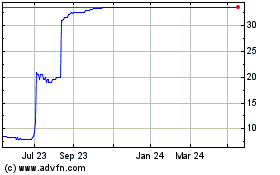

TIDMGLAN

RNS Number : 4721E

Glantus Holdings PLC

30 June 2023

30 June 2023

Glantus Holdings plc

("Glantus" or the "Company" or the "Group")

Full Year Results

Availability of Annual Report

Glantus (AIM: GLAN), the provider of Accounts Payable ("AP")

automation and analytics solutions, is pleased to announce its

final results for the twelve months to 31 December 2022 (FY22).

Copies of the Company's full Annual Report and Financial

Statements for the period ended 31 December 2022 will today be made

available on the Company's website at:

https://www.glantus.com/investors/reports-documents .

2022 Summary of Performance

2022 was a challenging year for our company. Integration issues

with an acquisition and a downturn in our productivity in the U.S.

market while we transitioned our operations to Costa Rica, meant

that our run-rate billing had reduced from an expected EUR1.5m per

month to EUR1m per month. With a cost base structured for a higher

revenue than what was being achieved, we were running at a

considerable loss. Accordingly, the management team set about

adjusting the cost base to align with our run-rate billing. Over

the final three months of 2022, we removed EUR4.2m from our

annualised costs and in the first quarter of 2023 we saw the

benefits of this work as we returned to profitability.

The company expects to give an H1 trading update in week

commencing 24 July 2023.

Financial Summary

EUR'000 FY22 FY21 YoY Change

%

Revenue including other

incomes 10,493 10,740 (3%)

Adjusted EBITDA (1,782) 3,103 (157%)

Adjusted EBITDA % (18%) 29% (162%)

Adjusted operating (loss)/profit (4,137) 1,676 (347%)

Adjusted (loss)/profit

before tax (5,583) 709 (887%)

Adjusted basic EPS (cents) (4.71) 9.36 (150%)

Closing cash and cash

equivalents 342 2,353 (85%)

Post Year End Highlights and Outlook

-- Trading in the new financial year has been ahead of

management's expectations (all figures for 2023 below are

unaudited):

o Jan - Apr 2023 revenues of c.EUR4.558m, adjusted EBITDA profit

of c.EUR1.3m

o Momentum has continued with revenues for May 2023 being ahead

of budget at EUR1.1m

o Realignment of cost base in 2022 has delivered much improved

adjusted EBITDA so far in 2023

-- Successful EUR1.4m (gross) fundraising through a subscription

of new shares in February 2023

-- Costa Rica operations now fully functional and delivering

growth in our audit revenues and improved margins

Board and Management Changes

o After over five years with Glantus, Gráinne McKeown resigned

as Executive Director and Chief Financial Officer on 9 Dec 2022,

having made a very valuable contribution to the growth and success

of the company

o Thomas Brooke was appointed as a Non-Executive Director on 8

December 2022

o After supporting the Company during a challenging period,

Diane Gray-Smith, Executive Director and Interim Chief Financial

Officer, stepped down from the Board on 16 May 2023

o Susan O'Connor, who previously worked with Glantus at the time

of its IPO, assumed the role of Chief Financial Officer on 16 May

2023

Enquiries:

Glantus Holdings

Maurice Healy, CEO

ir@glantus.com + 353 86 267 7800

Shore Capital

Nominated Advisor and Broker

Patrick Castle / Tom Knibbs + 44 207 408 4090

Yellow Jersey PR

Charles Goodwin / Annabelle

Wills +44 7747 788 221

About Glantus Holdings plc

Glantus Holdings (AIM: GLAN) Glantus is a global provider of

accounts payable automation and analytics solutions. Glantus'

mission is to harness technology to drive innovation, unlocking

efficiencies in AP to maximise working capital for global

enterprise organisations. The award-winning Glantus DataShark

Platform connects all AP systems and suppliers on one agile

platform, eliminating cost and delivering new revenue streams. We

work in tandem with our partners to deliver joint enterprise

digital transformation solutions. For more information see

glantus.com .

Founded in 2014 and headquartered in Dublin, Glantus has offices

in the United States, United Kingdom, Poland and Costa Rica.

Chief Executive Statement

The results presented above reflect the tumult in the latter

part of 2022. I am extremely proud of the work performed by our

executive team during this difficult period. Their professionalism

and commitment to the Company and its shareholders brought about a

remarkable turnaround in a short timeframe.

I would like to thank my fellow directors, Chairman Barry

Townsley, non-executive directors Tom Price and Thomas Brooke,

executive director Geoff Keating and former executive directors

Gráinne McKeown and Diane Gray-Smith for their invaluable

contributions during this period as we steered the Company to

firmer ground. Their dedication and commitment have been very much

appreciated.

Having overcome the challenges we faced, our teams are committed

to supporting our expanding service offering and achieving

operational efficiencies, whilst remaining focussed on delivery to

our customers and shareholders.

We look forward to the rest of 2023 with renewed energy and

confidence.

Strategy

Glantus operates in the very exciting AP market. This market

continues to grow and as we leave the Covid pandemic behind and

large organisations return to growth, opportunities will continue

to open up for Glantus.

Glantus' target customer is any organisation with an annual

spend of over $500m and in excess of 4,000 suppliers.

Our technology works by integrating with our clients' ERP

systems to discover and recover lost working capital, improve

efficiency, minimise errors, measure performance and mitigate risk.

Our award-winning Glantus Data Platform is deployed around existing

transactional systems to provide a single platform for Accounts

Payable transformation with the simple mission of simplifying data

to drive constant innovation.

People

In challenging times, we depend even more on our people. I am

very proud of all our teams globally, adapting to new ways of doing

business and the new technologies we introduced this year.

This is a rapidly changing market and I thank each and every one

of our people for their professionalism, enthusiasm and their

commitment to making Glantus the leading provider of AP services in

the market.

Outlook

Following the restructuring of the business, we have seen

significant cost savings through the reduction in headcount and

operational infrastructure costs. Paired with our efforts to

consolidate operations globally to re-focus on our technology to

encourage margins whilst scaling the business has meant trading in

the new financial year has been ahead of management's expectations

and the business model and strategy provides a strong platform for

significant growth.

Beach Point Capital (BPC) has confirmed that its EUR5m loan to

Glantus is now not repayable until August 2024 and EUR7.35m is

repayable in August 2025. The legal paperwork is in process to

formalise this extension.

We look forward to 2023 with increased confidence and

determination to grow our organisation and provide an exceptional

return to our shareholders.

Maurice Healy, CEO

29 June 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Note Year Ended Year Ended

31 December 31 December

2022 2021

EUR EUR

Revenue 4 9,798,212 10,523,198

Cost of sales (3,289,804) (2,178,431)

------------- -------------

Gross profit 6,508,408 8,344,767

Income from sale of legacy software 600,000 -

and contracts

Administrative expenses (8,985,378) (5,458,039)

Exceptional items 5 (1,339,224) (2,947,986)

Share based payments 19 (56,661) (23,512)

Amortisation 12 (2,211,004) (1,229,276)

Depreciation 13 (144,189) (198,266)

Other income 7 94,625 216,740

------------- -------------

Operating Loss (5,533,423) (1,295,572)

Finance costs 8 (1,444,983) (967,214)

------------- -------------

Loss on ordinary activities

before taxation 9 (6,978,406) (2,262,786)

Income tax credit/(charge) 10 258,482 (22,006)

------------- -------------

Loss for the financial year (6,719,924) (2,284,792)

Other comprehensive loss for

the year 8,890 126,299

------------- -------------

Total comprehensive loss for

the year attributable to the

owners of the group (6,711,034) (2,158,493)

============= =============

Loss per share - basic and diluted

(cent) 11 (17.76) (6.89)

============= =============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Note 31 December 31 December

2022 2021

EUR EUR

Assets

Non-current assets

Intangible assets 12 16,767,710 17,508,858

Property, plant and equipment 13 335,708 240,271

------------ ------------

17,103,418 17,749,129

Current assets

Trade and other receivables 14 4,760,993 6,750,691

Cash and cash equivalents 15 341,590 2,353,130

------------ ------------

5,102,583 9,103,821

------------ ------------

Total assets 22,206,001 26,852,950

============ ============

Equity and liabilities

Equity

Called up share capital presented

as equity 17 37,833 37,833

Share premium 18 12,082,742 12,082,742

Reorganisation reserve 18 656,060 656,060

Foreign exchange reserve 18 (34,921) (43,811)

Share option reserve 18 171,173 114,512

Retained earnings 18 (9,510,799) (2,790,875)

------------ ------------

Total equity 3,402,088 10,056,461

------------ ------------

Current liabilities

Trade and other payables 16 11,072,652 6,268,454

Non-current liabilities

Long term liabilities 16 7,731,261 10,528,035

------------ ------------

Total liabilities 18,803,913 16,796,489

------------ ------------

Total liabilities and equity 22,206,001 26,852,950

============ ============

The financial statements were approved and authorised for issue

by the board.

____________________________________

____________________________________

Maurice Healy Geoff Keating

Director Director

29 June 2023 29 June 2023

COMPANY STATEMENT OF FINANCIAL POSITION

Note 31 December 31 December

2022 2021

EUR EUR

Assets

Non-current assets

Financial assets 23 16,185,275 16,093,702

Property, plant and equipment 13 1,144 242

------------ ------------

16,186,419 16,093,944

Current assets

Trade and other receivables 14 6,283,583 4,708,843

Cash and cash equivalents 15 82,220 584,902

------------ ------------

6,365,803 5,293,745

------------ ------------

Total assets 22,552,222 21,387,689

============ ============

Equity and liabilities

Equity

Called up share capital presented

as equity 17 37,833 37,833

Share premium 18 12,082,742 12,082,742

Share option reserve 18 171,173 114,512

Retained earnings 18 (4,263,305) (2,634,784)

Total Equity 8,028,443 9,600,303

------------ ------------

Current liabilities

Trade and other payables 16 6,873,779 1,851,460

Non-current liabilities

Long term liabilities 16 7,650,000 9,935,926

------------ ------------

Total liabilities 14,523,779 11,787,386

------------ ------------

Total liabilities and equity 22,552,222 21,387,689

============ ============

The financial statements were approved and authorised for issue

by the board.

____________________________________

____________________________________

Maurice Healy Geoff Keating

Director Director

29 June 2023 29 June 2023

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Note Called Share Reorganisation Foreign Share Retained Total

up share premium reserve exchange option earnings

capital account reserves reserve

presented arising

as equity on

translation

At 1 January

2021 1,275 999,791 656,060 (170,110) 91,000 (1,480,874) 97,142

Share based

payment charge - - - - 23,512 - 23,512

Reorgansiation

for AIM

listing 18 25,000 (999,791) - - - 974,791 -

Issue of shares 18 11,558 12,082,742 - - - - 12,094,300

Total

comprehensive

loss

for the year - - - 126,299 - (2,284,792) (2,158,493)

---------- ----------- --------------- ------------ -------- ------------ ------------

At 31 December

2021 37,833 12,082,742 656,060 (43,811) 114,512 (2,790,875) 10,056,461

========== =========== =============== ============ ======== ============ ============

At 1 January

2022 37,833 12,082,742 656,060 (43,811) 114,512 (2,790,875) 10,056,461

Share based

payment charge 56,661 56,661

Total

comprehensive

loss

for the year 8,890 (6,719,924) (6,711,034)

---------- ----------- --------------- ------------ -------- ------------ ------------

At 31 December

2022 37,833 12,082,742 656,060 (34,921) 171,173 (9,510,799) 3,402,088

========== =========== =============== ============ ======== ============ ============

COMPANY STATEMENT OF CHANGES IN EQUITY

Called up Share Premium Share Option Retained earnings Total

share capital account reserve

presented

as equity

Note EUR EUR EUR EUR EUR

At 1 January 2021 1,275 999,792 91,000 (1,583,436) (491,369)

--------------- -------------- ------------- ------------------ ------------

Share based payment charge - - 23,512 - 23,512

Reorganisation for AIM

Listing 18 25,000 (999,792) - 974,792 -

Issue of shares 18 11,558 12,082,742 - - 12,094,300

Total comprehensive loss

for the period - - - (2,026,140) (2,026,140)

--------------- -------------- ------------- ------------------ ------------

At 31 December 2021 37,833 12,082,742 114,512 ( 2,634,784) 9,600,303

=============== ============== ============= ================== ============

At 1 January 2022 37,833 12,082,742 114,512 (2,634,784) 9,600,303

--------------- -------------- ------------- ------------------ ------------

Share based payment charge 56,661 56,661

Total comprehensive loss

for the year (1,628,521) (1,628,521)

--------------- -------------- ------------- ------------------ ------------

At 31 December 2022 37,833 12,082,742 171,173 (4,263,305) 8,028,443

=============== ============== ============= ================== ============

CONSOLIDATED STATEMENT OF CASH FLOWS

Year Ended Year Ended

31 December 31 December

2022 2021

EUR EUR

Cash flows from operating activities

Group loss after tax (6,719,924) (2,284,792)

Adjusted for:

Interest payable 1,444,983 967,214

R&D tax credit income (83,626) (72,180)

Income tax expense (258,482) 22,006

Depreciation 144,189 198,266

Amortisation 2,211,004 1,229,276

Movement in trade and other receivables 1,537,323 (2,339,028)

Movement in trade and other payables 3,111,289 1,795,343

Loss on disposal of tangible assets 17,855 17,180

Net tax (paid)/received - (3,852)

R&D refund (paid)/received - (71,596)

Share-based payment expense 56,661 23,512

Effects of movement in exchange rates 8,881 126,389

------------------------------ -------------

Net cash flows generated from/(used in)

operating activities 1,470,153 (392,262)

------------------------------ -------------

Cash flows from investing activities

Purchase of property, plant and equipment (257,460) (37,405)

Payment for acquisition of subsidiaries,

net of cash acquired - (6,853,315)

Payment of deferred consideration (836,833) (2,363,482)

Payment for software development asset (1,469,859) (1,189,195)

------------------------------ -------------

Net cash used in investing activities (2,564,152) (10,443,397)

------------------------------ -------------

Cash flow from financing activities

Loans received 1,866,666 4,536,666

Interest payable (1,444,983) (967,214)

Exceptional costs (including IPO in prior

year) (1,339,224) (2,947,986)

Equity (Proceeds from issue of shares) - 11,613,587

Equity (IPO costs against share premium) - (936,985)

------------------------------ -------------

Net cash generated (used in)/from financing

activities (917,541) 11,298,068

------------------------------ -------------

Net (decrease)/increase in cash and cash

equivalents (2,011,540) 462,409

Cash and cash equivalents at the beginning

of the year 2,353,130 1,890, 721

------------------------------ -------------

Cash and cash equivalents at the end of

the year 341,590 2,353,130

============================== =============

COMPANY STATEMENT OF CASH FLOWS

31 December 31 December

2022 2021

EUR EUR

Cash flows from operating activities

Company loss after tax (1,628,521) ( 2,026,140)

Adjusted for:

Interest payable 1,188,521 937,787

Income tax expense - 2,567

Depreciation 587 241

Movement in trade and other receivables 4,524 (21,940)

Movement in trade and other payables 1,036,181 -

Loss on disposal of tangible assets 1,155 1,916,680

Share-based payment expense 56,661 23,512

------------ -------------

Net cash flows generated from operating

activities 659,108 832,707

------------ -------------

Cash flows from investing activities

Purchase of property, plant and equipment (2,644) -

Payment of deferred consideration - (2,026,685)

------------ -------------

Net cash used in investing activities (2,644) (2,026,685)

------------ -------------

Cash flow from financing activities

Amounts (advanced to) group companies (1,496,299) (11,025,793)

Loans received 1,908,426 4,550,000

Interest payable (1,188,521) (937,787)

Exceptional costs (including IPO in prior

year) (382,752) (1,912,031)

Equity (Proceeds from issue of shares) - 11,590,075

Equity (IPO costs against share premium) - (936,985)

------------ -------------

Net cash (used in)/generated from financing

activities (1,159,146) 1,327,479

------------ -------------

Net (decrease)/increase in cash and cash

equivalents (502,682) 133,501

Cash and cash equivalents at the beginning

of the year 584,902 451,401

------------ -------------

Cash and cash equivalents at the end of

the year 82,220 584,902

============ =============

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. GENERAL INFORMATION

Glantus Holdings Plc ("the Company") is a public limited company

incorporated in the Republic of Ireland. The registered office is

Marina House, Block V, Eastpoint Business Park, Dublin, D03

AX24.

The principal activity of the Group is a provider of software as

a service ("SaaS") solutions, which assists global corporates

analyse, automate and digitise their accounts payable function on

its proprietary platform to recover lost working capital. Foreign

operations are included in accordance with the policies set out in

Note 3.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of preparation

Compliance with IFRS, new standards and interpretation

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRS') and interpretations issued by the IFRS Interpretations

Committee ('IFRS IC') applicable to companies reporting under IFRS.

The financial statements comply with IFRS as issued by the

International Accounting Standards Board and as adopted by the EU,

and the Companies Act 2014. The consolidated financial statements

of the group are presented in Euro ("EUR").

Under the Companies Act 2014 the company is exempt from the

requirement to present its own profit and loss account. The

company's loss for the year ended 2022 was EUR1,628,521 (2021:

EUR2,026,140).

The IFRS accounting policies adopted are consistently applied

for the previous financial year.

There are no changes to IFRS which became effective for the

company during the financial year which resulted in material

changes to the financial statements.

New standards and interpretations

The company financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRS)

and their interpretations issued by the International Accounting

Standards Board (IASB) as adopted by the EU.

The following new standards or interpretations issued by the

International Accounting Standards Board (IASB) and the

International Financial Reporting Interpretations Committee (IFRIC)

were effective in the current financial year and did not result in

a material impact to the company's results:

-- Amendments to IAS 37 - Onerous Contracts: Cost of Fulfilling a Contract

-- Amendments to IAS 16 - Property, Plant and Equipment: Proceeds before Intended Use

-- Amendments to IFRS 1 First-time Adoption of International

Financial Standards, IFRS 9 Financial Instruments, IFRS 16 Leases

and IAS 41 Agriculture: Annual Improvements to IFRS Standards

2018-2020

-- Amendments to IFRS 3 - Business Combinations: References to Conceptual Framework

The IASB and IFRIC have issued the following standards and

interpretations with an effective date after the date of the

Financial Statements which the company has not early adopted.

New/Revised Description Effective Date

International - periods beginning

Financial Reporting on or after

Standards

IFRS 17 Insurance Contracts 1 January 2023

IFRS 10 and Amendment to Sale or Contribution 1 January 2023

IAS 28 of Assets between an Investor

and its Associate or Joint

Venture

IAS 1 Amendment to Classification 1 January 2024

of Liabilities as Current

or Non-current

IAS 8 Amendment to Definition of 1 January 2023

Accounting Estimates

IAS 12 Amendment to Deferred Tax 1 January 2023

related to Assets and Liabilities

arising from a Single Transaction

IFRS 16 Amendment to Sale and Lease 1 January 2024

buyback

The Directors anticipate that the adoption of the above

standards and interpretations issued by the IASB and the IFRIC will

not have a material impact on the Company's Financial

Statements.

.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(b) Going concern

Management have prepared projections and forecasts taking

account of reasonably possible changes in trading performance and

the funding facilities available from the date of approval of the

financial statements.

The directors therefore have reasonable expectations that the

Group has adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the financial statements.

(c) Basis of consolidation

The financial statements of the Group incorporate the financial

information of the Company (the parent) and entities controlled by

the Company (its subsidiaries) made up to 31 December each

year.

Control is achieved when the Company:

-- has the power over the subsidiary entity;

-- is exposed, or has rights, to variable returns from its

involvement with the subsidiary entity; and

-- has the ability to use its power to affect those returns.

The Group reassesses whether it controls the subsidiaries if

facts and circumstance indicate that there are changes to their

control.

When the Company has less than a majority of the voting rights

of an investee, it considers that it has power over the investee

when the voting rights are sufficient to give it the practical

ability to direct the relevant activities of the investee

unilaterally. The Company considers all relevant facts and

circumstances in assessing whether or not the Company's voting

rights in an investee are sufficient to give it power,

including:

-- the size of the Company's holding of voting rights relative

to the size and dispersion of holdings of the other vote

holders;

-- potential voting rights held by the Company, other vote holders or other parties;

-- rights arising from other contractual arrangements; and

-- any additional facts and circumstances that indicate that the

Company has, or does not have, the current ability to direct the

relevant activities at the time that decisions need to be made,

including voting patterns at previous shareholders' meetings.

Consolidation of a subsidiary begins when the Company obtains

control over the subsidiary and ceases when the Company loses

control of the subsidiary. Intra-group assets and liabilities,

equity, income, expenses and cashflows relating to intra-group

transactions are eliminated on consolidation. Where necessary, the

accounting policies of subsidiaries have been changed to ensure

consistency with the policies adopted by the Group.

When the Group loses control over a subsidiary, the profit or

loss on disposal is calculated as the difference between (i) the

aggregate of the fair value of the consideration received and the

fair value of any retained interest and (ii) the previous carrying

amount of the assets (including goodwill), and liabilities of the

subsidiary and any non-controlling interests. Amounts previously

recognised in other comprehensive income in relation to the

subsidiary are accounted for (i.e. reclassified to profit or loss

or transferred directly to retained earnings) in the same manner as

would be required if the relevant assets or liabilities were

disposed of.

The fair value of any investments retained in the former

subsidiary at the date when control is lost is regarded as the fair

value on initial recognition for subsequent accounting or, when

applicable, the cost on initial recognition of an investment in an

associate or jointly controlled entity.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(d) Business combinations and goodwill

Business combinations are accounted for by applying the purchase

method.

The cost of a business combination is the fair value of the

consideration given, liabilities incurred or assumed and of equity

instruments issued. Where control is achieved in stages the cost is

the consideration at the date of each transaction.

On acquisition of a business, fair values are attributed to the

identifiable assets, liabilities and contingent liabilities unless

the fair value cannot be measured reliably, in which case the value

is incorporated in goodwill. Where the fair value of contingent

liabilities cannot be reliably measured, they are disclosed on the

same basis as other contingent liabilities.

Goodwill recognised represents the excess of the fair value and

directly attributable costs of the purchase consideration over the

fair value to the Group's interest in the identifiable net assets,

liabilities and contingent liabilities acquired.

On acquisition, goodwill is allocated to cash-generating units

that are expected to benefit from the combination. Goodwill is

assessed for impairment when there are indicators of impairment and

any impairment is charged to the statement of comprehensive

income.

(e) Revenue recognition

Revenue is measured based on the consideration to which the

Group expects to be entitled in a contract with a customer and

excludes amounts collected on behalf of third parties. The Group

recognises revenue when it transfers control of a product or

service to a customer. An analysis of the revenue recognition

principles applied in each of the Group's operating segments is

provided below:

Subscriptions

Annual subscriptions are recognised on a straight-line basis,

for the right to continued access to the licensed intellectual

property and the support and maintenance services for the licences

held, in accordance with the licence agreement in place. Annual

subscriptions include all support, maintenance, software updates

and other services provided to the customers.

Income arising on support contracts and subscription sales where

the provision of the service has not been completed at the year-end

date is deferred and recognised as the service is provided.

Transactional

Revenue is generated from the provision vendor credit recovery

services to its customers and earn a fixed contractual percentage

on the amount of vendor credits approved by the customer. Upon the

customer's acceptance of the vendor credits identified, revenue is

recognised at that point in time, net of discounts and provided

that the company has no significant related obligations or

collection uncertainties remaining.

Rendering of professional services and licences

Professional services are customer-specific services which are

provided for specific needs of individual customers with no

alternative uses for the Group. The Group has an enforceable right

to payment for performance towards the performance obligation

completed to date.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(e) Revenue recognition (continued)

Revenue from rendering of services is recognised over time in

the accounting period in which the services are rendered by

applying the input method of measuring progress toward complete

satisfaction of the performance obligation; primarily on a time and

materials basis. Revenue is recognised based on the amount of fees

that the Group is entitled to invoice for services performed to

date based on the pre-agreed contracted rates.

On the basis of the input method as described above, the time

and materials costs incurred to fulfil a contract are recognised as

revenue and a subsequent contract asset is recorded, if and only if

all of the following criteria are met:

-- the costs relate directly to a contract;

-- the costs generate or enhance resources of the entity that

will be used in satisfying performance obligations in the future;

and

-- the costs are expected to be recovered.

These include costs such as direct labour, direct materials, and

the allocation of overheads that relate directly to the contract.

Contract assets are disclosed separately as unbilled receivables in

Trade and other receivables (Note 14).

Revenue generated from the sale of software licenses and other

ready-made products is recognised at a point in time upon delivery

of the software and/or product to the customer, provided that the

Group has no significant related obligations or collection

uncertainties remaining.

(f) Leases

At inception of a contract, the Group assesses whether a

contract is, or contains, a lease. A contract is, or contains, a

lease if the contract conveys the right to control the use of an

identified asset for a period of time in exchange for

consideration.

The Group recognises a right-of-use asset and a lease liability

at the lease commencement date. The right-of-use asset is initially

measured at cost, which comprises the initial amount of the lease

liability adjusted for any lease payments made at or before the

commencement date, plus any initial direct costs incurred and an

estimate of costs to dismantle and remove the underlying asset or

to restore the underlying asset or the site on which it is located,

less any lease incentives received.

The right-of-use asset is subsequently depreciated using the

straight-line method from the commencement date to the earlier of

the end of the useful life of the right-of-use asset or the end of

the lease term. The estimated useful lives of right-of-use assets

are determined on the same basis as those of property and

equipment. In addition, the right-of-use asset is periodically

reduced by impairment losses, if any, and adjusted for certain

remeasurements of the lease liability.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted using the interest rate implicit in the lease or, if

that rate cannot be readily determined, the Group's incremental

borrowing rate. Generally, the Group uses its incremental borrowing

rate as the discount rate.

Lease payments included in the measurement of the lease

liability comprise:

-- fixed payments, including in-substance fixed payments;

-- variable lease payments that depend on an index or a rate,

initially measured using the index or rate as at the commencement

date; and

-- amounts expected to be payable under a residual value guarantee.

The lease liability is measured at amortised cost using the

effective interest method. It is remeasured when there is a change

in future lease payments arising from a change in an index or rate,

if there is a change in the Group's estimate of the amount expected

to be payable under a residual value guarantee.

When the lease liability is remeasured in this way, a

corresponding adjustment is made to the carrying amount of the

right-of-use asset or is recorded in profit or loss if the carrying

amount of the right-of-use asset has been reduced to zero.

The Group presents right-of-use assets that do not meet the

definition of investment property in 'property, plant and

equipment', and lease liabilities in trade and other payables in

the statement of financial position. Right-of-use asset of office

rentals is presented under 'property, plant and equipment'. The

movement of right-of-use of the assets of the Group during the

years is disclosed in Notes 13.

Short-term leases and leases of low-value assets

The Group has elected not to recognise right-of-use assets and

lease liabilities for short-term leases of offices and licenses

that have a lease term of 12 months or less and leases of low-value

assets. The Group recognises the lease payments associated with

these leases as an expense on a straight-line basis over the lease

term.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(g) Foreign currencies

Foreign currency transactions are translated into the individual

entities' respective functional currencies at the exchange rates

prevailing on the date of the transaction. At the end of each

financial year, monetary items denominated in foreign currencies

are retranslated at the rates prevailing as of the end of the

financial year. Non-monetary items carried at fair value that are

denominated in foreign currencies are retranslated at the rates

prevailing on the date when the fair value was determined.

Non-monetary items that are measured in terms of historical cost in

a foreign currency are not retranslated.

Exchange differences arising on the settlement of monetary

items, and on retranslation of monetary items are included in

profit or loss for the year. Exchange differences arising on the

retranslation of non-monetary items carried at fair value are

included in profit or loss for the year except for differences

arising on the retranslation of non-monetary items in respect of

which gains, and losses are recognised directly in equity. For such

non-monetary items, any exchange component of that gain or loss is

also recognised directly in other comprehensive income.

For the purpose of presenting consolidated financial statements,

the assets and liabilities of the Group's foreign operations

(including comparatives) are expressed in Euro using exchange rates

prevailing at the end of the financial year. Income and expense

items (including comparatives) are translated at the average

exchange rates for the period, unless exchange rates fluctuated

significantly during that period, in which case the exchange rates

at the dates of the transactions are used. Exchange differences

arising, if any, are classified as equity and transferred to the

Group's translation reserve. Such translation differences are

recognised in profit or loss in the period in which the foreign

operation is disposed of.

On consolidation, exchange differences arising from the

translation of the net investment in foreign entities (including

monetary items that, in substance, form part of the net investment

in foreign entities), and of borrowings and other currency

instruments designated as hedges of such investments, are taken to

the foreign currency translation reserve.

Goodwill and fair value adjustments arising on the acquisition

of a foreign operation are treated as assets and liabilities of the

foreign operation and translated accordingly.

(h) Employee benefits

The Group provides a range of benefits to employees, including

bonus arrangements, paid holiday arrangements and defined

contribution pension plans.

Short term benefits

Short term benefits, including holiday pay and other similar

non-monetary benefits, are recognised as an expense in the period

in which the service is received. A provision is made for the

estimated liability for annual leave as a result of services

rendered by employees up to the end of the financial year.

Defined contribution pension plans

The Group operates a defined contribution plan for certain

employees. A defined contribution plan is a pension plan under

which the Group pays fixed contributions into a separate entity.

Once the contributions have been paid the Group has no further

payment obligations.

The contributions are recognised as an expense when they are

due. Amounts not paid are shown in accruals in the statement of

financial position. The assets of the plan are held separately from

the Group in independently administered funds.

Share-based payments

The Group issues equity-settled share-based payments to certain

employees. Equity-settled share-based payments are measured at fair

value of the equity instruments (excluding the effect of

non-market-based vesting conditions) at the date of grant. Details

regarding the determination of the fair value of equity-settled

share-based transactions are set out in Note 19. The cost of

equity-settled transactions with employees is recognised as an

expense over the vesting period, which ends on the date on which

the relevant employees become fully entitled to the award. Fair

value is determined by an external valuer using an appropriate

pricing model. No expense is recognised for awards that do not

ultimately vest, except for awards where vesting is conditional

upon a market condition, which are treated as vesting irrespective

of whether or not the market condition is satisfied, provided that

all other performance conditions are satisfied.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(h) Employee benefits (continued)

At each year end date before vesting, the cumulative expense is

calculated, representing the extent to which the vesting period has

expired and management's best estimate of the achievement or

otherwise of non-market conditions, the number of equity

instruments that will ultimately vest, or in the case of an

instrument subject to a market condition, be treated as vesting as

described above. The movement in the cumulative expense since the

previous year end date is recognised in the statement of

comprehensive income, with a corresponding entry in 'share option

reserves'.

Where the terms of an equity-settled award are modified or a new

award is designated as replacing a cancelled or settled award, the

cost based on the original award terms continues to be recognised

over the original vesting period. In addition, an expense is

recognised over the remainder of the new vesting period for the

incremental fair value of any modification, based on the difference

between the fair value of the original award and the fair value of

the modified award, both as measured on the date of the

modification. No reduction is recognised if this difference is

negative.

(i) Borrowing costs

Borrowing costs are recognised in profit or loss in the period

in which they are incurred.

(j) Interest income

Interest income comprises of income on cash held on

interest-bearing bank deposits. Interest income is recognised as it

occurs in the statement of comprehensive income, using the

effective interest rate method.

(k) Income tax

The taxation expense for the period comprises current and

deferred tax recognised in the reporting period. Tax is recognised

in the statement of comprehensive income, except to the extent that

it relates to items recognised in other comprehensive income or

directly in equity. In this case tax is also recognised in other

comprehensive income or directly in equity, respectively.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from net profit as reported in profit

or loss because it excludes items of income or expense that are

taxable or deductible in other years and it further excludes items

that are never taxable or deductible. The Group's liability for

current tax is calculated using tax rates that have been enacted or

substantively enacted by the end of the reporting period.

A provision is recognised for those matters for which the tax

determination is uncertain but it is considered probable that there

will be a future outflow of funds to a tax authority. The

provisions are measured at the best estimate of the amount expected

to become payable. The assessment is based on the judgement of tax

professionals within the Group supported by previous experience in

respect of such activities and in certain cases based on specialist

independent tax advice.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial information and the corresponding tax bases used

in the computation of taxable profit and is accounted for using the

liability method.

Deferred tax liabilities are generally recognised for all

taxable temporary differences and deferred tax assets are

recognised to the extent that it is probable that taxable profits

will be available against which deductible temporary differences

can be utilised. Such assets and liabilities are not recognised if

the temporary difference arises from the initial recognition of

goodwill or from the initial recognition (other than in a business

combination) of other assets and liabilities in a transaction that

affects neither the taxable profit nor the accounting profit. In

addition, a deferred tax liability is not recognised if the

temporary difference arises from the initial recognition of

goodwill.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(k) Income tax (continued)

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in subsidiaries, except where

the Group is able to control the reversal of the temporary

difference and it is probable that the temporary difference will

not reverse in the foreseeable future. Deferred tax assets arising

from deductible temporary differences associated with such

investments and interests are only recognised to the extent that it

is probable that there will be sufficient taxable profits against

which to utilise the benefits of the temporary differences and they

are expected to reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each

reporting date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled, or the asset is

realised based on tax laws and rates that have been enacted or

substantively enacted at the reporting date.

The measurement of deferred tax liabilities and assets reflects

the tax consequences that would follow from the manner in which the

Group expects, at the end of the reporting period, to recover or

settle the carrying amount of its assets and liabilities.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Group intends to settle its

current tax assets and liabilities on a net basis.

(l) Research and development tax credit

Research and development tax credits are recognised as a gain,

set against the related expenditure in the year to which they

relate. To the extent that the related expenditure is capitalised

the tax credit is deferred on the statement of financial

position.

(m) Intangible assets

Intangible assets acquired are stated at cost less any

accumulated amortisation and any accumulated impairment losses.

Cost comprises purchase price and other directly attributable

costs.

Intangible assets are amortised on a straight-line basis over

its useful economic life, which is considered to be 3-5 years.

Internally--generated intangible assets

Research and development expenditure

Expenditure on research activities is recognised as an expense

in the period in which it is incurred.

An internally-generated intangible asset arising from

development (or from the development phase of an internal project)

is recognised if, and only if, all of the following conditions have

been demonstrated:

-- the technical feasibility of completing the intangible asset

so that it will be available for use or sale;

-- the intention to complete the intangible asset and use or sell it;

-- the ability to use or sell the intangible asset;

-- how the intangible asset will generate probable future economic benefits;

-- the availability of adequate technical, financial and other

resources to complete the development and to use or sell the

intangible asset; and

-- the ability to measure reliably the expenditure attributable

to the intangible asset during its development.

The amount initially recognised for internally-generated

intangible assets is the sum of the expenditure incurred from the

date when the intangible asset first meets the recognition criteria

listed above. Where no internally-generated intangible asset can be

recognised, development expenditure is recognised in profit or loss

in the period in which it is incurred.

Development expenditure is amortised on a straight-line basis

over its useful economic life, which commences when the asset is

brought into use, and is considered to be over 3 years.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(m) Intangible assets (continued)

Intellectual property and customer relationships intangible

assets

The amount initially recognised for intellectual property and

customer relationships acquired on Technology Insights Corporation

acquisition was the valuation at the date of acquisition.

Intellectual property is amortised on a straight-line basis over

its useful economic life, which commences when the asset was

purchased, and is considered to be over 5 years. Customer

relationships are amortised on a straight-line basis over its

useful economic life, which is considered to be 8 years.

Derecognition of intangible assets

An intangible asset is derecognised on disposal, or when no

future economic benefits are expected from use or disposal. Gains

or losses arising from derecognition of an intangible asset,

measured as the difference between the net disposal proceeds and

the carrying amount of the asset, are recognised in profit or loss

when the asset is derecognised.

(n) Property, plant and equipment

Property, plant and equipment are stated at cost less

accumulated depreciation and accumulated impairment losses. Cost

includes the original purchase price, costs directly attributable

to bringing the asset to its working condition for its intended

use, dismantling and restoration costs, and borrowing costs

capitalised.

Depreciation

Depreciation is calculated using the straight-line method to

write off the cost of property, plant and equipment over their

expected useful lives as follows:

Office equipment 15% - 20%

Fixtures and fittings 12.5% - 20%

Computer equipment 25%

Right of use assets Lower of the useful life of the asset or the lease term

The estimated useful lives, residual values and depreciation

method are reviewed at the end of each reporting period, with the

effect of any changes in estimate accounted for on a prospective

basis.

Subsequent additions

Subsequent costs are included in the assets carrying amount or

recognised as a separate asset, as appropriate, only when it is

probable that economic benefits associated with the item will flow

to the Group and the cost can be measured reliably.

The carrying amount of any replaced component is derecognised.

Major components are treated as a separate asset where they have

significantly different patterns of consumption of economic

benefits and are depreciated separately over its useful life.

Repairs, maintenance and minor inspection costs are expensed as

incurred.

Derecognition

An item of property, plant and equipment is derecognised upon

disposal or when no future economic benefits are expected to arise

from the continued use of the asset. The gain or loss arising on

the disposal or retirement of an asset is determined as the

difference between the sales proceeds and the carrying amount of

the asset and is recognised in profit or loss.

(o) Impairment of tangible and intangible assets

The Group reviews the carrying amounts of its tangible and

intangible assets as at each reporting date to assess for any

indication of impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any). Where it is not

possible to estimate the recoverable amount of an individual asset,

the Group estimates the recoverable amount of the cash-generating

unit to which the asset belongs.

Irrespective of whether there is any indication of impairment,

the Group also tests its intangible assets with indefinite useful

lives and intangible assets not yet available for use for

impairment annually by comparing their respective carrying amounts

with their corresponding recoverable amounts.

The recoverable amount of an asset or cash-generating unit is

the higher of its fair value less costs to sell and its value in

use. In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset.

An impairment loss for the amount by which the asset's carrying

amount exceeds the recoverable amount is recognised immediately in

profit or loss, unless the relevant asset is carried at a revalued

amount, in which case the impairment loss is treated as a

revaluation decrease.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(o) Impairment of tangible and intangible assets (continued)

Where an impairment loss subsequently reverses, the carrying

amount of the asset (cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (cash-generating unit) in prior years. A reversal of

an impairment loss is recognised immediately in profit or loss,

unless the relevant asset is carried at a revalued amount, in which

case the reversal of the impairment loss is treated as a

revaluation increase.

(p) Financial instruments

Financial assets and financial liabilities are recognised when

the Group becomes a party to the contractual provisions of the

instrument.

Effective interest method

The effective interest method is a method of calculating the

amortised cost of a financial instrument and allocating the

interest income or expense over the relevant period. The effective

interest rate is the rate that exactly discounts estimated future

cash receipts or payments (including all fees on points paid or

received that form an integral part of the effective interest rate,

transaction costs and other premiums or discounts) through the

expected life of the financial instrument, or where appropriate, a

shorter period, to the net carrying amount of the financial

instrument. Income and expense are recognised on an effective

interest basis for debt instruments other than those financial

instruments at fair value through profit or loss.

Financial assets

Financial assets and financial liabilities are initially

measured at fair value. Transaction costs that are directly

attributable to the acquisition or issue of financial assets and

financial liabilities (other than financial assets and financial

liabilities at fair value through profit or loss) are added to or

deducted from the fair value of the financial assets or financial

liabilities, as appropriate, on initial recognition. Transaction

costs directly attributable to the acquisition of financial assets

or financial liabilities at fair value through profit or loss are

recognised immediately in profit or loss.

All financial assets are recognised on a trade date - the date

on which the Group commits to purchase or sell the asset. They are

initially measured at fair value, plus transaction costs, except

for those financial assets classified as at fair value through

profit or loss, which are initially measured at fair value.

Financial assets are classified into the following specified

categories: financial assets at fair value through profit or loss;

held-to-maturity investments; loans and receivables; and

available-for-sale financial assets. The classification depends on

the nature and purpose for which these financial assets were

acquired and is determined at the time of initial recognition.

Loans and receivables

The Group's loans and receivables comprise trade and other

receivables, amounts due from contract customers and bank

balances.

Such loans and receivables are non-derivatives with fixed or

determinable payments that are not quoted in an active market. They

are measured at amortised cost, using the effective interest method

less impairment. Interest is recognised by applying the effective

interest rate, except for short-term receivables when the

recognition of interest would be immaterial.

Impairment of financial assets

The Group recognises a loss allowance for expected credit losses

on investments in debt instruments that are measured at amortised

cost or at FVTOCI, lease receivables, trade receivables and

contract assets, as well as on financial guarantee contracts. The

amount of expected credit losses is updated at each reporting date

to reflect changes in credit risk since initial recognition of the

respective financial instrument.

The Group always recognises lifetime Expected Credit Losses

("ECL") for trade receivables. The ECL on these financial assets

are estimated using a provision matrix based on the Group's

historical credit loss experience, adjusted for factors that are

specific to the receivables, general economic conditions and an

assessment of both the current as well as the forecast direction of

conditions at the reporting date, including time value of money

where appropriate. When there has not been a significant increase

in credit risk since initial recognition, the Group measures the

loss allowance for that financial instrument at an amount equal to

12-month ECL which represents the portion of lifetime ECL that is

expected to result from default events on a financial instrument

that are possible within 12 months after the reporting date; except

for assets for which simplified approach was used.

The Group assumes that the credit risk on a financial instrument

has not increased significantly since initial recognition if the

financial instrument is determined to have low credit risk at the

reporting date. A financial instrument is determined to have low

credit risk if:

(a) The financial instrument has a low risk of default,

(b) The debtor has a strong capacity to meet its contractual

cash flow obligations in the near term, and

(c) Adverse changes in economic and business conditions in the

longer term may, but will not necessarily, reduce the ability of

the borrower to fulfil its contractual cash flow obligations.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(p) Financial instruments (continued)

The Group considers a financial asset to have low credit risk

when the asset has external credit rating of 'investment grade' in

accordance with the globally understood definition or if an

external rating is not available, the asset has an internal rating

of 'performing'. Performing means that the counterparty has a

strong financial position and there is no past due amounts.

Derecognition of financial assets

The Group derecognises a financial asset only when the

contractual rights to the cash flows from the asset expire, or it

transfers the financial asset and substantially all the risks and

rewards of ownership of the asset to another entity. If the Group

neither transfers nor retains substantially all the risks and

rewards of ownership of the financial asset and continues to

control the transferred asset, the Group recognises its retained

interest in the asset and an associated liability for amounts it

may have to pay. If the Group retains substantially all the risks

and rewards of ownership of a transferred financial asset, the

Group continues to recognise the financial asset and also

recognises a collateralised borrowing for the proceeds

receivables.

Financial liabilities and equity

Classification of debt or equity

Debt and equity instruments are classified as either financial

liabilities or as equity in accordance with the substance of the

contractual arrangements and the definitions of a financial

liability and an equity instrument.

Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of the Group after deducting all of its

liabilities. Equity instruments are recorded at the proceeds

received, net of direct issue costs.

Ordinary share capital

Ordinary share capital is classified as equity. Incremental

costs directly attributable to the issue of ordinary shares and

share options are recognised as a deduction from equity.

Preference shares

The dividend rights of the preference shares are cumulative, and

payment is non-discretionary. The preference shares do not carry

any voting rights at meetings. Based on their characteristics the

directors consider that these shares should be regarded as a

financial liability rather than an equity instrument.

Share premium

The share premium reserve contains the premium arising on issue

of equity shares, net of issue expenses.

Financial liabilities

Financial liabilities are classified as either financial

liabilities at fair value through profit or loss or other financial

liabilities.

Financial liabilities are classified as at fair value through

profit or loss if the financial liability is either held for

trading or it is designated as such upon initial recognition.

Other financial liabilities

Trade and other payables

Trade and other payables are initially measured at fair value,

net of transaction costs, and are subsequently measured at

amortised cost, where applicable, using the effective interest

method, with interest expense recognised on an effective yield

basis.

Borrowings

Interest-bearing bank loans and overdrafts are initially

measured at fair value, and are subsequently measured at amortised

cost, using the effective interest method. Any difference between

the proceeds (net of transaction costs) and the settlement or

redemption of borrowings is recognised over the term of the

borrowings.

Derecognition of financial liabilities

The Group derecognises financial liabilities when, and only

when, the Group's obligations are discharged, cancelled or they

expire.

(q) Provisions and contingencies

Provisions

Provisions are recognised when the Group has a present

obligation (legal or constructive) as a result of a past event, it

is probable that the Group will be required to settle that

obligation and a reliable estimate can be made of the amount of the

obligation.

The amount recognised as a provision is the best estimate of the

consideration required to settle the present obligation at the

reporting date, taking into account the risks and uncertainties

surrounding the obligation.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(q) Provisions and contingencies (continued)

Where a provision is measured using the cash flows estimated to

settle the present obligation, its carrying amount is the present

value of those cash flows (when the effect of the time value of

money is material).

When some or all of the economic benefits required to settle a

provision are expected to be recovered from a third party, a

receivable is recognised as an asset if it is virtually certain

that reimbursement will be received and the amount of the

receivable can be measured reliably.

Contingencies

Contingent liabilities, arising as a result of past events, are

not recognised when (i) it is not probable that there will be an

outflow of resources or that the amount cannot be reliably measured

at the reporting date or (ii) when the existence will be confirmed

by the occurrence or non-occurrence of uncertain future events not

wholly within the Group's control. Contingent liabilities are

disclosed unless the probability of an outflow of resources is

remote.

Contingent assets are not recognised. Contingent assets are

disclosed when an inflow of economic benefits is probable.

(r) Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and demand

deposits and other short-term highly liquid investments which are

readily convertible to known amounts of cash and are subject to

insignificant risk of changes in value.

(s) Related party transactions

Transactions with entities not wholly group owned are disclosed

in accordance with IFRS.

(t) Segmental information

Segmental information is presented in respect of the Group's

geographical regions and operating segments. The operating segments

are based on the Group's management and internal reporting

requirements.

3. SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

In preparing this consolidated financial information, the Group

makes judgements, estimates and assumptions concerning the future

that impact the application of policies and reported amounts of

assets, liabilities, income and expenses.

The resulting accounting estimates calculated using these

judgements and assumptions are based on historical experience and

expectations of future events and may not equal the actual results.

Estimates and underlying assumptions are reviewed on an ongoing

basis, and revisions to estimates are recognised prospectively. The

judgements and key sources of assumptions and estimation

uncertainty that have a significant effect on the amounts

recognised in the financial information are discussed below.

Critical judgements made in applying the Group accounting

policies

Information about judgements made in applying accounting

policies that have the most significant effects on the amounts

recognised in this consolidated financial information are

below:

(a) Intangible assets: Development expenditure

The Group capitalises a proportion of costs related to software

development in accordance with its accounting policy. The Group

regularly reviews the carrying value of capitalised development

costs, which are amortised over 3 years, to ensure they are not

impaired, and the amortisation period is appropriate. Management

makes judgements about the technical feasibility and economic

benefit of completed products, as well as the period of time over

which the economic benefit will cease. The carrying value of the

internally generated intangible asset held by the Group at each

year end is shown in Note 12.

(b) Carrying value of goodwill

The Group tests annually whether the goodwill has suffered any

impairment. An impairment loss is recognised for the amount by

which the asset's carrying amount exceeds its recoverable amount.

The recoverable amount is the higher of an asset's fair value less

costs of disposal and value in use. The carrying value of the

goodwill held by the Group at each year end is shown in Note

12.

(c) Carrying value of intellectual property acquired

The Group regularly reviews the carrying value of intellectual

property acquired, which are amortised over 5 years, to ensure they

are not impaired, and the amortisation period is appropriate.

Management makes judgements about the period of time over which the

economic benefit will cease. The carrying value of the intangible

asset held by the Group at each year end is shown in Note 12.

3. SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS (continued)

(d) Carrying value of Customer Relationships

The Group regularly reviews the carrying value of customer

relationships, which are amortised over 8 years, to ensure they are

not impaired, and the amortisation period is appropriate.

Management makes judgements about the period of time over which the

economic benefit will cease. The carrying value of the intangible

asset held by the Group at each year end is shown in Note 12.

(e) Revenue recognition

The Group recognises revenue in line with IFRS 15 Revenue

recognition. Management applies judgement in determining the

nature, variable considerations, and timing of satisfaction of

promises in the context of the contract that meet the basis of

revenue recognition criteria. Significant judgements include

identifying performance obligations, identifying distinct

intellectual property licenses, and determining the timing of

satisfaction and approach in recognising the revenue of those

identified performance obligations; whether a point in time or a

passage of time approach to be adopted. See applied revenue

recognition criteria for each revenue streams within note 2(e) for

details on the Group's revenue recognition policies adopted. The

amount of the Group's revenue recognised in each year is shown in

Note 4.

4. REVENUE

Segmental information

Segmental information is presented in respect of the Group's

geographical regions and operating segments in accordance with IFRS

8 'Operating Segments'. The Board considers that there is one

identifiable business segment being the provision of software

solutions including related recovery audit services.

Recurring revenue is the revenue that annually repeats either

under contractual subscription or predicable transactional

billing.

2022 2021

EUR EUR

Recurring Revenue 7,951,661 9,050,442

Non-recurring revenue 1,846,551 1,472,756

---------------- -------------------

Reported revenue 9,798,212 10,523,198

================ ===================

Recurring as % of total revenue 80% 86%

2022 2021

EUR EUR

Amount of revenue by class

of activity:

Recurring subscriptions revenue 5,070,508 3,857,381

Recurring transactional revenue 2,881,153 5,193,061

Professional services and licences

revenue 1,846,551 1,472,756

---------------- -----------------

Reported revenue 9,798,212 10,523,198

================ =================

Geographical analysis

The Group operates in three principal geographical regions being

Republic of Ireland, the United Kingdom and the United States of

America. The Group has customers in other countries such as

Singapore, Australia, Spain, Switzerland, Canada, Mexico and the

Netherlands, which are not material for separate

identification.

4. REVENUE (Continued)

2022 2021

Amount of revenue by region: EUR EUR

United Kingdom 2,639,756 3,877,673

United States of America 3,879,503 3,678,896

Republic of Ireland 2,796,926 2,478,427

Others 482,027 488,202

---------------- -----------------

Reported Revenue 9,798,212 10,523,198

================ =================

Contract assets and contract liabilities

Contract assets

Contract assets are disclosed separately as unbilled receivables

in trade and other receivables amounting to EUR1,835,263 (2021:

EUR3,715,891) (Note 14).

Contract liabilities

Contract liabilities are disclosed separately as deferred income

in trade and other payables amounting to EUR1,054,800 (2021:

EUR723,764) (Note 16). The Group is availing of the practical

expedient which exempts the disclosure of unsatisfied performance

obligations to date since both of the following criteria are

met:

-- The performance obligations are part of contracts which have

an original expected duration of one year or less;

-- The Group recognises revenue from the satisfaction of the

performance obligations which has been completed to date and to

which the Group has a right to invoice.

5. EXCEPTIONAL COSTS

The exceptional items include IPO costs, acquisition costs and

costs incurred in post-acquisition restructuring.

2022 2021

EUR EUR

Acquisition costs - 1,014,864

Restructuring costs 1,317,706 489,297

AIM Admission costs - 902,104

Fee to Beach Point Capital on IPO

admission - 1,000,000

Other exceptional costs/(income) 21,518 (458,279)

---------- ----------

Total exceptional items 1,339,224 2,947,986

========== ==========

The majority of the restructuring costs of EUR1.3m consist of

redundancy costs of EUR0.8m

6. EMPLOYEES

The average monthly number of persons employed by the Group

(including directors) during the year was as follows:

2022 2021

Product development and

delivery 82 58

Sales and Marketing 5 12

Administration 19 15

----- -----

106 85

===== =====

6. EMPLOYEES (Continued)

2022 2021

The Staff costs comprise: EUR EUR

Wages and salaries 7,766,473 4,789,145

Redundancy costs 791,247

Social welfare costs 757,867 493,688

Pension costs 162,582 71,765

---------- ----------

9,478,169 5,354,598

========== ==========

Directors' remuneration 2022 2021

Directors' remuneration in EUR EUR

respect of qualifying

services in respect of the

Group:

Emoluments 685,943 485,434

Pensions 52,043 36,965

-------- --------

737,986 522,399

======== ========

The number of directors to whom retirement benefits are accruing

under defined contribution scheme pension costs noted above is 4

(2021: 3).

Staff costs as qualifying development expenditure

The qualifying development expenditure generating an asset as

shown in Note 12 consists of qualifying staff costs incurred in

relation to the development of the group's projects. During the

current period, qualifying costs amounted to EUR905,727 (2021:

EUR610,984).

7. OTHER INCOME

2022 2021

EUR EUR

Credit card cashback 10,999 -

Research and development

tax credit 83,626 72,180

Grant income - 144,560

------- --------

94,625 216,740

======= ========

8. FINANCE COSTS

2022 2021

EUR EUR

Loan interest 1,444,983 961,902

Interest on preference

shares - 5,312

---------- --------

1,444,983 967,214

========== ========

9. LOSS ON ORDINARY ACTIVITIES BEFORE TAXATION

The loss on ordinary activities before taxation is stated after

charging/ (crediting):

2022 2021

EUR EUR

- Audit of group

Auditor's remuneration companies 80,000 110,000

- Other assurance

services - 192,500

- Tax advisory

services - 66,750

- Other non-Audit

services 15,000 20,400

Directors' remuneration

(Note 6) 737,986 522,399

Depreciation (Note 13) 144,189 198,266

Amortisation (Note 12) 2,211,004 1,229,276

Research and development

tax credit (Note 7) ( 83,626) (72,180)

Grant income - (144,560)

Loss on disposal of fixed

assets 17,855 17,180

Foreign exchange loss/(gain) 151,813 (235,371)

---------- ----------

3,274,221 1,904,660

========== ==========

Other assurance services in 2021 very substantially relate to

advisory services work in connection with the IPO.

10. TAX ON LOSS ON ORDINARY ACTIVITIES

(a) Tax on loss on ordinary activities

The current tax charge for the year differs from the amount

computed by applying the standard rate of corporation tax in the

Republic of Ireland to the (loss) on ordinary activities before

taxation. The sources and tax effects of the differences are

explained below:

2022 2021

EUR EUR

Loss on ordinary activities before

tax (6,978,406) (2,262,786)

Loss on ordinary activities multiplied

by the standard rate of tax of

12.5% (872,301) (282,848)

------------ ------------

Effects of:

Depreciation/amortisation greater

than capital allowances 135,280 71,220

Non-deductible expenses 181,697 394,528

Disallowable loan interest 19,449 117,161

Higher rates of tax on foreign

income 30,306 72,052

Research and development tax credits

income 1,153 (44,127)

Tax adjustments in respect of

previous years - (15,134)

Tax relief at source/income tax 1,793 395

Deferred tax (286,815) (234,537)

Share options expense not allowable - 2,939

Profit on disposal 123,000 -

Losses carried forward 381,712

Loss utilised 26,244 (59,643)