Baker Steel Resources Trust Ltd Sale of Interest in Prognoz Silver Mine (1933F)

February 19 2018 - 2:00AM

UK Regulatory

TIDMBSRT

RNS Number : 1933F

Baker Steel Resources Trust Ltd

19 February 2018

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

19 February 2018

Polar Acquisition Limited ("PAL") agrees to sell its interest in

the Prognoz Silver Mine in Russia to Polymetal International

PLC.

-- Sale of 90% of Polar Silver Resources for US$72 million

-- PAL to retain a continued interest through royalty on future production from Prognoz

-- Transaction results in uplift in valuation of PAL of approximately 25%

Baker Steel Resources Trust Limited (the "Company") announces

that its largest investment, Polar Acquisition Limited ("PAL") has

agreed to sell its 90% interest in Polar Silver Resources Limited

("Polar Silver") to Polymetal International plc ("Polymetal") (LSE,

MOEX: POLY; ADR: AUCOY) for US$72 million to be satisfied in

Polymetal shares.

In January 2017, PAL sold a 10% stake in its subsidiary Polar

Silver to Polymetal, which committed to fund and undertake a

pre-feasibility study on the Prognoz silver project in Russia. As

part of that agreement Polymetal was granted an option to acquire

the remaining 90% of Polar Silver in March 2019 for a price based

on silver reserves and the silver price at that time. Following a

successful field season in 2017, during which 37km of diamond

drilling was undertaken, PAL and Polymetal have now agreed to

accelerate the exercise of the option such that Polymetal will upon

closing acquire PAL's 90% interest in Polar Silver for US$72

million to be satisfied in new Polymetal shares. 90% of the

consideration shares will be subject to a lock-up period of 180

days.

Polar Silver holds a 50% interest in Prognoz silver project

which has JORC-compliant Indicated and Inferred Resources

(estimated by Micon in 2009) of 292 million ounces of silver at a

grade of 586 g/t.

In order to retain exposure to Prognoz going forward, including

the attractive exploration potential, PAL will receive a royalty of

between 2% and 4% (pro rated by the net 45% stake being acquired)

on future production from the mine. The royalty has been valued

based on the current pre-development status of the Prognoz project

and it can be expected to appreciate as the project moves towards

production.

Taking into account the value of the Polymetal shares to be

received by PAL and the valuation of the royalty, the Company's

carrying value of PAL can be expected to increase to approximately

US$41 million at the next NAV date, a 25% increase on the carrying

value at 31 January 2018. On a pro forma basis this transaction

would have increased the Company's NAV by approximately 9% had the

agreement been signed prior to 31 January 2018. The Company has

invested a total of US$14.2 million over the past seven years into

PAL, realised US$6 million in cash during 2017, resulting in a

return on investment of in excess of 3 times.

Subject to the receipt of the required Russian regulatory

approvals, the transaction is expected to close in during the first

quarter of 2018

Polymetal is a major gold company listed on the London Stock

Exchange with a market capitalisation of approximately GBP3.5

billion. During 2017 it produced 1.43 million ounces of gold

equivalent. In 2017, Polymetal paid out US$138 million in

dividends, translating into a 2.7% dividend yield based on the

average share price for the year.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISGGUWGPUPRGMQ

(END) Dow Jones Newswires

February 19, 2018 02:00 ET (07:00 GMT)

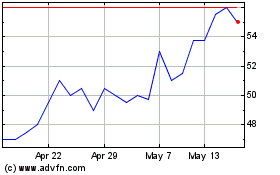

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024