TIDMGRIT

RNS Number : 6856C

Global Resources Investment Tst PLC

12 February 2020

12 February 2020

GLOBAL RESOURCES INVESTMENT TRUST PLC

("GRIT" or "the Company")

Notice of General Meeting

and

Proposed authorities to allot and to disapply pre-emption rights

in respect of up to 12,392,902 new Ordinary Shares

As anticipated in the announcement made on 23 December 2019, the

Company is calling a General Meeting of Shareholders in order to

seek Shareholders' authority to allot shares and to disapply

statutory pre-emption rights.

Details of the proposals and the relevant resolutions which will

be put to Shareholders at the General Meeting are set out in a

circular, being despatched to shareholders today, which is

reproduced below.

The General Meeting will be held at the offices of Peterhouse

Capital Limited, at 80 Cheapside, London EC2V 6EE on 6 March 2020

at 12.30 p.m.

A copy of the Circular will be available on the Company's

website www.grit.london

The circular reads as follows:

1. INTRODUCTION

I am writing to provide you with details of the General Meeting

which will be held at the offices of Peterhouse Capital Limited, at

80 Cheapside, London EC2V 6EE on 6 March 2020 at 12.30 p.m.

This document sets out details of, and seeks your approval for

the issue of up to 12,392,902 Shares and the disapplication of

associated pre-emption rights ("the Proposals").

Further details of the Proposals and the relevant Resolutions

which will be put to Shareholders at the General Meeting are set

out below.

Notice of the General Meeting is set out at the end of this

document and a Form of Proxy is enclosed with this document.

2. BACKGROUND TO AND REASONS FOR THE PROPOSALS

On 23 December 2019, the Company announced that, as a

consequence of the cessation of negotiations for the sale of its

interest in Anglo-African Minerals plc ('AAM') (itself announced on

17 December 2019), it would convene a meeting of shareholders.

As explained in the 23 December 2019 announcement, the purpose

of this meeting is to seek authority from shareholders to allot

shares and to disapply statutory pre-emption rights, because the

restricted authority currently available to the Board is a

constraint which severely hinders the Company's ability to consider

investment proposals that might give the Company a renewed

long-term purpose and life.

Since negotiations with the previous aspirant buyer ceased (and

as anticipated in the 17 December 2019 announcement), the sale of

AAM to alternative purchasers has continued to be actively

explored; and we remain hopeful that a sale of AAM and the

repayment by AAM of the Company's loan will be achieved within the

next few months.

It nevertheless remains the Board's intention at that time to

pursue this course of action; and thus enable the substantial part

of the profits realised from such a sale to be distributed to the

shareholders on the register at the date of the announcement of the

sale. In the event that we proceed to issue additional shares

pursuant to the new authorities currently being sought, we shall

ensure that measures are taken to protect the current shareholders

from the resulting dilutive effects that would otherwise impact on

their current entitlement to share in the substantial majority of

the proceeds of any future sale of AAM. This could be achieved in a

variety of ways but will be dependent on the circumstances

prevailing at the time and the relative proximity, or likelihood,

of the realisation of the investment in AAM.

The Company wishes to retain the flexibility to raise additional

capital through the issue of new Shares prior to the publication of

a prospectus in connection with any New Share Issuance Programme.

Accordingly, the Company is now seeking authority to issue and to

disapply statutory pre-emption rights for: (i) 8,392,902 Shares

(representing 20 per cent. of the issued share capital of the

Company as at 10 February 2020 (the latest practicable date prior

to the date of this document)) until the end of the Company's

annual general meeting to be held in 2020 (at which the Company

will seek renewal of such authority); and (ii) 4,000,000 Shares

(representing 9.53 per cent. of the issued share capital of the

Company as at 10 February 2020) for any share issuances which are

exempt from the obligation to publish a prospectus.

3. BENEFITS OF THE PROPOSALS

The Directors believe that the Proposals will yield the

following principal benefits. They will:

-- provide the basis for raising additional capital which will

enable the Company to benefit from the continued investment

opportunities in the market; and

-- increase the number of Shares in issue, which may provide

Shareholders with additional liquidity.

Accordingly, the Directors are recommending that Shareholders

vote in favour of the Proposals.

An announcement of each allotment under the authority conferred

by the Resolutions will be released through a Regulatory

Information Service, including details of the number of new Shares

allotted and the placing price for the relevant allotment.

4. USE OF NET PROCEEDS

The net proceeds of any new Shares issued pursuant to the

Resolutions, after providing for the Company's operational

expenses, will be used to make investments in accordance with the

Company's investment policy.

5. DILUTION AND TREASURY SHARES

As at 10 February 2020 (the latest practicable date prior to the

date of this document) there were 41,964,512 Shares in issue. If

12,392,902 Shares (being the maximum number of Shares available

under the authority granted pursuant to the Resolutions) were to be

issued, the issued share capital would have increased by 29.53 per

cent. and existing shareholders would be diluted by a maximum of

22.8 per cent.

No Shares are held in treasury at the date of this document.

6. GENERAL MEETING

In order to give effect to Proposals, Shareholders will need to

pass the Resolutions.

The Resolutions

Resolution 1, which will be proposed as an ordinary resolution,

will, if passed, give the Directors the authority to allot up to a

further 12,392,902 new Shares, equal to 29.53 per cent. of the

issued share capital as at the date of this document. Resolution 2,

which will be proposed as a special resolution, will, if passed,

give the Directors the authority to allot all the Shares over which

they are granted authority pursuant to Resolution 1 for cash on a

non-pre-emptive basis. Resolution 2 will not become effective

unless Resolution 1 is also passed.

The formal Notice convening the General Meeting is set out on

page 7 of this document.

7. ACTION TO BE TAKEN

Shareholders are asked to complete and return the Form of Proxy

in accordance with the instructions printed thereon to

Computershare Investor Services PLC, The Pavilions, Bridgwater

Road, Bristol, BS99 6ZY or deliver it by hand during office hours

only to Computershare Investor Services PLC, The Pavilions,

Bridgwater Road, Bristol BS13 8AE so as to be received as soon as

possible and in any event by no later than 12.30 p.m. on 4 March

2020. Shareholders who hold their shares electronically may submit

their votes through CREST.

Shareholders are requested to complete and return a Form of

Proxy or submit their votes through CREST, whether or not they wish

to attend the General Meeting.

8. SHAREHOLDER SUPPORT FOR THE RESOLUTIONS

The Company's two principal shareholders, representing in

aggregate 54.3% of the total voting rights, have expressed their

support for all the resolutions noted below and have signed

irrevocable undertakings to vote in favour of the Resolutions.

9. RECOMMATION

The Board considers that the Proposals are in the best interests

of the Company and its Shareholders as a whole. Accordingly, the

Board unanimously recommends that Shareholders vote in favour of

the Resolutions to be proposed at the General Meeting.

Yours faithfully

James Normand

Chairman

DEFINITIONS

The following definitions apply throughout this document and the

Form of Proxy, unless the context requires otherwise:

Articles the articles of association of the Company, as amended

from time to time

Board the board of Directors

Company Global Resources Investment Trust plc

CREST the computerised settlement system operated by Euroclear

which facilitates the transfer of title to shares in uncertificated

form

Directors the directors of the Company or any duly constituted

committee of the Board

Euroclear Euroclear UK & Ireland Limited, being the operator

of CREST

Form of Proxy the form of proxy provided with this document for

use by Shareholders in connection with the General Meeting

FSMA the Financial Services and Markets Act 2000 and any

statutory modification or re-enactment thereof for the time being

in force

General Meeting the general meeting of the Company to consider

the Resolutions, convened for 6 March 2020 at 12.30.p.m. or any

adjournment thereof, notice of which is set out on page 7 of this

document

London Stock Exchange London Stock Exchange plc

Notice of General Meeting the notice of the General Meeting as

set out on page 7 of this document

Registrar Computershare Investor Services PLC, in its capacity

as the Company's registrar

Resolutions the Resolutions to give effect to the Proposals

Shareholder a holder of Shares

Shares ordinary shares of 0.1p each in the capital of the

Company

GLOBAL RESOURCES INVESTMENT TRUST PLC

(Incorporated and registered in England and Wales with

registered number 08256031 and registered as an

investment company under Section 833 of the Companies Act

2006)

NOTICE OF GENERAL MEETING

NOTICE IS HEREBY GIVEN that a General Meeting of Global

Resources Investment Trust plc (the "Company") will be held at the

offices of Peterhouse Capital Limited, at 80 Cheapside, London EC2V

6EE at 12.30 p.m. on 6 March 2020 for the purpose of considering

and, if thought fit, passing the following resolutions, of which

Resolution 1 will be proposed as an ordinary resolution and

Resolution 2 will be proposed as a special resolution.

ORDINARY RESOLUTION

1. THAT the directors of the Company (the "Directors") be and

are generally and unconditionally authorised pursuant to and in

accordance with section 551 of Companies Act 2006 (the "Act") to

exercise all the powers of the Company to allot, or grant rights to

subscribe for or to convert any security into, up to 12,392,902

ordinary shares of 0.1 pence each in the capital of the Company

("Shares"), such authority to expire at the conclusion of the

annual general meeting of the Company to be held in 2020 (unless

previously renewed, varied or revoked by the Company at a general

meeting), save that the Company may, at any time prior to the

expiry of such authority, make an offer or enter into an agreement

which would or might require Shares to be allotted, or rights to

subscribe for or to convert securities into Shares to be granted,

after the expiry of such authority and the Directors may allot

Shares or grant such rights in pursuance of such an offer or

agreement as if the authority conferred hereby had not expired.

SPECIAL RESOLUTION

2. THAT subject to the passing of Resolution 2 above, the

Directors be and they are empowered pursuant to sections 570 to 573

of the Act to allot Shares for cash pursuant to the authority

referred to in Resolution 1 above as if section 561 of the Act did

not apply to any such allotment provided that this power: (i) shall

be limited to the allotment for cash of up to 12,302,902 Shares;

and (ii) expires at the conclusion of the annual general meeting of

the Company to be held in 2020 unless renewed at a general meeting

prior to such time, save that the Company may, at any time prior to

the expiry of such power, make an offer or enter into an agreement

which would or might require Shares to be allotted after the expiry

of such power, and the Directors may allot Shares in pursuance of

such an offer or agreement as if such power had not expired.

By order of the Board of Directors

Registered Office: 80 Cheapside, London EC2V 6EE

12 February 2020

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

James Normand, Chairman of GRIT, arranged for the release of

this announcement.

For further information:

Global Resources Investment Trust plc (www.grit.london)

James Normand, Chairman +44 (0) 7779 799431

Beaumont Cornish Limited (financial adviser) +44 (0) 20 7628

3396

Roland Cornish / Felicity Geidt

Peterhouse Capital Limited (sole broker) +44 (0) 20 7469

0930

Lucy Williams / Duncan Vasey

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCDFLFFBLLXBBQ

(END) Dow Jones Newswires

February 12, 2020 02:00 ET (07:00 GMT)

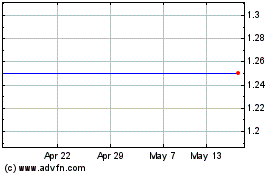

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Oct 2024 to Nov 2024

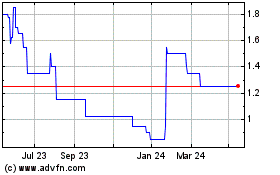

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Nov 2023 to Nov 2024