TIDMADA

RNS Number : 2339D

Adams PLC

28 June 2021

28 June 2021

Adams Plc

("Adams" or the "Company")

ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEARED 31 MARCH

2021

Adams Plc presents its annual report and audited financial

results for the year ended 31 March 2021.

Highlights:

- Net assets at 31 March 2021 of GBP5.15 million (2020: GBP2.06 million).

- Net assets per share 6.24 pence at 31 March 2021 (2020: 2.50 pence).

- Profit after tax of GBP3.09 million (2020: loss GBP0.30 million).

- Investments at 31 March 2021 valued at GBP5.11 million (2020: GBP1.18 million).

- Spend on new investments of GBP1.90 million (2020: GBP1.38 million).

- Investment realisation proceeds of GBP1.21 million (2020: GBP2.03 million).

- Cash at 31 March 2021 of GBP0.05 million (2020: GBP0.90 million).

- Post year end raised gross cash proceeds of GBP4.11 million

under a placing and open offer in April 2021.

- No part of the GBP3.00 million shareholder loan facility drawn down to date.

Michael Bretherton, Chairman, said:

"Whilst the arrival of a number of Covid-19 vaccines and the

associated roll-out of the global vaccination programs should now

provide a pathway for the gradual easing of the social and economic

restrictions currently in force, the full economic fallout from

this pandemic remains uncertain. Against this economic backdrop,

your Board will continue to maintain a rigorous and highly

selective investment approach which is committed to delivering

additional value for shareholders going forward. We remain

confident in the underlying fundamentals, technologies and

long-term potential for growth at the companies within our

investment portfolio."

The Company's 2021 Annual Report will shortly be posted to

shareholders together with a Notice of Annual General Meeting,

copies of which will be made available on the Company's website at

www.adamsplc.co.uk under the Investor Relations / Company &

Shareholder Documents section. The Annual General Meeting is to be

held at 11.00 a.m. on Wednesday 25 August 2021 at the Company's

registered office at 55 Athol Street, Douglas, Isle of Man, IM1

1LA. In accordance with current guidance regarding Covid-19 and the

travel restrictions into the Isle of Man, the Company recommends

that shareholders should not physically attend the AGM and should

instead vote by form of proxy.

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Enquiries:

Adams Plc Michael Bretherton Tel: +44 1534 719 761

Nomad Cairn Financial Advisers LLP. Sandy Jamieson, James

Caithie Tel: +44 207 213 0880

Broker Peterhouse Capital Limited. Heena Karani Tel: +44 207 469

3393

Chairman's Statement

Results

Adams Plc ("Adams" or the "Company") achieved a good performance

during the year ended 31 March 2021 recording a gross investment

return of GBP3.24 million, which, after overhead costs of GBP0.15

million, resulted in a net profit after tax of GBP3.09 million.

This compares to a loss after tax of GBP0.30 million for the prior

year ended 31 March 2020. The improvement in profitability is

principally due to higher investment returns in the year.

During the year, the Company spent GBP1.90 million on the

purchase of additional investments and generated cash proceeds of

GBP1.21 million from the sale of two of its investments and the

partial realisation of another. The carrying value of investments

at 31 March 2021 was GBP5.11 million, represented by six listed and

one un-listed investment holdings, versus GBP1.18 million at 31

March 2020, represented by five listed and one un-listed investment

holdings.

Net assets increased to GBP5.15 million (equivalent to 6.24p per

share) at the 31 March 2021 balance sheet date, compared with

GBP2.06 million (equivalent to 2.50p per share) at the previous

year end. The GBP3.09 million increase in net assets reflects the

profit reported for the year.

Cash and cash equivalent balances were GBP0.05 million at 31

March 2021 compared to cash balances of GBP0.90 million at 31 March

2020.

Subsequent to the 31 March 2021 year end, Adams raised gross

cash proceeds of GBP4.11 million under a placing and open offer in

April 2021 which has significantly further increased the Company's

net asset base. The Strategic Report includes a pro-forma balance

sheet for Adams which discloses net assets of GBP9.21 million

following the placing and open offer.

Business model and investing policy

Adams is an investing company with an investing policy under

which the Board is seeking to acquire interests in special

situation investment opportunities that have an element of

distress, dislocation, dysfunction or other special situation

attributes and that the Board perceives to be undervalued. The

principal focus is in the small to middle-market capitalisation

sectors in the UK or Europe, but the Directors will also consider

possible special situation opportunities anywhere in the world if

they believe there is an opportunity to generate added value for

shareholders.

Investment Portfolio

The principal listed investments held by the Company at 31 March

2021 comprised C4X Discovery Holdings Plc ("C4XD"), Circassia

Pharmaceuticals plc ("Circassia") and Griffin Mining Limited

("Griffin") and Adams also holds Oxehealth Limited ("Oxehealth") as

a principal unquoted investment.

C4XD is a pioneering drug discovery company combining scientific

expertise with cutting-edge drug discovery technologies to

efficiently deliver world--leading medicines which are developed by

licensing partners. The company applies its enhanced DNA-based

target identification and candidate molecule design capabilities to

generate small molecule drug candidates across multiple disease

areas including inflammation, oncology, neurodegeneration and

addictive disorders. To date C4XD has successfully out-licensed two

programmes with one candidate in clinical development. C4XD

reported a loss after tax of GBP3.6 million in the six months

ending 31 January 2021 inclusive of R&D investment of GBP3.3

million and with no revenues. Cash balances at 31 January 2021

amounted to GBP15.4 million. Post that period end, the company is

due an imminent EUREUR7 million upfront payment in relation to an

exclusive worldwide licensing agreement signed with Sanofi in April

2021. The shareholding of Adams in C4XD at 31 March 2021 was, and

continues to be, 2.21 per cent of the C4XD shares in issue.

Circassia is an AIM listed global medical device company focused

on respiratory diagnostics and monitoring. In April 2020, the

company announced a transaction to terminate the development and

commercialisation agreement between the company and AstraZeneca for

the U.S. commercial rights to Tudorza(R) and Duaklir(R) and the

transfer of these products back to Astra Zeneca in order to

transform Circassia into a debt-free business with a strong Niox

based continuing operations business. The company's management has

subsequently undertaken a major restructuring of the business to

focus on Niox which has delivered significant cost savings. On

current gross margins, this means that the EBITDA breakeven point

for the Niox business will be at around GBP30 million of annualised

revenue. Revenues for the continuing Niox business for the year

ended 31 December 2020 were GBP23.9 million (2019: GBP34.6 million)

having been impacted by the Covid-19 pandemic. Cash balances at 31

December 2020 amounted to GBP7.4 million but Circassia subsequently

raised gross cash proceeds of GBP5.0 million through a share

subscription in March 2021. The shareholding of Adams at 31 March

2021 was, and continues to be, 0.74 per cent of the Circassia

shares in issue.

Griffin i s an AIM listed mining and investment company that has

been the leader in foreign investment in mining in China having

been engaged in developing the Caijiaying zinc and gold project

since 1997. Despite Covid-19 related interruptions to operations in

the first quarter of 2020, the Group recorded a 6.5 per cent.

increase in operating profits in the year to 31 December 2020,

primarily as a result of higher zinc metal prices received and

reduced costs. Griffin reported a profit of US$8.9 million after

tax for that year on reduced revenues of US$74.4 million.

Subsequently in January 2021, Griffin announced a major achievement

in finally securing a significant new mining license from the

Chinese Ministry of Land and Natural Resources which catapults

Griffin into the ranks of one of the largest zinc producers in

China. The shareholding of Adams in Griffin as at 31 March 2021

was, and continues to be, 0.27 per cent of the Griffin shares in

issue.

Oxehealth is a private company that is involved in vision-based

patient monitoring and management, using proprietary signal

processing and computer vision to process normal digital video

camera data to measure the vital signs and activity of patients in

a number of different markets, primarily in Mental Health, Acute

Hospital settings, Primary Care settings, Care Home, and Custodial

facilities in both the UK and also in Sweden. This is achieved

through the deployment of their Digital Care Assistant platform

which enables clinicians to take non-contact cardiorespiratory

measurements of patients' pulse and breathing rate, generates

alerts to potentially risky activity and reports on patients' vital

signs and behaviour, all without the clinician entering the

patient's room. At 31 March 2021, the investment holding by Adams

in Oxehealth's represents 2.4 per cent of Oxehealth's issued share

capital at that date.

In addition to the above investments, at 31 March 2021 Adams

held quoted holdings in three other AIM listed companies comprising

4D Pharma Plc, which is a pioneer in harnessing bacteria of the gut

microbiome as a novel and revolutionary class of medicines, known

as live biotherapeutics; Source Bioscience International Plc ,

which is an international provider of state-of-the art laboratory

services, clinical diagnostics and analytical testing services; and

Afentra Plc, which has a strategic imperative of capitalising on

opportunities resulting from the accelerating energy transition on

the African continent.

Post year end investment transaction . Subsequent to the

Company's 31 March 2021 year end, Adams announced that on 6 May

2021 it had purchased 8 million shares in AIM listed Seeing

Machines Limited for a total cash consideration of GBP0.91 million.

The investment holding represents 0.21 per cent. of the currently

issued ordinary share capital of Seeing Machines. This company is

an industry leader in advanced computer vision technologies and

designs AI-powered operator monitoring systems to improve transport

safety in automotive, commercial fleet, aviation, rail and off-road

markets.

Adams subsequently also announced on 27 May 2021 that it had

committed to subscribe for 2.5 million shares in Motif Bio Plc for

a total cash consideration of GBP0.5 million under a conditional

placing agreement. The conditions of the placing were, however, not

met and the related GBP0.5 million commitment by Adams fell away on

14 June 2021.

Adams had remaining cash balances of approximately GBP3.18

million following the post year end investment transaction in

Seeing Machines noted above and receipt of the GBP4.11 million

placing and open offer cash proceeds in April 2021.

Outlook

Whilst the arrival of a number of Covid-19 vaccines and the

associated roll-out of the global vaccination programs should now

provide a pathway for the gradual easing of the social and economic

restrictions currently in force, the full economic fallout from

this pandemic remains uncertain.

The Adams Board will, therefore, remain vigilant in the face of

this uncertain future and will continue to apply a disciplined

investment approach to both preserve shareholder capital in the

near term and deliver additional value for shareholders over the

longer term. We remain confident in the underlying fundamentals,

technologies and long-term potential for growth at the companies

within our investment portfolio.

Michael Bretherton

Chairman

29 June 2020

Investing Policy

The current Investing Policy is:

The Board will seek to acquire a direct and/or indirect

interests in special situation investment opportunities that have

an element of distress, dislocation, dysfunction or other special

situation attributes and that they perceive to be undervalued. The

principal focus will be in the small to middle-market

capitalisation sectors in the UK or Europe but the Directors will

also consider possible special situation opportunities anywhere in

the world if they believe there is an opportunity to generate added

value for Shareholders.

The Directors intend to identify investment opportunities

offering the potential to deliver a favourable return to

Shareholders over the medium to long term, primarily in the form of

a capital gain. A particular consideration will be to identify

businesses which, in the opinion of the Directors, are under-valued

due to any of a number of special situations that adversely impact

the business's short-term prospects and/or underlying value but

which business interests the Directors believe have a solid

fundamental core or sound development potential to present

opportunities for value creation.

The Company's interest in a potential investment may range from

a minority position to 100 per cent. ownership and the interest may

be either quoted or unquoted. Investments may be made in shares, or

by the acquisition of assets (including intellectual property) of a

relevant business, or by entering into partnerships, joint

ventures, equity derivatives, contracts for differences or other

equity or debt related securities that the Board deem

appropriate.

There will be no limit on the number of projects into which the

Company may invest, and the Company's financial resources may be

invested in a number of propositions or in just one investment,

which may be deemed to be a reverse takeover pursuant to Rule 14 of

the AIM Rules.

While the Directors intend to take into account the level of

existing funds available for investment when assessing the amount

of any investment, it is not proposed that there be any maximum

investment limit.

The Company may be both an active and a passive investor

depending on the nature of the individual investments. Although the

Company intends to be a medium to long term investor, there will be

no minimum or maximum limit on the length of time that any

investment may be held and short-term investments may be made.

The Company will not have a separate investment manager.

The Company may require additional funding as investments are

made and new opportunities arise. The Directors may offer new

Ordinary Shares by way of consideration, as well as cash, thereby

helping to preserve the Company's cash resources. The Company may,

in appropriate circumstances, issue debt securities or otherwise

borrow money to complete an investment

Given the nature of the Company's Investing Policy, the Company

does not intend to make regular periodic disclosures or

calculations of net asset value other than at the time of

publication of its half year and annual results.

The Board's principal focus will be on achieving capital growth

for Shareholders.

Statement of Comprehensive Income for the year ended 31 March

2021

Year ended Year ended

31 March 2021 31 March 2020

GBP'000 GBP'000

-------------------------------------------------------- --------------- ----------------

Dividend income 3 83

Gain/(loss) on investments 3,234 (245)

--------------------------------------------------------- --------------- ----------------

Investment return 3,237 (162)

Expenses and other income

Administrative expenses (153) (152)

Other income - 1

--------------------------------------------------------- --------------- ----------------

Operating profit / (loss) 3,084 (313)

Interest income 6 10

--------------------------------------------------------- --------------- ----------------

Profit / (loss) on ordinary activities before taxation 3,090 (303)

Tax on profit on ordinary activities - -

-------------------------------------------------------- --------------- ----------------

Profit / (loss) for the year 3,090 (303)

--------------------------------------------------------- --------------- ----------------

Basic and diluted profit / (loss) per share 3.74 (0.37)p

--------------------------------------------------------- --------------- ----------------

Statement of Financial Position at 31 March 2021

31 March 31 March

2021 2020

GBP'000 GBP'000

----------------------------- --------- -----------

Assets

Non-current assets

Investments 5,105 1,178

------------------------------ --------- -----------

Current assets

Trade and other receivables 22 9

Cash and cash equivalents 49 904

------------------------------ --------- -----------

Current assets 71 913

------------------------------ --------- -----------

Total assets 5,176 2,091

------------------------------ --------- -----------

Liabilities

Current liabilities

Trade and other payables (23) (28)

------------------------------ --------- -----------

Total liabilities (23) (28)

------------------------------ --------- -----------

Net current assets 48 885

------------------------------ --------- -----------

Net assets 5,153 2,063

------------------------------ --------- -----------

Equity

Share capital 826 826

Retained earnings reserve 4,327 1,237

------------------------------ --------- -----------

Total shareholder equity 5,153 2,063

------------------------------ --------- -----------

Statement of Changes in Equity as at 31 March 2021

Share Capital Retained earnings reserve Total

GBP'000 GBP'000 GBP'000

At 1 April 201 9 826 1,540 2,366

Changes in equity

Total comprehensive loss - (303) (303)

At 31 March 2020 826 1,237 2,063

--------------------------- -------------- -------------------------- --------

Changes in equity

Total comprehensive gain - 3,090 3,090

--------------------------- -------------- -------------------------- --------

At 31 March 2021 826 4,327 5,153

--------------------------- -------------- -------------------------- --------

Statement of Cash Flows for the year ended 31 March 2021

Year ended Year ended

31 March

2020

31 March

2021 *Restated

GBP'000 GBP'000

Profit/(loss) for the year 3,090 (303)

Unrealised (gain)/loss on revaluation

of portfolio investments (2,644) 319

Realised gain on disposal of portfolio

investments (590) (74)

Increase in trade and other receivables (13) (7)

(Decrease)/increase in trade and other

payables (5) 2

--------------------------------------------- ----------- -------------

Net cash outflow from operating activities (162) (63)

--------------------------------------------- ----------- -------------

Cash flows from investing activities

Purchase of portfolio investments (1,900) (1,378)

Proceeds from sales of investments 1,207 2,030

--------------------------------------------- ----------- -------------

Net cash (used) / generated from investing

activities (693) 652

--------------------------------------------- ----------- -------------

Net (decrease) / increase in cash

and cash equivalents (855) 589

Cash and cash equivalents at beginning

of year 904 315

--------------------------------------------- ----------- -------------

Cash and cash equivalents at end of

year 49 904

--------------------------------------------- ----------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKOBPKBKDAAB

(END) Dow Jones Newswires

June 28, 2021 02:00 ET (06:00 GMT)

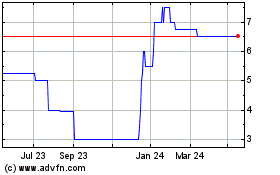

Adams (LSE:ADA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Adams (LSE:ADA)

Historical Stock Chart

From Jan 2024 to Jan 2025