RNS Number:9420F

Barker Securities PLC

27 June 2001

The following text replaces an old RNS announcement number 9397F. The

principal changes are the inclusion of a correct announcement date namely 27

June 2001, the deletion of the words "final version", corrections to paragraph

3 entitled, "Background to and reasons for the Offer" (sub paragraph 5) and an

adjustment to the definition of Cartmel Securities Limited, in paragraph 10,

where Colin Poole is shown to be a potential beneficiary under the trust. All

other details remain unchanged and the full corrected version is shown below.

27 June 2001

Not for release, publication or distribution in or into the United States,

Canada, Australia, Republic of Ireland or Japan.

Offer to be made by KPMG Corporate Finance

on behalf of

Barker Securities plc

for

Claims Direct plc

Summary

The board of Barker Securities announces the terms of a cash offer to be made

by KPMG Corporate Finance on behalf of Barker Securities, to acquire all of

the issued and to be issued share capital of Claims Direct other than the

83,050,565 Claims Direct Shares (representing approximately 42.8 per cent of

the current issued share capital of Claims Direct) currently owned by the

Barker Securities Directors.

The Offer will be 10 pence in cash for each Claims Direct Share, representing

a discount of approximately 20.0 per cent to the closing middle market price

of 12.5 pence on 26 June 2001 (being the last dealing date prior to the date

of this announcement) and a discount of approximately 31.0 per cent to the

closing middle market price of 14.5 pence on 25 June 2001 (being the last

dealing date prior to the date of the announcement that Tony Sullman and Colin

Poole had made an approach which might or might not lead to an offer being

made).

The Offer will value the existing issued share capital of Claims Direct at

approximately #19.4 million, and the Claims Direct Shares subject to the Offer

at approximately #11.1 million.

Barker Securities is a recently incorporated company formed for the purpose of

making the Offer for Claims Direct. The directors and shareholders of Barker

Securities are Tony Sullman and Colin Poole, both of whom are non-executive

directors of Claims Direct. Messrs Sullman and Poole will not take part in

the Claims Direct board's consideration of the Offer.

On 26 June 2001 Claims Direct announced its preliminary results for the year

ended 31 March 2001. While these showed an underlying operating profit of #

6.8 million (2000: #11.7 million), in the second half of the year an

underlying operating loss of #6.9 million was reported. For the full year a

loss before tax of #20.2 million (2000: profit #10.1 million) was reported.

No final dividend will be paid to Claims Direct Shareholders.

Commenting on the Offer, Tony Sullman, director of Barker Securities said:

"At the time of Claims Direct's flotation in July 2000, I believed that a

listing for Claims Direct was the best way to ensure the continued growth of

the Claims Direct Group. As the founder and a shareholder of Claims Direct, I

have been extremely disappointed by the subsequent operating performance and

the sharp fall in the share price. The business environment in which the

Claims Direct Group operates has altered rapidly and I believe that the Claims

Direct Group's current business model is no longer viable.

Prospects for the Claims Direct Group are uncertain and Colin Poole and I

believe that the only alternative open to Claims Direct is a major

repositioning of the Claims Direct Group's operations. In order to implement

these changes, we believe that it is necessary for us to take control of

Claims Direct so that we can actively manage the changes and that these

changes are best achieved by taking Claims Direct off the stock market. The

Offer Price reflects our view of the scale of these changes, the risks

associated with them and the future prospects for Claims Direct's business".

Enquiries:

Barker Securities plc Telephone: 020 7786 9600

Tony Sullman

Colin Poole

KPMG Corporate Finance Telephone: 0121 232 3000

(Financial adviser to Barker Securities)

Charles Cattaneo

Colin Graham

Binns & Co Telephone: 020 7786 9600

(PR adviser to Barker Securities)

Brian Coleman-Smith

Simon Ellis

This announcement does not constitute an offer or invitation to purchase any

securities.

KPMG Corporate Finance, a division of KPMG which is authorised by The

Institute of Chartered Accountants in England and Wales to carry on investment

business, is acting for Barker Securities and no one else in connection with

the Offer and will not be responsible to anyone other than Barker Securities

for providing the protections afforded to clients of KPMG Corporate Finance or

for giving advice in relation to the Offer.

The Offer will not be made, directly or indirectly, in or into, or by use of

the mails, or by any means or instruments of transportation or communication

(including, without limitation, facsimile transmission, electronic mail, telex

and telephone) of interstate or foreign commerce, or any facility of a

national securities exchange, of the United States, Canada, Australia,

Republic of Ireland or Japan. Accordingly copies of this announcement are not

being, and must not be, mailed or otherwise distributed or sent in or into the

United States, Canada, Australia, Republic of Ireland or Japan.

This summary should be read in conjunction with the full text of the following

announcement.

The contents of this announcement have been approved for the purposes of

section 57 of the Financial Services Act 1986 by KPMG Corporate Finance.

27 June 2001

Not for release, publication or distribution in or into the United States,

Canada, Australia, Republic of Ireland or Japan

Offer to be made by KPMG Corporate Finance

on behalf of

Barker Securities plc

for

Claims Direct plc

1. Introduction

The board of Barker Securities, a recently incorporated company formed for the

purpose of making the Offer, announces the terms of a cash offer of 10 pence

per Claims Direct Share, to be made by KPMG Corporate Finance, on behalf of

Barker Securities, to acquire all of the issued and to be issued share capital

of Claims Direct other than the 83,050,565 Claims Direct Shares (representing

approximately 42.8 per cent of the issued share capital of Claims Direct)

currently owned by the Barker Securities Directors.

2. The Offer

On behalf of Barker Securities, KPMG Corporate Finance will offer to acquire,

on the terms and subject to the conditions to be set out in the Offer Document

and in the Form of Acceptance, all of the Claims Direct Shares, other than

those currently owned by the Barker Securities Directors, on the following

basis:

for each Claims Direct Share (subject to the Offer) 10 pence in cash

The Offer will value the existing issued share capital of Claims Direct at

approximately #19.4 million, and the Claims Direct Shares subject to the Offer

at approximately #11.1 million. The Offer Price represents a discount of

approximately 20.0 per cent to the closing middle market price of 12.5 pence

on 26 June 2001 (being the last dealing date prior to the date of this

announcement) and a discount of approximately 31.0 per cent to the closing

middle market price of 14.5 pence per Claims Direct Share on 25 June 2001

(being the last dealing date prior to the date of the announcement that Tony

Sullman and Colin Poole had made an approach which might or might not lead to

an offer being made).

The Claims Direct Shares to be acquired by Barker Securities under the Offer

will be acquired fully paid and free from all liens, equities, charges,

encumbrances and other third party rights or interests and together with all

rights attaching thereto, including voting rights and the right to receive and

retain all dividends and other distributions (if any) declared, made or paid

hereafter.

The Offer will be conditional upon valid acceptances being received under the

Offer in respect of not less than 90 per cent of the Claims Direct Shares to

which the Offer relates and the satisfaction or waiver of the other conditions

set out in Appendix I to this announcement. The Offer will also be subject to

the further terms set out in the Offer Document and in the Form of Acceptance

which will accompany the Offer Document.

The Offer will extend to any Claims Direct Shares (other than those held by

the Barker Securities Directors) which are unconditionally allotted or issued,

including any Claims Direct Shares unconditionally allotted or issued on the

exercise of any options under the Claims Direct Share Option Schemes or on the

exercise of either of the Rew and Green Options or otherwise, prior to the

date on which the Offer closes (or such earlier date as Barker Securities may,

subject to the City Code, determine).

In the event that a more attractive competing offer or third party proposal is

announced, the directors of Barker Securities will consider whether to raise

the value of the Offer to match the value of such competing offer or third

party proposal, or to accept the same in relation to their beneficial

shareholdings.

3. Background to and reasons for the Offer

At the time of Claims Direct's flotation, in July 2000, the directors of

Claims Direct believed that a listing and trading facility on the London Stock

Exchange would give Claims Direct greater visibility and transparency which

would be important in attracting potential claimants and would assist in

recruiting and rewarding employees through share based incentive schemes. At

the time of flotation, Tony Sullman and Colin Poole were the executive

chairman and the chief executive of Claims Direct respectively.

In the short time since Claims Direct's flotation, consumer confidence has

been damaged by the negative publicity that Claims Direct received in the

autumn of 2000. Claims Direct has also faced increased levels of competition

and higher premium rates within the underwriting market as the personal injury

market has matured. All of this has contributed to a greatly reduced run rate

of accepted cases which together with litigation from Claims Direct's

franchisees and ex-gratia payments made to Claims Direct's clients has

resulted in a significant decline in the prospects of Claims Direct's

business. As a result, Claims Direct has failed to meet market expectations

and has issued three profit warnings since November 2000.

On 25 January 2001, Claims Direct issued a profit warning and also announced

that Tony Sullman was standing down as executive chairman and would become

non-executive chairman. On 6 June 2001 Colin Poole, then chief executive,

became non-executive deputy chairman. Messrs Sullman and Poole will not take

part in the Claims Direct board's consideration of the Offer.

On 26 June 2001 Claims Direct stated in its preliminary announcement of

results for the year ended 31 March 2001 that the number of cases accepted had

continued to decline since the year-end resulting in operating losses being

sustained in the new financial year and that it was not yet possible to

ascertain at what level the number of accepted cases would stabilise. The

preliminary results showed an underlying operating profit of #6.8 million

(2000: #11.7 million) for the year. However, in the second half of the year

the Claims Direct Group reported an underlying operating loss of #6.9 million.

For the full year, the Claims Direct Group reported a loss before tax of #20.2

million (2000: profit #10.1 million) and did not declare a final dividend.

In the preliminary announcement Claims Direct reported that a subsidiary

company, Claims Incorporated Plc, had received notification from approximately

10 franchisees of their intention to issue proceedings for breach of contract

and misrepresentation. Whilst full particulars of claims have yet to be

detailed to Claims Direct, the total claimed is approximately #5.7 million.

Claims Direct stated that: "These actions should the proceed will be

vigorously defended. The directors believe based on legal advice and in line

with the company's experience of concluding claims of this type, that they may

be concluded at amounts substantially below those claimed." It was also

reported that arbitration proceedings had commenced in respect of a further 25

franchisees and that the amounts claimed under these proceedings totalled #

16.6 million. In the preliminary announcement, the board of Claims Direct

stated that: "The legal advice given to the board is such that the board

believe these claims are substantially exaggerated. Accordingly the board do

not believe it is possible to reliably quantify the likely financial effect of

these actions, and are unable to make a realistic assessment as to the likely

impact on the group's future costs."

In the opinion of Tony Sullman and Colin Poole the prospects for the business

remain uncertain and Claims Direct's current business model is no longer

appropriate. In their view, a major repositioning of the business model is

required to return the Claims Direct Group to profitability and these changes

are best achieved by taking Claims Direct off the stock market. KPMG

Corporate Finance are making the Offer on behalf of Barker Securities to

Claims Direct Shareholders (other than the Barker Securities Directors) in

order to gain control of Claims Direct so that the directors of Barker

Securities can actively manage the changes that they believe are necessary.

The scale of these changes and the risks associated with them are such that

they believe that in the circumstances the Offer Price fairly reflects the

prospects for the business and the possibility that a profitable model may not

be achievable for the business going forward.

4. Information on Barker Securities and financing the Offer

Barker Securities, whose directors comprise two of the non-executive directors

of Claims Direct (namely Tony Sullman and Colin Poole), is a recently

incorporated company formed specifically for the purpose of making the Offer

which is to be funded by loans to Barker Securities from Tony Sullman and

Colin Poole. Barker Securities is owned by Tony Sullman and Colin Poole.

The Barker Securities Directors own 83,050,565 Claims Direct Shares,

representing approximately 42.8 per cent of the issued share capital of Claims

Direct.

Barker Securities is acting in concert with Tony Sullman, Colin Poole and

Cartmel Securities Limited for the purposes of the Offer pursuant to an

agreement dated 27 June 2001.

KPMG Corporate Finance is satisfied that sufficient financial resources are

available to Barker Securities to satisfy full acceptance of the Offer.

5. Information on Claims Direct

The Claims Direct Group provides a service to individuals who have suffered a

personal injury and who wish to recover damages from a third party. The

service offered covers the process of recovering damages, including making

people aware that they may have a claim, ensuring that the claim is properly

assessed and managing the progress of the claim once taken on. The Claims

Direct Group's principal service is structured so that each claimant is, in

normal circumstances, insured against the reasonable costs involved in

pursuing a claim if the claim is unsuccessful.

In July 2000, Claims Direct was listed on the London Stock Exchange raising

net proceeds of approximately #48.5 million through a placing and retail offer

of Claims Direct Shares at 180 pence per share.

6. Management and employees

The board of Barker Securities will ensure that the existing employment

rights, including pension rights, of all employees of Claims Direct will be

fully safeguarded.

7. Claims Direct Share Option Schemes and the Rew and Green

Options

The Offer will extend to any Claims Direct Shares (other than those held by

the Barker Securities Directors) issued or unconditionally allotted, including

any Claims Direct Shares issued or unconditionally allotted pursuant to the

exercise of outstanding options granted under the Claims Direct Share Option

Schemes and the Rew and Green Options, prior to the date on which the Offer

closes (or such earlier date as Barker Securities may, subject to the City

Code determine). To the extent that any such options are not or cannot be

exercised in full and provided the Offer becomes or is declared unconditional

in all respects, it is intended that appropriate proposals will be made to

option holders in due course.

8. Compulsory acquisition and de-listing

It is intended that, following the Offer becoming, or being declared,

unconditional in all respects and subject to any applicable requirements of

the UK Listing Authority, Barker Securities will procure that Claims Direct

will apply to the UK Listing Authority for the Claims Direct Shares to be

de-listed. It is anticipated that the cancellation of the listing of the

Claims Direct Shares on the Official List of the UK Listing Authority and

trading on the London Stock Exchange's market for listed securities will take

effect no earlier than 20 business days following the Offer becoming, or being

declared, unconditional in all respects. De-listing could significantly reduce

the liquidity and marketability of any Claims Direct Shares in respect of

which the Offer is not accepted.

If Barker Securities receives acceptances under the Offer in respect of or

otherwise acquires 90 per cent or more of the Claims Direct Shares to which

the Offer relates, Barker Securities intends to exercise its rights pursuant

to the provisions of sections 428 to 430F of the Act to acquire compulsorily

the balance of such Claims Direct Shares.

9. Posting of documents

The Offer Document and the Form of Acceptance, setting out full details of the

Offer, will be posted to Claims Direct Shareholders as soon as practicable.

10. Interests in Claims Direct Shares

The following Claims Direct Shares and options over Claims Direct Shares are

held by persons acting in concert with Barker Securities:

Name Number of Claims

Direct Shares

Colin Poole 11,200,000

Tony Sullman 56,728,758

Cartmel Securities Limited 15,121,807

Total 83,050,565

Cartmel Securities Limited is controlled by a discretionary trust constituted

under the laws of Guernsey. The trustees have the right in pursuance of their

discretionary powers to appoint any party a beneficiary. Colin Poole is a

potential beneficiary under the trust.

Colin Poole has options over 17,219 Claims Direct Shares pursuant to the terms

of the Claims Direct plc 2000 Savings Related Share Options Scheme. These

options are normally exercisable on or after 1 March 2006 at an exercise price

of 98 pence per Claims Direct Share.

Save as disclosed above, neither Barker Securities nor any person acting in

concert with Barker Securities owns or controls any Claims Direct Shares or

any options to purchase any Claims Direct Shares or has entered into any

derivatives referenced to securities of Claims Direct which remain

outstanding.

11. Bases and sources

(i) Unless otherwise stated, the financial information

concerning Claims Direct has been extracted from Claims Direct's 2001

preliminary results or other published sources.

(ii) The value of the existing issued share capital of Claims

Direct is based on 193,868,640 Claims Direct Shares in issue.

(iii) The value of the Claims Direct Shares subject to the

Offer is based on 110,818,075 Claims Direct Shares for which the Offer will be

made.

(iv) The closing middle market price of the Claims Direct Shares

is derived from the London Stock Exchange Daily Official List for the relevant

date.

12. Further information

The directors of Barker Securities accept responsibility for all the

information contained in this announcement save that the only responsibility

accepted by them in respect of information relating to the Claims Direct

Group (which has been compiled from public sources) has been to ensure that

such information has been correctly and fairly reproduced and presented. To

the best of the knowledge and belief of the directors of Barker Securities

(who have taken all reasonable care to ensure that such is the case), the

information contained in this announcement for which they are responsible is

in accordance with the facts and does not omit anything likely to affect the

import of such information.

This announcement does not constitute an offer or invitation to purchase any

securities.

The contents of this announcement have been approved for the purposes of

Section 57 of the Financial Services Act 1986 by KPMG Corporate Finance. KPMG

Corporate Finance is a division of KPMG which is authorised by the Institute

of Chartered Accountants in England and Wales to carry on investment business.

Enquiries:

Barker Securities plc Telephone: 020 7786 9600

Tony Sullman

Colin Poole

KPMG Corporate Finance Telephone: 0121 232 3000

(Financial adviser to Barker Securities)

Charles Cattaneo

Colin Graham

Binns & Co Telephone: 020 7786 9600

(PR adviser to Barker Securities)

Brian Coleman-Smith

Simon Ellis

KPMG Corporate Finance, a division of KPMG which is authorised by The

Institute of Chartered Accountants in England and Wales to carry on investment

business, is acting for Barker Securities and no one else in connection with

the Offer and will not be responsible to anyone other than Barker Securities

for providing the protections afforded to clients of KPMG Corporate Finance or

for giving advice in relation to the Offer.

The Offer will not be made, directly or indirectly, in or into, or by use of

the mails, or by any means or instruments of transportation or communication

(including, without limitation, facsimile transmission, electronic mail, telex

and telephone) of interstate or foreign commerce, or any facility of a

national securities exchange of the United States, Canada, Australia, Republic

of Ireland or Japan. Accordingly copies of this announcement are not being,

and must not be, mailed or otherwise distributed or sent in or into the United

States, Canada, Australia, Republic of Ireland or Japan.

APPENDIX I

CONDITIONS AND FURTHER TERMS OF THE OFFER

The Offer will be subject to the following conditions:

A. Valid acceptances being received (and not, where permitted,

withdrawn) by no later than 3.00 p.m. on the first closing date of the Offer

(or, subject to the City Code, such later time(s) and/or dates(s) as Barker

Securities may decide) in respect of not less than 90 per cent (or such lesser

percentage as Barker Securities may decide) of the Claims Direct Shares to

which the Offer relates. However, this condition will not be satisfied unless

Barker Securities have acquired or agreed to acquire Claims Direct Shares

carrying, in aggregate, over 50 per cent of the voting rights then normally

exercisable at general meetings of Claims Direct including, for this purpose,

to the extent (if any) required by the City Code, the voting rights attaching

to any Claims Direct Shares which may be unconditionally allotted or issued

before the Offer becomes or is declared unconditional as to acceptances and

Claims Direct Shares already held by the Barker Securities Directors. In this

condition:

(a) the expression "Claims Direct Shares to which the Offer relates"

shall be construed in accordance with Sections 428 to 430F of the Act; and

(b) Claims Direct Shares which have been unconditionally allotted but

not issued shall be deemed to carry the voting rights which they will carry

when they are issued.

B. No relevant person having taken, instituted, implemented or

threatened any legal proceedings, or having required any action to be taken or

otherwise having done anything or having enacted, made or proposed any

statute, regulation, order or decision or taken any other step and there not

continuing to be outstanding any statute, regulation, order or decision that

would or might:

(a) (i) make the Offer, its implementation or the acquisition or

proposed acquisition of any shares in, or control or management of, the Wider

Claims Direct Group by Barker Securities illegal, void or unenforceable; or

(ii) otherwise directly or indirectly restrict, restrain, prohibit,

delay or interfere in the implementation of or impose additional conditions or

obligations with respect to or otherwise challenge or require amendment of the

Offer or the proposed acquisition of Claims Direct by Barker Securities or any

acquisition of shares in Claims Direct by Barker Securities; or

(iii) result directly or indirectly in a delay in the ability of Barker

Securities, or render Barker Securities unable, to acquire some or all of the

shares in Claims Direct; or

(b) impose any limitation on the ability of Barker Securities or Claims

Direct or any member of the Wider Claims Direct Group to acquire or hold or

exercise effectively, directly or indirectly, any rights of ownership of

shares or other securities or the equivalent in the Wider Claims Direct Group

or management control over any member of the Wider Claims Direct Group; or

(c) require, prevent or delay the disposal by Claims Direct or require

the disposal or alter the terms of any proposed disposal by any member of the

Wider Claims Direct Group of all or any part of their respective businesses,

assets or properties or impose any limitation on the ability of any of them to

conduct their respective businesses or own their respective assets or

properties; or

(d) require Barker Securities or any member of the Wider Claims Direct

Group to offer to acquire any shares or other securities (or the equivalent)

in any member of the Wider Claims Direct Group owned by any third party other

than in the implementation of the Offer; or

(e) result in the Wider Claims Direct Group ceasing to be able to carry

on business under any name under which it presently does so; or

(f) otherwise adversely affect any or all of the businesses, assets,

prospects or profits of the Wider Claims Direct Group,

and all applicable waiting and other time periods during which any

such relevant person could institute, or implement or threaten any legal

proceedings, having expired, lapsed or been terminated.

C. In the period since the Accounting Date:

(a) no litigation or arbitration proceedings, prosecution, investigation

or other legal proceedings having been announced, instituted, threatened or

remaining outstanding by, against or in respect of, any member of the Wider

Claims Direct Group or to which any member of the Wider Claims Direct Group is

or may become a party (whether as claimant, defendant or otherwise); or

(b) no enquiry or investigation by, or complaint or reference to, any

relevant person against or in respect of any member of the Wider Claims Direct

Group having been threatened, announced, implemented or instituted or

remaining outstanding by, against or in respect of, any member of the Wider

Claims Direct Group; or

(c) no contingent or other liability having arisen or become apparent or

increased.

For the purposes of these conditions: (i) "the Accounting Date" means 31 March

2000 (the date of Claims Direct's latest audited annual report and accounts);

(ii) "legal proceedings" means actions, suits, proceedings, investigations,

references or enquiries; (iii) "significant interest" means a direct or

indirect interest in 20 per cent or more of the equity capital of an

undertaking; (iv) "third party" means any person, firm, company or body; (v) "

relevant person" means any government, government department or governmental,

quasi-governmental, supranational, statutory or regulatory body, court, trade

agency, association, institution or professional or environmental body in any

jurisdiction; and (vi) "Wider Claims Direct Group" means Claims Direct and its

subsidiary undertakings, associated undertakings and any other undertakings in

which Claims Direct and/or such undertakings (aggregating their interests)

have a significant interest.

The Offer will lapse unless all of the conditions relating to the Offer have

been fulfilled or satisfied or (if capable of waiver) waived by or, where

appropriate, at midnight on the twenty first day after the later of:

(i) the first closing date; or

(ii) the date on which the Offer is declared unconditional as to

acceptances

or such later date as Barker Securities may, with the consent of the Panel on

Takeovers and Mergers, decide. Barker Securities shall be under no obligation

to waive or treat as satisfied any condition by a date earlier than the latest

date specified above for its satisfaction even though the other conditions of

the Offer may, at such earlier date, have been waived or fulfilled and that

there are, at such earlier date, no circumstances indicating that any such

conditions may not be capable of fulfillment.

The conditions are inserted for the benefit of Barker Securities and no Claims

Direct Shareholder shall be entitled to waive any of the conditions without

the prior consent of Barker Securities.

If the Offer lapses, it will cease to be capable of further acceptance and

persons accepting the Offer and Barker Securities shall thereupon cease to be

bound by acceptances delivered on or before the date on which the Offer

lapses.

Claims Direct Shares will be acquired by Barker Securities fully paid and free

from all liens, charges, equitable interests, encumbrances, rights of

pre-emption and any other third party right of any nature whatsoever and

together with all rights now or subsequently attaching to them including the

right to receive in full all dividends and other distributions declared, paid

or made after the date of this announcement.

The Offer will comply with English law and the City Code.

APPENDIX II

DEFINITIONS

The following definitions apply throughout the announcement unless the context

requires otherwise:

"Act" the Companies Act 1985, as amended

"Barker Tony Sullman, Colin Poole and Cartmel Securities Limited

Securities

Directors"

"Barker Barker Securities plc

Securities"

"Canada" Canada, its provinces and territories and all areas subject to its

jurisdiction and any political subdivision thereof

"City Code" the City Code on Takeovers and Mergers

"Claims Claims Direct plc

Direct"

"Claims Claims Direct and its subsidiary undertakings

Direct Group"

"Claims the Claims Direct plc 2000 Savings Related Share Option Scheme and

Direct Share the Claims Direct plc 2000 Company Share Option Plan Part A and B

Option

Schemes"

"Claims holders of Claims Direct Shares

Direct

Shareholders"

"Claims the ordinary shares of 1 pence each in Claims Direct currently in

Direct issue and, where the context admits, any further such shares which

Shares" are unconditionally allotted or issued before the date on which

the Offer closes (or such earlier date as Barker Securities may,

subject to the City Code, determine, not being earlier than the

date on which the Offer becomes or is declared unconditional as to

acceptances or, if later, the first closing date of the Offer)

"Form of the form of acceptance and authority to be used in connection with

Acceptance" the Offer accompanying the Offer Document

"Japan" Japan, its cities and prefectures, territories and possessions

"London London Stock Exchange plc

Stock

Exchange"

"Offer" the offer to be made by KPMG Corporate Finance on behalf of Barker

Securities to acquire all the Claims Direct Shares not currently

owned by the Barker Securities Directors, on the terms and subject

to the conditions to be set out in the Offer Document and in the

Form of Acceptance and, where the content admits, any subsequent

revision, variation, extension or renewal thereof

"Offer the document to be addressed to Claims Direct Shareholders

Document" containing the Offer and which will be sent to Claims Direct

Shareholders as soon as practicable following the issue of this

announcement

"Offer Price" 10 pence per Claims Direct Share

"Rew and the options granted to Paul Rew and Kathryn Green pursuant to

Green agreements dated 5 July 2000 granting an option to each of Paul

Options" Rew and Kathryn Green over 55,556 ordinary shares of 1 pence in

the capital of Claims Direct at an exercise price of 1 pence per

share

"UK Listing the Financial Services Authority in its capacity as the competent

Authority" authority for the purpose of Part IV of the Financial Services Act

1986

"United the United Kingdom of Great Britain and Northern Ireland

Kingdom" or

"UK"

"United the United States of America, its territories and possessions, any

States" state of the United States and the District of Columbia and all

other areas subject to the jurisdiction of the United States of

America

Celsius Resources (LSE:CLA)

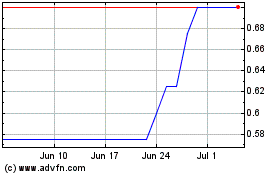

Historical Stock Chart

From Jun 2024 to Jul 2024

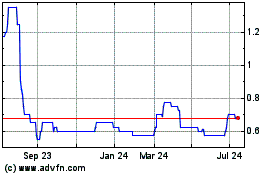

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jul 2023 to Jul 2024