TIDMCYAN

RNS Number : 7921S

Cyan Holdings Plc

29 September 2014

Cyan Holdings plc

("Cyan" or "the Company")

Interim Results for the six months ended 30 June 2014

Cyan Holdings plc (AIM:CYAN.L), the integrated system and

software design company delivering mesh based flexible wireless

solutions for utility metering and lighting control, announces its

Interim Results for the six months ended 30 June 2014.

Financial Highlights

-- Turnover of GBP65,510 (H1 2013: GBP51,512)

-- Operating loss of GBP1,273,333 (H1 2013: GBP1,300,060)

-- Basic and Diluted Loss Per Share of 0.03p (H1 2013: 0.05p)

-- Cash and cash equivalents at 30 June 2014 of GBP716,786 (H1 2013: GBP1,725,948)

Operational Highlights

-- First commercial order for retrofit smart metering solutions for Essel Utilities in India

-- First pilot deployment of a retrofit smart metering solution in Brazil

-- Deployment of pilots at two Tier 1 utilities with partner Nobre de la Torre in Brazil

-- Teaming agreement signed with the M2M unit of Vodafone

-- Board significantly strengthened with appointments of Harry Berry and Peter Mainz

-- Meeting hosted in Cambridge with Chinese Minister Counsellor Zhou

Post Period Highlights

-- First commercial order for smart metering solutions for Tata Power Mumbai, India

-- Commercial order for 15,000 smart lighting modules in China from Aska Technology Ltd

-- Second pilot deployment of a retrofit smart metering solution in Brazil

-- MoU signed with global meter vendor El-Sewedy

-- MoUs signed with Ecolibrium Energy & Innologix to build out India partner eco-system

-- Teaming agreement signed with Gridsense Inc

-- Partnership agreement signed with Dinsmore and Associates

-- Award received from Frost & Sullivan for Technology Innovation Leadership

-- Presentation delivered at India Utility Regulators & Policymakers Retreat, 2014 in Goa

-- Placing completed to raise GBP3.5 million

John Cronin, Executive Chairman, commented:

"I am pleased to report that Cyan is now in the process of

deploying our smart metering and lighting solutions in India,

Brazil and China. The two orders we received in June and July for

smart metering deployments at Tata Power Mumbai and Essel Utilities

in India were quickly followed by a substantial smart lighting

order from China. Additionally Cyan has now deployed multiple

pilots in Brazil and opened up an additional emerging market

opportunity in South Africa.

"Having raised significant additional funding from shareholders

a few weeks ago, we are now very well positioned to exploit the

commercial opportunity for Cyan's solutions in emerging markets

across the globe and I look forward to delivering further positive

news to shareholders in due course."

Enquiries:

Cyan Holdings plc www.cyantechnology.com

------------------------------------------- -----------------------

John Cronin, Executive Chairman Tel: +44 (0) 1954

234 400

------------------------------------------- -----------------------

Allenby Capital Limited (Nominated Adviser Tel: +44 (0) 20

and Joint Broker) 3328 5656

Jeremy Porter / Chris Crawford

------------------------------------------- -----------------------

Hume Capital Securities plc (Joint Broker) Tel: +44 (0) 20

Jon Belliss 7101 7070

------------------------------------------- -----------------------

Walbrook PR (Analyst and Media Relations) cyan@walbrookpr.com

Paul Cornelius / Nick Rome Tel: +44(0) 20 7933

8780

------------------------------------------- -----------------------

CHAIRMAN'S STATEMENT

We believe the two recently announced commercial orders from end

customers Tata Power Mumbai and Essel Utilities clearly demonstrate

that Cyan offers one of the leading smart metering solutions in

India. These commercial orders, in addition to the pilots currently

being deployed by our partners in Brazil and the recent lighting

order from China, give me confidence that Cyan is clearly moving

from a status of development to one of commercialisation. This

marks a clear transition for our shareholders in terms of the risk

to reward ratio in investing in our Company. This was illustrated

by new and existing shareholders through their recent investment of

a further GBP3.5 million to enable us to fully exploit the

expanding commercial opportunities across the multiple emerging

markets that the Company now addresses.

Commercial Deployments

In the six week period to the end of July, Cyan announced orders

for the commercial deployment of the Company's technology for Tata

Power Mumbai and Essel Utilities in India and customers of Aska

Technology in China.

In particular, Cyan's technology was selected by Larsen &

Toubro ("L&T") for the deployment of its CyLec(R) Advanced

Metering Infrastructure ("AMI") solution for Tata Power Mumbai

("Tata Power"). Tata Power Group is India's largest integrated

power company with over 1.8 million customers and currently serving

over 500,000 retail customers in Mumbai. Tata Power spent the

previous 12 months evaluating the technology and Cyan subsequently

received an order, via the consortium lead L&T, to provide a

complete AMI solution. The initial contract with Tata Power is for

the deployment of 5,000 consumer meters in a district of Mumbai and

is currently planned to go live in the first half of 2015.

Furthermore, Cyan was selected by Aquameas Instrument Pvt. Ltd

("Aquameas") for the first deployment of Cyan's retrofit CyLec AMI

solution at Essel Utilities. Aquameas designs, manufactures and

supplies electricity meters as well as water meters and other

metering equipment and Essel Utilities operates multiple private

utility franchises, serving one million customers across India.

After the first meeting in February 2014 between Essel, Aquameas

and Cyan the customer rapidly moved to a decision to place an

initial order for a 5,000 unit CyLec AMI retrofit solution. The

5,000 retrofit modules are expected to be fitted to consumer meters

manufactured by Genus, Landis+Gyr, HPL and Larsen & Toubro,

with a planned live date of the first half of 2015.

Additionally, in April 2014, Cyan signed a master distribution

agreement with Aska Technology Limited ("Aska") to act as the

distributor of Cyan's CyLux lighting solutions in the China market

and provide first line support to end customers. This was followed

by a purchase order from Aska in July 2014. The order for 15,000

Cyan smart lighting control modules, in addition to Cyan's server

control software, is expected to be delivered before the end of the

current financial year. This order was in addition to previous

orders for 9,000 lighting control modules, making a planned

installation total of 24,000 intelligent street lights for multiple

end customers across locations in mainland China.

Given our global ambitions for the Company, we remain focused on

developing our commercial reach in China. In March 2014 we welcomed

the Chinese Minister, Counsellor Zhou, to our office in Cambridge

where we showcased our leading technology to a delegation from the

Chinese Embassy.

In August 2014, Cyan was also recognized by Frost and Sullivan

through their 2014 European award for Technology Innovation

Leadership in developing a smart metering technology for the power

sector in emerging economies.

Pilot Deployments

Cyan has now deployed a total of nine smart metering pilots in

India for both private and public utilities with an additional

three pilots currently in the planning stage. These pilots

represent a strong pipeline of commercial opportunities for Cyan in

the smart metering market across India.

Having signed a strategic partnership agreement in December 2013

with Nobre de la Torre ("Nobre") in Brazil, Nobre deployed pilots

at two Tier 1 utilities during the period. The first pilot was a

full AMI solution using the CyLec retrofit module. For the second

retrofit pilot, in order to provide a thorough evaluation of the

Nobre and Cyan technology in the field, the utility selected three

different locations, each with different deployment challenges for

smart metering technology.

Eco-system of Partners

During the period under review, Cyan has made substantial

progress in developing its eco-system of partners. These partners

will act as low-cost distribution channels for Cyan's solutions, as

well as offering complementary solutions that utility customers

typically seek in order to maximize their return on investment in

smart metering and smart lighting solutions.

In June 2014, Cyan signed a teaming agreement with Vodafone's

M2M team to develop joint propositions, scope new opportunities and

submit compelling value propositions to customers to enable both

parties to capture the smart metering opportunity in India.

Vodafone and Cyan will deliver a managed service portfolio of

solutions including Cyan's wireless mesh networking platform as a

cost-effective extension to Vodafone's network for high-volume and

low-value 'last mile' data communications to utility end customers.

Vodafone's M2M Global Data Services Platform and managed hosting

provide secure data communication and storage beyond the networked

devices.

Cyan has now qualified eight meter manufacturer partners in

India to provide private and public utility customers with a wide

choice of smart meter hardware as well as adding further eco-system

channel partners for Cyan-based smart metering solutions.

In August 2014, Cyan signed a non-exclusive partnership

agreement with Dinsmore & Associates ("D&A"), who will act

as a business development partner to identify opportunities for

Cyan's smart metering, smart lighting and M2M solutions across the

sub-Saharan African market. D&A will meet with potential

partners and resellers independently to present Cyan's technology

as well as assisting in the negotiation of commercial contracts

with any opportunities that are taken forward.

Memorandums of Understanding ("MoUs") have recently been signed

with global meter vendor El-Sewedy, Ecolibrium Energy, GridSense

and Innologix to further build out the Company's eco-system of

partners.

Whilst Cyan will continue to build out its eco-system of

partners, many of the building blocks are now in place resulting in

sufficient, diverse channels to market as well as offering our

utility customers complete end-to-end solutions.

Strengthening of the Board of Directors

Cyan's Board of Directors has been significantly strengthened

recently with the appointments of Harry Berry and Peter Mainz. Both

individuals are already making a positive impact at Cyan and we

expect their contributions and expertise to become more valuable

over the coming months as the commercial opportunity unfolds.

Harry has over 30 years' experience in the technology and

telecommunications industries and has held a wide range of senior

positions and responsibilities across the sales, change management

and product development functions of global companies. Harry was

responsible for the creation of BT Brightstar, a corporate

incubator focusing on BT's R&D portfolio to create technology

venturing. He is currently European Partner with New Venture

Partners, a global venture capital firm dedicated to corporate

technology spinouts with over $700 million under management.

Between 2006 and 2011, Harry was an independent director on the

Board of Subex Azure Limited (now Subex Limited), a leading global

provider of Business Support Systems, headquartered in Bangalore

(India) with operations in the UK, US, Singapore, Dubai and

Australia.

Peter was the CEO & President of global smart metering

leader Sensus USA Inc. and this is his first non-executive role

since stepping down. Sensus is a leader in the electricity, water

and gas smart metering markets with operations in 22 countries

across five continents. Under his tenure the company grew into a

leading technology provider to the global utility industry through

multiple technology acquisitions, resulting in one of the largest

installed Advanced Metering Infrastructure bases in the world. The

growth included being part of the winning consortium for the UK

smart metering rollout for the North of England and Scotland

announced in August 2013 to connect 16 million meters to 10 million

homes.

Financial Review

For the six months ended 30 June 2014 turnover was GBP65,510 (H1

2013: GBP51,512). The continued low level of revenue was in line

with management expectations due to the ongoing focus on developing

a broad pipeline of smart metering and smart lighting

opportunities. Cost control within the business remained a core

focus resulting in an operating loss similar to the prior period of

GBP1,273,333 (H1 2013: GBP1,300,060), despite further investment in

R&D as well as the expansion of Cyan operations in both India

and the UK.

On 25 July 2014, Cyan announced that it had raised GBP3,500,000,

before expenses, by way of an equity placing where a total of

1,000,000,000 ordinary shares were issued at a price of 0.35 pence

per share. In addition to this placing, 500,000,000 warrants were

issued with an exercise price of 0.60 pence per share and

17,000,000 warrants with an exercise price of 0.349 pence per

share. The 0.60 pence warrants have an exercise period of twelve

months from their approval date on 19 August 2014 at the Company's

General Meeting and the 0.349 pence warrants have an exercise

period of six months from the same date. Together the warrants

allow the potential for raising a further GBP3,059,000. Net cash at

the period end was GBP716,786 (H1 2013: GBP1,725,948), whereas net

cash as of 31 August 2014 was GBP3,304,503.

I would like to take this opportunity to welcome the new

shareholders and thank our existing shareholders for their

continued support.

Outlook

During the remainder of 2014 and throughout 2015, the Board

intends to further develop the commercial opportunity for the

Company through a combination of:

-- conversion of existing deployed metering pilots in India and Brazil into commercial orders

-- deployment of additional metering and lighting pilots in

India, Brazil, China and Sub-Saharan Africa

-- adding complementary eco-system partnerships in our chosen

emerging markets as well as the commercial exploitation of the

existing partnerships

-- expansion into additional emerging markets through local partners

-- additional partnerships and commercial opportunities as a

result of the teaming agreement signed with Vodafone

-- conversion of follow on orders from the initial projects with

both Tata Power and Essel Utilities

-- further investment in a world class management team

The numerous opportunities around the world for Cyan's

technology and solutions provide confidence that the Company will

deliver on customers' expectations of return on investment of their

smart metering and lighting projects and as a result create

significant shareholder value.

Myself, the other Board members and the Cyan management team

firmly believe that Cyan remains in a strong position to secure

revenues from a very large market.

John Cronin

Executive Chairman

29 September 2014

Consolidated Income Statement

Six months ended 30 June 2014

Unaudited

six months

ended Unaudited six Year ended

30 June months ended 31 December

2014 30 June 2013 2013

Notes GBP GBP GBP

Continuing operations

Revenue 65,510 51,512 137,996

Cost of sales (30,170) (34,619) (87,366)

Gross profit 35,340 16,893 50,630

Operating costs (1,308,673) (1,316,953) (2,843,939)

Provision for stock obsolescence - - (473,448)

Operating loss (1,273,333) (1,300,060) (3,266,757)

Investment revenue 1,856 2,311 4,437

Finance costs (112) (10) (10)

--------------------------- ------------ --------- ------------ -------------- -------------

Loss before tax (1,271,589) (1,297,759) (3,262,330)

Tax 140,000 102,000 270,135

Loss for the period (1,131,589) (1,195,759) (2,992,195)

Loss per share (pence)

Basic 3 (0.03) (0.05) (0.1)

Diluted 3 (0.03) (0.05) (0.1)

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2014

Unaudited Unaudited

six months six months

ended ended Year ended

30 June 30 June 31 December

2014 2013 2013

GBP GBP GBP

Loss for period (1,131,589) (1,195,759) (2,992,195)

Exchange differences on translation

of foreign operations - (153,423) 65,075

-------------------------------------- ------------ ------------ -------------

Total comprehensive income for

the period (1,131,589) (1,349,182) (2,927,120)

-------------------------------------- ------------ ------------ -------------

Consolidated Balance Sheet

At 30 June 2014

Unaudited Unaudited 31 December

30 June 2014 30 June 2013 2013

GBP GBP GBP

Non-current assets

Property, plant and equipment 11,901 5,674 3,875

11,901 5,674 3,875

-------------- ------------- ------------------ -------------- ------------------------ --------------------

Current Assets

Inventories 593,967 1,080,431 583,200

Trade and other receivables 210,181 197,112 345,794

Cash and cash equivalents 716,786 1,725,948 1,636,149

---------------------------------------------- -------------- ------------------------ --------------------

1,520,934 3,003,491 2,565,143

-------------- ------------- ------------------ -------------- ------------------------ --------------------

Total assets 1,532,835 3,009,165 2,569,018

------------------------------- ------------- -------------- ------------------------ --------------------

Current liabilities

Trade and other

payables (318,630) (262,794) (298,441)

------------------------------- ------------- -------------- ------------------------ --------------------

Total liabilities (318,630) (262,794) (298,441)

------------------------------- ------------- -------------- ------------------------ --------------------

Net current assets 1,202,304 2,740,697 2,266,702

------------------------------- ------------- -------------- ------------------------ --------------------

Net assets 1,214,205 2,746,371 2,270,577

------------------------------- ------------- -------------- ------------------------ --------------------

Equity

Share capital 345,126 264,210 341,638

Share premium account 30,642,130 29,146,185 30,570,401

Own shares held (808,856) (808,856) (808,856)

Share option reserve 376,690 776,190 376,690

Translation reserve (149,742) (368,240) (149,742)

Retained loss (29,191,143) (26,263,118) (28,059,554)

---------------------------------------------- -------------- ------------------------ --------------------

Total equity being attributable

to owners of the Company 1,214,205 2,746,371 2,270,577

------------------------------------------ ----- -------------- ------------------------ --------------------

Consolidated statement of changes in equity

At 30 June 2014

Share

Share Own shares Option Translation Retained Total

Capital Share Premium held Reserve Reserve Losses Equity

GBP GBP GBP GBP GBP GBP GBP

Balance at 30

June 2013 264,210 29,146,185 (808,856) 776,190 (368,240) (26,263,118) 2,746,371

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Loss for the

period - - - - - (1,796,436) (1,796,436)

Other

comprehensive

income for the

period - - - - 218,498 - 218,498

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Total

comprehensive

income for the

period - - - - 218,498 (1,796,436) (1,577,938)

Issue of share

capital 77,428 1,424,216 - - - - 1,501,644

Debit to equity

for share

options - - - (399,500) - - (399,500)

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Balance at 31

December 2013 341,638 30,570,401 (808,856) 376,690 (149,742) (28,059,554) 2,270,577

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Loss for the

period - - - - - (1,131,589) (1,131,589)

Other

comprehensive

income for the

period - - - - - - -

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Total

comprehensive

income for the

period - (1,131,589) (1,131,589)

Issue of share

capital 3,488 71,729 - - - - 75,217

Balance at 30

June 2014 345,126 30,642,130 (808,856) 376,690 (149,742) (29,191,143) 1,214,205

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Consolidated Cash Flow Statement

Six months ended 30 June 2014

Notes Unaudited Unaudited Year ended

six months six months 31 December

ended ended 2013

30 June 30 June

2014 2013

-------------------------------------------- -------- ------------- ------------- --------------

GBP GBP GBP

-------------------------------------------- -------- ------------- ------------- --------------

Net cash outflow from operating activities 4 (985,310) (1,086,195) (3,001,981)

-------------------------------------------- -------- ------------- ------------- --------------

Investing activities

-------------------------------------------- -------- ------------- ------------- --------------

Interest received 1,856 2,311 4,437

-------------------------------------------- -------- ------------- ------------- --------------

Purchases of property, plant and

equipment (11,014) (2,854) (5,198)

-------------------------------------------- -------- ------------- ------------- --------------

Net cash used in investing activities (9,158) (543) (761)

-------------------------------------------- -------- ------------- ------------- --------------

Financing activities

-------------------------------------------- -------- ------------- ------------- --------------

Interest paid (112) (10) (10)

-------------------------------------------- -------- ------------- ------------- --------------

Proceeds on issue of shares 75,217 1,465,817 3,037,961

-------------------------------------------- -------- ------------- ------------- --------------

Share issue costs - (67,318) (137,818)

-------------------------------------------- -------- ------------- ------------- --------------

Net cash from financing activities 75,105 1,398,489 2,900,133

-------------------------------------------- -------- ------------- ------------- --------------

Net (decrease) / increase in cash

and cash equivalents (919,363) 311,751 (102,609)

-------------------------------------------- --------

Cash and cash equivalents at beginning

of period 1,636,149 1,618,574 1,618,574

-------------------------------------------- --------

Effect of foreign exchange rate changes - (204,377) 120,184

-------------------------------------------- -------- ------------- ------------- --------------

Cash and cash equivalents at end

of period 716,786 1,725,948 1,636,149

-------------------------------------------- -------- ============= ============= ==============

Notes to the Accounts

Six months ended 30 June 2014

1. Basis of preparation

The interim financial information has been prepared in

accordance with the IFRS accounting policies used in the statutory

financial statements for the year ended 31 December 2013.

These interim financial statements do not constitute statutory

financial statements within the meaning of section 435 of the

Companies Act 2006. Results for the six month periods ended 30 June

2014 and 30 June 2013 have not been audited. The results for the

year ended 31 December 2013 have been extracted from the statutory

financial statements of Cyan Holdings plc.

Statutory financial statements for the year ended 31 December

2013 are available on the Company's website www.cyantechnology.com

and have been filed with the Registrar of Companies. The Company's

auditor issued a report on those financial statements that was

unqualified and did not contain a statement under section 498(2) or

section 498(3) of the Companies Act 2006; however the auditor's

report was modified to emphasise the uncertainty around the

Company's ability to continue as a going concern.

2. Going Concern

Since the end of the period being reported, the Company has

raised a further GBP3.5 million (gross), with 0.6p warrants being

issued at the same time that could raise a further GBP3 million if

fully exercised. As a result of this, the Directors believe that

the Company will be able to meet their liabilities as they fall due

for at least 12 months, however they have highlighted the risks

that the company continues to face below.

The directors have recognised that the Group is trading

principally in three emerging country markets, namely India, Brazil

and China. These markets have an inherent level of uncertainty

associated with them and this may result in the predicted level of

sales not being achieved and/or the timing of orders being delayed,

as has been the case for the Group in the past. This may impact

both the Group's ability to generate positive cashflow and to raise

new finance should it be required in the future.

There is uncertainty as to whether or not the share price of the

Company will reach the level required for the 0.6p warrants issued

in August 2014 to be exercised before their expiration in August

2015.

The financial statements do not include the adjustments that

would result if the Company was unable to continue as a going

concern. In the event that the company ceased to be a going

concern, the adjustments would include writing down the carrying

value of assets, including stocks, to their recoverable amount and

providing for any further liabilities that might arise.

Notwithstanding the material uncertainties described above,

because of the additional funding raised in August 2014, the

directors have a reasonable expectation that the Company can

continue to meet their liabilities as they fall due, for a period

of at least 12 months from the date of approval of this report.

3. Loss per share

Basic and diluted loss per ordinary share has been calculated by

dividing the loss after taxation for the periods as shown in the

table below.

Unaudited Unaudited

six months six months

ended ended

30 June 30 June Year ended

2014 2013 31 December 2013

GBP GBP GBP

Losses (GBP) 1,131,589 1,195,759 2,992,195

Weighted average number

of shares 3,468,702,660 2,418,355,380 2,797,766,136

IAS33 "Earnings per share" requires presentation of diluted EPS when a company

could be called upon to issue shares that would decrease net profit or increase

net loss per share. For a loss making company with outstanding share options,

net loss per share would only be increased by the exercise of out of the

money options. Since it seems inappropriate to assume that option holders

would act irrationally and there are no other diluting future share issues,

diluted EPS equals basic EPS.

4. Reconciliation of operating loss to operating cash flows

Unaudited Unaudited

six months six months

ended ended Year ended

30 June 30 June 31 December

2014 2013 2013

GBP GBP GBP

Operating loss

for the period (1,273,333) (1,300,060) (3,266,757)

Adjustments for:

Depreciation of property, plant

and equipment 2,988 7,167 9,334

Share-based payment expense - - (399,500)

------------------------------------------------ ------------ ------------ -------------

Operating cash flows before movements

in working capital (1,270,345) (1,292,893) (3,656,923)

(Increase) / decrease in inventories (10,767) (56,190) 441,041

Decrease / (increase) in receivables 5,478 567 (12,773)

Increase / (decrease) in payables 20,189 24,978 (10,669)

----------------------------------------- --------- ------------ ------------ -------------

Cash reduced by operations (1,255,445) (1,323,538) (3,239,324)

Income taxes received 270,135 237,343 237,343

Net cash outflow from operating

activities (985,310) (1,086,195) (3,001,981)

----------------------------------------- --------- ------------ ------------ -------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QKADQABKDACB

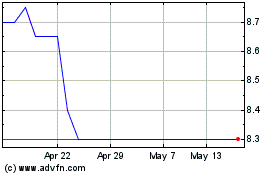

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024