TIDMCYAN

RNS Number : 3697U

Cyan Holdings Plc

02 December 2013

Cyan Holdings plc

("Cyan" or "the Company")

Proposed Placing, Directors' Dealings &

Notice of General Meeting

Cyan Holdings plc (AIM:CYAN.L), the integrated system and

software design company delivering mesh based flexible wireless

solutions for utility metering and lighting control, announces

raising, subject to certain conditions, approximately GBP1.1

million before expenses, by way of a share placing ("Placing")

pursuant to which 733,333,333 Ordinary Shares (the "Placing

Shares") will be issued at 0.15 pence each (the "Placing Price").

The Placing was managed by XCAP Securities plc ("XCAP") as joint

broker to the Company. It is intended that the net proceeds from

the Placing will be used for general working capital requirements,

business development and other product development work as set out

below.

The Placing is conditional, inter alia, on the passing of

resolutions at a General Meeting ("GM") to be held at 1.00 p.m. on

19 December 2013. A circular containing the notice of the GM (the

"Circular") will be posted to all shareholders in the Company today

and will be available to view on the Company's website at:

www.cyantechnology.com.

Assuming Shareholders approve the necessary resolutions at the

GM it is anticipated that the Placing Shares will be admitted to

trading on AIM and that dealings will commence at 8.00 a.m. on 20

December, 2013 ("Admission"). Following Admission, the Company will

have 3,402,700,256 Ordinary Shares in issue, assuming all of the

Placing Shares are subscribed for by the Placees.

Commenting on the Placing, John Cronin, Executive Chairman said

"We are pleased to be able to continue to attract interest in the

Company and its prospects. The net proceeds from the Placing will

provide the Company with additional stability and cash resources to

allow us to pursue our activities in India, Brazil and China as we

look to take advantage of the pipeline of opportunities in these

emerging markets. To demonstrate the board's confidence in these

opportunities and our commitment to the Company the directors of

Cyan have agreed to subscribe in the Placing for an aggregate

amount of GBP100,000."

Enquiries:

Cyan Holdings plc Tel: +44 (0) 1954 234 400

John Cronin, Chairman

www.cyantechnology.com

Allenby Capital Limited Tel: +44 (0)20 3328 5656

NOMAD and Joint Broker

Jeremy Porter / Mark Connelly

XCAP Securities plc Tel: +44 (0)20 7101 7070

Joint Broker

Jon Belliss / Adrian Kirk

Walbrook PR Tel: +44 (0)20 7933 8780

Financial PR

Paul Cornelius

Background to and reasons for the Placing

We realise that Shareholders will be disappointed that Cyan is

seeking to raise additional funding at a proposed price which is

significantly less than the previous funding rounds. Whilst the

Company still has sufficient funds to trade into 2014, the timing

of material orders from Cyan's prospective customers in India,

Brazil and China remains uncertain. The Board of Cyan has decided

that it is in the best interests of Shareholders to raise a limited

amount of cash as quickly and as inexpensively as possible to

provide further funding for the continued development of the

Company's activities in India, Brazil and China.

Over the previous six months, and following the lodging of the

Tamil Nadu Electricity Board ("TNEB") tender, Cyan has

significantly broadened its pipeline of opportunities and is now

well positioned in the three key emerging markets of India, Brazil

and China.

The Placing Shares will be issued at a price of 0.15 pence per

Ordinary Share. The Directors believe that this price represents

the best price achievable to raise additional working capital and

development funding. Without the proceeds of the Placing, the

Directors believe that the Company would not have sufficient funds

to take advantage of these opportunities as an independent

company.

The Cyan management team and Board of Directors remain highly

motivated and confident that the opportunities in the pipeline will

be converted into revenues in 2014. This confidence is reflected in

the significant participation in the Placing by the whole Board of

Cyan who, in aggregate, are subscribing for GBP100,000 of Placing

Shares in the Placing.

Therefore, Shareholders are requested to vote in favour of the

Resolutions in order to safeguard their investment and to allow the

Company to demonstrate a suitable level of financial strength to

its partners. The Directors believe that Cyan remains in a strong

position to secure substantial revenues from a very large

market.

We would like to take this opportunity to welcome the new

Shareholders and thank our existing Shareholders for their

continued support.

A presentation will be made to Shareholders at the General

Meeting, and this information will be published simultaneously on

the Company's website, where there will be an opportunity to ask

questions as well as interact with the management and Board.

Details of the Placing

The Company intends to raise approximately GBP1.1 million,

before expenses, through the issue of 733,333,333 Placing Shares at

the Placing Price pursuant to the Placing.

The Placing Price represents a discount of approximately 28.6

per cent. to the closing mid-market price of 0.21 pence per

Ordinary Share as at 29 November 2013, the latest practicable date

prior to the announcement of the Placing. The Placing Shares will,

when issued, rank pari passu in all respects with the Ordinary

Shares, including the right to receive dividends and other

distributions declared following Admission.

The Placing Shares will represent approximately 21.6 per cent.

of the Company's issued share capital immediately after the

completion of the Placing ("Enlarged Share Capital").

The Placing is being made on a non pre-emptive basis as the time

delay and costs associated with a pre-emptive offer are considered

by the Directors to be excessive.

Application will be made by the Company for the Placing Shares

to be admitted to trading on AIM. Subject to completion of the

Placing, it is expected that the Placing Shares will be admitted to

trading on AIM and that dealings will commence at 8.00 a.m. on 20

December 2013.

The issue of the Placing Shares, is conditional, inter alia,

upon:

(a) the approval of the resolutions at the GM;

(b) the conditional placing agreement dated 2 December 2013

between XCAP and the Company (the "Placing Agreement") becoming

wholly unconditional (save as to Admission) and not having been

terminated in accordance with its terms at any time prior to

Admission; and

(c) Admission,

in each case occurring no later than 8.00 a.m. on 20 December

2013 (or such time and date as the Company and XCAP may agree,

being not later than 14 January 2014).

Pursuant to the terms of the Placing Agreement, XCAP has

conditionally agreed to use its reasonable endeavours, as agent to

the Company, to place the Placing Shares at the Placing Price with

certain institutional and other investors. The above obligations

are subject to certain conditions including those listed above. The

Placing is not being underwritten by XCAP.

The Placing Agreement contains customary warranties given by the

Company with respect to its business and certain matters connected

with the Placing. In addition, the Company has given certain

indemnities to XCAP in connection with the Placing and XCAP's

performance of services in relation to the Placing. XCAP is

entitled to terminate the Placing Agreement in specified

circumstances including where there has been a material breach of

the warranties.

In accordance with the terms of the Placing Agreement, XCAP will

be issued with corporate finance warrants in addition to corporate

finance fees and commissions charged by them to the Company in

connection with their services relating to the Placing.

Directors' shareholdings

The current beneficial and non-beneficial interests of the

Directors in Ordinary Shares (not including Ordinary Shares held by

the Cyan Employee Benefit Trust) and the beneficial and

non-beneficial interests following the Placing are set out

below:

Placing

Date of this document Shares Following the Placing

subscribed

Number of Percentage Number of Number of Percentage

Ordinary of Ordinary Ordinary Ordinary of Ordinary

Shares Share capital Shares Shares Share capital

Director

John Cronin 50,696,884 1.90% 28,402,307 79,099,191 2.32%

Dr. John Read 25,892,621 0.97% 4,306,480 30,199,101 0.89%

Simon Smith 24,221,424 0.91% 28,402,307 52,623,731 1.55%

Stephen Newton - -% 5,555,573 5,555,573 0.16%

The following Ordinary Shares held by the Cyan Employee Benefit

Trust are beneficially owned by the following Directors to the

extent the share price of the Company exceeds 2.5 pence per

Ordinary Share, however the rights to such Ordinary Shares shall

expire on 18 December 2013:

Director Number of Ordinary

Shares

Dr. John Read 1,000,000

The Directors intend to subscribe for, in aggregate, 66,666,667

Placing Shares which represents, in aggregate, 9.1 per cent. of the

Placing Shares being issued pursuant to the Placing. Following the

Placing, the Directors will hold, in aggregate, 167,477,596

Ordinary Shares, accounting for 4.92 per cent. of the Enlarged

Share Capital.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFSAEFFFDSESE

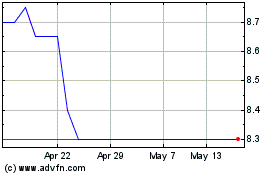

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024