TIDMIOG

RNS Number : 0555D

IOG PLC

16 June 2023

16 June 2023

IOG plc

Proposed short-term Bond amendments

IOG plc ("IOG", or "the Company"), (AIM: IOG.L) provides a

further update following the RNS of earlier today regarding

discussions with bondholders.

As stated, one of the Company's key objectives is to create a

stable period to address both near-term pressures and the

longer-term bond maturity. In that context, the Company has

requested bondholders to consider certain short-term amendments to

the Bond, notably:

-- that the minimum Interest Cover Ratio requirement pursuant to

paragraph 13.20(c) of the Bond Terms with respect to the Relevant

Period ending on 30 June 2023 is waived;

-- as indicated earlier, that the payment date for the interest

payment due to be made on 20 June 2023 pursuant to paragraph 9.2 of

the Bond Terms is deferred from 20 June 2023 to 31 July 2023 (with

those funds remaining in the Debt Service Reserve Account);

-- that any event of default arising out of cross default from a

claimed event of default under the subordinated LOG convertible

loan note is waived until 31 July 2023.

A summons for a written resolution ("the Proposed Resolution")

reflecting the above is being issued to bondholders seeking

approval of these amendments. The Company has received voting

undertakings of support to vote in favour of the Proposed

Resolution from bondholders controlling more than 50% of the Voting

Bonds.

Rupert Newall, CEO, commented:

"As noted earlier, we are engaging constructively with our

bondholders to ensure that the Company is best positioned to

deliver value for its stakeholders. That includes these proposed

short-term amendments to the Bond, for which I am pleased to say we

already have voting undertakings in support from bondholders

controlling more than 50% of the voting bonds. As ever we will keep

the market updated on progress."

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Enquiries:

IOG plc

Rupert Newall (CEO)

James Chance (Head of Capital Markets & ESG) +44 (0) 20 7036 1400

finnCap Ltd

Christopher Raggett / Simon Hicks +44 (0) 20 7220 0500

Peel Hunt LLP

Richard Crichton / David McKeown +44 (0) 20 7418 8900

Vigo Consulting

Patrick d'Ancona / Finlay Thomson +44 (0) 20 7390 0230

About IOG:

IOG is a UK developer and producer of indigenous offshore gas.

The Company began producing gas in March 2022 via its offshore and

onshore Saturn Banks production infrastructure. In addition to its

production assets, IOG operates several UK Southern North Sea

licences containing gas discoveries and prospects which, subject to

future investment decisions, may be commercialised through the

Saturn Banks infrastructure. All its assets are co-owned 50:50 with

its joint venture partner CalEnergy Resources (UK) Limited. Further

details of its portfolio can be found at www.iog.co.uk .

Denne meldingen til obligasjonseierne er kun utarbeidet på

engelsk. For informasjon vennligst kontakt Nordic Trustee AS.

To the bondholders of:

ISIN: NO0010863236 Independent Oil and Gas plc. FRN senior secured

EUR 130,000,000 bond 2019/2024

Oslo, 16 June 2023

Summons for a written resolution

Nordic Trustee AS (the "Bond Trustee") acts as bond trustee for

the holders of bonds (the "Bondholders") in the above mentioned

bond issue with ISIN NO0010863236 (the "Bonds") issued by IOG plc.

(previously known as Independent Oil and Gas plc.) as issuer (the

"Issuer") pursuant to the bond terms made between the Bond Trustee

and the Issuer dated 19 September 2019 (the "Bond Terms").

All capitalised terms used, but not defined, herein shall have

the meaning assigned to them in the Bond Terms, unless otherwise

stated herein. References to Clauses and paragraphs are references

to Clauses and paragraphs in the Bond Terms.

The Bond Trustee has issued this summons for a Written

Resolution pursuant to a request from the Issuer, in accordance

with the Bond Terms.

The information in this summons (the "Summons") regarding the

Issuer, market conditions and described transactions is provided by

the Issuer, and the Bond Trustee expressly disclaims all liability

whatsoever related to such information. Bondholders are encouraged

to read this Summons in its entirety.

1 background

The Bond Trustee has been informed by the Issuer that it is

seeking certain waivers to the Bond Terms as further described

below.

As a consequence of the sharp fall in gas prices during the

course of 2023 and the delay in bringing Blythe H2 on to production

at the expected gas flow rate, the liquidity position of the

Company has become an important area of focus. The Company is

looking to maintain an adequate liquidity buffer to secure

stability during its process of discussions with bondholders. The

purpose of these discussions is:

a) to secure pre-emptive waivers of potential covenant breaches;

b) to agree measures to enable the Company to withstand short

term consequences of recent gas price developments; and

c) to explore the most effective means of addressing the

maturity of the bond in September 2024.

In addition to self-help measures taken by the Company,

liquidity is also impacted by the requirement to pay cash interest

on the Bond, with the next payment due on 20 June 2023. Whilst

discussions between the Company and the Ad-Hoc Group (as defined

below) of Bondholders progress, it is important for stability that

the payment date for the next interest payment be deferred to 31

July 2023. The current balance held on the debt service retention

account is EUR3.11 million, and will remain in place until the

proposed deferred coupon date.

Alleviation of the constraints and demands on the Company's

liquidity resulting from the Bond Terms would not only directly

benefit the Company but would be likely to have a significantly

beneficial impact on the outcome of other self-help measures. Any

self-help measures will be considerably more difficult if there is

an impending breach of Bond Terms, including financial covenants,

as at 30 June 2023.

The Issuer has further made the Bond Trustee aware that pursuant

to the LOG Debt held by London Oil and Gas ("LOG") it is an

immediate event of default if, by reason of actual or anticipated

financial difficulties, any member of the Group commences

negotiations with one or more of its creditors (excluding LOG) with

a view to rescheduling any of its indebtedness.

This means that, unless an amendment is agreed, a cross default

in respect of the LOG Debt may be triggered under the Bond Terms as

a result of negotiations between the Issuer and the Bondholders.

The LOG Debt is subject to a subordination agreement with the Bond

Trustee which inter alia restricts LOG from taking action against

IOG whilst amounts due under the Bonds remain outstanding.

Accordingly, LOG's ability to do anything as a result of any

default under the LOG Debt will be severely limited. However, a

cross default provision exists whereby IOG would trigger an event

of default under the Bond Terms in the event that any creditor

(including LOG) became entitled to declare financial indebtedness

due and payable prior to its maturity date as a result of the event

of default.

Consequently, it is requested that the Bond Terms are amended so

that a default under the Bond Terms arising out of cross default

from a claimed LOG Debt event of default due to discussions taking

place between the Issuer and Bondholders is waived until 31 July

2023, as further specified in item 2 below.

The Issuer has informed the Bond Trustee that it has received

voting undertakings in support of the Proposal from Bondholders

controlling more than 50 per cent. of the Voting Bonds (the "Ad-Hoc

Group").

The Ad-Hoc Group contemplates to engage ABG Sundal Collier ASA

("ABGSC") as advisor to the Bond Trustee (on behalf of itself and

the Bondholders). The Issuer has agreed to cover the fees of ABGSC.

However, in the event that the Issuer does not cover the fees of

ABGSC, it is contemplated that the Bond Trustee shall be authorised

to cover such unpaid fees from the recovery of the Bondholders

under the Finance Documents, limited to 1% of the aggregate Nominal

Amount of the Outstanding Bonds at the date of this Summons.

2 The PROPOSAL

Based on the above, the Issuer has requested the Bond Trustee to

summon a Written Resolution to propose that the Bondholders resolve

to approve the following resolution (the "Proposal"):

(a) that the minimum Interest Cover Ratio requirement pursuant

to paragraph 13.20(c) of the Bond Terms with respect to the

Relevant Period ending on 30 June 2023 is waived;

(b) that the payment date for the interest payment due to be

made by the Issuer on 20 June 2023 pursuant to paragraph 9.2 of the

Bond Terms is deferred from 20 June 2023 to 31 July 2023 (and shall

be payable to the holders of the Bonds on such deferred payment

date with the record date for the payment being two Business Days

prior to such deferred payment date, and for the avoidance of doubt

no additional interest shall accrue on such amounts as a result of

the deferral);

(c) that any event of default under the Bond Terms pursuant to

paragraph 14.1(e) arising out of a composition, compromise,

assignment or arrangement with any creditor (including LOG) in

connection with the circumstances described above is waived until

31 July 2023;

(d) that any event of default under the Bond Terms pursuant to

paragraph 14.1(d)(iv) arising out of cross default from a claimed

event of default under the LOG Debt caused by discussions taking

place or any agreement or arrangement being entered into between

the Company and Bondholders (as well as the Company and any other

creditor of the Company) is waived until 31 July 2023, and the

Bondholders consent to the Issuer entering into negotiations with

LOG to agree a formal written waiver of any event of default under

the LOG Debt caused by the above;

(e) that the Bondholders confirm that all fees, costs and

expenses incurred by the Bond Trustee in connection with the

engagement of ABGSC, to the extent not covered by the Issuer, shall

be treated in the same manner as fees, costs and expenses incurred

under the Bond Trustee Fee Agreement, including, but not limited

to:

(i) that any Partial Payment received shall firstly be used to

settlement of fees, costs and expenses incurred by the Bond Trustee

prior to payment of any amounts outstanding under the Bond Terms,

cf. Clause 8.3 (Partial Payments) of the Bond Terms; and

(ii) that the Bond Trustee may make a reduction in the

Bondholders' proceeds equal to the amount owed to ABGSC in the

event that the Issuer does not reimburse the Bond Trustee's

incurred fees, costs and expenses, cf. paragraph (g) of Clause 16.4

(Expenses, liability and indemnity) of the Bond Terms; and

(f) that the Bond Trustee shall be authorised and instructed to

implement and effect the Proposal.

The Proposal shall take effect from the date on which it has

been duly approved by the necessary 2/3 majority of Voting Bonds as

per Clause 15.5 (Written Resolutions). Upon such approval, the

Issuer and the Bond Trustee shall enter into an amendment agreement

documenting the waivers granted herein.

Other than the waivers and amendments contemplated by the

Proposal (including any necessary logical and/or related

adjustments), the Bond Terms shall remain unchanged and continue to

apply in their existing form.

3 evaluation of the PROPOSAL

The Proposal is put forward to the Bondholders without further

evaluation or recommendation from the Bond Trustee, and the Bond

Trustee emphasises that each Bondholder should cast its vote based

on its own evaluation of the Proposal. Nothing herein shall

constitute a recommendation to the Bondholders by the Bond

Trustee.

The Bondholders must independently evaluate whether the Proposal

is acceptable and vote accordingly. The Bond Trustee urges each

Bondholder to seek advice in order to evaluate the Proposal.

4 Further information

Subject to adoption of the Proposed Resolution, the Bond Trustee

will (on behalf of itself and the Bondholders) retain ABGSC as

financial advisor (the "Advisor"). Bondholders may contact the

Advisor for further information:

Ola Nygård, +47 41 21 34 10, projectatom@abgsc.no

Harald Erichsen, +47 48 01 60 23, projectatom@abgsc.no .

The Advisor acts solely for the Bond Trustee and the Bondholders

and no-one else in connection with the Proposal. No due diligence

investigations have been carried out by the Advisor with respect to

the Issuer, and the Advisor expressly disclaims any and all

liability whatsoever in connection with the Proposal (including but

not limited to in respect of the information herein).

For further questions to the Bond Trustee, please contact Lars

Erik Lærum, +47 22 87 94 06, laerum@nordictrustee.com .

5 written resolution

Bondholders are hereby provided with a voting request for a

Written Resolution pursuant to Clause 15.5 (Written Resolutions).

For the avoidance of doubt, no Bondholders' Meeting will be

held.

It is proposed that the Bondholders resolve the following (the

"Proposed Resolution"):

"The Bondholders approve the Proposal as described in section 2

(The Proposal) of this Summons on the conditions set out

herein.

The Bondholders approve and instruct the Bond Trustee to engage

ABGSC on the terms set out herein.

The Bond Trustee is hereby authorized to implement the Proposal

and carry out other necessary work to implement the Proposal,

including to prepare, negotiate, finalize and enter into all

necessary agreements in connection with documenting the decisions

made by way of this Written Resolution as well as carry out

necessary completion work, including agreeing on necessary

amendments to the Bond Terms and other Finance Documents."

* * * *

Voting Period: The Voting Period shall expire ten (10) Business

Days after the date of this Summons, being on 3 July 2023 at 16:00

Oslo time. The Bond Trustee must have received all votes necessary

in order for the Written Resolution to be passed with the requisite

majority under the Bond Terms prior to the expiration of the Voting

Period.

How to vote: A scan of a duly completed and signed voting form

(attached hereto as Appendix 1), together with proof of

ownership/holdings must be received by the Bond Trustee no later

than at the end of the Voting Period and must be submitted by

e-mail to mail@nordictrustee.com .

A Proposed Resolution will be passed if either: (a) Bondholders

representing at least a 2/3 majority of the total number of Voting

Bonds vote in favour of the relevant Proposed Resolution prior to

the expiry of the Voting Period; or (b) (i) a quorum representing

at least 50% of the total number of Voting Bonds submits a timely

response to the Summons and (ii) the votes cast in favour of the

relevant Proposed Resolution represent at least a 2/3 majority of

the Voting Bonds that timely responded to the Summons.

If no resolution is passed prior to the expiry of the Voting

Period, the number of votes shall be calculated at the expiry of

the Voting Period, and a decision will be made based on the quorum

and majority requirements set out in Clause 15.1 (Authority of the

Bondholders' Meetings).

The effective date of a Written Resolution passed prior to the

expiry of the Voting Period is the date when the resolution is

approved by the last Bondholder that results in the necessary

voting majority being achieved.

If the above resolution is not adopted as proposed herein, the

Bond Terms and other Finance Documents will remain unchanged.

Yours sincerely,

Nordic Trustee AS

Appendices:

Appendix 1 - Voting form

Appendix 1: Voting Form - Written Resolution

ISIN NO0010863236 Independent Oil and Gas plc. FRN senior

: secured EUR 130,000,000 bond 2019/2024

The undersigned holder or authorised person/entity, votes in the

following manner to the Proposed Resolution as defined in the

Summons for a Written Resolution dated 16 June 2023:

In favour of the Proposed Resolution

Against the Proposed Resolution

ISIN Amount of bonds owned

NO0010863236

Custodian Name Account number at Custodian

----------------------------

Company Day time telephone number

----------------------------

E-mail

----------------------------

Enclosed to this form is the complete printout from our

custodian/VPS ([1]) , verifying our bondholding in the bond issue

as of ______________________ 2023.

We acknowledge that Nordic Trustee AS in relation to the Written

Resolution for verification purpose may obtain information

regarding our holding of Bonds on the above stated account in the

securities register VPS.

We consent to the following information being shared with the

Advisor:

Our identity and amounts of Bonds owned

Our vote

_____________________ ___________________________________________

Place, date Authorized signature

Return by mail:

Nordic Trustee AS

PO Box 1470 Vika

N-0116 Oslo

Norway

Telephone: +47 22 87 94 00

E-mail: mail@nordictrustee.com

[1] If the Bonds are held in custody other than in the VPS,

evidence provided from the custodian confirming that (i) you are

the owner of the Bonds, (ii) in which account number the Bonds are

held, and (iii) the amount of Bonds owned.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKABQPBKDKAD

(END) Dow Jones Newswires

June 16, 2023 11:53 ET (15:53 GMT)

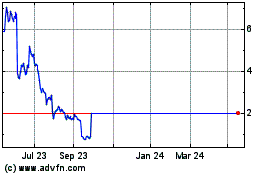

Iog (LSE:IOG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Iog (LSE:IOG)

Historical Stock Chart

From Jan 2024 to Jan 2025