UPDATE: Admiral 2010 Profit Up 23% On Higher Customer Numbers

March 02 2011 - 6:51AM

Dow Jones News

U.K. motor insurer Admiral Group PLC (ADM.LN) on Wednesday

posted a 23% rise in 2010 net profit, helped by continued strong

underwriting business in the U.K. and an increase in the number of

customers.

Admiral said net profit for the year ended Dec. 31 was GBP193.8

million, up from GBP156.9 million in 2009.

Pretax profit was up 23% at GBP265.5 million from GBP215.8

million previously. The pretax figure was higher than the GBP262.5

million average forecast from 16 analysts.

Group turnover was up 47% at GBP1.58 billion and the full-year

dividend was raised 18% to 68.1 pence a share from 57.5 pence a

year earlier.

"For the seventh consecutive year, indeed every year since we

became a public company, Admiral has reported record profits and

record turnover. We have now exceeded GBP1.5 billion turnover which

is a fantastic achievement," said Chief Executive Henry

Engelhardt.

"Does it make sense, however, to say that I am pleased, but far

from satisfied? In my view, 2010 was a mixed year for the group.

There were some big triumphs but also some quite sobering moments

and, in a lot of areas, it's too early to judge the quality of the

work completed," he said.

Engelhardt said "the big success was the U.K. motor insurance

business," with a more than 30% rise in the number of vehicles

insured.

The number of vehicles insured by Admiral grew 32% to some 2.5

million in 2010, giving it around 10% of the U.K. car insurance

market.

Its combined ratio improved to 89% from 92% in 2009. A combined

ratio is a measure of claims costs compared with premiums. A figure

below 100% indicates an underwriting profit, and a lower number

indicates higher profitability.

Engelhardt said "there is a lot of work to be done to create

sustainable, profitable and growing businesses outside the

U.K.."

Admiral's international business is still growing, though still

largely loss-making. It sold its German operation AdmiralDirekt

last year after only three years in that market.

In a briefing, Engelhardt said: "Putting these operations in a

success trajectory is our goal certainly for 2011."

In the U.K., Admiral also operates the Confused.com price

comparison website. It runs four web-based insurance operations

outside the U.K.--Balumba.es in Spain, ConTe.it in Italy, Elephant

Auto in the U.S. and L'Olivier in France.

It operates three price comparison sites outside the

U.K.--Rastreator in Spain, LeLynx.fr in France and Chiarezza.it in

Italy.

The company said Confused.com had "a tough year" in facing its

competitors in the U.K. and saw revenue fall by 10% to GBP71.8

million, while operating profit dropped 34% to GBP16.9 million.

Its total losses from outside the U.K. rose to GBP12.9 million

from GBP10.3 million previously. Balumba in Spain made its first

full-year profit of GBP800,000 after making a loss of GBP1.3

million in 2009.

At 1110 GMT, Admiral shares were down 3.4% at 1,649 pence while

the FTSE100 index was down 0.8%.

Analysts from Oriel Securities lauded Admiral's

better-than-expected earnings but said its shares are trading at a

premium compared with the insurance sector and offer limited

upside.

"With a 10% market share in the U.K., we expect the performance

of the international businesses to become an increasingly important

driver of share performance," Oriel said, keeping its hold rating

on the stock.

Shore Capital analyst Eamonn Flanagan noted that profit from

ancillary services, or extra services such as breakdown coverage on

top of core car insurance services, formed around 54% of pretax

profit, up from 49% in 2009.

Flanagan said "the reliance on such earnings [is] a worrying

trend" and that "the sustainability of these earnings remains in

doubt," partly because current economic conditions are "likely to

test the discretionary element of such income."

Flanagan kept his sell rating on the stock.

-By Vladimir Guevarra, Dow Jones Newswires; +44 (0) 2078429486,

vladimir.guevarra@dowjones.com

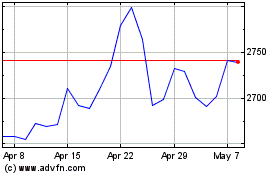

Admiral (LSE:ADM)

Historical Stock Chart

From Jul 2024 to Aug 2024

Admiral (LSE:ADM)

Historical Stock Chart

From Aug 2023 to Aug 2024