Proposed Placings

September 01 2010 - 6:16AM

UK Regulatory

TIDMCYAN

RNS Number : 9620R

Cyan Holdings Plc

01 September 2010

Cyan Holdings plc

("Cyan" or "the Company")

Proposed Placings

Notice of General Meeting

Cyan Holdings Plc (AIM:CYAN.L), announces details of proposed placings of

257,333,333 ordinary shares at 0.75 pence per ordinary share ("Placings") by

Cenkos Securities to raise approximately GBP1.8 million after expenses and a

General Meeting ("GM"), to be held at 11.00 a.m. on 16 September 2010. It is

intended that the net proceeds from the Placings will be used for general

working capital requirements and will provide the Company with sufficient

resources to execute orders to generate meaningful revenues. First Columbus also

acted as placing agent. The Company has also entered into non-binding heads of

terms relating to the proposed issue of a convertible loan note totalling

GBP450,000 (the "Convertible Loan Note"). A document containing the notice of

the GM has been posted to all shareholders in the Company and is available to

view on the Company's website at: www.cyantechnology.com.

Background to and reasons for the Placings

Cyan has completed the transition from a fabless MCU manufacturer to a system

supplier which offers an integrated suite of software and hardware products

targeting the utility metering and street lighting sectors. These products can

be retrofitted to customers' existing products, thus enabling them to benefit

from wireless control, enhanced range and penetration within buildings using

Cyan's mesh networking solution. The Company has now reached the stage where its

products have been designed into those of its customers, thereby significantly

improving the prospects for material orders over the next twelve months.

The Directors believe that the growth of Cyan's target markets is driven by a

number of factors, including detection and minimisation of fraud and enforcement

of payment for utility providers, which can generate financial returns for end

customers far in excess of the cost of retrofitting Cyan wireless meter control

products. Similarly, the Directors believe that energy and maintenance cost

savings realised from individually monitoring, controlling and dimming street

lighting can generate significant financial savings far in excess of the cost of

retrofitting Cyan wireless lighting control products. The Directors expect this

functionality to become a default requirement as governments become aware of the

energy savings that can be realised from street lighting monitoring and control

via mesh networks.

Cyan's products can be adapted to have additional features such as meter tamper

alarms and lighting power consumption reports. Importantly, Cyan's system

solutions are designed for ease of use, which the Directors believe has been an

important factor in these products being integrated into customers' end

products.

The Directors understand that Cyan's customers have tested competitors' products

alongside those of Cyan and in these tests Cyan's products have operated

consistently well in locations where those of competitors have failed.

Demonstration of this has, the Directors believe, assisted the Company's

distributors greatly, thereby accelerating the pace of new business prospects.

The Directors believe that Cyan has a technological advantage that has been

achieved through significant investment in development and field trials. The

Company's mesh networking protocol has been developed to operate in the sub 1GHz

frequency bands which have good building penetration capability and has been

further enhanced to maximise range at low signal strengths and data rates. The

intellectual property is embedded across multiple products and the Directors

believe that duplication of this would require considerable time and expense

from a competitor. The Directors believe that Cyan's superior building

penetration and signal range provides an opportunity for the Company to become

widely and quickly adopted, as well as being difficult to displace.

The existing manufacturing capacity of the customers with which Cyan is

currently engaged in tenders is comfortably in excess of the volume required to

take Cyan into profitability and the purpose of the Placings is to provide the

Company with sufficient resources to execute these initial and follow on orders

and to generate meaningful revenues through fulfilling the orders into 2011 and

beyond. The Directors are excited by the level of opportunities that they are

seeing and recommend that Shareholders support the Resolutions to enable the

Placings.

Issue of convertible loan note

Cyan has entered into non-binding heads of terms with an institution for the

issue of the Convertible Loan Note. The issue of the Convertible Loan Note is

still subject to negotiation of final terms, documentation and appropriate board

and shareholder approvals. The proposed terms of the Convertible Loan Note are

as follows:

a) interest rate of 6 per cent. per annum;

b) loan term of five years;

c) certain fixed and floating security in respect of the loan notes;

d) ability to convert the loan into ordinary shares at a conversion

price of 1 penny per ordinary share, a 33 per cent. premium to the Placing

Price; and

e) if the loan is redeemed early, Cyan shall issue warrants over such

number of Ordinary Shares which would have been issued had the loan been

converted at a price of 1 penny per Ordinary Share, exercisable until the end of

the 5 year term.

Current trading and prospects

Cyan has developed new products specifically for the Indian Electricity Metering

market and for the Sodium and Xenon HID lighting markets and has several

customers with these embedded into their own products which have already been

submitted into multiple tenders, some of which are understood to be for 100k

units. These customers are established suppliers to the utilities and all have

existing run rate manufacturing capacity in excess of one million units per

annum. These customers have indicated to Cyan that significant costs are

incurred in each tender bid and that they expect to win at least a portion of

most of the tenders for which they bid. Specifically, the Company has signed an

MOU with a multinational electronics customer to integrate Cyan's products into

that customer's sodium ballast and the Directors expect this to develop into a

volume order during 2011.

With a product range that is now well developed and which is receiving increased

levels of commercial traction from its primary customers, the Directors believe

that the prospects for the Company for the remainder of 2010 and beyond are

promising. Given the number of prospective companies with which Cyan is actively

engaged and the fact that several customers are tendering for major projects

which, if successful, would result in significant orders in 2011, the Directors

are excited about Cyan's prospects and view the future with confidence.

Serious loss of capital

The value of the Company's net assets has reached a level that is less than half

of its called-up share capital. In such circumstances, the Directors are

required under section 656 of the Companies Act 2006 to convene a general

meeting of the Company for the purpose of considering whether any, and if so

what, steps should be taken to deal with the situation. This matter will be

considered at the GM. The steps which are recommended by the Directors are set

out in paragraph 2 above. If the steps are implemented, the Directors do not

consider that any additional action needs to be taken.

Details of the Placings

The Company intends to raise approximately GBP1.8 million, net of expenses,

through the issue of 257,333,333 new ordinary shares (the "Placing Shares") at

0.75 pence per ordinary share (the "Placing Price") pursuant to the Placings,

comprising of a VCT placing and a general placing.

The Placing Price represents a discount of approximately 9.1 per cent. to the

closing mid-market price of 0.825 pence per ordinary share as at 31 August 2010,

the latest practicable date prior to the announcement of the Placings. The

Placing Shares will, when issued, rank pari passu in all respects with the

Existing Ordinary Shares, including the right to receive dividends and other

distributions declared following Admission.

The Placing Shares will represent approximately 28.21 per cent. of the Company's

enlarged share capital.

The Placings are being made on a non pre-emptive basis as the time delay and

costs associated with a pre-emptive offer are considered by the Directors to be

excessive.

Application will be made by the Company for the Placing Shares to be admitted to

trading on AIM. Subject to completion of the Placings, it is expected that the

Placing Shares will be admitted to trading on AIM and that dealings will

commence at 8.00 a.m. on 17 September 2010 in respect of the Placing Shares.

The issue of the Placing Shares, is conditional, inter alia, upon:

(a) the approval of the Resolutions at the GM;

(b) the Placing Agreement becoming unconditional in all respects and not

having been terminated in accordance with its terms; and

(c) Admission,

in each case by no later than 8.00 a.m. on 17 September 2010 (or such time and

date as the Company and Cenkos Securities plc may agree, being not later than 1

October 2010).

Pursuant to the terms of the Placing Agreement, Cenkos Securities plc has

conditionally agreed to use its reasonable endeavours, as agent to the Company,

to place the Placing Shares at the Placing Price with certain institutional and

other investors. The above obligations are subject to certain conditions

including those listed above. The Placings are not underwritten.

The Placing Agreement contains warranties given by the Company with respect to

its business and certain matters connected with the Placings. In addition, the

Company has given certain indemnities to Cenkos Securities plc in connection

with the Placings and Cenkos Securities plc's performance of services in

relation to the Placings. Cenkos Securities plc is entitled to terminate the

Placing Agreement in specified circumstances.

Directors' Shareholdings

The beneficial and non-beneficial interests of the Directors in Ordinary Shares

(not including Ordinary Shares held by the Cyan Employee Benefit Trust) on the

date of this document and following the Placings are set out below:

+-------------------+------------+------------+-----------+-----------+

| | Existing | Following the |

| | | Placings |

+-------------------+-------------------------+-----------------------+

| | Number of | Existing | Number | Issued |

| | Ordinary | Ordinary | of | Ordinary |

| | | | Ordinary | |

+-------------------+------------+------------+-----------+-----------+

| Director | Shares | Share | Shares | Share |

| | | Capital | | Capital |

+-------------------+------------+------------+-----------+-----------+

| Kenneth Lamb | 8,500,000 | 1.30% | 8,500,000 | 0.92% |

+-------------------+------------+------------+-----------+-----------+

| Dr. John Read | 5,351,636 | 0.82% | 5,351,636 | 0.58% |

+-------------------+------------+------------+-----------+-----------+

| Simon Smith | 3,000,000 | 0.46% | 3,000,000 | 0.33% |

+-------------------+------------+------------+-----------+-----------+

The following ordinary shares held by the Cyan Employee Benefit Trust are

beneficially owned by the following Directors to the extent the share price

exceeds 2.5p per ordinary share:

Number of Ordinary

Director

Shares

Kenneth Lamb

30,000,000

Dr. John Read

1,000,000

The Directors have also agreed that, in the interests of retaining cash within

the Company, they will use a determined portion of their income from the Company

to purchase newly issued ordinary shares on a monthly basis on the 1st day of

each month, the number of which will be determined by the closing mid-market

share price of the ordinary shares on the trading day immediately prior to the

issue of the ordinary shares. The following Directors have agreed to use a

percentage of their income to acquire ordinary shares:

Director Percentage of Income

Monetary amount

Kenneth Lamb

50% GBP5,010.21 per month

Dr. John Read

100% GBP2.794.01 per month

Save as stated above, the Directors have no interest in the share capital of the

Company.

Enquiries:

Cyan Holdings plc www.cyantechnology.com

Kenn Lamb, CEO Tel: +44 (0)1954 234 400

Cenkos Securities plc

Stephen Keys / Adrian Hargrave Tel: +44 (0)20 7397 8900

First Columbus Investments LLP

Chris Crawford / John Nuttall Tel +44 (0)20 3002 2070

Media - Hansard Group

John Bick Tel: +44(0)20 7245 1100

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOELLFLIASILIII

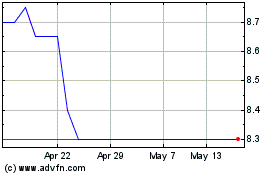

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024