TIDMLGRS

RNS Number : 1463I

Peel Hunt LLP

10 December 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014

RESULT OF SECONDARY PLACING IN LOUNGERS PLC (THE "COMPANY" OR

"LOUNGERS").

Lion Capital LLP ("Lion Capital"), Alex Reilley (Co-Founder and

Chairman), Nick Collins (Chief Executive Officer) and Jake Bishop

(Co-Founder and Commercial Director) (collectively, the "Selling

Shareholders") announce that, in aggregate, they have sold

approximately 4.25 million ordinary shares (the "Placing Shares")

in the Company at a price of 215 pence per share (the "Placing

Price"), which represents approximately 4.2% of the Company's

issued share capital.

The Placing was conducted through an accelerated bookbuild (the

"Placing"). Peel Hunt LLP ("Peel Hunt") and Liberum Capital Limited

("Liberum", and together with Peel Hunt the "Joint Bookrunners")

are acting for the Selling Shareholders in connection with the

Placing.

The proceeds of the Placing are payable in cash on usual

settlement terms, and closing of the Placing is expected to occur

on a T+2 basis on 14 December 2020.

Following the Placing the beneficial interests of the Selling

Shareholders are as follows:

Selling Shareholder Percentage of Issued Share Capital

Immediately Following Completion

of the Placing

Lion Capital 26.10%

-----------------------------------

Alex Reilley 6.79%

-----------------------------------

Nick Collins 1.06%

-----------------------------------

Jake Bishop 6.35%

-----------------------------------

The remainder of the Company's shares held by Alex Reilley, Nick

Collins, and Jake Bishop following the Placing will be subject to a

lock-up which ends 180 days after completion of the Placing

(subject to waiver by the Joint Bookrunners and to certain

customary exceptions).

The Company is not a party to the Placing and will not receive

any proceeds from the Placing.

Contacts / Enquiries

Peel Hunt

Al Rae / Sohail Akbar / Max Irwin (ECM)

Dan Webster / Andrew Clark / Will Bell (Consumer, +44 20 7418

Retail & Leisure) 8900

Liberum +44 20 3100

Andrew Godber / John Fishley / Louis Davies 2000

IMPORTANT NOTICE

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING. THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS

DIRECTED ONLY AT: (A) PERSONS IN MEMBER STATES OF THE EUROPEAN

ECONOMIC AREA ("EEA") WHO ARE QUALIFIED INVESTORS WITHIN THE

MEANING OF ARTICLE 2(E) OF REGULATION (EU) 2017/1129 (THE

"PROSPECTUS REGULATION") ("QUALIFIED INVESTORS") AND (B) IF IN THE

UNITED KINGDOM, PERSONS WHO (I) HAVE PROFESSIONAL EXPERIENCE IN

MATTERS RELATING TO INVESTMENTS WHO FALL WITHIN THE DEFINITION OF

"INVESTMENT PROFESSIONALS" IN ARTICLE 19(5) OF THE FINANCIAL

SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS

AMED (THE "ORDER"), OR ARE HIGH NET WORTH COMPANIES, UNINCORPORATED

ASSOCIATIONS OR PARTNERSHIPS OR TRUSTEES OF HIGH VALUE TRUSTS AS

DESCRIBED IN ARTICLE 49(2) OF THE ORDER AND (II) ARE "QUALIFIED

INVESTORS" AS DEFINED IN SECTION 86 OF THE FINANCIAL SERVICES AND

MARKETS ACT 2000 ("FSMA") AND (C) OTHERWISE, TO PERSONS TO WHOM IT

MAY OTHERWISE BE LAWFUL TO COMMUNICATE IT (EACH A "RELEVANT

PERSON"). NO OTHER PERSON SHOULD ACT OR RELY ON THIS ANNOUNCEMENT

AND PERSONS DISTRIBUTING THIS ANNOUNCEMENT MUST SATISFY THEMSELVES

THAT IT IS LAWFUL TO DO SO. ANY INVESTMENT OR INVESTMENT ACTIVITY

TO WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT

PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. THE

ANNOUNCEMENT DOES NOT ITSELF CONSTITUTE AN OFFER FOR SALE OF ANY

SECURITIES.

This announcement is not for publication or distribution or

release, directly or indirectly, in or into the United States of

America (including its territories and possessions, any state of

the United States and the District of Columbia), Canada, Australia,

Japan, South Africa or any other jurisdiction where such an

announcement would be unlawful. The distribution of this

announcement may be restricted by law in certain jurisdictions and

persons into whose possession this document or other information

referred to herein comes should inform themselves about and observe

any such restriction. Any failure to comply with these restrictions

may constitute a violation of the securities laws of any such

jurisdiction. No action has been taken that would permit an

offering of the Placing Shares or possession or distribution of

this announcement in any jurisdiction where action for that purpose

is required.

This announcement does not constitute or form part of an offer

for sale or solicitation of an offer to purchase or subscribe for

securities in the United States, Canada, Australia, Japan or any

other jurisdiction. The Placing Shares have not been and will not

be registered under the US Securities Act of 1933, as amended (the

"Securities Act"), or under the securities laws of any state or

other jurisdiction of the United States and may not be offered or

sold, directly or indirectly, in the United States, absent

registration except pursuant to an applicable exemption from, or in

a transaction not subject to, the registration requirements of, the

Securities Act and in accordance with any applicable securities

laws of any state or other jurisdiction of the United States. There

will be no public offering of the securities referred to herein in

the United States or in any other jurisdiction.

No offer and sale of Placing Shares is or will be made in

Canada, except to persons who are: (a) an "accredited investor"

within the meaning of Section 1.1 of National Instrument 45-106 -

Prospectus Exemptions ("NI 45-106") of the Canadian Securities

Administrators or subsection 73.3(1) of the Securities Act

(Ontario) (the "OSA"), as applicable, and is either purchasing the

Placing Shares as principal for its own account, or is deemed to be

purchasing the Placing Shares as principal for its own account in

accordance with applicable Canadian securities laws, for investment

only and not with a view to resale or redistribution; (b) such

person was not created or used solely to purchase or hold the

Placing Shares as an accredited investor under NI 45-106; (c) a

"permitted client" within the meaning of National Instrument 31-103

- Registration Requirements, Exemptions and Ongoing Registrant

Obligations ("NI 31-103") of the Canadian Securities

Administrators; and (d) entitled under applicable Canadian

securities laws to purchase the Placing Shares without the benefit

of a prospectus under such securities laws.

No prospectus or offering document has been or will be prepared

in connection with the Placing. Any investment decision in

connection with the Placing must be made on the basis of all

publicly available information relating to Loungers plc and

Loungers plc's shares. Such information has not been independently

verified. The information contained in this announcement is for

background purposes only and does not purport to be full or

complete. No reliance may be placed for any purpose on the

information contained in this announcement or its accuracy or

completeness.

In connection with the Placing, either of the Joint Bookrunners

or any of their respective affiliates may take up a portion of the

Placing Shares as a principal position and in that capacity may

retain, purchase, sell, offer to sell for its own accounts such

Placing Shares and other securities of Loungers plc or related

investments in connection with the Placing or otherwise.

Accordingly, references to the Placing Shares being issued,

offered, subscribed, acquired, placed or otherwise dealt in should

be read as including any issue or offer to, or subscription,

acquisition, placing or dealing by either of the Joint Bookrunners

and any of their respective affiliates acting as investors for

their own accounts. The Joint Bookrunners do not intend to disclose

the extent of any such investment or transactions otherwise than in

accordance with any legal or regulatory obligations to do so.

This announcement does not purport to identify or suggest the

risks (direct or indirect) which may be associated with an

investment in Loungers plc or its shares.

Liberum and Peel Hunt are each authorised and regulated by the

FCA. Each of the Joint Bookrunners is acting for the Selling

Shareholders only in connection with the Placing and no one else,

and will not be responsible to anyone other than the Selling

Shareholders for providing the protections offered to clients of

the Joint Bookrunners nor for providing advice in relation to the

Placing Shares or the Placing, the contents of this announcement or

any transaction, arrangement or other matter referred to in this

announcement.

This announcement has been issued by the Joint Bookrunners on

behalf of the Selling Shareholders and is the sole responsibility

of the Selling Shareholders apart from the responsibilities and

liabilities, if any, that may be imposed on Liberum or Peel hunt by

the Financial Services and Markets Act 2000. Neither Peel Hunt

accepts any responsibility whatsoever and makes no representation

or warranty, express or implied, for the contents of this

announcement, including its accuracy, completeness or verification

or for any other statement made or purported to be made by the

Selling Shareholders or on the Selling Shareholders' behalf or on

Liberum's or Peel Hunt's behalf, in connection with the Selling

Shareholders or the Placing, and nothing in this announcement is or

shall be relied upon as a promise or representation in this

respect, whether as to the past or the future. Each of Liberum and

Peel Hunt accordingly disclaims to the fullest extent permitted by

law all and any responsibility and liability, whether arising in

tort, contract or otherwise, which it might otherwise have in

respect of this announcement and any such statement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRDDBDDXGGDGGC

(END) Dow Jones Newswires

December 10, 2020 02:00 ET (07:00 GMT)

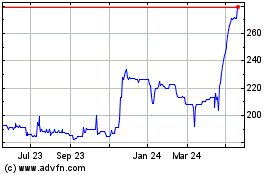

Loungers (LSE:LGRS)

Historical Stock Chart

From Oct 2024 to Nov 2024

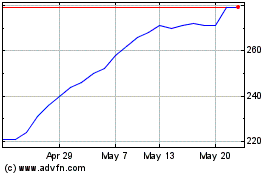

Loungers (LSE:LGRS)

Historical Stock Chart

From Nov 2023 to Nov 2024