TIDMADME

RNS Number : 5821A

ADM Energy PLC

25 May 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

25 May 2023

ADM Energy PLC

("ADM" or the "Company")

Investment in Onshore US Oil Leases and Work Programme

Issue of and Subscription for Secured Convertible Loan Notes

Directors' dealings, Grant of Options and Related Party

Transactions

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC), a natural

resources investing company, is pleased to announce that, through a

recently formed, wholly owned U.S. subsidiary company, ADM Energy

USA, Inc., it has invested in five on-shore US oil leases by way of

a Membership Interest Purchase Agreement ("the Investment") with

OFX Holdings, LLC (formerly Tennessee Black Gold, LLC), a

substantial shareholder of the Company. The Investment has been

made by the acquisition of Blade Oil V, LLC ("Blade V"), a Texas

limited liability company established as a vehicle for the purpose

of facilitating the Investment, for a total maximum consideration

of US$1,614,000 further details of which are provided below.

The Company further announces a subscription for secured

convertible loan notes, the proceeds of which will be used to

advance the Investment and the implementation of an unapproved

share option scheme, together with a grant of options.

Investment Highlights

Blade V owns a portfolio of interests in oil and gas projects

("the Assets"), the primary focus of which is a 70.0% working

interest participation in an initial three well drilling programme

to target shallow oil production on the Altoona Lease located in

the Midway-Sunset Oilfield, Kern County, California. The interests

held by Blade V also comprise:

-- 100.0% working interest in the Schweitzer Lease in Graham

County, Kansas where a work-over programme to restore production

from two wells is currently in process.

-- 50.0% fully funded working interest in a three well workover

programme in Texas targeting initiation of production from three

wells.

-- Total gross and net leasehold acreage associated with the

acquisition is 423 acres and 295.5 acres, respectively.

-- An Area of Mutual Interest allowing ADM to participate, at

cost, in any additional drilling, recompletion or workover

opportunities within two miles of any boundary of the leases

included in the Investment.

-- In conjunction with the Transaction, ADM Energy USA, Inc. and

OFX have entered into a loan facility (the "USA Loan Facility")

providing for loans of up to US$750,000 to be made available to the

Company. The Consideration Loan Notes (defined below) of US$235,720

will be issued as an advance under the USA Loan Facility.

-- ADM will be a non-operating financial investor in the interests.

Further details of the portfolio of interests comprising the

Investment are as follows:

Lease/Well County, Working Interest Net Revenue Interest Operator (1)

State

------------ ------------ ----------------- --------------------- -----------------

To Be Determined

Altoona Kern, CA 70.0% 52.5% (1)

Pearson Grimes, TX 50.0% 37.5% Guardian (2)

Oberlin Upshur, TX 50.0% 37.5% Guardian (2)

Moon Upshur, TX 50.0% 37.5% Guardian (2)

Schweitzer Graham, KS 100.0% 75.0% Tex Oil, LLC(3)

(1) Notes: Altoona: a California licensed and bonded contract

operator to be determined by OFX and ADM.

(2) Guardian Energy Operating Co., LLC is a registered Texas operator 75.0% owned by OFX.

(3) Tex Oil, LLC is a registered Kansas operator.

Midway-Sunset Oilfield, Kern County, California

The Midway-Sunset Oil Field is a large oil field in Kern County

, San Joaquin Valley , California in the United States. It is the

largest known oilfield in California and the third largest in the

United States. The field was discovered in 1894 and it is estimated

that the field has produced close to 3 billion barrels (480,000,000

m(3) ) of oil. At the end of 2008, the California Department of

Conservation estimated reserves amounted to approximately 532

million barrels (84,600,000 m(3) ), 18% of California's estimated

total.

The Altoona Lease

The Altoona Lease is a circa 20-acre lease located in a crestal

position within the Spellacy Anticline Region of the Midway-Sunset

Oilfield. Discovered in 1915, the Altoona Lease has produced less

than 1 million barrels of oil from multiple intervals primarily

between 1,000 and 1,600 feet. Chevron (USA), Inc. is actively

developing leases contiguous with and surrounding the Altoona

Lease. In March/April of 2020 Chevron (USA), Inc. drilled and

started producing the 3-8R and 3-8AR wells located approximately

250 meters from the Altoona Lease. These wells were drilled to

approximately 1,935 feet and, combined, have produced in excess of

150,000 barrels of oil from spud through the end of December 2022.

A work programme, considered exploratory by the Company, is being

planned to drill or deepen up to three wells to approximately 2,000

feet to test deeper potential, previously untested on the Altoona

Lease which may be contributing to the high level of production

realised by Chevron in the 3-8R and 3-8AR wells. ADM expects that

the operator of the Altoona work programme will commence before the

end of 2023. ADM will have a non-operated 70% working interest and

52.5% net revenue interest in the Altoona lease.

The Altoona work programme commitments are expected to be costed

at approximately US$1,500,000.

The Schweitzer Lease

The Schweitzer Lease is a 160-acre lease located in Graham

County, Kansas. Blade V owns a 100% working interest and 75% net

revenue interest in the Schweitzer Lease. The lease includes two

wells capable of being returned to production (the Schweitzer #3

and the Schweitzer #6), a salt-water disposal well and associated

production equipment.

The initial work programme will consist of:

-- Schweitzer #3: Already in progress. Pump a chemical scale

squeeze into Lansing-KC "J" and "K" intervals to inhibit the

precipitation of Barite/Celestite scale on downhole production

equipment. Return well to production via rod-beam pump.

-- Schweitzer #6: Equip well to produce via rod-beam pump in

replacement of electrical submersible pump.

The total cost of the work programme, which will be conducted by

Tex Oil LLC, is estimated at US$65,000 and will be funded by an

advance from the USA Loan Facility.

Pearson, Oberlin and Moon Leases: Three Well Workover

Programme

The Company will participate with a 50.0% working interest and

37.5% net revenue interest in a three well workover program with

Guardian Energy Operating Co., LLC ("Guardian"), a majority owned

subsidiary of OFXH. The programme will target the initiation of

production from the following wells:

Well County, State API# Operator Work Timing

Pearson 1RE Grimes, Texas 42-185-30529 Guardian May 2023

Oberlin 2 Upshur, Texas 42-459-31141 Guardian May 2023

Moon Well 1 Upshur, Texas 42-459-31438 Guardian To be determined

The three well work programme is fully funded by OFXH, the

Company's share of costs associated with its participation are

included as part of the Investment consideration and will not

require any cash investment or borrowings by the Company under the

USA Loan Facility.

Investment Consideration

The total maximum consideration for the Investment of

US$1,614,000 comprises US$478,280 to be financed via the issuance

of (1) 15,714,667 new ordinary shares at a price of 1.2p per share

("Consideration Shares"); (2) a US$235,720 loan note issued by ADM

Energy USA, Inc. (non-recourse to ADM Energy PLC) ("Consideration

Loan Notes"); (3) the issue of warrants over 7 million ordinary

shares in the Company ("the Warrants") exercisable at 2.5p per

warrant with a term of two years from Admission (defined below);

and (4) contingent deferred consideration of up to $900,000.

The contingent deferred consideration will be received on the

first 180,000 barrels of oil produced net to the interests of the

Company from the Assets. The production payment will be US$5.00 per

barrel if the realised price is greater than US$70.00 per barrel

and US$3.50 if the realised price is greater than US$50.00 per

barrel and less than US$70.00 per barrel. There will be no payment

in periods when the realised oil price is less than US$50.00 per

barrel. The production payment will be paid in arrears on a monthly

basis.

Secured Convertible Loan Note Subscription and Creditor

Conversions

Concurrent with the Investment, the Company has entered into

subscription agreements to issue secured convertible loan notes

("SCLN") with an aggregate face value of up to US$1.5 million, of

which US$900,000 has been subscribed for and US$600,000 remaining

available for subscription. The SCLN has a three-year term, an

interest rate payable-in-kind (which maybe settle with cash or

non-cash payments) of 8.0% per annum and the principal together

with any interest due may be converted at any time at a share price

of 1.2p per share. The purchasers of the SCLN will also be assigned

a proportionate economic interest in a 1.25% undivided over-riding

royalty interest in the Altoona Lease (further described below).

The SCLN will be secured by a pledge of and first-lien on the

shares of ADM Energy USA, Inc. held by the Company. A condition of

the subscription agreement associated with the SCLN is that the

funds raised must fully fund, and be first applied against, the

Company's net share of the costs of the Altoona work programme. Any

amount in excess of the

funds required to fund the Altoona work programme may be used by

the Company for general working capital purposes.

The following shareholders and directors of the Company have

subscribed for the SCLNs as indicated:

Hessia Group Limited, a substantial shareholder of the Company US$500,000

OFX Holdings, LLC, a substantial shareholder of the Company US$250,000

Mr. Oliver Andrews, a director of the Company US$100,000

Mr. Stefan Olivier, a director of the Company US$50,000

Total US$900,000

Signed subscription letters have been received and, upon receipt

of the cleared funds which are expected shortly, the SCLNs will be

issued.

In addition to the subscriptions noted above, the Company has

agreed with certain directors and creditors to convert outstanding

contractual liabilities of GBP683,117 into 56,926,417 new ordinary

shares in the Company ("Conversion Shares") at the same price as

the Consideration Shares being 1.2p per new ordinary share.

Conversion Shares issued to Directors of the Company, and their

respective shareholdings on Admission, are as follows:

Director Conversion value Number of Resulting Shares as percentage

(GBP) Conversion Shares to shareholding on of Enlarged Issued

be issued admission Share Capital on

Admission

Oliver Andrews 100,000 8,333,333 15,000,000 4.06%

Stefan Olivier 50,000 4,166,667 4,166,667 1.13%

Richard Carter 50,000 4,166,667 6,598,163 1.79%

Dr Stefan Liebing 19,617 1,634,750 2,290,722 0.62%

Lord Henry Bellingham 16,500 1,375,000 1,728,031 0.47%

Manuel Lamboley

(former director) 15,000 1,250,000 1,250,000 0.34%

---------------------- ---------------------- ---------------------- ---------------------

Total 251,117 20,926,417 31,033,583 8.67%

====================== ====================== ====================== =====================

Variation of Loan Facilities Agreement with OFX

Further to the announcement of 17 October 2022, OFX has provided

US$262,500 in loans to the Company (the "Equity Subscription

Loan"). In conjunction with the Investment, OFX and ADM have

formalised the "USA Loan Facility" with a total of US$235,720

advanced as part of the purchase price pursuant to the terms of the

Investment. By agreement between ADM and OFX, the Equity

Subscription Loan will be refinanced by the USA Loan Facility

resulting in a total of US$498,220 outstanding under the USA Loan

Facility with US$251,780 remaining available for use. Following

this variation, ADM Energy plc will not directly have any

outstanding loans due to OFX.

Key terms of the USA Loan Facility include:

1. Loans of up to US$750,000 with additional advances subject to

mutual agreement between the Company and OFX.

2. The USA Loan Facility is not secured nor is the Company a

guarantor of borrowings by ADM Energy USA, Inc.

3. Maturity date of 30 June 2025 ("Maturity Date").

4. Interest rate of 9.0% per annum with quarterly payments of

interest to commence in April 2024.

5. OFX may offset amounts due to it pursuant to the USA Loan

Facility against any amounts that would be due to the Company

should OFX exercise warrants held by it over ordinary shares in the

Company prior to the Maturity Date.

Grant of Options

The Company also announces that it has adopted an unapproved

share option scheme ("Scheme") and made a grant of options to

certain directors and employees. The purpose of the Scheme is to

incentivise management performance for the benefit of all

shareholders by way of options which are subject to vesting

conditions.

The terms of the Scheme provide that the Company can award

options over a maximum of 12 per cent. of the Company's issued

share capital, from time to time.

Vesting criteria for options granted under the Scheme are as

follows:

Amount Vesting Price Vesting Conditions

50 per cent. ("Tranche One") 1.2p On the business day following the second anniversary of the date of grant

50 per cent. ("Tranche Two") 2.4p On the business day following the third anniversary of the date of grant

Vesting conditions may be varied or waived provided that any

varied vesting condition shall be a fairer measure of performance,

as judged at the time, and no more difficult to satisfy than the

original vesting condition. The Scheme provides good leaver

provisions and other standard terms normally associated with such a

scheme.

The Company has granted the following options under the

Scheme:

Director Number of Options granted as Shareholding on Shareholding on

Options granted percentage of Enlarged Admission Admission as a

Issued Share Capital percentage of Enlarged

on Admission issued share capital

on Admission

Stefan Olivier 21,299,823 5.76% 4,166,667 1.13%

Richard Carter 10,649,911 2.88% 6,598,163 1.78%

Oliver Andrews 4,348,714 1.18%2.88% 15,000,000 4.06%

Lord Henry Bellingham 4,348,714 1.18% 1,728,031 0.47%

Dr Stefan Liebing 3,194,973 0.86% 2,290,722 0.62%

Total 43,842,135 11.86% 29,783,583 8.05%

----------------- ----------------------- ------------------------ -----------------------

In addition to the awards to directors of the Company above, the

Company has also issued 532,495 options over ordinary shares,

representing 0.14% of the enlarged issued share capital on

Admission to an employee. The total award of options represents

12.0% of the enlarged issued share capital on Admission.

Admission to AIM and Total Voting Rights

Application has been made for the Consideration Shares and the

Conversion Shares (together, "New Ordinary Shares"), which total

72,641,084 new ordinary shares and which will rank pari passu with

the Company's existing ordinary shares, to be admitted to trading

on AIM ("Admission"). It is expected that Admission of the New

Ordinary Shares will become effective and that dealings will

commence at 08.00 am on or around 1 June 2023.

Following Admission, the Company's enlarged issued share capital

("Enlarged Issued Share Capital") will comprise 369,788,614

ordinary shares of GBP0.01 each with voting rights in the Company.

This figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in the

interest in, the share capital of the Company under the FCA's

Disclosure and Transparency Rules.

Following issuance of the Consideration Shares, OFX will hold

57,381,334 ordinary shares of ADM Energy plc representing 15.58% of

the Enlarged Issued Share Capital of Company on Admission.

Related Party Transactions

Entering into the agreements for the Investment and the

variation of the existing loan arrangements with OFX, a substantial

shareholder of the Company, constitute related party transactions

for the purposes of AIM Rule 13. It was noted that Stefan Olivier

and Claudio Coltellini, whilst nominee directors for OFX, are not

related parties for the purpose of these transactions. The

Company's Directors consider, having consulted with the Company's

nominated adviser, Cairn Financial Advisers LLP, that the terms of

the transactions are fair and reasonable insofar as the Company's

shareholders are concerned.

Further, the subscriptions for the SCLN by Hessia and OFX, as

substantial shareholders, and Oliver Andrews and Stefan Olivier, as

Directors, constitute related party transactions for the purposes

of AIM Rule 13. With the exception of Oliver Andrews and Stefan

Olivier, the Company's Directors consider, having consulted with

the Company's nominated adviser, Cairn Financial Advisers LLP, that

the terms of the transactions are fair and reasonable insofar as

the Company's shareholders are concerned.

In addition, the agreement between the Company and certain

directors (including a former director) to convert outstanding

liabilities into Conversion Shares constitutes a related party

transaction pursuant to AIM Rule 13. With the exception of Oliver

Andrews and Stefan Olivier, the Company's Directors consider,

having consulted with the Company's nominated adviser, Cairn

Financial Advisers LLP, that the terms of the transaction are fair

and reasonable insofar as the Company's shareholders are

concerned.

Commenting on the Acquisition and SCLN Issuance

Stefan Olivier said, "I am excited about the Altoona acquisition

and support for ADM shown by our large shareholders and Board in

subscribing for the SCLN on agreed terms. I look forward to

updating the market in due course regarding our development plans

and timing for initiation of the drill programme on the Altoona

lease."

Enquiries:

ADM Energy plc +44 20 7459 4718

Oliver Andrews, Chairman

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Gracechurch Group +44 20 4582 3500

(Financial PR)

Harry Chathli, Alexis Gore, Henry Gamble

About ADM Energy PLC

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC) is a natural

resources investing company with an existing asset base in Nigeria.

ADM Energy holds a 9.2% profit interest in the oil producing Aje

Field, part of OML 113, which covers an area of 835km(2) offshore

Nigeria. Aje has multiple oil, gas, and gas condensate reservoirs

in the Turonian, Cenomanian and Albian sandstones with five wells

drilled to date.

ADM Energy is committed to maximizing long-term value from its

existing asset base in Nigeria while targeting other investment

opportunities in the oil and gas sector with attractive risk reward

profiles such as proven nature of reserves, level of historic

investment, established infrastructure and route to early cash

flow.

About OFX HOLDINGS LLC

OFX Holdings, LLC was founded as TN Black Gold LLC, a Florida

corporation. It is registered to do business in the U.S. state of

Texas as OFX Holdings, LLC and is completing a name change in

Florida to OFX Holdings, LLC.

Forward Looking Statements

Certain statements in this announcement are, or may be deemed to

be, forward looking statements. Forward looking statements are

identified by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements reflect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

Market Abuse Regulation (MAR) Disclosure

The notification below, made in accordance with the requirements

of the EU Market Abuse Regulation, provides further detail.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities / person closely associated

with them.

Details of the person discharging managerial responsibilities/person

1. closely associated

a) Name Stefan Olivier

Richard Carter

Oliver Andrews

Lord Henry Bellingham

Dr Stefan Liebing

------------------------------- -----------------------------------------------------------------------------

Reason for the notification

2.

--------------------------------------------------------------------------------------------------------------

a) Position/status Stefan Olivier CEO

Richard Carter COO

--------------

Oliver Andrews Chairman

--------------

Lord Henry Bellingham Non-executive

Director

--------------

Dr Stefan Liebing Non-executive

Director

--------------

------------------------------- -----------------------------------------------------------------------------

b) Initial notification/Amendment Initial Notification

------------------------------- -----------------------------------------------------------------------------

Details of the issuer, emission allowance market participant,

3. auction platform, auctioneer, or auction monitor

--------------------------------------------------------------------------------------------------------------

a) Name ADM Energy plc

------------------------------- -----------------------------------------------------------------------------

b) LEI 213800DY7G8EEJCCOL47

------------------------------- -----------------------------------------------------------------------------

Details of the transaction(s): section to be repeated for (i)

4. each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

--------------------------------------------------------------------------------------------------------------

a) Description of the financial Ordinary Shares of 1 pence each

instrument

GB00BJFDXW97

Identification code

------------------------------- -----------------------------------------------------------------------------

b) Nature of the transactions Grant of options over ordinary shares

------------------------------- -----------------------------------------------------------------------------

c) Price(s) and volume(s) Name Price Volume

1.2p

Stefan Olivier 2.4p 21,299,824

------- -----------

1.2p

Richard Carter 2.4p 10,649,912

------- -----------

1.2p

Oliver Andrews 2.4p 4,348,714

------- -----------

1.2p

Lord Henry Bellingham 2.4p 4,348,714

------- -----------

1.2p

Dr Stefan Liebing 2.4p 3,194,974

------- -----------

------------------------------- -----------------------------------------------------------------------------

d) Aggregated information Single transaction as in 4 c) above Name Price Volume

- Aggregated volume Stefan Olivier 21,299,824

- Price -----------

Richard Carter 10,649,912

-----------

Oliver Andrews 4,348,714

-----------

Lord Henry Bellingham 4,348,714

-----------

Dr Stefan Liebing 3,194,974

-----------

------------------------------- -----------------------------------------------------------------------------

e) Date of the transaction 25 May 2023

------------------------------- -----------------------------------------------------------------------------

f) Place of the transaction London Stock Exchange, AIM Market

------------------------------- -----------------------------------------------------------------------------

Details of the person discharging managerial responsibilities/person

1. closely associated

a) Name Stefan Olivier

Richard Carter

Oliver Andrews

Lord Henry Bellingham

Dr Stefan Liebing

------------------------------- ----------------------------------------------------------------------------

Reason for the notification

2.

-------------------------------------------------------------------------------------------------------------

a) Position/status Stefan Olivier CEO

Richard Carter COO

--------------

Oliver Andrews Chairman

--------------

Lord Henry Bellingham Non-executive

Director

--------------

Dr Stefan Liebing Non-executive

Director

--------------

------------------------------- ----------------------------------------------------------------------------

b) Initial notification/Amendment Initial Notification

------------------------------- ----------------------------------------------------------------------------

Details of the issuer, emission allowance market participant,

3. auction platform, auctioneer, or auction monitor

-------------------------------------------------------------------------------------------------------------

a) Name ADM Energy plc

------------------------------- ----------------------------------------------------------------------------

b) LEI 213800DY7G8EEJCCOL47

------------------------------- ----------------------------------------------------------------------------

Details of the transaction(s): section to be repeated for (i)

4. each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

-------------------------------------------------------------------------------------------------------------

a) Description of the financial Ordinary Shares of 1 pence each

instrument

GB00BJFDXW97

Identification code

------------------------------- ----------------------------------------------------------------------------

b) Nature of the transactions Conversion of liabilities into ordinary

shares

------------------------------- ----------------------------------------------------------------------------

c) Price(s) and volume(s) Name Price Volume

Stefan Olivier 1.2p 4,166,667

------ ----------

Richard Carter 1.2p 4,166,667

------ ----------

Oliver Andrews 1.2p 8,333,333

------ ----------

Lord Henry Bellingham 1.2p 1,375,000

------ ----------

Dr Stefan Liebing 1.2p 1,634,750

------ ----------

------------------------------- ----------------------------------------------------------------------------

d) Aggregated information Single transaction as in 4 c) above Name Price Volume

- Aggregated volume Stefan Olivier 1.2p 4,166,667

- Price ------ ----------

Richard Carter 1.2p 4,166,667

------ ----------

Oliver Andrews 1.2p 8,333,333

------ ----------

Lord Henry Bellingham 1.2p 1,375,000

------ ----------

Dr Stefan Liebing 1.2p 1,634,750

------ ----------

------------------------------- ----------------------------------------------------------------------------

e) Date of the transaction 25 May 2023

------------------------------- ----------------------------------------------------------------------------

f) Place of the transaction London Stock Exchange, AIM Market

------------------------------- ----------------------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUSAUROVUVUUR

(END) Dow Jones Newswires

May 25, 2023 02:00 ET (06:00 GMT)

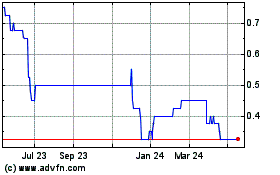

Adm Energy (LSE:ADME)

Historical Stock Chart

From Oct 2024 to Nov 2024

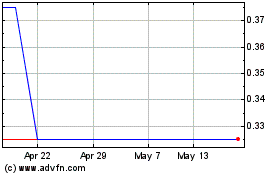

Adm Energy (LSE:ADME)

Historical Stock Chart

From Nov 2023 to Nov 2024