TIDMCYAN

RNS Number : 5611T

Cyan Holdings Plc

30 September 2010

Cyan Holdings Plc

("Cyan" or "the Group")

Half year report

for the six months ended 30 June 2010

Cyan Holdings plc (AIM:CYAN.L), the fabless semiconductor company providing

wireless utility metering and lighting control products announces its half year

results for the six months ended 30 June 2010.

Summary

· Completed transition from fabless MCU manufacturer to system supplier to

the wireless utility metering and street lighting control markets.

· Cyan's products have been designed into those of its customers,

significantly improving the prospects for material orders over the next 12

months.

· Raised circa GBP1.8 million in September 2010, net of expenses, in a

placing to provide additional working capital.

· Offer of GBP450,000 convertible loan note to provide further working

capital.

· Continued tight management of costs.

Kenn Lamb, CEO of Cyan, commented:

"After a slower than expected start to the year, the pace of new customer

engagements accelerated at the end of Q2 as changes in the sales team and

channels started to show results. In Q2 Cyan experienced significant new

interest in our wireless meter reading products for electricity meters and this

has been followed throughout the third quarter with broad interest in Cyan's

streetlight control products particularly new variants for Sodium and HID

lighting. Both of these new products built on features and customer feedback

gained from Cyan's Gas meter and LED lighting products that were released during

2009. There was a slower than expected uptake of LED street lighting in China

and an unexpected requirement for a second version of our Gas meter to

incorporate a feature dictated by a utility company. This work has been

completed and Cyan now has wireless products for electricity and gas metering,

LED, Sodium and HID lighting all of which are designed into customer meters and

lights which we are told are being bid into tenders at an accelerating pace.

Feedback from customers and partners supports our experience of the last few

months in that the market demand for the products that Cyan has developed is

growing rapidly and we have high expectations for the resulting growth of the

company."

Enquiries:

+--------------------------------+--------------------------------+

| Cyan Holdings plc | www.cyantechnology.com |

+--------------------------------+--------------------------------+

| Kenn Lamb, CEO | Tel: +44 (0) 1954 234 400 |

+--------------------------------+--------------------------------+

| Cenkos Securities plc | |

+--------------------------------+--------------------------------+

| Stephen Keys / Adrian Hargrave | Tel: +44 (0) 20 7397 8900 |

+--------------------------------+--------------------------------+

| Media - Hansard Group | |

+--------------------------------+--------------------------------+

| John Bick / Vikki Krause | Tel: +44(0) 20 7245 1100 |

+--------------------------------+--------------------------------+

Interim Statement

Cyan has completed the transition from a fabless MCU manufacturer to a system

supplier which offers an integrated suite of software and hardware products

targeting the utility metering and street lighting sectors. These products can

be retrofitted to customers' existing products, thus enabling them to benefit

from wireless control, enhanced range and penetration within buildings using

Cyan's mesh networking solution. Cyan has now reached the stage where its

products have been designed into those of its customers, thereby significantly

improving the prospects for material orders over the next twelve months.

We believe that the growth of Cyan's target markets is driven by a number

of factors, including detection and minimisation of fraud and enforcement of

payment for utility providers, which can generate financial returns for end

customers far in excess of the cost of retrofitting Cyan wireless meter control

products. In addition, we believe that energy and maintenance cost savings

realised from individually monitoring, controlling and dimming street lighting

can generate significant financial savings again far in excess of the cost of

retrofitting Cyan wireless lighting control products. We expect this

functionality to become a default requirement as governments become aware of the

energy savings that can be realised from street lighting monitoring and control

via mesh networks.

Cyan's products can have additional features such as meter tamper alarms and

lighting power consumption reports. Importantly, Cyan's system solutions are

designed for ease of use, which we believe has been an important factor in these

products being integrated into customers' end products.

We understand that Cyan's customers have tested competitors' products alongside

those of Cyan and in these tests Cyan's products have operated consistently well

in locations where those of competitors have failed. Demonstration of this has,

we believe, assisted the Cyan's distributors greatly, thereby accelerating the

pace of new business prospects.

We believe that Cyan has a technological advantage that has been achieved

through significant investment in development and field trials. Cyan's mesh

networking protocol has been developed to operate in the sub 1GHz frequency

bands which have good building penetration capability and has been further

enhanced to maximise range at low signal strengths and data rates. The

intellectual property is embedded across multiple products and we believe that

duplication of this would require considerable time and expense from a

competitor. We believe that Cyan's superior building penetration and signal

range provides an opportunity for Cyan's products to become widely and quickly

adopted, as well as being difficult to displace.

Financials

For the six months ended 30 June 2010 turnover was GBP66,207 (2009:GBP42,575).

The loss for the period was reduced to GBP1,069,933 (2009:GBP1,612,050), mainly

due to continuing effective cost controls and a reduced workforce. Cash balances

at the period end were GBP721,746 (2009: GBP1,504,783).

In order to fund the growth of the business and its resulting additional working

capital requirements Cyan on 1 September 2010 announced that it had secured a

further round of finance, successfully raising circa GBP1.8 million (net of

expenses) as a result of a placing of shares with new and existing shareholders.

In addition, the Company is currently in negotiation relating to the proposed

issue of a Convertible Loan Note to the value of GBP450,000.The Board would like

to take this opportunity to thank Cenkos Securities for their management of the

placing, and the new and existing shareholders for their support.

Outlook

Cyan has developed new products specifically for the Indian Electricity Metering

market and for the Sodium and Xenon HID lighting markets and has several

customers with these embedded into their own products which have already been

submitted into multiple tenders, some of which are understood to be for 100k

units. These customers are established suppliers to the utilities and all have

existing run rate manufacturing capacity in excess of one million units per

annum. These customers have indicated to Cyan that significant costs are

incurred in each tender bid and that they expect to win at least a portion of

most of the tenders for which they bid. Specifically, Cyan has signed an MOU

with an electronics customer to integrate Cyan's products into that customer's

sodium/HID ballast and we expect this to result in a first order in Q4 2010 and

to subsequently develop into further orders during 2011.

With a product range that is now well developed and which is receiving increased

levels of commercial traction from its primary customers, the Directors believe

that the prospects for the Company for the remainder of 2010, and particularly

2011, are promising. Given the number of prospective companies with which Cyan

is actively engaged and the fact that several customers are tendering for major

projects which, if successful, would result in significant orders in 2011, we

are excited about Cyan's prospects and view the future with confidence.

Kenn Lamb

Chief Executive Officer

30 September 2010

Consolidated Income Statement

Six months ended 30 June 2010

+--------+--------+------+----------+----------+------+-------------+--------------+-------------+

| | | | | | | |

+--------+--------+-----------------+-----------------+-------------+--------------+-------------+

| | | | | Unaudited | Unaudited | Year ended |

| | | | | six | six months |31 December |

| | | | | months | ended | 2009 |

| | | | | ended | 30 June 2009 | |

| | | | | 30 June | | |

| | | | | 2010 | | |

+--------+--------+-----------------+-----------------+-------------+--------------+-------------+

| | | | Notes | GBP | GBP | GBP |

+--------+--------+-----------------+-----------------+-------------+--------------+-------------+

| Continuing operations | | | |

+-----------------------------------------------------+-------------+--------------+-------------+

| Revenue | 66,207 | 42,575 | 95,569 |

+-----------------------------------------------------+-------------+--------------+-------------+

| Cost of sales | | | (38,046) | (27,313) | (62,897) |

+-----------------+----------------------------+------+-------------+--------------+-------------+

| | | | | | | |

+--------+--------+----------------------------+------+-------------+--------------+-------------+

| Gross Profit | | | 28,161 | 15,262 | 32,672 |

+-----------------+----------------------------+------+-------------+--------------+-------------+

| | | | | |

+----------------------------------------------+------+-------------+--------------+-------------+

| Operating costs | | (744,774) | (1,243,185) |(1,633,138) |

+----------------------------------------------+------+-------------+--------------+-------------+

| Research and development costs | | (504,231) | (528,289) |(1,532,669) |

+----------------------------------------------+------+-------------+--------------+-------------+

| | | | | | | |

+------------------------+----------+----------+------+-------------+--------------+-------------+

| Operating loss | (1,220,844) | (1,756,212) |(3,133,135) |

+-----------------------------------------------------+-------------+--------------+-------------+

| Investment | | | 911 | 1,085 | 1,639 |

| revenue | | | | | |

+-----------------+-----------------+-----------------+-------------+--------------+-------------+

| Finance costs | | | - | (11) | (11) |

+-----------------+-----------------+-----------------+-------------+--------------+-------------+

| Loss before tax | (1,219,933) | (1,755,138) |(3,131,507) |

+-----------------------------------------------------+-------------+--------------+-------------+

| Tax | 150,000 | 143,088 | 479,247 |

+-----------------------------------------------------+-------------+--------------+-------------+

| | | | | | | |

+--------+--------+-----------------+-----------------+-------------+--------------+-------------+

| Loss for the period | | (1,069,933) | (1,612,050) |(2,652,260) |

+-----------------------------------+-----------------+-------------+--------------+-------------+

| | | | | | | |

+--------+--------+-----------------+-----------------+-------------+--------------+-------------+

| Loss per share (pence) | | | | |

+-----------------------------------+-----------------+-------------+--------------+-------------+

| Basic and | | 2 | (0.17) | (0.3) | (0.5) |

| diluted | | | | | |

+-----------------+-----------------+-----------------+-------------+--------------+-------------+

| | | | | | | |

+--------+--------+-----------------+-----------------+-------------+--------------+-------------+

| | | | | | | |

+--------+--------+-----------------+-----------------+-------------+--------------+-------------+

| | | | | | | | | |

+--------+--------+------+----------+----------+------+-------------+--------------+-------------+

Consolidated Balance Sheet

At 30 June 2010

+-------------+----------+---------+----------+----------+--------------+--------------+--------------+

| | | | | Unaudited | Unaudited | |

| | | | | | 30 June 2009 | 31 |

| | | | | 30 June | | December |

| | | | | 2010 | | 2009 |

+-------------+----------+--------------------+----------+--------------+--------------+--------------+

| | | | | GBP | | |

| | | | | | GBP | GBP |

+-------------+----------+--------------------+----------+--------------+--------------+--------------+

| Non-current assets | | | | | |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Intangible assets | | | - | - | - |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Property, plant and equipment | | 37,373 | 48,680 | 39,729 |

+---------------------------------------------+----------+--------------+--------------+--------------+

| | | | | | | |

+-------------+----------+--------------------+----------+--------------+--------------+--------------+

| | | | | 37,373 | 48,680 | 39,729 |

+-------------+----------+--------------------+----------+--------------+--------------+--------------+

| Current Assets | | | | | |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Inventories | | | | 890,876 | 902,658 | 893,087 |

+-------------+----------+--------------------+----------+--------------+--------------+--------------+

| Trade and other receivables | | 568,491 | 242,840 | 569,601 |

+---------------------------------------------+----------+--------------+--------------+--------------+

| Cash and cash equivalents | | 721,746 | 1,504,783 | 1,968,072 |

+---------------------------------------------+----------+--------------+--------------+--------------+

| | | | | 2,181,113 | 2,650,281 | 3,430,760 |

+-------------+----------+--------------------+----------+--------------+--------------+--------------+

| Total assets | | | 2,218,486 | 2,698,961 | 3,470,488 |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Current | | | | | |

| liabilities | | | | | |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Trade and other | | | 229,782 | 331,937 | 229,332 |

| payables | | | | | |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Total liabilities | | | 229,782 | 331,937 | 229,332 |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Net assets | | | 1,988,704 | 2,367,024 | 3,241,157 |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| | | | | | | |

+-------------+----------+--------------------+----------+--------------+--------------+--------------+

| Equity | | | | | | |

+-------------+----------+--------------------+----------+--------------+--------------+--------------+

| Share capital | | | 1,309,565 | 1,118,259 | 1,309,565 |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Share premium account | | 19,026,290 | 17,353,068 | 19,026,290 |

+---------------------------------------------+----------+--------------+--------------+--------------+

| Own shares held | | | (690,191) | (690,191) | (690,191) |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Share option | | | 379,886 | 316,537 | 379,886 |

| reserve | | | | | |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Translation | | | (410,634) | (214,580) | (228,114) |

| reserve | | | | | |

+------------------------+--------------------+----------+--------------+--------------+--------------+

| Retained loss | | (17,626,212) | (15,516,069) | (16,556,279) |

+---------------------------------------------+----------+--------------+--------------+--------------+

| | | | | | | |

+-------------+--------------------+----------+----------+--------------+--------------+--------------+

| Total equity being | | | 1,988,704 | 2,367,024 | 3,241,157 |

| attributable to equity | | | | | |

| holders of the parent | | | | | |

+----------------------------------+----------+----------+--------------+--------------+--------------+

| | | | | | | | |

+-------------+----------+---------+----------+----------+--------------+--------------+--------------+

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2010

+------+------+---------------------+----------+-------------+--------------+-------------+

| | | | | Unaudited | Unaudited | Year ended |

| | | | | six | six months | 31 |

| | | | | months | ended | December |

| | | | | ended | 30 June 2009 | 2009 |

| | | | | 30 June | | |

| | | | | 2010 | | |

+------+------+---------------------+----------+-------------+--------------+-------------+

| | | | | GBP | GBP | GBP |

+------+------+---------------------+----------+-------------+--------------+-------------+

| | | | | |

+-----------------------------------+----------+-------------+--------------+-------------+

| Exchange differences on | | (186,679) | 159,368 | 145,834 |

| translation of foreign operations | | | | |

+-----------------------------------+----------+-------------+--------------+-------------+

| Loss for | | | (1,069,933) | (1,612,050) | (2,652,260) |

| period | | | | | |

+-------------+---------------------+----------+-------------+--------------+-------------+

| Total comprehensive income for | | (1,256,612) | (1,452,682) | (2,506,426) |

| the period | | | | |

+------+------+---------------------+----------+-------------+--------------+-------------+

Consolidated Cash Flow Statement

Six months ended 30 June 2010

+------+-------+--+--------+----+----------+----------+----------+----------+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six | six | ended |

| | | | | months | months | 31 |

| | | | | ended | ended | December |

| | | | | 30 June | 30 June | 2009 |

| | | | | 2010 | 2009 | |

+------+-------+----------------+-------------------------------------------+-------------+-------------+-------------+

| | | | Notes | GBP | GBP | GBP |

+------+-------+----------------+-------------------------------------------+-------------+-------------+-------------+

| Net cash outflow from | 3 | (1,013,617) | (1,287,671) | (2,400,080) |

| operating activities | | | | |

+-------------------------------+-------------------------------------------+-------------+-------------+-------------+

| Investing | | 4 | (1,362) | (1,200) | (9,288) |

| activities | | | | | |

+--------------+----------------+-------------------------------------------+-------------+-------------+-------------+

| Financing | | | 4 | - | 1,125,062 | 2,989,591 |

| activities | | | | | | |

+--------------+--+--------+------------------------------------------------+-------------+-------------+-------------+

| Net (decrease)/increase in cash and cash equivalents | (1,014,979) | (163,809) | 580,223 |

+---------------------------------------------------------------------------+-------------+-------------+-------------+

| Cash and cash equivalents at beginning of period | | 1,968,072 | 1,356,886 | 1,356,886 |

+----------------------------------------------------------------+----------+-------------+-------------+-------------+

| Effect of foreign exchange rate changes | | | | (231,347) | 311,706 | 30,963 |

+------------------------------------------+----------+----------+----------+-------------+-------------+-------------+

| Cash and cash equivalents at end of period | 721,746 | 1,504,783 | 1,968,072 |

+---------------------------------------------------------------------------+-------------+-------------+-------------+

| | | | | | | |

+------+-------+----------------+-------------------------------------------+-------------+-------------+-------------+

| | | | | | | | | | | | |

+------+-------+--+--------+----+----------+----------+----------+----------+-------------+-------------+-------------+

Notes to Accounts

Six months ended 30 June 2010

1. Basis of preparation

The interim financial information has been prepared in accordance with the IFRS

accounting policies used in the statutory financial statements for the year

ended 31 December 2009.

These interim financial statements do not constitute statutory financial

statements within the meaning of section 435 of the Companies Act 2006. Results

for the six month periods ending 30 June 2010 and 30 June 2009 have not been

audited. The results for the year ended 31 December 2009 have been extracted

from the statutory financial statements of Cyan Holdings plc.

Statutory financial statements for the year ended 31 December 2009 are available

on the Company's website www.cyantechnology.com and have been filed with the

Registrar of Companies. The Company's auditors issued a report on those

financial statements that was unqualified and did not contain a statement under

section 498(2) or section 498(3) of the Companies Act 2006; however the

auditor's report was modified to emphasise the uncertainty around the company's

ability to continue as a going concern.

2. Going Concern

The directors have prepared a business plan and cash flow forecast for the

period to 30 September 2011. The forecast contains certain assumptions about

the level of future sales and the level of gross margins. The directors

acknowledge that the Group is trading in a difficult economic environment and in

markets that are relatively new to the Group. This may impact both the Group's

ability to generate positive cash-flow and to raise new finance. There is a

risk that the level of sales achieved is materially lower than the level

forecast or at materially lower margins. The directors have taken steps to

satisfy themselves about the robustness of sales forecasts but acknowledge that

the timing of customer orders in the Group's target markets is inherently

uncertain. The directors are of the opinion that this business plan is

achievable. On this basis, the directors have assumed that the company is a

going concern.

There is however, material uncertainty related to the assumptions described

above which may cast significant doubt on the company's ability to continue as a

going concern and, therefore, it may be unable to realise its assets and

discharge its liabilities in the normal course of business. The financial

statements do not include the adjustments that would result if the Group was

unable to continue as a going concern. In the event the Group ceased to be a

going concern, the adjustments would include writing down the carrying value of

assets to their recoverable amount and providing for any further liabilities

that might arise.

3. Post balance sheet event

Since the end of the period, the Group has raised additional equity funding of

circa GBP1.8 million after expenses. In addition the Group is in negotiation

relating to the proposed issue of a convertible loan note for GBP450,000. The

placing and acceptance of the convertible were authorised by existing

shareholders on 16 September 2010.

4. Loss per share

Basic and diluted loss per ordinary share has been calculated by dividing the

loss after taxation for the periods as shown in the table below.

+------+------+-------------+-----+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | | | ended |

| | | | | six | six | 31 |

| | | | | months | months | December |

| | | | | ended | ended | 2009 |

| | | | | 30 June | 30 June | |

| | | | | 2010 | 2009 | |

+------+------+-------------+-----+-------------+-------------+-------------+

| | | | | GBP | GBP | GBP |

+------+------+-------------+-----+-------------+-------------+-------------+

| | | | | | | |

+------+------+-------------+-----+-------------+-------------+-------------+

| Losses | | | 1,069,933 | 1,612,050 | 2,652,260 |

| (GBP) | | | | | |

+-------------+-------------+-----+-------------+-------------+-------------+

| Weighted average number | | 617,279,500 | 597,095,436 |528,453,250 |

| of shares | | | | |

+---------------------------+-----+-------------+-------------+-------------+

| |

| IAS33 "Earnings per share" requires presentation of diluted |

| EPS when a company could be called upon to issue shares that |

| would decrease net profit or increase net loss per share. |

| For a loss making company with outstanding share options, |

| net loss per share would only be increased by the exercise |

| of out of the money options. Since it seems inappropriate to |

| assume that option holders would act irrationally and there |

| are no other diluting future share issues, diluted EPS |

| equals basic EPS. |

+---------------------------------------------------------------------------+

| | | | | | | |

+------+------+-------------+-----+-------------+-------------+-------------+

5. Reconciliation of operating loss to operating cash flows

+-------+-----------+---------+-------+-----+----------+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six months | six | ended |

| | | | | ended | months | 31 |

| | | | | 30 June | ended | December |

| | | | | 2010 | 30 June | 2009 |

| | | | | | 2009 | |

+-------+-----------+-----------------------+----------+-------------+-------------+-------------+

| | | | | GBP | GBP | GBP |

+-------+-----------+-----------------------+----------+-------------+-------------+-------------+

| Operating loss | | | (1,220,844) | (1,756,212) | (3,133,135) |

| for the period | | | | | |

+-------------------+-----------------------+----------+-------------+-------------+-------------+

| Adjustments for: | | | | | |

+-------------------+-----------------------+----------+-------------+-------------+-------------+

| Depreciation of property, plant and | | 14,576 | 44,520 | 62,232 |

| equipment | | | | |

+-------------------------------------------+----------+-------------+-------------+-------------+

| Share-based payment expense | | - | 47,685 | 111,034 |

+-------------------------------------------+----------+-------------+-------------+-------------+

| Operating cash flows before movements in | | (1,206,268) | (1,664,007) | (2,959,869) |

| working capital | | | | |

+-------------------------------------------+----------+-------------+-------------+-------------+

| Decrease/(increase) in inventories | | 2,211 | (55,308) | (45,734) |

+-------------------------------------------+----------+-------------+-------------+-------------+

| Decrease/ (increase) in receivables | 1,110 | 374,734 | 48,035 |

+------------------------------------------------------+-------------+-------------+-------------+

| Increase/ (decrease) in payables | | 450 | 56,921 | (45,363) |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Cash reduced by operations | | (1,202,497) | (1,287,660) | (3,002,931) |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Income taxes received | | 188,880 | - | 602,851 |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Interest paid | | - | (11) | - |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Net cash outflow from operating | | (1,013,617) | (1,287,671) | (2,400,080) |

| activities | | | | |

+-------------------------------------+----------------+-------------+-------------+-------------+

| | | | | | | |

+-------+-----------+-----------------+----------------+-------------+-------------+-------------+

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

+-------+-----------+-----------------+----------------+-------------+-------------+-------------+

| 6. Analysis of cash flows | | | | |

+-------------------------------------+----------------+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six months | six | ended |

| | | | | ended | months | 31 |

| | | | | 30 June | ended | December |

| | | | | 2010 | 30 June | 2009 |

| | | | | | 2009 | |

+-------+-----------+-----------------+----------------+-------------+-------------+-------------+

| | | | | GBP | GBP | GBP |

+-------+-----------+-----------------+----------------+-------------+-------------+-------------+

| Investing | | | | | |

| activities | | | | | |

+-------------------+-----------------+----------------+-------------+-------------+-------------+

| Interest receivable and similar | | 922 | 1,085 | 1,639 |

| income | | | | |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Purchase of property, plant and | | (2,284) | (2,285) | (10,927) |

| equipment | | | | |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Net cash used by/from investing | | (1,362) | (1,200) | (9,288) |

| activities | | | | |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Financing | | | | | |

| activities | | | | | |

+-------------------+-----------------+----------------+-------------+-------------+-------------+

| Proceeds on issue of shares | | - | 1,125,073 | 2,989,602 |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Interest paid | | - | (11) | (11) |

+-------------------------------------+----------------+-------------+-------------+-------------+

| Net cash from financing | | | - | 1,125,062 | 2,989,591 |

| activities | | | | | |

+-----------------------------+-------+----------------+-------------+-------------+-------------+

| | | | | | | | | |

+-------+-----------+---------+-------+-----+----------+-------------+-------------+-------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR VKLFLBKFXBBL

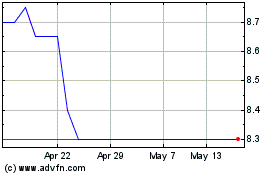

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024