TIDMHWG

RNS Number : 3963L

Harworth Group PLC

30 April 2020

30 April 2020

LEI 213800R8JSSGK2KPFG21

Harworth Group plc

TRADING UPDATE

Harworth Group plc ("Harworth" or the "Company"), a leading

regenerator of land and property for development and investment,

today provides a trading update covering the period since the

Preliminary Results announcement on 17 March 2020, in light of the

economic and social disruption caused by the COVID-19 pandemic.

Our priority remains the health, safety and well-being of our

employees and wider stakeholders, whilst protecting long-term

shareholder interests. The Company's strong balance sheet and

fundamentals means that it is well positioned to mitigate any

short-term market volatility and to take advantage of any land and

property opportunities that arise as a result of present market

conditions.

KEY OPERATIONAL & FINANCIAL HIGHLIGHTS

-- Completion of key commercial land sale at Skelton Grange on

16 April, for a total consideration of GBP13

million, ahead of 31 December 2019 book value

-- Continuing infrastructure works on six major development

sites, in order to support future agreed sales

programme

-- Income from the Company's diverse portfolio continuing to

cover operating costs, with March quarter rent received broadly in

line with previous quarters

-- New lettings have further reduced its Business Space vacancy rate to 4.8% (FY 2019: 6%)

-- GBP30 million increase to the revolving credit facility

agreed with lenders, to GBP130 million, providing increased

operational flexibility and the ability to take advantage of future

suitable land and property opportunities

-- A final dividend for FY 2019 will no longer be recommended

but an additional 2020 interim dividend, in

lieu of the FY 2019 final dividend, will be considered in due course

Balance Sheet and Liquidity

As reported in our Preliminary Results announcement on 17 March

2020, Harworth entered this unprecedented period in a strong

financial position, with cash and undrawn debt facilities of GBP36

million (at 31 December 2019).

The Company has continued to exercise a prudent and disciplined

approach to financing and as a result remains well capitalised,

with a net loan-to-portfolio value today (based on 31 December 2019

valuations) of 12.4% (FY 2019: 12.1%).

In support of the Company's strategy, our lenders have agreed to

increase our revolving credit facility limit by GBP30 million to

GBP130 million, providing both operational flexibility and the

ability to take advantage of future suitable land and property

opportunities. The pricing on these facilities will increase

marginally by 0.15%. This means that the Company will have

substantial available liquidity of GBP64 million once documented,

comprising GBP34 million of cash and GBP30 million of undrawn

facilities, with no significant debt maturities until 2023.

Update on Trading

With a number of housebuilder customers announcing reduced

activity on live construction sites and new purchases, the Company

is prioritising its capital expenditure on those of its major

development sites that have agreed sales in place for later in the

year, in line with its strategy of effectively managing cash flows

to fund sustainable growth. Infrastructure works are therefore

continuing on six active development sites across the portfolio.

The Company and our contractors are adhering strictly to all

government guidelines on social distancing and safe working

practices during this period.

The Company's financial position has been further strengthened

by the completed disposal earlier this month of 19.5 acres of land

at our Skelton Grange site in Leeds, to leading energy from waste

("EfW") operator and developer Wheelabrator Technologies,

("Wheelabrator") for a total consideration of GBP13 million. The

site, adjacent to Junction 45 of the M1 to the east of Leeds, has

planning consent for a 410,000 tonne per annum EfW facility. The

project will be taken forward by Wheelabrator with the support of

Multifuel Energy Limited, a 50:50 joint venture between

Wheelabrator and Scottish and Southern Energy.

Harworth's income collection, derived from its Business Space

and Natural Resources assets with its diversified tenant base,

continues to be robust and covers all business overheads and

interest on its loan facilities, with rental payments received for

the March quarter broadly in line with previous quarters.

In March we completed a fourth new letting in 2020 at Multiply

Logistics North, the joint venture between Harworth and the

Lancashire County Pension Fund at our Logistics North development.

The joint venture has completed a ten-year letting of Unit F2/B,

comprising c.55,600 sq. ft, to PJH Group Limited, the UK's largest

supplier of bathrooms, appliances, sinks and taps. As a result of

the active asset management undertaken in 2020 to date, the

Business Space portfolio vacancy has reduced to 4.8% (FY 2019: 6%),

with a weighted average lease length to expiry remaining in excess

of 13 years.

2019 Final Dividend and Annual General Meeting

Notwithstanding our current balance sheet strength and liquidity

headroom, the macro economic environment is one of heightened

uncertainty. After due consideration, the Board, therefore,

believes that it is now prudent to not recommend to the forthcoming

Annual General Meeting ("AGM") the previously announced final

dividend of 0.7p per share for the financial year ended 31 December

2019. This will therefore not be paid on 29 May as previously

announced on 17 March. However, the Board recognises the importance

of dividends to shareholders and therefore intends to consider the

appropriateness and timing of an additional interim dividend

(equivalent to the previously announced 2019 final dividend) for

the financial year ending 31 December 2020 when it has a clearer

view of the ongoing effects on the Company of the COVID-19

pandemic.

The Company is now planning to hold its 2020 AGM on 29 June

2020. This is a month later than in previous years, in order to

afford more time for the Board to monitor the COVID-19 backdrop

and, in particular, the evolving position with regard to

restrictions on movement and public gatherings. Further details

regarding its format will be provided to shareholders in due

course. The 2019 Annual Report and Accounts will be published and

distributed to shareholders alongside the Notice of AGM not less

than 20 working days in advance of the AGM.

Outlook

Whilst it is too early to say with any certainty, the Board

expects that the disruption caused by the COVID-19 pandemic will

likely have a material influence on the Company's results for the

financial year to 31 December 2020. However, given the positive

long-term fundamentals of the Company's strategy including its

focus on those structurally supported sectors of residential,

industrial and logistics within the North of England and the

Midlands, the Board remains confident that the Company is strongly

positioned for the future, continuing to transform land and

property into sustainable places where people want to live and

work, and directly supporting the UK's economic recovery.

-ENDS-

Enquiries:

Harworth Group plc FTI Consulting

Owen Michaelson, Chief Executive Dido Laurimore

Kitty Patmore, Chief Financial Officer Richard Gotla

Iain Thomson, Head of Communications Eve Kirmatzis

& IR Tel: +44 (0)20 3727 1000

Tel: +44 (0)114 349 3131 Harworth@fticonsulting.com

investors@harworthgroup.com

ABOUT HARWORTH GROUP PLC

Listed on the premium segment of the main market, Harworth Group

plc (LSE: HWG) invests to transform land and property into

sustainable places where people want to live and work. Harworth

owns and manages a portfolio of approximately 18,000 acres of land

on around 100 sites located throughout the North of England and

Midlands (harworthgroup.com).

This announcement contains certain forward-looking statements

which, by their nature, involve risk, uncertainties and assumptions

because they relate to future events and circumstances. Actual

outcomes and results may differ materially from any outcomes or

results expressed or implied by such forward looking statements.

Any forward-looking statements made by, or on behalf of, the

Company are made in good faith based on current expectations and

beliefs and on the information available at the time the statement

is made. No representation or warranty is given in relation to

these forward-looking statements, including as to their

completeness or accuracy or the basis on which they were prepared,

and undue reliance should not be placed on them. The Company does

not undertake to revise or update any forward-looking statement

contained in this announcement to reflect any changes in its

expectations with regard thereto or any new information or changes

in events, conditions or circumstances on which any such statement

is based, save as required by law and regulations. Nothing in this

announcement should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKKCBQFBKDBQB

(END) Dow Jones Newswires

April 30, 2020 02:00 ET (06:00 GMT)

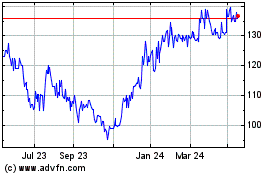

Harworth (LSE:HWG)

Historical Stock Chart

From Oct 2024 to Nov 2024

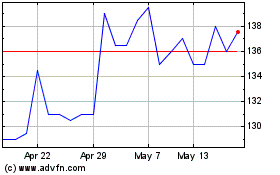

Harworth (LSE:HWG)

Historical Stock Chart

From Nov 2023 to Nov 2024