Current Report Filing (8-k)

April 07 2023 - 6:01AM

Edgar (US Regulatory)

0001669400

false

--12-31

0001669400

2023-03-31

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 31, 2023

| Veritas Farms, Inc. |

| (Exact name of registrant as specified in charter) |

| Nevada |

|

333-210190 |

|

90-1254190 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 401 E. Las Olas Boulevard Suite 1400, Fort Lauderdale, FL |

|

33301 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (833) 691-4367

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act: None

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As used in this Current Report on Form 8-K, and

unless otherwise indicated, the terms “the Company,” “Veritas Farms,” “we,” “us”

and “our” refer to Veritas Farms, Inc. and its subsidiary.

Item

5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

2023 Equity Incentive Plan

On March 31, 2023, the Board of Directors of Veritas

Farms, Inc. (the “Company”), adopted and approved the Veritas Farms, Inc. 2023 Equity Incentive Plan (the “2023 Plan”),

subject to stockholder approval. The 2023 Plan provides for the grant of awards to eligible employees, directors, and consultants in the

form of stock options, stock appreciation rights (“SARs”), restricted stock, unrestricted shares, restricted stock units (“RSUs”),

performance units, and cash-based awards. The purpose of the 2023 Plan is to optimize the profitability and growth of the Company through

incentives that link the personal interests of employees, directors and consultants to those of the Company’s stockholders, to provide

participants with an incentive for excellence in individual performance, and to promote teamwork. The 2023 Plan is a successor to the

Company’s 2017 Stock Incentive Plan (the “2017 Plan”) and, accordingly, no new grants will be made under the 2017 Plan

from and after the effective date of the 2023 Plan. The 2023 Plan has a term of 10 years and authorizes the issuance of up to 40,000,000

shares of the Company’s common stock. In addition, the number of shares of common stock available for issuance under the 2023 Plan

shall automatically increase on January 1st of each year for a period of nine (9) years commencing on January 1, 2024 and ending on (and

including) January 1, 2033, in an amount equal to ten percent (10%) of the total number of shares authorized under the 2023 Plan.

The Compensation Committee of the Board of Directors

will administer the 2023 Plan and has the power to determine the size and types of awards granted and may, in its discretion, determine

the performance measure(s) to be used for purposes of awards that are to be performance-based. The shares of common stock subject to awards

granted under the 2023 Plan that expire, are forfeited because of a failure to vest, or otherwise terminate without being exercised in

full will return to the 2023 Plan and be available for issuance under the 2023 Plan.

In the event of a change in control, notwithstanding

any vesting schedule with respect to an award of options, SARs, phantom stock units or restricted stock, such option or SAR shall become

immediately exercisable with respect to 100 percent of the shares subject to such option or SAR, and the restricted period shall expire

immediately with respect to 100 percent of the phantom stock units or shares of restricted stock subject to restrictions. In the event

of a change in control, all incomplete award periods in effect on the date the change in control occurs shall end on the date of such

change, and the committee shall, (i) determine the extent to which performance goals with respect to each such award period have been

met based upon such audited or unaudited financial information then available as it deems relevant, (ii) cause to be paid to each participant

partial or full awards with respect to performance goals for each such award period based upon the committee’s determination of the degree

of attainment of performance goals, and (iii) cause all previously deferred awards to be settled in full as soon as possible.

The Board of Directors or a duly appointed committee

thereof may amend or modify the 2023 Plan at any time, subject to any required stockholder approval. To the extent required by applicable

law or regulation, and except as otherwise provided in the 2023 Plan, stockholder approval will be required for any amendment that (a)

materially increases the number of shares available for issuance under the 2023 Plan, (b) materially expands the class of individuals

eligible to receive awards under the 2023 Plan, (c) materially increases the benefits accruing to the participants under the 2023 Plan

or materially reduces the price at which shares of common stock may be issued or purchased under the 2023 Plan, (d) materially extends

the term of the 2023 Plan, or (e) expands the types of awards available for issuance under the 2023 Plan.

The foregoing description of the terms of the

2023 Equity Incentive Plan does not purport to be complete and is qualified in its entirety by reference to the full text of the 2023

Equity Incentive Plan attached as Exhibit 10.1 to this Current Report on Form 8-K.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Amended and Restated Articles of Incorporation

to Increase Authorized Common Stock and Preferred Stock

To enable the Company to meet certain commitments

made to stockholders and convertible note holders, and keep available for issuance additional shares of its common stock and shares of

its ‘blank check’ preferred stock, the Company’s Board of Directors unanimously approved and adopted a resolution seeking

stockholder approval to authorize the Board of Directors to amend the Amended and Restated Articles of Incorporation of the Company dated

October 13, 2017 (“Amended and Restated Articles”) to increase the number of authorized shares of common stock from 200,000,000

shares to 800,000,000 shares (the “Authorized Common Share Increase Amendment”) and to increase the number of authorized shares

of ‘blank check’ preferred stock from 5,000,000 shares to 20,000,000 shares (the “Authorized Preferred Share Increase

Amendment”, and collectively with the Authorized Common Share Increase Amendment, the “Authorized Shares Increase Amendment”).

Shareholder approval for the Authorized Shares Increase Amendment was obtained on March 31, 2023 by written consent from stockholders

that held at least a majority of the voting power of the stock of the Company entitled to vote thereon. The consent from the stockholder

constituted a sufficient number of votes to approve the Authorized Shares Increase Amendment under the Company’s Amended and Restated

Articles, bylaws of the Company, and Nevada law. The Amended and Restated Articles of Incorporation containing the Authorized Shares Increase

Amendment was filed with the Secretary of State of the State of Nevada on April 4, 2023.

A copy of the Amended and Restated Articles of

Incorporation containing the Authorized Shares Increase Amendment is attached as Exhibit 3.1 to this Current Report on Form 8-K. The above

description is qualified by reference to the complete text of the Amended and Restated Articles of Incorporation containing the Authorized

Shares Increase Amendment.

Item

5.07 Submission of Matters to a Vote of Security Holders.

On March 31, 2023, the

record date, the stockholder holding a majority of the voting securities of the Company (the “Majority Stockholder”) of Company,

took action by written consent (“Written Consent”) in accordance with Article 1, Sections 7 of the Company’s by-laws

and Sections 78.320 and 78,390 of the Nevada Revised Statutes. As of such date, the Majority Stockholder held approximately 4,548,401,

or approximately 10.9% of the Company’s issued and outstanding common stock (“Common Stock”), 3,635,000 shares, or approximately

90.9% of the Company’s issued and outstanding Series A Convertible Preferred Stock (the “Series A Preferred Stock”),

and 1,000,000 shares, or 100% of the Company’s issued and outstanding Series B Convertible Preferred Stock (the “Series B

Preferred Stock”). The foregoing described shares of Common Stock, Series A Preferred Stock and Series B Preferred Stock held by

the Majority Stockholder represented a majority of the votes entitled to be cast on the matters voted upon.

Pursuant to the Written

Consent, the Majority Stockholder approved the following:

| ● | Approval of the Amended and Restated Articles of Incorporation containing the Authorized Shares Increase

Amendment; and |

| ● | Approval of the 2023 Equity Compensation Plan |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: April 6, 2023 |

VERITAS FARMS, INC. |

| |

|

|

| |

By: |

/s/ Ramon A. Pino |

| |

|

Ramon A. Pino,

Chief Financial Officer |

3

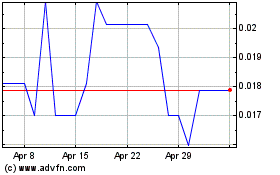

Veritas Farms (CE) (USOTC:VFRM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Veritas Farms (CE) (USOTC:VFRM)

Historical Stock Chart

From Feb 2024 to Feb 2025