TIDMCYAN

RNS Number : 6270I

CyanConnode Holdings PLC

15 December 2020

15 December 2020

CyanConnode Holdings plc

("CyanConnode" or the "Company")

Interim results for the six months ended 30 September 2020

CyanConnode (AIM: CYAN), a world leader in narrowband radio

frequency (RF) mesh networks, announces its interim results for the

six months ended 30 September 2020.

Financial and Operational Highlights

-- Revenue up 48% to GBP1.499m (H1 2019: GBP1.01m)

-- Gross profit up 74% to GBP831k (H1 2019: GBP477k)

-- LBITDA reduced by 55% to GBP1.317m (H1 2019: GBP2.909m)

-- GBP1.6 million cash received from customers during the period

-- Cash and cash equivalents at end of period GBP1m (H1 2019: GBP2.3m)

-- Order for 350,000 Omnimesh modules worth more than GBP6 million

-- Previously delayed Indian contract resumed worth INR 1

billion (c. GBP10.5m) with cash being received for the first 40,000

modules and a Letter of Credit securing remaining payments

-- Commencement of rollout of projects in India and Thailand

following easing of COVID-19 lockdowns

-- Continued rollout of Swedish projects

-- 92,000 modules shipped against current contracts during the period

Post-Period Highlights

-- The appointment of a new senior management team in India in December 2020

-- Significant increases of deliveries against existing

contracts in India and Thailand with the shipment of 121,000

modules since the end of September

-- Revenue in the eight months to the end of November 2020

exceeds revenue for the whole of the previous fifteen-month

financial period

-- Short-term working capital loan of GBP400,000 secured from

certain Directors in December 2020

John Cronin, CyanConnode Executive Chairman, commented:

"Despite most countries in which CyanConnode operates being in

lockdown for the first half of the period, between June and

September 2020 the Company saw a significant increase in the volume

of modules being shipped to customers and a significant increase in

cash collection as a result. The Board is very encouraged by the

success of all CyanConnode's deployments, and is especially pleased

to see the progress being made against contracts in India and

Thailand during the period.

"With the Government of India executing its plan to rollout 250

million meters in the next few years we were very pleased to

announce the appointment of a new senior management team, and look

forward to utilising their significant experience to take our

Indian business to the next stage of its development.

"The world continues to be affected by the COVID-19 pandemic and

the wellbeing and safety of our staff is paramount during these

unprecedented times. We continue to reassure our customers and

stakeholders that, as always, we are monitoring the situation and

working tirelessly to ensure that CyanConnode can continue to

deliver its products and services.

"Our teams continue to work closely with partners to demonstrate

the capability of our solution and to ensure that customers realise

the benefit of a fully automated smart metering system."

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation 596/2014

Enquiries:

CyanConnode Holdings plc Tel: +44 (0) 1223 225

060

John Cronin, Executive Chairman www.cyanconnode.com

Arden Partners Plc (Nomad and Broker) Tel: +44 (0) 20 7614

5900

Paul Shackleton / Dan Gee-Summons (Corporate

Finance)

Simon Johnson (Corporate Broking)

Yellow Jersey PR (Financial PR) Tel: +44(0) 20 3004 9512

Sarah Hollins/ Annabel Atkins cyanconnode@yellowjerseypr.com

About CyanConnode

CyanConnode (AIM:CYAN.L) is a world leader in Narrowband Radio

Frequency (RF) Smart Mesh Networks, which are used for machine to

machine (M2M) communication. As well as being self-forming and

self-healing, CyanConnode's RF Smart Mesh Networks are designed for

rapid deployment, whilst giving exceptional performance and

competitive total cost of ownership.

In June 2018, CyanConnode launched its award-winning Omnimesh

Advanced Metering Infrastructure (AMI) platform, which has already

gained considerable commercial traction, especially in India which

is a key market for the Company.

Through a Global partner eco-system, which is vendor agnostic,

CyanConnode has several routes to market, therefore it is well

positioned to capitalise upon increasing Global demand for smart

metering solutions.

For more information, please visit www.cyanconnode.com .

Chairman's Statement

Financial highlights

Key figures

Restated

H1 2020 H1 2019

GBP'000 GBP'000 % Change

Revenue 1,499 1,014 + 48%

========= ======== ==========

Gross profit 831 477 + 74%

========= ======== ==========

Operating costs (2,453) (3,621) -- 32%

========= ======== ==========

LBITDA * (1,317) (2,909) -- 55%

========= ======== ==========

Cash 952 2,288 -- 58%

========= ======== ==========

* Where "LBITDA" is Loss before Interest, Tax, Depreciation and

Amortisation. This is calculated by adding depreciation and

amortisation back to the Operating loss.

-- Revenue The first half-year of 2020/21 was marked by the

COVID-19 pandemic. Despite the lockdowns in most countries around

the world, CyanConnode was pleased to see revenue growth of almost

50% in the first six months of the financial year compared with the

first six months of 2019

-- Operating costs reduced by 32% (GBP1.2m) for the first six

months compared to the first six months of 2019. This was largely

due to reduction in staff costs, and travel costs reduced due to

the Covid-19 pandemic

-- LBITDA reduced by 55% (GBP1.6m) for the first six months

compared to the first six months of 2019

-- Basic and diluted loss per share improved by 53% from 1.64p

to 0.78p compared to the first six months of 2019

-- Cash and cash equivalent decreased from GBP2.3m in 30 June

2019 to GBP1.0m as at 30 September 2020

-- Accounts receivables a total of GBP1.6m cash has been

collected from customers during the period, and GBP0.75m since

period end

Operational Review

India

During the period, CyanConnode saw the deployment of its largest

order to date (430,000 modules) resume, and also announced the

winning of its second largest order to date (350,000 modules). This

order was for smart metering communications for the Indian

state-owned utility "Madhya Pradesh Paschim Kshetra Vidyut Vitaran

Company Ltd" ("MPWZ"), for smart metering communications in the

towns of Ujjain, Dewas, Ratlam, Mhow and Khargone.

MPWZ serves more than 3 million consumers and we have previously

announced and deployed two orders for this utility, totalling

120,000 modules. This latest order, which is the third order for

MPWZ, will increase the total number of its Omnimesh enabled smart

meters to 470,000. This is the first Indian order where the

Omnimesh Head End Server, ("HES"), will be deployed to communicate

with both RF Mesh and Cellular enabled smart meters.

Most of the order is being paid for under a CapEx model with the

balance of the order being paid for under an OpEx model with

Equated Monthly Instalments ("EMI"), over a five-year period. The

smart meters, which are being supplied by existing partners, will

be deployed over thirty months, with initial deliveries commencing

in Q3 2020. Installations of gateways and meters for this project

are now underway.

The value of orders currently being deployed by CyanConnode in

India is approximately INR 1.8 billion (c. GBP19m) and an update to

our order book for modules is set out in the table below. The

majority of the revenue for these orders is expected to be

recognised over the next two years, with payments secured against

LoCs.

Modules on order

Balance

Project Ordered Delivered* remaining

----------------- ------- ---------- ----------

JVVNL(1) 281,782 68,000 213,782

JVVNL(2) 149,089 52,000 97,089

Tangedco 142,069 34,000 108,069

MPWZ 350,000 6,000 344,000

Total 922,940 160,000 762,940

----------------- ------- ---------- ----------

*These include deliveries to the 14(th) of December just prior

to release of these interim results

During the first half of the current financial year there has

been a significant increase in activity in the Indian market as the

Government of India moves forward with its plan to deploy 250

million smart meters. The Government of India has issued a

framework for Advanced Metering Infrastructure Service Providers

("AMI SPs") to be set up to roll out and manage large scale

tenders. Under this framework, Special Purpose Vehicles ("SPVs")

will be set up to fund and run the projects. It is anticipated that

these large-scale projects will use 'Opex' models, where utilities

will pay the SPVs on a per meter per month basis.

Smart meters will help India develop a smart grid, reduce

consumer power outages, address challenges evolving from the energy

mix and improve billing efficiency. The deployment of these smart

meters is also expected to improve consumer energy efficiency and

the quality of networks and services.

The COVID-19 pandemic has caused global turmoil in financial and

commodity markets. The energy sector was also hit hard, with demand

dipping sharply as nearly one-third of the global population stayed

indoors during the lockdown. While the world concurrently deals

with the continued pandemic and the complexities of climate change,

it needs to plan for a clean and resilient recovery of the energy

sector. Smart metering presents exciting new opportunities for

energy companies and consumers alike, and will play an important

role in growing a low carbon energy sector. Considering COVID-19

social distancing guidelines and government regulations, or those

caused by any natural calamity where physical access is disrupted,

it is important to understand that smart metering supports remote

meter reading. This provides energy suppliers with the option to

connect (or disconnect) remotely, thus avoiding potential personal

conflict between a consumer and the energy supplier. It also

reduces the operational expenditure of the energy supplier, due to

manual meter reading and associated inefficiencies or manipulations

and eliminates physical activities, thereby helping to reduce the

energy supplier's carbon footprint.

APAC and Middle East

The smart metering market in the APAC and Middle East continues

to mature and presents a significant opportunity for

CyanConnode.

In December 2019, an order was received from its Agent and

Partner, The JST Group (JST), worth approximately GBP1.13 million.

The order included 33,000 Omnimesh RF Modules. The end customer is

Metropolitan Electricity Authority (MEA), a Thai state enterprise

under the Ministry of Interior. This order included an advance

payment of circa GBP0.3 million which was received in early January

2020. The purchase order relates to a smart metering deployment

which includes an Omnimesh Head End Server (HES). Under the

agreement CyanConnode is supplying hardware, HES and an Annual

Maintenance Contract (AMC). The AMC will deliver a recurring

revenue stream over an initial five-year period. Deliverables for

the integrated system, as well as hardware deliveries, commenced in

2020 and to the end of the period 15,000 modules had been shipped

to the customer. The remaining 18,000 modules have been shipped

since the end of the period. In total, an amount of USD [1.1

million] has been collected from the customer for the project.

In March 2020, a follow-on order from Thailand for 206,735

Omnimesh perpetual software licenses was received. The follow-on

order was place by Forth Corporation Public Company Limited (Forth)

with The JST Group (JST) acting as CyanConnode's Agent. The order

increased the total value of orders received for MEA to more than

USD 3 million. Under the contract, a payment of approximately USD

206,000, was made when the order was placed. The additional

Omnimesh software licenses will allow MEA to connect up to 240,000

smart meters to the Omnimesh HES, which will serve the Thai Smart

Metro Grid project. The order also includes an Annual Maintenance

Contract for the maintenance of the HES, providing a further

recurring revenue stream over an initial five-year period.

We are delighted to confirm that the project is progressing well

and our technology, (HES and Communications), is operating well

under Thai Radio Frequency ("RF") regulations. Installation in a

42-floor tower block is nearly complete and measurement of data

back to the Omnimesh HES is greater than 99% against the Service

Level Agreement.

Europe

In April 2019, a follow-on order worth GBP0.7m was received from

HM Power ("HMP"), for the smart metering of district heating and

power, which demonstrated the flexibility of CyanConnode's

standards-based Omnimesh products. The order also included the new

Omnimesh Long-Range RF Module that has a range of up to 12km, which

increases the resilience of the RF Smart Network in rural areas.

Delivery of the Omnimesh Long-Range RF Modules commenced in Q4 2019

and has continued throughout 2020 with more than 30,000 modules

(approximately one third of the contract) being delivered to the

customer during the period.

During 2019, the UK Government announced that it had extended

the deadline for the rollout of SMETS2 meters by four years to

2024. In early 2020 it extended this deadline by a further six

months because of the COVID-19 pandemic, which had stalled smart

meter installations due to lockdowns. The DCC aims to connect

around 53 million smart gas and electricity meters to its secure

network using SMETS2 meters and, in November 2020, it announced

that more than 5.9 million (circa 11% of the meter population) had

been connected, with October 2020 being its busiest month for

SMETS2 meter installations on record. The roll out of SMETS2 meters

commenced in Q4 2018 and, as previously announced, CyanConnode

believes that, for ease of rapid deployment, installers are

initially targeting installations of SMETS2 meters in densely

populated areas that have a reliable cellular signal. CyanConnode

believes that the installation of its RF technology will gain

momentum during later stages of the rollout.

Post period end developments

Since the end of September 2020, the Group has seen further

acceleration in the deployment of its projects, and is now shipping

larger numbers of modules than at any time in its history,

particularly in India against projects announced during the period.

A further 121,000 modules have been shipped since the end of

September, taking the total of modules shipped during the financial

year to 213,000. Revenue in the eight months to the end of November

has exceeded the revenue taken for the fifteen-month period ended

31 March 2020. Cash for these shipments is being collected either

by advance payment, or by LoCs.

In December 2020, the Company announced the appointment of a new

senior management team to head up its Indian operations.

Ajoy Rajani was appointed as Managing Director and Chief

Executive Officer India. Ajoy Rajani is a highly experienced and

well-regarded business leader within the Indian Power Sector and

also has a wealth of expertise in the Telecoms and IT Sectors. He

has held various senior positions with Reliance Communications and

Reliance Energy for the last sixteen years, also having held the

position of Senior Executive Vice President of Adani Energy Mumbai,

where he has driven technological innovation to increase revenues

to circa USD 100m.

Ratna Garapati joined CyanConnode as Chief Operating Officer

India and has over 25 years' experience in product development and

management, IT business operations management and strategic

planning and digital transformation. Ratna most recently held the

position of Vice President at Trilliant India, where he was

responsible for business development, strategy, and operations. His

key achievements at Trilliant India includes the winning and

implementation of multiple smart grid pilots and actively

participating in the implementation of over 5 million Smart Meters,

of which 1.3 million have been commissioned. Prior to Trilliant,

Ratna was Chief Delivery Officer of Smart Energy and Smart Cities

for Fluentgrid India, where he customised and deployed the world's

largest Cloud Utility Billing Solution in Uttar Pradesh for 22

million consumers in 6 months and demonstrated the scalability of

Meter Data Management System, (MDMS), for 10 million smart meters.

In his role as Chief Operating Officer India, he will be

responsible for managing CyanConnode India's operations and

customer delivery functions.

In addition, Atin Srivastava was appointed as Sales Director for

India. Having worked with Feedback Infra, Tech Mahindra, Ericsson,

HCL Infosystem, he has a recognised proficiency in leading business

development activities and spearheading sales and marketing

operations. Atin has deep expertise in the Indian power and energy

distribution market . He has built strong relationships with

agencies of the Indian central government including the Minister of

Power and Rural Electrification Corporation and has achieved more

than USD 100m in revenue this year.

At a Group level, Allan Baig was promoted to Group Chief

Operating Officer which is a non-Board role. Allan joined

CyanConnode in June 2017 and has thirty years' experience in

management and engineering with leading technology companies. Prior

to joining CyanConnode, he held the position of Project Manager at

Landis + Gyr and led their UK Smart Meter Implementation Program,

(UKSMIP). Alan was responsible for project management across

engineering functions, including product development, systems

integration, and deployment, predominantly for UKSMIP. As Group

Chief Operating Officer at CyanConnode, he will lead all operations

and engineering disciplines across teams in the UK and India.

In December 2020, the Company was also pleased to announce that

it had secured a GBP400,000 working capital facility from certain

Directors for working capital to fund growth.

COVID-19 Update

At the time of writing this report, the United Kingdom is out of

the second lockdown but is in a restricted tier system. CyanConnode

has considered the impact of COVID-19 on its business, including

first and foremost the wellbeing of employees, as well as contract

deliverables to customers and the management of cashflow, to ensure

the progression of its projects. Following advice issued by

National Governments, the Company has implemented a 'Home Working'

policy and employees continue to operate productively from their

homes.

In the UK, all engineering staff were provided with the

necessary equipment and the remote working model allows the

continuation of the Company's standard processes, with access to

development and test environments. By using video conferencing and

other remote meeting tools, CyanConnode's Project Management teams

continue to support customer projects, so that they remain on

track. CyanConnode's Engineering teams have the necessary equipment

at home, including hardware rigs, to allow collaboration with their

colleagues in different territories, to ensure customer deadlines

are met. CyanConnode's Manufacturing and Operations teams have been

working to secure the supply chain.

The engineering team's development work remains on track, thus

keeping deliverables aligned to the original project timelines.

When customers return to normal working practices the Company

expects to be on track and is ready for field work.

COVID-19 poses significant worldwide uncertainty. CyanConnode

has been working hard to tackle the risks and has implemented

policies to mitigate them, and put in place the most appropriate

measures to protect its business. CyanConnode is confident that it

has been effectively managing the challenges that COVID-19

presents.

CyanConnode is managing cash and costs and it expects to meet

its obligations as and when they fall due and GBP0.75 million of

cash has been received from customers since the period end.

Consolidated Income Statement

Restated**

Unaudited Unaudited

Note 6 months 6 months to 15 Months to

to 30 June 31 March

30 2019 2020

September GBP000 GBP000

2020

GBP000

============================ ===== ========== ======================= =========================================

Continuing operations

Revenue 1,499 1,014 2,451

Cost of sales (668) (537) (1,081)

============================ ===== ========== ======================= =========================================

Gross profit 831 477 1,370

============================ ===== ========== ======================= =========================================

Other operating costs (2,148) (3,386) (6,827)

Amortisation / depreciation (305) (235) (773)

============================ ===== ========== ======================= =========================================

Total operating costs (2,453) (3,621) (7,600)

============================ ===== ========== ======================= =========================================

Operating loss (1,622) (3,144) (6,230)

Investment income 1 10 17

Finance costs (102) (2) (30)

============================ ===== ========== ======================= =========================================

Loss before tax (1,723) (3,136) (6,243)

Tax credit 377 300 576

---------------------------- ----- ---------- ----------------------- -----------------------------------------

Loss for the period (1,346) (2,836) (5,667)

============================ ===== ========== ======================= =========================================

Loss per share (pence)

Basic 3 (0.78) (1.64) (3.27)

Diluted 3 (0.78) (1.64) (3.27)

============================ ===== ========== ======================= =========================================

** The comparatives for the 6 months to 30 June 2019 have been

restated to include a share-based payment charge of GBP107,000.

Consolidated statement of comprehensive income

Derived from continuing operations and attributable to the

equity owners of the Company

Restated

Unaudited Unaudited

6 months to 6 months to 15 months to

30 September 30 June 31 March

2020 2019 2020

GBP000 GBP000 GBP000

=============================================================== ============== ============ ==============

Loss for the period (1,346) (2,836) (5,667)

Items that may be reclassified subsequently to profit and loss

Exchange differences on translation of foreign operations 131 123 56

=============================================================== ============== ============ ==============

Total comprehensive income for the year (1,215) (2,713) (5,611)

=============================================================== ============== ============ ==============

Consolidated statement of Financial Position

As at Unaudited

30 September 31 March

2020 2020

GBP000 GBP000

======================================= ==================

Non-current assets

Intangible assets 4,365 4,558

Goodwill 1,930 1,930

Fixed asset investments 91 93

Property, plant and equipment 41 43

Right of use asset 196 274

--------------------------------------- ------------------ ----------

Total non-current assets 6,623 6,898

======================================= ================== ==========

Current assets

Inventories 304 308

Trade and other receivables 3,863 3,676

Cash and cash equivalents 952 1,172

======================================= ================== ==========

Total current assets 5,119 5,156

======================================= ================== ==========

Total assets 11,742 12,054

======================================= ================== ==========

Current liabilities

Short term borrowing (785) (560)

Trade and other payables (2,157) (1,491)

Lease liability (131) (121)

--------------------------------------- ------------------ ----------

Total current liabilities (3,073) (2,172)

======================================= ================== ==========

Net current assets 2,046 2,984

======================================= ================== ==========

Non-current liabilities

Lease liability (65) (153)

Deferred tax liability (853) (912)

--------------------------------------- ------------------ ----------

Total non-current liabilities (918) (1,065)

--------------------------------------- ------------------ ----------

Total liabilities (3,991) (3,237)

======================================= ================== ==========

Net assets 7,751 8,817

======================================= ================== ==========

Equity

Share capital 3,666 3,656

Share premium account 69,556 69,547

Own shares held (3,253) (3,253)

Share option reserve 2,158 2,028

Translation reserve 111 (20)

Retained losses (64,487) (63,141)

======================================= ================== ==========

Total equity being equity attributable

to

owners of the Company 7,751 8,817

======================================= ================== ==========

Consolidated statement of changes in equity

Share Own Shares Restated

Premium Held Share

Share Account GBP000 Option Translation Retained Total

Capital GBP000 Reserve Reserve Losses Equity

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Balance at 1 January

2019 3,648 69,515 (3,253) 1,761 (76) (57,474) 14,121

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Loss for the period - - - - - (2,836) (2,836)

Other comprehensive

income for the

period - - - - 123 - 123

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Total comprehensive

income for

The period - - - - 123 (2,836) (2,713)

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Issue of share capital - - - - - - -

Credit to equity for

share options - - - 107 - - 107

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Total transactions

with owners - - - 107 - - 107

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Balance at 30 June

2019 3,648 69,515 (3,253) 1,868 47 (60,310) 11,515

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Loss for the period - - - - - (2,831) (2,831)

Other comprehensive

income for the period - - - - (67) - (67)

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Total comprehensive

income for the period - - - - (67) (2,831) (2,898)

Issue of share capital 8 32 - - - - 40

Credit to equity for

share options - - - 160 - - 160

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Total transactions

with owners 8 32 - 160 - - 200

---------

Balance at 31 March

2020 3,656 69,547 (3,253) 2,028 (20) (63,141) 8,817

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Loss for the period - - - - - (1,346) (1,346)

Other comprehensive

income for the period - - - - 131 - 131

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Total comprehensive

income for the period - - - - 131 (1,346) (1,215)

Issue of share capital 10 9 - - - - 19

Credit to equity for

share options - - - 130 - - 130

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Total transactions

with owners 10 9 - 130 - - 149

---------

Balance at 30 September

2020 3,666 69,556 (3,253) 2,158 111 (64,487) 7,751

------------------------ --------- ---------- ------------- ----------- -------------------- --------- --------

Consolidated cash flow statement

Unaudited Unaudited

6 months to 6 months to 15 months to

30 September 30 June 31 March

2020 2019 2020

GBP000 GBP000 GBP000

----------------------------------------------------- --------------- -------------- ---------------

Net cash outflow from operating activities (Note 4) (375) (2,211) (3,677)

----------------------------------------------------- --------------- -------------- ---------------

Investing activities

Interest received 1 10 17

Purchases of property, plant and equipment (11) (18) (20)

Capitalisation of software development (20) - (36)

Disposal of investments - (55) (49)

----------------------------------------------------- --------------- -------------- ---------------

Net cash used in investing activities (30) (63) (88)

----------------------------------------------------- --------------- -------------- ---------------

Financing activities

Interest paid (24) (2) (4)

Capital repayments of lease liability (33) - (197)

Cash inflow from borrowing 225 - 560

Interest paid on lease liabilities (3) - (26)

Proceeds on issue of shares 20 - 40

----------------------------------------------------- --------------- -------------- ---------------

Net cash from financing activities 185 (2) 373

----------------------------------------------------- --------------- -------------- ---------------

Net decrease in cash and cash equivalents (220) (2,276) (3,392)

Cash and cash equivalents at beginning of period 1,172 4,564 4,564

----------------------------------------------------- --------------- -------------- ---------------

Cash and cash equivalents at end of period 952 2,288 1,172

----------------------------------------------------- --------------- -------------- ---------------

Notes to the Accounts

1. Basis of Preparation

The interim financial information has been prepared in

accordance with the IFRS accounting policies used in the statutory

financial statements for the period ended 31 March 2020.

These interim financial statements do not constitute statutory

financial statements within the meaning of section 435 of the

Companies Act 2006. Results for the six-month period ended 30

September 2020 have not been audited. The results for the financial

period ended 31 March 2020 have been extracted from the statutory

financial statements of CyanConnode Holdings plc.

Statutory financial statements for the period ended 31 March

2020 are available on the Group's website www.cyanconnode.com and

have been filed with the Registrar of Companies. The Group's

auditor issued a report on those financial statements that was

unqualified and did not contain a statement under section 498(2) or

section 498(3) of the Companies Act 2006; however, the auditor's

report emphasised the uncertainty around the Group's ability to

continue as a going concern.

2. Going Concern

To assess the ability of the Group to continue as a going

concern, the Directors have prepared a business plan and cash flow

forecast for the period to 31 March 2022 which, together, represent

the Directors' best estimate of the future development of the

Group. The forecast contains certain assumptions, the most

significant of which are the level and timing of sales and the

timing of customer payments. These detailed cashflow scenarios

include LoCs which have been secured from the customers against

contracts recently won. Cash has been received regularly against

these LoCs.

At 30 September 2020 the Group had cash reserves of GBP1 million

(31 March 2020: GBP1.1 million) and based on the detailed cash flow

provided to the Board within the FY2021/22 budget, there is

sufficient cash to see the Group through to profitability based on

its standard operating model. If a more pessimistic scenario were

taken and an assumption were taken that no cash is received within

the next twelve months from any new orders not currently

contracted, and that there were significant delays to receipts from

customers, there is a material uncertainty relating to the Group's

ability to continue as a going concern. Should the Group experience

such downside sensitivities the directors would first continue to

look at measures such as further cost reduction and working capital

facilities as ways to conserve cash within the business. The

Company has offers of convertible and secured loans which it could

accept should such a requirement arise.

In addition, during 2020 the COVID-19 pandemic has affected the

global economy and businesses around the world, particularly during

the lockdowns in each country. At the time of writing this report,

the effects continue to be seen.

To assist with working capital during this period of growth, the

Company accepted a loan of GBP400,000 from certain Directors in

December 2020.

Notwithstanding the material uncertainties described above, on

the basis of sensitivities applied to the cash flow forecast, the

directors have a reasonable expectation that the company can

continue to meet its liabilities as they fall due, for a period of

at least 12 months from the date of approval of this report.

3. Loss per Share

The calculation of the basic and diluted loss per share is based

on the following data:

Restated

Unaudited Unaudited

6 months to 6 months to 15 months to

30 September 30 June 31 March

2020 2019 2020

======================================================================= ==============

Loss for the purposes of basic loss per share being net loss

attributable to equity holders

of the parent (GBP000) (1,346) (2,836) (5,667)

======================================================================= ============== ============= ==============

Weighted average number of ordinary shares for the purposes of basic

and diluted loss per

share 173,548,480 172,931,267 173,047,934

======================================================================= ============== ============= ==============

Loss per share (pence)*** (0.78) (1.64) (3.27)

======================================================================= ============== ============= ==============

The weighted average number of shares and the loss for the

period for the purposes of calculating diluted loss per share are

the same as for the basic loss per share calculation. This is

because the outstanding share options would have the effect of

reducing the loss per share and would not, therefore, be dilutive

under the terms of IAS 33.

*** Loss per share for the unaudited 6 months to 30 June 2019

has been restated to exclude own shares held.

4. Reconciliation of Operating Loss to Operating Cash Flows

Restated

Unaudited Unaudited

6 months 6 months to 15 months to

30 September 2020 30 June 31 March

GBP000 2019 2020

GBP000 GBP000

--------------------------------- ---------------------------- ------------------------------------ ---------------

Operating loss for the period: (1,622) (3,144) (6,230)

Adjustments for:

Depreciation of property, plant

and equipment 95 25 247

Amortisation of Intangible

assets 210 210 526

Foreign exchange 71 115 59

Share-option payment expense 130 107 267

--------------------------------- ---------------------------- ------------------------------------ ---------------

Operating cash flows before

movements in working capital (1,116) (2,687) (5,131)

Decrease/(increase) in

inventories 4 25 11

(Increase)/decrease in

receivables (79) 940 (1,124)

Increase/(decrease) in payables 666 (489) (503)

--------------------------------- ---------------------------- ------------------------------------ ---------------

Cash reduced by operations (525) (2,211) (4,499)

Income taxes received 150 - 822

--------------------------------- ---------------------------- ------------------------------------ ---------------

Net cash outflow from operating

activities (375) (2,211) (3,677)

--------------------------------- ---------------------------- ------------------------------------ ---------------

5. Interim Results

The Group's Interim Results report is available for download on

the Group's website. The report will not be posted to

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZLLFBLLEFBL

(END) Dow Jones Newswires

December 15, 2020 02:00 ET (07:00 GMT)

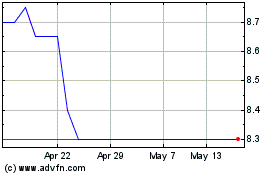

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024