TIDMEQLS

RNS Number : 0823M

Equals Group PLC

12 September 2023

12 September 2023

Equals Group plc

('Equals' or the 'Group')

Interim Results

'Significant revenue growth, record Adjusted EBITDA and strong

balance sheet'

Equals (AIM: EQLS), the fintech payments group focused on the

Enterprise and SME marketplaces, announces its interim results for

the six months ended 30 June 2023 (the 'period' or 'H1-2023') and

an update on trading for 49 trading days for the period from 1 July

2023 to 8 September 2023 ('Q3-2023').

H1-2023: Financial Summary

H1-2023 H1-2022 Change

GBP millions GBP millions % (**)

Underlying transaction values 5,964 4,169 +43%

Revenue 45.0 31.4 +43%

Gross profit 23.6 14.9 +59%

Gross profit % 52.4% 47.4%

Adjusted EBITDA* 9.8 4.9 +102%

Operating profit 5.5 1.1

Profit after taxation 4.8 0.8

EPS (Basic, in pence) 2.64 0.38

Notes

* Adjusted EBITDA is defined as operating profit before:

depreciation, amortisation, impairment charges and share option

charges and items of an exceptional nature. EBITDA is defined as

operating profit before depreciation and amortisation.

**Percentages are calculated based on underlying rather than

rounded figures.

H1-2023: Financial Highlights

-- Record transaction values, with revenues up 43% to GBP45.0

million (H1-2022: GBP31.4 million) including GBP13.6 million

derived from the Solutions platform (H1-2022: GBP6.3 million)

-- Further improvements to gross profit margin, increasing to

52.4% from 47.4%

-- Adjusted EBITDA* more than doubled to GBP9.8 million compared

to same period last year (H1-2022: GBP4.9 million)

-- GBP17.9 million Cash at Bank up from GBP15.0 million at 31

December 2022 despite GBP2.9 million spent on acquisitions

-- Basic EPS rising to 2.64 pence from 0.38 pence in H1-2022

H1-2023: Operational and Product Highlights

-- Acquisition of Oonex, now called Equals Money Europe, providing

EU market access

-- Acquisition of Roqqett, an open banking platform, completed

and now integrated

-- Automation of 'payments out' flows yielding increased efficiencies

-- Further investments into Compliance and Risk functions

-- API integration to Equals Platform deployed, opening new distribution

channels

Q3-2023 Trading (1 July 2023 to 8 September 2023) and

Outlook

-- Year-to-date revenue of GBP63.6 million, 39% ahead of the

same period in 2022

-- Revenues per day of GBP370k, compared to GBP265k in the same

period in 2022

-- Robust pipeline in Solutions underpinning further growth

-- FairFX B2C card product moved to Equals Core platform

-- Equals Money Europe integration progressing on plan

-- Continued strong cash generation

-- Proposed capital reduction being announced today to put the

Company in a position to pay dividends

-- The Board intends to pay a maiden dividend of 1.5 pence in

respect of the financial year ending 31 December 2023*

* Dividend payment subject to, inter alia, capital reduction,

shareholder and court approvals.

Commenting on the Interim Results, Ian Strafford-Taylor, CEO of

Equals Group plc, said:

"This is an outstanding set of results with record revenues

combining with improved gross profit retention to yield enhanced

profitability. These results, coupled with our continued cash

generation, enable us to announce our intention, conditional, inter

alia, upon the completion of the proposed capital reduction, to pay

our maiden dividend of 1.5 pence per share in respect of the

financial year 2023, while continuing our growth strategy. A

further announcement will be made in due course following the

conclusion of the capital reduction process.

"As well as strong financial performance, the Group completed

its acquisition of Oonex SA (subsequently renamed Equals Money

Europe), a Brussels-based payments services provider regulated by

the National Bank of Belgium. This acquisition enables Equals to

widen its distribution and addressable markets and the integration

of the business is proceeding according to plan.

"The first half of 2023 saw strong growth which has continued

into Q3 despite an uncertain macroeconomic environment. Given the

current trading, and a robust sales pipeline, we look to the future

with increased confidence, and we expect to be ahead of

expectations for the full year."

Analyst meeting

A conference call for analysts hosted by Ian Strafford-Taylor

(CEO) and Richard Cooper (CFO) will be held today at 9.30am. A copy

of the Interim Results presentation is available at the Group's

website: http://www.equalsplc.com.

For retail investors, an audio webcast of the conference call

with analysts will be available after 12pm today at:

https://stream.buchanan.uk.com/broadcast/64fb2da384cbf5eec802cac9 .

In addition, as previously announced, the Company will also be

presenting the Interim Results via the Investor Meet Company

platform at 6pm today. Please register at

https://www.investormeetcompany.com/equals-group-plc/register-investor

.

This announcement contains inside information.

- Ends -

For more information, please contact:

Equals Group plc

Ian Strafford-Taylor, CEO Tel: +44 (0) 20 7778

Richard Cooper, CFO 9308

www.equalsplc.com

Canaccord Genuity (Nominated Adviser &

Joint Broker)

Max Hartley / Harry Rees Tel: +44 (0) 20 7523

8150

Peel Hunt LLP (Joint Broker)

Paul Shackleton / John Welch Tel: +44 (0) 20 7418

8900

Buchanan (Financial Communications)

Henry Harrison-Topham / Stephanie Whitmore Tel: +44 (0) 20 7466

/ Toto Berger 5000

equals@buchanan.uk.com www.buchanan.uk.com

Chief Executive Officer's Report

The vision for the Group continues to be the simplification of

global money movement for business customers. Equals achieves this

through its B2B platforms, Equals Money being targeted at SME

customers and Equals Solutions which targets larger corporate

opportunities. The Group's growth potential is particularly strong

given that the core building blocks of its platforms, namely

own-name multi-currency IBANs and bank-grade connectivity and

clearance, are highly complex and time consuming to replicate. This

'first mover' advantage was achieved by the investments made in

previous years and will be continuously enhanced by the

developments planned in the Group's technical roadmap combined with

further investments into direct connectivity to payment

networks.

The ambition of Equals has never just been to operate within the

UK, and we were delighted to complete the acquisition of Oonex SA,

(subsequently renamed Equals Money Europe SA) on 4 July 2023.

Through its regulation by the National Bank of Belgium and strong

links to both a Belgian bank (KBC) and a Dutch bank (ING), this

provides the Group with cross-EU reach for its products,

particularly Equals Solutions, which has already exceeded

management's expectations in terms of revenue growth and

profitability.

In the period we also further enhanced the Group's product set

via the acquisition of Roqqett Limited, an open-banking payments

platform. The acquisition allows Equals to span the entire payment

cycle for its B2B customers by providing them with another method

to get paid by their customers, be that B2B or B2C. Roqqett has now

been successfully integrated into the FairFX card checkout process

and is being sold to external customers.

The investments made by the Group since 2018 have been

instrumental in driving the current strong performance. These

investments fall into two major categories, namely internal product

development and acquisitions. Investment into internal product

development remains vital to driving the business forward and we

anticipate keeping our spend in this area at a consistent level

going forwards. As will be illustrated in more detail in the CFO

Review which follows this Report, our investments into acquisitions

have all been successfully integrated and highly accretive.

The attractiveness of Equals' product set is illustrated by the

growing volume of transactions and load values across the Group's

platform:

GBP millions

H1-2021 H2-2021 H1-2022 H2-2022 H1-2023

Transaction value 2,424 *4,011 4,163 5,053 5,964

% growth on half year 25% 65% 4% 21% 18%

*H2-2021 shown here excludes the GBP114 million from the one-off

material trade announced on 28 October 2021.

This translates well to revenues which rose by 43% in H1-2023 to

GBP45.0 million (H1-2022: GBP31.4 million).

Revenue by six-month period, in GBP millions

H1-2021 H2-2021 H1-2022 H2-2022 H1-2023

Medium enterprises 8.1 11.8 10.3 12.1 14.0

Consumer and small

business 6.1 6.7 7.7 9.0 8.5

White-label 2.4 5.4 7.2 7.8 8.9

Large enterprises 0.3 1.8 6.2 9.4 13.6

Material trade - 1.5 - - -

Total 16.9 27.2 31.4 38.3 45.0

-------- -------- -------- -------- --------

Sales & Marketing

The composition of the Group's Sales and Marketing teams has

shifted over recent years reflecting Equals' pivot from a B2C to a

B2B focus. B2B customer acquisition requires strong processes for

lead generation and outbound sales augmented by high conversion

websites and cost-effective digital marketing. Equals has continued

to strengthen its sales capability by recruitment of experienced

professionals capable of consultative selling. In addition, the

Group has hired people with specific sector expertise as well as

rolling out a regional sales model rather than solely basing in

London. In keeping with the same theme of 'face-to-face' sales,

Equals has increased its presence at industry trade shows and has

salespeople consistently travelling to meet customers. The direct

sales efforts are augmented by a sales operations team to ensure

peak efficiency and conversion. Furthermore, given the roll-out of

API connectivity in H1 2023, the Group now has dedicated resources

within its Engineering team to onboard new customers.

Equals has significantly upgraded its approach to digital

marketing with all the Group's websites yielding increases in

conversion and have rolled out new digital marketing collateral for

the Group's multi-currency IBAN products. Equals' recruitment of

top-quality digital marketing professionals has transformed our

capabilities across the website, SEO and PPC yielding improvements

in customer acquisition and ability to optimise by channel using

test and refine techniques.

Profitability

A 43% increase in revenues, improvement in gross profit margin,

tight cost control in a tough labour market, combined to result in

adjusted EBITDA doubling from GBP4.9 million in H1-2022 to GBP9.8

million in H1-2023. A performance that as CEO, I am immensely proud

of.

Dividend

Equals has today announced a proposed capital reduction to

redeem around GBP25 million of its share premium account to create

distributable reserves. The proposed capital reduction is expected

to be completed by mid Q4-2023. The Board intends conditional,

inter alia, upon the completion of the proposed capital reduction,

to pay a maiden dividend of 1.5 pence per share in respect of the

financial year 2023. A further announcement will be made in due

course following the conclusion of the capital reduction

process.

Current trading and outlook

The Global macroeconomic environment continues to be challenging

with high inflation, high interest rates, concerns over China's

economy and the conflict in Ukraine all affecting confidence and

business activity. Against this market backdrop, Equals continues

to grow strongly because it has a product and capability suite that

is hard to replicate.

In Q3 2023 to date, revenues continued to perform strongly

reaching GBP63.6 million on a year-to-date basis as of 8 September

2023. This is 39% ahead of the same period in 2022 and represents

revenues per working day of GBP370k compared to GBP265k per day in

the prior year.

Equals has increased its addressable market by adding the

capability for customers to connect via API. Whilst these customers

take longer to on-board, due to the requirement to connect their

systems directly to Equals Core, they are typically larger in size,

and we expect to drive future revenue growth. The current pipeline

for new Solutions customers, both via direct login and API, is

strong and with the new capabilities of Equals Money Europe, the

Board believes that going forwards Equals is well positioned to

further increase its addressable markets and distribution

channels.

Given the strong current trading, and a robust sales pipeline,

the Board looks to the future with increased confidence, and we

expect to be ahead of expectations for the full year.

Ian Strafford-Taylor

Chief Executive Officer

12 September 2023

REVIEW OF THE CFO

Taking the financial information disclosed in the CEO's Report

one step further, I am pleased to present record Interim Results

for the six months ended 30 June 2023.

Totals may not sum due to rounding. Percentages are calculating

on underlying figures before rounding. Where costs cannot be

accurately attributed to each segment, they have been allocated on

the basis of revenue.

TABLE 1: INCOME AND EXPENSE ACCOUNT

H1-2023 H1-2022 H2-2022

GBP millions GBP millions GBP millions

------------- ------------- -------------

Revenue (table 3) 45.0 31.4 38.3

------------- ------------- -------------

Gross Profits (table 5) 23.6 14.9 18.8

Less: Marketing (1.2) (0.9) (0.9)

------------- ------------- -------------

Contribution 22.4 13.9 17.9

Staff costs (9.2) (6.6) (7.8)

Property and office cost (0.5) (0.4) (0.5)

IT and telephone costs (1.4) (0.9) (1.1)

Professional Fees (0.7) (0.6) (0.7)

Compliance Fees (0.6) (0.4) (0.3)

Travel and other expenses (0.3) (0.2) (0.3)

-------------

Adjusted EBITDA 9.8 4.9 7.2

------------- ------------- -------------

Less: Share option expense (0.7) (0.3) (0.6)

Less: Acquisition costs and exceptional

items 0.0 0.0 (0.2)

------------- ------------- -------------

EBITDA 9.1 4.6 6.4

------------- ------------- -------------

IFRS 16 Depreciation (table 6) (0.3) (0.4) (0.4)

Other depreciation (table 6) (0.2) (0.2) (0.2)

Amortisation of acquired intangibles

(table 7) (0.7) (0.6) (0.6)

Other amortisation (table 7) (2.5) (2.2) (2.2)

Contingent consideration credit

/ (cost) 0.2 0.0 (0.3)

-------------

(3.5) (3.5) (3.7)

------------- ------------- -------------

Gain on disposal of Travel Cash

CGU 0.4 0.0 0.0

------------- ------------- -------------

EBIT 5.9 1.1 2.7

Lease interest (0.1) (0.1) (0.1)

Foreign exchange differences 0.0 0.0 (0.1)

Contingent consideration finance

charges 0.0 (0.1) 0.0

-------------

(0.1) (0.2) (0.2)

------------- ------------- -------------

PROFIT BEFORE TAXATION 5.8 0.9 2.6

Corporate and deferred taxation (1.0) (0.1) 0.2

------------- ------------- -------------

PROFIT FOR THE YEAR 4.8 0.8 2.8

============= ============= -------------

TABLE 2 - ADJUSTED EBITDA BRIDGE FROM H1-2022 TO H1-2023 (in

GBP'000s)

H1-2022 Adjusted

EBITDA 4,852

Add: 61% uplift in contribution H1-2023 8,477

39% increase in staff costs, reflecting

higher planned headcount (23% up from

H1-2022), higher quality hires and

Less: salary increases (around 8%) (2,574)

47% increase in IT and communication

costs - mainly hosting and telephone

in line with transaction growth (432)

35% increase in professional and compliance

costs for enhanced procedures and

consultation, proactively ahead of

requirements (325)

20% increase in property costs arising

through service charge/utility inflation (87)

48% increase in travel and entertaining

costs incurred through ambassadorial

initiatives and industry awareness

events (86)

H1-2023

Adjusted EBITDA 9,825

========

Uplift over H1-2022 4,973

% uplift over H1-2022 102%

--------

Revenue

TABLE 3 - REVENUE BY CUSTOMER TYPE, IN GBP MILLIONS

The table below shows the revenue for the last five periods of

six months, split by customer grouping and within than the type of

business provided:

H1-2021 H2-2021 H1-2022 H2-2022 H1-2023

International Payments 6.0 8.7 6.9 8.0 9.2

Cards 2.1 3.1 3.4 4.1 4.8

-------- -------- -------- -------- --------

Medium enterprises 8.1 11.8 10.3 12.1 14.0

-------- -------- -------- -------- --------

International Payments 1.4 1.9 2.1 2.4 1.9

Cards 1.7 1.7 2.3 2.8 2.4

Banking 2.9 2.8 2.8 3.3 4.1

-------- -------- -------- -------- --------

Consumer and small business 6.0 6.4 7.2 8.5 8.4

-------- -------- -------- -------- --------

White Label

White-Label 2.4 5.4 7.2 7.8 8.9

Large enterprises ("Solutions") 0.3 1.8 6.2 9.4 13.6

Material trade - 1.5 - - -

Bureau de change 0.1 0.3 0.5 0.5 0.1

Total 16.9 27.2 31.4 38.3 45.0

-------- -------- -------- -------- --------

COST OF SALES & GROSS PROFITS

Cost of sales comprises three principal component which are

shown below. The cost for staff commissions includes Employers

National Insurance contributions.

TABLE 4 - COST OF SALES

H1-2023 H1-2022 H2-2022

GBP millions GBP millions GBP millions

Affiliate commissions 14.6 10.7 13.1

Staff commissions 1.8 1.7 1.9

Transactions costs and similar* 5.0 4.1 4.5

------------- ------------- -------------

Total 21.4 16.5 19.5

------------- ------------- -------------

*Transaction costs, includes bank charges and similar, and,

will, if applicable, include costs for any compensation associated

with the FCA's newly introduced Consumer Duty rules.

Gross profit margins differ between each business unit. The mix

of product (example: spot or forward FX) also influences the

margin. Margins continue to improve as the business mix changes,

and, with increased 'purchasing power' the Group should be able to

improve margins further but probably not higher than a full

percentage point.

Gross profit ratios over the last five six-month periods are

shown below:

Table 5 - GROSS PROFIT MARGIN OVER THE LAST FIVE SIX MONTH

PERIODS

H1-2021 H2-2021 H1-2022 H2-2022 H1-2023

International Payments 64% 54% 59% 51% 57%

Cards 71% 68% 59% 66% 65%

-------- -------- -------- -------- --------

Medium enterprises 66% 58% 58% 56% 59%

-------- -------- -------- -------- --------

International Payments 79% 74% 71% 71% 68%

Cards 71% 71% 61% 64% 58%

Banking 72% 71% 75% 79% 85%

-------- -------- -------- -------- --------

Consumer, and small business 73% 72% 69% 72% 74%

-------- -------- -------- -------- --------

White-Label 17% 11% 11% 13% 19%

Large enterprises (Solutions) 33% 44% 47% 50% 54%

Material trade - 54% - - -

Bureau de change - 67% 40% 40% -

Total 60% 51% 47% 49% 52%

-------- -------- -------- -------- --------

Staff costs

Staff costs shown, exclude staff commissions which are included

in cost of sales (see table 4).

Headcount numbers have moved from 285 as at 31 December 2022 to

323 as at 30 June 2023.

Performance related components, when combined with staff

commissions included in cost of sales are, in the aggregate, around

25% of the total cost of staff.

The charge to the P&L was GBP9.2 million, up 39% on H1-2022

(GBP6.6 million) and 18% on H2-2022 (GBP7.8 million).

Gross of capitalisation of GBP2.4 million (H1-2022: GBP2.1

million), costs were GBP11.7 million in H1-2023 (GBP8.8 million in

H1-2022). The amounts capitalised represent 21% of gross staff

costs, decrease from 23% in H1-2022 largely due to an increased

headcount not directly attributable to development projects.

Capitalisation is now broadly in line with the amortisation

charge relating to capitalised software.

Professional fees and Compliance costs

Owing to an increasing cross-industry compliance burden, the

Group has chosen to report compliance and similar costs separate to

other professional fees. Such costs, including onboarding systems,

have risen due to a combination of greater business activity and

the Group's desire to fast-track business applications proactive

with regulation but not at the expense of quality. Professional

fees have risen in line with trends widely reported in the national

press, most notably the provision for cost of the audit noting

increased acquisition activity and implantation of enhanced

systems.

Depreciation

Tangible fixed assets are depreciated over the anticipated

useful life with a maximum of 60 months (other than leasehold

improvements which is a maximum of 120 months).

TABLE 6 - DEPRECIATION

H1-2023 H1-2022

GBP'000s GBP'000s

IFRS 16 depreciation 332 445

Other depreciation 193 187

--------- ---------

525 632

--------- ---------

Based upon the expenditure incurred to 31 December 2022, the

total depreciation charges for assets in FY-2023 will be:

GBP'000s

IFRS 16 depreciation 668

Other depreciation 375

1,043

---------

Amortisation

Intangible assets acquired on acquisition are amortised over

their estimated useful lives, with a maximum of 60 months for

brands and a maximum of 108 months for customer relationships. The

charge to amortisation for the year can be analysed as follows:

TABLE 7 - COMPONENTS OF AMORTISATION CHARGES

H1-2023 H1-2022

GBP'000s GBP'000s

Amortisation charge arising

from the capitalisation of

internally developed software

in the following years:

2018 and earlier 272 458

2019 831 831

2020 447 447

2021 288 267

2022 377 86

H1-2023 123 -

---------- ----------

2,338 2,089

Amortisation charge for other

intangibles 141 128

---------- ----------

2,479 2,217

Amortisation of acquired intangibles 686 641

---------- ----------

Total amortisation charge 3,165 2,858

---------- ----------

Based upon expenditure to 31 December 2022, the total

amortisation charges for FY-2023 are expected to be:

GBP'000

Internally developed software 4,953

Other intangible assets 267

Acquired intangibles 984

--------

6,204

--------

Operating result

The Group made a profit before taxation of GBP5.8 million in

H1-2023, compared to GBP0.9 million in H1-2022.

Taxation, incorporating R&D credits

The Group has recognised a net tax charge of GBP1,031k (H1-2022:

GBP37k) of which GBPnil (H1-2022: GBP40k) relates to an R&D tax

credit repayment.

At 31 December 2022 the Group had utilisable tax losses of

GBP17.6 million. The White-Label business, Equals Connect Ltd, is

profitable and tax paying, as until 3 October 2022 its profits

could not be offset against other group company losses. At 30 June

2023 it is estimated that the Group has utilisable tax losses of

GBP13.5 million.

TABLE 8 - BALANCE SHEET

This table shows a compressed 'balance sheet' for the Group.

This splits-out (from the statutory disclosure) certain current

assets arising from the acquisitions being made.

30.06.2023 30.06.2022 31.12.2022

GBP'000s GBP'000s GBP'000s

Internally generated software -

cost 28,723 23,617 26,001

Internally generated software -

accumulated amortisation (15,749) (11,065) (13,411)

----------- ----------- -----------

12,974 12,552 12,590

Other non-current assets (other

than 'right to use') 22,965 19,066 18,558

IFRS 16 assets, less IFRS 16 liabilities (635) (976) (830)

35,304 30,642 30,318

----------- ----------- -----------

Liquidity (per Table 11) 16,621 12,825 14,321

Accrued Income and Trade Debtors 5,577 4,245 4,246

R&D rebates - 438 -

Prepayments 1,627 1,411 1,345

Working Capital advances to Roqqett - - 830

Other Sundry Debtors 164 190 189

Inventory of card stock 237 148 292

Accounts payable (2,616) (2,308) (2,070)

Affiliate commissions (3,061) (2,905) (2,563)

PAYE and Vat (849) (652) (816)

Staff commissions and accrued bonuses (1,436) (1,150) (1,690)

Other accruals and other creditors (2,050) (1,442) (1,938)

----------- ----------- -----------

14,214 10,800 12,145

Working Capital and prepaid advances 1,248 - -

to Oonex

Deferred consideration receivable 100 - -

arising from the disposal of the

bureau de change

----------- ----------- -----------

15,562 10,800 12,145

----------- ----------- -----------

Earn-out balances due (Table 9) (4,605) (303) (2,025)

Net corporation and deferred tax 986 1,148 1,639

Net value of forward contracts 827 511 827

----------- ----------- -----------

(2,793) 1,356 441

----------- ----------- -----------

NET SHAREHOLDER FUNDS 48,073 42,798 42,904

----------- ----------- -----------

INVESTMENTS

The Group invests in its future in two principal ways:

a. Product development, which is capitalised and can result in

R&D credits from the UK government.

b. Acquisitions of companies or businesses.

A. Product development

Over the period since January 2018, a total of GBP28.9 million

has been invested in product development of which GBP15.7 million

has already been amortised, more than 54%. In H1-2023 a total of

GBP2.7 million was capitalised of which GBP2.4 million related to

staff costs and GBP0.3 million to third party software.

Until the year ended 31 December 2022, the Group received GBP6.3

million in cash from the UK government in respect of R&D claims

and under IAS 12, this has to be accounted for through the charge

(or credit) to Corporation tax.

For each GBP100,000 of product development capitalised now, the

effect of the UK government's R&D scheme means that at current

rates of corporation tax, the effective P&L cost to the Group

is only GBP78,500.

The amortisation profile of the investments made is shown in

Table 7.

The Group's intellectual property comprises these investments,

and registered trademarks in various jurisdictions.

B. Acquisitions

Table of acquisitions since 1 January 2019

Table 9 below shows the financial position relating to

acquisitions in and after 2019, including Roqqett Limited and Hamer

& Hamer Limited acquired in the six month period ended 30 June

2023.

TABLE 9 - EARNOUTS

Hermex Casco Effective Roqqett Hamer Total

Limited & Hamer

Acquisition date 09.08.2019 19.11.2019 15.10.2020 06.01.2023 24.03.2023

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

Acquisition price

booked at acquisition 2,000 2,236 1,575 - - 5,811

Earn outs paid

by 31.12.2020 (2,000) (1,733) (125) - - (3,858)

Revaluation of

asset based on

performance - 793 - - - 793

----------- ----------- ----------- ----------- ----------- ---------

Gross outstanding

at 31.12.2020 - 1,296 1,450 - - 2,746

Paid during 2021 - (741) (368) - - (1,109)

Further change

in consideration - 46 - - - 46

----------- ----------- ----------- ----------- ----------- ---------

Gross Outstanding

at 31.12.2021 - 601 1,082 - - 1,683

Paid during 2022 - (601) (1,082) - - (1,683)

Purchase of the

remainder of the

NCI - 2,955 - - - 2,955

Initial consideration

paid by 31.12.2022 - (930) - - - (930)

----------- ----------- ----------- ----------- ----------- ---------

Gross Outstanding

at 31.12.2022 - 2,025 - - - 2,025

Acquisition price

booked at acquisition - - - 2,250 3,200 5,450

Less acquired gross

liabilities - - - (831) - (831)

Initial Consideration

Paid during H1-2023 - - - (169) (1,500) (1,669)

Deferred Consideration

on receipt of R&D

claim paid during

H1-2023 - - - (215) - (215)

Revaluation of

asset based on

performance - (155) - - - (155)

----------- ----------- ----------- ----------- ----------- ---------

Gross Outstanding

at 30.06.23 - 1,870 - 1,035 1,700 4,605

----------- ----------- ----------- ----------- ----------- ---------

Due in remainder

of 2023 - 1,087 - 1,035 - 2,122

----------- ----------- ----------- ----------- ----------- ---------

Due in or after

2024 - 783 - - 1,700 2,483

----------- ----------- ----------- ----------- ----------- ---------

Total consideration 2,000 5,875 1,575 1,419 3,200 14,069

=========== =========== =========== =========== =========== =========

Roqqett

Following regulatory approval from the FCA on 6 January 2023,

the acquisition of Roqqett Limited, an open-banking platform was

completed on 9 January 2023. Total consideration is up to GBP2.2

million less the gross liabilities of GBP0.8 million totalling

GBP1.4 million. A total of GBP384k had been settled by 30 June

2023. Two instalments with combined liability of just over GBP1

million will be due depending on certain deliverables.

Hamer & Hamer

On 24 March 2023 the Group acquired Hamer & Hamer, an

authorised payment institution regulated by the FCA for an initial

consideration of GBP1.5 million. The business focuses on the SME

segment. The deferred consideration based upon future performance

targets, is GBP1.7 million, giving a total consideration of up to

GBP3.2 million. In the case of super performance, the sellers could

earn a further GBP1.0 million which would be charged to the income

statement.

Oonex SA

On 27 March 2023, the Group announced that it had entered into

an agreement to acquire the entire share capital of Oonex SA, an

authorised payment institution licenced in Belgium. Oonex SA

(subsequently renamed as Equals Money Europe SA) provides card

acquiring services and is a Principal Member of Mastercard allowing

it to issue debit cards across the EEA. Additionally, Oonex SA is a

SWIFT and SEPA member and provides direct Payment Accounts

('IBANs') from Belgium to companies and individuals worldwide.

On 4 July 2023 the National Bank of Belgium consented to this

acquisition. The total consideration agreed was for five million

shares in Equals Group Plc with 3,938,294 issued in July 2023 and

1,061,706 deferred until 4 January 2024. The Group also assumed the

liabilities of Oonex SA and various associated entities for around

EUR6 million. These are expected to be treated as a loan repayable

out of the future profits of Equals Money Europe SA.

C. Disposals

On 14 March 2023, the Group disposed of its Bureau de Change to

an unrelated third party for an initial GBP250,000 with a further

GBP100,000 receivable based upon performance. A gain on disposal of

GBP379,723 has been recognised in these financial statements.

Share capital

The number of shares in issue at 1 January 2023 was 180,712,473.

This increased in the year through the exercise of 333,334 share

options, and 747,488 shares at nominal value were issued pursuant

to the 2022 SIP, thus the number of shares outstanding at 30 June

2023 was 181,793,295. A further 3,938,294 shares were issued and

admitted to trading, pursuant to the acquisition of Oonex SA, thus

at the date of this report the number of shares in issue is

185,731,589.

Share options

At 1 January 2023, the Company had 16,141,058 options

outstanding. 333,334 of these were exercised in 2023, and 36,512

were cancelled. After the 30 June 2023 but before the date of this

announcement, a further 500,000 share options lapsed, thus, at the

date of signing of these financial statements, there were

15,271,212 options, representing 8.2% of the issued share

capital.

The cost of external advice for these schemes amounted to GBP15k

in the period (H1-2022: GBP31k)

Earnings per share

Earnings per share are reported/calculated in accordance with

IAS 33. For non-diluted, the result after tax is divided by the

average number of shares in issue in the year. The average number

of shares in the period was 181,533,904 (H1-2022: 179,890,374).

The calculation of diluted EPS is based on the result after tax

divided by the number of actual shares in issue (above) plus the

number of options where the fair value exceeds the weighted average

share price in the year. The fair value of options is measured

using Black-Scholes and Monte-Carlo. It should be noted that in

accordance with Accounting Standards, this calculation is based on

fair value, not the difference between the market price at the end

of the year or the weighted average price and the exercise price.

The weighted average price was 91 pence (H1-2022: 78 pence), the

number of options exceeding the fair value was 8,089,807 (H1-2022:

6,537,453).

The basic and diluted EPS are shown below:

Basic Basic Diluted Diluted

H1-2023 H1-2022 H1-2023 H1-2022

Profit / (loss) per share

(in pence) 2.64 0.38 2.52 0.36

Adjusted earnings and adjusted EPS

We have observed that the analyst community prepares EPS

calculations on a number of different bases. To try and harmonise

these we have prepared below a basis which hopefully offers

consistency:

H1-2023 H1-2022

GBP'000s GBP'000s

P&L YTD Attributable to owners of Equals Group

PLC 4,788 675

Add back:

* Share option charges 741 290

* Amortisation of acquired intangibles. 686 641

Adjusted earnings 6,215 1,606

========= =========

The resulting earnings per share are shown below:

Basic Basic Diluted Diluted

H1-2023 H1-2022 H1-2023 H1-2022

Adjusted profit per share

(in pence) 3.42 0.89 3.27 0.86

CASH STATEMENT

The movement in the cash position is shown in the table below,

splitting out trading from M&A activities:

TABLE 10 - CASHFLOW H1-2023 H1-2022 H2-2022

GBP'000s GBP'000s GBP'000s

Adjusted EBITDA 9,825 4,852 7,268

Lease payments (principal and interest) (488) (371) (598)

R&D tax receipts relating to qualifying

Equals expenditure in prior periods - - 400

Acquisition costs - - (164)

Internally developed software capitalised

for R&D:

- Staff (2,449) (2,051) (2,140)

- IT Costs (273) (164) (244)

Purchase of other intangible assets

less disposals (284) (307) (138)

Purchase of other non-current assets (252) (122) (149)

Movement in working capital (551) 2,926 (1,780)

---------- ---------- ----------

5,528 4,763 2,455

---------- ---------- ----------

M&A activities:

- Net acquired consideration, and

earn-outs (1,669) (1,380) (1,233)

- Associated costs capitalised in (29) - -

acquisition

Costs relating to acquisitions after (319) - -

the balance sheet date

Loans in advance of acquisition:

- Oonex (729) - -

- Roqqett - - (830)

---------- ---------- ----------

(2,746) (1,380) (2,063)

---------- ---------- ----------

Funds from exercise of share options 97 193 -

External funding repaid (CBILS) - (228) (1,800)

NET CASHFLOWS 2,879 3,348 (1,408)

Balance at 1(st) January / 1(st) July 15,044 13,104 16,452

---------- ---------- ----------

Balance at 30(th) June / 31(st) December 17,923 16,452 15,044

---------- ---------- ----------

Cash per share 9.9 pence 9.1 pence 8.3 pence

Working capital movements commonly comprise:

-- Timing differences between accrued and paid affiliate commissions

-- Timing differences between accrued and paid performance related pay

-- Timing difference between accrued expenses and the settlement of subsequent invoices

-- Profit transfers from the Client ledgers

-- Margin calls (or releases) from liquidity providers

The Group enhances its reputation by aiming to pay all suppliers

on the invoice due date.

TABLE 11 - LIQUIDITY H1-2023 H1-2022

GBP'000s GBP'000s

Cash at bank 17,923 16,452

Balances with liquidity providers 2,863 1,499

Pre-funded balances with card provider 759 884

--------- ---------

Gross liquid resources 21,545 18,835

--------- ---------

Customer balances not subject to safeguarding (4,924) (4,210)

CBILS loan - (1,800)

--------- ---------

(4,924) (6,010)

--------- ---------

Net position 16,621 12,825

--------- ---------

The Group has its principal banking and deposit arrangements

with Barclays, NatWest, Citibank and Blackrock. As a member of

RTGS, the Group also holds interest-earning balances with the Bank

of England.

Richard Cooper

Chief Financial Officer

12 September 2023

INTERIM CONSOLIDATED statement OF COMPREHENSIVE INCOME

FOR THE six-month periodED 30 june 2023

Period Year end

end Period end 31

30 June 30 June December

2023 2022 2022

Unaudited Unaudited Audited

Note GBP000 GBP000 GBP000

Revenue on currency transactions 40,983 28,505 63,541

Banking revenue 4,045 2,868 6,141

----------- ----------- ----------

Revenue 2 45,028 31,373 69,682

Direct costs 2 (21,425) (16,507) (36,027)

----------- ----------- ----------

Gross profit 23,603 14,866 33,655

Administrative expenses 3 (14,395) (10,314) (22,576)

Depreciation (525) (632) (1,211)

Amortisation charge (3,165) (2,858) (6,008)

Acquisition costs - - (164)

Total operating expenses (18,085) (13,804) (29,959)

Operating profit 5,518 1,062 3,696

Other income and expenses:

Gain on the sale of the Cash

CGU 9 380 - -

Finance costs 8 (79) (177) (280)

----------- ----------- ----------

Profit before tax 5,819 885 3,416

Tax charge / (credit) 4 (1,031) (37) 135

----------- ----------- ----------

Profit after tax 4,788 848 3,551

=========== =========== ==========

Memo: Profit is attributable

to:

----------- ----------- ----------

Owners of Equals Group Plc 4,788 675 3,237

Non-controlling interest - 173 314

----------- ----------- ----------

Other comprehensive income:

Exchange differences arising - 1 -

on translation of foreign

operations

4,788 849 3,551

=========== =========== ==========

Profit per share

Basic 2.64p 0.38p 1.80p

Diluted 2.52p 0.36p 1.73p

=========== =========== ==========

All income and expenses arise from continuing operations.

INTERIM CONSOLIDATED statement OF FINANCIAL POSITION

FOR THE six-month periodED 30 june 2023

As at 30 As at 30 As at 31

June 2023 June 2022 December

2022

Unaudited Unaudited Audited

Note GBP000 GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 1,215 1,193 1,139

Right of use assets 3,171 4,067 3,367

Intangible assets and goodwill 34,724 30,425 30,008

Deferred tax assets 1,171 1,287 1,831

40,281 36,972 36,345

----------- ----------- ----------

Current assets

Inventories 237 148 292

Trade and other receivables 13,413 8,228 10,274

Current tax assets - 439 -

Derivative financial assets 5,616 2,593 5,616

Cash and cash equivalents 17,923 16,452 15,044

----------- ----------- ----------

37,189 27,860 31,226

----------- ----------- ----------

TOTAL ASSETS 77,470 64,832 67,571

=========== =========== ==========

EQUITY AND LIABILITIES

Equity attributable to equity

holders

Share capital 6 1,818 1,807 1,807

Share premium 6 53,498 53,405 53,405

Share based payment reserve 4,143 2,455 3,231

Other reserves 8,609 8,610 8,609

Retained deficit (19,995) (23,915) (24,148)

----------- ----------- ----------

Equity attributable to owners

of Equals Group Plc 48,073 42,362 42,904

Non-controlling interest - 436 -

----------- ----------- ----------

48,073 42,798 42,904

----------- ----------- ----------

Non-current liabilities

Borrowings 7 - 1,600 -

Right of use (lease) liabilities 3,063 4,224 3,417

3,063 5,824 3,417

----------- ----------- ----------

Current liabilities

Borrowings 7 - 200 -

Trade and other payables 20,617 12,970 15,489

Current tax liabilities 185 139 192

Right of use (lease) liabilities 743 819 780

Derivative financial liabilities 4,789 2,082 4,789

----------- ----------- ----------

26,334 16,210 21,250

----------- ----------- ----------

TOTAL EQUITY AND LIABILITIES 77,470 64,832 67,571

=========== =========== ==========

INTERIM CONSOLIDATEd STATEMENT OF changes in equity

For the SIX-MONTH period ended 30 june 2023

Group Total

attributable

Share to owners

Share Share based Retained Other of Equals Non-controlling

capital premium payment deficit reserves Group Plc interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January

2022 1,793 53,218 1,858 (24,590) 8,609 40,888 263 41,151

Income for the

period

and total

comprehensive

income - - - 675 - 675 173 848

Exchange

differences

arising on

translation

of foreign

operations - - - - 1 1 - 1

Acquisition of - - - - - - - -

the

remaining NCI

Share based

payment

charge - - 259 - - 259 - 259

Movement in

deferred

tax on

share-based

payment charge - - 338 - - 338 - 338

New shares

issued 14 187 - - - 201 - 201

At 30 June 2022 1,807 53,405 2,455 (23,915) 8,610 42,362 436 42,798

Income for the

period

and total

comprehensive

income - - - 2,562 - 2,562 141 2,703

Exchange

differences

arising on

translation

of foreign

operations - - - - (1) (1) - (1)

Acquisition of

the

remaining NCI - - - (2,902) - (2,902) (577) (3,479)

Share based

payment

charge - - 665 - - 665 - 665

Movement in

deferred

tax on

share-based

payment charge - - 218 - - 218 - 218

Share options

exercised

in year - - (107) 107 - - - -

New shares - - - - - - - -

issued

--------- --------- --------- --------- ---------- ---------------- ---------------- --------

At 31 December

2022 1,807 53,405 3,231 (24,148) 8,609 42,904 - 42,904

Income for the

period

and total

comprehensive

income - - - 4,788 - 4,788 - 4,788

Exchange - - - - - - - -

differences

arising on

translation

of foreign

operations

Purchase of

Roqqett

reserves - - - (666) - (666) - (666)

Purchase of

Hamer

& Hamer

reserves - - - 31 - 31 31

Share based

payment

charge - - 726 - - 726 - 726

Movement in

deferred

tax on

share-based

payment charge - - 186 - - 186 - 186

New shares

issued 11 93 - - - 104 - 104

--------- --------- --------- --------- ---------- ---------------- ---------------- --------

At 30 June 2023 1,818 53,498 4,143 (19,995) 8,609 48,073 - 48,073

========= ========= ========= ========= ========== ================ ================ ========

Other reserves comprise:

Merger reserve Arising on reverse acquisition from Group

reorganisation.

Contingent consideration Arising on equity based contingent consideration

reserve on acquisition of subsidiaries.

Foreign currency reserve Arising on translation of foreign operations

INTERIM Consolidated statement of cash flows

FOR THE SIX-MONTH PERIODED 30 JUNE 2023

Six month Six month Six month

period ended period ended period ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Operating Activities

Profit for the period 5,819 885 2,531

Adjustments for:

Depreciation 525 632 579

Amortisation 3,165 2,858 3,150

Share based payment charge 726 259 665

(Increase) in trade and other receivables (3,431) (188) (9,732)

Decrease in net derivative financial

assets / liabilities - - (3,023)

Increase in trade and other payables 5,356 1,561 8,146

Increase in derivative financial

liabilities - - 2,707

Decrease / (increase) in inventories 55 20 (144)

Finance costs 79 177 103

-------------- -------------- --------------

Net cash inflow 12,294 6,204 4,982

Tax receipts - - 400

Tax paid (192) - (61)

-------------- -------------- --------------

Net cash inflow from operating activities 12,102 6,204 5,321

Cash flows from investing activities

Acquisition of property, plant and

equipment (401) (122) (149)

Acquisition of intangibles (3,005) (2,323) (2,733)

Acquisition of subsidiary, net of (5,425) - -

cash acquired

Net cash used in investing activities (8,831) (2,445) (2,882)

Cash flows from financing activities

Principal elements of lease payments (415) (297) (540)

Interest paid on finance lease (73) (82) (87)

Interest paid (8) (33) (14)

Repayment of borrowings - (200) (1,800)

Acquisition of the remaining non-controlling

interest - - (1,405)

Proceeds from issuance of ordinary

shares 104 201 (1)

Net cash used in financing activities (392) (411) (3,847)

Net increase / (decrease) in cash

and cash equivalents 2,879 3,348 (1,408)

Cash and cash equivalents at the

beginning of the period 15,044 13,104 16,452

-------------- -------------- --------------

Cash and cash equivalents at end

of the period 17,923 16,452 15,044

============== ============== ==============

CONSOLIDATED NOTES TO THE INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2023

1. Basis of preparation

The principal accounting policies applied in the preparation of

the Group and Interim Consolidated financial statements are set out

below. These policies have been consistently applied to all the

years presented, unless otherwise stated. The financial statements

have been prepared on a historical cost basis with the exception of

derivative financial instruments which are measured at fair value

through profit or loss.

These financial statements are prepared in accordance with

UK-adopted International Accounting Standards in conformity with

the requirements of the Companies Act 2006. The financial

statements are presented in sterling, the Group's presentational

currency.

The unaudited consolidated Interim financial statements have

been prepared in accordance with the AIM rules and consistently

with the basis of preparation and accounting policies set out in

the accounts of the Group for the period ended 31 December 2022.

The information set out herein is abbreviated and does not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. These interim consolidated financial

statements do not include all disclosures which would be required

in a complete set of financial statements and should be read in

conjunction with the 2022 Annual Report.

The Company is a limited liability company incorporated and

domiciled in England and Wales and whose shares are quoted on AIM,

a market operated by The London Stock Exchange.

a) Critical judgements and estimates

IFRS requires management to make estimates, judgements and

assumptions that affect the application of the Group's accounting

policies and the reported amounts of assets, liabilities, income

and expenses. These estimates are based on the Directors best

knowledge and past experience. The existing critical judgements and

estimates set out in note [3.26] of the Group's annual report for

the year ended 31 December 2022 have been reviewed in preparing

these Interim consolidated financial statements and the Directors

believe they remain relevant.

b) Going concern

The Board continues to closely monitor its performance and

considers a range of risks that could affect the future performance

and position of the Group. The Board considers it has a reasonable

expectation that it has adequate resources to continue to operate

for the foreseeable future and therefore the financial statements

are prepared on a going concern basis.

2. Segmental Analysis

Based on previously identified cash generating units, the

segmental results were as follows:

Unaudited Currency International Solutions Travel Banking Central Total

Cards Payments Cash

6 months ended GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

30 June 2023

Segment revenue 7,205 19,986 13,587 129 4,121 - 45,028

Direct costs (2,650) (11,775) (6,230) (90) (680) - (21,425)

--------- -------------- ---------- ------- -------- --------- ---------

Gross profit 4,555 8,211 7,357 39 3,441 - 23,603

Administrative

expenses - - - - - (14,395) (14,395)

Depreciation - - - - - (525) (525)

Amortisation - - - - - (3,165) (3,165)

Gain on the sale

of the cash CGU - - - 380 - - 380

Finance costs - - - - - (79) (79)

--------- -------------- ---------- ------- -------- --------- ---------

Profit / (loss)

before tax 4,555 8,211 7,357 419 3,441 (18,164) 5,819

========= ============== ========== ======= ======== ========= =========

Current assets - - - - 3,143 34,046 37,189

Non-current assets 5,323 22,035 - - 2,371 10,552 40,281

Total liabilities - - - - (1,904) (27,493) (29,397)

--------- -------------- ---------- ------- -------- --------- ---------

Total net assets 5,323 22,035 - - 3,610 17,105 48,073

========= ============== ========== ======= ======== ========= =========

Unaudited Currency International Solutions Travel Banking Central Total

Cards Payments Cash

6 months ended GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

30 June 2022

Segment revenue 5,645 16,242 6,204 478 2,804 - 31,373

Direct costs (2,059) (10,183) (3,343) (239) (683) - (16,507)

--------- -------------- ---------- ------- -------- --------- ---------

Gross profit 3,586 6,059 2,861 239 2,121 - 14,866

Administrative

expenses - - - - - (10,314) (10,314)

Depreciation - - - - - (632) (632)

Amortisation - - - - - (2,858) (2,858)

Finance costs - - - - - (177) (177)

--------- -------------- ---------- ------- -------- --------- ---------

Profit / (loss)

before tax 3,586 6,059 2,861 239 2,121 (13,981) 885

========= ============== ========== ======= ======== ========= =========

Current assets - - - - 2,634 25,226 27,860

Non-current assets 5,120 18,051 - 178 2,434 11,189 36,972

Total liabilities - - - - (1,952) (20,082) (22,034)

--------- -------------- ---------- ------- -------- --------- ---------

Total net assets 5,120 18,051 - 178 3,116 16,333 42,798

========= ============== ========== ======= ======== ========= =========

Audited Currency International Solutions Travel Banking Central Total

Cards Payments Cash

6 months ended GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

31 December 2022

Segment revenue 6,894 18,115 9,432 531 3,337 - 38,309

Direct costs (2,559) (11,179) (4,746) (314) (722) - (19,520)

--------- -------------- ---------- ------- -------- --------- ---------

Gross profit 4,335 6,936 4,686 217 2,615 - 18,789

Administrative

expenses - - - - - (12,262) (12,262)

Depreciation - - - - - (579) (579)

Amortisation - - - - - (3,150) (3,150)

Acquisition costs - - - - - (164) (164)

Finance costs - - - - - (103) (103)

--------- -------------- ---------- ------- -------- --------- ---------

Profit / (loss)

before tax 4,335 6,936 4,686 217 2,615 (16,258) 2,531

========= ============== ========== ======= ======== ========= =========

Current assets - - - - 2,343 28,883 31,226

Non-current assets 5,341 17,975 - 128 4,372 8,529 36,345

Total liabilities - - - - (2,287) (22,380) (24,667)

--------- -------------- ---------- ------- -------- --------- ---------

Total net assets 5,341 17,975 - 128 4,428 15,032 42,904

========= ============== ========== ======= ======== ========= =========

3. Operating profit

Operating profit is stated after charging the following

operating expenses:

6 months 6 months 12 months ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Marketing costs 1,206 790 1,858

Staff costs 9,194 6,620 14,406

Property and office costs 517 430 932

Audit fees 231 180 350

Compliance costs 552 358 683

Other professional fees 460 380 851

IT and telephone cost 1,351 925 2,012

Travel and similar 257 329 440

Foreign exchange loss 30 10 71

Share option charge and other

share option related costs 741 291 970

Contingent consideration (155) - -

Other costs 11 1 3

--------------- --------------- ----------------

Administrative costs 14,395 10,314 22,576

Depreciation of right of use

assets 331 445 822

Depreciation of property, plant

and equipment 194 187 389

Amortisation charge 3,165 2,858 6,008

Acquisition costs - - 164

Total operating expenses 18,085 13,804 29,959

=============== =============== ================

4. Taxation

6 months 6 months 12 months ended

ended ended 30 June 31 December

30 June 2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Current year R&D credit - (40) -

Current year corporation tax

charge 185 78 192

-------------- --------------- ----------------

Current tax credit 185 38 192

-------------- --------------- ----------------

Origination and reversal of

temporary differences 38 (8) (203)

Recognition of previously

unrecognised deductible temporary

differences 808 7 (124)

-------------- --------------- ----------------

Deferred tax credit 846 (1) (327)

-------------- --------------- ----------------

Total tax charge / (credit) 1,031 37 (135)

============== =============== ================

5. Earnings per share

Basic earnings per share is calculated based on the GBP4,788k

profit attributable to owners of Equals Group plc (H1-2022:

GBP675k) divided by the weighted average number of shares of

181,533,904 in the period (H1-2022: 179,768,562), giving a result

of 2.64 pence per share (H1-2022: 0.38 pence per share).

6. Share capital

6 months 6 months 6 months 12 months

ended 30 ended 30 ended 30 ended 31 December

June 2023 June 2023 June 2022 2022

Unaudited Unaudited Unaudited Audited

No. GBP000 GBP000 GBP000

Authorised, issued and

fully paid-up ordinary

shares of GBP0.01 each

As at start of period 180,712,473 1,807 1,793 1,793

Issued during the period

under share options 333,334 3 7 7

Issued during the period

under the SIP 747,488 8 7 7

As at end of period 181,793,295 1,818 1,807 1,807

------------ ----------- ----------- -------------------

On 6 April 2023, Equals Group Plc issued 333,334 ordinary shares

of 1p each, for total consideration of GBP96,667. Of which

GBP93,333 (28p per share) was allocated to the Share Premium

reserve, in order to satisfy the exercise of share options by a

Director of the Group. Those shares have been retained by the

Director. As part of the longer-term incentive plans for members of

staff, on 20 January 2023, 747,488 shares were issued under a Share

Incentive Plan and placed into trust for 188 eligible employees.

The shares will remain in trust until the vesting conditions are

met at the end of the holding period on 20 January 2026.

7. Borrowings

2023 2022

GBP000 GBP000

Loan debenture - 1,800

======= =======

Under the Coronavirus Business Interruption Loan Scheme (CBILS)

to further support working capital, on 23 December 2020, the main

trading subsidiary of the Company, FairFX plc, entered into a

GBP2.0 million loan agreement with the Royal Bank of Scotland

('RBS').

The loan was originally for a six-year period, to mature on

December 2026, at the Bank Base rate + 2.53% and could be repaid

early at any point without penalty, and indeed the outstanding loan

of GBP1.8 million was repaid in full in August 2022.

8. Finance costs

Finance costs comprise: the unwind of discount on the lease

liability under IFRS 16; the unwind of discount on deferred

consideration in respect of business and company acquisitions made

by the Group and other financing interest costs.

9. Sale of the Cash CGU

The Cash CGU together with its property lease, staff and cash

stock was disposed on 14 March 2023 for a total consideration

GBP0.4 million. Of which, GBP0.1 million is a deferred

consideration receivable upon a future negotiation with the

property lease.

10. Post Balance Sheet Events

The Group completed the acquisition of Oonex S.A on 4 July 2023

following unconditional approval on 6 June 2023 from the National

Bank of Belgium. A total of 3,938,294 shares were issued and

admitted to trading, a further 1,061,706 shares subject to adverse

warranty claims should be issued by 4 January 2024. The acquisition

process was initiated on 24 March 2023 when the Share Purchase

Agreement (SPA) was signed.

The Group made payments totalling EUR2.9 million to address

known and initial liabilities on completion. Payments were made by

way of loans to the subsidiary.

Since completion a further EUR0.6 million was injected to settle

pre-acquisition liabilities. The Group expects to loan Oonex SA a

further EUR0.8 million for the period 1 September to 31 December

2023 but declining over time as the remediation project progresses.

On 9 August 2023 the company was renamed from Oonex SA to Equals

Money Europe SA.

- ENDS -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UAURROOUKAUR

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

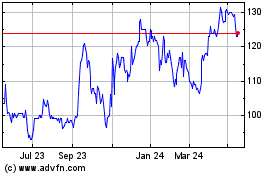

Equals (LSE:EQLS)

Historical Stock Chart

From Jun 2024 to Jul 2024

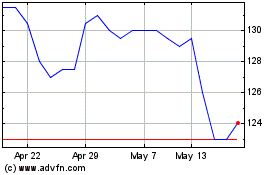

Equals (LSE:EQLS)

Historical Stock Chart

From Jul 2023 to Jul 2024