TIDMKRM

RNS Number : 8303E

KRM22 PLC

04 July 2023

KRM22 plc

("KRM22", the "Group" and the "Company")

Posting of Annual Accounts, Circular and

Notice of General Meeting to approve share authority, the

amendment of the Convertible Facility Agreement, and approve Annual

Accounts

KRM22 plc (AIM: KRM.L), the technology and software company

focused on risk management in capital markets, announces that the

Company's Annual Report and Accounts for the year ended 31 December

2022 have today been posted to shareholders. The Company is also

today posting a circular (the "Circular") to shareholders in

connection with the granting of authority to allot shares,

dis-apply pre-emption rights and approve the Annual Accounts,

including a notice of a general meeting to be held at 11.00 a.m. on

27 July 2023 for the purpose of approving the resolutions as set

out in the notice of GM.

Accounts

As explained in a letter to shareholders on 7 June 2023, at the

Annual General Meeting of the Company held on 30 June 2023, no

resolutions were proposed in relation to the Company's Annual

Report and Accounts for the appointment or remuneration of the

Company's auditors. The general meeting is therefore being convened

to enable voting on formal resolutions to approve the Annual Report

and Accounts of the Company for the year ended 31 December 2022 and

in relation to the Company's auditors.

Convertible Facility Agreement

On 19 June 2023 the Company announced that it had entered into a

GBP5 million facility agreement (the "Facility Agreement") arranged

by Trading Technologies International, Inc. ("TT"), the Company's

largest shareholder.

The maximum number of shares (3,566,630) that can be issued to

TT derives from the Company's pre-existing authorisation to allot

shares and disapplication of pre-emption rights approved by

shareholders at the 2022 AGM. The ability to convert part of the

outstanding amount under the Facility Agreement into this number of

shares came into being on execution of the Facility Agreement and

is not subject to any future shareholder approval.

Pursuant to the Facility Agreement, the Company agreed that it

will as soon as practicable convene a general meeting to approve

the allotment of new ordinary shares sufficient to convert the full

amount of the Facility Agreement at a conversion price as set out

in the agreement. If the full amount of GBP5 million was drawn down

under the Facility Agreement and converted at a conversion price of

GBP0.46 that would result in the issue of 10,869,565 new ordinary

shares to TT.

Side Letter and amendment of certain terms of the Facility

Agreement

Pursuant to shareholder consultation the Company has entered

into a side letter with TT (the "Side Letter") conditionally

amending the terms of the Facility Agreement such that, provided

the Company's shareholders vote to authorise the allotment of

shares in accordance with the Facility Agreement on or before 27

July 2023, the conversion price will now be capped at GBP0.46,

which would mean that the maximum number of shares that could be

issued in connection with the Facility Agreement would be

10,869,565. The Side Letter thereby removes any ability of TT to

convert the facility at share prices below 46p, provided the

requisite share authority is approved by shareholders as described

above.

Under the Side Letter, if the Company's shareholders have not

authorised the allotment of shares in accordance with the Facility

Agreement on or before 27 July 2023, then the term of the

conversion shall remain as previously announced on 19 June

2023.

Pursuant to Rule 9 of the Takeover Code, TT cannot acquire 30

per cent. or more of the voting rights in the Company without being

required to make a mandatory cash offer for all the shares in the

Company not already held by it. No waiver from Rule 9 is being

sought in connection with the conversion right under the Facility

Agreement.

Pursuant to its obligations under the Facility Agreement as

amended by the Side Letter, the Company is writing to shareholders

to convene the general meeting and seek authority to allot shares

in accordance with the Facility Agreement.

Related Party Transaction

TT is considered a "related party" as defined under the AIM

Rules as a result of its substantial shareholding of 25.0 per cent.

in the Company. The entering into of the Side Letter between the

Company and TT constitutes a related party transaction for the

purposes of Rule 13 of the AIM Rules.

The Independent Directors, being Stephen Casner, Kim Suter,

Garry Jones, Sandy Broderick and Steve Sparke, consider, having

consulted with the Company's nominated adviser, finnCap, for the

purposes of the AIM Rules, that the terms of the Side Letter and

the amendment to the Facility Agreement are fair and reasonable

insofar as the Company's shareholders are concerned.

General Meeting

The general meeting will be held at the offices of finnCap, One

Bartholomew Close, London, EC1A 7BL on Thursday, 27 July 2023 at

11.00 a.m.

The Circular and notice of general meeting will shortly be made

available on the Company's website,

https://www.krm22.com/investor-relations/documents .

Recommendation

The Directors consider the resolutions which are set out in the

notice and which are to be proposed at the forthcoming general

meeting, to be in the best interests of the Company and of

shareholders as a whole and unanimously recommend shareholders to

vote in favour of all such resolutions, as each of the Directors

intends to do in respect of their own beneficial holding. The

Directors have a beneficial interest in 3,764,958 ordinary shares

in the capital of the Company representing approximately 10.56 per

cent. of the Company's issued share capital.

For further information please contact:

KRM22 plc

InvestorRelations@krm22.com

Keith Todd CBE, Executive Chairman

Stephen Casner, CEO

Kim Suter, CFO

finnCap Ltd (Nominated Adviser and Broker) +44 (0)20 7220

0500

Carl Holmes / George Dollemore

Alice Lane / Sunila de Silva (ECM)

About KRM22 plc

KRM22 is a closed-ended investment company which listed on AIM

on 30 April 2018. The Company has been established with the

objective of creating value for its investors through the

investment in, and subsequent growth and development of, target

companies in the technology and software sector, with a focus on

risk management in capital markets.

Through its investments and the Global Risk Platform, KRM22

helps capital market companies reduce the cost and complexity of

risk management. The Global Risk Platform provides applications to

help address firms' trading and corporate risk challenges and to

manage their entire enterprise risk profile.

Capital markets companies' partner with KRM22 to optimise risk

management systems and processes, improving profitability and

expanding opportunities to increase portfolio returns by leveraging

risk as alpha.

KRM22 plc is listed on AIM and the Group is headquartered in

London, with offices in several of the world's major financial

centres.

See more about KRM22 at KRM22.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGBXLLBXDLFBBE

(END) Dow Jones Newswires

July 04, 2023 02:00 ET (06:00 GMT)

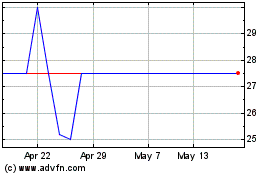

Krm22 (LSE:KRM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Krm22 (LSE:KRM)

Historical Stock Chart

From Mar 2024 to Mar 2025