TIDMENOG

RNS Number : 6172T

Energean PLC

16 November 2023

ENERGEAN ISRAEL LIMITED

UNAUDITED INTERIM CONDENCED CONSOLIDATED FINANCIAL

STATEMENTS

30 SEPTEMBER 2023

ENERGEAN ISRAEL LIMITED

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

AS OF 30 SEPTEMBER 2023

INDEX

Page

-----

Interim Condensed Consolidated Statement of Comprehensive

Income 3

Interim Condensed Consolidated Statement of Financial

Position 4

Interim Condensed Consolidated Statement of Changes

in Equity 5

Interim Condensed Consolidated Statement of Cash

Flows 6

Notes to the Interim Condensed Consolidated Financial

Statements 7-20

- - - - - - - - - - - - - - - - - - - -

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME

NINE MONTHSED 30 SEPTEMBER 2023

30 September (Unaudited)

2023 2022

Notes $'000 $'000

------------------------------------ ------ ------------- ----------

Revenue 3 646,585 -

Cost of sales 4 (313,374) -

---------------------------------------- ------ ------------- ----------

Gross profit 333,211 -

Administrative expenses 4 (13,182) (7,218)

Exploration and evaluation expenses 4 (50) (1,277)

Other expenses 4 (170) (1,079)

Other income 4 2 53

---------------------------------------- ------ ------------- ----------

Operating profit/(loss) 319,811 (9,521)

Financial income 5 9,133 5,757

Financial expenses 5 (120,379) (4,931)

Foreign exchange loss, net 5 (4,872) 1,405

---------------------------------------- ------ ------------- ----------

Profit/(loss) for the period before

tax 203,693 (7,290 )

Taxation (expense)/income 6 (46,766) 2,663

---------------------------------------- ------ ------------- ----------

Net profit (loss) for the period 156,927 (4,627 )

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION

AS OF 30 SEPTEMBER 2023

30 September

20 23 31 December

(Unaudited) 2022

Notes $'000 $'000

---------------------------------- ------ ------------- ------------

ASSETS:

NON-CURRENT ASSETS:

Property, plant and equipment 7 2,869,484 2,926,313

Intangible assets 8 160,410 143,554

Other receivables 10 507 108

Deferred tax asset 9 - 22,886

-------------------------------------- ------ ------------- ------------

3,030,401 3,092,861

------------------------------------- ------ ------------- ------------

CURRENT ASSETS:

Trade and other receivables 10 121,412 82,611

Inventories 11 11,856 8,313

Restricted cash 24,500 71,778

Cash and cash equivalents 239,076 24,825

-------------------------------------- ------ ------------- ------------

396,844 187,527

------------------------------------- ------ ------------- ------------

TOTAL ASSETS 3,427,245 3,280,388

-------------------------------------- ------ ------------- ------------

EQUITY AND LIABILITIES:

EQUITY:

Share capital 1,708 1,708

Share premium 212,539 212,539

Retained earnings ( losses) 86,399 (70,528)

-------------------------------------- ------ ------------- ------------

TOTAL EQUITY 300,646 143,719

-------------------------------------- ------ ------------- ------------

NON-CURRENT LIABILITIES:

Senior secured notes 12 2,587,848 2,471,030

Decommissioning provisions 73,602 84,299

Deferred tax liability 9 22,028 -

Trade and other payables 13 180,038 210,241

-------------------------------------- ------ ------------- ------------

2,863,516 2,765,570

------------------------------------- ------ ------------- ------------

CURRENT LIABILITIES:

Trade and other payables 13 263,083 371,099

-------------------------------------- ------ ------------- ------------

263,083 371,099

------------------------------------- ------ ------------- ------------

TOTAL LIABILITIES 3,126,599 3,136,669

-------------------------------------- ------ ------------- ------------

TOTAL EQUITY AND LIABILITIES 3,427,245 3,280,388

-------------------------------------- ------ ------------- ------------

15 November 2023

---------------- ---------------- ---------------

Panagiotis Benos Matthaios Rigas

Director Director

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN

EQUITY

NINE MONTHSED 30 SEPTEMBER 2023

Retained

Share Share earnings Total

capital Premium (losses) equity

$'000 $'000 $'000 $'000

-------------------------------- --- -------- --------- --------- ---------

Balance as of 1 January

2023 1,708 212,539 (70,528) 143,719

Profit for the period - - 156,927 156,927

------------------------------------- -------- --------- --------- ---------

Balance as of 30 September

2023 (unaudited) 1,708 212,539 86,399 300,646

===================================== ======== ========= ========= =========

Balance as of 1 January

2022 1,708 572,539 (35,946) 538,301

Transactions with shareholders

Share premium reduction

(*) - (360,000) - (360,000)

Comprehensive loss

Loss for the period - - (4,627) (4,627)

------------------------------------- -------- --------- --------- ---------

Balance as of 30 September

2022 (unaudited) 1,708 212,539 (40,573) 173,674

===================================== ======== ========= ========= =========

(*) In April 2022 the Company reduced its share premium capital

by US$360 million and credited US$346 million against the

shareholder loan account plus accrued interest.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

NINE MONTHS PERIODED 30 SEPTEMBER 2023

30 September (Unaudited)

Notes 2023 2022

$'000 $'000

---------------------------------------------- ------ ----------- -----------

Operating activities

Profit (Loss) for the period before

tax 203,693 (7,290)

Adjustments to reconcile loss before

taxation to net cash provided by operating

activities:

Depreciation, depletion and amortisation 4 132,527 232

Loss from sale on equipment 4 170 1,079

Exploration and evaluation expenses 8 - 1,277

Compensation to gas buyers, payment

made in advance 3 4,929 -

Finance Income 5 (9,133) (5,757)

Finance expenses 5 120,379 4,932

Net foreign exchange loss (gains) 5 4,872 (1,405)

-------------------------------------------------- ------ ----------- -----------

Cash flow from operations before working

capital 457,437 (6,932)

-------------------------------------------------- ------ ----------- -----------

(Increase)/decrease in trade and other

receivables (56,590) 906

Increase in inventories (3,543) -

Decrease in trade and other payables (20,930) (665)

-------------------------------------------------- ------ ----------- -----------

Cash from operations 376,374 (6,691)

-------------------------------------------------- ------ ----------- -----------

Income taxes paid (397) (572)

-------------------------------------------------- ------ ----------- -----------

Net cash inflows from/(used in) operating

activities 375,977

819 (7,263)

------------------------------------------------- ------ ----------- -----------

Investing activities

Payment for exploration and evaluation,

and other intangible assets 8(B) (92,634) (18,823)

Payment for purchase of property, plant

and equipment 7(C) (164,913) (232,037)

Proceeds from disposals of property,

plant and equipment 2 188

Amounts received from INGL related to

transfer of property, plant and equipment 10 56,906 17,371

Movement in restricted cash, net 47,278 127,945

Interest received 9,921 2,863

-------------------------------------------------- ------ ----------- -----------

Net cash outflows used in investing

activities (143,440) (102,493)

-------------------------------------------------- ------ ----------- -----------

Financing activities

Senior secured notes - interest paid 12 (128,906) (128,906)

Senior secured notes issuance 12 750,000 -

Senior secured notes repayment 12 (625,000) -

Other distribution (4,386) -

Other finance cost paid (335) (2,359)

Finance costs paid for deferred licence

payments (2,496) (1,501)

Transaction cost related to senior secured

notes issuance 16 (3,690) -

Repayment of obligations under leases 13 (1,942) (683)

-------------------------------------------------- ------ ----------- -----------

Net cash outflow used in financing activities (16,755) (133,449)

-------------------------------------------------- ------ ----------- -----------

Net increase/(decrease) in cash and

cash equivalents 215,782 (243,205)

-------------------------------------------------- ------ ----------- -----------

Cash and cash equivalents at beginning

of the period 24,825 349,827

Effect of exchange differences on cash

and cash equivalents (1,531) (2,656)

-------------------------------------------------- ------ ----------- -----------

Cash and cash equivalents at end of

the period 239,076 103,966

-------------------------------------------------- ------ ----------- -----------

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

NOTE 1: - GENERAL

a. Energean Israel Limited (the "Company") was incorporated in

Cyprus on 22 July 2014 as a private company with limited liability

under the Companies Law, Cap. 113. Its registered office is at

Lefkonos 22, 1(st) Floor, Strovolos, 2064 Nicosia, Cyprus.

b. The Company and its subsidiaries (the "Group") has been

established with the objective of exploration, production and

commercialisation of natural gas and crude oil. The Group's main

activities are performed in Israel by its Israeli Branch.

c. As of 30 September 2023, the Company had investments in the following subsidiaries:

Name of subsidiary Country of incorporation Principal Shareholding Shareholding

/ registered office activities

At 30 September At 31 December

2022

2023 (%)

(%)

--------------------- --------------------------- -------------------- ------------------ -----------------

121, Menachem

Begin St.

Azrieli Sarona

Energean Israel Tower, POB 24, Gas transportation

Transmission Tel Aviv 67012039 license

LTD Israel holder 100 100

121, Menachem

Begin St.

Azrieli Sarona

Tower, POB 24,

Energean Israel Tel Aviv 67012039 Financing

Finance LTD Israel activities 100 100

d. The Group's core assets as of 30 September 2023 are comprised of:

Country Asset Field Working interest Field phase

-------- -------------------- ---------------------- ----------------- ------------

Israel Karish Karish Main 100% Production

Israel Karish Karish North 100% Development

Israel Tanin Tanin 100% Development

Israel Block 12, Katlan 100% Appraisal

Israel Blocks 21, 23, 31 Hercules and Hermes 100% Exploration

NOTE 2: - Accounting policies and basis of preparation

The interim financial information included in this report has

been prepared in accordance with IAS 34 "Interim Financial

Reporting" . The results for the interim period are unaudited and,

in the opinion of management, include all adjustments necessary for

a fair presentation of the results for the period ended 30

September 2023. All such adjustments are of a normal recurring

nature. The unaudited interim condensed consolidated financial

statements do not include all the information and disclosures that

are required for the annual financial statements and must be read

in conjunction with the Group's annual consolidated financial

statements for the year ended 31 December 2022.

The financial information presented herein has been prepared in

accordance with the accounting policies expected to be used in

preparing the Group's annual consolidated financial statements for

the year ended 31 December 2023 which are the same as those used in

preparing the annual consolidated financial statements for the year

ended 31 December 2022.

The directors consider it appropriate to adopt the going concern

basis of accounting in preparing these interim financial

statements.

NOTE 3: - Revenues

30 September (Unaudited)

2023 2022

$'000 $'000

------------------------------------------- --- ----------- --- ----------

Revenue from gas sales (1) 484,238 -

Revenue from hydrocarbon liquids sales

(2) 167,275 -

Compensation to customers (3) (4,928) -

------------------------------------------- --- ----------- --- ----------

Total revenue 646,585 -

(1) Sales gas for nine months ended 30 September 2023 totaled

approximately 3.1 bcm (the Company started production on 26 October

2022).

(2) Sales from hydrocarbon liquids for nine months ended 30

September 2023 totaled approximately 2.22 mmbbl (the Company did

not sell hydrocarbon liquids during 2022).

(3) During 2021 and in accordance with the GSPAs signed with a

group of gas buyers, the Company paid compensation to these

counterparties following delays to the supply of gas from the

Karish project. The compensation is deducted from revenue, as

variable consideration, as the gas is delivered to the gas buyers,

in accordance with IFRS 15 Revenue Recognition

NOTE 4: - Operating profit (loss) before taxation

30 September (Unaudited)

2023 2022

$'000 $'000

-------------------------------------------- --- ------------ --- -----------

(a) Cost of sales

Staff costs 6,566 -

Energy cost 2,869 -

Royalty payable 117,266 -

Other operating costs 57,061 -

Depreciation and amortisation (Note 7) 131,262 -

Hydrocarbon liquids inventory movement

(Note 11) (1,650) -

------------------------------------------------- ------------ --- ---------------

Total cost of sales 313,374 -

(b) General & administration expenses (c)

Staff costs 2,544 1,115

Share-based payment charge 517 128

Depreciation and amortisation (Note 7,

8) 1,265 352

Auditor fees 135 200

Other general & administration expenses 8,721 5,423

------------------------------------------------- ------------ --- ---------------

Total administrative expenses 13,182 7,218

(c) Exploration and evaluation expenses

Other exploration and evaluation expenses 50 1,277

------------------------------------------------- ------------ --- ---------------

Total exploration and evaluation expenses 50 1,277

(d) Other expenses

Loss from disposal of inventory property,

plant and equipment 170 1,079

------------------------------------------------- ------------ --- ---------------

Total other expenses 170 1,079

(e) Other income (f)

Other income 2 53

------------------------------------------------- ------------ --- ---------------

Total other income 2 53

NOTE 5: - Net finance income/(expenses)

30 September (Unaudited)

2023 2022

$'000 $'000

-------------------------------------------------------- --- ----------- -----------

Interest on senior secured notes (1) 119,322 102,505

Interest expense on long terms payables (2) 2,485 8,716

Less amounts included in the cost of qualifying

assets (3) (11,813) (107,177)

------------------------------------------------------------- ----------- -----------

109,994 4,044

Finance and arrangement fees 1,757 3,681

Other finance costs and bank charges 497 319

Unwinding of discount on trade payable 5,407 -

Unwinding of discount on provision for decommissioning 2,513 568

Unwinding of discount on right of use asset

(1) 391 238

Less amounts included in the cost of qualifying

assets (3) (180) (3,919)

------------------------------------------------------------- ----------- -----------

10,385 887

------------------------------------------------------------ ----------- -----------

Total finance costs 120,379 4,931

------------------------------------------------------------- ----------- -----------

Interest income from time deposits (9,133) (2,543)

Interest income from loans to related parties - (3,214)

------------------------------------------------------------- ----------- -----------

Total finance income (9,133) (5,757)

Net foreign exchange (gains) losses 4,872 (1,405)

------------------------------------------------------------- ----------- -----------

Net finance expense (income) 116,118 (2,231)

------------------------------------------------------------- ----------- -----------

(1) Refer also to Note 12.

(2) Refer also to Note 13.

(3) Refer also to Note 7(A).

NOTE 6: - Taxation

1. Taxation charge:

30 September (Unaudited)

2023 2022

$'000 $'000

----------------------- --- -------------------- --------

Tax - current period (1,853) (291)

Deferred tax (44,913) 2,954

---------------------------- -------------------- --------

Total taxation income

(expense) yyyyyuuuu( (46,766) 2,663

---------------------------- -------------------- --------

NOTE 7: - Property, Plant and Equipment

a. Composition:

Furniture,

Oil and Leased fixtures

gas Assets assets and equipment Total

$'000 $'000 $'000 $'000

---------------------------------- ----------- ------- -------------- ---------

Cost:

At 1 January 2022 2,241,783 4,009 829 2,246,621

Additions (1) 514,373 731 1,165 516,269

Disposals (900) - - (900)

Capitalised borrowing cost 129,357 - - 129,357

Capitalised depreciation 632 - - 632

Change in decommissioning

provision 47,544 - - 47,544

----------------------------------- ----------- ------- -------------- ---------

Total cost at 31 December

2022 2,932,789 4,740 1,994 2,939,523

Additions (1) 175,598 12,197 311 188,106

Handover to INGL(2) (111,448) - - (111,448)

Capitalised borrowing cost 11,993 - - 11,993

Change in decommissioning

provision (13,211) - - (13,211)

----------------------------------- ----------- ------- -------------- ---------

Total cost at 30 September

2023 (unaudited) 2,995,721 16,937 2,305 3,014,963

Depreciation:

At 1 January 2022 433 693 228 1,354

Charge for the year 10,976 134 297 11,407

Capitalised to oil and gas

assets - 632 - 632

Disposals (433) - - (433)

Write down of the assets 250 - - 250

----------------------------------- ----------- ------- -------------- ---------

Total Depreciation at 31

December 2022 11,226 1,459 525 13,210

Charge for the period 130,211 1,400 659 132,270

Total Depreciation at 30

September 2023 (unaudited) 141,436 2,859 1,184 145,479

At 31 December 2022 2,921,563 3,281 1,469 2,926,313

----------------------------------- ----------- ------- -------------- ---------

At 30 September 2023 (unaudited) 2,854,285 14,078 1,121 2,869,484

----------------------------------- ----------- ------- -------------- ---------

(1) The additions to oil & gas assets in nine month period

2023 are primarily due to development costs for the FPSO, Karish

North and 2(nd) Oil Train. The additions in 2022 are primarily due

to development costs for the Karish field, incurred under the EPCIC

contract, FPSO, subsea and onshore construction.

(2) Handover to INGL took place on 22 March 2023, please refer

to note 13

NOTE 7: - Property, Plant and Equipment (Cont.)

b. Depreciation expense for the period has been recognised as follows:

30 September (Unaudited)

2023 2022

$'000 $'000

-------------------------------------- ------------- ----------

Cost of sales 131,262 -

Administration expenses 1,008 110

Capitalised depreciation in oil & gas

assets - 357

-------------------------------------- ------------- ----------

Total 132,270 467

c. Cash flow statement reconciliations:

30 September (Unaudited)

2023 2022

$'000 $'000

--------------------------------------------- ------------------------- ----------

Additions to property, plant and equipment 188,106 392,377

========================= ==========

Less:

============================================= ========================= ==========

Right-of-use asset additions 12,197 198

============================================= ========================= ==========

Capitalised depreciation - 656

============================================= ========================= ==========

Capitalised share-based payment charge - 174

============================================= ========================= ==========

Add:

============================================= ========================= ==========

Lease payments related to capital 1,942 -

activities

============================================= ========================= ==========

Capital expenditures 177,851 391,349

============================================= ========================= ==========

Movement in working capital (12,938) (159,312)

============================================= ========================= ==========

Payment for additions to property,

plant and equipment as per the cash

flow statement 164,913 232,037

============================================= ========================= ==========

NOTE 8: - Intangible Assets

a. Composition:

Exploration

and evaluation

assets Software licences Total

$'000 $'000 $'000

----------------------------------- --------------- ----------------- -------

Cost:

At 1 January 2022 20,141 255 20,396

Additions (1) 123,005 1,713 124,718

Write off of exploration and

evaluation costs (2) (1,277) - (1,277)

------------------------------------ --------------- ----------------- -------

At 31 December 2022 141,869 1,968 143,837

Additions (1) 17,113 - 17,113

At 30 September 2023 (unaudited) 158,982 1,968 160,950

Amortisation:

At 1 January 2022 - 255 255

Charge for the year - 28 28

------------------------------------ --------------- ----------------- -------

Total Amortisation at 31 December

2022 - 283 283

Charge for the period - 257 257

------------------------------------ --------------- ----------------- -------

Total Amortisation at 30 September

2023 (unaudited) - 540 540

At 31 December 2022 141,869 1,685 143,554

------------------------------------ --------------- ----------------- -------

At 30 September 2023 (unaudited) 158,982 1,428 160,410

------------------------------------ --------------- ----------------- -------

(1) Additions to exploration and evaluation assets are primarily

related to the 2022 growth drilling programme undertaken offshore

Israel.

(2) Zone D: On 27 July 2022, the Company sent a formal notice to

the Ministry of Energy notifying the relinquishment of Zone D and

discontinuation of related work. As such, the licences subsequently

expired on 27 October 2022.

b. Cash flow statement reconciliations:

30 September (Unaudited)

2023 2022

$'000 $'000

----------------------------- ----------- --------------

Additions to intangible

assets 17,113 66,219

Associated cash flows

Movement in working capital 75,521 (47,396)

=============================== =========== ==============

Payment for additions to

intangible assets 92,634 18,823

=============================== =========== ==============

NOTE 9: - Deferred taxes

The Group is subject to corporation tax on its taxable profits

in Israel at the rate of 23%. The capital gain tax rates depend on

the purchase date and the nature of the asset. The general capital

gains tax rate for a corporation is the standard corporate tax

rate.

Tax losses can be utilised for an unlimited period, and tax

losses may not be carried back.

According to Income Tax (Deductions from Income of Oil Rights

Holders) Regulations, 5716-1956, the exploration and evaluation

expenses of oil and gas assets are deductible in the year in which

they are incurred.

The Group expects that there will be sufficient taxable profits

in the following years and that deferred tax assets, recognised in

the interim condensed consolidated financial statements of the

Group, will be recovered.

NOTE 9: - Deferred taxes (Cont.)

Below are the items for which deferred taxes were

recognised:

Right of

use asset

Accrued

expenses

and other

Property, short --

plant and term liabilities

equipment Deferred and other

& intangible expenses Staff leaving long -- Decommissioning

assets IFRS 16 Tax losses for tax indemnities term liabilities provision Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

-------------------------------------------- --- ------------ --------- ----------- -------- ------------- ---------------- ---------------- --------

At 1 January 2022 (12,632) (762) 4,750 11,031 94 923 8,171 11,575

Increase/(decrease)

for the year through:

Profit or loss (27,712) 8 51,665 (4,822) 73 270 (8,171) 11,311

------------------------------------------------- ------------ --------- ----------- -------- ------------- ---------------- ---------------- --------

At 1 January 2023 (40,344) (754) 56,415 6,209 167 1,193 - 22,886

------------------------------------------------- ------------ --------- ----------- -------- ------------- ---------------- ---------------- --------

Increase/(decrease)

for the period through:

Profit or loss (16,269) (2,393) (28,382) (472) 50 2,552 - (44,914)

At 30 September 2023 (56,613) (3,147) 28,033 5,737 217 3,745 - (22,028)

------------------------------------------------- ------------ --------- ----------- -------- ------------- ---------------- ---------------- --------

30 September

20 23 31 December

(Unaudited) 2022

$'000 $'000

------------------------- ------------- ------------

Deferred tax liabilities (59,760) (41,099)

Deferred tax assets 37,732 63,985

----------------------------- ------------- ------------

(22,028) 22,886

NOTE 10: - Trade and other receivables

30 September

20 23 31 December

(Unaudited) 2022

$'000 $'000

---------------------------------------------- -------------- -------------

Current

Financial items

Trade receivables

Trade receivables 112,955 37,491

Other receivables (1) 6,646 999

Refundable VAT - 37,131

Accrued interest income 101 888

-------------------------------------------------- -------------- -------------

119,702 76,509

Non-financial items

Prepayments 544 159

Deferred expenses (2) - 4,929

Prepaid expenses and other receivable 1,166 1,014

-------------------------------------------------- -------------- -------------

1,710 6,102

Total current trade and other receivables 121,412 82,611

Non-current

Financial items

Deposits and prepayments 507 108

-------------------------------------------------- -------------- -------------

507 108

------------------------------------------------- -------------- -------------

Total non-current trade and other receivables 507 108

-------------------------------------------------- -------------- -------------

(1) The increase from 2022 is due to the recognition of a

receivable from INGL, please refer to Note 13(4) for further

details.

(2) Deferred expenses relate to compensation to gas buyers

following delays to the supply of gas from the Karish project. This

compensation is treated as variable consideration under IFRS 15

Revenue Recognition and therefore, reduced from gas sales following

commencement of production, please refer also Note 3.

NOTE 11: - Inventory

30 September

20 23 31 December

(Unaudited) 2022

$'000 $'000

--------------------------- ------------- ------------

Raw materials and supplies 7,379 5,563

Hydrocarbon liquids 3,987 2,367

Natural gas 490 383

Total 11,856 8,313

NOTE 12: - Borrowings and secured notes

a. Issuance of US$2,500,000,000 senior secured notes:

On 24 March 2021 (the "Issue Date"), Energean Israel Finance Ltd

(a 100% subsidiary of the Company) issued US$2,500 million of

senior secured notes. The proceeds were primarily used to repay in

full the project finance facility.

On 11 July 2023, Energean Israel Finance Ltd. Ltd completed the

offering of US$750 million aggregate principal amount of senior

secured notes with a fixed annual interest rate of 8.500%. The

interest on the Notes will be paid semi-annually, on March 30 and

September 30 of each year, beginning on March 30, 2024. The Notes

are listed for trading on the TASE-UP of the Tel Aviv Stock

Exchange Ltd. (the "TASE"). The proceed from the Offering, was

released from escrow in September 2023 and was used to a) refinance

the $625 million notes due in 2024 (redemption date on 30 September

2023), b) pay fees and expenses associated with this refinancing,

c) contribute towards funding the interest payment reserve account,

and d) contribute towards the payment of the final deferred

consideration to Kerogen.

The Notes were issued in five tranches as follows:

30 September 20 31 December

23

(Unaudited) 2022

Series Maturity Annual fixed

Interest Carrying value

rate Carrying value $'000 $'000

------------------ --------------- ------------- --------------------- ---------------

US$ 625 million 30 March 2024 4.500% - 620,461

US$ 625 million 30 March 2026 4.875% 619,462 617,912

US$ 625 million 30 March 2028 5.375% 617,852 616,767

US$ 625 million 30 March 2031 5.875% 616,628 615,890

30 September

US$ 750 million 2031 8.500% 733,906 -

------------------ --------------- ------------- --------------------- ---------------

US$2,625 million 2,587,848 2,471,030

The interest on each series of the Notes is paid semi-annually,

on 30 March and on 30 September of each year.

The Notes are listed on the TASE-UP of the Tel Aviv Stock

Exchange Ltd (the "TASE").

With regards to the indenture document, signed on 24 March 2021

with HSBC BANK USA, N.A (the "Trustee"), as amended and

supplemented, no indenture default or indenture event of default

has occurred and is continuing.

Collateral:

The Company has provided/undertakes to provide the following

collateral in favor of the Trustee:

a. First rank fixed charges over the shares of Energean Israel Limited, Energean Israel

Finance Ltd and Energean Israel Transmission Ltd, the Karish

& Tanin Leases, the gas sale and purchase agreements ("GSPAs"),

several bank accounts, operating permits, insurance policies, the

Company's exploration licences and the INGL Agreement.

b. Floating charge over all of the present and future assets of

Energean Israel Limited and Energean Israel Finance Ltd.

c. The Energean Power FPSO.

Credit rating:

The senior secured notes have been assigned a Ba3 rating by

Moody's and a BB- rating by S&P Global.

NOTE 13: - Trade and other payables

30 September

20 23 31 December

(Unaudited) 2022

$'000 $'000

------------------------------------------- ------------- --------------

Current

Financial items

Trade accounts payable (1) 144,990 209,853

Payables to related parties 14,103 21,028

VAT payable 5,105 -

Deferred licence payments due within one

year (2) 12,852 13,345

Other creditors 21,843 6,712

Current lease liabilities 7,870 1,792

----------------------------------------------- ------------- --------------

206,763 252,730

Non-financial items

Accrued expenses (1) 39,897 29,404

Other finance costs accrued 14,147 32,227

Contract liability (4) - 56,230

Social insurance and other taxes 759 502

Income taxes 1,517 6

----------------------------------------------- ------------- --------------

56,320 118,369

Total current trade and other payables 263,083 371,099

----------------------------------------------- ------------- --------------

Non-current

financial items

Trade and other payables (3) 144,092 169,360

Deferred licence payments (2) 28,629 38,488

Long term lease liabilities 6,786 2,214

----------------------------------------------- ------------- ------------

179,507 210,062

Non-financial items

Accrued expenses to related parties 531 179

531 179

---------------------------------------------- ------------- ------------

Total non-current trade and other payables 180,038 210,241

----------------------------------------------- ------------- ------------

(1) Trade payables and accrued expenses relate primarily to

development expenditure on the Karish project, with the main

contributors being FPSO and subsea construction costs and for

drilling activities performed offshore Israel. Trade payables are

non-interest bearing.

(2) In December 2016, the Company acquired the Karish and Tanin

leases for US$40 million of upfront consideration plus contingent

consideration of US$108.5 million (paid over 10 equal instalments)

bearing interest at an annual rate of 4.6%. On 30 September 2023,

the total discounted deferred consideration was US$41 million (31

December 2022: US$52million). Refer to Note 16.

(3) This represents the amount payable to Technip in respect of

the EPCIC contract. Under this contract, US$250 million becomes

payable nine months following the practical completion date (June

18, 2023), and is payable in eight equal quarterly instalments,

bearing no interest. A discount rate of 5.831% has been applied (

being the yield rate of the senior secured loan notes, maturing in

2024, at the date of entering into the settlement agreement) . The

amounts payable to Technip up to 30 September 2024 under this

contract are presented as part of trade accounts payable -

current.

(4) The contract liability relates to the agreement with Israel

Natural Gas Lines ("INGL") for the transfer of title (the "Hand

Over") of the near shore and onshore segments of the infrastructure

that delivers gas from the Energean Power FPSO into the Israeli

national gas transmission grid. The Hand Over became effective in

March 2023. Following the Hand Over, INGL is responsible for the

operations and maintenance of this part of the infrastructure and

the related asset (refer to Note 7) and contract liability was

derecognised. The final $5million consideration is receivable

within 12 months of handover and is recognised within other

receivable (refer to Note 10).

NOTE 14: - Financial Instruments

Fair Values :

The fair values of the Group's non-current liabilities measured

at amortised cost are considered to approximate their carrying

amounts at the reporting date.

The carrying value less any estimated credit adjustments for

financial assets and financial liabilities with a maturity of less

than one year are assumed to approximate their fair values due to

their short-term nature. The fair value of the Group's finance

lease obligations is estimated using discounted cash flow analysis

based on the Group's current incremental borrowing rates for

similar types and maturities of borrowing and are consequently

categorized in level 2 of the fair value hierarchy.

There were no transfers between fair value levels during the

period.

The fair value hierarchy of financial assets and financial

liabilities that are not measured at fair value (but fair value

disclosure is required) is as follows:

Fair value hierarchy as at 30

September 2023 (unaudited)

Level 1 Level 2 Total

$'000 $'000 $'000

--------------------------- --------- -------- ---------

Financial assets

Short term restricted cash 24,500 - 24,500

Short term trade and other

receivables - 119,702 119,702

Cash and cash equivalents 239,076 - 239,076

------------------------------- --------- -------- ---------

Total 263,576 119,702 383,278

------------------------------- --------- -------- ---------

Financial liabilities

Senior secured notes (1) 2,439,500 - 2,439,500

Trade and other payables -

long term - 179,507 179,507

Trade and other payables -

short term - 206,763 206,763

------------------------------- --------- -------- ---------

Total 2,439,500 386,270 2,825,770

------------------------------- --------- -------- ---------

Fair value hierarchy as at 31

December 2022

Level 1 Level 2 Total

$'000 $'000 $'000

--------------------------- --------- -------- ---------

Financial assets

Short term restricted cash 71,778 - 71,778

Short term trade and other

receivables - 76,509 76,509

Cash and cash equivalents 24,825 - 24,825

------------------------------- --------- -------- ---------

Total 96,603 76,509 173,112

------------------------------- --------- -------- ---------

Financial liabilities

Senior secured notes (1) 2,298,125 - 2,298,125

Trade and other payables -

long term - 210,062 210,062

Trade and other payables -

short term - 252,730 252,730

------------------------------- --------- -------- ---------

Total 2,298,125 462,792 2,760,917

------------------------------- --------- -------- ---------

(1) The senior secured notes are measured at amortised cost in

the Group's financial statements. The notes are listed for trading

on the TACT Institutional of the Tel Aviv Stock Exchange Ltd (the

"TASE"). The carrying amount as of 30 September 2023 was US$2,588

million and as of 31 December 2022 was US$2,471 million.

NOTE 15: - Significant events and transaction during the reporting period

(a) Gas Sales Agreements - Energean signed spot gas sale and

purchase agreement with three Israeli gas buyers. The gas price

will be determined in each period, with purchased amounts

determined on a daily basis. The agreement will be valid for an

initial one-year period with an option to extend subject to

ratification by both parties.

(b) INGL Hand-Over completion - The Hand Over became effective

in March 2023. Following the Hand Over, INGL is responsible for the

operations and maintenance of this part of the infrastructure.

(c) Completion of offering of US$750,000,000 senior secured notes - see Note 12.

NOTE 1 6: - Significant events and transaction after the reporting period

(a) Interim dividend - An interim dividend of US$78 million was

declared and paid on the 18 October, as part of the process to make

the final deferred consideration to Kerogen.

(b) Israel-Hamas conflict ( Swords of Iron War ) - as of 7

October 2023, following an unprecedented attack against Israel by

Hamas, Israel has been declared in a state of war. While the

situation has not impacted the Company's production from the FPSO,

it is not possible to predict whether the conflict will have a

material adverse effect on our future earnings, cash flows and

financial conditions.

(c) Karish and Tanin purchase agreement - In November 2023,

Energean Israel reached a settlement with NewMed Energy for the

remaining deferred consideration under the original purchase

agreement of the Karish and Tanin leases of approximately $47.4

million, which includes the agreed annual interest. This will be

paid in 2024 in two instalments. This agreement is final and

unappealable.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTFLFLALTLELIV

(END) Dow Jones Newswires

November 16, 2023 02:01 ET (07:01 GMT)

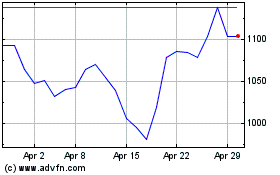

Energean (LSE:ENOG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Energean (LSE:ENOG)

Historical Stock Chart

From Dec 2023 to Dec 2024