TIDMHVT

RNS Number : 7193X

Heavitree Brewery PLC

21 February 2012

The Heavitree Brewery PLC

Trood Lane

Matford

Exeter EX2 8YP

Date: 21 February 2012

Contact: Graham Crocker - Managing Director - 01392 217733

Rod Glanville - Director and Company Secretary - 01392

217733

Pascal Keane - Shore Capital - 0207 408 4090

Following a Board Meeting held today, 21 February 2012, the

Directors announce the preliminary statement of results for the

year ended 31 October 2011.

ISIN: GB0004182720 for 'A' Limited Voting Ordinary Shares

ISIN: GB0004182506 for Ordinary Shares

Chairman's statement

Another year of good housekeeping has returned a satisfactory

set of results in what continues to be a difficult period for

Public Houses. The headline figures may appear to be somewhat flat

against the previous year but, given the uncertainty of the

European and National economic situations, I consider this to be a

solid performance; and I am most grateful for the hard work of our

head office team and the staff of the pubs themselves in achieving

these results.

Results

Turnover for the Group decreased by GBP36,000 (0.49%) to

GBP7,352,000 and generated a Group Operating Profit of GBP1,408,000

(2010 - GBP1,427,000) after consolidation adjustments.

Heavitree Inns remained dormant throughout the year.

Heavitree Inc. generated an operating profit of GBP9,000 (2010 -

Loss of GBP15,000).

Key Performance Indicators

-- Adjusted Operating Profit before Taxation GBP1,408,000 was down 1.33% on last year.

-- Interest costs were covered 13.40 times.

Dividend

The Directors recommend a final dividend of 3.5p per Ordinary

and 'A' Limited Voting Ordinary Share (2010 - 3.5p) making a total

for the year of 7p, which is unchanged from last year. The dividend

will be paid on 20 April 2012, subject to shareholder approval at

the Annual General Meeting on 13 April 2012, to shareholders on the

Register at 23 March 2012.

Capital Investments

Various capital works were carried out in the year under review

with those of significant expenditure being at the following

sites:

The New Inn, Alphington (major refurbishment).

Car park of the closed St. Loyes Hotel (housing

development).

The Royal Oak, Heavitree (creation of a new outside patio

seating area).

The Brunswick Arms, Dawlish (upgrade of lavatories).

Old Barbers Shop, Newton Abbot (conversion to residential

apartment).

Pension Scheme

The Company continues to meet its funding obligations to its

closed final salary Pension Scheme. The required Scheme triennial

valuation as at 1 January 2011 is not, at the time of writing,

completed. The deadline for completion is 31 March 2012 and I look

forward to providing an update at theAnnual General Meeting.

Repurchase of Shares

The Company did not repurchase any of its own shares during the

year under review, but the Directors intend to seek shareholder

approval at the forthcoming Annual General Meeting for the

continuing authority to do so.

Personnel

I am delighted to report the appointment of Nicky McLean as

Assistant Company Secretary during the year under review. Nicky

joined us in September 2001 and is a valued member of our head

office team. We wish her the very best in her new appointment.

Outlook

The company renewed its banking facilities with Barclays just

after the end of the year under review and this certainty of

finance, together with the continued support that we have always

offered to our landlords and landladies, leaves us well positioned

should there be a change in the economic climate. We also have

development plans for the small number of closed houses and I shall

report on them as and when they are completed.

The trading environment, as I reported last year, remains

difficult but I look forward to another steady performance by the

Company in 2012.

N H P TUCKER Chairman

Group income statement

for the year ended 31 October 2011

Total Total

2011 2010

Notes GBP000 GBP000

Revenue 7,352 7,388

-------- --------

Change in stocks - (9)

Other operating income 113 91

Purchase of inventories (3,134) (3,141)

Staff costs (1,194) (1,197)

Depreciation of property,

plant and equipment (295) (272)

Other operating charges (1,434) (1,433)

-------- --------

(5,944) (5,961)

-------- --------

Group operating profit 1,408 1,427

Profit on disposal

of non-current assets

and assets held for

sale 10 32

Group profit before

finance costs and taxation 1,418 1,459

Finance income 33 35

Finance costs (138) (141)

Other finance costs

- pensions (81) (128)

-------- --------

(186) (234)

Profit before taxation 1,232 1,225

Tax expense (389) (368)

Profit for the year

attributable to equity

holders of the parent 843 857

-------- --------

Basic earnings per

share 2 16.4p 16.7p

-------- --------

Diluted earnings per

share 2 16.4p 16.7p

-------- --------

All amounts in 2011 and 2010 relate to continuing

operations.

Group statement of comprehensive income

for the year ended 31 October 2011

2011 2010

GBP000 GBP000

Profit for the year 843 857

Other comprehensive income

Actuarial gains/(losses) on defined

benefit pension plans 130 (93)

Tax credit on items taken directly

to or transferred from equity (33) 26

Exchange difference on retranslation

of subsidiary - 3

Fair value adjustment 4 -

-------- --------

101 (64)

Total comprehensive income for the

year

944 793

Total comprehensive income attributable

to:

Equity holders of the parent 944 793

-------- --------

Group balance sheet

at 31 October 2011

2011 2010

GBP000 GBP000

Non-current assets

Property, plant and equipment 15,225 14,070

Financial assets 54 50

Deferred tax asset 325 505

-------- --------

15,604 14,625

-------- --------

Current assets

Inventories 10 10

Trade and other receivables 1,262 1,444

Cash and cash equivalents 86 216

-------- --------

1,358 1,670

-------- --------

Total assets 16,962 16,295

-------- --------

Current liabilities

Trade and other payables (1,095) (709)

Financial liabilities (5,062) (558)

Income tax payable (144) (248)

-------- --------

(6,301) (1,515)

-------- --------

Non-current liabilities

Other payables (327) (319)

Financial liabilities (11) (4,011)

Deferred tax liabilities (261) (265)

Defined benefit pension plan deficit (1,246) (1,802)

-------- --------

(1,845) (6,397)

-------- --------

Total liabilities (8,146) (7,912)

-------- --------

Net assets 8,816 8,383

-------- --------

Capital and reserves

Equity share capital 264 264

Capital redemption reserve 673 673

Treasury shares (840) (826)

Fair value adjustments reserve 34 30

Currency translation 6 6

Retained earnings 8,679 8,236

-------- --------

Total equity 8,816 8,383

-------- --------

Group statement of cash flows

for the year ended 31 October 2011

Notes 2011 2010

GBP000 GBP000

Operating activities

Profit for the year 843 857

Tax 389 368

Net finance costs 186 234

Profit on disposal of non current assets

and assets held for sale (10) (32)

Depreciation and impairment of property,

plant and equipment 295 272

Share-based payments - 11

Difference between pension contributions

paid and amounts

recognised in the income statement (507) (507)

Decrease in inventories - 9

Decrease in trade and other receivables 182 224

Decrease in trade and other payables 39 (158)

-------- --------

Cash generated from operations 1,417 1,278

Income taxes paid (349) (78)

Interest Paid (138) (141)

Net cash flow from operating activities 930 1,059

-------- --------

Investing activities

Interest received 33 35

Proceeds from sale of property, plant

and equipment and assets held for sale 114 91

Payments to acquire property, plant

and equipment (1,199) (718)

Net cash outflow from investing activities (1,052) (592)

-------- --------

Financing activities

Preference dividend paid (1) (1)

Dividends paid 3 (360) (359)

Repayment of loans from Directors - 8

Consideration received by EBT on sale

of shares 43 44

Consideration paid by EBT on purchase

of shares (194) (22)

Net movement in long term borrowings - (1,000)

Net cash flow from financing activities (512) (1,330)

-------- --------

Decrease in cash and cash equivalents (634) (863)

Cash and cash equivalents at the beginning

of the year (342) 521

-------- --------

Cash and cash equivalents at the year

end (976) (342)

-------- --------

Group statement of changes in equity

Equity Capital Fair

share redemption Treasury value Currency Retained Total

capital reserve shares adjustments translation earnings equity

GBP000 GBP000 GBP000 reserve GBP000 GBP000 GBP000

GBP000

At 1 November

2009 264 673 (994) 30 3 7,939 7,915

Profit for the

year - - - - - 857 857

Other comprehensive

income for the

year

net of income

tax - - - - 3 (67) (64)

--------- ------------ ---------- ------------- ------------- ---------- --------

Total comprehensive

income for the

year - - - - 3 790 793

--------- ------------ ---------- ------------- ------------- ---------- --------

Consideration

received

by EBT on sale

of - - 44 - - - 44

shares

Consideration

paid

by EBT on purchase

of shares - - (22) - - - (22)

Loss by EBT on

sale

of shares - - 146 - - (146) -

Share based payment - - - - - 12 12

Equity dividends

paid - - - - - (359) (359)

At 31 October

2010 264 673 (826) 30 6 8,236 8,383

--------- ------------ ---------- ------------- ------------- ---------- --------

Equity Capital Fair

share redemption Treasury value Currency Retained Total

capital reserve shares adjustments translation earnings equity

GBP000 GBP000 GBP000 reserve GBP000 GBP000 GBP000

GBP000

At 1 November

2010 264 673 (826) 30 6 8,236 8,383

Profit for the

year - - - - - 843 843

Other comprehensive

income for the

year

net of income

tax - - - 4 - 97 101

--------- ------------ ---------- ------------- ------------- ---------- --------

Total comprehensive

income for the

year - - - 4 - 940 944

--------- ------------ ---------- ------------- ------------- ---------- --------

Consideration

received

by EBT on sale

of

shares - - 43 - - - 43

Consideration

paid by

EBT on purchase

of shares - - (194) - - - (194)

Loss by EBT on

sale

of shares - - 137 - - (137) -

Equity dividends

paid - - - - - (360) (360)

--------- ------------ ---------- ------------- ------------- ---------- --------

At 31 October

2011 264 673 (840) 34 6 8,679 8,816

--------- ------------ ---------- ------------- ------------- ---------- --------

Equity share capital

The balance classified as share capital includes the total net

proceeds (nominal amount only) arising or deemed to arise on the

issue of the Company's equity share capital, comprising Ordinary

Shares of 5p each and 'A' Limited Voting Ordinary Shares of 5p

each.

Capital Redemption Reserve

The capital redemption reserve arises on the re-purchase and

cancellation by the Company of Ordinary Shares.

Treasury shares

Treasury shares represents the cost of The Heavitree Brewery PLC

shares purchased in the market and held by The Heavitree Brewery

PLC Employee Benefits Trust and Employee Share Option Scheme

('EBT').

At 31 October 2011 the Group held 68,174 Ordinary Shares and

146,641 'A' Limited Voting Ordinary Shares (2010: 58,779 Ordinary

Shares and 74,592 'A' Limited Voting Ordinary Shares) of its own

shares at an average cost of GBP3.90 (2010: GBP6.18). The market

value of these shares as at 31 October 2011 was GBP478,187 (2010:

GBP333,000).

Fair value adjustments reserve

The fair value adjustments reserve is used to record differences

in the market value of the available-for-sale investment year on

year.

Foreign currency translation reserve

The foreign currency translation reserve is used to record

exchange differences arising from the translation of the financial

statements of foreign subsidiaries.

Notes to the preliminary announcement

1. Basis of preparation

These figures do not constitute full accounts within the meaning

of Section 396 of the Companies Act 2006. They have been extracted

from the statutory financial statements for the year ended 31

October 2011. The statutory financial statements have not yet been

delivered to the Registrar of Companies.

The financial information is this statement has been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted for use in the European Union. The accounting policies

have been consistently applied and are described in full in the

statutory financial statements for the year ended 31 October 2011,

which are expected to be mailed to shareholders on 12 March 2012.

The financial statements will also be available on the Group's

website. www.heavitreebrewery.co.uk.

The Directors are of the opinion that the Group has adequate

resources to continue in operational existence for the foreseeable

future, and continue to adopt the going concern basis in preparing

the financial statements

2. Basic and diluted earnings per share

Basic earnings per share amounts are calculated by dividing

profit for the year attributable to ordinary equity holders of the

parent by the weighted average number of Ordinary shares and 'A'

Limited Voting Ordinary shares outstanding during the year.

Diluted earnings per share amounts are calculated by dividing

the profit attributable to ordinary equity holders of the parent by

the weighted average number of Ordinary shares and 'A' Limited

Voting Ordinary shares outstanding during the year as diluted for

the share options in issue.

The following reflects the income and shares data used in the

basic and diluted earnings per share

computations:

2011 2010

GBP000 GBP000

Profit for the year 843 857

-------- --------

2011 2010

N(o) . N(o) .

(000) (000)

Basic weighted average number of shares

(excluding treasury shares) 5,129 5,139

Dilutive potential ordinary shares:

Employee share options - -

Diluted weighted average number of shares 5,129 5,139

-------- --------

There have been no other transactions involving ordinary shares

or potential ordinary shares between the reporting date and the

date of completion of these financial statements.

Employee share options could potentially dilute basic earnings

per share in the future but are not included in the 2011

calculation of dilutive earnings per share because they are

antidilutive for the period presented.

3. Dividends paid and proposed

2011 2010

GBP000 GBP000

Declared and paid during the year:

Equity dividends on ordinary shares:

Final dividend for 2010: 3.5p (2009: 3.5p) 185 185

First dividend for 2011: 3.5p (2010: 3.5p) 185 185

Less dividend on shares held within employee

share schemes (10) (11)

Dividends paid 360 359

-------- --------

Proposed for approval at AGM

(not recognised as a liability as at 31

October)

Final dividend for 2011: 3.5p (2010: 3.5p) 180 180

Cumulative preference dividends 1 1

-------- --------

4. Segment information

Primary reporting format - business segments

During the year the Group operated in one business segment -

leased estate.

Secondary reporting format - geographical segments

The following tables present revenue, expenditure and certain

asset information regarding the Group's geographical segments for

the years ended 31 October 2011 and 2010. Revenue is based on the

geographical location of customers and assets are based on the

geographical location of the asset.

Segment information

Year ended 31 October 2011 UK United Total

GBP000 States GBP000

GBP000

Revenue

Sales to external customers 7,352 - 7,352

Other segment information

Segment assets 16,915 47 16,962

-------- -------- --------

Total Assets 16,915 47 16,962

-------- -------- --------

Capital expenditure

Property, plant and equipment 1,534 20 1,554

-------- -------- --------

Year ended 31 October 2010 UK United Total

GBP000 States GBP000

GBP000

Revenue

Sales to external customers 7,388 - 7,388

Other segment information

Segment assets 16,285 10 16,295

Total Assets 16,285 10 16,295

-------- -------- --------

Capital expenditure

Property, plant and equipment 718 - 718

-------- -------- --------

5. General information

The 2011 Annual Report and Financial Statements will be

published and posted to shareholders on 12 March 2012. Further

copies may be obtained by contacting the Company Secretary at The

Heavitree Brewery PLC, Trood Lane, Matford, Exeter EX2 8YP. The

2011 Annual Report and Financial Statements will also be available

on the Company's website at

http://www.heavitreebrewery.co.uk/financial/

The Annual General Meeting will be held at the Registered Office

on 13 April 2012 at 11.30am.

.

Ends.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR TMMMTMBJTBMT

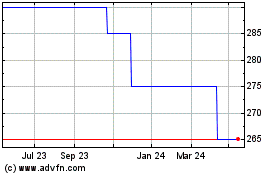

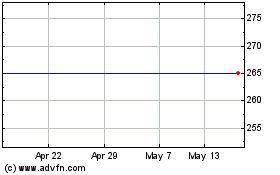

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

From Jul 2023 to Jul 2024