RNS Number:0082F

Gooch & Housego PLC

11 June 2001

FOR IMMEDIATE RELEASE 11 June 2001

GOOCH & HOUSEGO PLC

PRELIMINARY RESULTS FOR THE SIX MONTHS ENDED 31 MARCH 2001

Gooch & Housego PLC, the specialist manufacturer of precision optical

components and bespoke glass engineering items, acousto-optic devices and

instruments for measuring optical radiation, today announces preliminary

results for the six months ended 31 March 2001.

Highlights

* Excellent six month performance by the Group

* Pre tax profits increased by 67%

* Increase in earnings per share of 53%

* Increase in interim dividend to 0.9p

* Successful integration of the acquisition of NEOS Technologies Inc.

* Worldwide demand for the Group's Q-Switches continues at record

levels.

Archie Gooch, Chairman of Gooch & Housego, commented, " These results have

been achieved against a background of difficult trading conditions with

particular concern in the US of a deeper recession. Although our businesses

have not been directly affected, we are fully aware of the potential impact.

Our strategy of acquisitions in different sectors of the photonics industry

with diverse products and new geographical areas, stands us in good stead for

the future. "

For further information :

Archie Gooch / Ian Bayer 01460 52271

Gooch & Housego PLC

Tim Thompson 020 7466 5000

Buchanan Communications

CHAIRMAN'S STATEMENT

I am pleased to report further progress by the Group with an excellent

performance for the six months to 31st March 2001. Since flotation on the

Alternative Investment Market in December 1997, your Group has returned

increased profits in each of the subsequent reporting periods.

I would like to express my most sincere thanks and appreciation to my

Directors, Presidents, Vice Presidents and Staff at all levels within the

Group, without whom these results would not have been achieved

FINANCIAL RESULTS

For the half-year to 31st March 2001, Group turnover increased by 71% to #

10.24m (2000: #5.98m), with operating profit, after goodwill amortisation of #

148,000, 62% higher at #2.14m (2000 : #1.32m ). Profit before taxation was #

1.99m (2000 : #1.19m) an increase of 67% against the comparative period last

year. These results include the contribution from Neos Technologies Inc. which

was acquired in September 2000. Earnings per share for the period improved by

53% to 6.9p (2000 : 4.5p )

The Group's financial position remains strong despite additional loans

associated with the acquisition of NEOS Technologies Inc. Gearing is at 25%

(2000 : 34%) while interest was covered 11 times ( 2000 : 9 times).

DIVIDENDS

The Directors are declaring an interim dividend of 0.9p to be paid on 27 July

2001 to all shareholders on the register on 22 June 2001. This represents an

increase of 20% when compared to the 0.75p paid last year.

OPERATING PERFORMANCE

United Kingdom

Gooch & Housego

Turnover for the period was up 37% at #3.64m (2000 : #2.65m) while operating

profits, before goodwill amortisation, improved to #1.22m ( 2000 : #0.67m )

As reported in my last Chairman's statement of 14 December 2000 there was

strong growth in our acousto-optic products during 2000 and this trend has

continued throughout the period under review. In particular worldwide demand

for our Q-switches and acousto-optic products continues at record levels.

Our precision optics business also enjoyed a period of growth which was

supported by our supply of optical waveplates for the fibre optics

telecommunications business. The global downturn in demand for these products

has been well documented in the last few months and our supply to these

markets will be adversely affected. However a relatively small proportion of

our total sales is into this sector.

Our total order book continues to increase and now stands in excess of #5m.

This bodes well for our confidence in the future.

Our negotiations to purchase a suitable site for a new factory in the UK are

continuing. Our requirement to remain in an area relatively close to our

existing facility in Ilminster makes this search more difficult. I expect to

be in a position to make an announcement of our detailed plans for the

enlarged facility in the near future.

UNITED STATES

Optronic Laboratories

Optronic Laboratories (OLI) has shown an increase in profits for the first six

months of the financial year. Sales increased from #1.41m to #1.74m while

operating profits increased by 47% from #101,000 to #148,000. The new optics

facility that I referred to in my last statement is totally operational and

contributing to the present success. In addition OLI now supplies both NEOS

and CCI with a range of optical and transducer products previously purchased

from third party suppliers.

There continues to be steady worldwide demand for research-grade scanning

spectroradiometers and this technology is now beginning to migrate into the

commercial and industrial arenas. This is most evident in the Light Emitting

Diode ( LED ) industry, as LEDs are now designed in a whole range of

applications, which require precise measurements. To meet the demands of these

industries, we are launching a lower priced non-scanning high speed

spectroradiometer. We are very excited about this product based on initial

market feedback and have great hopes for its future.

Cleveland Crystals Inc.

The company has experienced a difficult start to the current financial year

with operating profits lower at # 116,000 ( 2000 : # 636,000 ) from sales of #

2.14m ( 2000 : #2.08m ). This has been the result of a temporary postponement

of a contract by a large public sector customer, the National Ignition

Facility (NIF) at the Lawrence Livermore National Laboratory (LLNL) in

California. These contracts are currently being rescheduled but will still not

recover the position before the end of this financial year. LLNL remain

committed to CCI and demonstrated their confidence in the company during this

first six months with further investment of almost $1.5m in additional capital

equipment and production facilities located in our factory in Cleveland. NIF

has recently announced that it has been awarded a further $70m of funding from

June 2001.

The original core business of electro-optics has remained flat during the

period but the new range of crystals shows continued improvement.

Having suffered these problems, CCI has responded with an aggressive sales and

product development campaign targeted at laser OEMs to increase unit volumes.

Progress is being made with firm orders from new OEM customers. Business

prospects in large crystalline optics for inertial confinement fusion lasers

continue to look strong and CCI is a world leader in this market.

NEOS Technologies Inc.

The acquisition of NEOS Technologies Inc (NEOS) was completed on 22 September

2000 and has made a valuable contribution to current profits. Sales for the

six months to 31 March 2001 were #2.94m with operating profits of # 0.8m.

These results represent a significant increase over the same period last year.

Following a full post-acquisition review we are now implementing a

rationalisation programme for the entire NEOS product range. In many areas of

manufacturing and marketing we have identified areas of commonality which will

lead to increased efficiency and reduced costs. An example of this is that,

as a result of investment by NEOS in new equipment, all RF Driver manufacture

for the Group is being transferred to them.

I am delighted with the performance and contribution made by NEOS in these six

months and in particular wish to thank Eddie Young, President, and Bob

Belfatto, Senior Vice President, for their efforts. As agreed at the time of

the acquisition, Eddie will retire at the end of the year, but has agreed to

continue to act as a consultant to the Company.

PROSPECTS

These results have been achieved against a background of difficult trading

conditions with particular concern in the US of a deeper recession. Although

our businesses have not been directly affected, we are fully aware of the

potential impact. Our strategy of acquisitions in different sectors of the

photonics industries with diverse products and new geographical areas, stands

us in good stead for the future.

The second half of the year has started well. Your Board continues to review

each of the Group's businesses and to examine various ways in which we can

provide increased focus on those activities that represent the greatest

opportunities.

Archie Gooch MBE JP

Executive Chairman 11 June 2001

GOOCH & HOUSEGO PLC

UNAUDITED CONSOLIDATED PROFIT AND LOSS ACCOUNT

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2001 2000 2000

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Turnover 10,240 5,976 12,510

Operating Profit 2,138 1,318 2,815

Net interest payable (153) (130) (226)

Profit on ordinary

activities before taxation 1,985 1,188 2,589

Tax on profit on ordinary (746) (433) (926)

activities

Profit on ordinary

activities after taxation 1,239 755 1,663

Dividends on equity shares (162) (127) (406)

Retained profit for the

financial period 1,077 628 1,257

Earnings per ordinary 6.9p 4.5p 9.8p

share

Dividend per share 0.9p 0.75p 2.3p

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

#'000 #'000 #'000

Profit for the financial period 1,239 755 1,663

Currency translation

differences on foreign currency 93 94 143

net investments

Taxation on retranslation gains

/losses on foreign currency 44 - 56

loans

hedged against foreign currency

investments

Total recognised gains and

losses for the financial period 1,376 849 1,862

GOOCH & HOUSEGO PLC

UNAUDITED CONSOLIDATED GROUP BALANCE SHEET

AS AT 31 MARCH 2001

As at As at As at

31 March 31 March 30 September

2001 2000 2000

(unaudited) (unaudited) (audited)

FIXED ASSETS

Intangible assets 5,481 3,250 5,629

Tangible assets 3,742 3,598 3,624

9,223 6,848 9,253

CURRENT ASSETS

Stock 3,457 1,602 3,225

Debtors 4,134 2,688 3,401

Cash at Bank and in

hand 2,056 1,000 1,930

9,647 5,290 8,556

CREDITORS

Amounts falling due (4,070) (2,781) (3,808)

within one year

NET CURRENT ASSETS 5,577 2,509 4,748

TOTAL ASSETS LESS

CURRENT LIABILITIES 14,800 9,357 14,001

CREDITORS

Amounts falling due (3,562) (2,573) (3,977)

after more than one

year

11,238 6,784 10,024

CAPITAL AND RESERVES

Called up share capital 3,600 3,381 3,600

Share premium 3,404 1,113 3,404

Revaluation reserve 308 308 308

Profit and loss account 3,926 1,982 2,712

11,238 6,784 10,024

GOOCH & HOUSEGO PLC

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 31 March 2001

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2001 2000 2000

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Cash flow from operating 2,222 2,157 4,142

activities (i)

Returns on investments and

servicing of finance

Interest received 45 14 38

Interest paid (197) (143) (276)

Interest element of hire purchase (1) (1) (2)

contracts

Debt issue costs - - (77)

Net cash outflow from returns on (153) (130) (317)

investments and servicing of finance

UK tax paid (164) (78) (301)

Overseas tax paid (664) (230) (511)

Cash outflow from taxation (828) (308) (812)

Capital expenditure

Purchase of tangible (295) (215) (404)

fixed assets

Net cash outflow from capital (295) (215) (404)

expenditure and financial investment

Acquisitions

Acquisition of subsidiary - NEOS (239) - (4,401)

Technologies Inc

Cash acquired on acquisition - - 388

Net cash outflow from acquisition (239) - (4,013)

Equity dividends paid (279) (220) (347)

Net cash inflow/(ouflow) before 428 1,284 (1,751)

financing

Financing

New bank loans - - 5,103

Repayment of bank loan (248) (421) (3,984)

Hire purchase repayment (20) (34) (13)

Issue of share capital - - 2,628

Net cash (outflow)/inflow (268) (455) 3,734

Increase in cash in the period 160 829 1,983

GOOCH & HOUSEGO PLC

GROUP CONSOLIDATED ACCOUNTS

Notes to the cash flow statement

6 months 6 months 12 months

ended ended ended

31 March 2001 31 March 2000 30 September 2000

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

( i ) Reconciliation of operating profit to operating cash flows

Operating profit 2,138 1,318 2,815

Amortisation of 148 86 173

goodwill & licenses

Amortisation of debt

issue costs 11 - 10

Depreciation 284 231 434

(Increase) in stock (86) (224) (326)

(Increase) / decrease

in debtors (565) 661 262

Increase in creditors 292 85 774

2,222 2,157 4,142

(ii) Reconciliation of net cash inflow / (outflow) to movement in

net debt

Increase in cash in year 160 829 1,983

Cash outflow / (inflow)

from decrease/(increase)

in debt and lease financing 268 455 (1,106)

Changes in net debt resulting

from cash flow 428 1,284 877

New hire purchase contracts - - (25)

Movement in debt issue costs (11) - 67

Translation difference (186) 13 (404)

Movement in net debt

in the period 231 1,297 515

Net debt at 1 October 2000 (3,067) (3,582) (3,582)

Net debt at 31 March 2001 (2,836) (2,285) (3,067)

(iii) Analysis of net debt

At 1 Cash Exchange Non-cash At 31 March

October flow Movement 2001

2000

#'000 #'000 #'000 #'000 #'000

Cash in hand and at bank 1,930 160 (34) - 2,056

Debt due after one year (3,942) - (109) 517 (3,534)

Debt due within one year (977) 248 (40) (528) (1,297)

Hire purchase (78) 20 (3) - (61)

(3,067) 428 (186) (11) (2,836)

NOTES TO THE INTERIM STATEMENT

1. The financial information set out above does not constitute statutory

accounts within the meaning of Section 240 of the Companies Act 1985. The

summarised results for the six months ended 31 March 2001 and the

comparative figures for the six months ended 31 March 200 are unaudited.

The figures for the year ended 30 Septemer 2000 have been extracted from

the Group statutory accounts, which have been filed with the Registrar of

Companies and contain an unqualified audit report.

2. Taxation for the six months ended 31 March 2001 and 31 March 2000 has

been estimated at prevailing rates. Taxation for the year ended 30

September 2000 is the actual provision for that year.

3. Earnings per share for the six months to 31 March 2001 have been

calculated using a total of 17,999,162 (2000 total of 16,904,162) shares,

being the average number of shares in issued throughout that period. For

the 12 months to 30 September 2000 the weighted average number of shares

in issue was 16,934,080.

4. All of the amounts above are in respect of continuing operations.

5. Accounting policies are consistent with those applied in previous years

and are as set out in the Group's audited accounts at 30 September 2000.

6. The interim dividend will be paid on 27 July 2001 to shareholders on the

register at close of business on 22 June 2001.

7. Copies of the Interim Statement will be desptached to Shareholders during

the week commencing 18 June 2001 and are available from the Company

Secretary, Gooch & Housego PLC, The Old Magistrates Court, Ilminster,

Somerset TA19 0AB.

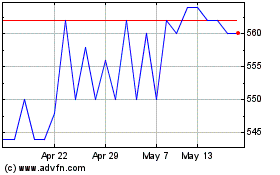

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jul 2023 to Jul 2024