TIDMCLA

RNS Number : 5389A

Capital Lease Aviation PLC

29 September 2015

Capital Lease Aviation PLC

("CLA" or "the Company" or "the Group")

Audited Results Announcement for the Year Ended 30 June 2015

Capital Lease Aviation PLC (LSE: CLA), the aircraft leasing

company, today announces audited consolidated financial results for

the Company and its subsidiaries for the year ending 30 June

2015.

Highlights:

-- Refinance of debt which released US$ 10.1 million in cash and

reduced the average interest rate from 6.0% to 4.6%

-- Part out of an A320 end of life aircraft which increased cash

reserves by US$ 5 million and resulted in a US$ 1.2 million loss

(after tax)

-- Total cash increased 103% to US$ 12.4 million (2014: US$ 6.1 million)

-- Revenue from continuing operations down 7.5% to US$10.8 million (2014: US$ 11.7 million)

-- Basic and diluted EPS from total operations of 0.47 US cents (2014: 2.30 US cents)

The audited results for the Group's financial year ended 30 June

2015 (pursuant to International Financial Reporting Standards

"IFRS") and reported in United States Dollars "US$" are as

follows:

Consolidated Results: 12 months 12 months Change

ended 30 ended 30 June

June 2015 2014

US$ US$ %

(restated)

*

--------------------------- ----------- --------------- -------

Continuing operations

- Lease Revenue 10,825,000 11,700,000 (7.5)

--------------------------- ----------- --------------- -------

Total Profit 451,070 2,239,248 (79.8)

--------------------------- ----------- --------------- -------

Total assets 90,195,065 92,287,404 (2.2)

--------------------------- ----------- --------------- -------

Net Assets 44,063,603 47,062,523 (6.3)

--------------------------- ----------- --------------- -------

Cash 12,416,554 6,122,479 103

--------------------------- ----------- --------------- -------

Basic and diluted EPS

from total operations 0.47 cents 2.30 cents (79.5)

--------------------------- ----------- --------------- -------

Average Fleet Age (years) 12.7 15.2 (16.4)

--------------------------- ----------- --------------- -------

Average Lease Term

( years) 4.8 4.4 9.1

--------------------------- ----------- --------------- -------

Average Interest Rate

( % ) 4.6 6.0 (23.3)

--------------------------- ----------- --------------- -------

*the explanation for the restatement is in the Chairman's

Statement

Jeff Chatfield, Executive Chairman, said:

"During the reporting period the Group has focused on realising

value from aircraft assets to create a platform for growth."

"The Group's key achievements during the year include the

refinance of senior loans which reduced the cost of debt by 23 per

cent and released US$ 10.1 million. The part-out of an end of life

aircraft which resulted in a reduction in the average age of the

fleet to 12.7 years and increased cash reserves by US$ 5 million.

These elements, including the extension of the average lease term

to 4.8 years during 2014, are a solid foundation for the next stage

of development."

"Our strategy remains to grow the fleet of mid-life narrow-body

jets in Asia and Europe, the cash generated through the sale of an

asset and refinancing will facilitate future growth. Our goal, for

2016, is to invest the capital in assets that create value for our

shareholders."

"The continued support of our shareholders is fundamental to our

growth plans, in recognition of their continued support the Board

has announced a 2p interim dividend from the cash released during

the period."

The Company's financial statements are expected to be posted to

shareholders on 16 October 2015 and will be available shortly on

the company website http://www.cl-aviation.com/

Enquiries:

Capital Lease Aviation PLC +65 97354151

Jeff Chatfield, Executive Chairman

Nominated Adviser

James Joyce, W H Ireland Limited 0207 220 1666

Company Stockbroker

W H Ireland Limited 0207 220 1670

Blytheweigh 0207 138 3204

Tim Blythe / Wendy Haowei / Fergus Lane

Website

http://www.cl-aviation.com/

Chairman's Statement

For the Year ended 30 June 2015

Background and Outcome

I am pleased to report that the Group is in a strong financial

position despite the lower operating result. The Group refinanced

two aircraft during the year, renegotiated a key loan covenant

which released cash onto the balance sheet and post the period end

completed the disposal by way of part out of a 25 year old Airbus

A320, which was at the end of its useful economic life.

Management have successfully achieved their objectives which

have been to strengthen our financial position through the

refinance of higher interest debt, extend leases on key aircraft,

remain profitable and pursue fleet growth.

Key Achievements:

-- Refinance of two aircraft which released US$ 10.1 million in cash;

-- Disposal of an end of life aircraft which added US$ 5 million

to the Company's cash reserves;

-- Repayment of significant related party loan agreements; and

-- Reduction in the average cost of senior debt from 6.0% to 4.6%.

Results

Significant changes implemented by the Group during the year

resulted in Total Profit for the year ending 30 June 2015 being US$

0.45 million (2014:US$ 2.2 million), which translates into earnings

per share from total operations of 0.47cents (2014: 2.30 cents).

The key drivers for the changes in the results were certain lower

lease rates, a change in the depreciation policy and the net impact

of a disposal of an end of life aircraft which resulted in a book

loss of US$ 1.2 million.

The $1.2 million loss is classified within discontinued

operations as it represented the Group's only aircraft operating in

North America and operations in that region have therefore been

discontinued. The Group's current strategy is to grow its fleet

through the acquisition of narrow-body, mid-life aircraft in Asia

and Europe.

The Group has amended the presentation of its financial

statements in the current financial year to provide greater

clarity. The comparative statement of profit or loss has been

restated to show discontinued operations separately from continuing

operations.

Revenue from continuing operations decreased by 7.5 per cent to

US$ 10.83 million (2014: US$ 11.7 million).The Board has previously

advised that lease extensions on two aircraft to 2021 have resulted

in slightly lower revenue and net income yield from the aircraft.

Lower income was a commercial trade off for a longer duration

lease. The two aircraft are significant components of the balance

sheet and represent over 70 per cent of the total revenue of the

Group.

In addition to lower revenue, depreciation expenses have

increased as a result of a change in the depreciation policy as

advised in October 2014. Administrative expenses increased due to a

number of one off costs.

Dividend

The Board would like to thank the shareholders for their

continued support and is pleased to announce an interim dividend of

2p to shareholders, as a direct result of the Company's success in

releasing equity from the balance sheet during the financial

year.

The interim dividend payable of US$ 3,013,819 for the financial

year has been charged to retained earnings.

Outlook

The Group is actively pursuing new aircraft acquisitions on both

an individual and portfolio basis, and has evaluated numerous

aircraft during the year. Further acquisitions are expected to

deliver economies of scale that will lead to an increase in

profitability. The Group will also seek to optimise structures for

tax and finance to increase returns to shareholders.

Risks

The risks remain typical for an aircraft leasing company that

uses leverage to build the fleet. Along with the risks associated

with obtaining finance, there is residual value risk and impairment

of aircraft assets.

The Board has a conservative approach to gearing (at 42 percent

it is below industry norms), asset management and the deployment of

capital and will use these criteria when assessing new investment

opportunities.

The Directors would like to take this opportunity to thank all

our shareholders for their continued support and look forward to

creating more value for you as we continue to develop our aircraft

leasing business.

Robert Jeffries Chatfield

Executive Chairman

29(th) September 2015

--ENDS--

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 06:05 ET (10:05 GMT)

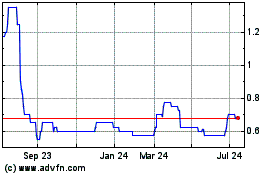

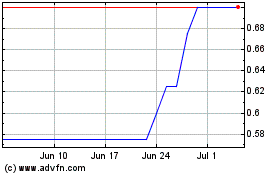

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jul 2024 to Aug 2024

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Aug 2023 to Aug 2024