Heavitree Brewery PLC Half Yearly Report (0511I)

June 28 2013 - 11:00AM

UK Regulatory

TIDMHVT

RNS Number : 0511I

Heavitree Brewery PLC

28 June 2013

The Heavitree Brewery PLC

Trood Lane

Matford

Exeter EX2 8YP

Date: 28 June 2013

Contact: Graham Crocker - Managing Director - 01392 217733

Nicola McLean - Company Secretary - 01392 217733

Pascal Keane - Shore Capital - 0207 468 7995

Following a meeting by a duly authorised committee of the Board

of Directors held today, 28 June 2013, the Directors announce the

interim results for the six months ended 30 April 2013.

Chairman's statement

I am pleased to report that, helped by the good control of

general costs, operating profit for the six months ended 30 April

2013 has improved by 11.7% over last year. This was despite

turnover being down 3.5% in the period due, in part, to a drop in

rental income as a result of two houses being closed for capital

investment and two other houses being marketed for sale. Also,

revenue has been affected by a drop in gaming machine income which

we believe may be as a result of the increased popularity of the

new style of machines in betting shops.

RESULTS

The Group operating profit is GBP541,000 (2012 - GBP484,000) an

increase of 11.7% on last year. After allowing for finance costs of

GBP143,000 which includes GBP40,000 in respect of the IAS 19

calculation referring to the closed final salary Pension Scheme

(2012 GBP132,000 and GBP37,000 respectively), the Group profit

before taxation is GBP398,000 (2012 - GBP352,000).

DIVIDEND

The Directors have resolved to pay an interim dividend of 3.5p

per Ordinary Share and 'A' Limited Voting Ordinary Share (2012 -

3.5p). The dividend will be paid on 2(nd) August 2013 to

shareholders on the Register at the close of business on 19th July

2013.

PROSPECTS

It remains a challenging time to trade Public Houses and once

again the adverse weather conditions and in particular the flooding

in the region at the start of the year has not helped many of our

Tenants. It is very much to the credit of those who were flooded

that they only lost in total two days of actual trading.

The Group operating profit at the end of the six months' period

is encouraging and we hope for another steady performance in the

second half of the year.

N H P TUCKER

Chairman

Group income statement (unaudited)

For the six months ended 30 April 2013

6 months 6 months Audited

to to 12 months

30 April 30 April to

2013 2012 31 October

2012

Note GBP' 000 GBP' 000 GBP' 000

Revenue 3,266 3,383 7,268

Change in stocks - - -

Other operating income 80 58 144

Purchase of inventories (1,353) (1,405) (3,097)

Staff Costs (501) (573) (1,211)

Depreciation of property, plant and

equipment (127) (181) (293)

Other operating charges (824) (798) (1,566)

(2,725) (2,899) (6,023)

Group operating profit 541 484 1,245

Profit on disposal of non-current

assets and assets held for sale - - (121)

Group profit before finance costs

and taxation 541 484 1,124

Finance income 11 14 26

Finance costs (114) (109) (168)

Other finance costs-pensions (40) (37) (55)

(143) (132) (197)

Profit before taxation 398 352 927

Tax (expense) (118) (131) (296)

Profit for the period 280 221 631

Earnings per share 2

- basic 5.5p 4.4p 12.5p

- diluted 5.5p 4.4p 12.5p

Group statement of comprehensive income (unaudited)

For the six months ended 30 April 2013

6 months 6 months Audited

to to 12months

30 April 30 April to

2013 2012 31 October

2012

GBP' 000 GBP' 000 GBP' 000

Profit for the period 280 221 631

Items that will not be reclassified

to profit or loss

Actuarial gains/(losses) on defined

benefit pension plans

Tax relating to items that will not

be reclassified 98 (17) (868)

(26) 5 208

72 (12) (660)

Items that may be reclassified to

profit or loss

Cash flow hedges 7 - (75)

Fair value adjustment - (23) (26)

Tax relating to items that may be

reclassified (2) - 18

5 (23) (83)

Other comprehensive income for the

year, net of tax 357 186 (112)

Total comprehensive income attributable

to:

Equity holders of the parent 357 186 (112)

Dividends

The Directors declare an interim dividend of 3.5p per share

(2012 - 3.5p) on the Ordinary and 'A' Limited Voting Ordinary

Shares. This dividend will be paid on 2 August 2013 to shareholders

on the register at 19 July 2013.

Group balance sheet (unaudited)

at 30 April 2013

30 April 30 April Audited

2013 2012 31 October

GBP' 000 GBP' 000 2012

GBP'000

Non-current assets

Property, plant and equipment 15,394 14,944 14,833

Financial assets 28 32 28

Deferred tax asset 268 190 417

15,690 15,166 15,278

Current assets

Trade and other receivables 1,242 1,450 1,362

Inventories 10 10 10

Cash and short-term deposits 74 114 78

1,326 1,574 1,450

Assets held for sale 525 - 525

Total assets 17,541 16,740 17,253

Current liabilities

Trade and other payables (600) (676) (970)

Financial liabilities (1,912) (1,619) (1,454)

Income tax payable (5) (5) (102)

(2,517) (2,300) (2,526)

Non-current liabilities

Other payables (258) (297) (292)

Financial liabilities (5,011) (4,261) (4,261)

Deferred tax liabilities (215) (251) (220)

Defined benefit pension plan (1,097) (793) (1,662)

(6,581) (5,602) (6,435)

Total liabilities (9,098) (7,902) (8,961)

Net assets 8,443 8,838 8,292

Capital and reserves

Equity share capital 264 264 264

Capital redemption reserve 673 673 673

Treasury shares (891) (804) (875)

Fair value adjustments reserve 8 11 8

Cash flow hedging reserve (52) - (57)

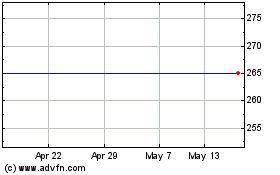

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

From Jun 2024 to Jul 2024

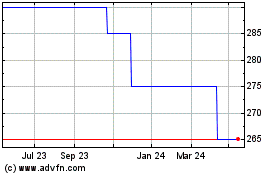

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

From Jul 2023 to Jul 2024