TIDMCORA

RNS Number : 9425O

Cora Gold Limited

06 February 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN ARE

RESTRICTED AND ARE NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR

ANY JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

SHALL NOT CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION,

RECOMMATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR,

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES IN CORA GOLD LIMITED

OR ANY OTHER ENTITY IN ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT

NOR THE FACT OF ITS DISTRIBUTION SHALL FORM THE BASIS OF, OR BE

RELIED ON IN CONNECTION WITH, ANY INVESTMENT DECISION IN RESPECT OF

CORA GOLD LIMITED. PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS

ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ('MAR'), AND IS DISCLOSED IN ACCORDANCE WITH

THE COMPANY'S OBLIGATIONS UNDER ARTICLE 17 OF MAR. IN ADDITION,

MARKET SOUNDINGS (AS DEFINED IN MAR) WERE TAKEN IN RESPECT OF

CERTAIN OF THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE

RESULT THAT CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE

INFORMATION, AS PERMITTED BY MAR. UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN

POSSESSION OF INSIDE INFORMATION.

Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector:

Mining

06 February 2023

Cora Gold Limited

('Cora' or 'the Company')

Fundraising and Notice of General Meeting

Cora Gold Limited, the West African focused gold company, is

pleased to announce that it is launching a financing to raise at

least US$19.566m comprised of both equity (the 'Equity

Fundraising') and convertible loan notes (the 'Convertible

Financing') (together the 'Fundraising').

The funds raised will be primarily used to commence development

of the Company's flagship Sanankoro Gold Project (the 'Project') in

southern Mali following the reported Optimised Project Economics

(announcement dated 21 November 2022), which highlighted strong

economic fundamentals including 52% internal rate of return ('IRR')

at US$1,750 gold price based on open pit oxide mining.

Highlights

-- Binding commitments received for aggregate investments of

US$19.566m pursuant to the Fundraising comprising commitments to

subscribe for:

-- 76,200,559 ordinary shares of no par value in the Company

('Ordinary Shares') at a price of US$0.0487 (GBP0.0394) per share

(the 'Issue Price') for total gross proceeds of US$3.711m in

respect of the Equity Fundraising

-- Convertible loan notes ('CLNs') convertible into Ordinary

Shares on the terms set out below and at a price as determined in

the table below (the 'Conversion Price') for a total of US$15.855m

in respect of the Convertible Financing,

(together the 'Binding Commitments').

-- Ongoing discussions with other parties interested in participating in the Fundraising.

-- Opportunity for other investors to subscribe for up to US$10m

in the Equity Financing and / or the Convertible Financing on the

same terms as the Company has received the Binding Commitments

-- Those interested in participating in the Fundraising should

contact the Company's brokers to seek further information.

-- The Company intends to close the book build for the

Fundraising on 23 February 2023 and will make further announcements

shortly thereafter.

-- In order to complete the Fundraising the Company is calling a

general meeting at 12.00 p.m. (United Kingdom time) on 28 February

2023 to, inter alia, grant the directors authority to:

-- issue up to 282,000,000 Ordinary Shares in respect of the

Equity Financing; and

-- issue sufficient number of Ordinary Shares to be issued as a

result of any conversion of the CLNs in due course.

Bert Monro, Chief Executive Officer of Cora, commented,

"Following the recent completion of technical studies on the

Sanankoro Gold Project I am very pleased that Cora's shareholders

continue to be strongly supportive of the Project's development

into an operating mine. The Company has already received Binding

Commitments of around US$20m, a significant sum in the context of

our development requirements, and we are delighted to be able to

provide other investors with the opportunity to participate in the

Fundraising on the same terms. Discussions are also ongoing with a

number of potential lenders to fully fund the Project. The Company

anticipates providing further updates on this in due course.

"Sanankoro is an exceptional project, as evidenced by the robust

fundamentals reported in the Optimised Project Economics, and the

outlook is extremely positive."

Further Information

Cora has entered into an up to US$30 million mandate and term

sheet (the 'Term Sheet') with Lionhead Capital Advisors Proprietary

Limited ('Lionhead') to fund the development of the Company's

Sanankoro Gold Project in southern Mali (the 'Project Financing').

This Term Sheet replaces the previous one with Lionhead, which was

announced on 08 September 2021.

Pursuant to the Term Sheet, the Company has, to date, received

binding commitments to subscribe for 76,200,559 new Ordinary Shares

for total gross proceeds of US$3,710,967.26 and for CLNs

convertible into new Ordinary Shares for a total of US$15,855,000.

In aggregate therefore, the Company will receive a minimum of

US$19,565,967.26 pursuant to the Binding Commitments received to

date.

Lionhead has agreed that existing shareholders and other agreed

investors may subscribe for up to US$10 million in the Equity

Financing and / or in the Convertible Financing (or such greater

amounts as may be made available if Lionhead does not take up its

full allotment of the Project Financing). The Project Financing is

conditional on, among other matters, the passing of the necessary

resolutions at a General Meeting of the shareholders of the Company

(the 'General Meeting') and admission to trading on AIM

('Admission') of ordinary shares in the Company in connection with

the Equity Financing.

Binding commitments

To date the Company has received Binding Commitments:

-- to subscribe for a total of 47,533,926 new Ordinary Shares at

the Issue Price (the 'Subscription Shares') from Brookstone

Business Inc ('Brookstone'; the Company's largest shareholder),

Lord Farmer (a substantial shareholder in the Company), and certain

directors of the Company (the 'Related Party Subscription').

Details of their participation are described below;

-- to subscribe for 28,666,633 new Ordinary Shares at the Issue Price from other investors;

-- to subscribe for CLNs with a total aggregate value of

US$10,370,000 from Brookstone, Lord Farmer and certain directors of

the Company (the 'Related Party CLN Subscription'). Details of

their participation are described below; and

-- to subscribe for CLNs with a total aggregate value of US$5,485,000 from other investors.

Other commitments

Other parties interested in participating in the Fundraising

should contact the Company's brokers to seek further information.

The Company intends to close the book build for the Fundraising on

23 February 2023 and will make further announcements shortly

thereafter.

Details of the Fundraising and Notice of General Meeting

The Equity Fundraising is conditional on, amongst other matters,

the passing of the necessary resolutions at a General Meeting of

the shareholders of the Company (the 'General Meeting') and

admission to trading on AIM ('Admission') of the new Ordinary

Shares to be issued pursuant to the Equity Financing.

The Convertible Fundraising is conditional on, amongst other

matters, the passing of the necessary resolutions at a General

Meeting to allow for Admission of the new Ordinary Shares to be

issued as a result of any conversion of the CLN in due course.

A Notice of General Meeting of the Company will be posted to

shareholders shortly. The General Meeting will be held at 12.00

p.m. (United Kingdom time) on 28 February 2023 at the offices of

Hannam & Partners, 3rd Floor, 7-10 Chandos Street, London, W1G

9DQ, United Kingdom and online. A copy of the Notice of General

Meeting will be made available on the Company's website shortly (

www.coragold.com ).

The terms of the CLN are as follows:

Maturity date 180 days following the date of

issue

Coupon 0%

-----------------------------------------------------------------

Mandatory Conversion In the event of conclusion of

definitive binding agreements

in respect of senior debt and

such agreements being unconditional:

* on or prior to the date falling 90 days after the

issue date of the CLN, at the lower of (a) US$0.0596

per ordinary share, (b) the market price per ordinary

share as at the date of the Mandatory Conversion and

(c) the price of any equity issuance by the Company

in the prior 60 days (excluding shares issued

pursuant to the Company's Share Option Scheme or

pursuant to terms of any other agreement entered into

prior to the issue date of the CLN);

* after the date falling 90 days after the issue date

of the CLN, at the lower of (a) US$0.0542 per

ordinary share, (b) the market price per ordinary

share as at the date of the Mandatory Conversion and

(c) the price of any equity issuance by the Company

in the prior 60 days (excluding shares issued

pursuant to the Company's Share Option Scheme or

pursuant to terms of any other agreement entered into

prior to the issue date of the CLN).

-----------------------------------------------------------------

Optional Conversion At the election of the holder

at any time after the date falling

90 days after the issue date of

the CLN, at US$0.0569 per ordinary

share.

-----------------------------------------------------------------

Repayment Repayable on Maturity Date, if

not converted, or earlier, at

the option of the holder, in the

case of a (i) a change of control

of Cora (ii) the merger or sale

of Cora (including the sale of

substantially all of the assets),

at a 5% premium to the total amount

outstanding under the CLN.

-----------------------------------------------------------------

Net Smelter Royalty Holders of CLN have proportionate

participation in a Net Smelter

Royalty ('NSR') of 1% in respect

of all ores, minerals, metals

and materials containing gold

mined and sold or removed from

the Project, until 250,000 ozs

of gold has been produced and

sold from the Project, provided

that Cora may purchase and terminate

the NSR, in full and not in part,

at any time for a value of US$3

million.

-----------------------------------------------------------------

Other CLN shall be issued fully paid

in amount and in integral multiples

of US$10,000 by the Company and

are fully transferable.

-----------------------------------------------------------------

The Company will make an announcement of the conversion of CLN

when such events arise.

For the purpose of converting the above per ordinary share

amounts from United States dollar ('US$' or 'USD') to British pound

sterling ('GBPGBP' or 'GBP') the exchange rate applied was

US$/GBPGBP = 1.2364 (source: Bloomberg on 20 January 2023).

Use of proceeds

It is intended that the proceeds of the Fundraising will

principally be used to develop the Company's flagship Sanankoro

Gold Project in southern Mali. Additionally, the proceeds of the

Fundraising will be used for general working capital purposes.

Related party transactions

Certain directors of the Company or their connected parties have

given Binding Commitments to subscribe for the following numbers of

new Ordinary Shares in the Equity Financing:

-- Edward Bowie (Non-Executive Director (Independent) &

Chair of the Board of Directors) - 100,000 new Ordinary Shares.

Upon Admission Edward Bowie will be interested in a total of

625,510 Ordinary Shares; and

-- Robert Monro (Chief Executive Officer & Director) -

206,000 new Ordinary Shares Upon Admission Robert Monro will be

interested in a total of 2,234,896 Ordinary Shares.

Certain existing substantial shareholders of the Company have

given Binding Commitments to subscribe for the following numbers of

new Ordinary Shares in the Equity Financing:

-- Brookstone - 20,533,881 new Ordinary Shares. Brookstone is

wholly owned and controlled by First Island Trust Company Ltd as

Trustee of The Nodo Trust, being a discretionary trust with a broad

class of potential beneficiaries. Patrick Quirk, father of Paul

Quirk (a Non-Executive Director of Cora), is a potential

beneficiary of The Nodo Trust. Upon Admission Brookstone will be

interested in a total of 103,329,906 Ordinary Shares; and

-- Lord Farmer - 26,694,045 new Ordinary Shares. Upon Admission

Lord Farmer will be interested in a total of 69,231,228 Ordinary

Shares.

Certain directors of the Company have given Binding Commitments

to subscribe for the following amounts of CLN in the

Fundraising:

-- Edward Bowie (Non-Executive Director (Independent) &

Chair of the Board of Directors) will be the registered holder of

CLN for a total of US$20,000;

-- Andrew Chubb (Non-Executive Director (Independent)) will be

the registered holder of CLN for a total of US$20,000; and

-- Robert Monro (Chief Executive Officer & Director) will be

the registered holder of CLN for a total of US$30,000.

Certain existing substantial shareholders have given a Binding

Commitments to subscribe for the following amounts of CLN in the

Fundraising:

-- Brookstone will be the registered holder of CLN for a total of US$7,000,000; and

-- Lord Farmer will be the registered holder of CLN for a total of US$3,300,000.

Paul Quirk (Non-Executive Director of the Company) is a director

of Lionhead. Pursuant to the Term Sheet a fee equal to 3% on

Lionhead's arrangement of the Equity Financing and / or Convertible

Subscription plus 1% on any funds raised by the Company pursuant to

the Fundraising shall be paid by the Company to Lionhead on receipt

of the proceeds in respect of the Equity Financing and Convertible

Financing. The Fundraising announced today is part of the Project

Financing arrangement with Lionhead.

The payment to Lionhead pursuant to the Term Sheet is deemed to

constitute a related party transaction for the purposes of Rule 13

of the AIM Rules for Companies. Cora's independent directors for

this purpose (being all those save for Paul Quirk) consider, having

consulted with the Company's nominated adviser, finnCap Ltd

('finnCap'), that the terms of the Term Sheet are fair and

reasonable insofar as the Company's shareholders are concerned.

The Related Party Subscription and / or Related Party CLN

Subscription by each of Brookstone, Lord Farmer, Edward Bowie,

Andrew Chubb and Robert ('Bert') Monro (the 'Related Parties')

constitute related party transactions pursuant to Rule 13 of the

AIM Rules for Companies. The Company's independent director for

this purpose, being David Pelham, considers, having consulted with

the Company's nominated adviser, finnCap, that the terms upon which

the Related Parties are participating in the Related Party

Subscription and / or Related Party CLN Subscription are fair and

reasonable insofar as the Company's shareholders are concerned.

Relationship Agreement

Brookstone, Key Ventures Holding Ltd (which is wholly owned and

controlled by First Island Trust Company Ltd as Trustee of The

Sunnega Trust, being a discretionary trust of which Paul Quirk (a

Non-Executive Director of Cora) is a potential beneficiary) and

Paul Quirk (collectively the 'Investors') entered into a

Relationship Agreement on 18 March 2020 to regulate the

relationship between the Investors and the Company on an arm's

length and normal commercial basis. In the event that Investors'

aggregated shareholdings becomes less than 30% then the

Relationship Agreement shall terminate. As at the date of this news

release the Investors' aggregated shareholdings were 33.32 per

cent. of the issued share capital of the Company.

Permitting

On 28 November 2022 the government of Mali announced that the

allocation of mining titles had been suspended. As a result

applications for mining titles are not currently being received or

processed by the government. The government has stated it will make

an announcement regarding the lifting of this moratorium in due

course. Meanwhile the Company is continuing its work towards

submitting an application for a mining permit once the moratorium

is lifted. The Company has been awarded an Environmental permit for

Sanankoro.

Additional project finance

The Company is in discussions with a number of potential lenders

to support the Fundraising to fully fund the Project. The Company

will provide further updates on this in due course.

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement.

* *S * *

For further information, please visit http://www.coragold.com or

contact:

Bert Monro Cora Gold Limited info@coragold.com

Craig Banfield

Christopher Raggett finnCap Ltd

Charlie Beeson (Nomad & Joint Broker) +44 (0)20 7220 0500

-------------------------- ---------------------

Andy Thacker Turner Pope Investments

James Pope (Joint Broker) +44 (0)20 3657 0050

-------------------------- ---------------------

Susie Geliher St Brides Partners pr@coragold.com

Charlotte Page (Financial PR)

Isabelle Morris

-------------------------- ---------------------

Notes

Cora is a West African gold developer with three principal

de-risked project areas within two known gold belts in Mali and

Senegal covering c.900 sq km. Led by a team with a proven track

record in making multi-million ounce gold discoveries that have

been developed into operating mines, its primary focus is on

developing the Sanankoro Gold Project in the Yanfolila Gold Belt,

southern Mali, into an open pit oxide mine. Based on a gold price

of US$1,750/oz and Maiden Probable Reserve of 422 koz at 1.3 g/t

Au, the project has strong economic fundamentals, including 52%

IRR, US$234m Free Cash Flow over life of mine and all-in sustaining

costs of US$997/oz.

Important Notice:

MEMBERS OF THE GENERAL PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN

THE FUNDRAISING. THIS ANNOUNCEMENT AND ANY OFFER OF SECURITIES TO

WHICH IT RELATES ARE ONLY ADDRESSED TO AND DIRECTED AT (1) IN THE

UNITED KINGDOM OR ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA,

PERSONS WHO ARE QUALIFIED INVESTORS WITHIN THE MEANING OF ARTICLE

2(e) OF EU REGULATION (EU) 2017/1129 AND ANY RELEVANT IMPLEMENTING

MEASURES (THE 'PROSPECTUS REGULATION'); AND (2) IN THE UNITED

KINGDOM, PERSONS WHO (I) HAVE PROFESSIONAL EXPERIENCE IN MATTERS

RELATING TO INVESTMENTS WHO FALL WITHIN ARTICLE 19(5) OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER

2005 (AS AMED) (THE 'ORDER'); OR (II) FALL WITHIN ARTICLE 49(2)(A)

TO (D) OF THE ORDER OR (III) ARE PERSONS TO WHOM AN OFFER OF THE

PLACING SHARES MAY OTHERWISE LAWFULLY BE MADE (ALL SUCH PERSONS

REFERRED TO IN (1) AND, (2) TOGETHER BEING REFERRED TO AS 'RELEVANT

PERSONS'). THE INFORMATION REGARDING THE PLACING SET OUT IN THIS

ANNOUNCEMENT MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE

NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO

WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT

PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

This announcement and the information contained herein is for

information purposes only and does not constitute or form part of

any offer or an invitation to acquire or dispose of securities in

the United States, Canada, Australia, South Africa or Japan or in

any jurisdiction in which such an offer or invitation is

unlawful.

Neither the new Ordinary Shares nor the CLNs have been, and nor

will either be, registered under the US Securities Act of 1933, as

amended (the 'Securities Act'), or under the securities laws of any

State or other jurisdiction of the United States, and, absent

registration, may not be offered or sold in the United States (as

defined in Regulation S under the Securities Act) except pursuant

to an exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and the securities

laws of any relevant State or other jurisdiction of the United

States. There will be no public offering of the new Ordinary Shares

or the CLNs in the United States or elsewhere.

Neither the new Ordinary Shares nor the CLNs have been approved

or disapproved by the US Securities and Exchange Commission, any

state securities commission or other regulatory authority in the

United States, nor have any of the foregoing authorities passed

upon or endorsed the merits of the Fundraising or the accuracy or

adequacy of this announcement. Any representation to the contrary

is a criminal offence in the United States.

No prospectus, admission document or offering document has been

or will be prepared in connection with the Fundraising. Any

investment decision to buy securities in the Placing must be made

solely on the basis of publicly available information. Such

information is not the responsibility of and has not been

independently verified by finnCap, Turner Pope or any of their

respective affiliates.

Neither this announcement nor any copy of it may be taken,

transmitted or distributed, directly or indirectly, in or into or

from the United States (including its territories and possessions,

any State of the United States and the District of Columbia),

Australia, Canada, the Republic of South Africa or Japan. Any

failure to comply with this restriction may constitute a violation

of US, Australian, Canadian, South African or Japanese securities

laws.

The distribution of this announcement and the offering or sale

of the new Ordinary Shares or CLNs in certain jurisdictions may be

restricted by law. No action has been taken by finnCap or Turner

Pope or any of their respective affiliates that would, or which is

intended to, permit a public offer of the new Ordinary Shares or

CLNs in any jurisdiction, or possession or distribution of this

announcement or any other offering or publicity material relating

to the new Ordinary Shares or CLNs, in any jurisdiction where

action for that purpose is required. Persons into whose possession

this announcement comes are required by the finnCap and Turner Pope

to inform themselves about and to observe any applicable

restrictions.

No reliance may be placed, for any purposes whatsoever, on the

information contained in this announcement or on its completeness

and this announcement should not be considered a recommendation by

the Company, finnCap, Turner Pope or any of their respective

affiliates in relation to any purchase of or subscription for

securities of the Company. No representation or warranty, express

or implied, is given by or on behalf of the Company, finnCap,

Turner Pope or any of their respective directors, partners,

officers, employees, advisers or any other persons as to the

accuracy, fairness or sufficiency of the information or opinions

contained in this announcement and none of the information

contained in this announcement has been independently verified.

Save in the case of fraud, no liability is accepted for any errors,

omissions or inaccuracies in such information or opinions.

finnCap, which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting only for the

Company in connection with the Fundraising and will not be

responsible to anyone other than the Company for providing the

protections offered to the clients of finnCap, nor for providing

advice in relation to the Fundraising or any matters referred to in

this announcement, and apart from the responsibilities and

liabilities (if any) imposed on finnCap by the Financial Services

and Markets Act 2000, any liability therefore is expressly

disclaimed. Any other person in receipt of this announcement should

seek their own independent legal, investment and tax advice as they

see fit.

Turner Pope, which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting only for the

Company in connection with the Fundraising and will not be

responsible to anyone other than the Company for providing the

protections offered to the clients of Turner Pope, nor for

providing advice in relation to the Fundraising or any matters

referred to in this announcement, and apart from the

responsibilities and liabilities (if any) imposed on Turner Pope by

the Financial Services and Markets Act 2000, any liability

therefore is expressly disclaimed. Any other person in receipt of

this announcement should seek their own independent legal,

investment and tax advice as they see fit.

References to time in this announcement are to London time,

unless otherwise stated. All times and dates in this announcement

may be subject to amendment.

Certain statements in this announcement are, or may be deemed to

be, forward-looking statements. By their nature, forward-looking

statements involve a number of risks, uncertainties and assumptions

that could cause actual results or events to differ materially from

those expressed or implied by the forward-looking statements. These

risks, uncertainties and assumptions could adversely affect the

outcome and financial consequences of the plans and events

described herein. No one undertakes any obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise. Readers should not

place any undue reliance on forward-looking statements which speak

only as of the date of this announcement. Statements contained in

this announcement regarding past trends or events should not be

taken as representation that such trends or events will continue in

the future.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ('MiFID II'); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the 'MiFID

II Product Governance Requirements'), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any 'manufacturer' (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the new Ordinary Shares and CLNs have been subject to a product

approval process, which has determined that the new Ordinary Shares

and CLNs are: (i) compatible with an end target market of (a)

retail investors, (b) investors who meet the criteria of

professional clients and (c) eligible counterparties, each as

defined in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the 'Target

Market Assessment'). Notwithstanding the Target Market Assessment,

distributors should note that: the price of the new Ordinary Shares

may decline and investors could lose all or part of their

investment; neither the new Ordinary Shares nor the CLNs offer

guaranteed income or capital protection; and an investment in the

new Ordinary Shares or CLNs is compatible only with investors who

do not need a guaranteed income or capital protection, who (either

alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such

an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Fundraising. Furthermore, it is noted that, notwithstanding

the Target Market Assessment, finnCap and Turner Pope will only

procure investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the new Ordinary Shares

or CLNs.

Each distributor is responsible for undertaking its own target

market assessment in respect of the new Ordinary Shares and CLNs

and determining appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUPUPAPUPWGCA

(END) Dow Jones Newswires

February 06, 2023 02:00 ET (07:00 GMT)

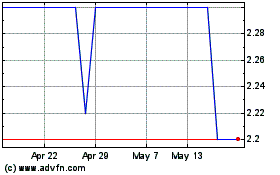

Cora Gold (LSE:CORA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cora Gold (LSE:CORA)

Historical Stock Chart

From Dec 2023 to Dec 2024