset

if, rarely, this is judged to be shorter than the lease term.

2 Basis of preparation (continued)

(n) Leases (continued)

When the group revises its estimate of the term of any lease

(because, for example, it re-assesses the probability of a lessee

extension or termination option being exercised), it adjusts the

carrying amount of the lease liability to reflect the payments to

make over the revised term, which are discounted using a revised

discount rate. The carrying value of lease liabilities is similarly

revised when the variable element of future lease payments

dependent on a rate or index is revised, except the discount rate

remains unchanged. In both cases an equivalent adjustment is made

to the carrying value of the right-of-use asset, with the revised

carrying amount being amortised over the remaining (revised) lease

term. If the carrying amount of the right-of-use asset is adjusted

to zero, any further reduction is recognised in profit or loss.

(o) Income tax

Income tax for the years presented comprises current and

deferred tax. Income tax is recognised in the income statement

except to the extent that it relates to items recognised directly

in equity, in which case it is recognised in equity. Current tax is

the expected tax payable on the taxable income for the year, using

tax rates enacted or substantively enacted at the statement of

financial position date, and any adjustment to tax payable in

respect of previous years.

Deferred tax is recognised on temporary differences arising

between the tax bases of assets and liabilities and their carrying

amounts.

The following temporary differences are not recognised if they

arise from (a) the initial recognition of goodwill; and (b) for the

initial recognition of other assets or liabilities in a transaction

other than a business combination that at the time of the

transaction affects neither accounting nor taxable profit or loss.

The amount of deferred tax provided is based on the expected manner

of realisation or settlement of the carrying amount of assets and

liabilities, using tax rates enacted or substantively enacted at

the statement of financial position date.

A deferred tax asset is recognised only to the extent that it is

probable that future taxable profits will be available against

which the asset can be utilised. Deferred tax assets are reduced to

the extent that it is no longer probable that the related tax

benefit will be realised.

Deferred income tax assets and liabilities are offset when there

is a legally enforceable right to offset current tax assets against

current tax liabilities and when the deferred income taxes assets

and liabilities relate to income taxes levied by the same taxation

authority on either the taxable entity or different taxable

entities where there is an intention to settle the balances on a

net basis.

(p) Foreign currency translation

i) Function and presentational currency

Items included in the financial statements of the Company are

measured using USD, the currency of the primary economic

environment in which the entity operates ('the functional

currency'), which is also the Company's presentation currency.

ii) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions. Foreign exchange gains and losses resulting from the

settlement of such transactions and from the translation at

year-end exchange rates, of monetary assets and liabilities

denominated in foreign currencies to USD, are recognised in the

income statement.

3 Critical accounting judgements and estimates

The preparation of the Company's historical financial

information under UK IFRS requires the directors to make estimates

and assumptions that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and

liabilities. Estimates and judgements are continually evaluated and

are based on historical experience and other factors including

expectations of future events that are believed to be reasonable

under the circumstances. Actual results may differ from these

estimates.

The Directors consider that the following estimates and

judgements are likely to have the most significant effect on the

amounts recognised in the financial information.

Carrying value of intangible assets, property, plant and

equipment

In determining whether there are indicators of impairment of the

Company's intangible assets, the directors take into consideration

various factors including the economic viability and expected

future financial performance of the asset and when it relates to

the intangible assets arising on a business combination, the

expected future performance of the business acquired.

Classification of the Mount Sinai License as an intangible

asset

As set out in note 13, o n 18 June 2021, the Company entered

into the Mount Sinai License Agreement, pursuant to which Mount

Sinai granted an option to the Company to obtain a licence, on a

non-exclusive basis, to use certain information held by Mount

Sinai. After considering the criteria in IAS38 the directors have

judged that the recognition criteria therein have been met and

classified the Mount Sinai license as an intangible asset.

4 Segment analysis

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Company that are

regularly reviewed by the chief operating decision maker (which

takes the form of the Board of Directors) as defined in IFRS 8, in

order to allocate resources to the segment and to assess its

performance.

The chief operating decision maker has determined that the

Company has one operating segment, the development and

commercialisation of its lung cancer early detection test. Revenues

are reviewed based on the products and services provided.

The Company operates in the United States of America. Revenue by

origin of geographical segment is as follows:

Year to Year to

31 December 31 December

2021 2020

US$ US$

Revenue

People's Republic of China 195,566 205,180

________ ________

195,566 205,180

________ ________

4 Segment analysis (continued)

2021 2020

US$ US$

Non-current assets

United States of America 6,597,577 476,672

________ ________

6,597,577 476,672

________ ________

Year to Year to

31 December 31 December

2021 2020

US$ US$

Product and service revenue

Royalty income 88,553 -

Consumable items 107,013 205,180

________ ________

195,566 205,180

________ ________

5 Financial instruments - Risk Management

The Company is exposed through its operations to the following

financial risks:

- Credit risk

- Foreign exchange risk and

- Liquidity risk

The Company is exposed to risks that arise from its use of

financial instruments. This note describes the Company's

objectives, policies and processes for managing those risks and the

methods used to measure them. Further quantitative information in

respect of these risks is presented throughout these financial

statements.

(i) Principal financial instruments

The principal financial instruments used by the Company, from

which financial instrument risk arises, are as follows:

- Cash and cash equivalents

- Trade and other payables

5 Financial instruments - Risk Management (continued)

(ii) Financial instruments by category

Financial asset

Amortised Amortised

cost cost

2021 2020

US$ US$

Cash and cash equivalents 14,628,351 127,628

Trade and other receivables 740,865 169,801

_________ _________

Total financial assets 15,369,216 297,429

_________ _________

Financial liabilities

Amortised Amortised

cost cost

2021 2020

US$ US$

Trade and other payables and loan 803,738 1,225,836

_________ _________

Total financial liabilities 803,738 1,225,836

_________ _________

(iii) Financial instruments not measured at fair value

Financial instruments not measured at fair value includes cash

and cash equivalents, trade and other receivables, and trade and

other payables.

Due to their short-term nature, the carrying value of cash and

cash equivalents, trade and other receivables, and trade and other

payables approximates their fair value.

5 Financial instruments - Risk Management (continued)

(iv) Financial instruments

General objectives, policies and processes

The Board has overall responsibility for the determination of

the Company's risk management objectives and policies and, whilst

retaining ultimate responsibility for them, it has delegated the

authority for designing and operating processes that ensure the

effective implementation of the objectives and policies to the

Company's finance function.

The overall objective of the Board is to set policies that seek

to reduce risk as far as possible without unduly affecting the

Company's competitiveness and flexibility. Further details

regarding these policies are set out below:

Credit risk

Credit risk is the risk of financial loss to the Company if a

customer or counterparty to a financial instrument fails to meet

its contractual obligations. Due to the current low level of

revenue, the Company's exposure to credit risk is on cash at bank.

The Company only deposits cash with major banks with high quality

credit standing.

Cash in bank and short-term deposits

The credit quality of cash has been assessed by reference to

external credit rating, based on Standard and Poor's long-term /

senior issuer rating:

2021 2021 2020 2020

Cash Cash

Rating at bank Rating at bank

US$ US$

Bank A A+ 8,140,196 A+ 127,628

Bank B BBB+ 6,425,645 -

Bank C A+ 62,510 -

_________ _________

14,628,351 127,628

_________ _________

5 Financial instruments - Risk Management (continued)

Foreign exchange risk

Foreign exchange risk arises when the Company enters into

transactions denominated in a currency other than its functional

currency. The Company's policy is, where possible, to settle

liabilities denominated in its functional currency. Currently the

Company's liabilities are either US dollar or UK sterling. No

forward contracts or other financial instruments are entered into

to hedge foreign exchange movements, with funds raised in the UK

being transferred to fund US operations using spot rates.

As at 31 December 2021 assets held in Sterling amounted to

US$6,488,154 (2020 - US$ Nil) and liabilities held in Sterling

amounted to US$65,772 (2020 - US$340,371).

The effect of a 5% strengthening of the Sterling against US

dollar at the reporting date on the Sterling denominated net assets

carried at that date would, all other variables held constant, have

resulted in a decrease in post-tax loss for the year and increase

of net assets of US$321,119. A 5% weakening in the exchange rate

would, on the same basis, have increased post-tax loss and

decreased net assets by US$321,119.

Liquidity risk

Liquidity risk is the risk that the Company will encounter

difficulty in meeting its financial obligations as they fall due.

This risk is managed by the production of annual cash flow

projections. The Company's continued future operations depend on

its ability to raise sufficient working capital through the issue

of share capital and generating revenue.

The following table sets out the contractual maturities

(representing undiscounted contractual cash-flows) of financial

liabilities which can all be met from the cash resources currently

available:

Between

Up to 3 3 and 12

months months

At 31 December 2021 US$ US$

Trade and other payables 275,276 -

_________ _________

Total 275,276 -

_________ _________

Between

Up to 3 3 and 12

months months

At 31 December 2020 US$ US$

Trade and other payables 822,758 -

Loan 206,164 -

_________ _________

Total 1,028,922 -

_________ _________

5 Financial instruments - Risk Management (continued)

Capital Disclosures

The Company monitors its capital which comprises all components

of equity (i.e. share capital, share premium, and accumulated

losses).

The Company's objectives when maintaining capital are to

safeguard the entity's ability to continue as a going concern.

6 Expenses by nature

Year to Year to

31 December 31 December

2021 2020

US$ US$

Employee benefit expenses (see note 8) 1,760,012 1,295,786

Share-based payments charge - non-employee

and directors 86,602 83,657

Depreciation of property, plant and equipment 323,758 282,654

Research and development expenditure 1,343,132 647,147

Professional costs 720,232 811,660

Legal settlement 687,409 525,000

Foreign exchange losses 96,690 -

Other costs 1,209,661 179,391

Other operating income included the forgiveness of the Paycheck

Protection Program Loan of US$206,164 (2020 - US$Nil)

7 Auditor's remuneration

During the year the Company obtained the following services from

the Company's auditor:

Year to Year to

31 December 31 December

2021 2020

US$ US$

Fees payable to the Company's auditor

for the audit of the Company 47,472 -

Fees payable to the Company's auditor

for other services:

Services in connection with listing 108,423 41,864

Taxation services - 2,500

_________ _________

Total 155,895 44,364

_________ _________

8 Employee benefit expenses

Year to Year to

31 December 31 December

2021 2020

US$ US$

Employee benefit expenses (including Directors)

comprise:

Wages and salaries 1,304,022 911,560

Benefits 75,350 79,433

Share-based payments expense (note xx ) 323,199 141,978

Social security contributions and similar

taxes 52,601 79,158

Pension 4,840 -

_________ _________

1,760,012 1,212,129

_________ _________

Key management personnel compensation

Key management personnel are those persons having authority and

responsibility for planning, directing and controlling the

activities of the Company, including the Directors of the

Company.

Year to Year to

31 December 31 December

2021 2020

US$ US$

Salary 599,232 299,042

Share based payment expense 312,706 126,175

_________ _________

911,938 425,217

_________ _________

The average number of employees (excluding Directors) in the

Company in the year was 8 (2020 - 10).

9 Net finance costs

Year to Year to

31 December 31 December

2021 2020

US$ US$

Finance expense

Interest expense on lease liabilities 107,601 23,390

Interest expense on liabilities measured

at amortised cost 309,327 747,157

Interest expense on other loans - 6,639

_________ _________

Total finance expense 416,928 777,186

_________ _________

9 Net finance costs (continued)

Year to Year to

31 December 31 December

2021 2020

US$ US$

Finance income

Bank interest 12,017 -

_________ _________

Total finance income 12,017 -

_________ _________

10 Tax expense

Year to Year to

31 December 31 December

2021 2020

US$ US$

Current tax expense

Current tax on loss for the year - -

Withholding tax on royalties 15,872 -

_________ _________

Total current tax 15,872 -

Deferred tax asset

On losses generated in the year - -

_________ _________

15,872 -

_________ _________

10 Tax expense (continued)

There were no charges to current corporation taxation due to the

losses incurred by the Company in the year. The reasons for the

difference between the actual tax charge for the year and the US

federal income tax rate of 21% and state of California income tax

rate of 8.84% are as follows:

Year to Year to

31 December 31 December

2021 2020

US$ US$

Loss for the year (7,428,316) (4,839,023)

_________ _________

Tax using 29.84% (2,216,610) (1,443,964)

Expenses not deductible for tax purposes 688,811 410,500

Unrecognised deferred tax assets for losses

carried forward 1,527,799 1,033,464

_________ _________

Total tax expense -

_________ _________

The unrecognised deferred tax is based on total taxable losses

carried forward of US$49,393,180 (2020 - US$44,940,832 and a

capital loss of US$4,583,333 (2020 - US$4,583,333). No deferred tax

asset is recognised for these losses due to early stage in the

development of the Company's activities. The losses do not expire

but can only be used against trading profits from the same

trade.

11 Loss per share

Year to Year to

31 December 31 December

2021 2020

Total Total

Numerator US$ US$

Loss for the year used in basic EPS (7,444,188) (4,839,023)

Denominator

Weighted average number of ordinary shares

used in basic EPS 15,870,143 6,515,838

Resulting loss per share (US$0.469) (US$0.743)

The Company has one category of dilutive potential ordinary

share, being share options (see note 23). The potential shares were

not dilutive in the year as the Company made a loss per share in

line with IAS 33. As described in note 21, on between 2 July 2021

and 7 July 2021the Company implemented a pre-Admission

reorganisation of its capital which included the conversion of

Series A and B Preferred Shares into Common Shares and a reverse

share split by way of the issue of one new Common Share and

Preferred Share for every 18 old Common Shares and Preferred Shares

held.

As required by IAS33, the number of shares presented as the

denominator in calculating loss per share has been adjusted from 1

January 2020, the beginning of the earliest period for which loss

per share information is presented in order to maintain

comparability.

12 Tangible assets

Furniture Computers

Leasehold and and IT Plant &

improvements equipment equipment machinery Total

US$ US$ US$ US$ US$

Cost or valuation

At 1 January

2020 981,613 1,102,464 49,831 - 2,133,908

Re-classification - (1,045,962) - 1,045,962 -

Additions - - - 5,328 5,328

________ ________ ________ _________ _________

At 31 December

2020 981,613 56,502 49,831 1,051,290 2,139,236

Landlord contribution (15,588) - - - (15,588)

Additions 349,338 - 35,126 257,428 641,892

________ ________ ________ ________ ________

At 31 December

2021 1,315,363 56,502 84,957 1,308,718 2,765,540

________ ________ ________ ________ ________

Accumulated

depreciation

and impairment

At 1 January

2020 558,051 786,784 48,310 1,393,145

Re-classification - (730,282) - 730,282 -

Depreciation 153,126 - 1,521 128,007 282,654

________ ________ ________ ________ ________

At 31 December

2020 711,177 56,502 49,831 858,289 1,675,799

Depreciation 233,253 - 3,173 87,332 323,758

________ ________ ________ ________ ________

At 31 December

2021 944,430 56,502 53,004 945,621 1,999,557

________ ________ ________ ________ ________

Net book value

At 31 December

2021 370,933 - 31,953 363,097 765,983

________ ________ ________ ________ ________

At 31 December

2020 270,436 - - 193,001 463,437

________ ________ ________ ________ ________

Included in leasehold improvements at 31 December 2021 are right

of use assets with a cost of $1,282,052 and accumulated

depreciation of $898,393.

13 Intangible assets

License Total

US$ US$

Cost

At 1 January 2020 - -

Additions - -

_________ _________

At 31 December 2020 - -

Additions 5,818,359 5,818,359

_________ _________

At 31 December 2021 5,818,359 5,818,359

_________ _________

Accumulated amortisation and impairment

At 1 January 2020 - -

Amortisation charge - -

_________ _________

At 31 December 2020 - -

Amortisation charge

_________ _________

At 31 December 2021 - -

_________ _________

Net book value

At 31 December 2021 5,818,359 5,818,359

_________ _________

At 31 December 2020 - -

_________ _________

On 18 June 2021, the Company entered into the Mount Sinai

License Agreement, pursuant to which the Icahn School of Medicine

at Mount Sinai granted an option to the Company to obtain a

licence, on a non-exclusive basis, to use certain information held

by Mount Sinai. The Mount Sinai License Agreement automatically

became effective on Admission. Exercise of the option contained in

the Mount Sinai License Agreement is conditional on: (i) Admission;

(ii) clearance by Mount Sinai's information security team; and

(iii) IRB, data security and data use approvals. Mount Sinai is

under an obligation to use commercially reasonable efforts to

obtain such clearances and approvals (other than Admission).

Pursuant to the Mount Sinai License Agreement, Mount Sinai has

granted the Company an option to obtain a licence, on a

non-exclusive basis, to use certain information held by Mount Sinai

to be able to develop future products.

14 Trade and other receivables

2021 2020

US$ US$

Amounts falling due within one year

Prepayments and accrued income 692,274 169,801

Other debtors 48,591 -

_________ _________

740,865 169,801

_________ _________

2021 2020

US$ US$

Amounts falling due after one year

Rent deposit 13,235 13,235

_________ _________

13,235 13,235

_________ _________

15 Trade and other payables

2021 2020

US$ US$

Trade payables 211,718 786,018

Accruals and other payables 570,920 439,818

_________ _________

Total financial liabilities classified as financial

liabilities measured at amortised cost 782,638 1,225,836

Other payables - tax and social security payments 21,100 -

_________ _________

Total trade and other payables 803,738 1,225,836

_________ _________

The carrying value of trade and other payables classified as

financial liabilities measured at amortised cost approximates fair

value.

16 Borrowings and Loans

2021 2020

US$ US$

Loans payable - 206,164

________ ________

- 206,164

________ ________

In May 2020 the Company applied for and received a loan under

the US Government Paycheck Protection Program. An application for

forgiveness of the entire principal balance as permitted under the

Program was made subsequent to 31 December 2020 and was granted in

the year to 31 December 2021.

17 Lease Liabilities

Land and Plant and

buildings machinery Total

US$ US$ US$

At 1 January 2020 349,803 144,629 494,432

Interest expense 23,390 - 23,390

Repayments (151,859) (28,520) (180,379)

________ ________ ________

At 31 December 2020 221,334 116,109 337,443

________ ________ ________

Additions 349,338 245,189 594,527

Repayments (156,306) (74,363) (230,669)

Interest expense 89,625 17,976 107,601

________ ________ ________

At 31 December 2021 503,991 304,911 808,902

________ ________ ________

The Company acquired certain tangible assets under capital lease

financing arrangements.

The Company operates from one office which is rented under a

lease agreement ending on 1 July 2022 under which rent is payable

monthly. During the year the Company extended this lease until 31

August 2025 commencing 1 July 2022 and with a two-month rent free

period.

2021 2020

US$ US$

Maturity of lease liabilities

Within 3 months 56,727 40,951

Between 3 - 12 months 150,553 131,045

Between 1 - 2 years 255,070 108,346

Between 2 - 5 years 346,552 57,101

________ ________

808,902 337,443

________ ________

18 Convertible Notes

2021 2020

US$ US$

Due within one year:

Convertible Secured Promissory Notes - 10,086,616

_________ _________

- 10,086,616

_________ _________

On 26 October 2017 the Company issued a Convertible Secured

Promissory Note Purchase Agreement (the "Notes") that provided for

the issuance of up to a principal amount US$3m on which interest of

eight per cent. Accrued. Unless converted into shares the principal

and accrued interest are payable in full at the earlier of the

maturity date of 26 January 2020 or the occurrence of a defined

corporate transaction.

On 31 December 2018 the total principal amount of Notes that

could be issued increased to US$6m and on 20 August 2019 the total

principal amounts of Notes that could be issued increased to

US$7.5m. On 20 August 2019 the Company determined that the Notes

issued before that date should be classified as Series A-1 Notes

and those issued after that date Series A-2 Notes. The Series A-2

Notes have a different conversion term and are repayable in

preference to the Series A-1 Notes.

As the conversion feature results in the conversion of a fixed

amount of stated principal into a fixed number of shares, it

satisfies the 'fixed for fixed' criterion and, therefore, it is

classified as an equity instrument.

The value of the liability component and the equity conversion

component were determined at the date the instrument was

issued.

The fair value of the liability component, included above, at

inception was calculated using a market interest rate for an

equivalent instrument without conversion option. The discount rate

applied was eight per cent.

On 15 June 2020 the Company entered into an agreement to extend

the maturity date of the Notes to 30 June 2021.

On [date] all the principal and accrued interest in the

Convertible Notes was converted into new Common Stock shares.

The interests of the Directors and their connected persons in

the Convertible Notes was:

2021 2020

US$ US$

Simon Raab (resigned 1 July 2021) - 3,232,380

Frederick Gluck (resigned 1 July 2021) - 1,711,953

_________ _________

- 4,944,333

_________ _________

19 Provisions

Dilapidations Total

US$ US$

At 1 January 2020 50,000 50,000

Movement - -

_________ _________

At 31 December 2020 50,000 50,000

_________ _________

Additions - -

_________ _________

At 31 December 2021 50,000 50,000

_________ _________

Provision is made for the anticipated cost of returning the

Company's premises to their prior state on termination of the

lease.

20 Net cash /(debt) reconciliation

2021 2020

US$ US$

Cash and cash equivalents 14,628,351 127,628

Convertible notes - (10,086,616)

Other borrowings and loans - (206,164)

Lease liabilities (808,902) (337,443)

_________ _________

Net cash / (debt) 13,819,449 (10,502,595)

_________ _________

Cash and Borrowings

cash equivalents and loans Net Debt

US$ US$ US$

Net debt at 1 January 2020 726,794 (7,678,186) (6,951,392)

Cash flows (599,166) (2,376,353) (2,975,519)

Other non-cash movements:

- - -

Lease liabilities

- 156,647 156,647

Accretion of interest on convertible

notes - (732,331) (732,331)

_________ _________ _________

Net debt at 31 December 2020 127,628 (10,630,223) (10,502,595)

_________ _________ _________

Cash flows 14,500,723 - 14,500,723

Other non-cash movements:

Conversion of Convertible Loan Notes - 10,395,943 10,395,943

Forgiveness of Payroll Protection

Program loan - 206,164 206,164

Lease liabilities - (471,459) (471,459)

Accretion of interest on convertible

notes - (309,327) (309,327)

_________ _________ _________

Net debt at 31 December 2021 14,628,351 (808,902) 13,819,449

_________ _________ _________

21 Share capital

Issued and fully paid

Number US$

Shares of US$0.0001 par value each

At 1 January 2020

Common shares 5,092,839 510

Preference shares, Series A and B 79,738,560 7,973

Issue of common shares in the year 1,820,407 184

_________ _________

Total at 31 December 2020 86,651,806 8,665

Reverse stock split, at ratio of 1 new common

share (81,837,883) (8,184)

Issue of common shares on conversion of the

Convertible Loan Notes and Warrants 9,350,888 935

Issue of common shares for cash 9,659,091 966

Issue of common shares for non-cash consideration 1,656,888 166

_________ _________

Total issued share capital at 31 December

2021 25,480,790 2,548

_________ _________

Between 2 July 2021 and 7 July 2021, the Company implemented a

pre-Admission reorganisation of its capital which included, inter

alia, the following:

-- A reverse split by way of the issue of one new Common or

Preferred Share for every 18 old Common or Preferred Shares

held

-- Conversion of Series A-1 and Series A-2 Convertible Notes and

related Warrants into Common Shares

-- Conversion of Series A Preferred Shares and Series B Preferred Shares into Common Shares

22 Reserves

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

Share premium Amount subscribed for share capital in

excess of nominal value.

Other equity Amount of proceeds on issue of convertible

debt relating to the equity component

(i.e., option to convert the debt into

share capital).

Retained earnings All other net gains and losses and transactions

with owners (e.g., dividends) not recognised

elsewhere.

23 Share-based payment

Prior to Admission to AIM the Company operated two share option

plans: the 2010 Stock Incentive Plan and approved by the Board on 1

January 2010 and the 2020 Stock Incentive Plan was approved on 14

May 2020:

(a) options granted under the 2010 Stock Incentive Plan fall into two groups:

(i) options granted in or before 2016 over a total of 2,183,634

shares, with exercise prices ranging from $0.10 to $0.16 per share,

these options are now fully vested; and

(ii) options granted in 2019 over a total of 6,951,463 shares,

with an exercise price of $0.025 per share: these options generally

vest on a monthly basis over three or four years from the date of

grant. However, those granted to current employees of the Company

were amended so that they became exercisable in full on

Admission.

(b) Options were granted in 2020 and 2021 under the 2020 Stock

Incentive Plan over a total of 5,364,385 shares with an exercise

price of $0.0044 per share. These options vest over four years from

the date of grant on a monthly basis, but certain of these options

accelerated immediately before Admission, and became fully

exercisable at Admission.

On 14 May 2021 the Board approved the Company's 2021 Omnibus

Long-Term Incentive Plan ("LTIP") and it was approved by

shareholders on 27 May 2021 to become effective approximately three

days prior to Admission. The LTIP provides for the grant of both

EMI Options and non-tax favoured options. Options granted under the

LTIP are subject to exercise conditions as summarised below.

The LTIP has a non-employee sub-plan for the grant of Options to

the Company's advisors, consultants, non-executive directors, and

entities providing, through an individual, such advisory,

consultancy, or office holder services and a US sub-plan for the

grant of Options to eligible participants in the LTIP and the

Non-Employee Sub-Plan who are US residents and US taxpayers.

With the exception of options over 384,924 shares, which vested

immediately on Admission, the options issued under the LTIP vest

25% on the first anniversary of the vesting commencement date and

an additional one forty-eighth of the total number of options after

each subsequent calendar month for employees. For consultants

options issued under the LTIP vest 25% on the first anniversary of

the vesting commencement date and an additional one sixteenth of

the total number of options after each subsequent quarter. If

options remain unexercised after the date one day before the tenth

anniversary of grant such options expire. Vesting shall accelerate

in full in the event of a change of control of the Company.

As described in note 21, between 2 July 2021 and 7 July 2021the

Company implemented a pre-Admission reorganisation of its capital

which included a reverse share split by way of the issue of one new

Common or Preferred Share for every 18 old Common or Preferred

Shares held.

At the date of the reorganisation there were 14,499,482

pre-Admission options outstanding to 32 option holders comprising

Directors, former Directors and employees with exercise prices

between $0.0044 and $0.16 per share. Those options were varied to

reflect the reverse share split so that they were replaced with

805,492 options with exercise prices of between $0.0792 and $2.88

per share. The directors consider that this was a mechanical

variation modification of the awards and not a modification for the

purposes of IFRS2. Comparative figures have been adjusted to

restate numbers and values of share options issued as if the

reverse share split had been in effect from 1 January 2020.

On Admission on 8 July 2021 the Board approved grants of 769,707

to Paul Pagano and 386,703 options to David Anderson and on 23

November 2021 and 27 December 2021 the Board approved further

grants, of 112,500 and 5,000 options respectively, to employees and

consultants.

23 Share-based payment (continued)

Weighted

average

exercise

price US$ Number

Outstanding at 1 January 2020 12,230,198

Granted during the year 2,345,845

Cancelled (25,000)

Exercised during the year (51,561)

_________

Outstanding at 31 December 2020 and 1 January

2021 14,499,482

Reverse share split (13,693,990)

_________

Revised balance outstanding at 31 December

2020 0.74 805,492

Granted during the year 2.19 1,260,035

Exercised or expired during the year 0.74 (13,913)

_________ _________

Outstanding at 31 December 2021 1.74 2,065,527

_________ _________

Vested at 31 December 2021 1.35 1,030,627

_________ _________

The exercise price of options outstanding at 31 December 2021

ranged between US$0.08 and US$2.70 and their weighted average

contractual life was 7.66 years and weighted average expected life

was 1.8 years. The fair value of each share option granted has been

estimated using a Black-Scholes model. The inputs into the model

are share prices of between US$0.08 and US$2.51, exercise prices of

between US$0.45 and US$2.77, expected volatility of 57.9%, expected

dividend yield of 0%, expected lives of between 1.25 and 3.75 years

and a risk-free interest rate of 0.29%. In the absence of historic

volatility data available at the grant date the expected volatility

of 57.9% was estimated based on comparable companies.

The Company recognised total expenses of US$409,801 (2020:

US$225,635) within administrative expenses relating to

equity-settled share-based payment transactions during the

year.

24 Events after the reporting date

There have been no events subsequent to the year-end that

require disclosure in these financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR VELFLLXLZBBD

(END) Dow Jones Newswires

March 28, 2022 02:00 ET (06:00 GMT)

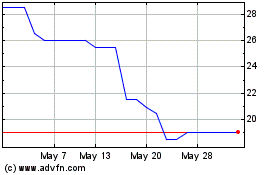

Lunglife Ai (LSE:LLAI)

Historical Stock Chart

From May 2024 to Jun 2024

Lunglife Ai (LSE:LLAI)

Historical Stock Chart

From Jun 2023 to Jun 2024