TIDMBRSD

RNS Number : 0466N

Brandshield Systems PLC

20 September 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

BrandShield Systems Plc

("BrandShield" or the "Company")

Subscription to raise c.GBP2.68 million ($3.32 million)

Open Offer to raise up to GBP2.20 million

Approval of Waiver of Obligations under Rule 9 of the Takeover

Code

Cancellation of admission of Ordinary Shares to trading on

AIM

and

Notice of General Meeting

BrandShield Systems plc (AIM: BRSD), a leading provider of

cybersecurity solutions for brand oriented digital risk protection

("DRP"), announces that it will shortly be posting a circular to

shareholders (the "Circular"), a n extract of which is set out

below:

1. Introduction

The Company announced today its proposals (the "Proposals")

to:

-- Raise $3.32 million (GBP2.68 million) in a Subscription of

47,137,662 new Ordinary Shares and up to GBP2.20 million in an Open

Offer of up to 38,669,962 new Ordinary Shares, each at 5.68 pence

per Ordinary Share (in each case before expenses);

-- Seek a waiver under Rule 9 of the Takeover Code;

-- Issue New Options to Directors/Senior management, and

re-price certain of the Existing Options; and

-- Cancel the admission of its Ordinary Shares to trading on AIM.

This letter sets out the background to and reasons for, and

provides further details of, the Proposals.

Implementation of the Proposals, is conditional, inter alia,

upon all of the Resolutions being passed at the GM to be held at

11.00 a.m. on 13 October 2023. The Notice of General Meeting

convening the General Meeting at which the Resolutions will be

proposed is set out at the end of this document.

Shareholders should note that unless all the Resolutions are

approved at the General Meeting, the Subscription and Open Offer

will not complete, and the issue of the New Options, the re-pricing

of certain of the Existing Options, and the De-Listing will not

occur as currently proposed.

2. Subscription

The Company today announced a conditional Subscription to raise

approximately GBP2.68 million ($3.32 million) (before expenses) by

the issue of the Subscription Shares at the Subscription Price to

the Subscribers.

The Subscription Shares will rank pari passu with the Existing

Ordinary Shares. Following their issue, the Subscription Shares

will represent approximately 18.40% of the Enlarged Ordinary Share

Capital assuming the Open Offer is fully subscribed (21.68% of the

Enlarged Ordinary Share Capital if there is no take up in the Open

Offer).

In addition, Subscribers will receive 1 Subscription Warrant for

every Subscription Share subscribed. The Subscription Warrants will

have an exercise price of 8.52 pence per share and shall be

exercisable at any time up until 4 years after Admission (16

October 2027).

Further details of the Subscription Agreements are set out in

paragraph 5.1 of Part III of this document.

The Subscribers are as follows:

Name of Subscriber Amount subscribed Number of Number of Subscription

Subscription Warrants

Shares

Joseph Haykov (1) GBP1,774,193 31,235,801 31,235,801

($2,200,000)

------------------ -------------- -----------------------

William Currie Investments

Limited ("WCIL") GBP403,226 7,099,045 7,099,045

($500,000)

------------------ -------------- -----------------------

Sir Terence Leahy GBP403,226 7,099,045 7,099,045

($500,000)

------------------ -------------- -----------------------

Gigi Levi Weiss GBP96,774 1,703,771 1,703,771

($120,000)

------------------ -------------- -----------------------

Total GBP2,677,419 47,137,662 47,137,662

($3,320,000)

------------------ -------------- -----------------------

(1) Joseph Haykov is participating in the Subscription via his

investment vehicle, Cloak, LLC.

The Subscription is conditional on, amongst other things: (a)

the Subscription Agreements having become unconditional and not

having been terminated in accordance with their terms, (b) all of

the Resolutions being passed at the General Meeting and (c)

Admission having become effective by no later than 8.00 a.m. on 16

October 2023 or such later time as the Company and the respective

Subscribers may agree.

The Subscription by Joseph Haykov (via Cloak, LLC) was brokered

by Mr Subramanian Subbiah under a broking agreement, as set out in

paragraph 5.2 of Part III of this document. Mr Subbiah will

receive, conditional on Admission, Broker Warrants as follows:

- 3,123,580 Broker Warrants to subscribe for Ordinary Shares at

an exercise price of 5.68 pence and an exercise period ending 4

years following Admission (16 October 2027).

- Up to a further 4,685,370 Broker Warrants to subscribe for

Ordinary Shares at an exercise price of 8.52 pence and an exercise

period ending 4 years following the date on which Cloak, LLC's

Subscription Warrants are exercised ; the actual number issued will

be determined in proportion to the number of Subscription Warrants

exercised by Joseph Haykov (through Cloak, LLC) of the aggregate

number of Subscription Warrants issued to him.

3. Details of the Open Offer

Qualifying Shareholders are being offered the opportunity to

apply for Open Offer Shares on the basis of:

1 Open Offer Share for every 2 Existing Ordinary Shares held at

the Issue Price of 5.68 pence per share

In addition, successful applicants under the Open Offer will be

issued with Open Offer Warrants, being warrants to subscribe for

new Ordinary Shares. The Open Offer Warrants are exercisable within

4 years of issuance (on a monthly basis) at a price of 8.52 pence

per Ordinary Share. The Open Offer Warrants will be issued on the

basis of 1 Warrant for every 1 Open Offer Share successfully

subscribed.

Whilst not members of the Concert Party, William Currie

Investments Limited ("WCIL") and Sir Terence Leahy, by virtue of

their participation in the Subscription, would have been deemed not

to be independent for the purposes of the Waiver Resolution.

However, as all Shareholders who did not participate in the

Subscription are able to participate on identical terms, and to at

least the same extent (as a % of their holding of Existing Ordinary

Shares) as WCIL and Sir Terence Leahy via the Open Offer, WCIL and

Sir Terence Leahy will be able to vote on the Waiver

Resolution.

The Open Offer is conditional on all Resolutions being passed at

the General Meeting, and Admission. It is expected that Admission

will occur and dealings in the Open Offer Shares will commence on

16 October 2023. If such condition is not fulfilled on or before

8.00 a.m. on 16 October 2023 (or such later date as the Company may

reasonably decide) application monies are expected to be returned

without interest and any Open Offer Entitlements admitted to CREST

will be disabled.

Assuming full take-up under the Open Offer, the issue of the

Open Offer Shares will raise gross proceeds of approximately

GBP2.20 million for the Company. The Open Offer Shares will, upon

issue, rank pari passu all respects with the Company's existing

Ordinary Shares including the right to receive all dividends and

other distributions declared, made or paid after their date of

issue.

Holdings of Existing Ordinary Shares in certificated and

uncertificated form will be treated as separate holdings for the

purpose of calculating entitlements under the Open Offer, as will

holdings under different designations and in different

accounts.

Qualifying Shareholders should be aware that the Open Offer is

not a rights issue. Accordingly, Qualifying Non-CREST Shareholders

should note that their Application Forms are not negotiable

documents and cannot be traded. Qualifying Non-CREST Shareholders

should note that applications in respect of Open Offer Entitlements

may only be made by the Qualifying Non-CREST Shareholder originally

entitled, or by a person entitled by virtue of a bona fide market

claim in accordance with paragraph 3.1(b) of Part IV of this

document.

Application will be made for the Open Offer Entitlements in

respect of Qualifying CREST Shareholders to be admitted to CREST.

It is expected that such Open Offer Entitlements will be admitted

to CREST at 8.00 a.m. on 21 September 2023. Applications through

the means of the CREST system may only be made by the Qualifying

CREST Shareholder originally entitled or by a person entitled by

virtue of a bona fide market claim.

Qualifying Non-CREST Shareholders will receive an Application

Form with this circular which sets out their entitlement to Open

Offer Shares as shown by the number of Open Offer Entitlements

allocated to them. Qualifying Non-CREST Shareholders should note

that the Application Form is not a negotiable document and cannot

be traded.

For Qualifying Non-CREST Shareholders, completed Application

Forms, accompanied by full payment, should be returned by post or

by hand (during normal business hours only) to Link Group,

Corporate Actions, Central Square, 29 Wellington Street, Leeds LS1

4DL so as to arrive as soon as possible and in any event so as to

be received no later than 11.00 a.m. on 5 October 2023. For

Qualifying CREST Shareholders the relevant CREST instructions must

have been settled as explained in this circular by no later than

11.00 a.m. on 5 October 2023.

If applications are made for less than all of the Open Offer

Shares available, then the lower number of Open Offer Shares will

be issued, and any outstanding Open Offer Entitlements will

lapse.

Further information on the Open Offer and the terms and

conditions on which it is made, including the procedure for

application and payment, are set out in Part IV of this

circular.

Members of the Concert Party and Subscribers - who in aggregate

hold 92,991,950 Existing Ordinary Shares amounting to 54.59% of the

Existing Ordinary Share Capital - have undertaken not to subscribe

for shares in the Open Offer. As such there are 38,669,962 shares

the subject of the Open Offer, which equates to 1 Open Offer Share

for every 2 Existing Ordinary Shares (i.e 50% of each of these

Shareholders' holdings) being made available to them in the Open

Offer

Warrants to subscribe for Ordinary Shares

The Open Offer Warrants will be issued to successful applicants

under the terms of the Open Offer on the basis of 1 Warrant for

every 1 Open Offer Share subscribed. The maximum number of Open

Offer Warrants that may be issued under the Open Offer (and

corresponding Ordinary Shares to be allotted pursuant to the

exercise of the Warrants) is 38,669,962.

The Open Offer Warrants will be exercisable at the subscription

price of 8.52 pence per Ordinary Share on a monthly basis from time

to time until the Lapse Date and if not exercised prior to that

date shall lapse. The minimum number of Warrants that may be

exercised at any one time is 1,000 Warrants (if the holder holds

less than 1,000 Warrants then the entire lesser amount).

No exercise of the Open Offer Warrants shall be permitted where

such exercise would result in any person or persons acquiring or

increasing control of the Company within the meaning given in

sections 181 and 182 of the FSMA, without the relevant regulatory

approval of such acquisition or increase of control having first

been obtained and not having expired prior to such exercise.

The Open Offer Warrants will be exercisable immediately from the

date of issue but will not be listed or admitted to trading.

Definitive certificates in respect of the Warrants are expected to

be dispatched within 10 days of Admission.

Upon exercise of the Open Offer Warrants, the resulting new

Ordinary Shares will be credited as fully paid and will rank pari

passu in all respects with the Company's existing Ordinary Shares

including the right to receive all dividends and other

distributions declared, made or paid after their date of issue.

4. Reasons for the Subscription, Open Offer, De-Listing and Use of funds

The funds secured in the Subscription and Open Offer will enable

the Company to continue accelerating its growth in securing new

clients and increasing its Annualised Recurring Revenue. In tandem,

efforts will continue to reduce operational cash burn and therefore

increase gross profit margins further and at a higher level of

revenues. These additional funds will be used to expand both the

sales team footprint and permit additional marketing spend to

reinforce the positive results we are seeing from such activity.

The Company announced improvements in gross margin in its recent

interim results, highlighting the increase to 68% in the 6 month

period to June 2023, up from 58% in 2022 and 55% in 2021. Against

that context, and in a sector in which the Company believes is ripe

for securing market share, the Board believes aggressive targeting

of growth of the top line should continue to be the over-riding

strategy. The Directors believe that reducing relative costs

remains important in order to secure a cash flow positive outcome

in 2024. The Company continually scans the competitive landscape in

the digital risk protection market, and is convinced of the

opportunities that exist to both penetrate the increasing market

size and to concurrently penetrate the existing market through

targeting clients from competitors. The Directors believe that the

De-Listing will assist in improving margins further and allow the

executive to focus on operational excellence without the additional

legal and regulatory burdens imposed through our current listed

status.

5. Issue of New Options and Re-pricing of Existing Options for Directors and employees

5.1 New Options - Yoav Keren/Yuval Zantkeren

It is proposed that New Options will be awarded to Yoav Keren

and Yuval Zantkeren as set out in the table below:

Name of Option Number of New Options Exercise Prices

holder

Yoav Keren up to 12,961,260 5.68p

up to 11,885,500 8.52p

326,850 10.5p

Total 40,120 14p

259,750 15p

798,650 20p

89,910 25p

up to 26,362,040

---------------------- ----------------

Yuval Zantkeren up to 12,961,260 5.68p

up to 11,885,500 8.52p

326,850 10.5p

Total 40,120 14p

259,750 15p

798,650 20p

89,910 25p

up to 26,362,040

---------------------- ----------------

The number of New Options to be granted as set out in the table

above has been calculated assuming that the Open Offer is

subscribed in full, and that the Open Offer Warrants are also fully

subscribed. In the event that there is no take up in the Open

Offer, 5,081,730 and 5,081,730 of the 5.68p and 8.52p New Options

respectively would not be issued to the Founders. The actual number

of New Options to be issued as result of the Open Offer, to

maintain the Founders' fully diluted shareholdings to under 10% of

the Fully Diluted Share Capital, will be proportionate to the take

up in the Open Offer.

The aim of granting the New Options is to provide a meaningful

incentive to the Founders to create value in the BrandShield

business. The quantum of New Options to be granted is such that the

Founders will (upon the exercise of all options held by them) each

own under 10% of the Fully Diluted Share Capital, in the event that

that all existing and proposed warrants and options in the Company

are fully exercised.

The exercise prices for the New Options range from 5.68 pence to

25 pence. The reason for the spread of prices is to ensure that the

grant of the New Options adheres to Israeli Tax Law requirement

that the holding will be under 10% at any level of exercise of

options and warrants as if all holders of options and warrants up

to that level have exercised.

In order to comply with Section 102 of the Israeli Income Tax

Ordinance the Founders will need to ensure that each of their

respective shareholdings (together with outstanding options held by

them) is under 10% of the Fully Diluted Share Capital of the

Company at any time. This may involve, as required, the forfeiture

by them of Existing Options or New Options. Further details of

Section 102 are set out in paragraph 6 of Part III of this

document.

The exercise period shall be 10 years from Admission (being 16

October 2033).

The grant of the New Options is conditional upon the Resolutions

being approved by Shareholders at the General Meeting and Admission

taking place.

Since BrandShield listed on AIM via a Reverse Takeover

transaction in December 2020 the key executives and founders have

delivered strong and consistent growth in terms of Annualised

Recurring Revenue ("ARR") and customer numbers, including securing

contracts with some of the world's leading companies in a range of

sectors. ARR has increased from approximately $2.87m at the time of

admission to trading on AIM in December 2020 to approximately

$9.71m as at the end of June 2023, representing compound annualised

growth in ARR of c60.3%. Despite this growth the share price has

performed poorly on the AIM market and successive fundraises have

been conducted at prices considerably lower than the original price

at which BrandShield joined the market in December 2020 of 20p per

share. This has led to sustained dilution of the Founders' equity

position in particular and it is the Board's view that it is

essential to incentivise both the Founders and key revenue

generating executives in an appropriate but fair manner that aligns

their interests with those of wider Shareholders.

As such, the Independent Directors believe that the introduction

of the New Options achieves that alignment and provides a mechanism

for those individuals to maintain a significant position in the

Company, should they choose to exercise their options at various

prices. Around 50% of the New Options are set at the Subscription

Price, with the balance set at exercise prices between 50% (8.52p)

and 340% (25p) above the Subscription Price.

5.2 Grant of New Employee Options - Ravit Freedman and other

employees

It is proposed that New Employee Options over up to 19,680,800

Ordinary Shares are awarded to employees, including a Director,

Ravit Freedman, (200,000 options), conditional upon Admission.

14,970,800 of these options will have an exercise price of 5.68

pence per share, and 4,710,000 of these options will have an

exercise price of 8.52 pence per share, and an exercise period of

10 years.

The number of New Employee Options to be granted has been

calculated assuming that the Open Offer is subscribed in full, and

that the Open Offer Warrants are fully subscribed. In the event

that there is no take up in the Open Offer, 2,034,700 and 2,034,740

of the 5.68p and 8.52p New Employee Options respectively would not

be issued.

5.3 Amendment to terms of Existing Options for Directors and

employees

It is proposed that a total of 9,304,909 Existing Options held

by employees, and 649,000 Existing Options held by Ravit Freedman,

and 3,127,196 Existing Options held by each of Yoav Keren and Yuval

Zantkeren, will be re-priced.

Employee options have been used by the Board as a means of

incentivising employees, by giving them a stake in the business.

Options are typically awarded following a probationary period.

However, many of these options have been issued historically at

exercise prices significantly higher than the current share price,

and at present are not serving the purpose for which they were

intended.

In order to comply with the Israeli Tax Authorities ruling

(Ruling no. 911), if a re-pricing of "out of the money" options is

performed, ALL existing options must be re-priced to the same

price, and therefore all the above Existing Options (being those

which are "out of the money") will be repriced to the Issue Price

of 5.68 pence, subject to Admission.

It is proposed that all of the above options (which will amount

to 7.68 per cent of the Enlarged Ordinary Share Capital (following

Admission) will, subject to Admission, be repriced to 5.68 pence

per share.

Further details of the Existing Options held by employees and

Directors, which are to be re-priced, are set out in paragraph 2 of

Part III of this document.

In addition, 925,236 Existing Options, including 263,037 held by

each of Yoav Keren and Yuval Zantkeren, and 399,162 held by other

employees have expiry dates of 31 December 2023. It is proposed

that the expiry dates are extended to 31 December 2028.

5.4 Amendments to exercise periods of Existing Warrants

It is proposed that all Existing Warrants whose expiry date is

before 1 December 2026 (details of which are set out in paragraph 3

of Part III of this document) have their exercise periods extended

to 1 December 2026.

Of the warrants (with an exercise price of 20 pence and an

exercise period ending 4 February 2025) issued in the February

2022, 1,785,714 are held by WCIL. The extension of the exercise

period of these warrants is a related party transaction (see

paragraph 6 below).

As part of Mr Subbiah's Broking Arrangement, New Enterprise

Limited will receive the above warrant extension. Given this

extension, it was felt appropriate by the Board to extend all other

warrants with an exercise period ending prior to 1 December 2026

out to the same point.

6. Related Party Transactions

There are four related party transactions under Rule 13 of the

AIM Rules, these are:

(i) Subscription by William Currie Investment Limited

("WCIL")

As WCIL holds 21,846,087 Existing Ordinary Shares, representing

12.83% of the current issued share capital, it is a related party

of the Company pursuant to the AIM Rules. Consequently, the

participation of WCIL in the Subscription (including the issue of

the Subscription Warrants) constitutes a related party transaction

for the purposes of AIM Rule 13. The Directors (all of whom are

independent of WCIL) consider, having consulted with SPARK, the

Company's nominated adviser, that the terms of WCIL's participation

in the Subscription are fair and reasonable in so far as

Shareholders are concerned.

(ii) Issue of the New Options to Yoav Keren, Yuval Zantkeren and

Ravit Freedman

Yoav Keren, Yuval Zantkeren and Ravit Freedman are Directors

and, as such, each is a related party pursuant to the AIM Rules.

Consequently, the issue of the New Options and New Employee Options

to them constitute related party transactions for the purposes of

AIM Rule 13. The Directors (excluding Yoav Keren, Yuval Zantkeren

and Ravit Freedman) consider, having consulted with SPARK, the

Company's nominated adviser, that the terms of the grant of New

Options and New Employee Options are fair and reasonable in so far

as Shareholders are concerned.

(iii) Amendment to the exercise price and/or exercise period of

Existing Options to Directors

Yoav Keren, Yuval Zantkeren and Ravit Freedman are Directors

and, as such, each is a related party pursuant to the AIM Rules.

Consequently, the amendment to the exercise price of 3,127,196,

3,127,196 and 649,000 Existing Options held by them respectively

(and in the case of Yoav Keren and Yuval Zantkeren, the extension

of the exercise period of 263,037 Options each) constitute related

party transactions for the purposes of AIM Rule 13. The Directors

(excluding Yoav Keren, Yuval Zantkeren and Ravit Freedman)

consider, having consulted with SPARK, the Company's nominated

adviser, that the terms of the amendments to the Existing Options

to Directors are fair and reasonable in so far as Shareholders are

concerned.

(iv) Extension to the exercise period of warrants held by

WCIL

As stated in (i) above, WCIL is a related party of the Company

pursuant to the AIM Rules. Consequently, the extension of the

exercise period of 1,785,714 warrants held by WCIL constitutes a

related party transaction for the purposes of AIM Rule 13. The

Directors (all of whom are independent of WCIL) consider, having

consulted with SPARK, the Company's nominated adviser, that the

terms of the extension of the expiry date of the warrants are fair

and reasonable in so far as Shareholders are concerned.

7. Implications of the Proposals under the Code

The Takeover Code (the "Code") applies to BrandShield. Under

Rule 9 of the Code, any person who acquires an interest in shares

which, taken together with shares in which that person or any

person acting in concert with that person is interested, carry 30%

or more of the voting rights of a company which is subject to the

Code is normally required to make an offer to all the remaining

shareholders to acquire their shares.

Similarly, when any person, together with persons acting in

concert with that person, is interested in shares which in the

aggregate carry not less than 30% of the voting rights of such a

company but does not hold shares carrying more than 50% of the

voting rights of the company, an offer will normally be required if

such person or any person acting in concert with that person

acquires a further interest in shares which increases the

percentage of shares carrying voting rights in which that person is

interested.

7.1 The Concert Party

The issue of the Subscription Shares, the New Options, the

Subscription Warrants and the Broker Warrants to members of the

Concert Party gives rise to certain considerations under the City

Code. Rule 9 of the City Code is designed to prevent the

acquisition of control of a company to which the City Code applies

without a general cash offer being made to all shareholders of that

company.

Joseph Haykov and Gigi Weiss are members of a Concert Party

which was deemed to exist at the time of the reverse takeover of

BrandShield Limited into Two Shields Investments plc on 1 December

2020.

Under Rule 9 of the City Code ("Rule 9"), when:

i. any person acquires, whether by a series of transactions over

a period of time or not, an interest in shares which (together with

shares in which persons acting in concert with him are interested)

carry 30% or more of the voting rights of a company; or

ii. a person, together with persons acting in concert with him,

is interested in shares which in aggregate carry not less than 30%

but does not hold shares carrying more than 50% of the voting

rights of a company and such person, or persons acting in concert

with him, acquires an interest in other shares which increases the

percentage of shares carrying voting rights in which he is

interested;

then, in either case, an offer under Rule 9 must be made in cash

at the highest price paid by the person required to make the offer,

or any person acting in concert with such person, for any interest

in shares of the company during the 12 months prior to the

announcement of the offer.

Accordingly, the participation by Joseph Haykov (via Cloak, LLC)

and Gigi Levi Weiss in the Subscription would normally give rise to

an obligation on the Concert Party to make a general offer to all

Shareholders.

Additionally, the exercise of (i) the Subscription Warrants by

Joseph Haykov (via Cloak, LLC) and/or Gigi Weiss, and/or (ii) New

Options by Yoav Keren and/or Yuval Zantkeren and/or (iii) Broker

Warrants by Subramanian Subbiah, whilst the Concert Party's holding

of voting rights is less than 50%, would also normally give rise to

an obligation on the Concert Party to make a general offer to all

Shareholders. The Company has agreed with the Panel that the

persons set out in the Tables below are acting in concert in

relation to the Company.

Following Admission, the members of the Concert Party will be

interested in 89,347,341 Ordinary Shares , representing between

34.88% (assuming full take up in the Open Offer) and 41.08%

(assuming no take up in the Open Offer ) of the voting rights of

the Company. Assuming exercise in full by the members of the

Concert Party of the Existing Options , Existing Warrants , New

Options, Subscription Warrants and Broker Warrants (and assuming

that no other person exercises any options or any other right to

subscribe for shares in the Company), the members of the Concert

Party would be interested in between 180,867,647 Ordinary Shares

(assuming no take up in the Open Offer, and representing 58.54% of

the voting rights of the Company in the Fully Diluted Share Capital

and 201,194,567 Ordinary Shares, representing approximately 54.67%

of the voting rights of the Company in the Fully Diluted Share

Capital assuming full take up in the Open Offer).

Tables showing the respective individual interests in shares of

the members of the Concert Party at Admission and following the

exercise of the Existing Options, Existing Warrants, New Options,

Subscription Warrants and Broker Warrants held by them is set out

below - with Table 1 showing a situation where the Open Offer is

fully subscribed by non-Concert Party members and Table 2 showing a

situation where there is no take up in the Open Offer by

non-Concert Party members.

Concert Number % Subscription Ordinary % of Existing Maximum Maximum Maximum

Party of Existing of Shares Shares Ordinary Options number Number of % of

Member Ordinary current held Share and of Shares Ordinary Ordinary

Shares issued post Capital Existing arising from Shares held Share

Ordinary Admission post Warrants exercise of by Concert Capital

Share Admission Existing Party held

Capital Options, Member by

Existing Concert

Warrants, Party

New Options, Member

Subscription

Warrants,

and Broker

Warrants

Yoav

Keren 11,888,670 6.98% 11,888,670 4.64% 7,885,800 26,362,040 46,136,510 12.54%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Yuval

Zantkeren 11,888,670 6.98% - 11,888,670 4.64% 7,885,800 26,362,040 46,136,510 12.54%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Gigi

Levi

Weiss 5,413,626 3.18% 1,703,771 7,117,397 2.78% - 1,703,771 8,821,168 2.40%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

New

Enterprise

Ltd 11,558,235 6.79% - 11,558,235 4.51% 2,603,024 - 14,161,259 3.85%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Leelavthi

Subbiah 3,275,329 1.92% - 3,275,329 1.28% - - 3,275,329 0.89%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Harel

Kodesh 1,381,761 0.81% - 1,381,761 0.54% - - 1,381,761 0.38%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Afterdox

and

Afterdox

Partners 10,003,127 5.87% - 10,003,127 3.91% - - 10,003,127 2.72%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Joseph

Haykov 998,351 0.59% 31,235,801 32,234,152 12.58% - 31,235,801 63,469,953 17.25%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Subramanian

Subbiah - 0.00% - - 0.00% - 7,808,950 7,808,950 2.12%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Total 56,407,769 33.12% 32,939,572 89,347,341 34.88% 18,374,624 93,472,602 201,194,567 54.67%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Table 1 : showing Concert Party holding assuming the Open Offer

is fully subscribed by non-Concert Party members

Notes:

Up to 10,163,460 of the New Options to each of Yoav Keren and

Yuval Zantkeren will be issued dependent on, and proportionate to,

the take up in the Open Offer to each maintain a fully diluted

shareholding of under 10%. (In the event that there is no take up

of the Open Offer none of the 10,163,460 will be issued - as set

out in Table 2 below; in the case of a full take up all 10,163,460

New Options will be issued).

the above table assumes the Open Offer is fully subscribed. Up

to 10,163,460 of the New Options awarded to Yoav Keren and Yuval

Zantkeren will be issued dependent on the level of take up in the

Open Offer).

In order to comply with Section 102 of the Israeli Tax Ordinance

t he Founders will need to ensure each of their shareholdings is

under 10% of the Fully Diluted Share Capital at any point in time.

They have indicated a current intention to forfeit Options, if

required, to ensure this threshold is not exceeded.

assuming no options or warrants held by persons other than

members of the Concert Party are exercised.

Table 2 : showing Concert Party holding assuming NO take up in

the Open Offer by non-Concert Party members

Concert Number % of Subscription Ordinary % of Existing Maximum Maximum Maximum

Party of Existing current Shares Shares Ordinary Options number Number % of

Member Ordinary issued held Share and of Shares of Ordinary Ordinary

Shares Ordinary post Capital Existing arising Shares Share

Share Admission post Warrants from held by Capital

Capital Admission exercise Concert held

of Existing Party by

Options, Member Concert

Existing Party

Warrants, Member

New Options, (2)(3)

Subscription

Warrants,

and Broker

Warrants

Yoav Keren 11,888,670 6.98% 11,888,670 5.47% 7,885,800 16,198,580 35,793,050 11.64%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Yuval

Zantkeren 11,888,670 6.98% - 11,888,670 5.47% 7,885,800 16,198,580 35,793,050 11.64%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Gigi Levi

Weiss 5,413,626 3.18% 1,703,771 7,117,397 3.27% - 1,703,771 8,821,168 2.85%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

New

Enterprise

Ltd 11,558,235 6.79% - 11,558,235 5.31% 2,603,024 - 14,161,259 4.58%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Leelavthi

Subbiah 3,275,329 1.92% - 3,275,329 1.51% - - 3,275,329 1.06%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Harel

Kodesh 1,381,761 0.81% - 1,381,761 0.64% - - 1,381,761 0.45%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Afterdox

and

Afterdox

Partners 10,003,127 5.87% - 10,003,127 4.60% - - 10,003,127 3.24%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Joseph

Haykov 998,351 0.59% 31,235,801 32,234,152 14.82% - 31,235,801 63,469,953 20.54%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Subramanian

Subbiah - 0.00% - - 0.00% - 7,808,950 7,808,950 2.53%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

Total 56,407,769 33.12% 32,939,572 89,347,341 41.08% 18,374,624 73,145,682 180,867,647 58.54%

------------ --------- ------------- ------------ ---------- ----------- ------------- ------------ ---------

the above table assumes that there is no take up in the Open

Offer.

In order to comply with Section 102 of the Israeli Tax Ordinance

t he Founders will need to ensure each of their shareholdings is

under 10% of the fully diluted share capital at any point in time.

They have indicated a current intention to forfeit Options, if

required, to ensure this threshold is not exceeded.

assuming no options or warrants held by persons other than

members of the Concert Party are exercised.

7.2 Waiver of Rule 9 of the City Code

Following Admission, the members of the Concert Party will be

interested in shares carrying more than 30% of the voting rights of

the Company, but will not hold shares carrying more than 50% of the

voting rights of the Company. For so long as they continue to be

acting in concert, any acquisition that increases their aggregate

interest in shares will be subject to the provisions of Rule 9.

The exercise by the members of the Concert Party of the warrants

and options described above would normally trigger an obligation

for an offer to be made under Rule 9. However, the Panel has agreed

to waive this obligation such that there will be no requirement for

an offer to be made in respect of the exercise of such warrants and

options.

If the members of the Concert Party were to exercise their

Existing Options, Existing Warrants, New Options, Subscription

Warrants and Broker Warrants in full (and assuming that no other

person exercises any options or any other right to subscribe for

shares in the Company), the members of the Concert Party would hold

shares carrying more than 50% of the voting rights of the Company

and (for so long as they continue to be acting in concert) could

accordingly increase their aggregate interests in shares without

incurring any obligation to make an offer under Rule 9, although

individual members of the Concert Party will not be able to

increase their percentage interests in shares through or between a

Rule 9 threshold without Panel consent.

The Panel has agreed to waive the obligation to make an offer

that would otherwise arise under Rule 9 as a result of the

Proposals, subject to the approval of Independent Shareholders.

Accordingly, Resolution 1 is being proposed at a general meeting of

the Company and will be taken on a poll.

None of the members of the Concert Party are able to vote on the

Rule 9 Waiver but may exercise their voting rights in respect of

Resolutions 2, 3 and 4.

In the event that the Proposals are approved, the Concert Party

will not be restricted from making an offer for the Ordinary Shares

in the Company.

Your attention is drawn to Parts II and III of this document

which set out certain further information and financial information

that is required to be disclosed in this document pursuant to the

rules contained in the Takeover Code.

Under Rule 25.2 of the Takeover Code, only the Independent

Directors are able to make a recommendation to the Independent

Shareholders with respect to the proposed Waiver Resolution. The

Independent Directors believe that the Proposals are in the best

interests of the Company and hereby recommend that Independent

Shareholders vote in favour of the Waiver Resolution. SPARK

Advisory Partners Limited, as the Company's independent financial

adviser, has provided formal advice to the Independent Directors

that it considers the terms of the Proposals to be fair and

reasonable and in the best interests of Shareholders and the

Company as a whole. In providing this advice, SPARK Advisory

Partners Limited has taken into account the Independent Directors'

commercial assessments.

7.3 Intentions of the Concert Party

At present the Company is a leading provider of cybersecurity

solutions for brand oriented digital risk protection. The Concert

Party confirms its intention will be to support BrandShield's

strategy as described in "Future Strategy of the Company" set out

in paragraph 8 below.

Immediately following the De-Listing, there will be no market

facility for dealing in the Ordinary Shares, and no price will be

publicly quoted for the Ordinary Shares. The Company intends to

review the options available for allowing dealing in the Company's

shares, for example by provision of a matched bargain facility or

periodic share auctions, however there is no guarantee that one

will be put in place. Any update will be made via the Company's

website address (www.brandshield.com).

Other than the De-Listing, the Concert Party has confirmed that

no changes will be made regarding:

i. the future business of the Company, including its research and development functions;

ii. the continued employment of the employees and management of

the Company and of its subsidiaries, including any material change

in the conditions of employment or in the balance of the skills and

functions of the employees and management;

iii. its strategic plans for the Company, which will therefore

have limited repercussions on employment and on the locations of

its places of business, including on the location of its

headquarters and headquarters functions;

iv. employer contributions into the Company's pension schemes

(including with regard to current arrangements for the funding of

any scheme deficit), the accrual of benefits for existing members,

and the admission of new members; and

v. the redeployment of the fixed assets of the Company.

7.4 Views of the Independent Directors

The Independent Directors support the Concert Party's stated

intentions for the business and its employees. The Independent

Directors firmly believe that the Proposals are in the interests of

both the Company and its Shareholders. Although the Board is

acutely aware that some Shareholders will be concerned about a

de-listing from AIM and the consequent reduction in immediate

liquidity it sees no prospect in the near to medium term for the

Company to achieve a valuation that reflects its actual performance

and future potential, demonstrated through sustained growth of ARR

and continued penetration of a fast-growing market. BrandShield has

been recognised independently as one of the leading players in the

Digital Risk Protection sector (Frost and Sullivan Report 2022) and

the Independent Directors believe that all its Shareholders will be

far more likely to achieve a positive outcome as a de-listed

company where it is likely to command higher valuations based on

realistic ARR multiples. In short, the Board believes the proposals

are significantly more likely to result in a positive outcome for

all its stakeholders, including employees and Shareholders. In

considering this, the Independent Directors have given due

consideration to the assurances relating to the Company, including

those given to its employees regarding the implementation of the

Proposals.

8. FUTURE STRATEGY OF THE COMPANY AND USE OF PROCEEDS

The existing strategy of the Company has delivered continual and

material increases in clients serviced and revenue generated.

Annual Recurring Revenue has increased from around $2.87m at the

time of admission to trading on AIM in December 2020 to nearly $10m

at present. Over this period, client numbers have increased from 74

to around 210. The strategy going forwards will be the continued

targeting of market share in a growing sector and the striving for

operational excellence within the Company. Funds will be used to

increase the sales footprint of BrandShield and to reinforce our

marketing spend in areas that we know yields results. This will be

within the backdrop of our more recent efforts to reduce

operational cash burn where efficiencies can be found without

prejudicing either capability or slowing growth. The costs of Cloud

computing will continue to be targeted closely and Research and

Development efforts will continue to be targeted at optimal

automation of tasks within our leading edge, AI based platform. The

Board believes that the implementation of BrandShield 3.0, the UI

interface with our customers, will be a step change in capability

from our clients and this will be enhanced incrementally to

continue to improve functionality. The optimisation of the

enforcement element of the Company has yielded considerable

efficiencies and this process will continue.

The Board believes that continued growth of client numbers,

revenue and margins will be best done in a de-listed environment

where the senior management can focus more of its capacity on the

core business without the distractions of the additional legal,

regulatory burden and cost implications of being a quoted company.

The Board also believes that BrandShield is a fast-growing company

in a fast-growing sector and the valuation attributed to it by the

London markets makes it vulnerable to acquisitive suitors. The

Board believes strongly that if any acquisition of BrandShield is

considered by other parties, that a considerably higher valuation

would be secured in a de-listed environment than if it remained

quoted, a situation that would benefit all our Shareholders despite

the reduction in immediate liquidity caused by a de-listing.

9. De-Listing

9.1 Reasons for the De-Listing

The Board has conducted a review of the benefits and drawbacks

to the Group retaining its listing on AIM and maintaining its

existing corporate structure. The Board believes that the

De-Listing is in the best interests of the Company and its

Shareholders as a whole. In reaching this conclusion, the Board has

considered the following key factors:

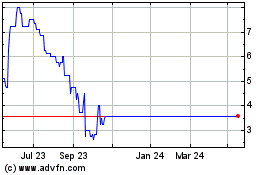

-- there is, and has been for some time, a lack of liquidity in

the Ordinary Shares such that there is a very limited market for

the Ordinary Shares;

-- there is limited trading of the Ordinary Shares. Over the

past 12 months 45,436,247 Ordinary Shares were traded representing

approximately 27 per cent. of the current issued share capital and

giving an average daily volume of approximately 195,005 Ordinary

Shares. Accordingly, the costs associated with maintaining the AIM

quotation are considered by the Directors to be disproportionately

high when compared to the benefits of being listed on AIM, even

though these costs have been, so far as reasonably possible,

controlled and minimised by the Company. The Board believes that

these funds could be better utilised for the benefit of the

Company.

-- the management time significant associated additional advisor

costs and the legal and regulatory burden associated with

maintaining the Company's admission to trading on AIM is, in the

Directors' opinion, disproportionate to the benefits to the

Company.

-- despite demonstrating consistent growth in customer numbers

and ARR, alongside maintaining a proactive investor relations

programme, the share price performance and subsequent valuation

placed on BrandShield since its listing on AIM has reduced in a

sustained manner. High growth businesses such as BrandShield will

seek to raise expansion capital in order to take advantage of

growth opportunities as and when they present themselves. The

Board's focus since listing has been the acquisition of new

customers and the subsequent growth of its top line revenue as the

Company expands to reach critical mass. Fundraises have been

conducted at ever-increasing discounts to the original listing

price and this has been deeply frustrating to the Board, Founders

and our Shareholders. This is despite the fact that the underlying

shareholder base has transformed over the listing period and has

been enhanced through material stakes being built up by a small and

focused number of institutional investors. This change in the

shareholder base has not managed to insulate the share price from

downward pressure created by generally low volumes of trading

across the Aim market. The Board does not believe that it is right

to expose our existing Shareholders further to future dilution

based valuation multiples that it does not believe reflect a

realistic valuation of BrandShield.

The Board therefore believes that the interests of all

Shareholders will be better served in an off-market context whereby

the Company can continue to focus on high growth levels and the

potential to provide all Shareholders with a liquidity event that

fairly reflects the true value of the business and its global

significance in this sector.

-- BrandShield Shareholders, whilst recognising and being

willing to accept the risks associated with remaining as an

investor in an unlisted company, who anticipate realising greater

value in their BrandShield Shares in the future, may wish to remain

as Shareholders in BrandShield.

9.2 Effect of De-Listing

The principal effects of the De-Listing will be that:

-- Shareholders will no longer be able to buy and sell Ordinary

Shares through a public stock market, further reducing the

liquidity in the Ordinary Shares; the Company intends to review the

options available for allowing dealing in the Company's shares, for

example by provision of a matched bargain facility or periodic

share auctions, however there is no guarantee that one will be put

in place.

-- the Company will no longer be required to announce material

events or interim results;

-- the Company will no longer be required to comply with many of

the corporate governance requirements applicable to companies

traded on AIM;

-- the Company will no longer be subject to the Disclosure

Guidance and Transparency Rules and will therefore no longer be

required to disclose major shareholdings in the Company;

-- the Company will no longer be subject to the AIM Rules, with

the consequence that Shareholders will no longer be afforded the

protections given by the AIM Rules. Such protections include a

requirement to obtain shareholder approval for reverse takeovers

and fundamental changes in the Company's business and to announce,

inter alia, certain substantial and/ or related party transactions;

and

-- the De-Listing may have either positive or negative taxation

consequences for Shareholders. Shareholders who are in any doubt

about their tax position should consult their own professional

independent adviser immediately.

Shareholders should note that the City Code will continue to

apply to the Company following the De-Listing. The Company will

also continue to be bound by the Companies Act (which requires

Shareholders' approval for certain matters) following the

De-Listing.

9.3 De-Listing Process

Under the AIM Rules, the De-Listing can only be effected by the

Company after securing a special resolution of Shareholders in a

general meeting and the expiry of a period of 20 clear Business

Days from the date on which notice of the De-Listing is given to

the London Stock Exchange.

In addition, a period of at least five clear Business Days

following Shareholders' approval of the De-Listing is required

before the De-Listing may become effective. The Resolutions seek

(amongst other matters) the approval of Shareholders for the

De-Listing. Assuming that the Resolutions are approved, it is

proposed that the De-Listing will take place by 7.00 a.m. on 23

October 2023.

9.4 Ordinary Share dealing Prior to De-Listing

If Shareholders wish to buy or sell Ordinary Shares on AIM they

must do so prior to the De-Listing becoming effective. As noted

above, in the event that Shareholders approve the De-Listing, it is

anticipated that the last day of dealings in the Ordinary Shares on

AIM will be 20 October 2023 and that the effective date of the

Cancellation will be 23 October 2023.

9.5 Ordinary Share dealing following De-Listing

Immediately following the De-Listing, there will be no market

facility for dealing in the Ordinary Shares, and no price will be

publicly quoted for the Ordinary Shares. The Company intends to

review the options available for allowing dealing in the Company's

shares, for example by provision of a matched bargain facility or

periodic share auctions, however there is no guarantee that one

will be put in place. Any update will be made via the Company's

website address (www.brandshield.com).

10. Current Trading and Future Prospects

The Company published its financial results for the six month

period ended 30 June 2023 on 19 September 2023. The Company's

highlights and outlook sections are detailed below:

"Financial highlights

-- H1 2023 Annual Recurring Revenue ("ARR") up 46% to $9.71m (H1 2022: $6.67m)

-- Positive momentum continued with the August 2023 ARR figure

reaching $9.85m, up 36% vs. $7.26m in August 2022.

-- Delivered revenue growth of 56.3% to $4.42m in H1 2023 (H1 2022: $2.83m)

-- Loss for the period decreased by 53% to $2.05m in H1 2023 (H1 2022: $4.37m)

-- As part of operational improvements Gross profit increased

from 48% in H1 2022 and 54% in December 2022 to 68% in H1 2023

-- Cash of $1.35m at period end (31 Dec 2022: $2.60m)

(1) Annual Recurring Revenue is a non-GAAP measure and an

industry specific measure

Operational highlights

-- Strong new business momentum achieved in the first half of

2023, with the Company securing 45 new customer wins in the period

to take its total number of customers to 209. This growth continued

post-period end, and as at end of August 2023, BrandShield services

214 customers.

-- Ongoing sales and marketing initiatives continues to support

the growth in the Company's customer footprint, expanding the

Group's presence across in key growth sectors such as

pharmaceutical, retail, ecommerce and finance.

-- BrandShield consolidated its position as one of the leading

Digital Risk Protection Provider

o BrandShield named the third best DRP service provider globally

in a 2022 review by Frost & Sullivan ("F&S") the global

business consultancy group.

o BrandShield cognised with the 2023 Global Digital Risk

Protection New Product Innovation and Best Practices Award by Frost

& Sullivan.

Post period-end and Outlook

-- The Company has made a solid start to H2 2023 and look

forward to reporting another period of both operational and

financial progress.

-- Recent focus on reducing cash burn is having a marked impact

on gross margins as the Company continues to grow towards becoming

cash flow positive".

The Directors of the Company can confirm that, since the date of

publication of these financial results, there has been no

significant change in the trading or financial position of the

Company.

Following the Proposals, the Company intends to continue

operating as it has done over the Company's last financial year and

carry out the same activities, and to retain the same business

strategy that it did as a quoted public company. Based on current

market conditions, the Company does not envisage any significant

changes to the Company's trading position once the Proposals are

completed.

11. Proposals to be voted on at the General Meeting

For the purposes of effecting the Proposals, the Resolutions

will be proposed at the General Meeting. Set out at the end of this

document is a notice convening the General Meeting to be held at

11.00 a.m. on 13 October 2023 at the offices of Edwin Coe LLP, 2

Stone Buildings, Lincoln's Inn, London, WC2A 3TH. The full texts of

the Resolutions are set out in that notice.

The Resolutions, which are summarised below, are necessary for

the implementation of the Proposals.

Resolution 1 (Ordinary Resolution)

THAT the waiver granted by the Takeover Panel of the obligation

that would otherwise arise on the Concert Party, both individually

and collectively, to make an offer to the shareholders of the

Company pursuant to Rule 9 of the Takeover Code as a result of the

Proposals is hereby approved.

Note: In order to comply with the Takeover Code, this Resolution

will be taken on a poll of Independent Shareholders.

Resolution 2 (Ordinary Resolution)

Conditional upon the passing of Resolutions 1, 3 and 4, this

ordinary resolution will grant the Directors authority to allot New

Ordinary Shares for the purposes of the Open Offer, to the extent

existing authorities are insufficient. The authority given by this

Resolution will expire on the earlier of 16 October 2024 or the

date of the Company's next annual general meeting.

Resolution 3 (Special Resolution)

Conditional on the passing of Resolutions 1, 2 and 4, this

special resolution will grant the Directors authority to disapply

the statutory pre-emption rights in respect of the allotment of the

new Ordinary Shares to be allotted pursuant to Resolution 2 in

connection with the Open Offer. The authority given by this

Resolution will expire on the earlier of 16 October 2024 or the

date of the Company's next annual general meeting.

Resolution 4 (Special Resolution)

Conditional on the passing of Resolutions 1, 2 and 3 that the

cancellation of the admission of the Ordinary Shares to trading on

AIM is approved.

12. Action to be taken

General Meeting

The appointment of a proxy will not preclude you from attending

and voting in person at the General Meeting or any adjournment

thereof, if you so wish and are so entitled.

If your proxy appointment has not been submitted by 11.00 a.m.

on 11 October 2023, your vote in relation to the Resolutions will

not count.

You can vote either:

-- by logging on to www.signalshares.com and following the instructions.

-- you may request a hard copy Form of Proxy directly from the

registrars. Link Group on Tel: 0371 664 0300. Calls are charged at

the standard geographical rate and may vary by provider. Calls

outside the United Kingdom will be charged at the applicable

international rate. Lines are open between 09:00 -17:30, Monday to

Friday excluding public holidays in England and Wales. The Form of

Proxy should be completed and returned in accordance with the

instructions printed thereon so as to arrive at the Company's

Registrars, Link Group, Central Square, 29 Wellington Street,

Leeds, LS1 4DL by 11.00 a.m. on 11 October 2023.

-- in the case of CREST members, by utilising the CREST

electronic proxy appointment service in accordance with the

procedures set out in the notes to the Notice of General

Meeting.

13. Recommendation

In respect of Resolution 1, the Independent Directors, having

been so advised by SPARK Advisory Partners, the Company's Financial

and Nominated Adviser, considers that the Proposals are fair and

reasonable and in the best interests of Shareholders and the

Company as a whole and accordingly recommend that Independent

Shareholders vote in favour of the Rule 9 Waiver. In providing its

advice to the Independent Directors, SPARK Advisory Partners has

taken into account the Independent Directors' commercial

assessments. Accordingly, the Independent Directors recommend that

Independent Shareholders vote in favour of Resolution 1 as they

intend to do in relation to their respective shareholdings.

All the Directors recommend that Shareholders vote in favour of

Resolutions 2 to 4 (inclusive) as they intend to do in relation to

their respective shareholdings.

Yours faithfully

Azriel Moscovici

Chairman

Enquiries:

BrandShield Systems plc +44 (0)20 3143

Yoav Keren, CEO 8300

Spark Advisory Partners Limited (Nominated

Adviser) +44 (0)20 3368

Neil Baldwin / Andrew Emmott / James Keeshan 3554

Shore Capital (Joint Broker)

Toby Gibbs / James Thomas (Corporate Advisory) +44 (0)20 7408

Henry Willcocks (Corporate Broking) 4090

Vigo Consulting (Financial Public Relations)

Jeremy Garcia / Kendall Hill +44 (0)20 7390

brandshield@vigoconsulting.com 0237

About BrandShield

Brandshield is a provider of cybersecurity solutions from brand

protection to online threat hunting. BrandShield detects online

threats and takes them down. The Company's client base is a growing

list of organisations including Fortune 500 and FTSE100 companies.

By utilising AI and big-data analysis, BrandShield monitors,

detects, and removes online threats facing companies. These threats

include social phishing, executive impersonation, fraud, brand

abuse, and counterfeits.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Date and Time (2023)

Record Date for entitlement under Close of business on 18

the Open Offer September

Announcement of the Proposals including 20 September

the Subscription, the Rule 9 Waiver,

the Open Offer and the De-Listing

Ex-Entitlement Date 7.00 a.m. on 20 September

Posting of this Circular and Application 20 September

Form to Shareholders

Open Offer Entitlements credited 21 September

to stock accounts in CREST of Qualifying

CREST Shareholders 4.30 p.m. on 29 September

Latest recommended time and date

for requesting withdrawal of Open

Offer Entitlements from CREST

Latest time for depositing Open 3.00 p.m. on 2 October

Offer Entitlements into CREST

Latest time and date for splitting 3.00 p.m. on 3 October

Application Forms (to satisfy bona

fide market claims) 11.00 a.m. on 5 October

Latest time and date for receipt

of completed Application Forms and 6 October

payment in full from Qualifying

Shareholders under the Open Offer

or settlement of relevant CREST

instruction (as appropriate)

Result of the Open Offer announced

through a Regulatory Information

Service

Voting deadline ( no later than 11.00 a.m. on 11 October

48 hours before the General Meeting)

General Meeting 11.00 a.m. on 13 October

Admission of the Open Offer Shares 8.00 a.m. on 16 October

and the Subscription Shares to trading

on AIM

CREST accounts expected to be credited 16 October

for the Open Offer Shares and the

Subscription Shares in uncerti cated

form (where applicable)

Earliest date for the De-Listing 7.00 a.m. on 23 October

and cancellation of admission of

the Ordinary Shares to trading on

AIM

Posting of share certi cates and within 14 days of Admission

warrant certificates for the Open

Offer Shares and the Subscription

Shares by the Registrar (where applicable)

The Company reserves the right to alter the date and times

referred to above and to accept applications under the Open Offer

at any time prior to 5 October 2023. If any of the above times

and/or dates change, the revised times and/or dates will be

notified to Shareholders by announcement through a Regulatory

Information Service.

All times are references to London time.

All events in the above timetable following the GM are

conditional, inter alia, upon the approval of all the

Resolutions.

The De-Listing requires the approval of not less than 75 per

cent. of the votes cast by Shareholders at the General Meeting.

If you have any questions on the procedure for acceptance and

payment, you should contact Link Group on +44 (0) 371 664 0321.

Calls are charged at the standard geographic rate and will vary by

provider. Calls from outside the United Kingdom will be charged at

the applicable international rate. The helpline is open between

9.00 a.m. - 5.30 pm, Monday to Friday excluding public holidays in

England and Wales. Please note that Link Group cannot provide any

financial, legal or tax advice and calls may be recorded and

monitored for security and training purposes.

DEFINITIONS

The following shall apply throughout this document unless the

context otherwise requires:-

"2022 Options" the share options granted on 26

May 2022 by the Company to Yoav

Keren, Yuval Zantkeren and others;

"Act" the Companies Act 2006;

"acting in concert" has the meaning given to it in the

Takeover Code;

"Admission" admission of the Open Offer Shares

and Subscription Shares to trading

on AIM;

"AIM" a market operated by the London

Stock Exchange;

"AIM Rules" the "AIM Rules for Companies" published

by the London Stock Exchange from

time to time;

"Articles" the articles of association of the

Company, as amended from time to

time;

"Annualised Recurring Revenue" calculated by annualising the monthly

or "ARR" revenue on all of BrandShield's

active subscriptions for its services

in a particular month;

"Application Form" the application form for use in

"Associates" the Open Offer;

any person who, from time to time,

is connected or associated with

a Shareholder for the purposes of

sections 252 to 255 Companies Act

2006;

"Board" the board of directors of the Company,

as set out on page 13;

"Broker Warrants" the warrants to be issued to Mr

Subramanian Subbiah in respect of

his fee for brokering the subscription

by Joseph Haykov (via Cloak, LLC),

details of which are set out in

paragraph 5.2 of Part III of this

document;

"Business Day" a day, not being a public holiday,

Saturday or Sunday on which clearing

banks in London are open for business;

"City Code" or "Takeover the UK City Code on Takeovers and

Code" Mergers;

"Company" BrandShield Systems Plc;

"Concert Party" certain Shareholders, as more fully

described in paragraph 1 of Part

II of this document;

"CREST" or " CREST System" the relevant system (as de ned in

the Regulations) which enables title

to units of relevant securities

(as de ned in the Regulations) to

be evidenced and transferred without

a written instrument and in respect

of which Euroclear UK & International

Limited is the Operator (as de ned

in the Regulations);

"CREST Manual" the compendium of documents entitled

"CREST Manual" issued by Euroclear

from time to time and comprising

the CREST Reference Manual, the

CREST Central Counterparty Service

Manual, the CREST International

Manual, the CREST Rules (including

CREST Rule 8), the CREST CCSS Operating

Manual and the CREST Glossary of

Terms;

"CREST member" a person who has been admitted to

CREST as a system-member (as de

ned in the CREST Manual);

"CREST member account ID" the identi cation code or number

attached to a member account in

CREST;

"CREST participant" a person who is, in relation to

CREST, a system-participant (as

de ned in the CREST regulations);

"CREST participant ID" shall have the meaning given in

the CREST Manual issued by Euroclear;

"CREST payment" shall have the meaning given in

the CREST Manual issued by Euroclear;

"CREST Regulations" the Uncerti cated Securities Regulations

2001 (SI 2001/3755) (as amended

from time to time);

"CREST sponsor" a CREST participant admitted to

CREST as a CREST sponsor;

"CREST sponsored Member" a CREST member admitted to CREST

as a sponsored member;

"De-Listing" the proposed cancellation of admission

of the Ordinary Shares to trading

on AIM, subject to passing of Resolution

numbered 4 at the General Meeting

and in accordance with Rule 41 of

the AIM Rules;

"Directors" the directors of the Company (each

being a "Director");

"Disclosure and Transparency The Disclosure Guidance and Transparency

Rules" Rules published by the Financial

Conduct Authority from time to time;

"Disclosure date" 19 September 2023, being the latest

practicable date prior to the publication

of this document;

"Eligible Shareholders" Shareholders on the register of

members of the Company on the Record

Date;

"Enlarged Ordinary Share the enlarged issued ordinary share

Capital" capital following Admission (assuming

full subscription under the Open

Offer);

"Euroclear" Euroclear UK & International Limited;

"Existing Options" the options over 27,968,483 Ordinary

Shares in issue at the date of this

document, as set out in more detail

in paragraph 2 of Part III;

"Existing Ordinary Share the existing issued share capital

Capital" or "Existing Ordinary of the Company, being 170,331,874

Shares" Ordinary Shares as at the date of

this document;

"Existing Warrants" the warrants over 12,122,247 Ordinary

Shares in issue at the date of this

document, which entitle the holders

to subscribe for Ordinary Shares,

as set out in more detail in paragraph

3 of Part III;

"Form of Proxy" or "Proxy the individual form of proxy for

Form" use by Ordinary Shareholders in

connection with the General Meeting;

"Founders" Yoav Keren and Yuval Zantkeren;

"FSMA" the Financial Services and Markets

Act 2000, as amended from time to

time;

"Fully Diluted Share Capital" the issued share capital of the

Company assuming (i) completion

of the Open Offer and Subscription,

and (ii) exercise of all of the

Existing Options, the Existing Warrants,

the New Options, the Subscription

Warrants, the Open Offer Warrants

and the Broker Warrants;

"General Meeting" or "GM" the general meeting of the Company

convened for 11.00 a.m. on 13 October

2023, notice of which is set out

at the end of this document (including

any adjournment of such meeting);

"Group" the Company and its subsidiary undertakings

(as defined in the Act);

"Independent Directors" the Directors (excluding Yoav Keren,

Yuval Zantkeren and Harel Kodesh

who are members of the Concert Party);

"Independent Shareholders" Shareholders who are entitled to

vote on the Waiver Resolution, namely

Shareholders who are not members

of the Concert Party;

"ISIN" International Securities Identi

cation Number;

"Lapse Date" the date on which an Open Offer

Warrant lapses, being the date that

"LTIP" or "Long Term Incentive is 4 years after the issue of the

Plan" Open Offer Shares;

the long term incentive plan of

the Company, adopted on 1 December

2020;

"LTIP Options" the options granted pursuant to

the LTIP;

"Money Laundering Regulations" The Money Laundering, Terrorist

Financing and Transfer of Funds

(Information on the Payer) Regulations

2017 (as amended and supplemented);

"New Options" the new unapproved share options

over up to 52,724,080 to be granted

to Yoav Keren and Yuval Zantkeren,

as set out in paragraph 5 of Part

I of this document;

"New Employee Options" the new share options over up to

19,680,800 Ordinary Shares to be

granted to employees including 200,000

to Ravit Freedman;

"Notice of General Meeting" the Notice of General Meeting set

out at the end of this document;

"Official List" the official list of the FCA;

"Open Offer" the invitation to Qualifying Shareholders

to subscribe for Open Offer Shares

at the Issue Price on the terms

of and subject to the conditions

set out or referred to in Part IV

"Open Offer Entitlement" of this document;

with respect to each Qualifying

Shareholder, the pro rata entitlement

to apply to subscribe for 1 Open

"Open Offer Warrants" Offer Share for every 2 Existing

Ordinary Shares held by them on

the Record Date pursuant to the

Open Offer;

"Open Offer Shares" up to 38,669,962 warrants which

entitle the holders to subscribe

for Ordinary Shares to be issued

on a 1:1 basis to subscribers for

"Overseas Shareholders" the Open Offer Shares;

the up to 38,669,962 New Ordinary

Shares to be issued pursuant to

the Open Offer subject to, inter

alia, the passing of the Resolutions

at the General Meeting;

a Shareholder who has a registered

address outside the United Kingdom,

or who is a citizen or resident

of, or is incorporated or registered

in, a country other than the United

Kingdom, or who is holding Ordinary

Shares for the bene t of such a

person (including, without limitation

and subject to certain exceptions,

custodians, nominees, trustees and

agents);

"Ordinary Shareholders" holders of Ordinary Shares;

"Ordinary Shares" ordinary shares of 1 penny each

in the capital of the Company;

"Placing" the institutional placing of 29,166,667

new ordinary shares of 1 penny each

in the capital of the Company in

November 2022 as more fully detailed

in paragraph 5.4 of Part III of

"Placing Agreement" this document;

the placing agreement entered into

by the Company and Shore Capital

Stockbrokers Limited dated 28 November

2022 in respect of the Placing;

"Proposals" together the Subscription, the Open

Offer, the Rule 9 Waiver, the De-Listing,

the issue of the New Options, the

re-pricing of certain of the Existing

Options and the amendments to the

exercise period of certain of the

Existing Warrants, all as described

in this document;

"Record Date" 18 September 2023;

"Registrar " Link Group, Central Square, 29 Wellington

Street, Leeds, LS1 4DL ;

"Register" the register of members of the Company;

"Retail Investors" eligible investors (being existing

Qualifying Shareholders) in the

Open Offer;

"Qualifying CREST Shareholders" Qualifying Shareholders whose Existing

Ordinary Shares on the register

of members of the Company on the

Record Date are held in uncertificated

form on CREST;

"Qualifying Non-CREST Shareholders" Qualifying Shareholders whose Existing

Ordinary Shares on the register

of members of the Company on the

Record Date are held in certificated

"Qualifying Shareholders" form;

holders of Existing Ordinary Shares

on the register of members of the

Company on the Record Date for the

"Resolutions" Offer (other than certain Overseas

Shareholders);

"Restricted Jurisdictions" the resolutions to be tabled at

the General Meeting;

each and any of the United States,

Australia, Canada, Hong Kong, Japan,

New Zealand and the Republic of

South Africa and any other jurisdiction

where the extension or the availability

of the Placing would breach any