TIDMKED

RNS Number : 4658J

Kedco PLC

31 March 2010

31 March 2009

Kedco plc

Interim results for the Half Year to 31 December 2009

Kedco plc ("Kedco" or the "Company"), an Irish-based energy group focusing on

green energy production in the UK, Ireland and Eastern Europe, announces today

its interim results for the half year to 31st December 2009.

Key Operational Highlights

· Project Joint Venture and 20 year lease signed for 4 megawatt ("MW")

gasification plant located in Newry, Northern Ireland which has full permitting

approval.

· Kedco has invested in excess of GBP5 million in the project to date and

site construction is almost complete.

· One 2MW gasification unit for the Newry plant has been shipped from

preferred suppliers in the US.

· Kedco generating electricity for sale to national grid from 75 kilowatt

("KW") containerised gasifier located in Cork.

· Significant advancements made in the Company's strategy of deploying

smaller anaerobic digestion, ranging from 75 KW to 500KW, in the United Kingdom

and Ireland.

· Completed factory acceptance of 2 MW gasifier and produced gas of

sufficient quantity and quality to meet the engine specifications for power

generation.

Key Financial Highlights

· Revenues of EUR4.2 million in line with management's expectations and 28% up

on the prior year comparable period (2008: EUR3.2 million)

· Loss for the period reduced to EUR1.5 million representing a 50% improvement

on the prior year comparable period (2008 loss: EUR3.0 million).

· Additional capital of EUR3.1 million (before expenses) sourced from a variety

of institutional investors and the Irish Government during the period.

Donal Buckley, Chief Executive of Kedco, commented:

"Kedco continues to progress its strategy of generating electricity and power

from Biomass sources. Having successfully generated electricity from the smaller

gasification plant located in Cork our priority now is to generate electricity

from the gasification plant in Newry before the end of the calendar year. We

will continue to progress our pipeline of large scale biogas projects and to

advance our strategy of deploying smaller anaerobic digestion and gasification

plants to the marketplace."

For additional information please contact:

+------------------------------------------+------------------+

| | |

| Kedco plc | +353 (0)21 467 |

| Donal Buckley, Chief Executive | 0427 |

| Gerry Madden, Finance Director | |

| | |

+------------------------------------------+------------------+

| Deloitte Corporate Finance - Nomad | +44 (0)20 7936 |

| Jonathan Hinton / David Smith | 3000 |

+------------------------------------------+------------------+

| | |

| Lewis Charles Securities Ltd. | +44 (0)20 7456 |

| David Lawman | 9100 |

| | |

+------------------------------------------+------------------+

| Beaufort International Associates Ltd. | +44 (0)20 7930 |

| Kealan Doyle / Nicholas Nicolaides | 8222 |

+------------------------------------------+------------------+

Chairman's Statement

I am pleased to report our interim results for the six months ended 31 December

2009. Since our last annual report we have made what we consider to be good

progress in our strategy to generate shareholder value from the sale and

operation in partnership of biomass waste-to-energy power plants.

Kedco's business strategy is to design, build and operate power plants with an

output greater than 1MW using two tried and tested technologies: gasifiation of

wood and wood waste; and anaerobic digestion of either food or agricultural

waste.

A key element of our business model is to establish relationshipswith

medium-sized waste operators, food companies, agricultural operators and local

municipal authorities who can act as feedstock and site providers. We have

advanced a number of these relationships since our last annual report including

the signing of a joint venture agreement and site lease in relation to the

gasification project located in Newry, Northern Ireland in December 2009.

We believe that growing regulation and legislation in respect of the renewable

energy requirements of the jurisdictions in which we operate continues to

support the marketability of our business model and the validity of our

long-term strategy.

We had set ouselves a challenging milestone of generating electricity by the end

of 2009. Whilst we have generated electricity from a 75KW containerised gasifier

for sale to the grid in Cork, we now expect to generate electricity in the 4MW

Newry plant in the second half of 2010. This remains an important objective for

us.

Ours continues to be a long-term goal that, as we stated in our last annual

report, requires much up-front investment, effort and dedication. I am pleased

with the progress the Company has made this half year in attracting further

funding from a variety of respected sources including the Irish Government.

On behalf of the Board I would like to thank all Kedco employees for their

continued commitment and achievements. I would also like to thank again our

shareholders and funding partners for their continuing support of the Company's

aims.

William Kingston

Non-Executive Chairman

Chief Executive's Report

Operational Review

The results for the six months to 31 December were in line with our

expectations. I am particularly pleased with the performance of our business in

Latvia, which saw an increase in sales and in profitability on the comparable

period last year. We have exercised tight control of our cost base and this

together with increased sales has led to a reduction in losses of 50 per cent.

on the same period last year.

The current economic climate has been challenging but during the period, we

continued to invest capital in developing customer and partner relationships and

in furthering projects in the UK and Ireland. We have also continued to build up

the pipeline of projects on which we are either planning our involvement or

already working towards a finished installation.

Continued progress was made towards the Company's objective of commencing

electricity generation at the 4 megawatt ("MW") gasification project located in

Newry, Northern Ireland including the signing of a joint venture agreement, and

a 20 year lease on the site. The project joint venture entity has full

permitting approval for the project. As previously announced the board now

expects the plant to be commissioned before the end of the calendar year

conditional on receipt of additional project finance. Kedco has already invested

approximately EUR5.9 million into the project.

Kedco has taken delivery of a 75KW containerised gasifier which has been

commissioned and is operational at its headquarters in Cork and is currently

being used to generate electricity from biomass which is sold to the national

grid. This plant is acting as a demonstration site for the UK and European

markets.

Financial review

Revenues in the first half to 31 December 2009 related entirely to the Kedco

Energy division and increased to EUR4.2 million, an increase of 28 per cent. when

compared with the corresponding period for the prior year. The loss for the

period was EUR1.5 million (2008: EUR3.0 million). This represents a reduction of 50

per cent. when compared to the comparable period for the prior year. This loss

continues to include costs that reflect the Company's continued use of resource

to grow and execute the electricity generating business in line with the

Company's stated strategy.

We continue to manage our financial resources prudently. Cash and cash

equivalents at the period end were EUR333,238.

The Company has in the last month issued Convertible Loan Note instruments to a

number of investors totaling EUR630,000. The term of these notes ranges from 5 to

6 months and the conversion price is 10c per share.

The board is currently engaged in advanced discussions with a number of

different parties around the potential investment of equity and/or debt finance

into the Company. The board remains confident that suitable investment will be

secured. The board continues to pursue alternative means of maintaining adequate

cash reserves and continues to manage its working capital position tightly. The

interim financial information is prepared on a going concern basis as discussed

in more detail in Note 2.

Outlook

We believe that the outlook for Kedco in the waste-to-energy market is extremely

positive. The twin drivers of regulation in relation to waste disposal and

legislation in relation to the generation of renewable electricity, could

significantly enhance the performance of the Company in the future.

Looking forward to the remainder of the year, we consider the main areas of

uncertainty to be the impact of the tightening in credit markets on the cost and

availability of finance for new projects. With this in mind the business has

continued to exercise tight control over its cost base. As we said in our last

annual report, in order to scale up and accelerate the development of our

project pipeline, there will be a need for us to increase the scale and timing

of our fund-raising activities. As our operational assets mature, we expect to

be able to secure more readily bank finance to fund the initial development of

new projects. In the interim, we will continue to have a requirement for equity

and/or hybrid debt capital. In this regard, Kedco believes it is prudent to

consider all available funding options and the Company will continue to execute

to its strategy, where appropriate, of seeking to raise additional finance by

way of equity or structured debt instruments.

The long-term outlook for our business model remains positive, supported by an

ever increasing amount of regulatory pressure in favour of localised, targeted

green-energy solutions. The Board and management of Kedco looks forward to the

future with confidence.

Donal Buckley

Chief Executive Officer

Condensed Consolidated Income Statement

For the six months ended 31 December 2009

+-------------------------------------+---------------+-------------+-------------+

| | | 6 months | 6 months |

| | | ended | ended |

| | | 31 Dec | 31 Dec |

| | | 2009 | 2008 |

| | | EUR | EUR |

+-------------------------------------+---------------+ + +

| | | | |

+-------------------------------------+---------------+ + +

| | | | |

+-------------------------------------+---------------+ + +

| | Notes | | |

+-------------------------------------+---------------+-------------+-------------+

| Revenue | 5 | 4,156,130 | 3,220,751 |

+-------------------------------------+---------------+-------------+-------------+

| Cost of sales | | (3,124,275) | (2,722,957) |

+-------------------------------------+---------------+-------------+-------------+

| Gross profit | | 1,031,855 | 497,794 |

+-------------------------------------+---------------+-------------+-------------+

| Operating expenses | | | |

+-------------------------------------+---------------+-------------+-------------+

| Administrative expenses: | | | |

+-------------------------------------+---------------+-------------+-------------+

| Once off listing expenses | | - | (946,024) |

+-------------------------------------+---------------+-------------+-------------+

| Other | | (2,203,003) | (2,356,953) |

+-------------------------------------+---------------+-------------+-------------+

| | | (2,203,003) | (3,302,977) |

+-------------------------------------+---------------+-------------+-------------+

| Operating loss | 5 | (1,171,148) | (2,805,183) |

+-------------------------------------+---------------+-------------+-------------+

| Finance costs | | (432,990) | (323,834) |

+-------------------------------------+---------------+-------------+-------------+

| Finance income | | 1,900 | 99,187 |

+-------------------------------------+---------------+-------------+-------------+

| Loss before taxation | | (1,602,238) | (3,029,830) |

+-------------------------------------+---------------+-------------+-------------+

| Income tax expense | 6 | 68,410 | - |

+-------------------------------------+---------------+-------------+-------------+

| Net loss | | (1,533,828) | (3,209,830) |

+-------------------------------------+---------------+-------------+-------------+

| Attributable to: | | | |

+-------------------------------------+---------------+-------------+-------------+

| Equity holders of the parent | | (1,606,976) | (2,989,249) |

+-------------------------------------+---------------+-------------+-------------+

| Minority interest | | 73,148 | (40,581) |

+-------------------------------------+---------------+-------------+-------------+

| | | (1,533,828) | (3,029,830) |

+-------------------------------------+---------------+-------------+-------------+

+-------------------------------------+---------------+-----------+----------+

| | | 12 months | 6 months |

| | | ended | ended |

| | | 30 June | 31 Dec |

| | | 2009 | 2008 |

| | | Euro per | Euro per |

| | | share | share |

+-------------------------------------+---------------+ + +

| | | | |

+-------------------------------------+---------------+ + +

| | | | |

+-------------------------------------+---------------+ + +

| | | | |

+-------------------------------------+---------------+ + +

| | Notes | | |

+-------------------------------------+---------------+-----------+----------+

| Basic loss per share: | | | |

+-------------------------------------+---------------+-----------+----------+

| From continuing operations | 7 | (0.007) | (0.017) |

+-------------------------------------+---------------+-----------+----------+

| Diluted loss per share: | | | |

+-------------------------------------+---------------+-----------+----------+

| From continuing operations | 7 | (0.006) | (0.015) |

+-------------------------------------+---------------+-----------+----------+

Condensed Consolidated Balance Sheet

As at 31 December 2009

+--------------------------------------+--------------+--------------+--------------+

| | | As at | As at |

| | | 31 Dec | 30 June |

| | | 2009 | 2009 |

| | | EUR | EUR |

+--------------------------------------+--------------+ + +

| | | | |

+--------------------------------------+--------------+ + +

| | Notes | | |

+--------------------------------------+--------------+--------------+--------------+

| ASSETS | | | |

+--------------------------------------+--------------+--------------+--------------+

| Non-current assets | | | |

+--------------------------------------+--------------+--------------+--------------+

| Goodwill | 8 | 549,451 | 549,451 |

+--------------------------------------+--------------+--------------+--------------+

| Intangible assets | | 114,605 | 157,309 |

+--------------------------------------+--------------+--------------+--------------+

| Property, plant and equipment | 9 | 5,931,951 | 6,138,936 |

+--------------------------------------+--------------+--------------+--------------+

| Share of gross assets of jointly | 11 | 1,350,189 | 1,000,593 |

| controlled entities | | | |

+--------------------------------------+--------------+--------------+--------------+

| Total non-current assets | | 7,946,196 | 7,846,289 |

+--------------------------------------+--------------+--------------+--------------+

| Current assets | | | |

+--------------------------------------+--------------+--------------+--------------+

| Inventories | | 1,813,955 | 1,327,324 |

+--------------------------------------+--------------+--------------+--------------+

| Trade and other receivables | 12 | 10,182,664 | 9,395,782 |

+--------------------------------------+--------------+--------------+--------------+

| Cash and cash equivalents | | 333,238 | 340,242 |

+--------------------------------------+--------------+--------------+--------------+

| Total current assets | | 12,329,857 | 11,063,348 |

+--------------------------------------+--------------+--------------+--------------+

| Total assets | | 20,276,053 | 18,909,637 |

+--------------------------------------+--------------+--------------+--------------+

| EQUITY AND LIABILITIES | | | |

+--------------------------------------+--------------+--------------+--------------+

| Equity | | | |

+--------------------------------------+--------------+--------------+--------------+

| Share capital | 14 | 3,239,407 | 3,065,807 |

+--------------------------------------+--------------+--------------+--------------+

| Share premium | | 17,410,077 | 15,096,219 |

+--------------------------------------+--------------+--------------+--------------+

| Share-based payment reserve | | 246,286 | 164,188 |

+--------------------------------------+--------------+--------------+--------------+

| Retained earnings - deficit | | (15,863,017) | (14,252,107) |

+--------------------------------------+--------------+--------------+--------------+

| Equity attributable to equity | | 5,032,753 | 4,074,107 |

| holders of the parent | | | |

+--------------------------------------+--------------+--------------+--------------+

| Minority interest | | 563,615 | 490,467 |

+--------------------------------------+--------------+--------------+--------------+

| Total equity | | 5,596,368 | 4,564,574 |

+--------------------------------------+--------------+--------------+--------------+

| Non-current liabilities | | | |

+--------------------------------------+--------------+--------------+--------------+

| Borrowings | | 6,981,030 | 6,746,220 |

+--------------------------------------+--------------+--------------+--------------+

| Deferred income - government grants | | 51,511 | 56,662 |

+--------------------------------------+--------------+--------------+--------------+

| Finance lease liabilities | | 65,121 | 50,324 |

+--------------------------------------+--------------+--------------+--------------+

| Deferred tax liability | | 12,668 | 81,078 |

+--------------------------------------+--------------+--------------+--------------+

| Total non-current liabilities | | 7,110,330 | 6,934,284 |

+--------------------------------------+--------------+--------------+--------------+

| Current liabilities | | | |

+--------------------------------------+--------------+--------------+--------------+

| Share of gross liabilities of | 11 | 1,060,753 | 990,000 |

| jointly controlled entities | | | |

+--------------------------------------+--------------+--------------+--------------+

| Trade and other payables | | 5,077,100 | 4,925,895 |

+--------------------------------------+--------------+--------------+--------------+

| Borrowings | | 1,382,590 | 1,371,176 |

+--------------------------------------+--------------+--------------+--------------+

| Deferred income - government grants | | 10,302 | 15,033 |

+--------------------------------------+--------------+--------------+--------------+

| Finance lease liabilities | | 38,610 | 108,675 |

+--------------------------------------+--------------+--------------+--------------+

| Total current liabilities | | 7,569,355 | 7,410,779 |

+--------------------------------------+--------------+--------------+--------------+

| Total equity and liabilities | | 20,276,053 | 18,909,637 |

+--------------------------------------+--------------+--------------+--------------+

Condensed Consolidated Statement of Changes in Equity

For the six months ended 31 December 2008 and the six months ended 31 December

2009

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| | | | | | Sub-total | | |

| | | | | | Attributable | | |

| | | | | | to equity | | |

| | | | | | holders | | |

| | | | | | of the | | |

| | | | | | parent | | |

| | | | | | EUR | | |

+-----------------------+-------------+--------------+--------------+-------------+ +----------+--------------+

| | | | | Share-based | | | |

| | | | | payment | | | |

| | | | | reserve | | | |

| | | | | EUR | | | |

+-----------------------+-------------+--------------+--------------+ + +----------+--------------+

| | Share | Share | Retained | | | Minority | Total |

| | capital | premium | earnings | | | Interest | equity |

| | EUR | EUR | EUR | | | EUR | EUR |

+-----------------------+ + + + + + + +

| | | | | | | | |

+-----------------------+ + + + + + + +

| | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Balance at 1 July | 1,807,933 | 7,084,737 | (8,133,321) | - | 759,349 | 596,651 | 1,356,000 |

| 2008 | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Issue of Ordinary | | | | | | | |

| Shares in | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Kedco Block Holdings | 685,148 | 6,889,852 | - | - | 7,575,000 | - | 7,575,000 |

| Limited | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Issue of Ordinary | | | | | | | |

| Shares in Kedco plc | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| in a share-for-share | 1,994,465 | 32,908,669 | - | - | 34,903,134 | - | 34,903,134 |

| exchange | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Issue of 'A' Ordinary | | | | | | | |

| Shares in Kedco plc | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| in a share for share | 498,616 | - | - | - | 498,616 | - | 498,616 |

| exchange | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Issue of 'A' Ordinary | 492,564 | - | - | - | 492,564 | - | 492,564 |

| Shares in Kedco plc | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Reverse acquisition | (2,493,081) | (32,908,669) | - | - | (35,401,750) | - | (35,401,750) |

| adjustment under IFRS | | | | | | | |

| 3 | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| (Loss)/profit for the | - | - | (2,989,249) | - | (2,989,249) | (40,581) | (3,029,830) |

| period | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Unrealised foreign | - | - | 27,690 | - | 27,690 | 1,612 | 29,302 |

| exchange gain | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Balance at 31 | 2,985,645 | 13,974,589 | (11,094,880) | - | 5,865,354 | 557,682 | 6,423,036 |

| December 2008 | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Balance at 1 July | 3,065,807 | 15,096,219 | (14,252,107) | 164,188 | 4,074,107 | 490,467 | 4,564,574 |

| 2009 | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Issue of Ordinary | 173,600 | 2,313,858 | - | - | 2,487,458 | - | 2,487,458 |

| Shares in Kedco plc | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Loss for the year | - | - | (1,606,976) | - | (1,606,976) | 73,148 | (1,533,828) |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Unrealised foreign | - | - | (3,934) | - | (3,934) | - | (3,934) |

| exchange loss | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Share-based payment | - | - | - | 82,098 | 82,098 | - | 82,098 |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

| Balance at 31 | 3,239,407 | 17,410,077 | (15,863,017) | 246,286 | 5,032,753 | 563,615 | 5,596,368 |

| December 2009 | | | | | | | |

+-----------------------+-------------+--------------+--------------+-------------+--------------+----------+--------------+

Condensed Consolidated Cashflow Statement

For the six months ended 31 December 2009

+-------------------------------------+--------------+-------------+-------------+

| | | 6 months | 6 months |

| | | ended | ended |

| | | 31 Dec | 31 Dec |

| | | 2009 | 2008 |

| | | EUR | EUR |

+-------------------------------------+--------------+ + +

| | | | |

+-------------------------------------+--------------+ + +

| | | | |

+-------------------------------------+--------------+ + +

| | Notes | | |

+-------------------------------------+--------------+-------------+-------------+

| Cash flows from operating | | | |

| activities | | | |

+-------------------------------------+--------------+-------------+-------------+

| Loss before taxation | | (1,602,238) | (3,029,830) |

+-------------------------------------+--------------+-------------+-------------+

| Adjustments for: | | | |

+-------------------------------------+--------------+-------------+-------------+

| Share-based payments | | 82,098 | - |

+-------------------------------------+--------------+-------------+-------------+

| Depreciation of property, plant and | | 324,436 | 255,033 |

| equipment | | | |

+-------------------------------------+--------------+-------------+-------------+

| Amortisation of intangible assets | | 42,704 | 41,563 |

+-------------------------------------+--------------+-------------+-------------+

| Profit on disposal of property, | | (823) | - |

| plant and equipment | | | |

+-------------------------------------+--------------+-------------+-------------+

| Unrealised foreign exchange | | (3,934) | 16,587 |

| (loss)/gain | | | |

+-------------------------------------+--------------+-------------+-------------+

| Interest expense | | 432,990 | 323,834 |

+-------------------------------------+--------------+-------------+-------------+

| Interest income | | (1,900) | (99,187) |

+-------------------------------------+--------------+-------------+-------------+

| Operating cash flows before working | | (726,667) | (2,492,000) |

| capital changes | | | |

+-------------------------------------+--------------+-------------+-------------+

| (Increase)/decrease in: | | | |

+-------------------------------------+--------------+-------------+-------------+

| Trade and other receivables | | (780,593) | (2,947,296) |

+-------------------------------------+--------------+-------------+-------------+

| Inventories | | (486,631) | 467,758 |

+-------------------------------------+--------------+-------------+-------------+

| Increase/(decrease) in: | | | |

+-------------------------------------+--------------+-------------+-------------+

| Trade and other payables | | (106,573) | (489,731) |

+-------------------------------------+--------------+-------------+-------------+

| | | (2,100,464) | (5,461,269) |

+-------------------------------------+--------------+-------------+-------------+

| Income taxes paid | | (18,000) | - |

+-------------------------------------+--------------+-------------+-------------+

| Net cash used in operating | | (2,118,464) | (5,461,269) |

| activities | | | |

+-------------------------------------+--------------+-------------+-------------+

| Cash flows from investing | | | |

| activities | | | |

+-------------------------------------+--------------+-------------+-------------+

| Additions to property, plant and | | (117,451) | (518,717) |

| equipment | | | |

+-------------------------------------+--------------+-------------+-------------+

| Proceeds from sale of property, | | 823 | 67,582 |

| plant and equipment | | | |

+-------------------------------------+--------------+-------------+-------------+

| Additions to intangibles | | - | (7,660) |

+-------------------------------------+--------------+-------------+-------------+

| Interest received | | 5,417 | 97,157 |

+-------------------------------------+--------------+-------------+-------------+

| Net cash used in investing | | (111,211) | (361,638) |

| activities | | | |

+-------------------------------------+--------------+-------------+-------------+

| Cash flows from financing | | | |

| activities | | | |

+-------------------------------------+--------------+-------------+-------------+

| Net proceeds from borrowings | | 234,810 | 147,833 |

+-------------------------------------+--------------+-------------+-------------+

| Proceeds from issuance of Ordinary | | 2,473,437 | 7,575,000 |

| Shares | | | |

+-------------------------------------+--------------+-------------+-------------+

| Payments of finance leases | | (55,268) | (154,188) |

+-------------------------------------+--------------+-------------+-------------+

| Interest paid | | (441,722) | (365,652) |

+-------------------------------------+--------------+-------------+-------------+

| Net cash from financing activities | | 2,211,257 | 7,202,993 |

+-------------------------------------+--------------+-------------+-------------+

| Net (decrease)/increase in cash and | | (18,418) | 1,380,086 |

| cash equivalents | | | |

+-------------------------------------+--------------+-------------+-------------+

| Cash and cash equivalents at the | | (1,030,934) | (265,168) |

| beginning of the financial period | | | |

+-------------------------------------+--------------+-------------+-------------+

| Cash and cash equivalents at the | | (1,049,352) | 1,114,918 |

| end of the financial period | | | |

+-------------------------------------+--------------+-------------+-------------+

Notes to the Condensed Consolidated Financial Statements

For the six months ended 31 December 2009

1. General information

Kedco plc (the "Company" or the "Group") was incorporated in Ireland on 2

October 2008. The address of its registered office and principal place of

business is Unit 6, Portgate Business Park, Monkstown, Co. Cork.

The principal activities of the Group are as follows:

- acts as project developer for power plants that convert Waste and Biomass to

Clean Power using Anaerobic Digestion, Gasification and Biomass Combustion; and

- the provision of the wholesale of wood and biomass materials.

2. BASIS OF PREPARATION

The interim condensed consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRS) and are in

compliance with International Accounting Standard (IAS) 34 Interim Financial

Reporting.

The interim condensed consolidated financial statements are presented in Euro

and have been prepared under the historical cost convention.

The preparation of the interim condensed consolidated financial statements

requires management to make judgements, estimates and assumptions that affect

the application of policies and reported amounts of certain assets, liabilities,

revenues and expenses together with disclosure of contingent assets and

liabilities. Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions of accounting estimates are recognised in the period in which

the estimate is revised, if the revision affects only that period, or in the

period of the revision and future periods if the revision affects both current

and future periods.

As described in the Chief Executive's Report, the Group continues to invest

capital in developing customer and partner relationships in the UK and Ireland.

The Group has also continued to develop and expand its pipeline of projects and

currently awaits the commissioning of the electricity generating plant at Newry.

These activities together with the current challenging economic environment have

resulted in the Group continuing to report losses for the half year to 31

December 2009.

The Directors have instituted a number of measures to preserve cash and also

secure additional finance. The board is currently engaged in advanced

discussions with a number of different parties around the potential investment

of equity and/or debt finance into the Company and in the meantime continues to

manage its working capital position tightly. The board remains confident that

suitable investment will be secured.

The interim financial statements have been prepared on a going concern basis.

The Directors have given careful consideration to the appropriateness of the

going concern concept in the preparation of the financial statements. The

validity of the going concern concept is dependent upon finance being available

for the Company's working capital requirements and for the completion of the 4MW

project so that the Group can continue to realise its assets and discharge its

liabilities in the normal course ofbusiness. The interim financial statements do

not include any adjustments that would result should the above conditions not be

met.

After making enquiries and considering the items referred to above, the

Directors believe that solid progress towards securing finance is being made and

that, whilst there is no guarantee that such investment will be forthcoming, the

going concern basis is appropriate for these financial statements.

The interim financial information for both the six months ended 31 December 2009

and the comparative six months ended 31 December 2008 are unaudited and have not

been reviewed by the auditors. The financial information for the year ended 30

June 2009 represents an abbreviated version of the Group's financial statements

for that year. Those financial statements contained an unqualified audit report

and have been filed with the Registrar of Companies.

The interim condensed consolidated financial statements have neither been

audited nor reviewed pursuant to guidance issued by the Auditing Practices

Board.

3. BASIS OF CONSOLIDATION

The interim condensed consolidated financial statements include the financial

statements of the Company and all subsidiaries. The financial period ends of all

entities in the Group are coterminous.

The financial statements of subsidiaries are included in the interim condensed

consolidated financial statements from the date on which control over the

operating and financial decisions is obtained and cease to be consolidated from

the date on which control is transferred out of the Group. Control exists where

the Company has the power, directly or indirectly, to govern the financial and

operating policies of the entity so as to obtain economic benefits from its

activities.

All inter-company balances and transactions, including unrealised gains arising

from inter-group transactions, have been eliminated in full. Unrealised losses

are eliminated in the same manner as unrealised gains except to the extent that

they provide evidence of impairment.

The interest of minority shareholders in the acquiree is measured at the

minority's proportion of the fair value of the assets, liabilities and

contingent liabilities recognised.

4. significant accounting policies

The principal accounting policies used in preparing the interim condensed

consolidated financial information are unchanged from those disclosed In the

Annual Report and Accounts of Kedco plc for the year ended 30 June 2009.

5. segment reporting

The Group's primary format for segmental reporting is business segments and the

secondary format is geographical segments. The risks and returns of the Group's

operations are primarily determined by the different products that the Group

supplies rather than the geographical location of the Group's operations.

The Group has two separate business segments: Kedco Power and Kedco Energy.

The Kedco Power business is the main focus of the Group and specialises in

electrical power generation from biomass and waste.

Kedco Energy contains a number of ancillary businesses serving industrial and

residential customers, all with a renewable energy focus.

Corporate activities, such as the cost of corporate stewardship, which includes

administrative, finance and head office costs are reported along with the

elimination of the inter-group activities under the heading 'Head office

services and intercompany eliminations'. Inter-segment pricing is determined on

an arm's length basis.

The Group's segmental information contains certain headings which are not

defined under IFRS. For clarity, the following are the definitions as applied by

the Group in their management Information:

· 'Trading loss' refers to the operating loss generated by the businesses

before intangible asset amortisation and depreciation on property, plant and

equipment and before once off listing expenses;

· 'Operating loss' is loss before taxation and finance costs and represents

the result for each segment.

The Group makes this distinction to give a better understanding of the

performance of the business.

The Group's primary geographical segments are Ireland and Latvia. The

geographical segment 'Other Europe' includes sales in the United Kingdom.

By business segment:

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| | 6 months ended 31 December | 6 months ended 31 December |

| | 2009 | 2008 |

+----------------------+---------------------------------------------------------+------------------------------------------------------+

| | Kedco | Kedco | Head | Total | Kedco | Kedco | Head | Total |

| | Energy | Power | office | | Energy | Power | office | |

| | | | services | | | | services | |

| | | | and | | | | and | |

| | | | intercompany | | | | intercompany | |

| | | | eliminations | | | | eliminations | |

| | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| | EUR | EUR | EUR | EUR | EUR | EUR | EUR | EUR |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Revenue | 4,133,180 | 22,950 | - | 4,156,130 | 3,220,751 | - | - | 3,220,751 |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Trading | 488,078 | (685,578) | (606,508) | (804,008) | (493,236) | (670,796) | (440,094) | (1,604,126) |

| profit/(loss) | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Depreciation | (316,118) | (9,787) | (41,235) | (367,140) | (208,443) | (5,355) | (41,235) | (255,033) |

| and | | | | | | | | |

| amortisation | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Once-off | - | - | - | - | - | - | (946,024) | (946,024) |

| listing costs | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Segment result | 171,960 | (695,365) | (647,743) | (1,171,148) | (701,679) | (676,151) | (1,427,353) | (2,805,183) |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Segment assets | 8,430,601 | 8,877,345 | 2,618,511 | 19,926,457 | 9,158,955 | 3,043,367 | 3,105,606 | 15,307,928 |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Segment | (5,186,198) | (4,500,538) | (4,643,353) | (14,330,089) | (4,959,376) | (113,507) | (3,812,009) | (8,884,892) |

| liabilities | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Net | 3,244,403 | 4,376,807 | (2,024,842) | 5,596,368 | 4,199,579 | 2,929,860 | (706,403) | 6,423,036 |

| assets/(liabilities) | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Other | | | | | | | | |

| segmental | | | | | | | | |

| information | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Property, | 112,298 | 5,153 | - | 117,451 | 465,573 | 53,144 | - | 518,717 |

| plant and | | | | | | | | |

| equipment | | | | | | | | |

| additions | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Intangible | - | - | - | - | 7,660 | - | - | 7,660 |

| asset | | | | | | | | |

| additions | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Impairment | - | - | - | - | - | - | - | - |

| losses | | | | | | | | |

| recognised in | | | | | | | | |

| profit or | | | | | | | | |

| loss | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Provision for | 204,863 | - | - | 204,863 | 201,554 | - | - | 201,554 |

| impairment of | | | | | | | | |

| inventory | | | | | | | | |

| to net | | | | | | | | |

| realisable | | | | | | | | |

| value | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

| Provision for | 263,206 | 4,310 | - | 267,516 | 356,269 | 5,215 | - | 361,484 |

| impairment of | | | | | | | | |

| trade | | | | | | | | |

| receivables | | | | | | | | |

+----------------------+-------------+-------------+--------------+--------------+-------------+-----------+--------------+-------------+

By geographic segment:

+--------------+--------------+-------------+--------+--------------+-------------+-------------+---------+-------------+

| | 6 months ended 31 | 6 months ended 31 |

| | December 2009 | December 2008 |

+--------------+----------------------------------------------------+---------------------------------------------------+

| | Ireland | Latvia | Other | Total | Ireland | Latvia | Other | Total |

| | EUR | EUR | Europe | EUR | EUR | EUR | Europe | EUR |

| | | | EUR | | | | EUR | |

+--------------+ + + + + + + + +

| | | | | | | | | |

+--------------+--------------+-------------+--------+--------------+-------------+-------------+---------+-------------+

| Revenue by | 479,298 | 3,632,692 | 44,140 | 4,156,130 | 1,232,368 | 1,820,238 | 168,145 | 3,220,751 |

| location by | | | | | | | | |

| customers | | | | | | | | |

+--------------+--------------+-------------+--------+--------------+-------------+-------------+---------+-------------+

| Segment | 13,649,812 | 6,276,645 | - | 19,926,457 | 9,604,749 | 5,703,179 | - | 15,307,928 |

| assets by | | | | | | | | |

| location | | | | | | | | |

+--------------+--------------+-------------+--------+--------------+-------------+-------------+---------+-------------+

| Segment | (11,557,941) | (2,772,148) | - | (14,330,089) | (6,506,833) | (2,378,059) | - | (8,884,892) |

| liabilities | | | | | | | | |

| by location | | | | | | | | |

+--------------+--------------+-------------+--------+--------------+-------------+-------------+---------+-------------+

6. income tax

+------------------------------------------------------+-----------+----------+

| | 6 months | 6 months |

| | ended | ended |

| | 31 | 31 |

| | December | December |

| | 2009 | 2008 |

| | EUR | EUR |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+-----------+----------+

| Income Tax | - | - |

+------------------------------------------------------+-----------+----------+

| Deferred Tax | (68,410) | - |

+------------------------------------------------------+-----------+----------+

| | | |

+------------------------------------------------------+-----------+----------+

| Income Tax Expense | (68,410) | - |

+------------------------------------------------------+-----------+----------+

An income tax charge does not arise for the six months ended 31 December 2009 or

31 December 2008 as the effective tax rate applicable to expected total annual

earnings is nil as the Group has sufficient tax losses coming forward to offset

against any taxable profits. A deferred tax asset has not been recognised for

the losses coming forward.

7. Loss per share

+------------------------------------------------------+-----------+----------+

| | 6 months | 6 months |

| | ended | ended |

| | 31 | 31 |

| | December | December |

| | 2009 | 2008 |

| | Euro per | Euro per |

| | share | share |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+-----------+----------+

| Basic loss per share | | |

+------------------------------------------------------+-----------+----------+

| From continuing operations | (0.007) | (0.017) |

+------------------------------------------------------+-----------+----------+

| Diluted loss per share | | |

+------------------------------------------------------+-----------+----------+

| From continuing operations | (0.006) | (0.015) |

+------------------------------------------------------+-----------+----------+

Basic Loss Per Share

The loss and weighted average number of Ordinary Shares used in the calculation

of the basic loss per share are as follows:

+------------------------------------------------------+-------------+-------------+

| | 6 months | 6 months |

| | ended | ended |

| | 31 | 31 |

| | December | December |

| | 2009 | 2008 |

| | EUR | EUR |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+-------------+-------------+

| Loss for year attributable to equity holders of the | (1,533,828) | (3,029,830) |

| parent | | |

+------------------------------------------------------+-------------+-------------+

| Weighted average number of Ordinary Shares for the | 216,142,651 | 181,175,867 |

| purposes of basic loss per share | | |

+------------------------------------------------------+-------------+-------------+

Diluted Loss Per Share

The loss used in the calculation of all diluted earnings per share measures is

the same as that for the equivalent basic earnings per share measures, as

outlined above.

The weighted average number of Ordinary Shares for the purposes of diluted loss

per share reconciles to the weighted average number of Ordinary Shares used in

the calculation of basic loss per share as follows:

+------------------------------------------------------+-------------+-------------+

| | 6 months | 6 months |

| | ended | ended |

| | 31 | 31 |

| | December | December |

| | 2009 | 2008 |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+-------------+-------------+

| Weighted average number of Ordinary Shares used | | |

+------------------------------------------------------+-------------+-------------+

| in the calculation of basic loss per share | 216,142,651 | 181,175,867 |

+------------------------------------------------------+-------------+-------------+

| Shares deemed to be issued in respect of long-term | 49,256,332 | 16,418,777 |

| incentive plan | | |

+------------------------------------------------------+-------------+-------------+

| Weighted average number of Ordinary Shares used in | 265,398,983 | 197,594,644 |

| the calculation of diluted earnings per share | | |

+------------------------------------------------------+-------------+-------------+

Share warrants which could potentially dilute basic earnings per share in the

future have not been included in the calculation of diluted earnings per share

as they are anti-dilutive for the periods presented. The dilutive effect as a

result of share warrants in issue as at 31 December 2009 would be to increase

the weighted average number of shares by 5,905,764 (2008: Nil).

8. Goodwill

+------------------------------------------------------+-----------+----------+

| | At | At |

| | 31 | 30 June |

| | December | 2009 |

| | 2009 | EUR |

| | EUR | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+ + +

| | | |

+------------------------------------------------------+-----------+----------+

| Balance at beginning and end of the year | 549,451 | 549,451 |

+------------------------------------------------------+-----------+----------+

Goodwill arose on the acquisition of an 80% shareholding in SIA Vudlande, a

limited liability company incorporated in Latvia.. Goodwill was allocated to the

Latvian CGU within the Kedco Energy segment.

Annual Test for Impairment

During the financial year/period presented, the Group assessed the recoverable

amount of goodwill and determined that the goodwill associated with the

acquisition of SIA Vudlande was not impaired.

The full amount of goodwill for impairment testing purposes relates to the SIA

Vudlande cash-generating unit. The principal activities of SIA Vudlande are the

processing of wood, sawn timber production and wood realisation. SIA Vudlande

has maintained its position in the competitive Latvian market as the company has

access to continuous raw material input and it has the flexibility to produce

different types of sawn material. Development which has been undertaken in SIA

Vudlande has expanded the production capacity of the company. The recoverable

amount of this cash-generating unit is determined based on a value in use

calculation which uses cash flow projections from financial budgets approved by

the Directors for a five-year period.

The cash flow forecasts employed for the value-in-use comparisons are based on

budgeted figures for the first year and on a four-year forecast approved by the

Board for the following four years. Cash flow is then projected forward for the

following ten years based on an assumed growth of 3% per annum. The discount

factors applied to future cash flows range from 9% to 12% as deemed appropriate.

The directors believe that any reasonably possible change in key assumptions on

which the value-in-use is based would not cause the aggregate carrying amount to

exceed the aggregate recoverable amount of the cash-generating unit. A 1%

increase in the discount rate would not result in an impairment charge for the

periods presented.

No impairment losses have arisen in any financial period to date.

9. property, plant and equipment

During the period, the Group invested EUR66,218 in improving the efficiency of its

biomass wood processing plant in Latvia. This investment was financed through

debt.

10. Subsidiaries

Details of Kedco plc subsidiaries at 31 December 2009 are as follows:

+---------------------+---------------+--------------+----+----------------------+

| Name | Country of | Shareholding | | Principal activity |

| | incorporation | | | |

+---------------------+---------------+--------------+----+----------------------+

| Kedco Block | Republic of | 100% | | Investment company |

| Holdings Limited | Ireland | | | |

+---------------------+---------------+--------------+----+----------------------+

| Kedco Power Limited | Republic of | 100% | | Provision of energy |

| | Ireland | | | solutions |

+---------------------+---------------+--------------+----+----------------------+

| Kedco Block Limited | United | 100% | | Contracting company |

| | Kingdom | | | |

+---------------------+---------------+--------------+----+----------------------+

| Granig Trading | Republic of | 100% | | Dormant company |

| Limited | Ireland | | | |

+---------------------+---------------+--------------+----+----------------------+

| SIA Vudlande | Latvia | 80% | | Wood processing & |

| | | | | sawn material |

| | | | | production |

+---------------------+---------------+--------------+----+----------------------+

| Castle Home | Republic of | 100% | | Dormant company |

| Supplies Limited | Ireland | | | |

+---------------------+---------------+--------------+----+----------------------+

| Kedco Energy | Republic of | 100% | | Provision of energy |

| Limited | Ireland | | | solutions |

+---------------------+---------------+--------------+----+----------------------+

| Kedco Investment Co | Republic of | 100% | | Investment company |

| (No.1) Limited | Ireland | | | |

+---------------------+---------------+--------------+----+----------------------+

| Kedco Fabrication | Republic of | 100% | | Contracting company |

| Limited | Ireland | | | |

+---------------------+---------------+--------------+----+----------------------+

| Kedco Group | United | 100% | | Dormant company |

| Holdings USA Inc. | States of | | | |

| | America | | | |

+---------------------+---------------+--------------+----+----------------------+

| Ardstown | Republic of | 100% | | Dormant company |

| Investments Limited | Ireland | | | |

+---------------------+---------------+--------------+----+----------------------+

The shareholding in each company above is equivalent to the proportion of voting

power held.

SIA Vudlande is a limited liability company registered in Latvia. Shares in SIA

Vudlande are held by Kedco Block Limited, a wholly owned subsidiary incorporated

in the United Kingdom under a trust deed with Kedco Block Holdings Limited.

Kedco Block Limited acknowledges holding shares upon trust for Kedco Block

Holdings Limited 'the beneficial owner'. All dividends and interest accrued or

to accrue upon same, including bonuses, rights and other privileges shall be

transferred, paid, or dealt with in such manner as the beneficial owner shall

from time to time direct.

11. Interests in jointly controlled entities

Details of the Group's interests in jointly controlled entities are as follows:

+---------------------+---------------+--------------+----+----------------------+

| Name of jointly | Country of | Shareholding | | Principal activity |

| controlled entity | incorporation | | | |

+---------------------+---------------+--------------+----+----------------------+

| Best Kedco Limited | Northern | 50% | | Energy utility |

| | Ireland | | | company |

+---------------------+---------------+--------------+----+----------------------+

| Kedco Howard | United | 50% | | Energy utility |

| Limited | Kingdom | | | company |

+---------------------+---------------+--------------+----+----------------------+

| Asdee Renewables | Republic of | 50% | | Energy utility |

| Limited | Ireland | | | company |

+---------------------+---------------+--------------+----+----------------------+

| Bridegreen Energy | Republic of | 50% | | Energy utility |

| Limited | Ireland | | | company |

+---------------------+---------------+--------------+----+----------------------+

None of the above companies have commenced trading as of 31 December 2009.

The Company has entered into a guarantee in respect of Kedco Howard Limited in

relation to the due and proper performance of its duties and obligations under

the joint venture agreement.

Kedco Investment Co (No. 1) Limited has entered into a put and call option

agreement and a second call option agreement relating

to the shares in Kedco

Howard Limited. Under the put and call option agreement, Kedco Investment Co

(No. 1) Limited may be required to purchase the remaining 50% of shares in Kedco

Howard Limited for EUR510,000. Under the second call option agreement, Kedco

Investment Co (No. 1) Limited may be required to sell 50% of the shares it

acquired, under the put and call option agreement, in Kedco Howard Limited for

EUR1,510,000.

Summarised financial information in respect of the Group's interests in jointly

controlled entities are as follows:

+-----------------------------------------------------------------+-------------+

| | 31 |

| | December |

| | 2009 |

| | EUR |

+-----------------------------------------------------------------+ +

| | |

+-----------------------------------------------------------------+-------------+

| Total assets | 2,700,378 |

+-----------------------------------------------------------------+-------------+

| Total liabilities | (2,121,506) |

+-----------------------------------------------------------------+-------------+

| Net assets | 578,872 |

+-----------------------------------------------------------------+-------------+

| Group's share of gross assets of jointly controlled entities | 1,350,189 |

+-----------------------------------------------------------------+-------------+

| Group's share of gross liabilities of jointly controlled | (1,060,753) |

| entities | |

+-----------------------------------------------------------------+-------------+

| Total revenue | - |

+-----------------------------------------------------------------+-------------+

| Total profit for the year | - |

+-----------------------------------------------------------------+-------------+

| Group's share of profits of jointly controlled entities | - |

+-----------------------------------------------------------------+-------------+

23. 12. Trade and other receivables

Included in trade and other receivables at 31 December 2009 are amounts due from

customers under construction contracts of EUR8,282,877 (see note 13 below).

13. Construction contracts

Contracts in progress at the balance sheet date

+----------------------------------------------------+-------------+-------------+

| | At | At |

| | 31 | 30 June |

| | December | 2009 |

| | 2009 | EUR |

| | EUR | |

+----------------------------------------------------+ + +

| | | |

+----------------------------------------------------+ + +

| | | |

+----------------------------------------------------+-------------+-------------+

| Construction costs incurred | 8,282,877 | 7,065,467 |

+----------------------------------------------------+-------------+-------------+

| Less payment received in advance | (1,272,222) | (1,000,000) |

+----------------------------------------------------+-------------+-------------+

| | 7,010,655 | 6,065,467 |

+----------------------------------------------------+-------------+-------------+

| Recognised and included in the financial | | |

| statements as amounts due | | |

+----------------------------------------------------+-------------+-------------+

| From customers under construction contracts | 8,282,877 | 7,065,467 |

+----------------------------------------------------+-------------+-------------+

| To customers under construction contracts | (1,272,222) | (1,000,000) |

+----------------------------------------------------+-------------+-------------+

| | 7,010,655 | 6,065,467 |

+----------------------------------------------------+-------------+-------------+

Construction costs incurred relate to advance payments to equipment and other

suppliers for an electricity generating project, construction of which the Group

is currently engaged in.

At 31 December 2009, retentions held by customers for contract work amounted to

EURNil (30 June 2009: EURNil). Advances received from customers for contract work

amounted to EUR1,272,222 (30 June 2009: EUR1,000,000).

14. Share capital

+-------------------------------------+----------------+-------------+-------------+-----------+

| | | Allotted | | Allotted |

| | | and | | and |

| | | called | | called |

| | | up | | up |

| | | Number | | EUR |

+-------------------------------------+----------------+ +-------------+ +

| | Authorised | | Authorised | |

| | Number | | EUR | |

+-------------------------------------+ + + + +

| | | | | |

+-------------------------------------+----------------+-------------+-------------+-----------+

| At 31 December 2009 | | | | |

+-------------------------------------+----------------+-------------+-------------+-----------+

| Ordinary shares of EUR0.01 each | 10,000,000,000 | 224,822,657 | 100,000,000 | 2,248,227 |

+-------------------------------------+----------------+-------------+-------------+-----------+

| A shares of EUR0.01 each | 10,000,000,000 | 99,117,952 | 100,000,000 | 991,180 |

+-------------------------------------+----------------+-------------+-------------+-----------+

| | | | | 3,239,407 |

+-------------------------------------+----------------+-------------+-------------+-----------+

| | | | | |

+-------------------------------------+----------------+-------------+-------------+-----------+

| | | Allotted | | Allotted |

| | | and | | and |

| | | called | | called |

| | | up | | up |

| | | Number | | EUR |

+-------------------------------------+----------------+ +-------------+ +

| | Authorised | | Authorised | |

| | Number | | EUR | |

+-------------------------------------+ + + + +

| | | | | |

+-------------------------------------+----------------+-------------+-------------+-----------+

| At 30 June 2009 | | | | |

+-------------------------------------+----------------+-------------+-------------+-----------+

| Ordinary shares of EUR0.01 each | 10,000,000,000 | 207,462,644 | 100,000,000 | 2,074,627 |

+-------------------------------------+----------------+-------------+-------------+-----------+

| A shares of EUR0.01 each | 10,000,000,000 | 99,117,952 | 100,000,000 | 991,180 |

+-------------------------------------+----------------+-------------+-------------+-----------+

| | | | | 3,065,807 |

+-------------------------------------+----------------+-------------+-------------+-----------+

The holders of the Ordinary Shares are entitled to receive dividends as declared

and are entitled to one vote per share at meetings of the company. All Ordinary

Shares are fully paid up, with the exception of EUR40,000 which is disclosed in

Note 23.

The Company was incorporated on 2 October 2008 with an initial authorised share

capital of EUR100,000,000 divided into 100,000,000 Ordinary Shares of EUR1.00 each

of which 38,100 Ordinary Shares of EUR1.00 each fully paid up were issued.

On 14 October 2008 the Ordinary Shares were subdivided so that each Ordinary

Share had a nominal value of EUR0.01 each as opposed to the previous nominal value

of EUR1.00 each.

Reverse Acquisition

On 13 October 2008, the Company acquired the entire issued share capital of

Kedco Block Holdings Limited ('KBHL') in consideration for the allotment and

issue of 2,493,081 Ordinary Shares of EUR1.00 each to the former members of KBHL.

Pursuant to the agreement, the Company allotted and issued one ordinary share of

EUR1.00 each in consideration for the transfer to it of each share held in KBHL.

The fair value of the shares in Kedco Block Holdings Limited received as

consideration for the issue of these shares in Kedco plc was EUR34,903,134 which

resulted in a share premium in the Company of EUR32,908,669. From a group

perspective, since the acquisition is being accounted for as a reverse

acquisition, the shares of the new legal parent (Kedco plc) were recognised and

the shares of the accounting parent (Kedco Block Holdings Limited) were

derecognised. A reverse acquisition adjustment has been made for the share

capital of the accounting parent and is offset against the share premium of the

new legal parent.

Movements in the six months to 31 December 2009

Kedco plc:

On 5 October 2009, the Company issued 17,360,013 Ordinary Shares of EUR0.01

each at a premium of EUR2,313,858. The company also issued warrants to subscribe

for 8,680,006 shares at a subscription price of EUR0.25 per share. The warrants

may be exercised

at any date in the period from 5 October 2009 to 4 October

2011.

15. events since the balance sheet date

The Company has in the last month issued Convertible Loan Note instruments to a

number of investors totaling EUR630,000. The term of these notes ranges from 5 to

6 months and the conversion price is 10c per share.

16. approval of financial statements

The condensed consolidated financial statements for the six months ended 31

December 2009, which comply with IAS 34, were approved by the Board of Directors

on 30 March 2010.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DMGFFVGVGGZM

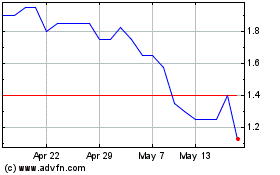

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024