TIDMCYAN

RNS Number : 9501F

Cyan Holdings Plc

31 May 2013

Cyan Holdings plc

("Cyan or "the Company")

Preliminary Results

for the year ended 31 December 2012

Cyan Holdings plc (AIM: CYAN.L), the integrated system design

company delivering wireless solutions for lighting control, utility

metering and industrial telemetry announces its audited preliminary

results for the year ended 31 December 2012.

Key achievements

-- Significant progress on Tamil Nadu Electricity Board tender

-- Appointment of telecoms and smart metering expert John Cronin as Executive Chairman

-- Strategic partnership with Larsen & Toubro to provide

Indian utility customers with Advanced Metering Infrastructure

("AMI") solutions

-- Substantial metering order of over US$1M from Indian partner

-- Deployment of smart metering pilots with leading integrated

power company in Mumbai and for Power Grid Corporation of India in

Puducherry

-- Equity fund raisings during the year of GBP3.8M before

expenses (including GBP1.7M from the placing in December 2011 which

was concluded in January 2012)

Financial highlights

-- Decrease in revenue during 2012 to GBP315,194 (2011: GBP455,591)

-- Operating loss for the year reduced to GBP3,103,622 (2011 restated: GBP3,575,000)

-- Cash balance at end of year GBP1,618,574 (2011: GBP364,590)

Post period end highlights

-- Operations established in India to drive and support future

growth, including hire of Country Manager

-- Deployment of AMI pilot with large public utility in the north of India

-- Equity fund raising of GBP1M before expenses in April 2013 to

strengthen balance sheet and fund continued expansion of

operations

John Cronin, Executive Chairman of Cyan, commented:

"By the end of 2012, Cyan had successfully positioned itself as

a low cost, low power wireless solutions provider for the rapidly

growing Machine to Machine (M2M) markets. We have created many

smart metering opportunities in India through our eco-system

programme which includes strategic partners both at a meter

manufacturer and system integrator level, thus giving us first

mover advantage in deploying many pilots throughout the country.

This now offers Cyan an opportunity to deliver significant revenue

growth, both in India and other emerging markets worldwide."

Enquiries:

Cyan Holdings plc www.cyantechnology.com

John Cronin, Executive Chairman Tel: +44 (0) 1954 234 400

Cenkos Securities plc Tel: +44 (0)20 7397 8900

NOMAD and Joint Broker

Stephen Keys / Adrian Hargrave Tel: 044 (20) 7101 7070

XCAP Security plc

Joint Broker

Jon Belliss / Adrian Kirk

Walbrook PR (Financial PR) Tel: +44 (0)20 7933 8780

Bob Huxford/Paul Cornelius

Chairman's Statement

Operational Review

At the beginning of 2012, it was the Board's view that

shareholder interests were best served by focussing our limited

resources on doing everything possible to ensure our meter

manufacturer partners are awarded a significant share of the 1.5

million unit Tamil Nadu Electricity Board ("TNEB") tender, which is

the first part of an overall program to install/replace 18 million

meters. This opportunity continues to represent a potentially

significant turning point for the Company and will strengthen our

position to establish Cyan's Automated Meter Reading ("AMR") and

Advanced Metering Infrastructure ("AMI") solutions as the market

standard in India.

In February 2012, Cyan continued to strengthen its strategic

partnerships in the Indian energy market with the announcement that

it was entering into a Strategic Partnership Agreement with Larsen

& Toubro ("L&T"). L&T is a recognised leader in the

energy and utilities sector with proven products and a Tier 1

reputation. The alliance with Cyan was to enable L&T to offer

an 865MHz interoperable smart metering solution to a number of

projects identified in India and this has been the case.

In May 2012, we announced receipt of an order exceeding US$1M,

from a major metering customer in India. After the successful

integration of CyLec(R) products, the customer placed the order to

fulfil several projects across a range of utilities. Due to delays,

in particular with the TNEB tender process, we announced in

December that fulfilment of this order will now be in 2013.

During the second quarter of 2012, we announced the submission

deadline for the TNEB tender for 1.5 million units and that five

meter manufacturers had submitted samples based on Cyan's CyLec(R)

solution. By June, four of the Cyan partners had been formally

authorised to advance to the next stage of the tender, installation

of 500 unit pilots in Trichy (Tiruchirappalli). Throughout

September and October, Cyan continued to support the partners

including working with them on the ground in Trichy as well as from

Cambridge to ensure the pilots were successfully installed. After

the pilots were installed and commissioned, TNEB began evaluations,

including on site meter readings. Cyan's technology performed

reliably, the technical field trials in Trichy are now complete and

we believe our solution is very well placed to result in orders for

our meter manufacturer partners. As TNEB is a public utility, it is

required to comply with the Indian government tendering regulations

to ensure that the decision is arrived at in a fully transparent

manner and given the substantial monies involved in this tender,

the tender attribution decision has been delayed. As Cyan is not

directly tendering to TNEB, we were asked by our meter manufacturer

partners in the second half of 2012 to limit the updates on the

tender process we put into the public domain (through RNS) in order

to protect their competitive positions and after taking local

advice we have endeavoured to comply with this request. The TNEB

tender document states that inter-operability is required (ie. TNEB

can buy meters from multiple suppliers and they will seamlessly

work together). Based upon the companies that have bid on the TNEB

tender and deployed pilots in Trichy, our view is that the Cyan

enabled meters are the only way to achieve the tender specification

regarding inter-operability.

In December 2012, we announced that another strategic meter

manufacturer partner had deployed Cyan's AMI solution as a pilot

for a leading integrated power company in Mumbai. The pilot

involved deploying single and three phase CyLec(R) enabled meters

in Mumbai for evaluation by the power company for three to six

months.

Since I joined Cyan in March 2012, the Company has made

significant progress on the TNEB tender and we believe our solution

is very well placed and should result in significant orders for our

meter manufacturer partners over the very near term. However, the

TNEB tender process has admittedly taken much longer than either

the Company, or our local meter manufacturer partners, had

projected. Furthermore, as our product development and sales

management efforts have been heavily focussed on supporting our

local partners on this tender, as well as developing the

electricity metering business overall in India, our lighting

revenues in China have inevitably declined. This is reflected in

revenues for the period of GBP315,194 versus GBP455,591 for the

corresponding period last year and I recognise that shareholders

might have expected further progress on this front.

Metering

Cyan's focus has been dominated by the Indian smart metering

market with its key strategy of building key strategic partnerships

and supporting its meter manufacturing partners on pilot projects.

The Indian market is undoubtedly a huge opportunity for the

Company, with an estimated 120-200 million meters that need to be

installed/replaced over the next 10 years as well as the Indian

utilities' pressing need to reduce losses due to theft of

electricity.

One of the obstacles the utilities face is collecting data from

millions of meters deployed in rapidly growing and typically

unplanned urban conditions. It is often problematic trying to

locate and gain physical access to the meters and the process is at

best slow or error prone. Cyan's AMR and AMI solutions address

these key issues by providing high quality and timely information

from each meter. Cyan's 865MHz based solution has been specifically

designed to cope with demanding specifications such as a

communication range of more than 60 meters and to be able to be

read through concrete walls in order to cope with the dense urban

conditions in India. In comparison, a 2.4GHz Zigbee solution has

been observed to struggle to achieve a reliable communication range

greater than 30 meters in the same challenging conditions.

India's transmission and distribution losses are among the

highest in the world. When non-technical losses such as energy

theft are included in the total, these losses increase to as high

as 65% in some Indian States against an overall average of 30%-40%.

The financial loss has been estimated at 1.7% of the national GDP.

To address the issue of Aggregate Transmission and Commercial

(AT&C) losses, the Government of India implemented an

Accelerated Power Development Reforms Programme (APDRP). Its key

objectives were to reduce AT&C losses, improve customer

satisfaction, introduce greater transparency and improve the

financial viability of the State Distribution Companies (SDCs). It

was against this backdrop that the Restructured APDRP (R-APDRP) was

conceived in September 2008 for the 11th Five Year Plan (2007-12).

The tender that Cyan's meter manufacturer partners are bidding for

in Tamil Nadu is funded under this R-APDRP program. Monies are

provided by the Indian Government as loans for the provision of

advanced metering solutions and once in place, the loans are

converted into grants.

With a number of the leading meter manufacturer partners in

India now offering CyLec(R) enabled smart meters, Cyan has a strong

foothold in the Indian market. In November, we announced that one

of our partners was participating in a high profile smart grid

project in Puducherry, India. The smart grid pilot project is being

led by the Power Grid Corporation of India Limited (PGCIL), a

government of India enterprise. The project was to install an AMI

solution in houses throughout Puducherry to support the electricity

department's objective to save power.

Cyan provides a platform product (CyLec(R)) to enable deployment

of AMI. AMI is an architecture for automated end-to-end two way

communications between a utility company and electricity meters

(smart meters). The CyLec(R) solution provides utilities with real

time data about power consumption and allows customers to make

informed choices about energy usage based on price at time of use.

The Cylec(R) solution includes hardware and software to enable this

communication and allows easy interfacing to existing meter data

management (MDMS), billing systems and other Smart Grid

infrastructure monitoring tools within the utility such as outage

detection and load management. Consumer meter tamper and

electricity theft detection features are included and this helps

utilities ensure they collect revenue for electricity that is used

by consumers. The CyLec(R) solution has been proven to be easy to

integrate to existing meters from various metering companies to

upgrade them to be AMI compatible smart meters.

Lighting

Cyan has continued to receive small lighting orders in China

during the year. As explained above, the Board determined in early

2012 that shareholders' interests were best served by focussing the

Company's limited resources on metering in India and therefore

progress on lighting has been disappointing, which has in turn

resulted in lower overall revenues for 2012.

Machine to Machine ("M2M")

Cyan's technology allows networked devices to exchange

information and perform actions without the manual assistance of

humans. This automated communication between devices comes under a

broad label of Machine to Machine ("M2M") or the 'Internet of

Things'. Our target markets, wireless metering and lighting

control, are two applications of this type of communication.

However, M2M is used in telemetry, data collection, remote control,

robotics, remote monitoring, status tracking, road traffic control,

offsite diagnostics and maintenance, security systems, logistic

services, fleet management, telemedicine, as well as smart metering

and lighting control.

Cyan provides technology and is a service provider delivering

the global, wireless mesh networks specifically designed for M2M

communications.

Financial Review

During 2012, Cyan announced its involvement in a number of pilot

projects which demonstrated significant progress towards the

adoption of our metering products in India. Our focus was to ensure

we had the products and resource to support our partners.

Furthermore, demand for AMI products required increased development

work to integrate Cyan's AMI solution into the high level

systems.

Despite this operational progress, commercial orders remained

below the level required to sustain the business. In 2012, the

company raised approximately GBP3.8 million before expenses, by way

of share placings (including GBP1.7M from the placing in December

2011 which was concluded in January 2012). In addition to the

placings the company received a total of GBP271k from the exercise

of warrants during the second half of the year. This income

provided the Company incremental financial resources for general

working capital, customer support activities in India and further

development to integrate Cyan's AMI solution into high level

enterprise software.

Revenue decreased from GBP455,591 in 2011 to GBP315,194 in 2012.

Operating loss for the year ended 31 December 2012 was GBP3,103,622

(2011 restated: GBP3,575,000) and net loss decreased to

GBP2,876,772 (2011 restated: GBP3,227,077). This was predominantly

due to decreased staff costs. Cash at year end was GBP1,618,574

(2011: GBP364,590).

In April 2013, the company announced that it had raised a

further GBP1 million before expenses. The Board felt that this

additional funding was crucial not only to support the expansion of

activities into India, but also to strengthen the balance sheet at

a key time in the tender process of TNEB. Included in this placing

was an issue of a further 74,444,444 warrants with an exercise

price of 0.65 pence per share, however shareholder approval of this

warrant issue will be sought at the Company's AGM in June 2013.

Board Changes

"It was with great sorrow that the board learned of the death of

Kenn Lamb, formerly CEO of the company, on 5 July 2012 after a long

illness. Kenn had received successful treatment over a number of

years but in 2010 and 2011 needed further treatment, operations and

hospitalisation which increasingly affected his mobility and

ability to lead Cyan. As a result he gave notice of resignation and

stepped down at the beginning of 2012.

Kenn initially became involved with Cyan as a consultant in

October 2006 reviewing the strategy, products and sales

organisation. In March 2007 he was offered the position of CEO to

implement his proposals, and accepted. The initial micro-controller

focus of the company changed to supplying modules but it became

apparent that the real opportunity was as a supplier of bespoke

'smart' systems solutions. Building on the market knowledge gained

through presence in China an RF mesh solution for street lighting

was developed and deployed in several pilots. However further

commercial engagement was extremely slow and when interest was seen

for applications in smart metering the focus of product and market

development was changed and, along with this the company began to

develop a presence in India. This has now grown to implementation

of several major pilots and a leading position in bidding on supply

for a large utility in the SE of India. It is sad that Kenn will

not see the outcome of this major strategy evolution.

Kenn showed energy and compassion in his leadership. He was a

'larger than life' charismatic character and always a pleasure to

work with. He is much missed by the company and more so by his

wife, and young family. Our thoughts continue to be with them as

they grow up without him."

John Read, Former Chairman of Cyan

Outlook

At the time of preparation of this report to shareholders, I am

disappointed that we have not been able to announce the award of

the TNEB tender to Cyan's meter manufacturer partners. As noted

above, the tender is now at an advanced stage and all the technical

evaluations are complete. Based on Cyan's interoperable solution,

our meter manufacturer partners are very well placed to be awarded

this tender, which will then in turn give them a strong position

for the second and larger tender, that we understand will follow on

shortly afterwards.

The award of the TNEB tender to Cyan's partners will be

transformational in terms of our competitive position in the Indian

metering market as well as putting Cyan on a solid financial

foundation. The Cyan Board continues to believe that it's in

shareholders' interest to focus resources on the Indian metering

market and as I stated in my first report back in September 2012, I

appreciate the continued patience of shareholders and continue to

look forward to delivering them outstanding value.

John Cronin

Executive Chairman

30 May 2013

Consolidated income statement

For the year ended 31 December 2012 Note 2012 2011

-------------------------------------- ------ -------------- --------------

GBP GBP

(Restated)

(note

6)

-------------------------------------- ------ -------------- --------------

Continuing operations

-------------------------------------- ------ -------------- --------------

Revenue 315,194 455,591

-------------------------------------- ------ -------------- --------------

Cost of sales (203,654) (321,477)

-------------------------------------- ------ -------------- --------------

Gross profit 111,540 134,114

-------------------------------------- ------ -------------- --------------

Research and development costs (1,141,005) (1,865,982)

-------------------------------------- ------ -------------- --------------

Other operating costs (2,074,157) (1,843,132)

-------------------------------------- ------ -------------- --------------

Operating loss (3,103,622) (3,575,000)

-------------------------------------- ------ -------------- --------------

Investment revenue 4,091 2,146

-------------------------------------- ------

Finance costs (3) (7)

-------------------------------------- ------ -------------- --------------

Loss before tax (3,099,534) (3,572,861)

-------------------------------------- ------ -------------- --------------

Tax 222,762 345,784

-------------------------------------- ------ -------------- --------------

Loss for the year (2,876,772) (3,227,077)

-------------------------------------- ------ ============== ==============

Loss per share (pence)

-------------------------------------- ------

Basic 3 (0.1) (0.3)

-------------------------------------- ------ ============== ==============

Diluted 3 (0.1) (0.3)

-------------------------------------- ------ ============== ==============

Consolidated Statement of Comprehensive Income

For the year ended 31 December

2012 2012 2011

------------------------------------------ -------------- --------------

GBP GBP

(Restated)

(note

6)

----------------------------------------- -------------- --------------

Loss for the year (2,876,772) (3,227,077)

------------------------------------------ -------------- --------------

Exchange differences on translation

of foreign operations 113,540 (34,104)

------------------------------------------ -------------- --------------

Total comprehensive income for

the period (2,763,232) (3,261,181)

------------------------------------------ ============== ==============

Consolidated balance sheet

At 31 December 2012

Note 2012 2011

GBP GBP

(Restated)

(note 6)

---------------------------------------- ------ --- ------------- -------------

Non-current assets

Intangible assets - -

---------------------------------------- ------ ---

Property, plant and equipment 8,990 29,843

------------------------------------------------ --- ------------- -------------

8,990 29,843

----------------------------------------------- --- ------------- -------------

Current assets

---------------------------------------- ------ --- ------------- -------------

Inventories 1,024,241 973,577

------------------------------------------------ --- ------------- -------------

Trade and other receivables 333,022 562,182

------------------------------------------------ --- ------------- -------------

Cash and cash equivalents 1,618,574 364,590

------------------------------------------------ --- ------------- -------------

2,975,836 1,900,349

----------------------------------------------- --- ------------- -------------

Total assets 2,984,826 1,930,192

------------------------------------------------ --- ============= =============

Current liabilities

---------------------------------------- ------ --- ------------- -------------

Trade and other payables 287,772 349,126

------------------------------------------------ --- ------------- -------------

Total liabilities 287,772 349,126

------------------------------------------------ --- -------------

Net assets 2,697,054 1,581,066

------------------------------------------------ --- ============= =============

Equity

---------------------------------------- ------ --- ------------- -------------

Share capital 4 232,681 2,385,401

------------------------------------------------ --- ------------- -------------

Share premium account 27,779,215 21,654,936

------------------------------------------------ --- ------------- -------------

Own shares held (808,856) (690,191)

------------------------------------------------ --- ------------- -------------

Share option reserve 776,190 749,865

------------------------------------------------ --- ------------- -------------

Translation reserve (214,817) (328,358)

------------------------------------------------ --- ------------- -------------

Retained earnings (25,067,359) (22,190,587)

------------------------------------------------ --- ------------- -------------

Total equity being equity attributable

to owners of the Company 2,697,054 1,581,066

------------------------------------------------ --- ============= =============

Consolidated Statement of Changes in Equity

At 31 December 2012

Share

Share Share Own shares Option Retained Total

Capital Premium held Reserve TranslationReserve Losses Equity

Notes GBP GBP GBP GBP GBP GBP GBP

Balance at 31

December

2010 (as

previously

reported) 1,847,666 20,378,625 (690,191) 476,999 (294,254) (19,204,395) 2,514,450

Prior year

adjustment 6 - (310,713) - 69,828 - 240,885 -

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Balance at 31

December

2010 (restated) 1,847,666 20,067,912 (690,191) 546,827 (294,254) (18,963,510) 2,514,450

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Loss for the

year - - - - - (3,227,077) (3,227,077)

Other

comprehensive

income for the

year - - - - (34,104) - (34,104)

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Total

comprehensive

income for the

year - - - - (34,104) (3,227,077) (3,261,181)

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Issue of share

capital 537,735 1,587,024 - - - - 2,124,759

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Credit to equity

for share

options - - - 203,038 - - 203,038

Balance at 31

December

2011 (restated) 2,385,401 21,654,936 (690,191) 749,865 (328,358) (22,190,587) 1,581,066

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Balance at 31

December

2011 (as

previously

reported) 2,385,401 21,965,649 (690,191) 604,536 (328,358) (22,355,971) 1,581,066

Prior year

adjustment 6 - (310,713) - 145,329 - 165,384 -

Balance at 31

December

2011 as

restated 2,385,401 21,654,936 (690,191) 749,865 (328,358) (22,190,587) 1,581,066

Loss for the

year - - - - - (2,876,772) (2,876,772)

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Other

comprehensive

income for the

year - - - - 113,541 - 113,541

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Total

comprehensive

income for the

year - - - - 113,541 (2,876,772) (2,763,231)

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Issue of share

capital 114,781 3,856,778 (118,665) - - - 3,852,894

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Capital

Restructure (2,267,501) 2,267,501 - - - - -

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Credit to equity

for share

options - - - 26,325 - - 26,325

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Balance at 31

December

2012 232,681 27,779,215 (808,856) 776,190 (214,817) (25,067,359) 2,697,054

----------------- ------------------------------------------ -------------------------- ------------- -------------------------- -------------- ------------

Consolidated cash flow statement

For the year ended 31 December 2012

Notes 2012 2011

-------------------------------------------- ------- ------------ ------------

GBP GBP

-------------------------------------------- ------- ------------ ------------

Net cash outflow from operating activities 5 (2,765,349) (3,177,846)

-------------------------------------------- ------- ------------ ------------

Investing activities

-------------------------------------------- ------- ------------ ------------

Interest received 4,091 2,146

-------------------------------------------- ------- ------------ ------------

Purchases of property, plant and equipment (4,919) (29,782)

-------------------------------------------- ------- ------------ ------------

Net cash used in investing activities (828) (27,636)

-------------------------------------------- ------- ------------ ------------

Financing activities

-------------------------------------------- ------- ------------ ------------

Interest paid (3) (7)

-------------------------------------------- ------- ------------ ------------

Proceeds on issue of shares 4,185,627 2,225,862

-------------------------------------------- ------- ------------ ------------

Share issue costs (296,094) (101,103)

-------------------------------------------- ------- ------------ ------------

Net cash from financing activities 3,889,530 2,124,752

-------------------------------------------- ------- ------------ ------------

Net increase / (decrease) in cash and

cash equivalents 1,123,353 (1,080,730)

-------------------------------------------- -------

Cash and cash equivalents at beginning

of year 364,590 1,484,437

-------------------------------------------- -------

Effect of foreign exchange rate changes 130,631 (39,117)

-------------------------------------------- ------- ------------ ------------

Cash and cash equivalents at end of

year 1,618,574 364,590

-------------------------------------------- ------- ============ ============

Notes to the Financial Information

For the year ended 31 December 2012

1. General information

Cyan Holdings plc is a Company incorporated in the England and

Wales under the Companies Act 2006. The address of the registered

office is Cyan Holdings plc, Buckingway Business Park, Swavesey

CB24 4UQ.

The preliminary announcement is based on the financial

statements which have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the EU.

The financial information set out above does not constitute the

company's statutory accounts for the years ended 31 December 2012

or 2011, but is derived from those accounts. Statutory accounts for

2011 have been delivered to the Registrar of Companies and those

for 2012 will be delivered following the company's annual general

meeting. The auditors have reported on those accounts: their

reports were unqualified and did not contain statements under s498

(2) or (3) Companies Act 2006 or equivalent preceding legislation

but did contain an emphasis of matter concerning the uncertainties

around the Group's ability to continue as a going concern. While

the financial information included in this preliminary announcement

has been prepared in accordance with the measurement and

recognition criteria of IFRS, this announcement itself does not

contain sufficient information to comply with IFRS. The company

expects to publish full financial statements that comply with IFRS,

as adopted by the EU, a copy of which will be posted to the

shareholders.

The financial statements were approved by the Board of Directors

on 30 May 2013 and authorised for issue. The Group's specific IFRS

accounting policies can be found in the 2011 annual report.

Going concern

The directors have prepared a business plan and cash flow

forecast for the period to 31 December 2014 which, together,

represent the directors' best estimate of the future development of

the Group. The forecast contains certain assumptions, the most

significant of which are the level and timing of sales and the

gross margin on those sales, together with the need to secure

additional finance in order to fund working capital within the next

twelve months.

At the time of the preparation of these financial statements,

the sales forecast includes a potential large contract with an

Indian utility customer (Tamil Nadu Electricity Board or TNEB). The

TNEB tender has been issued for 1.5M units and the directors

believe that the Group is well placed to be awarded contracts

(through local meter manufacturer partners) for the majority, or

possibly all of the tender. If successful, the directors believe

that delivery on the tender would commence in Q3 2013 and that this

contract would be transformational for the Group in terms of both

customer and shareholder perception. The directors' understanding

is that TNEB have plans to install/replace 18M meters over a

multi-year period and further tenders towards this goal will be

issued in the second half of 2013. However the variables are such

that there is a material uncertainty that forecast sales will be

achieved. The Group has other sales opportunities in the pipeline

(including multiple installed pilots in India) that are being

progressed in parallel.

The directors have recognised that the Group is trading

principally in two emerging country markets, namely India and

China. These markets have an inherent level of uncertainty

associated with them and this may result in the predicted level of

sales not being achieved and/or the timing of orders being delayed,

as has been the case for the Group in the past. The directors have

taken reasonable steps to satisfy themselves about the robustness

of sales forecasts but acknowledge that the timing of customer

orders in the Group's target markets is inherently uncertain. This

may impact both the Group's ability to generate positive cash flow

and to raise new finance. Consequently, there is a significant risk

that the level of sales achieved is materially lower than the

forecast or at materially lower margins. These constitute material

uncertainties.

At the Group's General Meeting held on 2 August 2012,

resolutions were passed to: (i) complete placings of GBP2.1 million

(before expenses) through the issue of 603 million new ordinary

shares; and (ii) issue 301 million warrants to the placees that

have an exercise price of 0.5p and a 12 month exercise window until

1 August 2013. If exercised in full, the warrants would provide the

Group with additional funding of GBP1.5 million (before expenses).

Given the commercial prospects at the time of the preparation of

this report (particularly TNEB described above), the directors

consider that the Group has a good opportunity to see the share

price remain above 0.5p before 1 August 2013 and therefore benefit

from the exercise of the warrants. At the time of writing this

report a total of 87 million of these warrants have been exercised,

raising a total of GBP433k of additional funds. In addition to this

in April 2013 the Board announced that it had raised GBP1 million

before expenses to support the expansion of operations in India and

strengthen the balance sheet.

If, however the share price is at or below 0.5p on 1 August

2013, it is likely that the remainder of the warrants will not be

exercised and the Group may need additional funding from another

source. There remains a significant risk that the required level of

funding will not be received in the necessary timescales or at all.

This constitutes a material uncertainty.

Notwithstanding the material uncertainties described above, the

directors have a reasonable expectation that the Group and Company

can continue to meet their liabilities as they fall due, for a

period of at least 12 months from the date of approval of this

report. Accordingly, they have prepared these financial statements

on the going concern basis.

The financial statements do not include the adjustments that

would result if the Group was unable to continue as a going

concern. In the event the Group ceased to be a going concern, the

adjustments would include writing down the carrying value of

assets, including inventories, to their recoverable amount and

providing for any further liabilities that might arise.

2. Dividends

The directors do not recommend the payment of a dividend (2011:

GBPnil). The Group has no plans to adopt a dividend policy in the

immediate future and all funds generated by the Group will be

invested in the further development of the business, as is normal

for a company operating in this industry sector and at this stage

of its development.

3. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Earnings

2012 2011

------------------------------------ ----- ------------ ----------

GBP GBP

------------------------------------ ----- ------------ ----------

Earnings for the purposes of basic

earnings per share being net loss

attributable to equity holders of

the parent 2,872,772 3,227,077

------------------------------------------ ============= ==========

Number of shares

2012 2011

------------------------------- ----------------- --------------- -------------

No. No.

------------------------------- ----------------- --------------- -------------

Weighted average number of

ordinary shares for the purposes

of basic and diluted earnings

per share 2,297,507,867 1,021,124,228

-------------------------------------- ----------- ============== ================

4. Share capital

2012 2011

---------------------------------------

GBP GBP

---------------------------------------

Issued and fully paid:

---------------------------------------

2,326,805,503 ordinary shares of

0.01 pence each (2011: 1,192,700,288

ordinary shares of 0.2 pence each) 232,681 2,385,401

--------------------------------------- ======== ==========

5. Notes to the consolidated cash flow statement

2012 2011

--- ------------------------------------------ ---- -------------- ------------

GBP GBP

(Restated)

(note 6)

----------------------------------------------- ---- -------------- ------------

Operating loss for the year (3,103,622) (3,575,000)

------------------------------------------------ -------------- ------------

Adjustments for:

----------------------------------------------- ---- -------------- ------------

Depreciation of property, plant and

equipment 24,993 28,690

------------------------------------------------ -------------- ------------

Share-based payment expense (10,314) 203,038

------------------------------------------------ --------------

Operating cash flows before movements

in working capital (3,088,943) (3,343,272)

----------------------------------------------- ---- -------------- ------------

Increase in inventories (50,664) (100,654)

------------------------------------------------ -------------- ------------

Decrease / (increase) in receivables 98,436 (116,848)

------------------------------------------------

(Decrease)/increase in payables (61,355) 65,255

------------------------------------------------ -------------- ------------

Cash reduced by operations (3,102,526) (3,495,519)

----------------------------------------------- ---- -------------- ------------

Income taxes received 337,177 317,673

------------------------------------------------

Net cash outflow from operating activities (2,765,349) (3,177,846)

----------------------------------------------- ---- -------------- ------------

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with maturity of

three months or less.

6. Restatement of prior periods

The financial statements include a prior period restatement in

relation to the treatment of warrants issued in prior periods. In

prior periods, these warrants were accounted for in accordance with

IFRS 2 Share based payments.

In the restated financial statements, these warrants have been

accounted for based on the agreement in place as follows:

-- For warrants issued to placees as part of an equity fund

raising where no service has been, or will be provided to Cyan,

these are outside the scope of IFRS2, and no charge is recorded in

the income statement; and

-- For warrants issued to service providers as part of the

consideration payable to them, these are within the scope of IFRS2,

and the total fair value of the warrants is spread over the related

service period, or expensed immediately if the service has already

been received. For service provided in connection with share

issues, the expenses are recorded against share premium.

Consolidated income statement (extracts)

2011 2011 2011

GBP GBP GBP

as reported adjustment restated

Other operating costs 1,767,631 75,501 1,843,132

-------------- ------------- -------------

Operating loss 3,499,499 75,501 3,575,000

Loss before tax 3,497,360 75,501 3,572,861

Loss for the year 3,151,576 75,501 3,227,077

------------------------------------------- -------------- ------------- -------------

Consolidated statement of comprehensive income

(extracts)

2011 2011 2011

GBP GBP GBP

as reported adjustment restated

Loss for the year 3,151,576 75,501 3,227,077

Total comprehensive income for

the period 3,185,680 75,501 3,261,181

Consolidated balance sheet (extracts)

2011 2011 2011

GBP GBP GBP

as reported adjustment restated

Equity

Share premium account 21,965,649 (310,713) 21,654,936

Share option reserve 604,536 145,329 749,865

Retained earnings 22,355,971 (165,384) 22,190,587

Company balance sheet (extracts)

2011 2011 2011

GBP GBP GBP

as reported adjustment restated

Non-current assets

Investment in subsidiaries 607,858 (240,885) 366,973

Equity

Share premium account 21,965,649 (310,713) 21,654,936

Share option reserve 604,536 145,329 749,865

Retained earnings 23,984,988 75,501 24,060,489

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BLGDUGDXBGXG

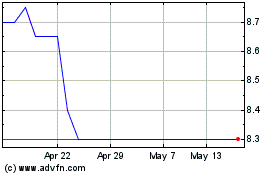

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024