RNS Number:5990J

Cyan Holdings Plc

28 September 2006

Press Release 28 September 2006

Cyan Holdings Plc

("Cyan" or "the Group")

Interim Results

Cyan Holdings Plc (AIM: CYAN.L), the fabless semiconductor company specialising

in the development of low powered, configurable microcontroller chips, announces

its Interim Results for the six months ended 30 June 2006.

Business Highlights

* new 16 bit eCOG1X microcontroller product range released for production

* Tier One global brand name opportunity over 1 million units per annum

* 14 design wins already for eCOG1X estimated to generate 250,000 units per

annum

* 18 further opportunities for eCOG1X over 50,000 units per annum amounting

to 3.5 million units per annum

* P&L and cash reserves in line with forecasts

* Cyan Asia well established and generating significant opportunities

* Strong pipeline of business building

* Very strong position in the huge Chinese tax control terminal market with

potential for significant market share

Commenting on the results, Paul Johnson, Chief Executive, of Cyan, said: "We

have seen tremendous potential in China and are buoyed by our solid

relationships throughout the area. Our eCOG1X product range will generate

significant business in Europe and Asia as demonstrated by early stage design

wins and opportunities. We look forward to continued and increasing success in

Asia."

For further information:

Cyan Holdings plc

Paul Johnson, Chief Executive Officer Tel: +44 (0) 1954 234 400

www.cyantechnology.com

Collins Stewart Limited

Simon Atkinson, Corporate Finance Tel: +44 (0) 20 7523 8312

www.collins-stewart.com

Media enquiries:

Abchurch Communications

Heather Salmond / Franziska Boehnke Tel: +44 (0) 20 7398 7700

franziska.boehnke@abchurch-group.com www.abchurch-group.com

Interim Statement

The announcement at the end of August that our new 16 bit eCOG1X microcontroller

has been released into its production stage marks a sea change in the evolution

of the Company. For the first time we will be able to supply customers with a

full product range for 16 bit solutions and this has already been welcomed by

existing customers; even more importantly, it should have a positive impact with

those potential customers who wanted a larger and more flexible product range

available before committing to using Cyan chips. We can now deliver across a

significantly broader range of performance, power consumption and price points.

This increase in our product offerings, which now totals 32 versions, enables us

to compete in many more market areas, including motor control and

instrumentation, and we anticipate a significant contribution to revenues in

2007 resulting from design wins, opportunities and sales within this extended

market.

Not only are we confident that the launch of the eCOG1X will be very positive

for growth, we are seeing the benefits of being a PLC with greater access to

larger, well established companies. While we cannot be specific as to the

identity of these companies, because of issues of client confidentiality, we can

disclose that we are now in active dialogue with five of the World's largest and

best known consumer electronic companies of which four are based in Asia and the

other is in the United States.

eCOG1X will be available to customers in production quantities in early 2007

thereby allowing deliveries against normal lead times during the course of the

year. Pre-production chips and development kits will be available to customers

by the end of 2006 to support our existing eCOG1X design wins and opportunities

for the new product. Based on our current conversations with customers, we feel

that meaningful sales of eCOG1X could commence in the third quarter 2007, though

second quarter sales are not out of the question.

We currently have 14 design wins for eCOG1X which, when in full production, are

expected to generate 250,000 units of sales per annum. However, more

importantly, we are also in discussion (in some cases late stage discussions) on

a number of large opportunities from which we are confident of achieving

important design wins. To date we have identified 18 opportunities for more than

50,000 units per annum that amount in total to 3.5 million units per annum when

in full production. One of these opportunities is with a 'Tier One' global

player, with a market capitalisation well in excess of US$40 billion. The

product for which they wish to use the eCOG1X is already in volume production

using a different microcontroller plus other chips with per annum unit sales of

over 1 million units. Substituting the Cyan product would give the customer

annual savings of almost $20 million - a compelling reason to change. This

project is already in the late stages of development with working prototypes and

software and is a drop in replacement for the current solution. These cost

savings could well open new market opportunities for Cyan's customer generating

further high volume sales for Cyan.

eCOG1K addresses real market needs in the shape of lower cost, less complex

applications, particularly those needing ultra low power characteristics and

continues to find design wins and opportunities for its unique features. The

eCOG1K product family will see further additions in the future and these R&D

programs have commenced. We have now sold product to twelve separate companies,

one of which is high volume, although most of our early stage customers were in

lower volumes than recent design wins and opportunities. Design wins for the

eCOG1K represent about 1.7 million units per annum when all are in full

production and opportunities represent about 13 million units per annum.

The whole product range is supported by the unique CyanIDE software development

environment which is rapidly growing into an extremely powerful development

engineering support tool. To date Cyan has released major new versions of

CyanIDE, with enhanced features and functionality about every 6 months.

During the period the Company has further developed and enhanced the quality of

its sales network by signing up new distributors in both Germany and Korea. Both

distributors were impressed with the Cyan product range and CyanIDE development

tools and are well positioned to introduce the Company to significant new

accounts in their respective territories. We are currently in early stage talks

with a potential distributor for the Japanese market and have started the

process of broadening our representation in Europe, which is still a significant

user of microcontrollers.

Cyan has put everything in place, ready for launch with a significant customer

in China using the eCOG1K. This order represented a large part of our projected

2006 and 2007 turnover at the time of flotation. The balance of our initial

100,000 unit order was shipped in Q3 and we await the rollout of the project in

China. The delays are not of our own making, nor those of our customer, but

rather due to government delay in the rollout of the project, which had

initially been projected for Jan 05. All of our enquiries indicate that the

delay is administrative and that all back office IT systems are complete and

functioning. Our customer is already an established supplier to the Chinese

market with a reputed 20% market share and has after sales service and support

across the country and knows the Chinese ePOS market very well. They are also

very successful outside China having shipped over 1 million units to brand names

in Europe to date. (This is with an earlier generation product which does not

use a Cyan chip). Our customer's projections for the Chinese market exceed 50

million units by 2010 and they expect to be the market leader, to which end they

have already invested very heavily in products, production tooling and capacity.

Turnover for the period was #60,000. Costs have been kept tightly under control

during the period and the Company has earned interest of #102,000 from

investments in treasury deposits. Our six months' operating loss and our cash

balance remain in line with expectations at #1,400,000 and #4,298,000

respectively. The Company expects to maintain its steady progress during the

second half of 2006. We look forward to exploiting the potential of the new

product range over the course of the final quarter of 2006 and beyond.

Mike Hughes Dr Paul Johnson

Chairman Chief Executive Officer

CONSOLIDATED PROFIT AND LOSS ACCOUNT

Results for the six months ended 30 June 2006

Note Six months Six months Year

ended 30 ended 30 ended 31

June June December

2006 2005 2005

Unaudited Unaudited Audited

As restated As restated

see note 7 see note 7

# # #

Turnover 60,458 20,453 29,899

Cost of sales (48,874) (2,837) (4,966)

Gross profit 11,584 17,616 24,933

Administrative expenses

Share option charges (84,286) (168) (13,673)

Other (1,327,312) (1,019,712) (2,228,526)

(1,411,598) (1,019,880) (2,242,199)

Operating loss (1,400,014) (1,002,264) (2,217,266)

Interest receivable and similar 107,180 20,458 61,970

income

Interest payable and similar charges (41,347) (3,608) (12,621)

Loss on ordinary activities (1,334,181) (985,414) (2,167,917)

before taxation

Tax on loss on ordinary activities - - 67,381

Loss for the financial period (1,334,181) (985,414) (2,100,536)

Loss per share - basic and diluted 2 (1.6) (2.0) (3.8)

(pence)

All activities derive from continuing operations.

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

Results for the six months ended 30 June 2006

Six months Six months Year

ended 30 ended 30 ended 31

June June December

2006 2005 2005

Unaudited Unaudited Audited

As restated- As restated-

see note 6 see note 6

# # #

Loss for the financial period (1,334,181) (985,414) (2,100,536)

Currency translation difference on

foreign currency net 19,027 - (5,400)

investments

Total recognised gains and losses (1,315,154) (985,414) (2,105,936)

relating to the period

CONSOLIDATED BALANCE SHEET

At 30 June 2006

Note As at 30 As at 30 As at 31

June June December

2006 2005 2005

Unaudited Unaudited Audited

as restated as restated

see note 7 see note 7

# # #

FIXED ASSETS

Intangible assets 2,000 6,000 4,000

Tangible assets 148,044 176,527 163,236

150,044 182,527 167,236

CURRENT ASSETS

Stocks 127,939 36,563 59,583

Debtors 78,525 101,903 182,560

Current investments 4,030,000 1,090,000 5,375,000

Cash at bank and in hand 267,870 153,589 192,680

4,504,334 1,382,055 5,809,823

CREDITORS: amounts falling due (230,451) (308,902) (338,105)

within one year

NET CURRENT ASSETS 4,273,883 1,073,153 5,471,718

TOTAL ASSETS LESS CURRENT 4,423,927 1,255,680 5,638,954

LIABILITIES, BEING NET ASSETS

CAPITAL AND RESERVES

Called up share capital 3 169,762 109,315 168,621

Share premium account 3 8,612,930 3,126,739 8,598,230

Other reserve - shares for issue - 40,506 -

Profit and loss account (4,456,724) (2,021,048) (3,141,570)

Share option reserve 97,959 168 13,673

EQUITY SHAREHOLDERS' FUNDS 6 4,423,927 1,255,680 5,638,954

CONSOLIDATED CASH FLOW STATEMENT

Results for the six months ended 30 June 2006

Note Six Six Year

months months ended 31

ended 30 ended 30 December

June June 2005

2006 2005 Audited

Unaudited Unaudited

# # #

Net cash outflow from operations 4 (1,331,873) (873,774) (2,015,849)

Returns on investments and servicing of finance

Interest received and similar income 107,180 20,458 61,970

Interest paid and similar charges (41,347) (3,608) (12,621)

Net cash inflow from returns on investments and

servicing of finance 65,833 16,850 49,349

Capital expenditure and financial investment

Purchase of tangible fixed assets (19,611) (46,590) (66,114)

Net cash outflow from capital expenditure and

financial investment (19,611) (46,590) (66,114)

Net cash outflow before management of liquid

resources and financing (1,285,651) (903,514) (2,032,614)

Management of liquid resources

Decrease/(increase) in short term deposits 1,345,000 (1,090,000) (5,375,000)

Net cash inflow/(outflow) from management of liquid 1,345,000 (1,090,000) (5,375,000)

resources

Financing

Issue of ordinary share capital (net of issue costs) 15,841 1,943,644 7,396,835

Net cash inflow from financing 15,841 1,943,644 7,396,835

Increase/(decrease) in cash 5 75,190 (49,870) (10,779)

NOTES TO THE FINANCIAL INFORMATION

1. Basis of preparation

The financial information has been prepared in accordance with the policies set

out in the statutory financial statements of Cyan Holdings plc for the year

ended 31 December 2005 with the exception of accounting for share options.

FRS20 "Share Based Payments" is applicable for the first time and has a prior

year impact which is detailed in note 7.

These interim financial statements do not constitute statutory financial

statements within the meaning of Section 240 of the Companies Act 1985. Results

for the six month periods ended 30 June 2006 and 30 June 2005 have not been

audited. The results for the year ended 31 December 2005 have been extracted

from the statutory financial statements of Cyan Holdings plc and restated where

appropriate as explained in note 7. The financial statements for the year ended

31 December 2005 have been filed with the Registrar of Companies and upon which

the auditors' report was not qualified and did not contain a statement under

Section 237(2) or (3) of the Companies Act 1985.

2. Loss per share

Basic and diluted loss per ordinary share has been calculated by dividing the

loss after taxation for the periods as shown in the table below.

Six months Six months ended Year ended

ended 30 30 June 2005 31 December

June 2006 As restated - 2005

see note 6 As restated -

see note 6

Losses (#) (1,334,181) (985,414) (2,100,536)

Weighted average number of shares 84,670,828 48,665,598 54,823,213

FRS 22 requires presentation of diluted EPS when a company could be called upon

to issue shares that would decrease net profit or increase net loss per share.

For a loss making company with outstanding share options, net loss per share

would only be increased by the exercise of out of the money options. Since it

seems inappropriate to assume that option holders would act irrationally and

there are no other diluting future share issues, diluted EPS equals basic EPS.

3. Share capital and share premium account

As at As at As at

30 June 30 June 31

2006 2005 December

2005

# # #

Authorised:

150,000,000 (June 2005: 100,000,000, December 2005: 300,000 200,000 300,000

150,000,000) ordinary shares of #0.002 each

Called up, allotted and fully paid

84,881,140 (June 2005: 54,657,675, December 2005: 84,310,515) 169,762 109,315 168,621

ordinary shares of #0.002 each

Share Premium Account

As at As at As at

30 June 30 June 31

2006 2005 December

2005

# # #

At start of period 8,598,230 1,121,634 1,121,634

Premium on share issues 14,700 2,005,105 7,476,596

At end of period 8,612,930 3,126,739 8,598,230

4. Reconciliation of operating loss to operating cash outflow

Six Six months Year ended 31

months ended 30 December

ended 30 June 2005 2005

June As restated As restated -

2006 - see note 7 see note 7

# # #

Operating loss (1,400,014) (1,002,264) (2,217,266)

Currency translation difference 19,027 - (5,400)

Depreciation and amortisation 36,803 27,864 62,679

FRS 20 share option charge 84,286 168 13,673

Increase in stocks (68,356) (1,167) (24,187)

Decrease/(increase) in debtors 104,035 (42,543) (93,719)

(Decrease)/increase in creditors (107,654) 144,168 248,371

(1,331,873) (873,774) (2,015,849)

5. Analysis and reconciliation of net funds

31 Cash 30

December flow June

2005 2006

# # #

Cash at bank and in hand 192,680 75,190 267,870

Current asset investments 5,375,000 (1,345,000) 4,030,000

Net funds 5,567,680 (1,269,810) 4,297,870

6. Reconciliation of movements in group shareholders' funds

Six Six Year

months months ended 31

ended 30 ended 30 December

June June 2005

2006 2005

# # #

Loss for the financial period (as restated, see note 7) (1,334,181) (985,414) (2,100,536)

Other recognised gains and losses 19,027 - (5,400)

(1,315,154) (985,414) (2,105,936)

New shares issued (net of expenses) 15,841 2,033,238 7,396,835

Movement in share option reserve (as restated, see note 7) 84,286 (126,526) 13,673

Net (decrease)/increase in shareholders' funds (1,215,027) 921,298 5,304,572

Opening shareholders' funds 5,638,954 334,382 334,382

Closing shareholders' funds 4,423,927 1,255,680 5,638,954

7. Prior year restatement - Implementation of FRS 20 "Share-based payment"

Accounting policy change

The Group has applied the requirements of FRS 20 Share-based payments. In

accordance with the transitional provisions, FRS 20 has been applied to all

grants of equity instruments after 7 November 2002 that were unvested as of 1

January 2005.

The Group issues equity-settled share-based payments to certain employees and

directors. Equity-settled share-based payments are measured at fair value at the

date of grant. The fair value determined at the grant date of the equity-settled

share-based payments is expensed on a straight-line basis over the vesting

period, based on the group's estimate of shares that will eventually vest.

Fair value is measured by use of a Black-Scholes model. The expected life used

in the model has been adjusted, based on management's best estimate, for the

effects of non-transferability, exercise restrictions, and behavioural

considerations.

A liability equal to the portion of the goods or services received is recognised

at the current fair value determined at each balance sheet date for cash-settled

share-based payments.

Impact of restatement

The impact of implementing FRS 20 "Share-based payment" has had the following

impact on the financial statements.

PROFIT AND LOSS ACCOUNT Six Year

months ended 31

ended 30 December

June 2005

2005

# #

Administrative expenses as previously stated 1,019,712 2,228,526

FRS 20 "Share-based payment" charge 168 13,673

Administrative expenses as restated 1,019,880 2,242,199

Loss per share - basic and diluted (pence) as previously 2.0 3.8

stated

FRS 20 "Share-based payment" charge - -

Loss per share - basic and diluted (pence) as restated 2.0 3.8

8. Prior year restatement - Implementation of FRS 20 "Share-based payment"

(continued)

BALANCE SHEET As at 30 As at 31

June December

2005 2005

# #

Profit and loss account as previously stated (2,020,880) (3,127,897)

FRS 20 "Share-based payment" charge (168) (13,673)

Profit and loss account as restated (2,021,048) (3,141,570)

Share option reserve as previously stated - -

FRS 20 "Share-based payment" charge 168 13,673

Share option reserve as restated 168 13,673

The impact on the current period has been to increase administrative expenses by

#84,286 and to increase the share option reserve by #84,286.

INDEPENDENT REVIEW REPORT TO CYAN HOLDINGS PLC

Introduction

We have been instructed by the company to review the financial information for

the six months ended 30 June 2006 which comprises the profit and loss account,

the statement of total recognised gains and losses, the balance sheet, the cash

flow statement and related notes 1 to 7. We have read the other information

contained in the interim report and considered whether it contains any apparent

misstatements or material inconsistencies with the financial information.

This report is made solely to the company, in accordance with Bulletin 1999/4

issued by the Auditing Practices Board. Our work has been undertaken so that we

might state to the company those matters we are required to state to them in an

independent review report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to anyone other than

the company, for our review work, for this report, or for the conclusions we

have formed.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by, the directors. The directors

are also responsible for ensuring that the accounting policies and presentation

applied to the interim figures are consistent with those applied in preparing

the preceding annual accounts except where any changes, and the reasons for

them, are disclosed.

Review work performed

We conducted our review in accordance with the guidance contained in Bulletin

1999/4 issued by the Auditing Practices Board for use in the United Kingdom. A

review consists principally of making enquiries of group management and applying

analytical procedures to the financial information and underlying financial data

and, based thereon, assessing whether the accounting policies and presentation

have been consistently applied unless otherwise disclosed. A review excludes

audit procedures such as tests of controls and verification of assets,

liabilities and transactions. It is substantially less in scope than an audit

performed in accordance with International Standards on Auditing (UK and

Ireland) and therefore provides a lower level of assurance than an audit.

Accordingly, we do not express an audit opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30 June 2006.

Deloitte & Touche LLP

Chartered Accountants

Cambridge

Notes: A review does not provide assurance on the maintenance and integrity of

the website, including controls used to achieve this, and in particular on

whether any changes may have occurred to the financial information since first

published. These matters are the responsibility of the directors but no control

procedures can provide absolute assurance in this area.

Legislation in the United Kingdom governing the preparation and dissemination of

financial information differs from legislation in other jurisdictions.

-Ends-

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR AKOKBCBKDACB

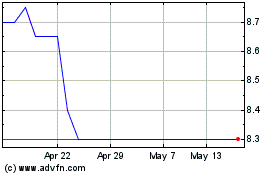

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024