TIDMCYAN

RNS Number : 1193L

CyanConnode Holdings PLC

04 September 2019

CyanConnode Holdings plc

("CyanConnode" or the "Company")

Interim results for the six months ended 30 June 2019

CyanConnode (AIM: CYAN), a world leader in narrowband radio

frequency (RF) mesh networks, announces its interim results for the

six months ended 30 June 2019.

Financial Highlights

-- Revenue of GBP1.0 million (H1 2018 restated: GBP1.3 million)

-- Operating costs reduced by GBP1.1 million to GBP3.5 million (H1 2018: GBP4.6 million)

-- Operating losses reduced by 16% to GBP3.0 million (H1 2018 restated: GBP3.6 million)

-- Basic and diluted loss per share improved by 57% to 1.50p

from 3.50 p loss per share in H1 2018

-- Cash, cash equivalents and investments at 30 June 2019 was

GBP2.4 million (H1 2018: GBP2.8 million; FY 2018 GBP4.6 million).

R&D tax credits of GBP0.8 million to be received bringing total

cash available to GBP3.2 million

-- Approximately GBP2 million cash collected from debtors during the period

Operational Highlights

-- GBP0.7 million follow-on order secured from HM Power to supply several Swedish utilities

-- GBP0.4 million follow-on order from Larsen & Toubro

("L&T"), relating to the order announced in May 2018

-- New order from new strategic partner, an Indian state-owned

Utility for deployment of 3,000 smart meter modules, which utilise

a hybrid radio frequency ("RF") Smart Mesh and cellular

communication network

-- New long-range (up to 12 kms) RF module developed

-- UK Smart Metering programme ("UK SMIP") gaining momentum

-- Chris Jones and Peter Tyler appointed Non-Executive Directors in March 2019

Post Period Highlights

-- Follow-on order for 4,050 modules secured from Genus Power

Infrastructures Ltd ("Genus") for deployment to Uttar Gujarat Vij

Company Ltd ("UGVCL")

-- GBP0.2 million order from Toshiba Information Systems (UK)

Ltd ("Toshiba") for service enhancements relating to the UK SMIP

contract

-- Follow-on order received from existing partner for legacy

hardware and software for a Nordic Utility

-- Memorandum of Understanding signed with Hexing Electrical Co.

Ltd ("Hexing") to expand geographical reach and introduce products

and services to new customers

John Cronin, CyanConnode Executive Chairman, commented:

"Whilst we have made good progress during H1 2019, securing a

number of follow-on orders in India and Europe, the Indian General

Election had an impact upon the number of new tenders awarded

during the period owing to a prohibition on Government departments

awarding contracts during the elections. After the result was

announced in May 2019, business activity started to resume in India

and we expect to report significantly higher revenues for H2 2019,

than that reported for H1 2019. The demand from India remains

strong and to the extent that orders have been delayed, other

orders from the rest of the world, which had not been anticipated

at the beginning of the year, will be recognised in the period. We

are currently working on a large number of tenders which we believe

will result in substantial new contract wins for the Company by end

of October and accordingly we anticipate that the outcome for the

year will be in line with Market Expectations."

Enquiries:

CyanConnode Holdings plc Tel: +44 (0) 1223 225

060

John Cronin, Executive Chairman www.cyanconnode.com

Arden Partners Plc (Nomad and Broker) Tel: +44 (0) 20 7614

5900

Paul Shackleton / Dan Gee-Summons (Corporate

Finance)

Simon Johnson (Corporate Broking)

Yellow Jersey PR (Financial PR) Tel: +44(0) 20 3004 9512

Felicity Winkles / Sarah Hollins/ Annabel cyanconnode@yellowjerseypr.com

Atkins

About CyanConnode

CyanConnode (AIM:CYAN.L), is a world leader in Narrowband

Radio Frequency (RF) Smart Mesh Networks, which are used for

machine to machine (M2M) communication. As well as being self-forming

and self-healing, CyanConnode's RF Smart Mesh Networks are

designed for rapid deployment, whilst giving exceptional performance

and competitive total cost of ownership.

In June 2018, CyanConnode launched its award-winning Omnimesh

Advanced Metering Infrastructure (AMI) platform, which has

already gained considerable commercial traction, especially

in India which is a key market for the Company.

Through a Global partner eco-system, which is vendor agnostic,

CyanConnode has several routes to market, therefore it is

well positioned to capitalise upon increasing Global demand

for smart metering solutions.

For more information, please visit www.cyanconnode.com.

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation 596/2014.

Operational Review

India

In February 2019, CyanConnode announced a follow-on order from

Larsen & Toubro ("L&T"), worth approximately GBP0.4m. The

follow-on order relates to the order announced in May 2018, worth

GBP2.5m. Deployment has progressed rapidly and already showing

benefits of the Omnimesh solution to the Utility. All the modules

were delivered in H1 2019 and revenue recognised during the period.

The full contract is being rolled out over a period of up to two

years, followed by a five-year support and maintenance period.

In April 2019, CyanConnode announced an order from a new

partner, an Indian state-owned Utility, for the deployment of 3,000

smart meter modules, which utilise a hybrid RF Smart Mesh and

cellular communication network. All hardware was delivered to the

new end customer, an Indian State-owned Utility, and revenue

recognised in H1 2019.

In July 2019, a follow-on order for 4,050 modules was secured

from Genus for deployment to UGVCL.

Europe

In April 2019, CyanConnode announced a GBP0.7m follow-on order

from HM Power ("HMP") to several Swedish Utilities. The order

leverages the functionality of CyanConnode's standards-based

Omnimesh Advanced Metering Infrastructure ("AMI") platform, for the

smart metering of district heating, as well as electricity. The

Company is also supplying HMP with a new product, long-range RF

communication modules, (modules with a range of up to 12km), to

increase the resilience of the RF Smart Network in rural areas.

Delivery of these modules is expected to commence in Q4 2019.

In July 2019 CyanConnode received a follow-on order from Toshiba

worth approximately GBP0.2 million for service enhancements

relating to the UK SMIP, which it expects to recognise as revenue

in H2 2019.

Additionally, in July 2019, CyanConnode secured a follow-on

Nordic order worth EUR489,000. The order, for legacy CyanConnode

hardware and software, is from an existing Partner and the end

customer is a Nordic Utility, who is expanding an existing smart

metering deployment. The Company expects to recognise 50% of the

revenues for this follow-on order in 2019 and 50% in 2020.

In September 2019 the DCC confirmed that more than 1.8 million

SMETS2 meters were connected to its secure network. CyanConnode

believes that its UK Smart Metering Implementation Programme ("UK

SMIP") contract will ultimately deliver revenue of circa GBP25.7m.

CyanConnode believes that the UK SMIP rollout will start to deliver

revenues in 2020.

APAC and Middle East

The smart metering market in the APAC and Middle East continues

to mature and presents a significant opportunity for

CyanConnode.

In January 2019, members of the Company's engineering team

visited Beijing Jingyibeifang Instruments Co Ltd ("Beijing

Instruments"), a Chinese partner with a license to manufacture

CyanConnode's RF modules and gateways. The team, led by Allan Baig

(VP Engineering & Operations), visited Beijing Instruments to

develop the project plan, establish peer-to-peer relationships and

provide the hardware design and manufacturing information to enable

Beijing Instruments to set up the production line for manufacturing

in H2 2019. We are at the Firmware testing stage, the stage after

will see Beijing Instruments find customer projects.

In August 2019, the Company signed a Memorandum of Understanding

(MoU) with Hexing Electrical Co. Ltd ("Hexing") to explore the

possibilities of collaborating and delivering smart metering

solutions in certain territories. It is expected that as part of

the collaboration, Hexing will integrate CyanConnode's RF Modules

with its meters and CyanConnode's Omnimesh Advanced Metering

Infrastructure (AMI) platform with Hexing's Meter Data Management

System (MDMS), to create a cost-effective turnkey solution.

Due to geopolitical factors, which have accelerated in recent

months, the Company has removed from its order pipeline an Iranian

order from Micromodje, for a smart metering contract that was

announced in February 2016. The customer has not cancelled this

contract, however the Company felt it prudent to remove the order

as a result of the political tensions.

Capital

Whilst there are currently no plans to raise further capital

from investors, several avenues are being pursued to secure working

capital facilities, should it become necessary to ease cash flows

and or mitigate against any unforeseen delays in deliveries or

customer payments.

Board and senior management changes

Harry Berry and Paul Ratcliff stepped down from the Board during

the period, and two new Non-Executive Directors, Chris Jones and

Peter Tyler, were appointed.

There were also changes to senior management with the promotion

of Heather Peacock to Chief Financial Officer, Anil Daulani to

Chief Executive Officer & Managing Director of India, and Allan

Baig to Vice President Engineering & Operations.

Financial Review

Revenue for the six months ended 30 June 2019 was GBP1.0 million

(H1 2018 restated: GBP1.3 million). This decrease in revenue,

compared to the same period in the prior year, was expected as the

General Election in India delayed the roll-out of one of the

Group's major projects with Genus, and the General Election also

caused delays in awarding of new contracts during the period. The

reason for the restating of the H1 2018 revenue was as a result of

the adjustment made to revenue during the 2018 audit and related to

software revenue to be spread over the period of the contract

rather than recognised up front.

The operating loss for the period was GBP3.0 million (H1 2018

restated: GBP3.6 million) and net loss after tax was GBP2.7 million

(H1 2018: GBP3.4 million). Staff costs (including contractors) were

GBP2.3 million (H1 2018: GBP3.1 million) with headcount remaining

stable at December 2018 levels.

In the first six months of 2019 cash used by operations was

GBP2.2 million (H1 2018: GBP4.1 million) (see note 4). Cash

received from debtors during H1 2019 was GBP2.0 million (H1 2018:

GBP0.9 million). Net cash, cash equivalents and investment as at 30

June 2019 was GBP2.4 million (H1 2018: GBP2.8 million) with GBP0.8

million expected from HMRC for R&D tax credits during Q3 2019.

Investments within the GBP2.4 million totalled GBP0.1 million.

Outlook

Following the re-election of Narendra Modi as Indian Prime

Minister as a result of the recent Indian General Election,

CyanConnode expects to see a material acceleration of the Indian

Smart Meters National Programme. The Company is working on several

large tenders, both in India and the rest of the world, which the

Board believes will result in significant new orders in H2 2019

which the Company hope to announce before the end of October

2019.

Consolidated income statement

Restated*

Unaudited Unaudited

6 months to 6 months to 12 months to

Note 30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

============================ ====== ============= ============ ==============

Continuing operations

Revenue 3 1,014 1,344 4,465

Cost of sales (537) (342) (1,724)

============================ ====== ============= ============ ==============

Gross profit 477 1,002 2,741

============================ ====== ============= ============ ==============

Other operating costs (3,279) (4,373) (8,589)

Amortisation / depreciation (235) (238) (472)

============================ ====== ============= ============ ==============

Total operating costs (3,514) (4,611) (9,061)

============================ ====== ============= ============ ==============

Operating loss (3,037) (3,609) (6,320)

Investment income 10 6 13

Finance costs (2) (1) (2)

============================ ====== ============= ============ ==============

Loss before tax (3,029) (3,604) (6,309)

Tax credit 300 250 927

============================ ====== ============= ============ ==============

Loss for the period (2,729) (3,354) (5,382)

============================ ====== ============= ============ ==============

Loss per share (pence)

Basic 4 (1.50) (3.50) (4.26)

Diluted 4 (1.50) (3.50) (4.26)

============================ ====== ============= ============ ==============

* Results for the six months ended 30 June 2018 have been

restated. Please see Note 3 for further information.

Consolidated statement of comprehensive income

Derived from continuing operations and attributable to the

equity owners of the Company

Restated

Unaudited Unaudited

6 months to 6 months to 12 months to

30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

=============================================================== ============= ============ ==============

Loss for the period (2,729) (3,354) (5,382)

Items that may be reclassified subsequently to profit and loss

Exchange differences on translation of foreign operations 123 - 54

=============================================================== ============= ============ ==============

Total comprehensive income for the period (2,606) (3,354) (5,328)

=============================================================== ============= ============ ==============

* Results for the six months ended 30 June 2018 have been

restated. Please see Note 3 for further information.

Consolidated statement of Financial Position

Restated

As at Unaudited Unaudited

30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

========================================== ===========

Non-current assets

Intangible assets 4,846 5,259 5,048

Goodwill 1,930 1,930 1,930

Investments 99 43 44

Property, plant and equipment 66 57 73

========================================== =========== ========== =============

Total non-current assets 6,941 7,289 7,095

Current assets

Inventories 294 1,138 319

Trade and other receivables (Note 3) 4,187 2,358 4,827

Cash and cash equivalents 2,288 2,753 4,564

========================================== =========== ========== =============

Total current assets 6,769 6,249 9,710

========================================== =========== ========== =============

Total assets 13,710 13,538 16,805

========================================== =========== ========== =============

Current liabilities

Trade and other payables (1,505) (1,984) (1,994)

========================================== =========== ========== =============

Total current liabilities (1,505) (1,984) (1,994)

========================================== =========== ========== =============

Net current assets 5,264 4,265 7,716

========================================== =========== ========== =============

Non-current liabilities

Deferred tax liability (690) (859) (690)

========================================== =========== ========== =============

Total non-current liabilities (690) (859) (690)

Total liabilities (2,195) (2,843) (2,684)

========================================== =========== ========== =============

Net assets 11,515 10,695 14,121

========================================== =========== ========== =============

Equity

Share capital 3,648 2,571 3,648

Share premium account 69,515 65,637 69,515

Own shares held (3,253) (3,253) (3,253)

Share option reserve 1,761 1,316 1,761

Translation reserve 47 (130) (76)

Retained losses (60,203) (55,446) (57,474)

========================================== =========== ========== =============

Total equity being equity attributable to

owners of the Company 11,515 10,695 14,121

========================================== =========== ========== =============

* Results for the six months ended 30 June 2018 have been

restated. Please see Note 3 for further information.

Consolidated statement of changes in equity

Own Share Restated* Restated*

Share Share Shares Option Translation Retained Total

Capital Premium Held Reserve Reserve Losses Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------- --------- --------- -------- --------- ------------ ---------- ----------

Balance at

30 June 2018 2,571 65,637 (3,253) 1,316 (130) (55,446) 10,695

--------------------- --------- --------- -------- --------- ------------ ---------- ----------

Restated

loss for

the period - - - - - (2,028) (2,028)

Other comprehensive

income for

the period - - - - 54 - 54

--------------------- --------- --------- -------- --------- ------------ ---------- ----------

Total comprehensive

income for

the year - - - - 54 (2,028) (1,974)

Issue of

share capital 1,077 3,878 - - - - 4,955

Credit to

equity for

share options - - - 445 - - 445

--------------------- --------- --------- -------- --------- ------------ ---------- ----------

Balance at

31 December

2018 3,648 69,515 (3,253) 1,761 (76) (57,474) 14,121

--------------------- --------- --------- -------- --------- ------------ ---------- ----------

Loss for

the period - - - - - (2,729) (2,729)

Other comprehensive

income for

the period - - - - 123 - 123

--------------------- --------- --------- -------- --------- ------------ ---------- ----------

Total comprehensive

income for

the period - - - - 123 (2,729) (2,606)

Balance at

30 June

2019 3,648 69,515 (3,253) 1,761 47 (60,203) 11,515

--------------------- --------- --------- -------- --------- ------------ ---------- ----------

* Results for the six months ended 30 June 2018 have been

restated. Please see Note 3 for further information.

Consolidated cashflow statement

Unaudited Unaudited

6 months to 6 months to 12 months to

30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

===================================================== ============

Net cash outflow from operating activities (Note 4) (2,211) (2,734) (5,843)

Investing activities

Interest received 10 7 13

Purchases or property, plant and equipment (18) (2) (41)

Disposal/(purchase) of investments (55) 5 4

===================================================== ============ ============ ==============

Net cash used in investing activities (63) 10 (24)

===================================================== ============ ============ ==============

Financing activities

Interest paid (2) (1) (2)

Proceed on issue of shares - 84 5,467

Share issue costs - - (428)

===================================================== ============ ============ ==============

Net cash from financing activities (2) 83 5,037

===================================================== ============ ============ ==============

Net (decrease)/increase in cash and cash equivalents (2,276) (2,641) (830)

Cash and cash equivalents at beginning of period 4,564 5,394 5,394

===================================================== ============ ============ ==============

Cash and cash equivalents at end of period 2,288 2,753 4,564

===================================================== ============ ============ ==============

Notes to the Accounts

1. Basis of Preparation

The interim financial information has been prepared in

accordance with the IFRS accounting policies used in the statutory

financial statements for the year ended 31 December 2018.

These interim financial statements do not constitute statutory

financial statements within the meaning of section 435 of the

Companies Act 2006. Results for the six-month periods ended 30 June

2019 and 30 June 2018 have not been audited. The results for the

year ended 31 December 2018 have been extracted from the statutory

financial statements of CyanConnode Holdings plc.

Statutory financial statements for the year ended 31 December

2018 are available on the Group's website www.cyanconnode.com and

have been filed with the Registrar of Companies. The Group's

auditor issued a report on those financial statements that was

unqualified and did not contain a statement under section 498(2) or

section 498(3) of the Companies Act 2006; however the auditor's

report emphasised the uncertainty around the Group's ability to

continue as a going concern.

2. Going Concern

To assess the ability of the Group to continue as a going

concern, the Directors have prepared a business plan and cash flow

forecast for the period to 31 December 2020 which together

represent the Directors' best estimate of the future development of

the Group. The forecast contains certain assumptions, the most

significant of which are the level and timing of customer receipts.

The Directors believe that the Group will be able to meet their

liabilities as they fall due for at least 12 months and that no

equity funding will be required in the Company, however they have

highlighted the risks that the Group continues to face below.

The Group trades in emerging country markets. Such markets have

an inherent level of uncertainty associated with them and this may

result in the predicted level of sales not being achieved, and/or

the timing of customer receipts being delayed. The Directors have

taken reasonable steps to satisfy themselves about the robustness

of their forecasts but acknowledge that the collection of customer

receipts in the Group's target markets can take longer than

expected. This may impact the timing of the Group's ability to

generate positive cash flow. There is also a risk that the level of

sales achieved is lower than the forecast or may be delayed.

There is a level of uncertainty related to the assumptions

described above which may cast doubt on the Group and Company's

ability to continue as a going concern and, therefore, it may be

unable to realise its assets and discharge its liabilities in the

normal course of business. The financial statements do not include

the adjustments that would result if the Group or Company was

unable to continue as a going concern. In the event the Group and

Company ceased to be a going concern, the adjustments would include

writing down the carrying value of assets, including stocks, to

their recoverable amount and providing for any further liabilities

that might arise.

Notwithstanding the uncertainties described above, on the basis

of sensitivities applied to the cash flow forecast, of contracted

sales orders which are currently being delivered to customers on

further orders which the Group expects to win, the Directors have a

reasonable expectation that the Company and Group can continue to

meet its liabilities as they fall due, for a period of at least

twelve months from the date of approval of this report.

3. Restatement of prior year

The Company's initial assessment of a contract under IFRS 15 as

at 30 June 2018 resulted in GBP293,000 of revenue being recognised

for software licenses in its prior year interim accounts. However,

the Company's subsequent reassessment of the adoption of this new

standard resulted in this revenue being reversed out in its full

year results to 31 December 2018. In order to allow a like-for-like

comparison, the Company has restated its prior year interim results

to exclude this anomaly.

Previously

Restated reported

unaudited unaudited

6 months to 6 months to

30 June 30 June

2018 2018

=======================================

Revenue GBP000 1,344 1,637

======================================== ============= =============

Operating Loss GBP000 3,609 3,316

======================================== ============= =============

Loss for the period GBP000 3,354 3,061

======================================== ============= =============

Trade and other receivables GBP000 2,358 2,651

======================================== ============= =============

Retained losses at 30 June 2018 GBP000 55,446 55,153

======================================== ============= =============

Loss per share (pence) (3.50) (3.19)

======================================== ============= =============

4. Loss per Share

The calculation of the basic and diluted loss per share is based

on the following data:

Restated*

Unaudited Unaudited

6 months to 6 months to 12 months to

30 June 30 June 31 December

2019 2018 2018

========================================================================= =============

Loss for the purposes of basic loss per share being net loss attributable

to equity holders

of the parent (GBP000) (2,729) (3,354) (5,382)

========================================================================= ============= ============ ==============

Weighted average number of ordinary shares for the purposes of basic and

diluted loss per

share 182,398,523 95,907,867 126,443,036

========================================================================= ============= ============ ==============

Loss per share (pence) (1.50) (3.50) (4.26)

========================================================================= ============= ============ ==============

* Results for the six months ended 30 June 2018 have been

restated. Please see Note 3 for further information.

The denominations used are the same as those detailed above for

both basic and diluted earnings per share from continuing

operations. However, in accordance with IAS 33 "Earnings Per

Share", potential ordinary shares are only considered dilutive when

their conversion would decrease the profit per share or increase

the loss per share from continuing operations attributable to the

equity shareholders.

5. Reconciliation of Operating Loss to Operating Cash Flows

Restated*

Unaudited Unaudited

6 months to 6 months to 12 months to

30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

========================================================= ============= ============ ==============

Operating loss for the period: (3,037) (3,609) (6,320)

Adjustments for:

Depreciation of property, plant and equipment 25 27 51

Amortisation of Intangible assets 210 210 421

Impairment of stock 4 - 578

Provision for expected credit losses (27) - 64

Foreign exchange 115 - 55

Share-option payment expense - - 445

--------------------------------------------------------- ------------- ------------ --------------

Operating cash flows before movements in working capital (2,710) (3,372) (4,706)

Decrease/(increase) in inventories 21 (10) 231

Decrease/(increase) in receivables 967 (410) (2,441)

(Decrease)/increase in payables (489) (264) (253)

--------------------------------------------------------- ------------- ------------ --------------

Cash reduced by operations (2,211) (4,056) (7,169)

Income taxes received - 1,322 1,326

========================================================= ============= ============ ==============

Net cash outflow from operating activities (2,211) (2,734) (5,843)

========================================================= ============= ============ ==============

* Results for the six months ended 30 June 2018 have been

restated. Please see Note 3 for further information.

6. Interim Results

The Group's Interim Results report is available for download on

the Group's website. The report will not be posted to

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DBGDCXXGBGCX

(END) Dow Jones Newswires

September 04, 2019 02:01 ET (06:01 GMT)

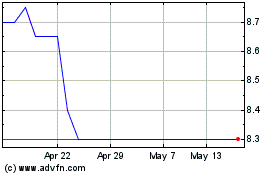

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024