Barclays PLC Form 8.5 (EPT/NON-RI) Capricorn Energy plc (0707R)

July 01 2022 - 9:10AM

UK Regulatory

TIDMBARC TIDMCNE

RNS Number : 0707R

Barclays PLC

01 July 2022

FORM 8.5 (EPT/NON-RI)

PUBLIC OPENING POSITION DISCLOSURE/DEALING DISCLOSURE BY

AN

EXEMPT PRINCIPAL TRADER WITHOUT RECOGNISED INTERMEDIARY

("RI") STATUS

(OR WHERE RI STATUS IS NOT APPLICABLE)

Rule 8.5 of the Takeover Code (the "Code")

1. KEY INFORMATION

Name of exempt principal trader: BARCLAYS CAPITAL

(a) SECURITIES LTD

-----------------------------------------------------

Name of offeror/offeree in relation to CAPRICORN ENERGY

(b) whose PLC

----------------------

relevant securities this form relates:

------- ----------------------------------------------------- ---------- ------

Name of the party to the offer with which Tullow Oil plc

(c) exempt

----------------------

principal trader is connected

------- -------------------------------------------- ------- ---------- ------

Date position held/dealing undertaken: 30 June 2022

(d)

------- ----------------------------------------------------- ----------------------

In addition to the company in 1(b) above, YES:

(e) is the exempt principal

trader making disclosures in respect of TULLOW OIL PLC

any other party to the offer?

------- ----------------------------------------------------- ------------------

2. POSITIONS OF THE EXEMPT

PRINCIPAL TRADER

Interests and short positions in the relevant securities

(a) of the offeror or offeree

to which the disclosure relates following the dealing (if

any)

Class of relevant security: 21/13p ordinary

--------------------- ------------------

Interests Short Positions

--------------------- ------------------

Number (%) Number (%)

--------------------------------------- ------------ ------- ---------- ------

Relevant securities

(1) owned

and/or controlled: 8,521,563 2.70% 724,200 0.23%

Cash-settled derivatives:

(2)

500,764 0.16% 8,477,207 2.69%

Stock-settled derivatives

(3) (including options)

and agreements to

purchase/sell: 0 0.00% 0 0.00%

TOTAL: 9,022,327 2.86% 9,201,407 2.92%

Rights to subscribe for new securities (including directors

(b) and other executive

options)

Class of relevant security in relation

to

-------

which subscription right exists

----------------------------------------------------- -------------------------------

Details, including nature of the rights

-------

concerned and relevant percentages:

----------------------------------------------------- -------------------------------

3. DEALINGS (IF ANY) BY THE EXEMPT PRINCIPAL

TRADER

(a) Purchases and sales

------------------ ---------------------------------- -------------- --------------

Class of relevant Purchase/sale Total number Highest price Lowest price

of per unit per unit

security securities paid/received paid/received

21/13p ordinary Purchase 159,930 2.1800 GBP 2.1601 GBP

21/13p ordinary Sale 348,366 2.1801 GBP 2.164 GBP

---------------- ---------------- -------------- --------------

(b) Cash-settled derivative transactions

---------------- -------------------------------------------------- -----------

Class of Product Nature of Number Price per

dealing of

relevant description reference unit

security securities

---------------- -------------- -------------- ------------ -----------

21/13p ordinary CFD Decreasing 6,158 2.1740 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Decreasing 7,534 2.1779 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary CFD Decreasing 10,280 2.1682 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary CFD Decreasing 11,529 2.1800 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary CFD Decreasing 13,549 2.1673 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary CFD Decreasing 45,097 2.1798 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary CFD Decreasing 191,779 2.1800 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 1,047 2.1814 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 1,049 2.1560 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 2,239 2.1741 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 3,106 2.1774 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 4,087 2.1881 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 4,155 2.1748 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 5,637 2.1839 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 9,297 2.1800 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 13,191 2.1716 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 14,247 2.1785 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 26,814 2.1717 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Increasing 83,435 2.1799 GBP

Short

---------------- ---------------- ------------ -----------

21/13p ordinary SWAP Opening Short 4,410 2.1861 GBP

---------------- ---------------- ------------ -----------

(c) Stock-settled derivative transactions (including options)

(i) Writing, selling, purchasing or varying

Class Product Writing, Number Exercise Type Expiry Option

of description purchasing, of price date money

relevant selling, securities per unit paid/

security varying to received

etc which

option per unit

relates

------------- -------------- ------------ -------------- ----- ------------ -----------

(ii) Exercising

Class of Product description Exercising/ Number Exercise

relevant exercised against of price per

security securities unit

----------- ------------- -------------- ------------ ------------ -----------

(d) Other dealings (including subscribing for new securities)

Class of Nature Details Price

relevant of Dealings per unit

(if

security applicable)

----------- ------------- -------------- ------------ ------------ -----------

4. OTHER INFORMATION

(a) Indemnity and other dealings arrangements

Details of any indemnity or option arrangement, or any agreement

or understanding,

formal or informal, relating to relevant securities which may be

an inducement to deal

or refrain from dealing entered into by the exempt principal trader

making the disclosure and any party

to the offer or any person acting in concert with a party

to the offer:

--------------------------------------------------------------------------------------------- -----------

NONE

----------------------------------------------------------------------------------------------------------

(b) Agreements, arrangements or understandings relating to

options or derivatives

Details of any agreement, arrangement or understanding, formal or

informal, between

the exempt principal trader making the disclosure and any other person

relating to:

(i) the voting rights of any relevant securities under

any option; or

(ii) the voting rights of future acquisition or disposal of any relevant

securities to which

any derivative is referenced:

------------------------------------------ ------------ -------------- ----- ------------ -----------

NONE

----------------------------------------------------------------------------------------------------------

(c) Attachments

Is a Supplemental Form 8 (Open Positions) NO

attached?

------------------------------------------------

Date of disclosure: 1 Jul 2022

Contact name: Large Holdings Regulatory Operations

Telephone number: 020 3134 7213

--------------------- ------------ -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FEOXFLFBLDLBBBK

(END) Dow Jones Newswires

July 01, 2022 09:10 ET (13:10 GMT)

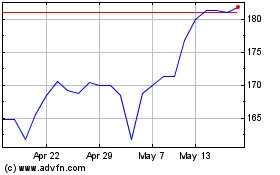

Capricorn Energy (LSE:CNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

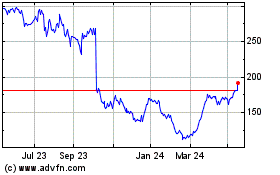

Capricorn Energy (LSE:CNE)

Historical Stock Chart

From Jul 2023 to Jul 2024