Interim Management Statement

November 18 2010 - 2:00AM

UK Regulatory

TIDMKLR

RNS Number : 3781W

Keller Group PLC

18 November 2010

Thursday, 18 November 2010

Keller Group plc

Interim Management Statement

Keller Group plc ("Keller" or "the Group"), the international ground engineering

specialist, issues this Interim Management Statement covering the period from 1

July to 17 November 2010.

Overview

Keller's developing markets still present excellent growth opportunities.

However, conditions in the Group's mature markets continue to be difficult and

the overall picture remains challenging.

In the four months to the end of October, like-for-like revenue was in line with

the same period last year. This shows an improvement on the first six months,

for which like-for-like revenue was down by 14% compared with the previous first

half, in part reflecting the severe weather impact on many of the Group's

businesses. However, as anticipated at the time of the half-year results,

intense competition in the Group's mature markets has meant that margins have

remained under pressure.

Management is implementing further cost reduction measures in its more difficult

markets, which will result in a total of GBP3m of redundancy and other

reorganisation costs in 2010, most of which will be incurred in the final

quarter. After taking account of these charges, the Board expects the 2010

full-year results to be around the bottom end of the current range of market

expectations.

Divisional Review

US

Conditions in the general US construction market overall remain challenging,

although the rate of year-on-year decline in spending has slowed.

In the Group's US foundation contracting businesses, contract awards since the

half year and the order book at the end of October were both ahead of the same

time last year. However, this has not yet fed through into higher activity

levels and, as anticipated at the time of our half-year results, margins have

remained under significant pressure. Trading within Suncoast continues to be

challenging, with its residential and commercial high-rise markets still in the

doldrums, and management has responded with further headcount reductions in the

second half.

Continental Europe, Middle East & Asia (CEMEA)

Within Continental Europe, the Group's Polish business has performed well in a

market which remains strong and the business in Germany has continued to hold

up. Elsewhere in Continental Europe, conditions in our other major markets

remain difficult, necessitating further cost reduction measures, most notably in

France and Spain.

With good demand for our products, we continue to grow profitably in India and

our other Asian markets and the Middle East remains stable.

Australia

The Group's Australian business is still performing strongly, largely on the

back of infrastructure and resources-related projects. Looking ahead, this

business should benefit from a number of major projects which are in the

pipeline, albeit that some will not be awarded before late 2011.

The integration of Waterway, the near-shore marine foundation contractor

acquired by the Group in June 2010, is progressing well and already several

opportunities have been identified where synergies exist with one or more of the

Group's other Australian companies.

UK

The Group's business in the UK has continued to be beset by very weak market

conditions. Actions taken in the first half to reduce overheads and operating

costs will not be sufficient to offset the impact on its full-year results of a

reduction in volume in the second half.

Financial Position

The Group's financial position remains strong, with net debt at the end of

October standing at approximately GBP109m (30 June 2010: GBP121m). The Group

continues to have sufficient available financing to meet all of its strategic

and operational goals and the planned refinancing of the Group's central banking

facilities is expected to be completed by the end of the year.

Outlook

After charging GBP3m of redundancy and other reorganisation costs, most of which

will be incurred in the final quarter, the Board expects the 2010 full-year

results to be around the bottom end of the current range of market expectations.

The improvement in contract awards in the first half of the year has been

maintained and, as at the end of October, the order book was 7% ahead of the

same time last year on a constant currency basis, compared with 1% at the end of

June. However, as previously stated, underlying margins are not expected to

begin to improve until such time as there is confidence in a sustained recovery

in volumes.

Keller will issue a routine pre-close statement in respect of the year ending 31

December 2010 on 17 December 2010.

For further information, please contact:

+------------------------------------+------------------------+

| Keller Group plc | www.keller.co.uk |

+------------------------------------+------------------------+

| Justin Atkinson, Chief Executive | 020 7616 7575 |

+------------------------------------+------------------------+

| James Hind, Finance Director |

+-------------------------------------------------------------+

| |

+-------------------------------------------------------------+

| Finsbury | |

+------------------------------------+------------------------+

| James Leviton, Clare Hunt, Alison | 020 7251 3801 |

| Kay | |

+------------------------------------+------------------------+

This document contains forward-looking statements which have been made in good

faith based on the information available at the time of its approval. It is

believed that the expectations reflected in these statements are reasonable, but

they may be affected by a number of risks and uncertainties that are inherent in

any forward-looking statement which could cause actual results to differ

materially from those currently anticipated.

Note to Editors

Keller is the world's largest independent ground engineering specialist,

providing technically advanced and cost-effective foundation solutions to the

construction industry. With 2009 revenue of GBP1,038m, Keller is a member of the

FTSE-250. It has around 6,000 staff world-wide, with offices in over 30

countries on five continents.

Keller is the market leader in the US and Australia; it has prime positions in

most established European markets; and a strong profile in many developing

markets.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSLLFIDLVLDLII

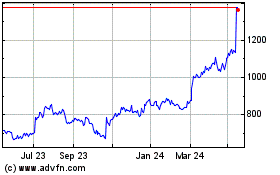

Keller (LSE:KLR)

Historical Stock Chart

From Jun 2024 to Jul 2024

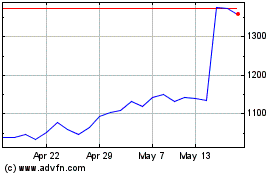

Keller (LSE:KLR)

Historical Stock Chart

From Jul 2023 to Jul 2024