City of London Investment Group PLC Trading Update (6507Z)

January 14 2020 - 2:00AM

UK Regulatory

TIDMCLIG

RNS Number : 6507Z

City of London Investment Group PLC

14 January 2020

City of London Investment Group PLC

14 January 2020

CITY OF LONDON INVESTMENT GROUP PLC

("City of London", "the Group" or "the Company")

FUNDS UNDER MANAGEMENT AS AT 31 December 2019,

TRADING UPDATE

City of London (LSE: CLIG), a leading specialist asset

management group offering a range of institutional products

investing in closed-end funds, announces that as at 31 December

2019, FuM were US$6 billion (GBP4.5 billion). This compares with

US$5.4 billion (GBP4.3 billion) at the Company's year-end on 30

June 2019. A breakdown by strategy follows:

FuM ($mn) Strategy Index

Dec-19 Jun-19 % Net %

(estimate) inc/dec Flows inc/dec

EM 4,429 4,221 5% (118) MSCI EM 7%

DEV 1,109 729 52% 272 MSCI ACWI 7%

Opportunistic ACWI/Barclays

Value 270 233 16% 20 Global Agg 5%

Frontier 206 206 0% 8 S&P Frontier 150 0%

------

6,014 5,389 182

--------------- ------- ------- -------- ------ ----------------- --------

Excludes seed investments

The EM and International Developed strategies outperformed,

driven by narrower discounts, positive country allocation and good

NAV performance. The Opportunistic Value Strategy outperformed led

by good NAV performance and significant discount narrowing. The

Frontier strategy underperformed due primarily to negative country

allocation and discount widening.

During the period under review, the Developed strategies

recorded net inflows of $272 million. The EM strategies saw net

outflows of $118 million. We have to date received notification of

circa $200 million of net inflows in aggregate across all

strategies, which we expect to fund over the next quarter.

With regard to business development, the Group continues to

maintain an active pipeline across all of its major CEF offerings

with an increased interest in the diversification CEF

strategies.

Operations

The Group's income currently accrues at a weighted average rate

of approximately 75 basis points of FuM, net of third party

commissions. "Fixed" costs are cGBP1.1 million per month, and

accordingly the current run-rate for operating profit, before

profit-share of 30% and an EIP charge of 5%, is approximately

GBP1.8 million per month based upon current FuM and a US$/GBP

exchange rate of US$1.3257 to GBP1 as at 31 December 2019.

The Group estimates the unaudited profit before taxation for the

six months ended 31 December 2019 to be approximately GBP6.3

million, which compares with GBP5.2 million for the equivalent

period to 31 December 2018.

The Company is currently in a close period which will end with

the publication of results for the six months ended 31 December

2019 on 17 February 2020.

Dividend

In recognition of the improved results and having regard to the

current dividend cover policy the Board has decided to increase the

interim dividend by 1p to 10p per share, which will be paid on 20

March 2020 to shareholders registered at the close of business on 6

March 2020 (2019: 9 pence).

Template

Please see the attached graph which is based on the following

assumptions and includes the estimated quarterly cost of the

dividend:

http://www.rns-pdf.londonstockexchange.com/rns/6507Z_1-2020-1-13.pdf

Key assumptions:

(June 2019 comparatives in Italics)

- Starting point Current FuM (end December 2019)

- Net increase for the remainder of this financial year (straight-lined

to June 2020):

- emerging market CEF strategy zero (zero)

- non-emerging market CEF strategies US$250 (US$250m over

the full year)

- Net increase in 2020/2021 (straight-lined to June 2021):

- emerging market CEF strategy zero

- non-emerging market CEF strategies US$250m

- Operating margin adjusted monthly for change in product

mix and commission run-off

- Market growth: 0%

- Overheads for 2019/20: no increase on 2018/2019 (0%)

- Overheads for 2020/21: +3% compared with 2018/2019

- EIP cost for 2019/20: 5% of operating profit (5%)

- EIP cost for 2020/21: n/a now falls within 30% profit-share

- Corporation tax based on an estimated average rate of 21%

(21%)

- Exchange rate assumed to be GBP1/$1.31 for entire period

(GBP1/US$1.27)

- Number of CLIG Shares in issue (26.6m) less those held by

the ESOP Trust (1.7m) as at 31 December 2019 (26.6 m CLIG

shares in issue less 1.5m ESOP Trust holding)

For further information, please visit http://www.citlon.co.uk/

or contact:

Tom Griffith, CEO

City of London Investment Group PLC

Tel: 001-610-380-0435

Martin Green

Zeus Capital Limited

Financial Adviser & Broker

Tel: +44 (0)20 3829 5000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTSFSFMDESSESF

(END) Dow Jones Newswires

January 14, 2020 02:00 ET (07:00 GMT)

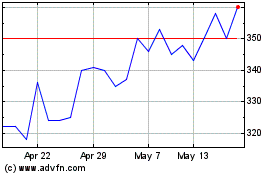

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Jun 2024 to Jul 2024

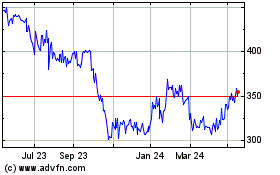

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Jul 2023 to Jul 2024