TIDMFOUR

RNS Number : 4753V

4imprint Group PLC

10 August 2022

10 August 2022

4imprint Group plc

Half year results for the 26 weeks ended 2 July 2022

(unaudited)

4imprint Group plc (the "Group"), a direct marketer of

promotional products, today announces its half year results for the

26 weeks ended 2 July 2022.

Half year Half year

2022 2021

Financial Overview $m $m Change

----------- ----------

Revenue 515.54 326.81 +58%

Operating profit 43.98 3.60 +1,122%

Profit before tax 43.91 3.37 +1,203%

Cash 67.10 52.80 +27%

------------------------------------- ----------- ---------- ---------------

Basic EPS (cents) 118.90 9.12 +1,204%

Interim dividend per share (cents) 40.00 15.00 +167%

Interim dividend per share (pence) 33.01 10.83 +205%

------------------------------------- ----------- ---------- ---------------

The results for the half year and prior half year are

unaudited.

Operational Overview

* Customer demand at record levels:

-- 886,000 total orders processed in H1 2022 (H1 2021: 616,000;

H1 2019: 778,000)

-- 146,000 new customers acquired in H1 2022 (H1 2021: 113,000;

H1 2019: 147,000)

-- July 2022 demand activity has remained encouraging

* Marketing efficiency led by increasing proportion of

brand awareness producing market share gains and

strengthening the business for the future

* Success in attracting and retaining team members in

difficult labour markets

* Supply chain challenges being addressed in

partnership with tier 1 suppliers

* Interim dividend of 40.00c per share declared (2021:

15.00c) reflects performance in the first half of the

year and the Group's strong financial position

Paul Moody, Chairman said:

"The Board remains very confident in the Group's strategy, the

strength and resilience of its business model and its competitive

position. This confidence is expressed in our expectation of

reaching our long-held revenue target of $1bn during the 2022

financial year.

At the same time, the Board is cognisant of continuing

uncertainty in the form of geo-political and broad economic factors

that could potentially slow down the Group's performance during the

remainder of 2022.

Trading momentum in the first few weeks of the second half of

2022 has remained encouraging. "

For further information, please contact:

4imprint Group plc MHP Communications

Tel. + 44 (0) 20 3709 9680 Tel. + 44 (0) 20 3128 8794

hq@4imprint.co.uk 4imprint@mhpc.com

Kevin Lyons-Tarr, Chief Executive

Officer

David Seekings, Chief Financial

Officer Katie Hunt

Chairman ' s Statement

Performance summary

The Group has delivered a remarkable financial performance in

the first half of 2022.

Group revenue in the first half of 2022 was $515.54m, an

increase of $188.73m, or 58% over the same period in 2021. Profit

before tax for the period was $43.91m (2021: $3.37m), resulting in

basic earnings per share of 118.90c (2021: 9.12c). The business

model remains very cash-generative, leaving the Group with a net

cash balance at the half year of $67.10m (3 July 2021:

$52.80m).

The strong trading momentum driving these results was described

in our market updates of 6 May 2022 and 19 July 2022. Measured

against the 2019 comparative, (the most recent 'normal' year),

order counts at the half year were up 14%. Average order values

also increased by 14%, resulting in overall demand revenue for the

period at 30% above the 2019 comparative.

Strategic progress

The progress made in the first half of 2022 directly reflects

both the clarity of our strategic direction and our unwavering

commitment to 'doing the right thing' by taking a long-term view of

the business throughout the pandemic-affected years of 2020 and

2021. In particular:

-- We remain fully committed to our people, whose hard work and

dedication has allowed us to produce such impressive results; they

are at the heart of the 4imprint culture.

-- We continue to develop and invest in a brand component to our

marketing engine. This strategic initiative was launched in 2018,

before the pandemic, and has given us the flexibility we

anticipated to make a positive impact on the efficiency of our

marketing.

Dividend

The Group is very well financed. In consequence, the Board has

declared an interim dividend of 40.00c per share, an increase of

167% over the prior year. The well-established Group balance sheet

funding and capital allocation guidelines will continue to shape

decisions on future dividend payments to Shareholders.

Outlook

The Board remains very confident in the Group's strategy, the

strength and resilience of its business model and its competitive

position. This confidence is expressed in our expectation of

reaching our long-held revenue target of $1bn during the 2022

financial year.

At the same time, the Board is cognisant of continuing

uncertainty in the form of geo-political and broad economic factors

that could potentially slow down the Group's performance during the

remainder of 2022.

Trading momentum in the first few weeks of the second half of

2022 has remained encouraging.

Paul Moody

Chairman

10 August 2022

Operating and Financial Review

Operating Review

Half

year Half year

2022 2021

Revenue $m $m

----------------------------- ------- ----------

North America 505.86 321.70

UK & Ireland 9.68 5.11

----------------------------- ------- ----------

Total 515.54 326.81

----------------------------- ------- ----------

Half

year Half year

2022 2021

Operating profit $m $m

----------------------------- ------- ----------

Direct Marketing operations 46.29 5.69

Head Office costs (2.31) (2.09)

----------------------------- ------- ----------

Total 43.98 3.60

----------------------------- ------- ----------

The results for the half year and prior half year are

unaudited.

Performance overview

The first half of 2022 produced outstanding financial

results.

In total, 886,000 orders were processed in the first half of

2022. This represents an increase of 44% against 616,000 in 2021,

and an increase of 14% compared to 778,000 in 2019. Importantly, we

have continued to attract new customers at an encouraging rate; in

the first half of 2022 we acquired 146,000 new customers, a 29%

increase over the 113,000 acquired over the same period in

2021.

These markedly improved demand numbers translated into

significant gains in year-on-year financial performance. Group

revenue for the 2022 half year was $515.54m (2021: $326.81m), an

increase of 58%. Operating profit for the period was $43.98m,

compared to $3.60m in the first half of 2021.

The 4imprint direct marketing business model remains very cash

generative, with free cash flow of $33.65m in the period (2021:

$13.04m), contributing to a cash balance at the 2022 half year of

$67.10m (3 July 2021: $52.80m).

We are in no doubt that the strength of the Group's financial

performance in the first half of 2022 is a direct result of our

strategic commitment to maintain the financial resource to keep

investing in the business even during an economic downturn. We are

secure in the knowledge that this continued investment, primarily

in people and marketing, lays the foundation for the significant

market share opportunity ahead.

Operational highlights

Progress has been made in the following operational areas in the

period.

-- People. Our people are a crucial element in our success. This

was readily apparent in the context of the very strong demand seen

in the first half of 2022. The willingness of our team members

across the entire business to go above and beyond to deliver

outstanding customer service in the face of a rapid increase in

demand and a challenging supply chain is indicative of 4imprint's

culture and values. Despite an extremely tight labour market, we

have been able to attract the necessary talent to service the

increasing demand that we are seeing. To further strengthen this

ability to attract and retain great people we have invested in

remuneration and benefit initiatives and will continue to do so in

the second half of the year. In addition, with input from our team

we have continued with the development of a permanent 'hybrid'

working environment for our office-based team members. As well as

improving the resilience of the business, this reduces our need for

future office space without sacrificing our ability to provide a

remarkable customer experience.

-- Marketing. We have always understood the importance of

staying in front of our customers during an economic downturn. The

pandemic years of 2020 and 2021 were no exception. The strategic

evolution of our marketing mix in 2018 to include and increasingly

invest in a new brand awareness programme was accelerated during

this time. We used the improved flexibility this new mix offers to

take full advantage of the immediate market share opportunity at

the same time as strengthening the business for the long-term. This

approach has clearly been successful in the first half of 2022 as

an essential driver of our revenue per marketing dollar KPI in the

period of $8.19, a 50% increase over prior year (2021: $5.46).

-- Supply. As anticipated, the first half of 2022 saw sometimes

acute pressure due to challenges around global logistics, inventory

availability and production capacity to keep up with demand. The

deep relationships that we have with our key tier 1 suppliers again

proved to be invaluable in dealing with these supply chain issues.

In addition, we experienced significant inflationary pressure on

cost of product in the period. Whilst we have implemented carefully

considered price increases to help address these increasing costs,

we continue to approach pricing thoughtfully so as to remain very

well positioned in the market, supporting the strong customer

acquisition and retention numbers described above.

-- Screen-printing. In April 2022 we completed the purchase of

the business and assets of a small, nearby apparel screen-printing

business that had been a long-standing and valued supplier. Our

intention is to use the assets and, more importantly, the expertise

acquired to scale up our apparel decorating capacity in support of

the continued growth of this category. In terms of strategic

direction, the parallel is the substantial in-house embroidery

operation that we have built from small beginnings over the last

several years.

-- Solar array project. We are pleased to report good progress

in our carbon reduction initiatives. Our $2m solar array project at

the Oshkosh Distribution Center recently produced its first power

and is expected to be fully operational by the end of August 2022.

This project will help reduce the amount of carbon offsets required

to retain our CarbonNeutral (R) certification.

Summary

The financial performance of the Group in the first half of 2022

provides firm validation that our strategy remains fully relevant.

The opportunities in the markets in which we operate are attractive

and we see strong potential for further market share gains.

Financial Review

Half

year Half year

2022 2021

$m $m

----------------------- -------- ----------

Operating profit 43.98 3.60

Net finance cost (0.07) (0.23)

Profit before tax 43.91 3.37

Taxation (10.54) (0.81)

------------------------- -------- ----------

Profit for the period 33.37 2.56

------------------------- -------- ----------

The results for the half year and prior half year are

unaudited.

The Group's operating result in the period, summarising expense

by function, was as follows:

Half year Half year

2022 2021

$m $m

----------------------------------------------------- ---------- ----------

Revenue 515.54 326.81

----------------------------------------------------- ---------- ----------

Gross profit 147.94 95.61

Marketing costs (62.94) (59.89)

Selling costs (18.05) (15.43)

Administration and central costs (22.33) (16.19)

Share option related charges (0.46) (0.33)

Defined benefit pension scheme administration costs (0.18) (0.17)

----------------------------------------------------- ---------- ----------

Operating profit 43.98 3.60

----------------------------------------------------- ---------- ----------

Revision to the definition of underlying profit measures

In previous half year results announcements, defined benefit

pension charges were not included in the definition of underlying

operating profit. These charges have now become relatively stable

and are not material, therefore they are now included in

underlying, which is defined as before exceptional items. There are

no exceptional items in the half year 2022 or half year 2021, so

the term underlying is not used in relation to any measurements of

profit in these 2022 half year results.

Operating result

The momentum built in the second half of 2021 has continued into

the first six months of 2022. Strong demand activity resulted in

both total order counts and average order values at the half year

up 14% over the first half of 2019 (the most recent 'normal' year),

leading to revenue for the period increasing to $515.54m (H1 2021:

$326.81m; H1 2019: $405.06m).

The gross profit percentage has stabilised at 28.7% (H1 2021:

29.3%), despite the high inflationary environment. A considered

approach to selling price adjustments has helped to offset supplier

cost increases. Other factors affecting gross margin percentage

include continuing strength in average order values and increases

in other directly variable costs such as transportation.

Marketing costs reduced to 12.2% of revenue in the period,

compared to 18.3% of revenue in the first half of 2021. The

improved productivity of our marketing programme, driven by the

shift towards the brand component and efficiencies in search engine

marketing yields, has resulted in our revenue per marketing dollar

KPI in the period rising to $8.19, a 50% increase over prior year

(2021: $5.46).

Selling, administration, and central costs together have

increased 27.7% year-on-year. This reflects additional investment

in team members, particularly in customer service and at our

operational facilities to support elevated demand activity, and

higher incentive compensation accruals and revenue reserves in line

with trading performance.

These factors, when combined together, demonstrate the financial

leverage in the business model, thereby delivering a material

uplift in operating profit to $43.98m for the period (H1 2021:

$3.60m).

Foreign exchange

The primary US dollar exchange rates relevant to the Group's

results were as follows:

Half year 2022 Half year 2021 Full year 2021

Period Average Period Average Period end Average

end end

---------- ------- -------- ------- -------- ----------- --------

Sterling 1.20 1.30 1.38 1.39 1.35 1.38

Canadian

dollars 0.77 0.79 0.81 0.80 0.79 0.80

---------- ------- -------- ------- -------- ----------- --------

The Group reports in US dollars, its primary trading currency.

It also transacts business in Canadian dollars, Sterling and Euros.

Sterling/US dollar is the exchange rate most likely to impact the

Group's financial performance.

The primary foreign exchange considerations relevant to the

Group's operations are as follows:

-- Translational risk in the income statement remains low with

the majority of the Group's revenue arising in US dollars, the

Group's reporting currency. The net impact on the 2022 half year

income statement from trading currency movements was not material

to the Group's results.

-- Most of the constituent elements of the Group balance sheet

are US dollar-based. Exceptions are the Sterling-based defined

benefit pension asset and UK cash balance, which produced exchange

losses of $0.12m and $1.05m respectively in the first half of

2022.

-- The Group generates cash mostly in US dollars, but its

primary applications of post-tax cash are Shareholder dividends,

pension contributions and some Head Office costs, all of which are

paid in Sterling. As such, the Group's cash position is sensitive

to Sterling/US dollar exchange movements. To the extent that

Sterling weakens against the US dollar, more funds are available in

payment currency to fund these cash outflows.

Share option charges

A total of $0.46m (H1 2021: $0.33m) was charged in the period in

respect of IFRS 2 'Share-based Payments'. This was made up of two

elements: (i) executive awards under the 2015 Incentive Plan, now

replaced by the Deferred Bonus Plan ("DBP"); and (ii) charges in

respect of the 2019 UK SAYE Scheme and the 2021 US Employee Stock

Purchase Plan.

Current options and awards outstanding are 13,833 share options

under the UK SAYE scheme, 91,838 share options under the 2021 US

Employee Stock Purchase Plan, and 29,633 share awards under the

2015 Incentive Plan.

Net finance cost

Net finance cost in the period was $0.07m (H1 2021: $0.23m).

This comprises lease interest charges under IFRS 16, the net

finance income/cost on the defined benefit pension plan assets and

liabilities, and interest earned on cash deposits.

The net finance cost has reduced year-on-year due to improving

yields on cash deposits, particularly in the US where interest

rates have steadily increased during the period, and net interest

on the defined benefit pension plan becoming positive as the Plan

has moved into a net asset position on an IAS 19 basis.

Taxation

The tax charge for the half year was $10.54m (H1 2021: $0.81m),

giving an effective tax rate of 24% (H1 2021: 24%). The tax charge

relates principally to taxation payable on profits earned in North

America.

Earnings per share

Basic earnings per share was 118.90c (H1 2021: 9.12c). This

reflects the strong financial results in the period, a consistent

effective tax rate, and a weighted average number of shares in

issue similar to prior year.

Dividends

Dividends are determined in US dollars and paid in Sterling,

converted at the exchange rate on the date that the dividend is

declared.

The Board has declared an interim dividend per share of 40.00c,

(2021: 15.00c), an increase of 167%. In Sterling, the interim

dividend per share will be 33.01p (2021: 10.83p). The dividend will

be paid on 16 September 2022 to Shareholders on the register at the

close of business on 19 August 2022.

Defined benefit pension plan

The Group sponsors a legacy UK defined benefit pension plan (the

"Plan") which has been closed to new members and future accruals

for several years. The Plan has 114 pensioners and 221 deferred

members.

At 2 July 2022, the surplus of the Plan on an IAS 19 basis was

$0.72m, compared to a surplus of $1.97m at 1 January 2022. Gross

Plan assets under IAS 19 were $26.14m, and liabilities were

$25.42m.

The change in the surplus is analysed as follows:

$m

----------------------------------------------------- --------

IAS 19 surplus at 1 January 2022 1.97

Company contributions to the Plan 2.20

Defined benefit pension scheme administration costs (0.18)

Pension finance income 0.03

Re-measurement gain due to changes in assumptions 8.20

Return on scheme assets (excluding interest income) (11.38)

Exchange loss (0.12)

------------------------------------------------------ --------

IAS 19 surplus at 2 July 2022 0.72

------------------------------------------------------ --------

The surplus reduced by $1.25m in the period. This was mainly the

result of a fall in the Plan asset values driven by the high

inflation to 2 July 2022 (the assets are held in gilts, credit

funds and liquidity funds, the value of which move with inflation

and interest rate expectations), partly offset by the increase in

the discount rate used to measure the Plan liabilities.

The Company continues to pay regular monthly contributions into

the Plan as part of a recovery plan agreed by the Company and the

Trustee that aims towards funding on a buyout basis by mid-2024. As

the Plan moves towards becoming 'buyout ready', the Company and the

Trustee continue to assess options on the timing and route to

achieving this objective.

A triennial actuarial valuation of the Plan was completed in

September 2019 and this forms the basis of the 2022 half year IAS

19 valuation set out above. The next triennial Plan valuation is

scheduled for September 2022.

Business combination

On 25 April 2022, the Group acquired the trade and assets of Fox

Graphics Ltd, an unlisted company based in Oshkosh, Wisconsin, that

specialises in screen-printing services. The acquired

screen-printing operations will enable the Group to bring this

capability in-house. With future investment the objective is to

secure the capacity to meet the anticipated growth in demand for

the apparel category.

The acquisition constitutes a business combination as defined in

IFRS 3, as the three elements of a business (input, process,

output) have been identified as having been acquired. Accordingly,

the acquisition has been accounted for using the acquisition

method.

The fair value of the consideration transferred was $1.70m and

the net identifiable assets acquired and liabilities assumed as at

the date of acquisition have been determined at $0.69m. The

resulting goodwill of $1.01m has been recognised on the balance

sheet during the period.

Further information on this acquisition is provided in note 7 to

these interim financial statements.

Cash flow

Net cash was $67.10m at 2 July 2022 (3 July 2021: $52.80m; 1

January 2022: $41.59m).

Cash flow in the period is summarised as follows:

Half year Half year

2022 2021

$m $m

----------------------------------------------------- ---------- ----------

Operating profit 43.98 3.60

Share option related charges 0.44 0.32

Defined benefit pension scheme administration costs 0.18 0.17

Depreciation and amortisation 1.98 1.76

Lease depreciation 0.68 0.67

Change in working capital 4.58 11.32

Capital expenditure (2.44) (0.96)

----------------------------------------------------- ---------- ----------

Underlying operating cash flow 49.40 16.88

Tax and interest (9.25) (1.04)

Consideration for business combination (1.70) -

Defined benefit pension scheme contributions (2.20) (2.07)

Own share transactions (0.97) (0.30)

Capital element of lease payments (0.58) (0.55)

Exchange and other (1.05) 0.12

----------------------------------------------------- ---------- ----------

Free cash flow 33.65 13.04

Dividends to Shareholders (8.14) -

----------------------------------------------------- ---------- ----------

Net cash inflow in the period 25.51 13.04

----------------------------------------------------- ---------- ----------

The Group generated underlying operating cash flow of $49.40m

(H1 2021: $16.88m), a conversion rate of 112% of operating profit.

The net working capital position, whilst remaining elevated, has

improved since the 2021 year end as the open order book has been

closely managed and supply chain issues have started to stabilise.

Capital expenditure includes $1.71m on a solar array at the Oshkosh

Distribution Center which recently produced its first power and is

expected to be fully operational by the end of August 2022.

Free cash flow improved by $20.61m to $33.65m (H1 2021:

$13.04m). This is attributable to the excellent trading performance

during the period and is net of $1.70m of business acquisition

consideration. The 2021 final dividend of $8.14m was paid in May

2022.

Balance sheet and Shareholders' funds

Net assets at 2 July 2022 were $103.79m, compared to $82.97m at

1 January 2022. The balance sheet is summarised as follows:

2 July 1 January

2022 2022

$m $m

-------------------- -------- ----------

Non-current assets 39.51 38.04

Working capital 7.77 12.27

Net cash 67.10 41.59

Lease liabilities (11.62) (12.09)

Pension asset 0.72 1.97

Other assets - net 0.31 1.19

-------------------- -------- ----------

Net assets 103.79 82.97

-------------------- -------- ----------

Shareholders' funds increased by $20.82m since the 2021

year-end. Constituent elements of the change were retained profit

in the period of $33.37m and share option related movements of

$0.44m, net of equity dividends paid to Shareholders of $(8.14)m,

own share transactions of $(0.97)m, the after tax impact of returns

on pension plan assets and re-measurement gains on pension

obligations of $(2.62)m, and currency translation differences of

$(1.26)m.

The Group had a net positive working capital balance of $7.77m

at 2 July 2022 (1 January 2022: $12.27m). This reflects the

build-up of accrued revenue and inventory on orders being processed

and has been impacted by global and local supply chain issues. The

working capital balance has reduced since the year-end as orders

have been completed and the supply of product has stabilised.

Financing and liquidity

Full details of the Board's balance sheet funding guidelines and

capital allocation priorities are set out on page 33 of the 2021

Annual Report. The Board retains the same guidelines in both

areas.

The primary aim of these guidelines is to provide operational

and financial flexibility through economic cycles, to be able to

invest in opportunities as they arise, and to meet commitments to

Shareholders through dividend payments and to the defined benefit

pension plan through regular contributions.

The Group has a $20.0m working capital facility with its

principal US bank, JPMorgan Chase, N.A. The facility has a minimum

EBITDA test and standard debt service coverage ratio and debt to

EBITDA covenants. The interest rate is the Secured Overnight

Financing Rate ("SOFR") plus 2.1%, and the facility expires on 31

May 2024. In addition, an overdraft facility of GBP1.0m, with an

interest rate of the Bank of England base rate plus 2.00% (or 2.00%

if higher), is available from the Group's principal UK bank, Lloyds

Bank plc, until 31 December 2022.

The Group had cash balances of $67.10m at the period end and has

no current requirement or plans to raise additional equity or core

debt funding.

Critical accounting policies

Critical accounting policies are those that require significant

judgments or estimates and potentially result in materially

different results under different assumptions or conditions. It is

considered that the Group's only critical accounting policies are

in respect of revenue, leases, and the retirement benefit

asset.

Key sources of estimation uncertainty

Determining the carrying amount of some assets and liabilities

requires estimation of the effects of uncertain future events. The

key sources of estimation uncertainty are considered to be in

relation to the valuation of the defined benefit Plan liabilities

and assets.

Principal risks and uncertainties

The Board has ultimate responsibility for the Group's risk

management process, although responsibility for reviewing specific

risks and controls is delegated to the Audit Committee. The

Executive Directors and operational management teams, co-ordinated

by the Business Risk Management Committee ("BRMC"), are responsible

for the identification and evaluation of risks and the subsequent

implementation of specific risk mitigation activities.

The Group's risk management process identifies, evaluates, and

manages the Group's principal risks and uncertainties. These risks

are identified through a variety of sources, both internal and

external, to ensure that emerging risks are identified and

considered on a timely basis.

The principal risks and uncertainties, including emerging risks,

faced by the Group are set out on pages 36 to 43 of the 2021 Annual

Report, a copy of which is available on the Group's investor

relations website at https://investors.4imprint.com . These

are:

1. Macroeconomic conditions.

2. Markets & competition.

3. Effectiveness of key marketing techniques and brand development.

4. Business facility disruption.

5. Domestic supply and delivery.

6. Failure or interruption of information technology systems and infrastructure.

7. Cyber threats.

8. Supply chain compliance & ethics.

9. Legal, regulatory, and compliance.

10. Climate change.

11. Products and market trends.

Whilst these risks have not changed materially since year-end,

updates to the risk environment in respect of COVID-19, the

availability of labour, and the fulfilment of customer orders are

provided below.

COVID-19 pandemic

Whilst concerns remain with respect to potential new virus

variants, the risk of a negative effect on demand for our products

arising from the pandemic is considered to have receded over the

period. Demand activity for our primary North American business has

fully recovered and is now exceeding pre COVID-19 levels, with

total order counts at the half year 14% ahead of 2019 (the most

recent 'normal' year).

Availability of labour

The labour market in the US remains extremely tight. This is

presenting challenges in hiring production and support staff to

meet the material increase in demand activity. Considerable

resource has been invested to ensure 4imprint remains an employer

of choice. This has included a review of wage levels in light of

the high inflationary environment and strong employment market to

ensure we remain competitive, as well as ensuring that the IT

infrastructure is in place to support the flexible working

practices that are highly valued by our office-based teammates.

Customer order fulfilment

The sustained disruption to global and local supply chains,

challenges in recruiting staff by both 4imprint and our supply

partners, and elevated order levels experienced during the first

half of 2022, have increased the risk of not being able to fulfil

customer orders on a timely basis. The Group's reputation for

excellent service and reliability is a core tenet of our customer

proposition. Recruitment activity has been ongoing throughout the

period, particularly in our Oshkosh Distribution Center and for

customer service staff to help meet demand for apparel orders and

to keep our customers informed and supported through the order

process.

Going concern statement

In adopting the going concern basis for preparing these

condensed consolidated financial statements, the Directors have

carefully considered:

-- The Group's strategy, market position and business model, as

set out in the Strategic Report section on pages 9 to 19 of the

2021 Annual Report.

-- The principal risks and uncertainties facing the Group, as

outlined in the Principal risks and uncertainties section of this

Financial Review.

-- Information contained in this Financial Review concerning the

Group's financial position, cash flows and liquidity position.

-- Regular management reporting and updates from the Executive Directors.

-- Recent detailed financial forecasts and analysis for the period to 30 December 2023.

The strength of the Group's business model and market position,

as evidenced by the financial resilience shown through the COVID-19

pandemic and excellent demand activity in the first half of 2022,

leaves the Group in a very strong financial position. In

consequence, the Board has considerable confidence in the Group's

prospects, whilst remaining conscious of the current geo-political

and broad economic factors that may affect the Group's performance

over the period to 30 December 2023.

Financial position

The Group had net cash of $67.10m at 2 July 2022 (1 January

2022: $41.59m) and maintains a $20.0m working capital facility with

its principal US bank, JPMorgan Chase, N.A., which expires on 31

May 2024, and an overdraft facility of GBP1.0m with its principal

UK bank, Lloyds Bank plc, which is available until 31 December

2022. Based on our forecast, we have no requirement to draw on

either of these facilities.

Financial modelling

We undertake regular forecasting and budgeting exercises which

are reviewed and approved by the Board. On an annual basis, we also

model a distressed scenario based upon severe, but plausible,

downside demand assumptions to support our assessment of

viability.

These forecasts, and our experience from the COVID-19 pandemic

that resulted in sustained diminished corporate demand in a

downsized promotional products market, have demonstrated the

Group's ability to flex its marketing and other costs to mitigate

the impact of severe falls in revenue, whilst still retaining

flexibility to further reduce costs if required.

Combined with a healthy net cash position maintained in

accordance with our balance sheet funding guidelines, the Board

considers the Group to be in a strong position to withstand severe

economic stress and to take market share opportunities as they

arise.

Going concern

Based on the assessment outlined above, the Directors have a

reasonable expectation that the Group will continue to operate and

to meet its liabilities as they fall due over the period to 30

December 2023. On this basis, the Directors continue to adopt the

going concern basis in preparing these condensed consolidated

financial statements.

Kevin Lyons-Tarr David Seekings

Chief Executive Officer Chief Financial Officer

10 August 2022

Condensed Consolidated Income Statement (unaudited)

For the 26 weeks ended 2 July 2022

Half Half Full

year year year

2022 2021 2021

Note $'000 $'000 $'000

--------------------------------- ------ ---------- ---------- ----------

Revenue 6 515,536 326,808 787,322

Operating expenses (471,553) (323,213) (756,676)

--------------------------------- ------ ---------- ---------- ----------

Operating profit 6 43,983 3,595 30,646

Finance income 108 15 33

Finance costs (205) (228) (435)

Pension finance income/(charge) 27 (15) (15)

--------------------------------- ------ ---------- ---------- ----------

Net finance cost (70) (228) (417)

Profit before tax 43,913 3,367 30,229

Taxation 8 (10,539) (808) (7,643)

--------------------------------- ------ ---------- ---------- ----------

Profit for the period 33,374 2,559 22,586

--------------------------------- ------ ---------- ---------- ----------

Cents Cents Cents

--------------------------------- ------ ---------- ---------- ----------

Earnings per share

Basic 9 118.90 9.12 80.46

Diluted 9 118.67 9.09 80.26

--------------------------------- ------ ---------- ---------- ----------

Condensed Consolidated Statement of Comprehensive Income

(unaudited)

For the 26 weeks ended 2 July 2022

Half Half Full

year year year

2022 2021 2021

$'000 $'000 $'000

--------------------------------------------------- --------- -------- --------

Profit for the period 33,374 2,559 22,586

---------------------------------------------------- --------- -------- --------

Other comprehensive (expense)/income

Items that may be reclassified subsequently

to the income statement:

Currency translation differences (1,269) 137 (97)

Items that will not be reclassified subsequently

to the income statement:

Return on pension scheme assets (excluding

interest income) (11,381) (3,440) (1,391)

Re-measurement gains on post-employment

obligations 8,201 2,664 2,506

Tax relating to components of other comprehensive

(expense)/income 560 147 (1,411)

Total other comprehensive expense net

of tax (3,889) (492) (393)

---------------------------------------------------- --------- -------- --------

Total comprehensive income for the period 29,485 2,067 22,193

---------------------------------------------------- --------- -------- --------

Condensed Consolidated Balance Sheet (unaudited)

At 2 July 2022

At At At

2 July 3 July 1 Jan

2022 2021 2022

Note $'000 $'000 $'000

------------------------------- ----- --------- --------- ---------

Non-current assets

Property, plant and equipment 25,765 24,063 24,667

Intangible assets 1,002 1,078 1,045

Right-of-use assets 11,153 12,395 11,725

Goodwill 7 1,010 - -

Deferred tax assets 579 3,857 600

Retirement benefit asset 11 717 - 1,974

------------------------------- ----- --------- ---------

40,226 41,393 40,011

------------------------------- ----- --------- --------- ---------

Current assets

Inventories 22,726 12,646 20,559

Trade and other receivables 82,030 48,652 63,589

Current tax debtor 1,331 2,449 2,034

Cash and cash equivalents 67,096 52,802 41,589

------------------------------- ----- --------- --------- ---------

173,183 116,549 127,771

------------------------------- ----- --------- --------- ---------

Current liabilities

Lease liabilities 12 (1,246) (1,133) (1,150)

Trade and other payables (96,981) (74,110) (71,877)

(98,227) (75,243) (73,027)

------------------------------- ----- --------- ---------

Net current assets 74,956 41,306 54,744

------------------------------- ----- --------- --------- ---------

Non-current liabilities

Lease liabilities 12 (10,370) (11,519) (10,939)

Retirement benefit obligation 11 - (2,244) -

Deferred tax liabilities (1,022) (1,478) (850)

(11,392) (15,241) (11,789)

------------------------------- ----- --------- --------- ---------

Net assets 103,790 67,458 82,966

------------------------------- ----- --------- --------- ---------

Shareholders' equity

Share capital 18,842 18,842 18,842

Share premium reserve 68,451 68,451 68,451

Other reserves 4,751 6,254 6,020

Retained earnings 11,746 (26,089) (10,347)

------------------------------- ----- --------- --------- ---------

Total Shareholders' equity 103,790 67,458 82,966

------------------------------- ----- --------- --------- ---------

Condensed Consolidated Statement of Changes in Shareholders'

Equity (unaudited)

For the 26 weeks ended 2 July 2022

Retained earnings

--------------------

Share

Share premium Other Own Profit Total

capital reserve reserves shares and loss equity

$'000 $'000 $'000 $'000 $'000 $'000

-------------------------------------- --------- --------- ---------- -------- ---------- --------

Balance at 3 January 2021 18,842 68,451 6,117 (581) (27,458) 65,371

--------------------------------------

Profit for the period 2,559 2,559

Other comprehensive income/(expense) 137 (629) (492)

-------------------------------------- --------- --------- ---------- -------- ---------- --------

Total comprehensive income 137 1,930 2,067

-------------------------------------- --------- --------- ---------- -------- ---------- --------

Own shares utilised 572 (572) -

Own shares purchased (301) (301)

Share-based payment charge 321 321

At 3 July 2021 18,842 68,451 6,254 (310) (25,779) 67,458

-------------------------------------- --------- --------- ---------- -------- ---------- --------

Profit for the period 20,027 20,027

Other comprehensive (expense)/income (234) 333 99

Total comprehensive income (234) 20,360 20,126

-------------------------------------- --------- --------- ---------- -------- ---------- --------

Own shares utilised 1 (1) -

Own shares purchased (542) (542)

Share-based payment charge 281 281

Deferred tax relating to

share options 5 5

Deferred tax relating to

losses attributable to share

options (228) (228)

Dividends (4,134) (4,134)

At 1 January 2022 18,842 68,451 6,020 (851) (9,496) 82,966

--------- --------- ---------- -------- ---------- --------

Profit for the period 33,374 33,374

Other comprehensive expense (1,269) (2,620) (3,889)

-------------------------------------- --------- --------- ---------- -------- ---------- --------

Total comprehensive income (1,269) 30,754 29,485

-------------------------------------- --------- --------- ---------- -------- ---------- --------

Own shares utilised 825 (825) -

Own shares purchased (980) (980)

Proceeds from options exercised 12 12

Share-based payment charge 442 442

Dividends (8,135) (8,135)

Balance at 2 July 2022 18,842 68,451 4,751 (1,006) 12,752 103,790

-------------------------------------- --------- --------- ---------- -------- ---------- --------

Condensed Consolidated Cash Flow Statement (unaudited)

For the 26 weeks ended 2 July 2022

Half Half Full

year year year

2022 2021 2021

Note $'000 $'000 $'000

---------------------------------------------- ----- -------- ------- --------

Cash flows from operating activities

Cash generated from operations 13 49,639 15,770 18,257

Tax paid (9,151) (820) (6,414)

Finance income received 108 15 33

Finance costs paid (35) (42) (65)

Lease interest (176) (193) (377)

---------------------------------------------- ----- -------- ------- --------

Net cash generated from operating activities 40,385 14,730 11,434

---------------------------------------------- ----- -------- ------- --------

Cash flows from investing activities

Purchases of property, plant and equipment (2,263) (769) (3,083)

Purchases of intangible assets (179) (194) (382)

Proceeds from sale of property, plant

and equipment 3 - -

Consideration for business combination 7 (1,700) - -

--------

Net cash used in investing activities (4,139) (963) (3,465)

---------------------------------------------- ----- -------- -------

Cash flows from financing activities

Capital element of lease payments (584) (554) (1,117)

Proceeds from share options exercised 12 - -

Purchases of own shares (980) (301) (843)

Dividends paid to Shareholders 10 (8,135) - (4,134)

---------------------------------------------- ----- -------- ------- --------

Net cash used in financing activities (9,687) (855) (6,094)

---------------------------------------------- ----- -------- ------- --------

Net movement in cash and cash equivalents 26,559 12,912 1,875

Cash and cash equivalents at beginning

of the period 41,589 39,766 39,766

Exchange (losses)/gains on cash and

cash equivalents (1,052) 124 (52)

---------------------------------------------- ----- -------- ------- --------

Cash and cash equivalents at end of

the period 67,096 52,802 41,589

---------------------------------------------- ----- -------- ------- --------

Notes to the Interim Financial Statements

1 General information

4imprint Group plc is a public limited company incorporated in

England and Wales, domiciled in the UK and listed on the London

Stock Exchange. Its registered office is 25 Southampton Buildings,

London, WC2A 1AL.

These interim condensed consolidated financial statements, which

were authorised for issue in accordance with a resolution of the

Directors on 9 August 2022, do not comprise statutory accounts

within the meaning of Section 434 of the Companies Act 2006.

Statutory accounts for the period ended 1 January 2022 were

approved by the Board of Directors on 15 March 2022 and delivered

to the Registrar of Companies. The report of the auditors on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under Section 498 of

the Companies Act 2006.

The financial information contained in this report has neither

been audited nor reviewed by the auditors, pursuant to Auditing

Practices Board guidance on Review of Interim Financial

Information.

2 Basis of preparation

These interim condensed consolidated financial statements for

the 26 weeks ended 2 July 2022 have been prepared, in US dollars,

in accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority and IAS 34 'Interim Financial

Reporting', as adopted by the United Kingdom, and should be read in

conjunction with the Group's financial statements for the period

ended 1 January 2022, which were prepared in accordance with

UK-adopted International Accounting Standards.

As outlined in the Going concern section of the Financial

Review, the Directors consider it appropriate to continue to adopt

the going concern basis in preparing these interim condensed

consolidated financial statements.

The tax charge for the interim period is accrued based on the

best estimate of the tax charge for the full financial year.

3 Accounting policies

The accounting policies applied in these interim condensed

consolidated financial statements are consistent with those

followed in the preparation of the Group's annual consolidated

financial statements for the period ended 1 January 2022, as

described in those annual financial statements, except for a new

accounting policy adopted for goodwill as detailed below. New

accounting standards applicable for the first time in this

reporting period have no impact on the Group's results or balance

sheet.

Goodwill

Goodwill represents the excess of the fair value of the

consideration of an acquisition over the fair value attributed to

the net assets acquired (including contingent liabilities).

Goodwill is not amortised but is reviewed annually for

impairment.

4 Use of assumptions and estimates

The preparation of the interim financial statements requires

management to make judgments, estimates and assumptions that affect

the application of policies and reported amounts of assets and

liabilities, income and expenses. The estimates and associated

assumptions are based on historical experience and various other

factors that are believed to be reasonable under the circumstances,

the results of which form the basis of making estimates about

carrying values of assets and liabilities that are not readily

apparent from other sources. Actual results may differ from these

estimates.

There have been no changes in the critical accounting judgments

and key sources of estimation uncertainty since the 2021 year-end,

other than the assumptions and sensitivities on the recalculation

of the defined benefit pension obligations as shown in note 11.

5 Financial risk management

The Group's activities expose it to a variety of financial

risks: currency risk; credit risk; liquidity risk; and capital

risk. These interim condensed consolidated financial statements do

not include all financial risk management information and

disclosures required in the annual financial statements; they

should be read in conjunction with the Group's annual consolidated

financial statements for the period ended 1 January 2022. There

have been no changes in any financial risk management policies

since that date.

6 Segmental analysis

The chief operating decision maker has been identified as the

Board of Directors and the segmental analysis is presented based on

the Group's internal reporting to the Board.

At 2 July 2022, the Group had two operating segments, North

America and UK & Ireland. The costs of the Head Office are

reported separately to the Board, but this is not an operating

segment.

Half Half Full

year year year

2021 2021

2022 $'000 $'000

Revenue $'000

--------------------- -------- -------- --------

North America 505,864 321,698 773,710

UK & Ireland 9,672 5,110 13,612

--------------------- -------- -------- --------

Total Group revenue 515,536 326,808 787,322

--------------------- -------- -------- --------

Half Half Full

year 2022 year year

2021 2021

Profit $'000 $'000 $000

--------------------------------------------------- ----------- -------- --------

North America 46,420 6,654 36,006

UK & Ireland (132) (968) (1,464)

--------------------------------------------------- ----------- -------- --------

Operating profit from Direct Marketing operations 46,288 5,686 34,542

Head Office costs (2,305) (2,091) (3,896)

--------------------------------------------------- ----------- -------- --------

Operating profit 43,983 3,595 30,646

Net finance cost (70) (228) (417)

--------------------------------------------------- ----------- -------- --------

Profit before tax 43,913 3,367 30,229

--------------------------------------------------- ----------- -------- --------

Other segmental information

Assets Liabilities

---------------------------- --------------------------------

2 July 3 July 1 Jan 2 July 3 July 1 Jan

2022 2021 2021

$'000 $'000 2022 2022 $'000 2022

$'000 $'000 $'000

--------------- -------- -------- -------- ---------- --------- ---------

North America 140,731 98,152 120,284 (105,346) (84,645) (81,674)

UK & Ireland 3,948 2,752 3,017 (3,798) (3,156) (2,618)

Head Office 68,730 57,038 44,481 (475) (2,683) (524)

--------------- -------- -------- -------- ---------- --------- ---------

213,409 157,942 167,782 (109,619) (90,484) (84,816)

--------------- -------- -------- -------- ---------- --------- ---------

Head Office assets include cash and cash equivalents, deferred

tax assets and retirement benefit assets. Head Office liabilities

at 3 July 2021 include retirement benefit obligations.

7 Business combinations

Acquisition of screen-printing business

On 25 April 2022, the Group acquired the trade and assets of Fox

Graphics Ltd, an unlisted company based in Oshkosh, Wisconsin, that

specialises in screen-printing services. The acquired

screen-printing operations will enable the Group to bring this

capability in-house. With future investment the objective is to

secure the capacity to meet the anticipated growth in demand for

the apparel category.

The acquisition constitutes a business combination as defined in

IFRS 3, as the three elements of a business (input, process,

output) have been identified as having been acquired. Accordingly,

the acquisition has been accounted for using the acquisition

method.

The fair values of the identifiable assets acquired and

liabilities assumed as at the date of acquisition were:

Fair value recognised

on acquisition

$'000

--------------------------------------------- ----------------------

Assets

Property, plant and equipment 690

Right-of-use assets 111

801

--------------------------------------------- ----------------------

Liabilities

Lease liabilities (111)

(111)

--------------------------------------------- ----------------------

Total identifiable net assets at fair value 690

--------------------------------------------- ----------------------

Goodwill arising on acquisition 1,010

--------------------------------------------- ----------------------

Purchase consideration transferred 1,700

--------------------------------------------- ----------------------

Analysis of cash flows on acquisition:

Cash paid 1,700

--------------------------------------------- ----------------------

Net cash flow on acquisition 1,700

--------------------------------------------- ----------------------

In addition to the purchase consideration transferred, a

potential further $560,000 is payable in annual instalments over

the five year period following closing, subject to certain

conditions being satisfied, including the continued employment of

the selling shareholder with the Group. These contingent payments

constitute remuneration for future services and will be expensed to

profit and loss as services are rendered; $20,000 has been

recognised at the 2022 half year in operating expenses in the

income statement and trade and other payables in the balance

sheet.

Reconciliation of the carrying amount of goodwill at the

beginning and end of the reporting period is presented below:

Goodwill

$'000

------------------------------------------------- ---------

Cost

At 2 January 2022 -

Acquisition of screen-printing trade and assets 1,010

------------------------------------------------- ---------

At 2 July 2022 1,010

------------------------------------------------- ---------

The Group did not acquire any receivables as part of the

business combination.

The acquired business generated revenues and net income of

approximately $2.0m and $0.4m respectively for the twelve months

ended 31 December 2021. The Group was the principal customer of the

acquired business, contributing approximately $1.7m of the total

$2.0m of revenue and approximately $0.3m of the total $0.4m net

income.

The impact on the Group's financial statements, both from the

date of acquisition and as if the acquisition had taken place at

the beginning of the period, are not material as demonstrated by

the full year results of Fox Graphics Ltd noted above. As most of

the revenue of the acquired business was contributed by the Group,

these transactions will be eliminated upon consolidation from the

date of acquisition as intra-group trading and thus only external

sales will impact Group revenue (based on 2021 results, this would

be expected to add circa $0.3m to revenue for a full year). The

Group will benefit from lower product costs associated with

integrating the production operations of Fox Graphics Ltd; based on

2021 results and without any new investment by the Group, the

acquisition would be expected to add circa $0.4m to the Group's

profit before tax for a full year.

The goodwill recognised is primarily attributable to the

specialised operational knowledge acquired and benefits of bringing

the activities of the screen-printing business in-house to secure

capacity and support the growing demand for decorated garments from

our customers. The total amount of goodwill that is expected to be

deductible for tax purposes is $1,010,000.

Total acquisition-related transaction costs of $17,000 will be

expensed in 2022; $13,000 is included in operating expenses in the

income statement for the 26 weeks ended 2 July 2022 and is part of

operating cash flows in the cash flow statement; the remaining

$4,000 of costs will be expensed in the second half of the

financial year.

8 Taxation

The taxation rate was 24%, based on the estimated rate for the

full year (H1 2021: 24%; FY 2021: 25%). Tax paid in the period was

$9.15m (H1 2021: $0.82m; FY 2021: $6.41m).

The deferred tax assets/liabilities at 2 July 2022 have been

calculated at a tax rate of 19% in respect of deferred tax items

that are expected to reverse before 1 April 2023 (H1 2021: 19%; FY

2021: 19%) and 25% in respect of deferred tax items expected to

reverse after 1 April 2023 (H1 2021: 25%; FY 2021: 25%) for UK

deferred tax items, and 25% (H1 2021: 25%; FY 2021: 25%) in respect

of US deferred tax items.

9 Earnings per share

Basic and diluted

The basic and diluted earnings per share are calculated based on

the following data:

Half Half Full

year year year

2022 2021 2021

$'000 $'000 $'000

------------------ ------- ------ -------

Profit after tax 33,374 2,559 22,586

------------------ ------- ------ -------

Half Half Full

year year year

2022 2021 2021

Number Number Number

000's 000's 000's

------------------------------------------- ------- ------- -------

Basic weighted average number of shares 28,070 28,072 28,072

Adjustment for employee share options 53 65 68

------------------------------------------- ------- ------- -------

Diluted weighted average number of shares 28,123 28,137 28,140

------------------------------------------- ------- ------- -------

Cents Cents Cents

------------------------------------------- ------- ------- -------

Basic earnings per share 118.90 9.12 80.46

------------------------------------------- ------- ------- -------

Diluted earnings per share 118.67 9.09 80.26

------------------------------------------- ------- ------- -------

The basic weighted average number of shares excludes shares held

in the 4imprint Group plc employee benefit trust. The effect of

this is to reduce the average by 15,931 (H1 2021: 13,340; FY 2021:

13,888).

10 Dividends Half Half Full

year year year

2022 2021 2021

$'000 $'000 $'000

---------------------------------- ------ ------ ------

Dividends paid in the period 8,135 - 4,134

---------------------------------- ------ ------ ------

Cents Cents Cents

---------------------------------- ------ ------ ------

Dividends per share

declared - Interim 40.00 15.00 15.00

- Final - - 30.00

--------------------------------- ------ ------ ------

The interim dividend for 2022 of 40.00c per ordinary share

(interim 2021: 15.00c; final 2021: 30.00c) will be paid on 16

September 2022 to Shareholders on the register at the close of

business on 19 August 2022.

11 Employee pension schemes

The Group operates defined contribution pension schemes for its

UK and US employees. The regular contributions are charged to the

income statement as they are incurred.

The Group also sponsors a UK defined benefit pension scheme

which is closed to new members and future accrual. The funds of the

scheme are held in trust, administered by a corporate Trustee, and

are independent of the Group's finances.

The last full actuarial valuation was carried out by a qualified

independent actuary as at 30 September 2019 and this has been

updated on an approximate basis to 2 July 2022 in accordance with

IAS 19. There have been no changes in the valuation methodology

adopted for this period's disclosures compared to previous periods'

disclosures.

The principal assumptions applied by the actuaries at 2 July

2022 were:

Half Half Full

year year year

2022 2021 2021

----------------------------------------- ------ ------ ------

Rate of increase in pensions in payment 3.10% 3.10% 3.25%

Rate of increase in deferred pensions 2.60% 2.60% 2.75%

Discount rate 3.55% 1.80% 1.80%

Inflation assumption - RPI 3.20% 3.20% 3.35%

Inflation assumption - CPI 2.60% 2.60% 2.75%

----------------------------------------- ------ ------ ------

The mortality assumptions adopted at 2 July 2022 imply the

following life expectancies at age 65:

Half Half Full

year year year

2022 2021 2021

Years Years Years

Male currently aged 45 22.3 22.4 22.3

Female currently aged 45 24.3 24.2 24.2

Male currently aged 65 21.3 21.3 21.3

Female currently aged 65 23.1 23.1 23.0

-------------------------- ------- ------- -------

The movement on the net retirement benefit asset, and the value

of the gross scheme assets and liabilities, are shown in the

Financial Review.

The sensitivities on key actuarial assumptions at the end of the

period were:

Change in defined benefit

Change in assumption obligation

------------------- ----------------------------- --------------------------

Discount rate Decrease of 0.50% +8.00%

Rate of inflation Increase of 0.50% +3.30%

Increase in life expectancy

Rate of mortality of one year +3.70%

------------------- ----------------------------- --------------------------

12 Leases

The Group leases office and industrial space in facilities in

Oshkosh. The additions during the period relate to a sub-lease for

real estate entered as part of the acquisition of the

screen-printing business (see note 7 for further information). The

movement in lease liabilities in the period is shown below:

2 July 3 July 1 Jan

2022 2021 2022

$'000 $'000 $'000

----------------------------------------------- ------------ ------- --------

At start of period 12,089 13,206 13,206

Additions 111 - -

Interest charge 176 193 377

Lease interest payments - operating cash flow (176) (193) (377)

Lease capital payments - financing cash flow (584) (554) (1,117)

At end of period 11,616 12,652 12,089

----------------------------------------------- ------------ ------- --------

13 Cash generated from operations

Half Half Full

year year year

2022 2021 2021

$'000 $'000 $'000

--------------------------------------------------- --------- --------- ---------

Profit before tax 43,913 3,367 30,229

Adjustments for:

Depreciation of property, plant and equipment 1,757 1,547 3,237

Amortisation of intangible assets 216 216 437

Amortisation of right-of-use assets 683 672 1,340

Loss on disposal of property, plant and equipment 3 - -

Share option charges 442 321 602

Net finance cost 70 228 417

Defined benefit pension administration charge 175 172 340

Contributions to defined benefit pension scheme (2,202) (2,069) (4,589)

Changes in working capital:

Increase in inventories (2,167) (1,375) (9,288)

Increase in trade and other receivables (18,587) (11,778) (26,831)

Increase in trade and other payables 25,336 24,469 22,363

Cash generated from operations 49,639 15,770 18,257

--------------------------------------------------- --------- --------- ---------

14 Capital commitments

The Group had capital commitments contracted but not provided

for in these financial statements of $4.1m in relation to

embroidery machines and screen-printing equipment (3 July 2021:

$1.49m; 1 January 2022: $nil).

15 Related party transactions

Transactions and balances between the Company and its

subsidiaries have been eliminated on consolidation. The Group did

not participate in any related party transactions with parties

outside of the Group.

16 Alternative performance measures

An Alternative Performance Measure ("APM") is a financial

measure of historical or future financial performance, financial

position, or cash flows, other than a financial measure defined or

specified within IFRS.

The Group uses APMs to supplement standard IFRS measures to

provide users with information on underlying trends and additional

financial measures, which the Group considers will aid users'

understanding of the business.

Definitions of the Group's APMs can be found on page 134 of the

2021 Annual Report.

Reconciliations of the free cash flow and underlying operating

cash flow APMs to their closest IFRS measures are provided

below:

Half

Half year

year 2022 2021

$m $m

------------------------------------------------ ----------- ------

Net movement in cash and cash equivalents 26.56 12.91

Add back: Dividends paid to Shareholders 8.14 -

Less: Exchange (losses)/gains on cash and cash

equivalents (1.05) 0.13

------------------------------------------------ ----------- ------

Free cash flow 33.65 13.04

------------------------------------------------ ----------- ------

Half

Half year

year 2022 2021

$m $m

---------------------------------------------------- ----------- -------

Cash generated from operations 49.64 15.77

Add back: Contributions to defined benefit pension

scheme 2.20 2.07

Less: Purchases of property, plant and equipment

and intangible assets (2.44) (0.96)

Underlying operating cash flow 49.40 16.88

---------------------------------------------------- ----------- -------

Statement of Directors' Responsibilities

The Directors confirm that, to the best of their knowledge,

these interim condensed consolidated financial statements have been

prepared in accordance with IAS 34 as adopted by the United Kingdom

and that the interim management report includes a fair review of

the information required by DTR 4.2.7 and 4.2.8, namely:

-- An indication of the important events that have occurred

during the first half of the year and their impact on the interim

condensed consolidated financial statements, and a description of

the principal risks and uncertainties for the remaining six months

of the financial year; and

-- Material related party transactions in the first half of the

year and any material changes in the related party transactions

described in the last annual report.

The Directors of 4imprint Group plc are as listed in the Group's

Annual Report and Accounts 2021.

By order of the Board

Kevin Lyons-Tarr David Seekings

Chief Executive Chief Financial

Officer Officer

10 August 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFEDTDIAIIF

(END) Dow Jones Newswires

August 10, 2022 02:00 ET (06:00 GMT)

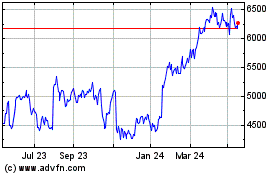

4imprint (LSE:FOUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

4imprint (LSE:FOUR)

Historical Stock Chart

From Dec 2023 to Dec 2024