Admiral Shares Rise On Extension Of Reinsurance Agreements

February 03 2012 - 6:16AM

Dow Jones News

Shares in Admiral Group PLC (ADM.LN) rose strongly Friday after

the U.K. car insurer said it is extending its existing U.K. car

reinsurance partnerships with several foreign reinsurers until

2014, showing continued support for Admiral despite it facing some

challenges in its U.K. business.

At 1031 GMT, Admiral shares were up 8% at 1039 pence, making it

the best performer among FTSE100 stocks. Meanwhile, the FTSE100

index was up 0.47%.

Admiral said it extended its partnerships with Hannover Re AG

(HNR1.XE), Mapfre Re, New Re and Swiss Re AG (SREN.VX) into 2014

and that the costs of these arrangements have not changed.

It said these are in addition to a current co-insurance

agreement with Munich Re AG (MUV2.XE), which covers 40% of the U.K.

business and which runs until at least the end of 2016.

"We are happy to announce these extensions to our underwriting

arrangements into 2014. Reinsurance has been at the core of

Admiral's successful business model since 2000 and we look forward

to continuing our mutually beneficial relationships with our

partners for many years to come," said Chief Executive Henry

Engelhardt.

The announcement comes after Admiral issued a profit warning in

November, saying that its 2011 pretax profit will be at the lower

end of expectations due in part to record levels of personal injury

claims.

Analysts have also said Admiral is exposed to the U.K.

government's effort to introduce major changes in the way car

insurance is being sold in Britain.

The U.K. Office of Fair Trading in December launched a market

study on how car insurers provide third-party repairs and

replacement vehicles to claimants, as part of efforts to weed out

possible anti-competitive practices in the industry.

In September, the Ministry of Justice said it was looking into

banning the payment of referral fees in personal injury claims.

Such referral fees contribute to Admiral's sales.

"This morning's announcement, while not hugely significant, does

highlight the continuing support that Admiral enjoys from its

reinsurance partners," said Peel Hunt analyst Mark Williamson, who

kept his buy rating on the stock.

Oriel Securities analyst Marcus Barnard said: "This announcement

is good news for Admiral as it removes some uncertainty over the

future of these arrangements."

Shore Capital analyst Eamonn Flanagan said the agreement with

the reinsurers is "likely to be taken well by the market."

"However, our concerns over both the bodily injury issues and

the threat to the ancillary income line from the Ministry of

Justice and OFT investigations remain," Flanagan said, keeping his

sell rating on the stock.

-By Vladimir Guevarra, Dow Jones Newswires; +44 (0) 2078429486,

vladimir.guevarra@dowjones.com

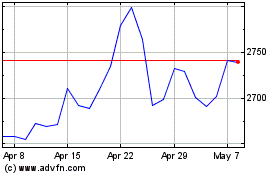

Admiral (LSE:ADM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Admiral (LSE:ADM)

Historical Stock Chart

From Jul 2023 to Jul 2024