Comino Launches Subsidiary

January 16 2001 - 3:00AM

UK Regulatory

RNS Number:2585X

Comino Group PLC

16 January 2001

COMINO GROUP LAUNCHES COMINO TECHFLOW LIMITED SUBSIDIARY

WITH APPOINTMENT OF MANAGING DIRECTOR

Comino Group plc (Comino), the provider of software solutions for the local

government, housing association and occupational pensions sectors, announces

it has established a new subsidiary, Comino Techflow Limited, to progress the

opportunity referred to in the interim statement dated 20 November 2000. It

has appointed Phillip Hunter as Managing Director of Comino Techflow to head

this new operation. The new subsidiary will be based at Comino's head offices

in Buckinghamshire.

In the November statement, the company said: "The group has identified

another product opportunity in a growth sector which is new to Comino but one

where its application expertise and existing product strategy can be applied.

A new subsidiary with a new Managing Director and staff will invest a limited

amount to develop the concept and produce exact specifications. Following a

formal review, more detail will be released to shareholders after establishing

some competitive advantage but prior to investing in the full development."

Comino Techflow has been established to take that work forward. Its newly

appointed Managing Director, Phillip Hunter, 45, is a Chartered Accountant and

a former Divisional Managing Director of a Misys plc subsidiary.

Commenting, Garth Selvey, Comino's Chief Executive, said: "We have known and

worked with Phillip Hunter for a number of years and are delighted that he is

joining us. He has the skills to help Comino grow this project into a

significant operation."

Comino Techflow is 80% owned by Comino Group. The remaining shares, reserved

for existing and future employees, are the subject of various put and call

options between Comino and the minority shareholders. The price to be paid by

Comino for the minority shareholding is based on a formula which makes

reference to a discount of 20% to the group's pe ratio at the time of exercise

applied to the post tax profits of Comino Techflow. The maximum consideration

for the minority shareholding, payable in shares or cash at Comino Group's

option, is #12 million. According to the formula, this maximum payment would

equate to pre-tax profits of #3.57m in Comino Techflow using 30 as an

illustrative price earnings ratio.

For further information please contact:

Garth Selvey, Chief Executive, Comino Group plc

Tel: 01628 525 433

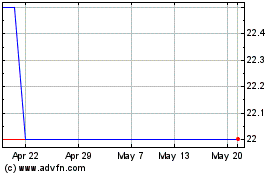

Cmo (LSE:CMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

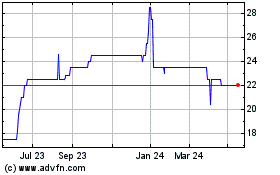

Cmo (LSE:CMO)

Historical Stock Chart

From Jul 2023 to Jul 2024