Admiral Group PLC : Interim Management Statement

November 09 2011 - 2:00AM

UK Regulatory

TIDMADM

Admiral Group plc

Q3 Interim Management Statement

9 November 2011

Admiral Group plc ('Admiral' or 'the Group') today releases its Interim

Management Statement covering the period 1 July to 9 November 2011. Unless

otherwise stated, figures quoted are for the quarter ended 30 September 2011,

with comparatives reflecting the position compared against the same quarter in

2010.

Comment from Henry Engelhardt, Chief Executive

"Admiral now insures over three million vehicles. This is a great achievement

and provides a fantastic base from which to continue our long sustained growth

in the scale of our business and its profitability.

"Across 2011 as a whole we are likely to have grown our UK vehicle count by more

than 20%. Our international insurance business also continues to achieve strong

growth and further improvement in operating results.

"Notwithstanding the continued higher level of large claims in the quarter, I

expect us to once again report record profits for the full year, probably some

10% higher than last year. I am confident that with Admiral's enlarged customer

base and significant combined ratio advantage we are in a strong position for

sustained long term growth and good news in 2012 and beyond."

Group highlights

* Group turnover* increased by 30% to GBP582m (Q3 2010: GBP446 million)

* Group vehicle count increased 27% to 3.3 million (Q3 2010: 2.6 million)

* International car insurance turnover up 45% to GBP27.0 million (Q3 2010: GBP18.6

million)

* International car insurance vehicle count up 53% to 267,000 (Q3

2010: 175,000)

* Annualised UK vehicle count growth rate of just over 13%

* Modest UK premium rate increases achieved

* UK ancillary contribution per vehicle in line with H1 2011

* Combined ratio remains significantly lower than the market

* Financial position remains strong

* Turnover is defined as total premiums written (including co-insurers' share)

and Other Revenue

Outlook

Our claims experience in Q3, if replicated in Q4, would lead to a small

improvement at the end of the year in the aggregate projected ultimate loss

ratios for the back years (2000-2009). However, consistent with the trend

reported in H1 2011, the frequency and expected cost of new large personal

injury claims has remained above historical levels of experience. This leads us

currently to expect some adverse development at the full year on the projected

ultimate loss ratios for 2010 and 2011 which would affect both overall reserve

movements and recognised profit commission.

If there is no reversal in Q4 of this higher than normal level of large claims,

we anticipate that full year pre-tax profits will be towards the lower end of

the range of analysts' estimates, or some 10% ahead of 2010, with no further

reserve releases in the second half.

Management presentation

Admiral Group plc is holding an investor day and analyst presentation today, 9

November 2011.

This will include discussion of the Q3 2011 Interim Management Statement and

presentations by members of the senior management team.

A copy of the presentation will be available on Admiral's corporate website,

www.admiralgroup.co.uk today at 9am and a live webcast of the presentation will

be broadcast from the corporate website at 2.30pm.

Additional 8.00am analyst conference call

The Group will also host an analyst conference call to begin at 8am today.

Please see below for dial-in details.

Participant phone: +44 (0) 207 959 6790

Participant passcode: 616049

For further information, please contact:

Admiral

Louise O'Shea Investors & Analysts +44 (0) 7791 443732

Louisa Scadden Media +44 (0) 29 20434394

FTI Consulting

Paul Marriott +44 (0) 20 7269 7252

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Admiral Group PLC via Thomson Reuters ONE

[HUG#1561948]

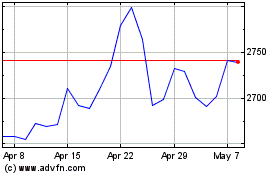

Admiral (LSE:ADM)

Historical Stock Chart

From Jul 2024 to Aug 2024

Admiral (LSE:ADM)

Historical Stock Chart

From Aug 2023 to Aug 2024