TIDMCYAN

RNS Number : 3047J

Cyan Holdings Plc

29 March 2010

29 March 2010

Cyan Holdings plc

("Cyan or "the Company")

Preliminary Results

for the year ended 31 December 2009

Cyan Holdings plc (AIM: CYAN.L), the fabless semiconductor company providing

wireless utility metering and lighting control products based on its feature

rich, low power, microcontroller chips announces its preliminary results for the

year ended 31 December 2009.

Summary of key achievements

· Partnership with Future Electronics Inc, a global electronics distributor

operating in 41 countries giving Cyan access to major distribution networks into

the global lighting and smart metering market.

· A range of field trials completed and/or progressing with OEMs and systems

suppliers.

· Increasing level of customer engagements across our three key target

areas:

· Automated/smart metering market

· Street lamp control market

· Supply of gateways (data access points) to a wide range of industrial

wireless networks

· Management has maintained a tight control of cost base

· Two equity placings during the year raised GBP3.2 million (gross) of new

funds to provide additional working capital.

Commenting, Kenn Lamb, CEO of Cyan, said:

"Cyan's products have been designed into a range of established customers'

meters and lighting systems. These products have been through or are currently

undergoing field trials. Cyan expects that in 2010 a growing number of these

customers will win tenders and commence production deployment, although we

remain aware that the current economic climate means that it is not easy to

predict precise timing."

www.cyantechnology.com

Enquiries:

+------------------------------+---------------------------------------+

| Cyan Holdings plc | Tel: +44 (0) 1954 234 400 |

| John Read, Chairman | |

| Kenn Lamb, CEO | |

| | |

+------------------------------+---------------------------------------+

| Cenkos Securities plc | Tel: +44 (0)20 7397 8900 |

| Stephen Keys / Camilla Hume | |

| | |

+------------------------------+---------------------------------------+

| Hansard Communications Ltd | Tel: +44 (0)20 7245 1100 |

| John Bick / Kirsty Corcoran | Tel: +44 (0) 7872 061007 |

+------------------------------+---------------------------------------+

Chairman's Statement

During 2009, Cyan continued to make significant progress in the marketing of its

wireless utility metering products. Our primary goal is the commercialisation

of our market-leading products and throughout the period customer engagements

increased significantly across our three key target areas, namely the

automated/smart metering market, the global street lamp control market and

supplier of gateways (access points) to a wide range of industrial wireless

networks.

Cyan's strategic aim is to become a major supplier to each of these important

global markets and progress was made during the year which included the sale of

tens of thousands of microcontrollers, thousands of wireless gas meter

controllers and hundreds of street light controllers for prototypes,

pre-production and field trials. Cyan is engaged with a range of customers in

China, India, Africa, Europe and the USA that have completed or undertaken

trials during the year. Cyan also has contract manufacturing partners ready to

support any rapid increase in orders of our solutions.

Cyan has successfully secured and maintained key partnerships, most recently

with Future Electronics Inc, a top three worldwide electronic component

distributor with divisions focussed on metering and lighting products. Future

Electronics provides a global distribution network for all Cyan products.

The agreement announced in July with Future Electronics recognises the synergy

between Cyan's products and the global markets in which Future is well

established. Future supplies a substantial portion of the global in-building

LED lighting market through its Future Lighting Solutions ('FLS') division. As a

result of the relationship with Future, Cyan is currently working on wireless

lighting control for incorporation into a new product expected to go into

production during 2010, to be offered to current and prospective FLS customers.

As we have progressed through the year Cyan has continued to meet the demands of

potential key customers in cost and performance and has received orders for

field trials across a range of applications. In September 2009 Cyan

demonstrated the first 470MHz version of its wireless meter, the required

frequency specified for all future meters in China. Cyan's product is now able

to address electricity metering opportunities in China in addition to gas and

water meter opportunities across all Chinese provinces.

While undergoing trials with key customers, Cyan's technology has developed to

incorporate features significantly improving the performance of Cyan's wireless

metering solutions. We continue to work with potential customers, who

incorporate our products into their own, to present new features to their target

markets. The technical performance of Cyan's products continues to drive demand

for field trials in different countries and across a number of potentially large

scale applications.

For the year ended 31 December 2009 both operating costs and R&D costs were

significantly reduced, resulting in an operating loss of GBP3,133,135 (2008:

GBP4,557,917). Loss for the year was also reduced to GBP2,652,260 (2008:

GBP3,999,326). Cash at year end sat at GBP1,968,072 (2008: GBP1,356,886).

The Company successfully completed two equity placings to new and existing

investors during the period, raising a total of GBP3.0 million of new money (net

of expenses) to fund working capital requirements to support customer trial

orders and partnerships.

The Board is happy with the progress and contribution made to date from the two

recent additions to the Company's management team in December 2009. Bijan

Mohandes joined as Vice President of Worldwide Sales and Marketing and is

working to expand Cyan's indirect sales channels and Paul Ruskin, who joined as

COO, is managing and converging multiple customer projects into a set of

products that Cyan can promote globally.

Board Changes

I am delighted that Simon Smith has today been appointed as non-executive

director. Simon is an experienced financial executive with over twenty years

experience in the semiconductor and technology sectors. He is currently an

independent advisor to both start-up and listed technology companies providing a

range of assistance including fund raising, business planning and contract

negotiation.

Prior to establishing himself as an independent advisor in 2007, Simon held the

position of Chief Financial Officer/Director of Finance at multi-national

businesses in both the UK and USA since 1997 and his experiences include

multiple business acquisitions/disposals, fund raising, business planning, cash

management and customer contract negotiation.

Finally, I would like to thank David Gutteridge for his contribution to the

Board and the Company as non-executive director and we wish him well when he

steps down from the Board at the Company's Annual General Meeting to be held on

21 April 2010.

John Read

Chairman

29th March 2010

Chief Executive's Statement

Smart Meters, Smart Grid, and Automated Meter Reading: These are all terms which

are seen more and more frequently in applications and referred to in the press.

Each offers different benefits, but all require remote access to monitor and

control utility meters.

The green agenda is the driving force behind these meter initiatives, each

intended to be energy saving, primarily delivered by modifying consumer

behaviour. Energy saving light bulbs are promoted for domestic use, but it is

street lighting and commercial buildings where substantial energy savings can be

made. To realise such savings individual lights must be monitored and

controlled. It is analogous to the metering requirement and again, wireless

communication is the dominant choice to provide that control.

Cyan provides that wireless communication and is: 'The Gateway to Intelligent

Connectivity'.

Cyan has developed a comprehensive range of wireless control and monitoring

products for these markets. The requirement sounds easy, but the successful

implementation has required many years of development. As individuals, we carry

mobile phones, and as a result are familiar with point-to-point wireless

communication. Every time we connect wirelessly to the Internet we use point to

multipoint. What is relatively new and a future requirement for these markets is

a mesh connection, where communication is relayed between individual lights or

meters from one or multiple access points. Communication percolates through the

mesh, each meter or light is connected to more than one other meter or light,

thus offering multiple communication routes and automatically building in

communication redundancy. Range and, more importantly, penetration through

reinforced concrete floors in tower blocks, is increased by taking multiple hops

through only a few floors at a time while using no more than the transmit power

achievable with batteries or limited by regulation.

Cyan has four specialised capabilities that we believe are not available from

any other single supplier.

Cyan's microcontrollers minimise the components required for any meter or

lighting product by utilising our own 16bit MCU device. This has processing

power sufficient to handle both the wireless communication as well as the

metering or lighting control functions. The alternative is to use two MCUs

adding significantly to the cost.

Cyan's mesh networking protocol CyNet(TM) has been developed specifically for

metering and lighting applications. This requires detailed knowledge and

practical experience from multiple field trials to understand how to make

systems that are:

· Self Forming, to simplify deployment

· Self Healing, to make them robust and automatically support

additional meters or lights

· Low power, to enable battery operation for gas and water meters

· Low network overhead, to increase the maximum size of a single

network.

Cyan's wireless products operate in all global sub 1GHz ISM bands. These are the

frequency bands allocated for metering and lighting. Cyan has a single

interchangeable product family that allows our customers to deploy their

products anywhere in the world. The sub 1GHz frequencies are more difficult to

use for wireless mesh networking, the data throughput is lower so tuning the

protocol to the application is a critical requirement. These bands have

significant advantages in range and penetration making them a preferred choice

for these applications.

Cyan's products provide a complete solution. Wireless nodes for retrofitting as

well as complete meter and lighting control electronics supplied as production

ready modules. Access points using USB, Ethernet and GPRS allows connection

wirelessly, from a PC, over the Internet or even via a mobile phone network.

Concentrators actually process meter readings and present these via a web

server. All these functions are managed by Cyan's 16bit MCU's offering

significant cost savings compared to 32 bit alternatives. Significantly, through

CyanIDE, a state of the art graphical development tool that we issue free of

charge, all of these products are also user programmable.

This range of capabilities enables Cyan to offer a compelling solution for the

metering and lighting markets. In recent months we have taken this one stage

further and developed, for specific customers, products that provide wireless

mesh capability plus all the electronics required for a meter including the

display. These meter products are battery operated and demonstrate the low

system cost and low power consumption that can be realised by using a single

Cyan MCU.

Cyan has also developed, again for specific customers, lighting control products

that combine wireless mesh capability with monitoring and control of the light

intensity, again from a single Cyan MCU. Cyan is currently working with Future

Lighting Solutions (a leading supplier to the global LED lighting market) to add

wireless control to their lighting platform. All of these products are supported

with software that customises Cyan's Gateway and Concentrator products, to

provide a near complete wireless mesh solution ready to incorporate into the

customer's product. In 2009 the Cyan team has continued to work hard to enhance

its understanding of the requirements of our target markets, reinforcing our

technology leadership.

Looking Forward

Cyan's products have been designed into a range of established customers' meters

and lighting systems. These products have been through or are currently

undergoing field trials. Cyan expects that in 2010 a growing number of these

customers will win tenders and commence production deployment, although we

remain aware that the current economic climate means that precise timing is not

certain.

The Group's business plan for 2010 and beyond includes significant assumptions

around the timing and value of future sales and the level of gross margins. It

also identifies the need for additional financing within the next six months for

working capital purposes. We draw your attention to the information in note 1

about the basis on which the Board has concluded that the Group is a going

concern and the risks and uncertainties within the business plan. Those

uncertainties include the level and timing of future sales, the level of gross

margin achieved and the availability or otherwise of additional funding.

Once again I wish to acknowledge and thank Cyan employees for their enthusiasm

and dedication, and acknowledge the continued support of the Company's

shareholders for whom 2010 should finally reveal the potential of Cyan.

Kenn Lamb

Chief Executive Officer

29th March 2010

Consolidated income statement

For the year ended 31 December 2009

+------------------------------------+----+----------+-------------+-+-------------+

| | | | 2009 | | 2008 |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | GBP | | GBP |

+------------------------------------+----+----------+-------------+-+-------------+

| Continuing operations | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Revenue | | | 95,569 | | 145,627 |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Cost of sales | | | (62,897) | | (86,321) |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Gross profit | | | 32,672 | | 59,306 |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Operating costs | | | (1,633,138) | | (2,485,486) |

+------------------------------------+----+----------+-------------+-+-------------+

| Research and development costs | | | (1,532,669) | | (1,953,937) |

+------------------------------------+----+----------+-------------+-+-------------+

| Restructuring costs | | | - | | (177,800) |

+------------------------------------+----+----------+-------------+-+-------------+

| Operating loss | | | | | |

| | | | (3,133,135) | | (4,557,917) |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Investment revenue | | | 1,639 | | 92,885 |

+------------------------------------+----+----------+-------------+-+-------------+

| Finance costs | | | (11) | | (1) |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Loss before tax | | | (3,131,507) | | (4,465,033) |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Tax | | | 479,247 | | 465,707 |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Loss for the year | | | (2,652,260) | | (3,999,326) |

+------------------------------------+----+----------+-------------+-+-------------+

| | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Loss per share (pence) | | | | | |

+------------------------------------+----+----------+-------------+-+-------------+

| Basic | | | (0.5) | | (1.7) |

+------------------------------------+----+----------+-------------+-+-------------+

| Diluted | | | (0.5) | | (1.7) |

+------------------------------------+----+----------+-------------+-+-------------+

+-----------------------------------+-------+---------------+-+---------+

| | | | | |

+-----------------------------------+-------+---------------+-+---------+

+--------------------------------------------------------------------------------+---+----------+-+--------+

| Consolidated Statement of Comprehensive Income | | | | |

| For the year ended 31 December | | | | |

| 2009 | | | | |

| | | | | |

| 2009 2008 | | | | |

| GBP GBP | | | | |

| | | | | |

| Exchange differences on 145,834 (373,948) | | | | |

| translation of foreign operations | | | | |

| | | | | |

| | | | | |

| Loss for the year (2,652,260) (3,999,326) | | | | |

| | | | | |

| Total comprehensive income for (2,506,426) (4,373,274) | | | | |

| the period | | | | |

| | | | | |

+--------------------------------------------------------------------------------+---+----------+-+--------+

Consolidated balance sheet

At 31 December 2009

+--------------------------------+-----+-+--------------+-+--------------+

| | | | 2009 | | 2008 |

| | | | GBP | | GBP |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Non-current assets | | | | | |

| Intangible assets | | | - | | - |

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Property, plant and equipment | | | 39,729 | | 99,769 |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Current assets | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Inventories | | | 893,087 | | 847,351 |

+--------------------------------+-----+-+--------------+-+--------------+

| Trade and other receivables | | | 569,601 | | 617,636 |

+--------------------------------+-----+-+--------------+-+--------------+

| Cash and cash equivalents | | | 1,968,072 | | 1,356,886 |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | 3,430,760 | | 2,821,873 |

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Total assets | | | 3,470,489 | | 2,921,642 |

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Current liabilities | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Trade and other payables | | | 229,332 | | 274,695 |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | 229,332 | | 274,695 |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Non-current liabilities | | | - | | - |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Total liabilities | | | 229,332 | | 274,695 |

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Net assets | | | 3,241,157 | | 2,646,947 |

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Equity | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Share capital | | | 1,309,565 | | 954,259 |

+--------------------------------+-----+-+--------------+-+--------------+

| Share premium account | | | 19,026,290 | | 16,391,994 |

+--------------------------------+-----+-+--------------+-+--------------+

| Own shares held | | | (690,191) | | (690,191) |

+--------------------------------+-----+-+--------------+-+--------------+

| Share option reserve | | | 379,886 | | 268,852 |

+--------------------------------+-----+-+--------------+-+--------------+

| Translation reserve | | | (228,114) | | (373,948) |

+--------------------------------+-----+-+--------------+-+--------------+

| Retained earnings | | | (16,556,279) | | (13,904,019) |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| Total equity being equity | | | 3,241,157 | | 2,646,947 |

| attributable to equity holders | | | | | |

| of the parent | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

| | | | | | |

+--------------------------------+-----+-+--------------+-+--------------+

Consolidated statement of changes in equity

+--------+------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| at 31 December 2009 | | | | | |

| | | | | | |

| | | | | | |

+---------------------------------------------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| | | Share | Share | Own | Share | Translation | Retained | Total |

| | | Capital | Premium | shares | Option | Reserve | Losses | Equity |

| | | | | held | Reserve | | | |

+--------+------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Bal at 31 | 279,252 | 13,600,291 | | 209,398 | | (9,904,693) | 4,184,248 |

| December | | | - | | - | | |

| 2007 | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Loss for | - | - | - | - | - | (3,999,326) | (3,999,326) |

| the year | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Other | - | - | - | - | (373,948) | - | (373,948) |

| comprehensive | | | | | | | |

| income for | | | | | | | |

| the year | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Total | - | - | - | - | (373,948) | (3,999,326) | (4,373,274) |

| comprehensive | | | | | | | |

| income for | | | | | | | |

| the year | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Issue of | 675,007 | 2,791,703 | (690,191) | - | - | - | 2,776,519 |

| share | | | | | | | |

| capital | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Credit to | - | - | - | 59,454 | - | - | 59,454 |

| equity for | | | | | | | |

| share | | | | | | | |

| options | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Bal at 31 | 954,259 | 16,391,994 | 690,191 | 268,852 | 373,948 | (13,904,019) | 2,646,947 |

| December | | | | | | | |

| 2008 | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Loss for | - | - | - | - | - | (2,652,260) | (2,652,260) |

| the year | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Other | - | - | - | - | 145,834 | - | 145,834 |

| comprehensive | | | | | | | |

| income for | | | | | | | |

| the year | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Total | | | | | 145,834 | (2,652,260) | (2,506,426) |

| comprehensive | | | | | | | |

| income for | | | | | | | |

| the year | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Issue of | 355,306 | 2,634,296 | - | - | - | - | 2,989,602 |

| share | | | | | | | |

| capital | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Credit to | - | - | - | 111,034 | - | - | 111,034 |

| equity for | | | | | | | |

| share | | | | | | | |

| options | | | | | | | |

+---------------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

| Bal at 31 | 1,309,565 | 19,026,290 | (690,191) | 379,886 | (228,114) | (16,556,279) | 3,241,157 |

| December | | | | | | | |

| 2009 | | | | | | | |

+--------+------+------------------+----------------------------------------------+-------------------+----------------+-------------------+---------------+----------------+

Consolidated cash flow statement

For the year ended 31 December 2009

+----------------------------------------+----+-------------+----------+-------------+

| | | | | |

| | | 2009 | | 2008 |

+----------------------------------------+----+-------------+----------+-------------+

| | | GBP | | GBP |

+----------------------------------------+----+-------------+----------+-------------+

| Net cash from operating activities | | (2,400,080) | |(5,609,327) |

+----------------------------------------+----+-------------+----------+-------------+

| | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Investing activities | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Interest received | | 1,639 | | 92,885 |

+----------------------------------------+----+-------------+----------+-------------+

| Purchases of property, plant and | | (10,927) | | (30,008) |

| equipment | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Net cash from investing activities | | (9,288) | | 62,877 |

| | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Financing activities | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Interest paid | | (11) | | (1) |

+----------------------------------------+----+-------------+----------+-------------+

| Proceeds on issue of shares | | 2,989,602 | | 2,776,519 |

+----------------------------------------+----+-------------+----------+-------------+

| Net cash from financing activities | | 2,989,591 | | 2,776,518 |

+----------------------------------------+----+-------------+----------+-------------+

| | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Net (decrease)/increase in cash and | | 580,223 | | (2,769,932) |

| cash equivalents | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Cash and cash equivalents at beginning | | 1,356,886 | | 4,079,534 |

| of year | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Effect of foreign exchange rate | | 30,963 | | 47,284 |

| changes | | | | |

| | | | | |

+----------------------------------------+----+-------------+----------+-------------+

| Cash and cash equivalents at end of | | 1,968,072 | | 1,356,886 |

| year | | | | |

| | | | | |

+----------------------------------------+----+-------------+----------+-------------+

Notes to the Financial Information

For the year ended 31 December 2009

1. General information

Cyan Holdings plc is a company incorporated in the United Kingdom under the

Companies Act 2006. The address of the registered office is Cyan Holdings plc,

Buckingway Business Park, Swavesey CB24 4UQ.

The financial information set out above does not constitute the company's

statutory accounts for the years ended 31 December 2009 or 2008, but is derived

from those accounts. Statutory accounts for 2008 have been delivered to the

Registrar of Companies and those for 2009 will be delivered following the

company's annual general meeting. The auditors have reported on those accounts:

their reports were unqualified and did not contain statements under s498 (2) or

(3) Companies Act 2006 or equivalent preceding legislation but did contain an

emphasis of matter concerning the uncertainties around the Group's ability to

continue as a going concern. While the financial information included in this

preliminary announcement has been computed in accordance with International

Financial Accounting Standards (IFRS), this announcement itself does not contain

sufficient information to comply with IFRS. The company expects to publish full

financial statements that comply with IFRS, a copy of which will be posted to

the shareholders.

The financial statements were approved by the Board of Directors on 26 March

2010. The Group's specific IFRS accounting policies can be found in the 2008

annual report.

Going concern

The directors have prepared a business plan and cash flow forecast for the

period to 30 June 2011. The forecast contains certain assumptions about the

level of future sales and the level of gross margins and also identified the

need within the next six months for additional finance to fund working capital.

The directors acknowledge that the Group is trading in a difficult economic

environment and in markets that are new to the Group. This may impact both the

Group's ability to generate positive cashflow and to raise new finance. There

is a risk that the level of sales achieved is materially lower than the level

forecast or at materially lower margins. The directors have taken steps to

satisfy themselves about the robustness of sales forecasts but acknowledge that

the timing of customer orders in the Group's target markets is inherently

uncertain. In addition, the directors have reason to believe that additional

funding could be obtained from potential investors, including current

shareholders, upon evidence of firm sales orders. There does remain significant

risk, however, that the required level of funding will not be received in the

necessary timescale or at all. The directors are of the opinion that this

business plan is achievable. On this basis, the directors have assumed that the

company is a going concern.

There is a material uncertainty related to the assumptions described above which

may cast significant doubt on the company's ability to continue as a going

concern and, therefore, it may be unable to realise its assets and discharge its

liabilities in the normal course of business. The financial statements do not

include the adjustments that would result if the Group was unable to continue as

a going concern. In the event the Group ceased to be a going concern, the

adjustments would include writing down the carrying value of assets to their

recoverable amount and providing for any further liabilities that might arise.

2. Earnings per share

The calculation of the basic and diluted earnings per share is based on the

following data:

Earnings

+-------------------------------------------+--------+--------+--------+--+-----------+

| | | 2009 | | 2008 |

+-------------------------------------------+-----------------+--------+--+-----------+

| | | GBP | | GBP |

+-------------------------------------------+-----------------+--------+--+-----------+

| | | | | |

+-------------------------------------------+-----------------+--------+--+-----------+

| Earnings for the purposes of basic | | | | |

| earnings per share being net loss | | | | |

| attributable to equity holders of the | | | | |

| parent | | | | |

+-------------------------------------------+-----------------+--------+--+-----------+

| | | 2,652,260 | | 3,999,326 |

+-------------------------------------------+--------+-----------------+--+-----------+

| | | | | | |

+-------------------------------------------+--------+--------+--------+--+-----------+

Number of shares

+---------------------------+--------+---------+-----+--------------+----------+----------+----------+

| | | | | | |

| | | 2009 | | 2008 | |

+---------------------------+------------------+--------------------+----------+----------+----------+

| | | No. | | No. | |

+---------------------------+------------------+--------------------+----------+----------+----------+

| | | | | | |

+---------------------------+------------------+--------------------+----------+----------+----------+

| Weighted average number of | | 528,453,250 | | 239,626,314 |

| ordinary shares for the purposes | | | | |

| of basic and diluted earnings per | | | | |

| share | | | | |

+------------------------------------+---------------+--------------+----------+---------------------+

| | | | | | |

+---------------------------+------------------+--------------------+----------+----------+----------+

| | | | | | | | |

+---------------------------+--------+---------+-----+--------------+----------+----------+----------+

3. Share capital

+-----------------------------------------+------+-------------+--+-------------+

| | | 2009 | | 2008 |

+-----------------------------------------+------+-------------+--+-------------+

| | | number | | number |

+-----------------------------------------+------+-------------+--+-------------+

| Authorised: | | | | |

+-----------------------------------------+------+-------------+--+-------------+

| Ordinary shares of 0.2 pence each | | 800,000,000 | | 600,000,000 |

| | | | | |

+-----------------------------------------+------+-------------+--+-------------+

| | | | | |

+-----------------------------------------+------+-------------+--+-------------+

| | | | | |

+-----------------------------------------+------+-------------+--+-------------+

| | | 2009 | | 2008 |

+-----------------------------------------+------+-------------+--+-------------+

| | | GBP | | GBP |

+-----------------------------------------+------+-------------+--+-------------+

| Issued and fully paid: | | | | |

+-----------------------------------------+------+-------------+--+-------------+

| 654,782,659 (2008: 477,129,314) | | 1,309,565 | | 954,259 |

| ordinary shares of 0.2 pence each | | | | |

+-----------------------------------------+------+-------------+--+-------------+

+------------------------------------------------------+-----------+

| | |

+------------------------------------------------------+-----------+

4. Notes to the consolidated cash flow statement

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | | | 2009 | | 2008 |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | | GBP | | GBP |

| | | | | |

| | | | | |

+-----------------------------------------------+----------+-------------+----------+-------------+

| | Operating loss for the year | | (3,133,135) | | (4,557,917) |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | | | | | |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| Adjustments for: | | | | |

+-----------------------------------------------+----------+-------------+----------+-------------+

| | Depreciation of property, plant and | | 62,232 | | 67,100 |

| | equipment | | | | |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | Amortisation of intangible assets | | - | | 28,793 |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | Share-based payment expense | | 111,034 | | 59,454 |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | | | | | |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| Operating cash flows before movements in | | (2,959,869) | | (4,402,570) |

| working capital | | | | |

+-----------------------------------------------+----------+-------------+----------+-------------+

| | | | | | |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | Increase in inventories | | (45,734) | | (667,111) |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | Decrease/(increase) in receivables | | 48,035 | | (114,411) |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | Increase/(decrease) in payables | | (45,363) | | (429,528) |

| | | | | | |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| Cash reduced by operations | | (3,002,931) | | (5,613,620) |

+-----------------------------------------------+----------+-------------+----------+-------------+

| | | | | | |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | Income taxes received | | 602,851 | | 4,293 |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| | | | | | |

+-+---------------------------------------------+----------+-------------+----------+-------------+

| Net cash outflow from operating activities | | (2,400,080) | | (5,609,327) |

+-----------------------------------------------+----------+-------------+----------+-------------+

| | | | | | |

+-+---------------------------------------------+----------+-------------+----------+-------------+

Cash and cash equivalents (which are presented as a single class of assets on

the face of the balance sheet) comprise cash at bank and other short-term highly

liquid investments with maturity of three months or less.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JRMJTMBBTBJM

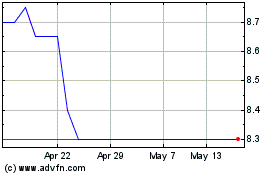

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024