RNS Number:8983U

Claims Direct PLC

29 November 2000

CLAIMS DIRECT PLC

"Excellent maiden interim results from the UK market leader"

Interim Results for the six months ended 30 September 2000

Claims Direct plc ("Claims Direct"), the UK market leader in

personal injury compensation, announces its unaudited results

for the six months ended 30th September 2000:

Highlights

- Underlying operating profits* up 174% to #11.8m (1999:

#4.3m)

- Turnover up 336% to #42.7m (1999: #9.8m)

- Basic earnings per share of 3.9p (1999: 1.9p)

- Maiden interim dividend per share of 0.5p

- First half accepted cases run rate average of 5,065 per

month (1999: 1,857)

- First half number of accepted cases rose 172% to 30,388

(1999: 11,141) greater than last year as a whole

- Number of cases covered by insurance total 25,886 (1999:

592)

*before amortisation and exceptional employee costs

Tony Sullman, Chairman of Claims Direct, commenting on the

interim results, said:

"Our half-year results reflect our market leadership in the

personal injury claims management industry, the success of our

brand, and our marketing drive.

"We are determined to rebuild consumer confidence by continuing

to enable members of the public who have suffered injury or

disability through the fault of another party to have 'Access to

Justice'.

"We are operating in a long term growth market and are confident

that the strong momentum we have demonstrated will continue.

The outlook for the remainder of the current financial year,

although clouded by recent events, continues to be positive."

An analysts' meeting will be held today at 9:30am at Founders

Hall, Cloth Fair, EC1

For further information, please contact:

Claims Direct plc

Colin Poole, Chief Executive 01952 284838

Paul Doona, Finance Director 01952 284938

Web Site www.claimsdirect.com

Golin/Harris Ludgate 0207 253 2252

Reg Hoare/Robin Hepburn

Chairman's Statement

I am pleased to report Claims Direct's maiden set of interim

results since becoming a quoted company, for the six months

ended 30 September 2000.

Operating results

The group has recorded an excellent performance for the period.

Operating profit before exceptional employee costs and

amortisation, the best measure of our underlying performance,

rose 174% to #11.8m (1999: #4.3m). Basic earnings per share were

3.9p (1999: 1.9p).

Balance Sheet

At the end of the period the Group had a robust financial

position, with net assets of #57.8m (1999 #2.1m) and cash at

bank and in hand of #43.2m (1999: #0.6m). #48.5m was raised in

the flotation as proceeds for the Company's use.

Dividend

As a sign of your board's confidence in the progress of your

company, it is proposed to pay a maiden interim dividend of 0.5p

on 14 January 2001 to all shareholders on the register as at 15

December 2000. As indicated in the Company's flotation

prospectus, the Directors intend to adopt a progressive dividend

policy while maintaining an appropriate level of dividend cover.

Operating review

The last six months have been an exciting period for the group,

during which we achieved a successful flotation on the London

Stock Exchange and acquired the vetting business of Poole and

Company for a consideration of #9.75 million. The number of

cases accepted during the period was 30,388 (1999: 11,141), of

which 25,886 were covered by the Claims Direct Protect insurance

policy. Furthermore, substantial progress has been made in

relation to the litigation initiated by certain franchisees who

declined to operate the Claims Direct Protect insurance policy.

Gross payments to potential litigants were #976,000 in the

period, but taking into account the benefit of the cases

returned to Claims Direct from these franchisees, the costs to

the Group are not expected to be material.

The accounts include the estimated cost of ex gratia payments

which the company expected to make to claimants who had

voluntarily transferred to the insurance policy from the

previous percentage fee arrangement, and had not been able to

recover the cost of insurance premiums from third party insurers

on policies taken out before 1 April 2000.

Subsequent to the period end your company suffered damaging

media comment about the issue of premium recoverability pre 1

April 2000. The Board has therefore taken the initiative by

announcing that all clients who have taken out insurance

policies prior to 1 April will be guaranteed that they will

placed in no worse a position than they would have been under

the Company's previous arrangements.

The cost of this guarantee is expected to be approximately #5

million, thus requiring a further provision of #4 million to

that contained in the interim results. This will also be

treated as an exceptional cost in the second half. The Board

believes that this action will arrest and reverse any slow down

in business activity which may result from a reduction in consumer

confidence due to media comment.

Recent comment has also centred on the defendant insurance

industry's apparent reluctance to re-imburse the premiums paid

by claimants for after-event insurance effective since 1 April

2000. We remain confident and will continue to support the Lord

Chancellor's stated objective to protect the client's

compensation in full via the Access to Justice legislation. We

continue to monitor the situation closely and should the need

arise are prepared to refine our business model as we have done

in the past.

The Claims Direct Protect policy still, however, remains central

to our business. It is a means of protecting our clients from

paying legal costs, or even the cost of the insurance premium

itself, if they lose their case. It ensures that we can

continue to provide access to justice for all, no matter their

means, on a 'no win, no fee' basis.

As we had predicted competition has increased with the emergence

of new entrants into the market. We believe that this acts as a

spur to growth as well as to our own aim of maintaining our

market leadership. We operate a network of claims managers

providing nationwide coverage in support of more than 300 firms

of solicitors. This unique and expensive infrastructure has

taken years to build - and encompasses considerable experience

backed by full training and accreditation through the law

industry's leading training organisation, Central Law Training.

Our direct response TV advertising has been and will remain our

principal marketing tool as evidenced by the fact that Claims

Direct is the UK's leader by reference to rate card spend.

Advertising expenditure in the first half totalled approximately

#7m. We intend to refresh the campaign in the second half and to

use advertising to support our position as UK market leader.

As the increase in administrative costs show, staff numbers have

increased to cope with the demands of a growing business. In

particular, we have invested in well-proven senior managers at

operational board level.

During the last 12 months we have developed a retail presence of

some 20 shop-units. We will closely monitor progress before

making a decision about further expansion next year, but we are

encouraged by the results to date.

New developments

We are in the process of finalising arrangements for the launch

of Accident Assist, a unique form of work in progress funding

for solicitors which we are arranging through a leading UK bank.

The importance of this initiative lies not only in freeing up

solicitor capacity, but also in providing an additional route to

market, as it encourages solicitors, both panel and non-panel,

to refer claims to the Company.

While we build our share of the UK market, we are also looking

to develop the "Claims Direct" brand overseas and have appointed

an International Business Development Director to explore master

licensing agreements in Europe, the USA and Australasia.

Overseas development is an area of the business which I intend

to concentrate upon in the second half of the year.

We are also developing an advanced computerised claims

management system. This will not only ensure rapid co-

ordination between claims managers, central office and

solicitors, but will also enable insurance companies to proceed

more rapidly to settlement. The system is due to be in place by

the middle of next year.

Outlook

Our half-year results reflect our market leadership in the

personal injury claims management industry, the success of our

brand, and our marketing drive.

We are determined to re-build consumer confidence by continuing

to enable members of the public who have suffered injury or

disability through the fault of another party to have 'Access to

Justice'.

We are operating in a long term growth market and are confident

that the strong momentum we have demonstrated will continue.

The outlook for the remainder of the current financial year,

although clouded by recent events, continues to be positive.

Tony Sullman

Chairman

29 November 2000

Consolidated profit and loss accounts

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2000 30 Sept 1999 31 Mar 2000

Note #'000 #'000 #'000

----------- ----------- -----------

Turnover - continuing

operations 42,710 9,796 39,964

------- ------- -------

Cost of sales

- before exceptional costs (24,249) (2,369) (22,215)

- exceptional costs 1 (1,913) -- --

------- ------- -------

(26,162) (2,369) (22,215)

------- ------- -------

Gross profit 16,548 7,427 17,749

------- ------- -------

Administrative expenses

- before amortisation of goodwill

and exceptional costs (4,705) (3,142) (6,027)

- amortisation of goodwill (612) (68) (968)

- exceptional employee

costs 1 (1,611) -- (350)

------- ------- -------

(6,928) (3,210) (7,345)

------- ------- -------

Operating profit-continuing

operations 9,620 4,217 10,404

Net interest receivable/

(payable) 689 (82) (297)

------- ------- -------

Profit on ordinary activities

before taxation 10,309 4,135 10,107

Tax on profit on ordinary

activities 2 (3,435) (1,171) (3,457)

------- ------- -------

Profit on ordinary

activities after taxation 6,874 2,964 6,650

Dividends (963) (216) (2,858)

------- ------- -------

Profit for the period 5,911 2,748 3,792

------- ------- -------

Earnings per ordinary share

- before exceptional employee

costs, amortisation of

goodwill and

interest 3 4.7p 1.9p 5.1p

- basic 3 3.9p 1.9p 4.2p

- diluted 3 3.8p 1.9p 4.2p

Dividend per ordinary share* 0.5p 2.3p 47.8p

There were no recognised gains and losses in the period other

than those arising in the profit and loss account.

* The dividend per ordinary share declared in the six month

period to 30 September 1999 and the year to 31 March 2000 are

not comparable with that declared in the six month period.

These being dividends paid in the run up to flotation to a

significantly smaller shareholder base.

Consolidated balance sheets

Unaudited Unaudited Audited

at at at

30 Sept 2000 30 Sept 1999 31 Mar 2000

Note #'000 #'000 #'000

----------- ----------- -----------

Fixed assets

Intangible assets 4 12,610 572 3,472

Tangible assets 1,180 189 466

Investments 5 623 -- --

------- ------- -------

Total fixed assets 14,413 761 3,938

------- ------- -------

Current assets

Debtors 30,311 10,691 19,103

Investments 6 10,535 -- --

Cash at bank and in hand 43,210 611 5,059

------- ------- -------

Total current assets 84,056 11,302 24,162

------- ------- -------

Creditors: amounts falling

due within one year (33,784) (8,620) (17,450)

Net current assets 50,272 2,682 6,712

Total assets less current

liabilities 64,685 3,443 10,650

Creditors: amounts falling

due after more than one year -- (13) --

Provisions for liabilities

& charges (6,868) (1,375) (7,296)

------- ------- -------

Net assets 57,817 2,055 3,354

------- ------- -------

Capital & reserves

Called up share capital 1,926 94 94

Share premium account 48,222 -- --

Merger reserve 333 644 401

Profit & loss account 7,336 1,317 2,859

------- ------- -------

Equity shareholders' funds 57,817 2,055 3,354

------- ------- -------

The interim financial statements were approved by the Board of

Directors on 29 November 2000.

Consolidated cash flow statements

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2000 30 Sept 1999 31 March 2000

#'000 #'000 #'000

----------- ----------- -----------

Net cash inflow/(outflow)

from operating activities 6,160 (1,294) 4,813

------- ------- -------

Returns on investments and

servicing of finance

Interest received 764 -- 44

Interest paid (341) (82) (341)

------- ------- -------

Net cash inflow/(outflow) from

returns on investments and

servicing of finance 423 (82) (297)

Taxation (2,074) -- (76)

Capital expenditure and

financial investment -

Purchase of tangible fixed assets (903) (59) (426)

Purchase of fixed asset

investments (623) -- --

Acquisitions

Poole & Company vetting

operation (9,750) -- --

Deferred consideration

in relation to acquisition

in previous period (1,000) -- --

Equity dividends paid

to shareholders (590) (33) (1,605)

------- ------- -------

Net cash (outflow)/inflow

before use of liquid

resources and financing (8,357) (1,468) 2,409

------- ------- -------

Management of liquid resources

Increase in short-term

restricted deposits

with banks (4,003) -- (4,259)

Current asset investments (10,535) -- --

Financing

Issue of ordinary

shares (net of costs) 48,552 -- --

(Decrease)/increase

in bank loans (5) 4 (8)

Capital element of

finance lease payments (3) (3) (9)

Increase in invoice

discounting facility 8,572 2,629 3,144

------- ------- -------

Net cash inflow from financing 57,117 2,630 3,127

------- ------- -------

Increase in cash in the period 34,222 1,162 1,277

------- ------- -------

Reconciliation to net cash/(debt)

Net cash/(debt) at 1 April 1,131 (1,278) (1,278)

Increase in net cash 34,222 1,162 1,277

Movement in liquid resources 14,538 (9) 4,259

Movement in financing (8,565) (2,630) (3,127)

------- ------- -------

Net cash/(debt) at period end 41,326 (2,755) 1,131

------- ------- -------

Supplementary statements to the consolidated cash flow statement

Reconciliation of operating profit to operating cash flow

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2000 30 Sept 1999 31 March 2000

#'000 #'000 #'000

----------- ----------- -----------

Operating profit 9,620 4,217 10,404

Depreciation charge 189 23 89

Loss on sale of fixed assets -- -- 15

UITF 17 charge -- -- 255

Amortisation of goodwill 612 68 968

Increase in debtors (10,942) (6,437) (15,197)

Increase in creditors 6,109 1,376 6,756

Increase/(decrease) in

provisions 572 (541) 1,523

------- ------- -------

Net cash inflow/(outflow)

from operating activities 6,160 (1,294) 4,813

------- ------- -------

Reconciliation of movement in net debt

At 1 April At 30 Sept

2000 Cash flow 2000

#'000 #'000 #'000

----------- ----------- -----------

Cash at bank and in hand 800 34,148 34,948

Overdrafts (74) 74 --

------- ------- -------

726 34,222 34,948

------- ------- -------

Debt due within one year (3,848) (8,568) (12,416)

Finance leases (6) 3 (3)

------- ------- -------

(3,854) (8,565) (12,419)

------- ------- -------

Liquid Resources

- restricted cash balances 4,259 4,003 8,262

- current asset investments - 10,535 10,535

------- ------- -------

4,259 14,538 18,797

------- ------- -------

1,131 40,195 41,326

------- ------- -------

Supplementary statement

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2000 30 Sept 1999 31 Mar 2000

#'000 #'000 #'000

----------- ----------- -----------

Reconciliation of movements

in shareholders' funds

Profit attributable to

shareholders 6,874 2,964 6,650

Dividends (963) (216) (2,858)

UITF 17 charge -- -- 255

------- ------- -------

5,911 2,748 4,047

New share capital (net of costs) 48,552 -- --

------- ------- -------

Net addition to shareholders'

funds 54,463 2,748 4,047

Opening shareholders' funds 3,354 (693) (693)

------- ------- -------

Closing shareholders' funds 57,817 2,055 3,354

Notes to the accounts

1. Exceptional costs

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 Sept 2000 30 Sept 1999 31 Mar 2000

#'000 #'000 #'000

----------- ----------- -----------

(a) Included in cost of sales

- ex-gratia payments

and provision 937 - -

- gross payments to potential

litigants 976 - -

------- ------- -------

1,913 - -

------- ------- -------

(b) Included in administrative

expenses

- flotation bonuses 481 - -

- national insurance paid on

share options exercised 654 - -

- national insurance provided

on share options not

exercised 476 - -

- UITF 17 charge - - 350

------- ------- -------

1,611 - 350

------- ------- -------

3,524 - 350

------- ------- -------

2.Taxation

The taxation charge for the six months to 30 September 2000

has been calculated by applying the estimated tax rate for

the current financial year ending 31 March 2001.

3.Earnings per ordinary share

Earnings per ordinary share before amortisation of goodwill,

interest and exceptional employee costs is calculated by

adjusting the profit attributable to ordinary shareholders by

the after tax effect of those items (#1,257,000) and then

dividing the adjusted earnings by the weighted average number

of ordinary shares (174,103,729).

Basic and diluted earnings per ordinary share, the latter of

which allows for the impact of the exercise of outstanding

share options, are calculated by dividing the profit

attributable to ordinary shareholders of #6,874,000 (1999:

#2,964,000) by the weighted average number of ordinary

shares.

In the case of basic earnings per share, the weighted average

number of ordinary shares, excluding the shares held by the

long-term share incentive scheme which are owned by the

company, totals 174,103,729 (1999: 159,706,993); and for

diluted earnings per share, totals 181,576,271 (1999:

160,043,146).

4.Intangible fixed assets

Intangible fixed assets comprise goodwill arising on

consolidation and on acquisitions. During the period goodwill

of #9,750,000 arose on the acquisition of the vetting

business of Poole & Co. This and other goodwill arising has

been capitalised and is being amortised over its estimated

useful economic life, being five years for past acquisitions.

5.Fixed assets investments

Fixed assets investments comprise investment in own shares

held within an Employee Trust and relate to the long-term

incentive scheme for executive directors. The costs of shares

acquired are amortised over the performance period to which

they relate.

6.Current assets investments

Current assets investments comprise loans to claimants and

were made to facilitate the movement from the company's

previous to present funder.

7.Contingent liabilities

As disclosed in the annual report for the year ended 31 March

2000, the group had become aware of the intentions of a

number of current and former franchises to initiate

proceedings against the group. As commented upon in the

Chairman's statement, substantial progress has been made

towards settling these disputes.

The Directors, accordingly, remain confident that the

resolution of outstanding disputes, will not have a

significant impact on the group's financial position.

8. Other information

(a) The figures for the year to 31 March 2000 have been

extracted from the full group accounts for that period on

which an unqualified report was made by the group's auditors

and which have been delivered to the Registrar of Companies.

(b) The interim financial statements for the six months ended

30 September 2000, whilst not constituting statutory accounts

within the meaning of section 240 of the Companies Act 1985,

are prepared in accordance with applicable accounting

standards, using the same accounting policies as set out in

the group accounts for the year ended 31 March 2000.

(c) A copy of this interim statement will be sent to all

shareholders on 6 December 2000 and copies will be available

at the company's registered office, Grosvenor House, Central

Park, Telford, TF2 9TU from that date

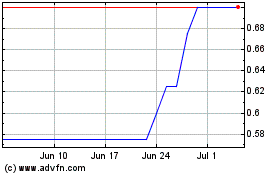

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jun 2024 to Jul 2024

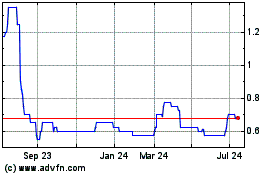

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jul 2023 to Jul 2024