London & Associated Properties Plc Report on Payments to Governments

June 01 2022 - 9:00AM

UK Regulatory

TIDMLAS

FOR IMMEDIATE RELEASE

1 June 2022

London & Associated Properties PLC ("LAP" or the Company"):

Report on Payments to Governments for the year 2021

LAP's main market quoted subsidiary company (a subsidiary under IFRS 10),

Bisichi PLC ("Bisichi"), in which the Company owns 41.52% of Bisichi's issued

ordinary share capital, together with its subsidiaries has issued the following

report on Payments to Governments for the year ended 31 December 2021.

INTRODUCTION

This Report provides an overview of the payments to governments made by Bisichi

PLC and its subsidiaries for the year ended 31 December 2021 as required under

the UK Reports on Payments to Governments Regulation 2014 and its amendment in

December 2015 (the UK Regulations). This Report is also intended to satisfy the

requirements of the Disclosure and Transparency Rules of the Financial Conduct

Authority in the United Kingdom.

BASIS OF PREPARATION

Reporting entities

This report includes payments to governments made by Bisichi PLC and its

subsidiary undertakings (Bisichi). Payments made by associates and entities

over which Bisichi has joint control are excluded from this report.

Activities

Payments made by Bisichi to governments arising from activities involving the

exploration, prospection, discovery, development and extraction of minerals

(extractive activities) are to be disclosed in this report.

Government

Government includes any national, regional or local authority of a country, and

includes a department, agency or entity that is a subsidiary of a government.

Project

Payments that are reported at project level except that payments that are not

attributable to a specific project are reported at legal entity level. Project

is defined as being the operational activities which are governed by a single

contract, or licence agreement, and form the basis for payment liabilities with

a government.

If agreements of this kind are substantially interconnected (i.e. forming a set

of operationally and geographically integrated contracts, licenses, leases or

concessions) these are treated for the purposes of these Regulations as a

single project. Indicators of integration include geographic proximity and

common operational management.

Payments

The information is reported under the following payment types:

Taxes

These are any taxes paid by Bisichi on its income and profits in accordance

with legislation enacted in the applicable jurisdiction. Payments are reported

net of refunds. Value added tax, personal income taxes, social taxes, property

taxes are excluded.

Royalties

Royalties is any mining royalty payable in the Republic of South Africa.

Fees

These are any fees and other sums paid as consideration for acquiring a licence

for gaining access to an area where extractive activities are performed.

Administrative government fees that are not specifically related to the

extractive sector are excluded.

Infrastructure improvements

Payments in kind in the form of infrastructure expenditure other than in

circumstances where the infrastructure is expected to be primarily dedicated to

operational activities throughout its useful life. UK Regulations do not

require reporting social or community payments, such as payments to build a

hospital or a school.

Other types of payments

Other types of payments that are required to be disclosed in accordance with

the UK Regulations but are not relevant to Bisichi operations are the

following:

- Production entitlements

- Dividends

Including dividends paid to a government in lieu of production entitlements or

royalties. Dividends paid to a government as an ordinary shareholder on the

same terms as to other ordinary shareholders and not paid in lieu of production

entitlements or royalties are excluded.

- Signature, discovery and production bonuses

Payments are reported on a cash basis. No in-kind payments were made during

year ended 31 December 2021.

Materiality Level

In line with the UK Regulations, where a payment or a series of related

payments have not exceeded £86,000 they have not been disclosed.

Exchange Rate

Relevant payments are made by Bisichi in South African Rand and for the purpose

of this report are translated to UK Sterling using the annual average exchange

rate for the period.

PAYMENTS PER GOVERNMENT

Government Taxes Royalties Fees Infrastructure Total

improvements

Republic of South £229,245 - - - £229,245

Africa

Total £229,245 - - - £229,245

PAYMENTS PER

PROJECT

Entity Project Country/ Taxes Royalties Fees Infrastructure Total

Government improvements

Black Wattle Black Wattle South Africa £117,950 - - - £117,950

Colliery

(Pty) Ltd

Sisonke Coal Sisonke Coal South Africa £111,295 - - - £111,295

Processing Processing

(Pty) Ltd

Total £229,245 - - - £229,245

A copy of the report referred to above has been sent to the National Storage

Mechanism and will shortly be available for viewing at https://data.fca.org.uk/

#/nsm/nationalstoragemechanism

For further information, please contact:

Jonathan Mintz

Company Secretary

London & Associated Properties PLC

Tel: 020 7415 5000

END

(END) Dow Jones Newswires

June 01, 2022 09:00 ET (13:00 GMT)

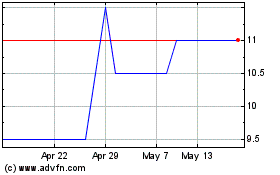

London & Associated Prop... (LSE:LAS)

Historical Stock Chart

From Oct 2024 to Nov 2024

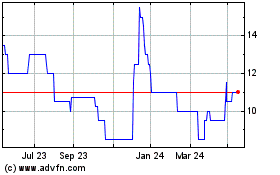

London & Associated Prop... (LSE:LAS)

Historical Stock Chart

From Nov 2023 to Nov 2024