TIDMCREI

RNS Number : 6960G

Custodian REIT PLC

24 November 2015

THE INFORMATION IN THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION DIRECTLY OR INDIRECTLY IN

OR INTO OR FROM THE UNITED STATES, AUSTRALIA, JAPAN, THE REPUBLIC

OF SOUTH AFRICA, ANY EEA STATE (OTHER THAN THE UK) OR ANY OTHER

EXCLUDED TERRITORY.

24 November 2015

Custodian REIT plc

("Custodian REIT" or "the Company")

Interim Results

Custodian REIT (LSE: CREI), the UK commercial real estate

investment company focused on smaller lot sizes, today reports its

interim results for the six months ended 30 September 2015 ("the

Period").

Financial highlights and performance summary

-- Net asset value ("NAV") per share total return(1) of 4.6%

-- NAV per share of 103.0p(2) (unaudited NAV previously reported

as 102.6p, including fair value adjustment for fixed rate loan)

-- Portfolio value of GBP232.9m

-- GBP23.4m invested in 14 acquisitions and on-going developments during the Period

-- GBP0.1m profit on disposal from one property sale

-- Average portfolio net initial yield ("NIY") 7.1%, unexpired

lease term 6.8 years, occupancy rate 97.7%

-- GBP14.3m(3) of new equity raised at an average dividend adjusted premium of 7.2% to NAV

-- Placing, open offer and offer for subscription in progress targeting GBP50m of new monies

-- Profit after tax of GBP7.9m

-- Dividends of 3.0p per share paid in the Period(4) , proposed Q2 dividend of 1.5p per share

-- Net gearing(5) of 13.7%

-- Pipeline of GBP78.1m properties under offer or in solicitors' hands

1. NAV movement including dividends paid.

2. See Note 16.

3. Before costs and expenses of GBP0.3 million.

4. Dividends of 1.5p paid for each of the quarters ended 31

March 2015 and 30 June 2015.

5. Gross borrowings less unrestricted cash divided by property

portfolio valuation.

David Hunter, Chairman of Custodian REIT, said:

"This has been another period of significant investment, as we

seek to realise economies of scale offered by the Company's

relatively fixed cost base, while adhering to the Company's

investment policy and maintaining the quality of both properties

and income. We remain well placed to meet our goal of paying

further quarterly dividends, fully covered by income, to achieve an

annual dividend of 6.25p for the year ending 31 March 2016.

"The current market dynamic supports our strategy of targeting

high quality, smaller lot size properties across regional markets,

with the type of institutional grade property targeted by the

Company showing value relative to larger lots through a higher net

income return and opportunities for future rental growth.

"I expect occupational demand, combined with a limited supply of

new development, to drive further rental growth across regional

markets and minimise vacancy rates, supporting both sustainable

income returns and capital value growth over the long-term."

Important notice

Past performance cannot be relied on as a guide to future

performance.

Further information

Further information regarding the Company can be found at the

Company's website www.custodianreit.com or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240

Imlach / Ian Mattioli 8740

www.custodiancapital.com

Numis Securities Limited

Nathan Brown / Hugh Jonathan Tel: +44 (0)20 7260 1000

www.numiscorp.com

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Chairman's statement

I am pleased to report the Company's results for the six months

ended 30 September 2015. We invested a total of GBP23.4 million

during the Period, completing 14 acquisitions and achieving

practical completion on two developments, funded by GBP14.3 million

raised from the issue of new shares and a new GBP20 million term

loan. We continue to target growth, seeking to realise the

potential economies of scale offered by the Company's relatively

fixed cost base, while adhering to the Company's investment policy

and maintaining the quality of both properties and income.

At the same time as rapidly growing the portfolio, we have

continued to pay fully covered dividends in line with target,

minimising 'cash drag' on the issue of new shares by taking

advantage of the flexibility offered by the Company's revolving

credit facility ("RCF").

The successful deployment of new monies on the acquisition of

high quality assets at an average NIY of 7.35% highlights a key

advantage of our strategy to focus on smaller lots in strong,

regional markets.

Following the Period end, the Board announced the Company's

intention to raise GBP50 million of new monies through the issue of

new shares, with the ability to increase this to up to GBP75

million subject to demand ("the Issue"). Admission of the new

shares is expected on 3 December 2015.

The Issue is expected to be accretive to shareholder value as

the premium to NAV exceeds the expected costs of the issue and the

increased NAV in excess of GBP200 million will attract a lower

marginal annual management charge, as set out in the investment

management agreement.

The Board was also delighted to announce the exchange of

contracts for the acquisition of a property portfolio for GBP69.4

million due to complete in January 2016, details of which are set

out in the Investment Manager's report.

Market

Custodian Capital Limited ("CCL" or "the Manager"), the

Company's discretionary investment manager, anticipates continued

demand for property investment as interest rates stay 'lower for

longer', with a competitive market offering potential value growth.

The Company has targeted high quality, regional lot sizes below

GBP7.5 million and has benefitted from a significant net initial

yield advantage accordingly. The Manager expects less competition

for smaller lot sizes, with the type of institutional grade

regional property targeted by the Company showing value relative to

larger lots through a higher net income return and opportunities

for future rental growth, which are not 'priced-in' to every

deal.

The focus of demand from institutional funds, open-ended retail

funds, public property companies and overseas investors has been

for lot sizes greater than GBP10 million, leading to strong

competition for larger assets. Many of these investors have been

simultaneously selling smaller properties, creating a strong

pipeline of high quality assets that fit Custodian REIT's

investment strategy. The Manager believes these dynamics will

continue through the first half of 2016. In addition, the property

market has entered a phase of rental growth, which I expect to

enhance future income returns and support capital value growth over

the long-term.

Net Asset Value

The Company delivered NAV total return per share of 4.6% for the

Period. The first half was a period of significant new investment,

where the initial costs (primarily stamp duty) of acquiring 14 new

properties diluted NAV total return by circa 0.6%.

Pence

per

share GBPmillion

--------------------------------------------- --------- -----------

NAV at 31 March 2015 101.3 180.0

Issue of equity (net of costs) 0.4 14.0

101.7 194.0

Valuation uplift in property portfolio 1.4 2.6

Profit on disposal of investment properties 0.1 0.1

Impact of acquisition costs (0.6) (1.1)

0.9 1.6

Income 4.7 8.7

Expenses and net finance costs (1.3) (2.3)

Dividends paid (3.0) (5.5)

NAV at 30 September 2015 103.0(6) 196.5

--------------------------------------------- --------- -----------

6. Unaudited NAV per share of 102.6p (as previously reported) is

referenced in Note 16.

In addition to new acquisitions, activity during the Period also

focused on pro-active asset management, which generated GBP0.7

million of the GBP2.6 million valuation uplift. During the

remainder of the financial year we intend to continue our asset

management activities and complete on the current acquisition

pipeline, with the deployment of existing debt facilities

increasing gearing towards our target level of 25% loan to

value.

Share price

Total shareholder return for the first half of the financial

year was 1.8%, with a closing price of 108.5 pence per share on 30

September 2015 representing a 5.8% premium to NAV. During the

Period the Company has traded at a consistent premium to NAV, with

low volatility offering shareholders stable returns. I believe the

premium to NAV has been a function of both strong demand for

closed-ended property funds and the attractive income offered by

the Company's dividend policy.

Placing of new ordinary shares

The Company issued 13.2 million new shares during the Period, at

an average premium to dividend adjusted NAV of 7.2%. These issues

have been accretive to NAV, with positive investor demand for the

Company's shares a testament to our success to date.

Borrowings

The Company's target gearing ratio is 25% loan to value, with a

loan to value ratio of 13.7% at 30 September 2015.

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

The Board is keen to reduce risk to shareholders wherever

possible and has taken advantage of the prevailing low interest

rates to secure long term borrowing at a fixed rate. On 14 August

2015 the Company entered into an agreement for Scottish Widows plc

to provide a new 10 year term loan facility of GBP20 million,

repayable on 14 August 2025. Under this agreement, the Company will

pay a fixed interest rate of 3.935% per annum.

To allow further expansion of the portfolio as we seek to take

advantage of expected rental growth across the market, following

the Period end the Company has increased the RCF facility from

GBP25 million to GBP35 million and extended its term from expiry in

March 2019 to November 2020.

The three acquisitions completed since 30 September 2015 have

increased the current gearing ratio to 17.3% and I anticipate that

following the proposed Issue and completion on the acquisition

pipeline, the Company's gearing will increase further towards our

target.

Investment Manager

The Board is pleased with the progress and performance of the

Investment Manager, particularly its success in continuing growth

through the deployment of new monies, while securing the earnings

required to pay fully covered dividends in line with target.

Dividends

Income is a major component of total return. The Company paid

two interim dividends totalling 3.0 pence per share during the

Period. To provide greater flexibility over future dividend policy,

on 14 August 2015 the Company's share premium account of GBP181.5

million was cancelled and transferred to distributable

reserves.

The Board intends to pay an interim dividend of 1.5 pence per

share for the quarter ended 30 September 2015, which will be paid

on 31 December 2015. In the absence of unforeseen circumstances,

the Board believes the Company is well placed to meet its target of

paying further quarterly dividends, fully covered by income, to

achieve an annual dividend of 6.25 pence per share for the year

ending 31 March 2016.

The Board is committed to growing the dividend sensibly, at a

rate which is fully covered by net rental income and does not

inhibit the flexibility of the Company's investment strategy.

Outlook

While the investment market has tightened significantly, in

large part this is being matched by the strengthening occupational

market. This, combined with a dearth of modern, vacant space, is

leading to rental growth in most office and industrial markets,

with reducing vacancy rates on the High Street driving a return to

rental growth in many retail centres.

The current market dynamic supports the Company's strategy of

targeting a high income return, fully covered by income from

smaller lot size properties across regional markets. I expect

occupational demand, combined with a limited supply of new

development, to drive further rental growth across regional markets

and minimise vacancy rates, supporting both sustainable income

returns and capital value growth over the long-term.

David Hunter

Chairman

23 November 2015

Investment Manager's report

Property market performance in 2015 has been dominated by

continued yield compression and the increasing importance of the

regions as the engine room of growth. CBRE's Marketview(7) reported

a yield compression of 93 bps in the 'All Property Yield' for the

three years to Q3 2015, of which 31 bps was recorded for the last

twelve months. While partly due to the expectation of future rental

growth, we believe a large part is a function of extraordinary

demand across the spectrum of the investment market, which remains

primarily focused on larger lot sizes in excess of GBP10

million.

Demand is also increasingly focused on regional markets, with

Savills(8) recently reporting a record level of overseas investment

into UK regional markets, again focused on large lot sizes either

by way of portfolio transactions or the prime regional cities. By

contrast, the smaller lots typical of the Custodian REIT portfolio

have not experienced the same demand pressures and consequently the

Company's assets have witnessed only 30 bps of yield compression

over the same three years to Q3 2015. In addition to smaller lot

size properties offering a higher income return, these statistics

suggest there is less volatility in the valuation of this sector,

which should support sustainable income returns going forward.

LSH UK Investment Transactions data(9) indicates the NIY gap

between small and large lots traded in the market has fallen to 138

bps in Q3 2015.

The Investment Property Forum(10) forecasts average rental

growth of 2.45% per annum over the next four years, following 3.8%

of growth in 2015. I believe it is likely that rental growth,

rather than further yield compression, will be the key driver of

capital growth over the next few years. This further underlines the

importance of income and income driven returns in real estate

investment, and supports Custodian REIT's strategic focus on

income.

7. Source: CBRE Marketview UK Prime Rent and Yield, Q3 2012 and

Q3 2015.

8. Source: www.costar.co.uk.

9. Source: UK Investment Transactions Bulletin Q3 2015.

10. Source: Investment Property Forum UK Consensus Forecasts

2015.

Pipeline

Since Admission, Custodian REIT has taken advantage of the

pricing advantage offered by smaller lots to acquire 56 properties

for GBP149.6 million and agree terms on a further GBP78.1 million

on 13 small lot size, regional properties, at a combined average

NIY of 7.1%. This is consistent with the Company's investment

policy and supports the target dividend.

The Company recently exchanged contracts to acquire a portfolio

of 11 UK commercial properties ("the Target Portfolio") for GBP69.4

million in an off-market transaction. The Target Portfolio is also

consistent with the Company's investment policy, comprising smaller

size, good quality, secondary offices, retail and industrial assets

diversified by tenant and region. The tenant covenant profile also

meets the minimum criteria set out in the investment policy.

The acquisition of the Target Portfolio is expected to complete

in two tranches in early January 2016. Five properties, totalling

GBP28 million, will be funded through a combination of the

Company's existing cash resources and capacity under the RCF. The

balance of six properties will be acquired by the Company subject

to the availability of the net proceeds of the Issue.

Following completion of the intended acquisition of the Target

Portfolio, the weighted average unexpired lease term of the

property portfolio would stand at approximately 6.1 years as at

January 2016, although completion of ongoing asset management

initiatives is expected to increase WAULT to 6.5 years by 31 March

2016. The Board expects the acquisition of the Target Portfolio to

enhance returns to shareholders by deploying cash raised from the

Issue promptly, improving dividend cover and offering the potential

for a number of further asset management opportunities.

In addition to the Target Portfolio, the Company has a GBP5

million committed pipeline of pre-let industrial development

fundings in Cannock and Stevenage, and the refurbishment of an

industrial unit in Milton Keynes. The Company also has a GBP6.6

million leisure park and a GBP2.1 million high street retail

property adjoining an existing portfolio holding under offer, and

the Manager continues to track other investment opportunities,

including a single let industrial property and a city centre office

building. The combined value of these other opportunities is

approximately GBP12.5 million.

Investment objective

The key investment objective of Custodian REIT is to provide

shareholders with an attractive level of income by maintaining the

high level of dividend, fully covered by earnings, with a

conservative level of gearing.

Since Admission, minimising cash drag through the prompt

deployment of funds raised at IPO, on subsequent share placings and

from new term debt facilities has been central to realising the key

investment objective. The Company benefits from a GBP35 million

RCF, which has been integral to reducing cash drag, giving us the

flexibility to reduce debt in the Company when new equity is

issued.

The rate of investment during the Period has been ahead of the

Board's expectations, which we believe demonstrates the success of

the Company's strategy of focusing on smaller lots in strong,

regional markets. We remain confident we can continue to acquire

properties that meet the Company's investment criteria and improve

the portfolio mix. In 2016 we expect to see continued rental growth

and low vacancy rates, supporting the Company's investment

objectives.

Portfolio performance

During the Period the Company completed on 14 new property

acquisitions and achieved practical completion on two development

fundings, adding GBP23.4 million of assets to the portfolio.

Property acquisitions are shown below:

Industrial

Location: Glasgow International Location: Cannock (development)

Airport Tenant: Hellermann Tyton

Tenant: DHL Global Forwarding Net initial yield: 6.38%

(UK) Consideration: GBP4.22m

Net initial yield: 7.08%

Consideration: GBP1.23m

Location: Warwick (development) Location: Bristol*

Tenant: Semcon Tenant: BSS

Net initial yield: 6.64% Net initial yield: 6.70%

Consideration: GBP2.64m Consideration: GBP3.53m

--------------------------------

Location: Farnborough* Location: Kettering*

Tenant: Triumph Structures Tenant: Sealed Air

Net initial yield: 11.53% Net initial yield: 7.28%

Consideration: GBP1.05m Consideration: GBP1.55m

--------------------------------

Location: Normanton*

Tenant: Acorn Web Offset

Net initial yield: 3.38%

Consideration: GBP1.22m

--------------------------------

*Acquired as part of the 'Blue Oaks' portfolio

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

Retail

Location: Chester* Location: St Albans*

Tenant: Aslan Jewellery Tenant: EE

and Kuoni Travel Net initial yield:

Net initial yield: 6.35% 5.74%

Consideration: GBP1.90m Consideration: GBP1.24m

Location: Bedford* Location: Scarborough*

Tenant: Waterstones Booksellers Tenant: Waterstones

Net initial yield: 7.01% Booksellers

Consideration: GBP1.16m Net initial yield:

7.23%

Consideration: GBP1.21m

----------------------------

Location: Swansea* (Sold) Location: Taunton*

Tenant: Shoezone Tenant: Wilkinson Hardware

Stores

Net initial yield:

6.51%

Consideration: GBP1.34m

----------------------------

*Acquired as part of the 'Blue Oaks' portfolio

Other

Location: Lincoln

Tenant: MKM Building

Supplies

Net initial yield: 6.90%

Consideration: GBP2.33m

In the six months ended 30 September 2015, valuation increases

were GBP2.6 million before acquisition costs (1.3% of opening

portfolio value), split by sector below:

Weighting

Valuation Valuation by

Change Change

30 September 31 March Income in in

2015 2015 30 September Valuation(11) Valuation(11)

Sector GBPm GBPm 2015 GBPm %

------------ -------------- ---------- -------------- --------------- ---------------

Industrial 102.0 91.3 47.0% 2.1 2.3

Retail 55.6 49.7 24.0% 0.1 0.2

Office 24.1 24.1 17.0% 0.0 0.0

Other 51.2 42.2 12.0% 0.4 0.9

232.9 207.3 100.0% 2.6

------------ -------------- ---------- -------------- ---------------

11. Excluding the impact of acquisitions and disposals.

A shortage of modern, vacant industrial space is leading to

strong rental growth in the sector as tenant demand competes for

limited supply, although in core industrial and distribution

locations occupier-led and speculative development is now a

feature. The Company's investment strategy is well suited to the

industrial and distribution sector by virtue of lot size, quality

of building, strength of tenant covenant and relatively low

obsolescence of the underlying real estate. This sector remains a

key target for acquisitions, although we are cautious around the

recent squeeze on pricing and remain very focused on both the

underlying vacant possession value and the prospects for rental

growth.

High street retail remains polarised between high-end comparison

retailing and convenience retailing. Rental growth has returned to

the retail markets as vacancy rates have fallen. The importance of

multi-channel retailing has seen even 'die-hard' catalogue

retailers, such as Boden, looking for physical stores,

demonstrating the importance of retail property to the market.

Retail property continues to be an important part of an income

focused portfolio and the sector also benefits from lower

re-letting costs than in others.

The retail warehouse sector is running at two speeds with

institutional demand focused on retail parks with an open A1

planning consent, where rents have seen significant growth.

Meanwhile, retail warehouse units with planning consent limited to

bulky goods benefit from much lower rents and have also avoided the

significant yield compression associated with retail parks with

unrestricted planning.

Offices that meet the demands of growing, modern businesses are

in short supply and, in key locations, the market requires new

development to meet occupier demand. These factors are driving

rental growth and have even encouraged speculative development in

strategic locations. Our focus is on modern or fit-for-purpose

offices where there is evidence of this growth.

The 'other' sector of the portfolio, which includes car

showrooms, restaurants, hotels, children's day nurseries and petrol

filling stations can offer long leases, indexed or fixed rental

uplifts as well as portfolio diversification, and remains a target

sector for further additions to the Company's portfolio.

Portfolio risk

The portfolio's risk exposure is reduced by 24% of income

benefitting from either fixed or indexed rent reviews, with there

being increasingly strong evidence of open market rental growth

across all sectors.

Short term income at risk is a relatively low proportion of the

portfolio's total income, with only 22% expiring in the next three

years (7% within one year).

Asset management

While the principal focus since Admission has been the

acquisition of new properties, we have also been proactively

managing the portfolio to enhance income and maintain cash flow. We

have approached more than 20 tenants across the portfolio regarding

various asset management initiatives, including new lettings, lease

renewals, lease extensions, rent reviews, lease surrenders,

refurbishment, development or a combination of the above. We are

now in active discussions with a number of tenants with

overwhelmingly positive responses received, demonstrating a strong

prevailing occupational market.

Key asset management events completed during the Period

include:

-- A property in Swansea, acquired for GBP0.4 million in June

2015 as part of a portfolio, was considered sub-scale for the

portfolio and was disposed of to a private investor in September

2015 for GBP0.5 million.

-- Savers has signed a five year reversionary lease in Bury St

Edmunds commencing from current expiry in January 2017 in return

for three months' rent free. The new lease contains a fixed rental

uplift from GBP49,900 to GBP53,000 with expiry in January 2022.

-- Laura Ashley in Grantham has agreed to remove the tenant

break option in May 2016 in return for a reverse premium equating

to 4.5 months' rent, extending the lease term to May 2021.

-- Chesham Insurance's lease in Leicester has been extended to

December 2015, and a five year renewal from December 2015 with a

tenant only break option in June 2018 is in discussion.

-- At Bradbourne Drive, Milton Keynes, which was acquired with

the tenant having issued notice to exit, an early surrender was

accepted in June 2015 in consideration for all rent due to expiry

and a dilapidations settlement. A comprehensive refurbishment of

the unit is underway for a total of c. GBP1 million, to be

completed in January 2016, with agents actively marketing the unit

to let.

Since the Period end, Superdrug's lease in Southsea was

re-geared to remove the May 2018 tenant break option and three

months' rent free due at that point for a cash incentive, and a new

three year lease was agreed with MTS in Bardon, which has been in

occupation via a tenancy at will since the head lease holder's

expiry.

Outlook

We believe demand for property investment, led by overseas

investors, UK institutions and open-ended retail funds, is likely

to continue from across the spectrum as interest rates stay 'lower

for longer'. Despite this continued demand, we expect to see larger

funds continuing to sell smaller lots regarded as being sub-scale

for the ambitions of those funds. Accordingly, we anticipate this

trend will maintain a pipeline of new acquisition opportunities for

Custodian REIT and the relative imbalance of demand will lead to

smaller lots showing 'value' relative to larger lots in terms of

income returns.

Growth in rents is now taking hold in the regional markets and

we expect that this will continue, driven by the significant lack

of supply of good quality, modern real estate combined with growing

occupational demand.

I am confident the Company's strategy of targeting income with

low gearing in a well-diversified regional portfolio will continue

to deliver the stable long term returns demanded by our

shareholders.

Richard Shepherd-Cross

for and on behalf of Custodian Capital Limited

Investment Manager

23 November 2015

Portfolio summary

Town Address Tenant %Portfolio

Income

Industrial

1 Chesford Grange,

Chesford Warrington Cheshire JTF Wholesale 2.76%

Unit 16, Ashby

Park, Ashby De

Ashby La Zouch Teleperformance 2.65%

Zeus Building,

Tally Close,

Agecroft Commerce

Salford Park, Salford Restore Scan 2.30%

Emerson Network

Units 1 & 2,Priory Power & Elma

Bedford Business Park Electronics 2.26%

Doncaster 3 Carriage Way Portola Packaging 2.02%

The Diamond,

Diamond Way,

Stone Business

Stone Park Revlon International 1.83%

Pegasus Drive,

Stratton Business Turpin Distribution

Biggleswade Park Services 1.71%

Blakeney Way,

Kingswood Lakeside,

Cannock Cannock 1.62%

Unit B, Centre

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

31, Foxbridge YESSS Electrical

Way (B) 1.61%

Milton Keynes Bradbourne Drive Massmould 1.60%

Unit 10 Albert

Bristol Reach BSS 1.42%

Alto House, Ravensbank SAPA Profiles

Redditch Drive UK 1.42%

DX Network

Nuneaton Harrington Way Services 1.38%

Western Wood Sherwin-Williams,

Way, Langage Diversified

Plymouth Business Park Brands 1.34%

South Delivery

Office, Orchard Royal Mail

Coventry Business Park Group 1.32%

Trafford Unit 4 The Furrows,

Park Trafford Park Unilin Distribution 1.25%

Superdrug

Avonmouth Unit M3, RD Park Stores 1.23%

Sytner Body Shop,

Brades Road,

Oldbury Oldbury Ryland Properties 1.19%

Unit A, 14-18

Bermondsey Verney Street Constantine 1.14%

55 Westburn Drive,

Clydesmill Industrial

Cambuslang Estate Brenntag UK 1.13%

Howemoss Drive,

Kirkhill Industrial DHL Express

Aberdeen Estate UK 1.10%

Edgehill Drive,

Warwick Tournament Fields Semcon 1.03%

1 Livingstone

Hamilton Boulevard Ichor Systems 1.00%

West Midlands

NHS Ambulance Ambulance

Centre, Opus Service NHS

Erdington Aspect Trust 0.86%

Synergy Health

Sheffield Sheffield Parkway (UK) 0.78%

21/21A Invincible Triumph Structures

Farnborough Road Farnborough 0.78%

Unit C, Estuary,

Speke Commerce Park Powder Systems 0.77%

Unit E/F, Reg's

Coalville Way, Bardon MTS Logistic 0.74%

Unit 1, Willowbridge

Way, Whitwood,

Castleford Wakefield Bunzl UK 0.71%

Kettering Telford Way Sealed Air 0.68%

Unit E, Estuary

Commerce Park, DHL International

Speke Speke (UK) 0.68%

National Court,

Unit A, South Nationwide

Accommodation Crash Repairs

Leeds Road Centres 0.66%

Lancaster Way,

Ermine Business

Huntington Park PHS Group 0.60%

Units 2, 7, 8 River Island

& 9 Shepcote Clothing &

Sheffield Enterprise Park Andrew Page 0.60%

Royal Mail

Kilmarnock 3 Queens Drive Group 0.54%

DHL Global

Forwarding

Glasgow 2 Campsie Drive (UK) 0.53%

Phoenix Business

Park, Brindley

Hinckley Road Multi-Let 0.44%

National Court,

Unit B, South

Accommodation Sovereign

Leeds Road Air Movement 0.41%

Acorn Web

Normanton Loscoe Close Offset 0.25%

Tilbrook Industrial

Milton Keynes Estate Vacant 0.00%

Town Address Tenant %Portfolio

Income

Retail

North Row, Grafton

Milton Keynes Gate Staples UK 2.39%

Discovery Retail Laura Ashley,

Park, London Poundstretcher

Grantham Road & Carpetright 1.85%

2/6 Long Wyre Poundland

Colchester Street & Savers 1.41%

54 Above Bar

Southampton Street URBN UK 1.25%

Sainsbury's

Torpoint Anthony Road Supermarket 1.24%

The Crystal Retail

Stourbridge Centre Multi-Let 1.17%

9 White Lion

Norwich Street Specsavers 1.14%

Llandudno 101 Mostyn Street WH Smith 0.85%

T J Morris

Limited (t/a

Portishead Harbour Road Home bargains) 0.83%

15 St Peters The White

Nottingham Gate Company (UK) 0.80%

28/29a Pride

Shrewsbury Hill Cotswold Outdoor 0.77%

Jewellery

Quarter, 37-40A Frederick

Birmingham Street Multi-Let 0.74%

Kings Lynn 43/44 High Street Top Man 0.71%

Superdrug

Weston-Super-Mare 27/29 High Street Stores 0.70%

Glasgow 98 Argyle Street Greggs 0.68%

Superdrug

19/23 Palmerston Stores & Portsmouth

Southsea Road City Council 0.66%

Chester Eastgate Street Kuoni Travel 0.63%

Phase Eight

(Fashion &

Edinburgh 47B George Street Designs) 0.63%

17-18 Bath Street

and 59-65A High Landmark Property

Redcar Street Investments 0.56%

Wilkinson

Taunton 61 East Gate Hardware Stores 0.53%

Scarborough 97-98 Westborough Waterstones 0.53%

Bury St The Works

Edmunds 14 Cornhill Street Store 0.51%

11/13 Silver

Bedford Street Waterstones 0.49%

165/171 High

Dumfries Street Iceland Foods 0.48%

Trident House,

St Albans Mosquito Way EE 0.43%

Hinckley,29/31,Castle

Hinckley Street W H Smith 0.40%

Framemaker

Galleries

& Danish Wardrobe

Cirencester 6/8 Dyer Street Company 0.34%

10 Watergate

Chester Street Whistles Holdings 0.33%

Bury St 15 Abbeygate Savers Health

Edmunds Street & Beauty 0.28%

Majestic Wine

Portishead Harbour Road Warehouses 0.26%

Done Brother

(Cash Betting)

Cheltenham 85 High Street t/a Betfred 0.24%

109 Commercial

Portsmouth Road Vacant 0.00%

Town Address Tenant %Portfolio

Income

Office

Gateway House,

Grove Park, Penman Mattioli Woods,

Leicester Way RBS & Regus 2.73%

Leeds Cardinal House Enact Properties 1.93%

Leeds David Street Enact Properties 1.65%

1 Pride Place,

Derby Pride Park Geldards LLP 1.46%

MW House, Grove Mattioli Woods

Park, Penman & Chesham

Leicester Way Insurance 1.42%

250 West George

Glasgow Street Multi-Let 1.26%

Solihull Westbury House Lyons Davidson 1.08%

Central Manchester

University

Unit C, Madison Hospitals

Place, Central NHS Foundation

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

Manchester Park Trust 0.68%

Town Address Tenant %Portfolio

Income

Other

Mobberley Road,

Park Gate Bentley R Stratton

Knutsford Manchester & Co 2.10%

Somerfield

Gillingham Beechings Way Stores 1.53%

489 Aylestone

Leicester Road Magnet 1.41%

Dudley Castlegate Way Premier Inn 1.36%

Marshall Motor

Peterborough Mallory Road Group 1.28%

Travelodge

Portishead Harbour Road Hotels 1.14%

Stephenson Road, MKM Building

Lincoln North Hykeham Supplies 1.09%

Coventry Road, Allen Ford

Solihull Elmdon (UK) t/a Kia 0.83%

Plumbase,

Multi Tile

F1 Autocentres

Counterpoint, & South Cheshire

Crewe Weston Road Glass 0.80%

105-107 Brighton Honda Motor

Redhill Road Europe 0.80%

Bluecoat House,

Bath Saw Close Prezzo 0.70%

Stonegate

High Wycombe 46/50a Frogmore Pub Co 0.66%

MKM Building

Castleford Castlewood Way Suppliers 0.63%

Apartments 1-10,

1 Cottesmore Multi tenanted

Lenton Road - Residential 0.50%

84/90 Palmerston

Southsea Road JD Wetherspoon 0.49%

Pizza Hut

Watford The Dome Roundabout (UK) 0.49%

Pizza Hut

Leicester Grove Farm Triangle (UK) 0.47%

Portishead Harbour Road JD Wetherspoon 0.40%

Basingstoke 10 Chequers Road Teddies Nurseries 0.36%

107 Bois Moor

Chesham Road Teddies Nurseries 0.30%

The Old Knutsford Knutsford

Knutsford Library Day Nursery 0.28%

Condensed consolidated statement of comprehensive income

For the six months ended 30 September 2015

Audited

Unaudited Unaudited 12

6 6 months

months months to

to 30 September to 30 September 31 March

2015 2014 2015

Note GBP000 GBP000 GBP000

----------------------------------------- ----- ----------------- ----------------- ----------

Revenue 4 8,686 4,958 11,570

Investment management

fee (974) (686) (1,542)

Operating expenses

of rental property

* rechargeable to tenants (427) (314) (342)

* directly incurred (180) (178) (373)

Professional fees (191) (345) (494)

Directors' fees (77) (115) (190)

Administrative expenses (66) (59) (101)

Expenses (1,915) (1,697) (3,042)

Operating profit before

financing and revaluation

of investment properties 6,771 3,261 8,528

Analysed as:

Operating profit before

exceptional items 6,821 3,480 8,747

Exceptional cost 5 (50) (219) (219)

6,771 3,261 8,528

Profit on disposal

of investment properties 77 - 269

Unrealised gains on

revaluation of investment

properties:

- relating to property

revaluations 10 2,624 2,597 6,083

* relating to costs of acquisition 10 (1,168) (2,553) (5,844)

----------------------------------------- ----- ----------------- ----------------- ----------

1,533 44 508

Operating profit before

financing 8,304 3,305 9,036

Net finance costs 6,7 (399) (49) (289)

----------------------------------------- ----- ----------------- ----------------- ----------

Profit before tax 7,905 3,256 8,747

Income tax expense 8 - - (2)

Profit for the period

and total comprehensive

income for the period,

net of tax 7,905 3,256 8,745

Attributable to:

Owners of the Company 7,905 3,256 8,745

Earnings per ordinary

share:

Basic and diluted (pence

per share) 3 4.3 2.5 6.0

The profit for the period arises from the Company's continuing

operations.

Condensed consolidated statement of financial position

As at 30 September 2015

Registered number: 8863271

Unaudited Unaudited Audited

30 30 31

September September March

2015 2014 2015

Note GBP000 GBP000 GBP000

------------------------------- ----- ----------- ----------- ----------

Non-current assets

Investment properties 10 232,850 145,894 207,287

Total non-current assets 232,850 145,894 207,287

------------------------------- ----- ----------- ----------- ----------

Trade and other receivables 11 1,931 1,898 1,072

Cash and cash equivalents 13 8,347 1,343 849

Total current assets 10,278 3,241 1,921

------------------------------- ----- ----------- ----------- ----------

Total assets 243,128 149,135 209,208

------------------------------- ----- ----------- ----------- ----------

Equity

Issued capital 15 1,908 1,320 1,776

Share premium 15 7,404 128,487 175,009

Retained earnings 15 187,145 1,608 3,201

Total equity attributable

to equity holders of

the Company 196,457 131,415 179,986

------------------------------- ----- ----------- ----------- ----------

Non-current liabilities

Borrowings 14 39,280 12,600 23,811

Total non-current liabilities 39,280 12,600 23,811

------------------------------- ----- ----------- ----------- ----------

Current liabilities

Trade and other payables 12 3,741 2,812 2,292

Deferred income 3,650 2,308 3,119

Total current liabilities 7,391 5,120 5,411

------------------------------- ----- ----------- ----------- ----------

Total liabilities 46,671 17,720 29,222

------------------------------- ----- ----------- ----------- ----------

Total equity and liabilities 243,128 149,135 209,208

------------------------------- ----- ----------- ----------- ----------

These interim financial statements of Custodian REIT plc were

approved and authorised for issue by the Board of Directors on 23

November 2015 and are signed on its behalf by:

David Hunter

Director

Condensed consolidated statement of cash flows

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

For the period ended 30 September 2015

Unaudited Unaudited Audited

6 6 12

months months months

to 30 to 30 to

September September 31 March

2015 2014 2015

Note GBP000 GBP000 GBP000

--------------------------- ----- ----------- ----------- -----------

Operating activities

Profit for the period 8,304 3,305 9,036

Adjustments for:

Increase in fair value

of investment property 10 (2,624) (2,597) (6,083)

Profit on disposal

of investment properties (77) - (269)

Net non-cash finance

charges 6,7 28 (36) (85)

Income tax 8 - - (2)

Cash flows from operating

activities before

changes in working

capital and provisions 5,631 672 2,597

--------------------------- ----- ----------- ----------- -----------

Increase in trade

and other receivables (797) (1,898) (1,072)

Increase in trade

and other payables 1,980 5,120 5,411

Cash generated from

operations 6,814 3,894 6,936

--------------------------- ----- ----------- ----------- -----------

Interest paid 7 (431) (56) (258)

--------------------------- ----- ----------- ----------- -----------

Net cash flows from

operating activities 6,383 3,838 6,678

--------------------------- ----- ----------- ----------- -----------

Investing activities

Purchase of investment

property (23,353) (66,306) (125,728)

Disposal of investment

property 492 - 1,784

Interest received 6 4 43 54

Net cash from investing

activities (22,857) (66,263) (123,890)

--------------------------- ----- ----------- ----------- -----------

Financing activities

Proceeds from the

issue of share capital 14,294 55,000 102,620

Payment of costs of

share issue (282) (2,182) (2,824)

New borrowings (net

of costs) 15,407 12,600 23,811

Dividends paid 9 (5,447) (1,650) (5,546)

Net cash from financing

activities 23,972 63,768 118,061

--------------------------- ----- ----------- ----------- -----------

Net increase in cash

and cash equivalents 7,498 1,343 849

Cash and cash equivalents

at start of the period 849 - -

--------------------------- ----- ----------- ----------- -----------

Cash and cash equivalents

at end of the period 8,347 1,343 849

--------------------------- ----- ----------- ----------- -----------

Condensed consolidated statement of changes in equity

For the period ended 30 September 2015

Issued Share Retained Total

capital premium earnings equity

Note GBP000 GBP000 GBP000 GBP000

------------------------- ------- --------- ---------- ---------- ----------

As at 24 March 2014 50 - - 50

Profit for the period - - 8,745 -

Total comprehensive

income for period - - 8,745 8,745

Transactions with

owners of the Company,

recognised directly

in equity

Dividends (5,546) (5,546)

Issue of share capital 15 1,726 175,009 - 176,735

Profit on disposal

of own shares 2 2

As at 1 April 2015

(audited) 1,776 175,009 3,201 179,986

------------------------- ------- --------- ---------- ---------- ----------

Profit for the period - - 7,905 7,905

Total comprehensive

income for period - - 7,905 7,905

Transactions with

owners of the Company,

recognised directly

in equity

Dividends 9 - - (5,447) (5,447)

Issue of share capital 15 132 13,881 - 14,013

Transfer of reserves 15 - (181,486) 181,486 -

As at 30 September

2015 (unaudited) 1,908 7,404 187,145 196,457

------------------------- ------- --------- ---------- ---------- ----------

Retained earnings include GBP4.2 million of realised trading

profits, GBP181.5 million transferred from share premium account

(distributable "legal reserves" under the United Kingdom Listing

Authority Prospectus Rules issued by the Financial Conduct

Authority) and GBP1.5 million of unrealised profits relating to

property valuation movements.

Condensed consolidated statement of changes in equity

For the period ended 30 September 2014

Issued Share Retained Total

capital premium earnings equity

Note GBP000 GBP000 GBP000 GBP000

------------------------- ------- --------- ---------- ---------- ----------

As at 25 March 2014

(unaudited) 50 - - 50

------------------------- ------- --------- ---------- ---------- ----------

Total comprehensive

income for period - - 3,256 3,256

Transactions with

owners of the Company,

recognised directly

in equity

Dividends - - (1,650) (1,650)

Issue of share capital 15 1,270 128,487 - 129,757

Profit on disposal

of own shares - - 2 2

As at 30 September

2014 (unaudited) 1,320 128,487 1,608 131,415

------------------------- ------- --------- ---------- ---------- ----------

Notes to the interim financial statements for the period ended

30 September 2015

1. Corporate information

The Company is a public limited company incorporated and

domiciled in England and Wales, whose shares are publicly traded on

the London Stock Exchange plc's main market for listed securities.

The interim financial statements have been prepared on a historical

cost basis, except for the revaluation of investment properties and

certain financial assets, and are presented in pounds sterling with

all values rounded to the nearest thousand pounds (GBP000), except

when otherwise indicated. The interim financial statements were

authorised for issue in accordance with a resolution of the

Directors on 23 November 2015.

2. Basis of preparation and accounting policies

2.1. Basis of preparation

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting. The interim

financial statements do not include all the information and

disclosures required in the annual financial statements. The annual

report for the year ending 31 March 2016 will be prepared in

accordance with International Financial Reporting Standards adopted

by the International Accounting Standards Board ("IASB") and

interpretations issued by the International Financial Reporting

Interpretations Committee ("IFRIC") of the IASB (together "IFRS")

as adopted by the European Union, and in accordance with the

requirements of the Companies Act applicable to companies reporting

under IFRS.

The information relating to the Period is unaudited and does not

constitute statutory financial statements within the meaning of

section 434 of the Companies Act 2006. A copy of the statutory

accounts for the period ended 31 March 2015 has been delivered to

the Registrar of Companies. The auditor's report on those accounts

was not qualified, did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying the report and did not contain statements under section

498(2) or (3) of the Companies Act 2006.

The interim financial statements have been reviewed by the

auditor and their report to the Company is included within these

interim financial statements.

Certain statements in this report are forward looking

statements. By their nature, forward looking statements involve a

number of risks, uncertainties or assumptions that could cause

actual results or events to differ materially from those expressed

or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the

future. Accordingly, undue reliance should not be placed on forward

looking statements.

2.2. Significant accounting policies

The principal accounting policies adopted by the Company and

applied to these interim financial statements are consistent with

those policies applied to the Company's annual report and financial

statements.

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

2.3. Going concern

The Directors believe the Company is well placed to manage its

business risks successfully. The Company's projections show that

the Company should continue to be cash generative and be able to

operate within the level of its current financing arrangements.

Accordingly, the Directors continue to adopt the going concern

basis for the preparation of the interim financial statements.

2.4. Segmental reporting

An operating segment is a distinguishable component of the

Company that engages in business activities from which it may earn

revenues and incur expenses, whose operating results are regularly

reviewed by the Company's chief operating decision maker to make

decisions about the allocation of resources and assessment of

performance and about which discrete financial information is

available. As the chief operating decision maker reviews financial

information for and makes decisions about the Company's investment

properties and properties held for trading as a portfolio, the

Directors have identified a single operating segment, that of

investment in and trading of commercial properties.

2.5. Principal risks and uncertainties

The Company's assets consist of direct investments in UK

commercial property. Its principal risks are therefore related to

the UK commercial property market in general but also the

particular circumstances of the properties in which it is invested

and their tenants. Other risks faced by the Company include

economic, strategic, regulatory, management and control, financial

and operational.

These risks, and the way in which they are mitigated and

managed, are described in more detail under the heading Principal

Risks and Uncertainties within the Report of the Directors in the

Company's Annual Report for the year ended 31 March 2015. The

Company's principal risks and uncertainties have not changed

materially since the date of that report and are not expected to

change materially for the remaining six months of the Company's

financial year.

3. Earnings per ordinary share

Basic earnings per share amounts are calculated by dividing net

profit for the year attributable to ordinary equity holders of the

Company by the weighted average number of ordinary shares

outstanding during the year.

Diluted earnings per share amounts are calculated by dividing

the net profit attributable to ordinary equity holders of the

Company by the weighted average number of ordinary shares

outstanding during the year plus the weighted average number of

ordinary shares that would be issued on the conversion of all the

dilutive potential ordinary shares into ordinary shares. There are

no dilutive instruments.

The following reflects the income and share data used in the

basic and diluted earnings per share computations:

Unaudited Unaudited Audited

6 6 12

months months months

to 30 to 30 to

September September 31 March

2015 2014 2015

---------------------------- -------------- -------------- --------------

Net profit and diluted

net profit attributable

to equity holders of the

Company (GBP000) 7,905 3,256 8,745

----------------------------- -------------- -------------- --------------

Weighted average number

of ordinary shares:

Issued ordinary shares

at start period 177,605,659 5,000,000 5,000,000

Effect of shares issued

during the period 5,135,246 126,989,310 141,061,038

Basic and diluted weighted

average number of shares 182,740,905 131,989,310 146,061,038

Basic and diluted earnings

per share (pence) 4.3 2.5 6.0

----------------------------- -------------- -------------- --------------

4. Revenue

Unaudited 6 Unaudited

months 6 months Audited 12

to 30 to 30 months to

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

----------------------------------------------- ----------- ---------- ------------

Gross rental income from investment properties 8,280 4,644 11,228

Income from recharges to tenants 406 314 342

8,686 4,958 11,570

----------------------------------------------- ----------- ---------- ------------

5. Exceptional items

During the Period, the Company incurred costs of GBP0.05 million

in relation to the cancellation of the share premium account as

detailed in Note 15.

One-off costs incurred on Admission in the period ended 30

September 2014 totalled GBP2.40 million of which GBP0.22 million

was recognised in the statement of comprehensive income and GBP2.18

million was taken to the share premium account as being directly

related to the issue of new shares.

6. Finance income

Unaudited 6 Unaudited 6

months months Audited 12

to 30 to 30 months to

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

--------------- ----------- ----------- ------------

Bank interest 4 43 54

Finance income 119 - 30

123 43 84

--------------- ----------- ----------- ------------

7. Finance costs

Unaudited 6 Unaudited 6

months months Audited 12

to 30 to 30 months to

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

---------------------------------------------------- ----------- ----------- ------------

Amortisation of arrangement fees on debt facilities 91 36 115

Bank interest 431 56 258

522 92 373

---------------------------------------------------- ----------- ----------- ------------

8. Income tax

The tax charge assessed for the Period is lower than the

standard rate of corporation tax in the UK during the Period of

20.0%. The differences are explained below:

Unaudited 6 Unaudited

months 6 months Audited 12

to 30 to 30 months to

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

------------------------------------------------------------------------------ ----------- ---------- ----------

Profit before income tax 7,905 3,256 8,747

------------------------------------------------------------------------------- ----------- ---------- ----------

Tax charge on profit at a standard rate of 20.0% (30 September 2014: 21.3%, 31

March 2015:

21.0%) 1,581 694 1,837

Effects of:

REIT tax exempt rental profits and gains (1,581) (694) (1,835)

Income tax expense for the period Nil Nil 2

------------------------------------------------------------------------------- ----------- ---------- ----------

Effective income tax rate 0.0% 0.0% 0.0%

------------------------------------------------------------------------------- ----------- ---------- ----------

The Company operates as a Real Estate Investment Trust and hence

profits and gains from the property investment business are

normally exempt from corporation tax.

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

The UK Government reduced the rate of corporation tax from 21%

to 20% effective from 1 April 2015.

9. Dividends

Audited

Unaudited Unaudited 12

6 months 6 months months

to 30 to 30 to

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

------------------------------ ----------- ----------- ----------

Equity dividends on ordinary

shares:

Interim dividend for the

quarter ended

30 June 2014: 1.25p - 1,650 1,650

Interim dividend for the

quarter ended

30 September 2014: 1.25p - - 1,948

Interim dividend for the

quarter ended

31 December 2014: 1.25p - - 1,948

Interim dividend for the

quarter ended

31 March 2015: 1.5p 2,672 - -

Interim dividend for the

quarter ended

30 June 2015: 1.5p 2,775 - -

5,447 1,650 5,546

------------------------------ ----------- ----------- ----------

The Directors propose that the Company pays a third interim

dividend relating to the quarter ended 30 September 2015 of 1.5

pence per ordinary share. This dividend has not been included as a

liability in these financial statements. The third interim dividend

is expected to be paid on 31 December 2015 to shareholders on the

register at the close of business on 27 November 2015.

In the absence of unforeseen circumstances, the Board intends to

pay further quarterly dividends to achieve an annual dividend of

6.25 pence per share(12) for the financial year ending 31 March

2016.

12. This is a target only and not a profit forecast. There can

be no assurance that the target can or will be met and it should

not be taken as an indication of the Company's expected or actual

future results. Accordingly, shareholders or potential investors in

the Company should not place any reliance on this target in

deciding whether or not to invest in the Company or assume that the

Company will make any distributions at all and should decide for

themselves whether or not the target dividend yield is reasonable

or achievable.

10. Investment properties

GBP000 GBP000

------------------------- -------- --------

At 31 March 2015 207,287

Additions 24,522

Disposals (415)

Property revaluations 2,624

Acquisition costs (1,168)

Net revaluation gain 1,456

------------------------- -------- --------

As at 30 September 2015 232,850

------------------------- -------- --------

Included in investment properties is GBP1.24 million relating to

ongoing development funding.

The carrying value at 30 September 2015 comprises freehold and

leasehold properties summarised as follows:

Freehold Leasehold Total

Investment properties GBP000 GBP000 GBP000

------------------------ -------- --------- -------

Historical cost 189,273 40,532 229,805

Valuation gain 2,237 808 3,045

At 30 September 2015 191,510 41,340 232,850

------------------------ -------- --------- -------

The investment properties are stated at the Directors' estimate

of their 30 September 2015 fair values. Lambert Smith Hampton Group

Limited ("LSH"), a professionally qualified independent valuer,

valued the properties as at 30 September 2015 in accordance with

the Appraisal and Valuation Standards published by the Royal

Institution of Chartered Surveyors. LSH has recent experience in

the relevant location and category of the properties being

valued.

Investment properties have been valued using the investment

method which involves applying a yield to rental income streams.

Inputs include yield, current rent and estimated rental value

("ERV"). For the period end valuation, the equivalent yields used

ranged from 5.0% to 10.1%. Valuation reports are based on both

information provided by the Company e.g. current rents and lease

terms which are derived from the Company's financial and property

management systems are subject to the Company's overall control

environment, and assumptions applied by the valuer e.g. ERVs and

yields. These assumptions are based on market observation and the

valuer's professional judgement. In estimating the fair value of

the property, the highest and best use of the properties is their

current use. Included within the condensed consolidated statement

of comprehensive income is GBP1.5 million of valuation gains and

profits on disposal of investment property which represent

unrealised movements on investment property.

11. Trade and other receivables

Unaudited Audited

as at Unaudited as

30 as at at

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

Trade receivables 1,052 962 451

Other receivables 57 450 92

Prepayments and accrued income 822 486 529

1,931 1,898 1,072

-------------------------------- ----------- ----------- ----------

The Company has provided fully for those receivable balances

that it does not expect to recover. This assessment has been

undertaken by reviewing the status of all significant balances that

are past due and involves assessing both the reason for non-payment

and the creditworthiness of the counterparty. Included within

accrued income are balances totalling GBP0.59 million which are to

be held for a period over one year.

12. Trade and other payables

Unaudited Unaudited Audited

as at as at as

30 30 at

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

Falling due in less than one

year:

Trade and other payables 564 725 338

Social security and other taxes 885 721 687

Accruals 2,038 1,136 1,037

Rental deposit held 254 230 230

3,741 2,812 2,292

--------------------------------- ----------- ----------- ----------

The Directors consider that the carrying amount of trade and

other payables approximates to their fair value. Trade payables and

accruals principally comprise amounts outstanding for trade

purchases and ongoing costs. For most suppliers interest is charged

if payment is not made within the required terms. Thereafter,

interest is chargeable on the outstanding balances at various

rates. The Company has financial risk management policies in place

to ensure that all payables are paid within the credit

timescale.

13. Cash and cash equivalents

Unaudited Unaudited Audited

as at as at as

30 30 at to

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

Cash and cash equivalents 8,347 1,343 849

--------------------------- ----------- ----------- ----------

Cash and cash equivalents include GBP0.25 million (30 September

2014 and 31 March 2015: GBP0.23 million) of restricted cash in the

form of rental deposits held on behalf of tenants.

14. Borrowings

Unaudited Unaudited Audited

as at as at as

30 30 at

September September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

Falling due in more than one

year:

Bank borrowings 40,000 12,600 24,300

Costs incurred in the arrangement

of bank borrowings (720) - (489)

39,280 12,600 23,811

----------------------------------- ----------- ----------- ----------

During the Period, the Company and Scottish Widows plc, with

Lloyds Bank plc acting as agent, entered into an agreement for

Scottish Widows plc to provide the Company with a new term loan

facility of GBP20 million, repayable on 14 August 2025. Under the

terms of the agreement, the Company will pay fixed interest of

3.935% per annum on the balance.

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

The Company's borrowing position at 31 March 2015 is set out in

the Annual Report.

15. Issued capital and reserves

Ordinary shares Unaudited

Share capital of 1p GBP000

------------------------ ---------------- ------------

At 25 March 2014 131,989,310 1,320

Issue of share capital 45,616,349 456

------------------------ ---------------- ------------

At 31 March 2015 177,605,659 1,776

------------------------ ---------------- ------------

Issue of share capital 13,200,000 132

At 30 September 2015 190,805,659 1,908

------------------------ ---------------- ------------

The Company raised GBP25.0 million (before costs and expenses)

through a placing of 23,866,349 on 8 October 2014 and GBP22.62

million (before costs and expenses) through a placing of 21,750,000

new ordinary shares in the Company on 12 February 2015.

During the Period, the Company raised GBP14.3 million (before

costs and expenses) through further placings of 13,200,000 new

ordinary shares. The Company has made further issues of new shares

since the Period end, which are detailed in Note 18 to the

financial statements.

Rights, preferences and restrictions on shares

All ordinary shares carry equal rights and no privileges are

attached to any shares in the Company. All the shares are freely

transferable, except as otherwise provided by law. The holders of

ordinary shares are entitled to receive dividends as declared from

time to time and are entitled to one vote per share at meetings of

the Company. All shares rank equally with regard to the Company's

residual assets.

On 25 February 2014, Ian Mattioli, the Company and the Company's

broker, Numis Securities Limited ("Numis"), entered into a lock-in

agreement. Under the terms of the agreement, Ian Mattioli has

undertaken not to dispose of any ordinary shares or any interest in

ordinary shares for a period of twelve months commencing on

Admission and for a further period of twelve months' thereafter not

to dispose any ordinary shares or any interest in ordinary shares

without the prior written consent of Numis.

At the AGM of the Company held on 22 July 2015, the Board was

given authority to issue up to 120,670,439 shares, pursuant to

section 551 of the Companies Act 2006. This authority is intended

to satisfy market demand for the ordinary shares and raise further

monies for investment in accordance with the Company's investment

policy.

In addition, the Company was granted authority to make market

purchases of up to 18,100,565 Ordinary Shares under section 701 of

the Companies Act 2006.

On 14 August 2015, registration was completed of the Chancery

Division of the High Court of Justice's approval of the

cancellation of the Company's share premium account, standing at

GBP181,485,649 as of 22 July 2015. Further details, including the

rationale for the cancellation, are set out in the Notice of Annual

General Meeting available at the Company's website.

The following table describes the nature and purpose of each

reserve within equity:

Reserve Description and purpose

------------------ ------------------------------

Share premium Amounts subscribed for

share capital in excess

of nominal value less any

associated issue costs

that have been capitalised.

Retained earnings All other net gains and

losses and transactions

with owners (e.g. dividends)

not recognised elsewhere.

16. Financial instruments

Fair values

The fair values of financial assets and liabilities are not

materially different from their carrying values in the financial

statements. The fair value hierarchy levels are as follows:

-- Level 1 - quoted prices (unadjusted) in active markets for identical assets and liabilities;

-- Level 2 - inputs other than quoted prices included within

level 1 that are observable for the asset or liability, either

directly (i.e. as prices) or indirectly (i.e. derived from prices);

and

-- Level 3 - inputs for the assets or liability that are not

based on observable market data (unobservable inputs).

There have been no transfers between Levels 1, 2 and 3 during

the Period. The main methods and assumptions used in estimating the

fair values of financial instruments and investment property are

detailed below.

Investment property - level 3

Fair value is based on valuations provided by an independent

firm of chartered surveyors and registered appraisers. These values

were determined after having taken into consideration recent market

transactions for similar properties in similar locations to the

investment properties held by the Company. The fair value hierarchy

of investment property is level 3. At 30 September 2015, the

Company fair value of investment properties was GBP232.9

million.

Interest bearing loans and borrowings - level 3

As at 30 September 2015 the amortised cost of the Company's

loans with Lloyds Bank plc and Scottish Widows plc approximated

their fair value. The loan from Scottish Widows plc includes a

market-based break cost for early repayment ("Prepayment Option"),

which is classified as a non-separable component of the loan. If

the Prepayment Option was classified as a separate financial

instrument, it would decrease the Company's NAV per share at 30

September 2015 to 102.6p (as previously reported in the quarterly

NAV statement released on 20 October 2015 and the prospectus

relating to the Issue dated 4 November 2015).

Trade and other receivables/payables - level 3

The carrying amount of all receivables and payables deemed to be

due within one year are considered to reflect the fair value.

17. Related party transactions

Transactions with directors

Each of the directors is engaged under a letter of appointment

with the Company and does not have a service contract with the

Company. Under the terms of their appointment, each director is

required to retire by rotation and seek re-election at least every

three years. Each director's appointment under their respective

letter of appointment is terminable immediately by either party

(the Company or the director) giving written notice and no

compensation or benefits are payable upon termination of office as

a director of the Company becoming effective.

Fees payable to the Manager

On 25 February 2014 the Company entered into a three year

Investment Management Agreement ("IMA") with the Investment

Manager, under which the Investment Manager has been appointed as

Alternative Investment Fund Manager with responsibility for the

property management of the Company's assets, subject to the overall

supervision of the Directors. The Investment Manager manages the

Company's investments in accordance with the policies laid down by

the Board and the investment restrictions referred to in the IMA,

and charges fees for annual management and administration as set

out in the Annual Report.

Ian Mattioli is Chief Executive of Mattioli Woods plc, the

parent company of the Investment Manager, and is a director of the

Investment Manager. As a result, Ian Mattioli is not independent.

The Company Secretary, Nathan Imlach, is also a director of

Mattioli Woods plc and the Investment Manager.

During the Period the Company paid the Investment Manager

GBP1.59 million (September 2014: GBP0.70 million, March 2015:

GBP1.79 million) in respect of annual management charges,

administrative fees and marketing fees.

The Company owed GBP8,063 to the Investment Manager at 30

September 2015 (September 2014: GBP546,871, March 2015:

GBPnil).

Certain investment properties are partially let to Mattioli

Woods plc. Mattioli Woods plc paid the Company rentals of GBP0.21

million during the Period (September 2014: GBP0.18 million, March

2015: GBP0.35 million) and owed the Company GBP54,736 at 30

September 2015 (September 2014: GBP514, March 2015: GBPnil).

Ian Mattioli, Nathan Imlach, Richard Shepherd-Cross and the

private pension schemes of Ian Mattioli, Nathan Imlach and Richard

Shepherd-Cross continue to have a beneficial interest in the

Company.

18. Events after the reporting date

New equity

Since the reporting date the Company has issued 2,500,000 new

ordinary shares of 1 pence each, raising GBP2.68 million (before

costs and expenses).

Acquisitions

On 7 October 2015 the Company acquired Lancaster House, a

prominent 39,600 sq ft office building on the corner of Newhall

Street and Great Charles Street, in Birmingham city centre for

GBP6,650,000. The property is let to 15 tenants with lease expiries

between 30 June 2016 and 31 July 2025, with a total passing rent of

GBP505,752 per annum, reflecting a net initial yield of 7.19%.

On 23 October 2015 the Company acquired the ground floor and

part of the first floor of a leisure development in Abbey Sands,

Torquay for GBP4.33 million let to Le Bistro Pierre Limited, Las

Iguanas Limited, Loungers Limited and Jurassic Coast Coffee Limited

(trading as Costa Coffee) at an aggregate passing rent of

GBP285,000 per annum.

The Company also acquired 1.3 acres of development land at the

Gunnels Wood Industrial Estate, Stevenage for a purchase price of

GBP1.0 million pre-let to Morrison Utility Services Limited at a

passing rent of GBP226,551, reflecting a net initial yield of

7.21%. The construction of a 23,161 sq ft warehouse unit will be

phased over a seven month build period with funding drawn-down via

monthly certified payments, which will attract an annualised coupon

of 6.25% until completion.

On 18 November 2015 the Company exchanged contracts to acquire a

property portfolio for GBP69.4 million due to complete in January

2016.

Placing

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:01 ET (07:01 GMT)

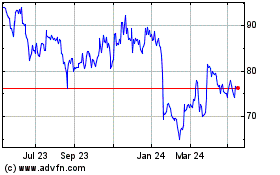

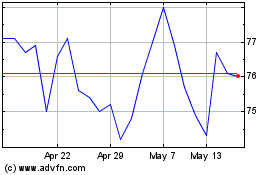

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024