TIDMKRS

RNS Number : 7288Q

Keras Resources PLC

30 June 2022

30 June 2022

Keras Resources plc / Index: AIM / Epic: KRS / Sector:

Mining

Keras Resources plc ('Keras' or the 'Company')

Notice of General Meeting and proposed Share Consolidation

Keras Resources (AIM:KRS) , announces that a General Meeting is

being convened for Monday 25 July 2022 at 11:15 a.m. (or as soon as

the Annual General Meeting convened for 11.00 a.m. is concluded) at

Coveham House, Downside Bridge Road, Cobham, Surrey, KT11 3EP to

address the proposed consolidation of the Company's share capital

("Consolidation").

The Directors believe that the Company's existing share capital

structure is no longer appropriate, as the high number of shares in

issue combined with the relatively low price per share is thought

to result in excess volatility, reduced liquidity and a widening in

the market bid and ask share price spread in the Company's shares.

They are therefore proposing consolidating the Company's ordinary

shares of 0.01p each in issue ("Existing Ordinary Shares") so that

every 100 Existing Ordinary Shares will be consolidated into 1

ordinary share of 1p ("Consolidated Ordinary Share"). The

Consolidation will reduce the 7,973,573,068 Existing Ordinary

Shares currently in issue to 79,735,731 Consolidated Ordinary

Shares and is expected to:

-- increase the Company's share price proportionately and in

doing so help improve the market liquidity of, and trading activity

in, the Company's shares;

-- provide the basis for a narrowing in the market bid and ask

share price spread in the Company's shares; and

-- overall, further enhance the perception of the Company and its prospects and help improve the marketability of the Company's shares to a wider group of potential investors.

The Company's predominantly retail investor shareholder base has

been an essential part of the Company's growth since its admission

to AIM and remains the case. Their ongoing support has been

important to the Company building its portfolio of projects.

As all of the Existing Ordinary Shares are proposed to be

consolidated, the proportion of Consolidated Ordinary Shares held

by each Shareholder immediately before and immediately after the

Consolidation will, save for Fractional Entitlements (which are

described below), remain unchanged.

The Consolidation requires the approval of the Company's

shareholders ("Shareholders") by way of an ordinary resolution at

the General Meeting ("Resolution"). The Board considers the

Consolidation to be in the best interests of the Company and its

Shareholders and all the Directors are unanimous in their

support.

Expected Timetable of Principal Events(1)

Publication and posting of Notice of GM 30 June 2022

Latest time and date for return of Form 11:15 a.m. on 21 July

of Proxy for GM 2022

General Meeting 11:15 a.m. on 25 July

2022

Announcement of the result of the General 25 July 2022

Meeting

Record Date and final date for trading in 6.00 p.m. on 25 July

Existing Ordinary Shares 2022

Expected Admission to trading on AIM of 8.00 a.m. on 26 July

the Consolidated Ordinary Shares arising 2022

from the Consolidation

Share certificates in relation to the Consolidated Ordinary Shares

to be despatched by no later than 2 August 2022

(1) The above times and/or dates are indicative only and may

change. If any of the above times and/or dates change, the revised

times and/or dates will be notified by announcement through a

Regulatory Information Service.

Statistics relating to the Consolidation

Number of Existing Ordinary Shares in issue

at the date of this GM Notice 7,973,573,068

Number of Existing Ordinary Shares expected

to be in issue on the Record Date 7,973,573,100

Conversion ratio of Existing Ordinary Shares

to Consolidated Ordinary Shares 100:1

Total number of Consolidated Ordinary Shares

in issue following the GM 79,735,731

Nominal share value pre-consolidation 0.01 p.

Nominal share value post-consolidation 1 p.

ISIN code for Consolidated Ordinary Shares GB00BMY2T534

SEDOL code for the Consolidated Ordinary Shares BMY2T53

A notice of this meeting is also being posted to shareholders

and will be available on the Company's website.

All Shareholders are encouraged to submit their vote using the

proxy form enclosed with the Notice. Details of how to do this are

contained in the document. All valid proxy votes will be included

in the poll to be taken at the meeting.

The result of the GM will be announced shortly after its

conclusion and published on the Company's website.

1. Share Consolidation

In anticipation of the Resolution being passed by the

Shareholders, the Company will prior to the General Meeting, issue

and apply for admission to trading on AIM, such number of

additional Ordinary Shares as will result in the total number of

Ordinary Shares in issue being exactly divisible by 100. On the

assumption that no Existing Ordinary Shares are issued between the

date of this document and immediately before the General Meeting,

this will result in 32 additional Existing Ordinary Shares being

issued and admitted to trading on AIM. These additional 32 Existing

Ordinary Shares will be issued to the Registrar and will only

represent a fraction of a Consolidated Ordinary Share. This

fraction will be combined with other fractional entitlements and

sold pursuant to the arrangements for fractional entitlements

detailed below.

No Shareholder will, pursuant to the Consolidation, be entitled

to receive a fraction of a Consolidated Ordinary Share. In the

event that the number of Existing Ordinary Shares attributed to a

Shareholder is not exactly divisible by 100, the Consolidation will

generate an entitlement to a fraction of a Consolidated Ordinary

Share. Such fractional entitlements will be aggregated and sold on

the open market (see further explanation regarding fractional

entitlements below).

Accordingly, following the implementation of the Consolidation,

any Shareholder who as a result of the Consolidation has a

fractional entitlement to any Consolidated Ordinary Share, will not

have a resultant proportionate shareholding of Consolidated

Ordinary Shares exactly equal to their proportionate holding of

Existing Ordinary Shares.

Furthermore, any Shareholder who holds fewer than 100 Existing

Ordinary Shares as at the Record Date (being 6.00p.m. on 25 July

2022) ("Record Date") will, by virtue of holding a fractional

entitlement on a post-Consolidation basis, cease to be a

Shareholder. The minimum threshold to receive Consolidated Ordinary

Shares will be 100 Existing Ordinary Shares.

As set out above, the Consolidation will give rise to fractional

entitlements to a Consolidated Ordinary Share where any holding is

not precisely divisible by 100. As regards the Consolidated

Ordinary Shares, no certificates regarding fractional entitlements

will be issued. Any Consolidated Ordinary Shares in respect of

which there are fractional entitlements will be aggregated and sold

in the market for the best price reasonably obtainable on behalf of

Shareholders entitled to fractions ('Fractional Shareholders').

As the net proceeds of sale due to a Fractional Shareholder are

expected to amount in aggregate to only a trivial sum, the

Directors are of the view that, as a result of the disproportionate

costs, it would not be in the best interests of the Company to

consolidate and distribute all such proceeds of sale, which instead

shall be retained by the Company in accordance with the Articles of

Association of the Company.

For the avoidance of doubt, the Company is only responsible for

dealing with fractions arising on registered holdings. For

Shareholders whose shares are held in the nominee accounts of UK

stockbrokers, the effect of the Consolidation on their individual

shareholdings will be administered by the stockbroker or nominee in

whose account the relevant shares are held. The effect is expected

to be the same as for shareholdings registered in beneficial names,

however it is the stockbroker's or nominee's responsibility to deal

with fractions arising within their customer accounts, and not the

Company's responsibility.

Subject to the adjustments required for fractional entitlements

described above, the number of Consolidated Shares to be issued to

each shareholder will be based upon the number of Existing Ordinary

Shares registered to each shareholder on the Company's share

register at the Record Date.

It is expected that the Consolidated Ordinary Shares held in

uncertificated form will be credited to Shareholders' CREST

accounts at 8:00 a.m. on 26 July 2022.

It is expected that definitive share certificates in respect of

the Consolidated Ordinary Shares held in certificated form will be

despatched to relevant Shareholders by 1(st) class post, at the

risk of the Shareholder, within seven days of the admission of the

Consolidated Ordinary Shares to trading on AIM (which is expected

to occur at 8:00 a.m. on 26 July 2022). No temporary documents of

title will be issued. Share certificates in respect of Existing

Ordinary Shares will cease to be valid on 25 July 2022 and, pending

delivery of share certificates in respect of Consolidated Ordinary

Shares, dealings will be certified against the register.

2. Resulting share capital

If approved by Shareholders, the issued share capital of the

Company immediately following the Consolidation is expected to

comprise 79,735,731 Consolidated Ordinary Shares (assuming that no

other shares are allotted and issued by the Company between the

date of this letter and the General Meeting, excluding the issue of

the additional Existing Ordinary Shares noted above).

3. Rights attaching to Consolidated Ordinary Shares

The Consolidated Ordinary Shares arising upon implementation of

the Consolidation will have the same rights as the Existing

Ordinary Shares including voting, dividend, return of capital and

other rights.

4. Admission of the Consolidated Ordinary Shares

Application will be made for the Consolidated Ordinary Shares to

be admitted to trading on AIM in place of the Existing Ordinary

Shares ("Admission"). Subject to the Resolution being passed,

dealings in the Existing Ordinary Shares will cease on the Record

Date. It is expected that Admission will become effective and that

dealings in the Consolidated Ordinary Shares will commence at 8:00

am on 26 July 2022.

Following the Consolidation, the Company's new ISIN Code will be

GB00BMY2T534 and its new SEDOL Code will be BMY2T53.

5. Action to be Taken

A Form of Proxy for use at the General Meeting accompanies this

document. The Form of Proxy should be completed and signed in

accordance with the notes in the Notice of General Meeting and the

instructions contained in the Form of Proxy and returned to Share

Registrars Limited at 3 The Millennium Centre, Crosby Way, Farnham,

Surrey, GU9 7XX, by no later than 11:15 a.m. on 21 July 2022.

6. Recommendation

The Directors consider the Consolidation to be in the best

interests of the Company and its Shareholders as a whole and

unanimously recommend Shareholders to vote in favour of the

Resolution to be proposed at the General Meeting as they intend to

do so in respect of their beneficial holdings amounting, in

aggregate, to 1,699,448,231 Existing Ordinary Shares, representing

approximately 21.31% of the existing ordinary share capital of the

Company.

=

**ENDS**

For further information please visit www.kerasplc.com , follow

us on Twitter @kerasplc or contact the following:

Graham Stacey Keras Resources plc annabel@kerasplc.com

Annabel Redford

Nominated Adviser & Joint

Broker +44 (0) 20 3470

Ewan Leggat / Charlie SP Angel Corporate Finance 0470

Bouverat LLP

Joint Broker +44 (0) 207 186

Damon Heath / Erik Woolgar Shard Capital Partners 9900

LLP

Financial and Corporate

Communications +44 (0) 774 884

Felicity Winkles Celicourt 3871

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFFILRDIAFIF

(END) Dow Jones Newswires

June 30, 2022 02:00 ET (06:00 GMT)

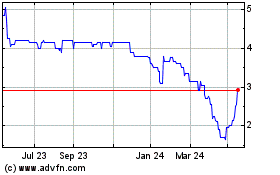

Keras Resources (LSE:KRS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Keras Resources (LSE:KRS)

Historical Stock Chart

From Jan 2024 to Jan 2025