Investment Update (1597659)

March 31 2023 - 2:00AM

UK Regulatory

Molten Ventures Plc (GROW; GRW) Investment Update 31-March-2023

/ 07:00 GMT/BST

-----------------------------------------------------------------------------------------------------------------------

31 March 2023

Molten Ventures Plc

("Molten", the "Group" or the "Company")

Investment Update

Molten (LSE: GROW, Euronext Dublin: GRW), a leading venture

capital firm investing in and developing high growth digital

technology businesses, is pleased to confirm that its portfolio

company, Ledger, the leading global platform for digital assets and

Web3, yesterday announced the close of its Series C extension

round.

The extension round maintains Ledger's valuation at EUR1.3

billion, and was well supported by new and existing investors.

Molten participated in the funding round alongside new investors

True Global Ventures, Cite Gestion SPV, Digital Finance Group and

VaynerFund. Existing investors including 10T, Cap Horn, Morgan

Creek, Cathay Innovation and Korelya Capital also continued their

support.

Ledger continues to grow rapidly with recent cryptocurrency

newsflow highlighting the importance of secure consumer devices.

Ledger has sold over six million devices, securing more than 25% of

the world's cryptocurrencies and over 30% of the world's NFTs. This

extension round will enable Ledger to further its global ambitions

and accelerate its drive to support blockchain innovation. The

company recently announced that the demand for its Ledger Stax

device, launched in December 2022, had already exceeded supply,

making it the most successful product launch in Ledger's

history.

Elsewhere in the Molten portfolio, satellite launch service

company Isar Aerospace recently announced the closing of its Series

C round raising USD165m and metaverse startup, Hadean, closed its

Series A round with an additional USD5m, bringing its total raise

to USD35m.

All three fundraising rounds took place at valuations that are

supportive of Molten's fair value holdings as at 30 September

2022.

Martin Davis, Chief Executive Officer of Molten Ventures,

commented:

"This latest round is testament to the strength of Ledger's

business and its revolutionary technology that will continue to

play a critical role in the future of crypto assets and

blockchain.

Together with Isar Aerospace and Hadean, all three rounds

demonstrate the quality of our portfolio, and the ability of our

companies to maintain or increase valuations and attract financing

even in challenging environments."

-ENDS -

Enquiries:

Molten Ventures plc

Martin Davis (Chief Executive Officer) +44 (0)20 7931 8800

Ben Wilkinson (Chief Financial Officer)

Numis Securities

Joint Financial Adviser and Corporate Broker

Simon Willis

+44 (0)20 7260 1000

Jamie Loughborough

Havish Patel

Iqra Amin

Goodbody Stockbrokers

Joint Financial Adviser and Corporate Broker,

Euronext Dublin Sponsor

+44 (0) 20 3841 6202

Don Harrington

Charlotte Craigie

Dearbhla Gallagher

Powerscourt

Public relations +44 (0)7970 246 725 /

Elly Williamson +44 (0)7713 246 126

Jane Glover

About Molten Ventures

Molten Ventures is a leading venture capital firm in Europe,

developing and investing in disruptive, high growth technology

companies. We inject visionary companies with energy to help them

to transform and grow. This energy comes in many forms - capital,

of course, but also knowledge, experience, and relationships. We

believe it is our role to support the entrepreneurs who will invent

the future, and that future is being built, today, in Europe.

As at 30 September 2022, Molten Ventures had a diverse portfolio

with shareholdings in 78 companies, 21 of which represent our Core

holdings and account for 64% of the Gross Portfolio Value. Our Core

companies include Aiven, Thought Machine, Coachhub, Graphcore, and

Ledger. We invest across four sectors: Enterprise Technology,

Hardware and Deeptech, Consumer Technology, and Digital Health and

Wellness, with highly experienced partners constantly looking for

new opportunities in each. We look for high-growth companies

operating in new markets, with high potential for global expansion,

strong IP, powerful technology, and strong management teams to

deliver success. We also look for businesses with the potential to

generate strong margins to ensure rapid, sustainable growth in

substantial addressable markets.

Molten Ventures provides a unique opportunity for public market

investors to access these fast-growing tech businesses, without

having to commit to long term investments with limited liquidity.

Since our IPO in June 2016, we have deployed over GBP970m capital

into fast growing tech companies and have realised over GBP450m to

30 September 2022.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BY7QYJ50

Category Code: PFU

TIDM: GROW; GRW

LEI Code: 213800IPCR3SAYJWSW10

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 233919

EQS News ID: 1597659

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1597659&application_name=news

(END) Dow Jones Newswires

March 31, 2023 02:00 ET (06:00 GMT)

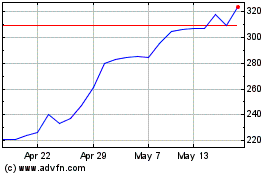

Molten Ventures (LSE:GROW)

Historical Stock Chart

From Apr 2024 to May 2024

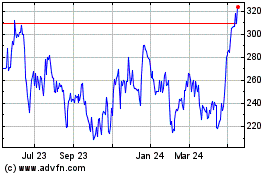

Molten Ventures (LSE:GROW)

Historical Stock Chart

From May 2023 to May 2024