TIDMCLA

RNS Number : 2850F

Capital Lease Aviation PLC

19 February 2015

Capital Lease Aviation Plc

("CLA" or "the Company")

HALF YEAR RESULTS TO 31 DECEMBER 2014

and Interim Management Report

19 February 2015

Capital Lease Aviation Plc (LSE: CLA), the aircraft leasing

company, today announces unaudited financial statements for the

Company and its subsidiaries for the six month period ended 31

December 2014.

Highlights:

-- CLA Group total assets of US$94,136,241;

-- Revenue of US$5,946,667;

-- Group Net post-tax profits of US$1,047,113;

-- Net assets of US$47,713,273;

-- EPS (fully diluted) of 1.08 cents.

The results for the Group's half year ended 31 December 2014

(pursuant to International Financial Reporting Standards "IFRS")

and reported in United States Dollars "US$" are as follows:

Consolidated US$ GBP

6 months ended Equivalent

31 Dec 2014 (1)

--------------------- ----------- ------------

Revenue 5,946,667 3,657,795

--------------------- ----------- ------------

Group Net post

tax profits 1,047,113 644,079

--------------------- ----------- ------------

Total assets 94,136,241 60,595,498

--------------------- ----------- ------------

Net Assets 47,713,273 30,713,034

--------------------- ----------- ------------

EPS (fully diluted) 1.08 cents 0.66 pence

--------------------- ----------- ------------

Jeff Chatfield, Executive Chairman, said, "The Company has

continued to grow net assets and restructure debt facilities. These

achievements provide both short and long term financial support for

the company strategy and increased shareholder value."

Notes: For the convenience of international shareholders, an

additional column is included to show an equivalent value in Pounds

Sterling "GBP".

1. In this announcement, the applicable exchange rate between

US$ and GBP was taken to be the average exchange rate of 1: 0.6151

for Income Statement items and 1: 0.6437 for Statement of Financial

Position items.

Directors' Review of Operations and Strategy

and Interim Management Report

Strategy, Background and Outcome

The strategic targets for management over the past six months

were to strengthen our financial position, confirm the long term

sustainable business model, remain profitable, actively assess

aircraft and pursue new aircraft acquisitions.

Profit was in excess of US$1.0m generating earnings per share of

1.08 cents. The financial position of the group remains strong and

it has been able to maintain a strong current asset position at the

end of the period.

Key achievements in the period included:

- Refinancing of two A321-200s with a major European Bank;

- Lowering the cost of debt for the two aircraft from 6.23% to 4.22%

- Repayment of US$ 4.5m of junior debt on 31 December;

- Restructuring of the senior and junior loans has reduced the

average cost of debt from 6.42% to 4.59%

Outlook and Risks

The outlook for CLA is positive with future periods expected to

benefit from the recently reduced cost of capital. The Board

remains optimistic and will continue to evaluate opportunities to

grow the company.

CLA remains subject to the typical risks of the aircraft leasing

industry along with the risks associated with obtaining finance,

residual value risk and impairment in aircraft assets.

I would like to take this opportunity to thank all the

shareholders for their continued support.

Jeff Chatfield

Executive Chairman

18 Feb 2015

Enquiries:

Capital Lease Aviation PLC

Jeff Chatfield, Executive Chairman +65 9735 4151

Nominated Adviser

James Joyce, W H Ireland +44 207 220 1666

Company Stockbroker

W H Ireland +44 207 220 1670

Blytheweigh

Tim Blythe / Alex Shilov / Andrea Benton +44 207 138 3204

www.cl-aviation.com

CAPITAL LEASE AVIATION PLC

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE PERIOD 1 JULY 2014 TO 31 DECEMBER 2014

31 December 31 December

2014 2013

US$ US$

Continuing operations

Revenue 5,946,667 6,150,000

Other income 68,092 5,527

Other operating expenses (2,378,274) (2,248,226)

Expenses

- Administrative expenses (1,141,067) (1,065,547)

- Finance expense (1,334,113) (1,535,427)

Profit before taxation 1,161,305 1,306,327

Taxation (114,192) (77,409)

Profit for the financial

year 1,047,113 1,228,918

------------ ------------

Other comprehensive income:

Items that may be reclassified

to profit or loss:

Foreign currency translation

loss (12,600) (49)

Other comprehensive income,

net of tax (12,600) (49)

------------ ------------

Total comprehensive income

for the financial year, all

attributable to equity holders

of the Company 1,034,513 1,228,869

============ ============

Earnings per share - continuing

and total operations

* Basic 1.08 cents 1.26 cents

============ ============

* Fully diluted 1.08 cents 1.26 cents

============ ============

CAPITAL LEASE AVIATION PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2014

31 December 31 December

2014 2013

US$ US$

ASSETS

Current assets

Cash and cash equivalents 3,137,818 5,994,980

Trade and other receivables 11,107,958 1,016,855

Inventories 2,840,000 -

Total current assets 17,085,776 7,011,835

Non-current assets

Property, plant and equipment 77,050,465 89,013,410

Total non-current assets 77,050,465 89,013,410

Total assets 94,136,241 96,025,245

EQUITY AND LIABILITIES

Current liabilities

Trade and other payables 1,139,934 2,602,772

Provision for taxation 19,392 65,603

Loans and borrowings 6,069,628 11,715,805

Total current liabilities 7,228,954 14,384,180

Non-current liabilities

Loans and borrowings 37,657,733 33,837,703

Deferred tax liabilities 1,536,281 1,505,835

Total non-current liabilities 39,194,014 35,343,538

Capital and reserves

Share capital 196,393 196,393

Treasury shares (631,191) -

Share premium 21,696,406 21,696,406

Asset revaluation reserve 3,839,923 3,839,923

Foreign currency translation

reserve (10,959) (453)

Retained earnings 22,622,701 20,565,258

Net equity 47,713,273 46,297,527

Total equity and liabilities 94,136,241 96,025,245

CAPITAL LEASE AVIATION PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIOD 1 JULY 2014 TO 31 DECEMBER 2014

31 December 31 December

2014 2013

US$ US$

Cash flows from operating activities

Profit before taxation 1,161,305 1,306,327

Adjustments for:

Depreciation expense 2,377,909 2,241,570

Interest expense 1,331,113 1,535,427

Interest income (64,020) (5,527)

Operating cash flows before

changes in working capital 4,806,307 5,077,797

Movements on:

Trade and other receivables (7,151,658) (318,003)

Trade and other payables (911,027) 811,276

Cash flows from operations (3,256,378) 5,571,070

Interest paid (1,273,207) (1,395,152)

Interest received 64,020 5,527

Corporation tax paid (59,820) (31,416)

Net cash flows (used in) from

operating activities (4,525,385) 4,150,029

Investing activity

Purchase of property, plant

and equipment (59,749) (2,004)

Net cash flows used in investing

activity (59,749) (2,004)

Financing activities

Purchase of treasury shares (383,763) -

Proceeds from loans and borrowings 10,098,941 -

Repayment of loans and borrowings (8,102,105) (3,870,009)

Cash flows from/(used in) financing

activities 1,613,073 (3,870,009)

Effects of exchange rates on

cash and cash equivalents (12,600) (49)

Net (decrease) increase in

cash and cash equivalents (2,984,661) 277,967

Cash and cash equivalents at

the beginning of the financial

period 6,122,479 5,717,013

Cash and cash equivalents at

the end of the financial period 3,137,818 5,994,980

Approved by the board of Capital Lease Aviation PLC on 18th

February 2015.

The above financial information has been extracted from the

management accounts and has not been audited.

These interim statements have been prepared on a basis

consistent with International Financial Reporting Standards (IFRS)

except that IAS34 "Interim Financial Reporting" which is not

mandatory for AIM companies, has not been adopted in the

preparation of this statement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DMGMZVRLGKZM

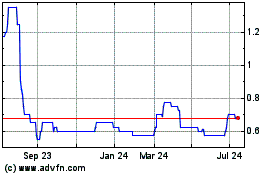

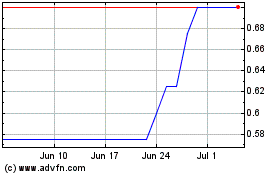

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jul 2024 to Aug 2024

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Aug 2023 to Aug 2024