TIDMCYAN

RNS Number : 6083J

CyanConnode Holdings PLC

14 December 2022

14 December 2022

CyanConnode Holdings plc

("CyanConnode" or the "Company")

Interim results for the six months ended 30 September 2022 (H1

FY 2023)

CyanConnode (AIM: CYAN), a world leader in narrowband radio

frequency (RF) mesh networks, announces its interim results for the

six months ended 30 September 2022 (H1 FY 2023).

John Cronin, CyanConnode Executive Chairman, commented:

"Revenue for the six months ended 30 September 2022 met our

expectations. We have, in previous statements, spoken of the

significant contracts secured so far this year and as a result

revenue for the next quarter is expected to be at least three times

higher than the first six months. The Board hopes that this

success, which we have been working towards for some time now, is a

sign of things to come. Consequently, we are pleased to confirm

that we expect to meet market revenue forecasts for the full

financial year ended 31 March 2023.

"Despite a delay to tenders until India's Prime Minister, Shri

Narendra Modi PM, launched the power sector's Revamped Distribution

Sector Scheme, (RDSS) in August 2022, CyanConnode was delighted to

announce its first order for one million Omnimesh Modules from

India. However, at the same time tenders were delayed until India's

Prime Minister, Shri Narendra Modi PM, launched the power sector's

Revamped Distribution Sector Scheme, (RDSS) in August 2022. As we

have previously highlighted, the 'Collection Efficiency' of not

less than 98%, as set out in the RDSS and which CyanConnode

Omnimesh achieves, favours our technology for network communication

and management and as a result our partners are currently busy

tendering for more than 75 million Smart Meters. CyanConnode

therefore expects to announce material orders from India in due

course.

"As well as the positive news flow from India, further

substantial orders were also received from new territories during

the period, including orders from the Middle East and North Africa

(MENA) region worth over USD 9 million.

"Our recent win rate from contracts tendered has been 27% in

volume (this financial year) and installed rate is circa 25%.

CyanConnode is currently bidding for contracts worth more than GBP1

billion in value. Our Partners have recently been named as Level 1

status for greater than 25 million units, which, whilst we don't

expect to win all of them, suggests a bright future and we look

forward to making further announcements in due course."

Financial Highlights

-- Revenue of GBP1.3m (H1 FY 2022: GBP4.1m) which is in line

with the Board's expectations (management forecast that circa 90%

of full financial year revenue will be delivered in H2).

-- Gross profit of GBP0.7m (H1 FY 2022: GBP1.7m)

-- Operating loss of GBP2.4m (H1 FY 2022: loss of GBP1.2m)

-- Cash received from customers of GBP4.5m (H1 FY 2022: GBP3.8m)

-- Cash and cash equivalents at end of period GBP1.0m (H1 FY 2022: GBP1.7m)

Operational Highlights

-- 1,000,000 Omnimesh RF Modules and associated products ordered

from Genus Power Infrastructure Limited (Genus)

-- Two orders won from IntelliSmart Infrastructure Pvt Ltd

(IntelliSmart) for a total of 300,000 Omnimesh RF Modules and

associated products

-- Order worth USD 6.7 million won from MENA for NB-IoT gateways

-- Further new order worth USD 2.5 million won from MENA for Cellular gateways

-- Omnimesh integration implemented for nine new meter types in India

-- RDSS approved by the Government of India

-- Power Distribution Companies in India (DISCOMS) empowered to release tenders under the RDSS

-- CyanConnode's technology aligns with RDSS for network communication and management

Post-Period Highlights

-- GBP0.5 million raised by way of a share subscription

-- Revenue for the quarter ending 31 December 2022 expected to

be three times higher than the first half of the financial year

-- Revenue for the financial year ending 31 March 2023 expected to meet market forecasts

-- Cash collected from customers since the period end of GBP2.3

million taking cash received for the nine-month period to GBP6.8

million

-- Cash at end of November 2022 of GBP1 million

-- Current tenders in India for circa 75 million Smart Meters

following the launch of the RDSS Scheme

-- GBP1 million worth of components purchased to meet current orders

The information contained within this announcement is deemed

to constitute inside information for the purposes of Article

7 of EU Regulation 596/2014 (Market Abuse Regulations) which

is part of UK law by virtue of the European Union (Withdrawal)

Act 2018. Upon publication of this announcement, this inside

information is now considered to be in the public domain.

Enquiries:

CyanConnode Holdings plc Tel: +44 (0) 1223 865

750

John Cronin, Executive Chairman www.cyanconnode.com

Cenkos Securities plc (Nomad and Joint Tel: +44 (0) 20 7397

Broker) 8900

Stephen Keys / Charlie Combe (Corporate

Finance)

Arden Partners Plc (Joint Broker) Tel: +44 (0) 20 7614

5900

Simon Johnson (Corporate Broking)

About CyanConnode

CyanConnode (AIM:CYAN.L) is a world leader in Narrowband Radio

Frequency (RF) Smart Mesh Networks, which are used for machine to

machine (M2M) communication. As well as being self-forming and

self-healing, CyanConnode's RF Smart Mesh Networks are designed for

rapid deployment, whilst giving exceptional performance and

competitive total cost of ownership.

In June 2018, CyanConnode launched its award-winning Omnimesh

Advanced Metering Infrastructure (AMI) platform, which has already

gained considerable commercial traction, especially in India which

is a key market for the Company.

Through a global partner eco-system, which is vendor agnostic,

CyanConnode has several routes to market, therefore it is well

positioned to capitalise upon increasing global demand for smart

metering solutions.

For more information, please visit www.cyanconnode.com .

Chairman's Statement

Financial highlights

Key figures

H1 FY 2023 H1 FY 2022

GBP'000 GBP'000 % Change

Revenue 1,347 4,078 - 67%

============ ============ ==========

Gross profit 665 1,696 - 61%

============ ============ ==========

Operating costs (3,043) (2,900) + 5%

============ ============ ==========

Operating loss (2,378) (1,204) + 97%

============ ============ ==========

Cash 1,033 1,740 - 41 %

============ ============ ==========

Basic and diluted loss per share 0.94p 0.49p +92%

============ ============ ==========

Revenue and Operating Costs

Revenue for the first six months of FY 2023 was in line with

management's expectations. With orders having been won in India for

1.3m Omnimesh modules and associated products during H1 of FY 2023,

and large orders being won for other regions, the Company expects a

significant increase in revenue during the second half of FY 2023.

The increase in operating costs was mainly due to the growth of the

business and increasing inflation rates.

Cash

During the period cash was utilised to purchase stocks of long

lead-time components to support delivery during the remainder of

the financial year. Stock of 350,000 long lead-time components were

held at period end to ensure H2 FY23 deliveries are met.

Accounts receivable

A total of GBP4.5m cash has been collected from customers during

the period (FY22: GBP3.8m), and a further GBP2.3 million since the

period end. Receivables for new contracts in India, signed during

the period and going forward, are expected to be received earlier

than historically due to a change in the business model, (payments

that were previously milestone based will now be received in Equal

Monthly Instalments (EMIs)). Contracts in the MENA region require

payments prior to delivery.

Operational Review

India

The Government of India plans to rollout 250 million smart

meters and tenders for large volumes, which currently total 75

million smart meters, have now been issued.

CyanConnode has had a successful period in India, doubling its

order book in 5 months and significantly increasing its pipeline of

opportunities and key partnerships which include;

-- In May 2022, an order was received for 100,000 Omnimesh RF

Modules together with advanced metering infrastructure,

standards-based hardware, services, Omnimesh head-end software,

perpetual license and an annual maintenance contract, for a smart

metering project in Assam. This order was received from

IntelliSmart, who were the first service provider to use the

Design, Build, Finance, Own, Operate, Transfer (DBFOOT) model and

they also installed the first smart prepaid meter in India under

the RDSS.

-- In June 2022, CyanConnode announced a further order from

Intellismart for the same project for 200,000 Omnimesh RF Modules

together with advanced metering infrastructure, standards-based

hardware, services, Omnimesh head-end software, perpetual license,

and annual maintenance contract.

-- In August 2022, the Group was delighted to announce that its

subsidiary, CyanConnode India Pvt Ltd, won its largest-ever order.

The Order was for 1,000,000 Omnimesh Modules, together with

Advanced Metering Infrastructure, Standards-Based Hardware,

Omnimesh Head-End Software, Perpetual License and a Support and

Maintenance Contract.

In August 2022, the Government of India approved the RDSS to

help DISCOMs improve their operational efficiencies and financial

sustainability by providing result-linked financial assistance to

strengthen supply infrastructure. The 'Collection Efficiency' of

not less than 98%, as set out in the RDSS and which CyanConnode

achieves, favours the Group's technology for network communication

and management, and the RDSS has an outlay of Rs 3,03,758 Crore

(circa GBP30 billion) over 5 years. RDSS mandates compulsory

installation of smart meters across the country.

In addition, the Rural Electrification Corporation floated a

Request for Empanelment (RFE) to allow participation in the RDSS

tenders. This requires Advanced Metering Infrastructure Service

Providers (AMISP) to demonstrate their solutions in a controlled

test environment. Empanelment will be required by all AMISPs to

allow participation in RDSS tenders. Following an initial delay in

the empanelment process, thirty-one companies are now

empanelled.

CyanConnode's Omnimesh mesh networks reliably meet stringent

service level agreements (SLAs) in dense terrain as well as

semi-urban, rural and mountainous regions, this has resulted in its

technology being deployed in approximately 25% of all smart

metering deployments. CyanConnode has a long track record of

successful deployments in India and is regarded as a safe pair of

hands, which is borne out by the strong take-up its Omnimesh

platform. The company is currently integrating its technology into

nine new meter types, a process which is required before new

suppliers enter the Indian market.

APAC and MENA

The smart metering market in the APAC and MENA continues to

mature and presents a significant opportunity for CyanConnode.

In April 2022, an order was won for a smart metering deployment

in the MENA region. Under this contract CyanConnode will supply

65,000 interoperable smart NB-IoT gateways which will communicate

with and control all existing smart meters for both electricity and

water; the gateways will have the capacity to connect up to one

million smart meters. The integration of all variants of water

meters for this project is now complete and ten types of

electricity meters have been integrated out of a total of

twenty-three. A large part of this order is expected to be

delivered during H2 of this financial year.

In August 2022, an order was announced for Cellular Gateways to

provide smart communications for an Advanced Metering

Infrastructure project located in the MENA region. This order,

worth USD 2.5 million, was for a new cellular product to be fitted

to existing electricity meters. The integration of the meters

required for this project is now complete and a large part of this

project is also expected to be delivered during H2 of this

financial year.

CyanConnode continues to deliver The Metropolitan Electricity

Authority (MEA) project with JST's partner Forth (Forth Corporation

Public Company Limited), a telecommunication and electronics

company that provides products and integration services throughout

Thailand. MEA, who serve around 4 million customers in the city of

Bangkok and two adjacent provinces, is deploying a Smart Metro Grid

platform to improve power availability and reliability, as well as

to analyse distribution losses, automate meter reading, and

increase customer satisfaction.

CyanConnode's Omnimesh technology has been integrated into

Forth's electricity meters, using the frequency bands of 442 and

447MMHz, which have been allocated to the Thai energy utilities by

The National Broadcasting and Telecommunications Commission (NBTC)

of Thailand. During the period CyanConnode's scope of the Site

Acceptance Test (SAT) has been successfully delivered.

Post period end developments and outlook

In October 2022, the Company raised GBP0.5 million by way of a

share subscription from an existing shareholder. The net proceeds

of this share subscription will be used for working capital

purposes.

Business has expanded significantly since the end of the period

with revenue in the three months following the end of the period

expected to be more than three times the revenue in the first six

months. In addition, cash collection has continued favourably with

a further GBP2.3 million being collected since the period end,

taking total cash collection to date to circa GBP6.8 million.

Tenders for significant volumes have begun to be awarded in

India. Since the launch of the RDSS in August 2022, tenders for

more than 30 million units have been awarded, with more than 20

million of those units having been awarded since mid-November and

CyanConnode expects to receive material orders from those tenders

in due course.

Consolidated income statement

Note Unaudited Unaudited Audited

6 months 6 months to 12 months to

to 30 September 31 March

30 2021 2022

September GBP000 GBP000

2022

GBP000

============================== ===== ========== ======================== ========================================

Continuing operations

Revenue 1,347 4,078 9,562

Cost of sales (682) (2,382) (4,554)

============================== ===== ========== ======================== ========================================

Gross profit 665 1,696 5,008

Other operating costs (3,043) (2,900) (6,025)

------------------------------ ----- ---------- ------------------------ ----------------------------------------

Underlying operating loss (2,035) (838) (38)

Amortisation and depreciation (243) (296) (616)

Share based payments (100) (70) (363)

------------------------------ ----- ---------- ------------------------ ----------------------------------------

Operating loss (2,378) (1,204) (1,017)

Finance income 11 3 3

Finance costs (49) (61) (164)

============================== ===== ========== ======================== ========================================

Loss before tax (2,416) (1,262) (1,178)

Tax credit 302 333 307

------------------------------ ----- ---------- ------------------------ ----------------------------------------

Loss for the period (2,114) (929) (871)

============================== ===== ========== ======================== ========================================

Loss per share (pence)

Basic 3 (0.94) (0.49) (0.42)

Diluted 3 (0.94) (0.49) (0.42)

============================== ===== ========== ======================== ========================================

Consolidated statement of comprehensive income

Derived from continuing operations and attributable to the

equity owners of the Company

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2022 2021 2022

GBP000 GBP000 GBP000

========================================================== ================== ============== ==============

Loss for the period (2,114) (929) (871)

Exchange differences on translation of foreign operations 425 186 76

========================================================== ================== ============== ==============

Total comprehensive income for the year (1,689) (743) (795)

========================================================== ================== ============== ==============

Consolidated statement of financial position

Unaudited Unaudited Audited

As at 30 September 30 September 31 March

2022 2021 2022

GBP000 GBP000 GBP000

========================================== ============= ==============

Non-current assets

Intangible assets 3,988 4,131 4,093

Goodwill 1,930 1,930 1,930

Fixed asset investments 68 64 58

Property, plant and equipment 33 37 31

Right of use asset 152 25 153

Trade receivables 520 - 458

------------------------------------------ ------------- -------------- ---------

Total non-current assets 6,691 6,187 6,723

========================================== ============= ============== =========

Current assets

Inventories 955 560 159

Trade and other receivables 4,586 7,563 6,993

R&D tax credit receivables 884 276 562

Cash and cash equivalents 1,033 1,740 2,355

========================================== ============= ============== =========

Total current assets 7,458 10,139 10,069

========================================== ============= ============== =========

Total assets 14,149 16,326 16,792

========================================== ============= ============== =========

Current liabilities

Short term borrowing (800) (2,593) (1,867)

Trade and other payables (2,362) (3,612) (2,364)

Corporation tax liabilities (137) - (193)

Lease liabilities (15) (25) (28)

------------------------------------------ ------------- -------------- ---------

Total current liabilities (3,314) (6,230) (4,452)

========================================== ============= ============== =========

Net current assets 4,144 3,909 5,617

========================================== ============= ============== =========

Non-current liabilities

Lease liabilities (137) - (125)

Deferred tax liability (745) (779) (746)

Other payables (97) - (38)

------------------------------------------ ------------- -------------- ---------

Total non-current liabilities (979) (779) (909)

------------------------------------------ ------------- -------------- ---------

Total liabilities (4,293) (7,009) (5,361)

========================================== ============= ============== =========

Net assets 9,856 9,317 11,431

========================================== ============= ============== =========

Equity

Share capital 4,728 4,400 4,726

Share premium account 73,895 71,978 73,883

Own shares held (3,611) (3,253) (3,611)

Share option reserve 1,168 995 1,068

Translation reserve 456 141 31

Retained losses (66,780) (64,944) (64,666)

========================================== ============= ============== =========

Total equity being equity attributable to

owners of the Company 9,856 9,317 11,431

========================================== ============= ============== =========

Consolidated statement of changes in equity

Share Own Shares Share

Share Premium Held Option Translation Total

Capital Account GBP000 Reserve Reserve Retained Losses Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Balance at 1

April

2021 3,735 69,662 (3,253) 925 (45) (64,015) 7,009

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Loss for the

period - - - - - (929) (929)

Other

comprehensive

income for the

period - - - - 186 - 186

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Total

comprehensive

income for

The period - - - - 186 (929) (743)

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Issue of share

capital 665 2,316 - - - - 2,981

Credit to equity

for

share options - - - 70 - - 70

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Total

transactions

with owners 665 2,316 - 70 - - 3,051

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Balance at 30

September

2021 4,400 71,978 (3,253) 995 141 (64,944) 9,317

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Profit for the

period - - - - - 58 58

Other

comprehensive

income for the

period - - - - (110) - (110)

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Total

comprehensive

income for the

period - - - - (110) 58 (52)

Issue of share

capital 326 1,905 (358) - - - 1,873

Credit to equity

for

share options - - - 293 - - 293

Transfer - - - (220) - 220 -

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Total

transactions

with owners 326 1,905 (358) 73 - 220 2,166

---------

Balance at 31

March

2022 4,726 73,883 (3,611) 1,068 31 (64,666) 11,431

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Loss for the

period - - - - - (2,114) (2,114)

Other

comprehensive

income for the

period - - - - 425 - 425

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Total

comprehensive

income for the

period - - - - 425 (2,114) (1,689)

Issue of share

capital 2 12 - - - - 14

Credit to equity

for

share options - - - 100 - - 100

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Total

transactions

with owners 2 12 - 100 - - 114

---------

Balance at 30

September

2022 4,728 73,895 (3,611) 1,168 456 (66,780) 9,856

----------------- --------- ---------- ------------- ---------- -------------------- ----------------- --------

Consolidated cash flow statement

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2022 2021 2022

GBP000 GBP000 GBP000

============================================================== ==============

Net cash outflow from operating activities (Note 4) (143) (2,968) (3,134)

Investing activities

Interest received 11 3 3

Purchases of property, plant and equipment (6) (6) (26)

Capitalisation of software development (109) (76) (259)

(Purchase)/disposal of investments (10) (20) (14)

============================================================== ============== ============== ==============

Net cash used in investing activities (114) (99) (296)

============================================================== ============== ============== ==============

Financing activities

Interest paid (43) (60) (157)

Cash (outflow)/inflow from borrowing - 860 500

Cash net outflow from debt factoring (967) - (366)

Cash outflow from Directors' loan (100) - -

Loan repayment - (385) (385)

Capital repayments of lease liabilities (15) (73) (153)

Interest paid on lease liabilities (6) (1) (7)

Proceeds on issue of shares - 3,151 5,177

Share issue costs - (174) (327)

-------------------------------------------------------------- -------------- -------------- --------------

Net cash from financing activities (1,131) 3,318 4,282

============================================================== ============== ============== ==============

Net (decrease)/increase in cash and cash equivalents (1,388) 251 852

Effects of exchange rate changes on cash and cash equivalents 66 - 14

Cash and cash equivalents at beginning of period 2,355 1,489 1,489

============================================================== ============== ============== ==============

Cash and cash equivalents at end of period 1,033 1,740 2,355

============================================================== ============== ============== ==============

Notes to the Accounts

1. Basis of Preparation

The interim financial statements are for the six months ended 30

September 2022. They do not include all the information required

for full annual financial statements and should be read in

conjunction with the consolidated financial statements of the Group

for the year ended 31 March 2022, which have been filed at

Companies House. The Group's auditor issued a report on those

financial statements that was unqualified and did not contain a

statement under section 498(2) or section 498(3) of the Companies

Act 2006, however, the auditor's report emphasized the uncertainty

around the Group's ability to continue as a going concern.

These interim financial statements have been prepared in

accordance with UK-adopted International Accounting Standards.

These financial statements have been prepared under the historical

cost convention.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 31 March 2022. The accounting

policies have been applied consistently throughout the group for

the purpose of preparation of these interim financial statements

and are expected to be followed throughout the year ending 31 March

2023.

2. Going Concern

To assess the ability of the Group to continue as a going

concern, the Directors have prepared a business plan and cash flow

forecast for the period to 31 March 2024 which, together, represent

the Directors' best estimate of the future development of the

Group. The forecast contains certain assumptions, the most

significant of which are the level and timing of sales and the

timing of customer payments. These detailed cashflow scenarios

include Letters of Credit which have been secured from the

customers against contracts recently won.

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

have been considered in depth as part of the Directors' assessment

of the Group's ability to continue as a going concern. The

Directors have reviewed detailed trading forecasts for H2 of FY23.

An upturn in business activities and revenue is expected during

this period, which will ensure the Group's ability to meet market

expectations for the full financial year. At 30 September 2022 the

Group had cash reserves of GBP1 million (31 March 2022: GBP2.4

million) and based on detailed cash flow provided to the Board to

31 March 2024, there is sufficient cash to see the Group through to

profitability based on its standard operating model. If a more

pessimistic scenario were taken and an assumption were taken that

no cash is received within the next twelve months from any new

orders not currently contracted, and that there were significant

delays to receipts from customers, there is a material uncertainty

relating to the Group's ability to continue as a going concern.

Should the Group experience such downside sensitivities the

directors would first continue to look at measures such as cost

reduction and working capital facilities as ways to conserve cash

within the business. The Company has offers of convertible and

secured loans which it could accept should such a requirement

arise.

To assist with working capital, one Director has extended a

short-term loan of GBP300,000. The Company received a R&D tax

credit of GBP585,000 from HMRC in October 2022 and have an advance

of GBP500,000 in place which is secured against its R&D tax

credit for FY23. The Group also completed a GBP0.5 million

subscription in October 2022.

Notwithstanding the material uncertainties described above,

which may cast significant doubt on the ability of the Group to

continue as a going concern, on the basis of sensitivities applied

to the cash flow forecast, the directors have a reasonable

expectation that the company can continue to meet its liabilities

as they fall due, for a period of at least 12 months from the date

of approval of this report.

3. Loss per Share

The calculation of the basic and diluted loss per share is based

on the following data:

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2022 2021 2022

====================================================================== ==============

Loss for the purposes of basic loss per share being net loss

attributable to equity holders

of the parent (GBP000) (2,114) (929) (871)

====================================================================== ============== ============== ==============

Weighted average number of ordinary shares for the purposes of basic

and diluted loss per

share 225,033,577 188,367,747 205,173,434

====================================================================== ============== ============== ==============

Loss per share (pence) (0.94) (0.49) (0.42)

====================================================================== ============== ============== ==============

The denominations used are the same as those detailed above for

both basic and diluted earnings per share from continuing

operations. However, in accordance with IAS 33 "Earnings Per

Share", potential ordinary shares are only considered dilutive when

their conversion would decrease the profit per share or increase

the loss per share from continuing operations attributable to the

equity shareholders.

4. Reconciliation of Operating Loss to Operating Cash Flows

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2022 2021 2022

GBP000 GBP000 GBP000

======================================================== ============================ ============== ==============

Operating loss for the period: (2,378) (1,204) (1,017)

Adjustments for:

Depreciation of property, plant and equipment 15 13 31

Amortisation of Intangible assets 214 210 432

Depreciation on right of use assets 14 73 153

Foreign exchange 334 (6) 20

Share issued in lieu of service/bonus 14 4 5

Share-option payment expense 100 70 363

-------------------------------------------------------- ---------------------------- -------------- --------------

Operating cash flows before movements in working capital (1,687) (840) (13)

(Increase)/decrease in inventories (796) (349) 52

Decrease/(increase) in receivables 2,410 (1,908) (2,054)

(Decrease)/increase in payables (2) (468) (1,568)

-------------------------------------------------------- ---------------------------- -------------- --------------

Cash reduced by operations (75) (3,565) (3,583)

Income taxes received/(paid) (68) 597 449

-------------------------------------------------------- ---------------------------- -------------- --------------

Net cash outflow from operating activities (143) (2,968) (3,134)

======================================================== ============================ ============== ==============

5. Interim Results

The Group's Interim Results report is available for download on

the Group's website. The report will not be posted to

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCBDDGBBDGDX

(END) Dow Jones Newswires

December 14, 2022 02:00 ET (07:00 GMT)

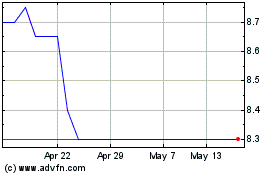

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024