Kennedy Ventures PLC Half Yearly Report (9522C)

March 24 2014 - 5:00AM

UK Regulatory

TIDMKENV

RNS Number : 9522C

Kennedy Ventures PLC

24 March 2014

KENNEDY VENTURES PLC

Interim statement for the 6 months ended 31 December 2013

Chairman's Statement

As shareholders will recall, I commented in my Chairman's

Statement in relation to the accounts for the year ended 30 June

2013, the Company needed to be refinanced in order to give it the

resources needed to act effectively and attract a worthwhile

transaction. The limited scale of the rescue refinancing and the

costs incurred then and subsequently in clearing away the problems

of the past left it frankly sub-scale as an AIM investing company

and it was to a large extent dependent on a term loan for its

financial viability, matters which we now have under active

review.

During the half-year now under review, Kennedy's costs were

materially reduced compared to those incurred in the previous two

half-year periods but remained too high for a company of its size.

Costs in the current trading period should be materially lower.

Peter Redmond

Chairman

21 March 2014

FOR FURTHER INFORMATION, PLEASE CONTACT:

Kennedy Ventures plc

Peter Redmond, Chairman +44 7718 660727

Cenkos Securities plc

Alan Stewart

Derrick Lee +44 20 7397 8900

Peterhouse Corporate Finance

John Levinson +44 20 7469 0935

KENNEDY VENTURES PLC

UNAUDITED INCOME STATEMENT

for the period ended 31

December 2013

Six months Six months

ended ended Year ended

31 December 31 December 30 June

Note 2013 2012 2013

GBP'000 GBP'000 GBP'000

Continuing Operations

Loss on disposal of investments - - (6)

Administrative expenses (60) (102) (133)

OPERATING LOSS (60) (102) (139)

Financial income - - -

------------ -------------- -----------

LOSS BEFORE TAX (60) (102) (139)

Income tax 3 - - -

LOSS FOR THE FINANCIAL PERIOD (60) (102) (139)

============ ============== ===========

Basic loss per ordinary

share 4 (0.22)p (0.38)p ( 0.51)p

============ ============== ===========

Diluted loss per ordinary

share 4 (0.22)p (0.37)p ( 0.51)p

============ ============== ===========

KENNEDY VENTURES PLC

UNAUDITED STATEMENT OF CHANGES IN EQUITY

for the period ended 31

December 2013

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2013 2012 2013

GBP'000 GBP'000 GBP'000

At beginning of period 99 238 238

Loss for the financial period (60) (102) (139)

AT END OF PERIOD 39 136 99

============ ============== ===========

Equity comprises share capital, share premium, capital redemption

reserve and retained profit.

KENNEDY VENTURES PLC

UNAUDITED BALANCE SHEET

as at 31 December 2013

31 December 31 December 30 June

Note 2013 2012 2013

GBP'000 GBP'000 GBP'000

NON CURRENT ASSETS

Available for sale Investments 55 55 77

------------ ------------ --------

CURRENT ASSETS

Trade and other receivables 9 32 25

Cash and cash equivalents 203 134 206

212 166 231

------------ ------------ --------

TOTAL ASSETS 267 221 308

============ ============ ========

CURRENT LIABILITIES

Trade and other payables (78) (85) (59)

(78) (85) (59)

------------ ------------ --------

NON CURRENT LIABILITIES

Secured loan notes 5 (150) - (150)

------------ ------------ --------

TOTAL LIABILITIES (228) (85) (209)

============ ============ ========

NET ASSETS 39 136 99

============ ============ ========

EQUITY

Share capital 8 271 271 271

Share premium account 7,571 7,571 7,571

Capital redemption reserve 2,077 2,077 2,077

Retained earnings (9,880) (9,783) (9,820)

TOTAL EQUITY 39 136 99

============ ============ ========

KENNEDY VENTURES PLC

UNAUDITED CASH FLOW STATEMENT

for the period ended 31

December 2013

Six months Six months

ended ended Year ended

31 December 31 December 30 June

Note 2013 2012 2013

GBP'000 GBP'000 GBP'000

CASH FLOW FROM OPERATING

ACTIVITIES

Net cash used in operating

activities 6 (25) (225) (297)

NET CASH USED IN OPERATING

ACTIVITIES (25) (225) (297)

------------ ------------------------------ -----------

INVESTING ACTIVITIES

Purchase of available for

sale investments - (55) (175)

Proceeds from disposal of

available for sale investments 22 114

NET CASH FROM / (USED IN)

INVESTING ACTIVITIES 22 (55) (61)

------------ ------------------------------ -----------

FINANCING ACTIVITIES

Net proceeds from loan note

issue - - 150

NET CASH FROM FINANCING

ACTIVITIES - - 150

------------ ------------------------------ -----------

NET DECREASE IN CASH (3) (280) (208)

CASH AT THE BEGINNING OF

PERIOD 206 414 414

CASH AT THE END OF THE PERIOD 203 134 206

============ ============================== ===========

KENNEDY VENTURES PLC

NOTES TO THE UNAUDITED FINANCIAL

STATEMENTS

for the period ended 31 December

2013

GENERAL INFORMATION AND ACCOUNTING

1 POLICIES

These interim consolidated financial statements are

for the six months ended 31 December 2013. The interim

financial report, which has not been audited or reviewed,

has been prepared in accordance with International Financial

Reporting Standards (IFRS) adopted for use in the European

Union.

The information for the period ended 30 June 2013 does

not constitute statutory accounts as defined in section

434 of the Companies Act 2006. A copy of the statutory

accounts for that year has been delivered to the Registrar

of Companies. The auditors reported on those accounts:

their report was unqualified but contained the following

words representing an emphasis of matter:

"Emphasis of Matter - Going Concern

In forming our opinion on the financial statements,

which is not modified, we have considered the adequacy

of the disclosure made in note 2 to the financial statements

concerning the Company's ability to continue as a going

concern. The conditions explained in note 2 to the financial

statements indicate the existence of a material uncertainty

that may cast significant doubt about the Company's

ability to continue as a going concern. The financial

statements do not include the adjustments that would

result if the Company were unable to continue as a going

concern."

The annual financial statements are prepared in accordance

with applicable IFRSs as adopted by the European Union.

The condensed set of financial statements included in

this half-yearly financial report has been prepared

in accordance with International Accounting Standard

34 "Interim Financial Reporting", as adopted by the

European Union.

The same accounting policies, presentation and methods

of computation are followed in the condensed set of

financial statements as applied in the Group's latest

audited financial statements.

Going concern

The Directors are satisfied that the Group has sufficient

resources to continue in operation for the foreseeable

future, a period of not less than 12 months from the

date of this report. Accordingly, they continue to adopt

the going concern basis in preparing the financial statements.

2 BUSINESS, GEOGRAPHICAL AND SEGMENTAL REPORTING

The Group's operations were only in the United Kingdom

and relate solely to the Company's operations as an

investing company seeking investments in businesses

including those with the potential to be provided with

management services by the Company.

3 TAX

Corporation tax charge for the six month period has

been estimated at GBPnil (six months ended 31 December

2012 and year ended 30 June 2013: GBPnil). No deferred

tax asset has been recognised in relation to the losses

in the period.

KENNEDY VENTURES PLC

NOTES TO THE UNAUDITED FINANCIAL STATEMENTS

For the period ended 31 December 2013

4 EARNINGS PER ORDINARY SHARE

The calculation of basic and diluted loss per share

is based on the following data:

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2013 2012 2013

GBP'000 GBP'000 GBP'000

Loss for the financial

period (60) (102) (139)

============ ============ ===========

Number of shares

Weighted average number

of ordinary shares for

the purposes of basic earnings

per share 27,098,000 27,098,000 27,098,000

Potentially dilutive ordinary

shares - 420,645 290,067

Weighted average number

of shares for the purposes

of diluted earnings per

share 27,098,000 27,518,645 27,388,067

============ ============ ===========

Basic (loss) per ordinary

share (pence) (0.22) (0.38) (0.51)

============

Diluted (loss) per ordinary

share (pence) (0.22) (0.37) (0.51)

5 BORROWINGS

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2013 2012 2013

GBP'000 GBP'000 GBP'000

Secured loan notes 150 - 150

============ ============ ===========

On 10(th) May 2013 the Company issued GBP150,000 secured

loan notes repayable on 31 October 2014, on which there

is a facility fee at the rate of GBP2,000 per quarter,

payable on redemption.

KENNEDY VENTURES PLC

NOTES TO THE UNAUDITED FINANCIAL STATEMENTS

For the period ended 31 December 2013

NOTES TO THE CASH FLOW

6 STATEMENT

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2013 2012 2013

GBP'000 GBP'000 GBP'000

Operating loss (60) (102) (139)

Loss on disposal of investments - - 6

Operating cash flows before

movement in working capital (60) (102) (133)

Decrease in receivables 16 2 9

(Decrease) / increase in

payables 19 (125) (173)

Net cash flow from operating

activities (25) (225) (297)

============ ============ ===========

7 DIVIDEND

No dividend is proposed in respect of the period to

31 December 2013 (period to 31 December 2012 and year

to 31 December 2012: GBPnil).

8 SHARE CAPITAL

31 December 30 December 30 June

2013 2012 2013

GBP'000 GBP'000 GBP'000

Issued and fully paid

27,098,000 ordinary shares

of 1p each (31 December

2012 and 30 June 2013:

27,098,000 ordinary shares

of 1p each) 271 271 271

============ ============ ===========

Note

Following the change in the Company's Articles of Association

approved by members in May 2012, the Company no longer

has an authorised share capital.

On 25 May 2012 and in association with the CVA and Placing,

the Company granted a warrant to subscribe shares representing

3% of the Company's issued ordinary share capital from

time to time exercisable at 2 pence per share at any

time up to 20 March 2015. Subsequently, it has been

agreed with the holders that the warrant will be in

respect of a fixed number of shares, being 1,142,940

ordinary shares

9 RELATED PARTY TRANSACTIONS

Apart from the remuneration of the Directors, who are

key management personnel of the Group, there have been

no other material transactions with the Board.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGUGGWUPCPGG

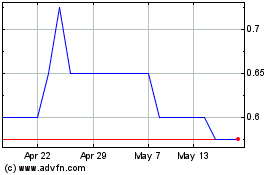

Kazera Global (LSE:KZG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kazera Global (LSE:KZG)

Historical Stock Chart

From Jul 2023 to Jul 2024