NEW DELHI (Dow Jones)--India's Supreme Court Thursday ordered

cancellation of mobile-telecom-service licenses issued without

auction after January 2008, raising uncertainty over billions of

dollars that companies like Japan's NTT DoCoMo Inc. (9437.TO) and

Telenor ASA (TEL.OS) of Norway have invested in the South Asian

nation.

The ruling, which will be operative after four months, comes on

complaints of corruption in the allotment of licenses for

second-generation services and raises concerns about the foreign

investment climate in Asia's third-largest economy because of

uncertain policies. It also raises worries about protracted legal

tussles between the government and the affected operators who may

demand a refund of the billions they spent as license fees and in

network expansion.

NTT DoCoMo, Telenor as well as Russia's Sistema JFC (AFKS.RS)

and Emirates Telecommunications Corp. (ETISALAT.AD) of the United

Arab Emirates and Bahrain Telecommunications Co. (BATELCO.BH) had

bought major stakes in companies that got licenses in 2008 as India

presented a major growth market to global telecom operators. The

Tatas and the Aditya Birla group, two big Indian conglomerates, are

also affected by the court order.

The Supreme Court scrapped 122 licenses issued to nine companies

across India's 22 telecom services areas--each service area

requires a separate license--citing "a fundamental flaw" in the

first-come, first-served policy followed for granting them.

Methods like first-come, first-served are "likely to be misused

by unscrupulous people who are only interested in garnering maximum

financial benefit," said a two-judge bench comprising Justices G.S.

Singhvi and Asok Kumar Ganguly.

The court said the telecom regulator has to frame new

recommendations for license and bandwidth allocation, and that the

government needs to decide on the proposals in a month's time,

after which new licenses need to be auctioned.

According to data from the regulator, operations under these 122

licenses covered just about 5% of India's nearly 894 million mobile

users as of December end. The users won't be affected immediately

as the order won't be operative for four months.

The 122 licenses include 15 of Etisalat DB Telecom Pvt. Ltd.,

majority owned by Emirates Telecommunications; 22 of Telenor's unit

Unitech Wireless Ltd.; 21 of Sistema's unit Sistema Shyam

Teleservices Ltd. and three given to Tata Teleservices Ltd., in

which NTT DoCoMo holds 26%.

The court also ordered scrapping of licenses in 13 services

areas for Aditya Birla Group's Idea Cellular Ltd. (532822.BY), 21

each for Loop Telecom Pvt. Ltd. and Videocon Telecommunications

Pvt. Ltd. and all the six licenses given to S Tel Pvt. Ltd.,

majority held by Bahrain Telecommunications. The 13 licenses of

Idea include some the company got through its merger with Spice

Communications Ltd. in late 2008.

The court fined Tata Teleservices, Etisalat DB and Unitech

Wireless INR50 million (about $1 million) each for having gained by

selling their stakes after getting the licenses. It also fined S

Tel, Loop, Videocon Telecommunications and Sistema Shyam INR5

million each for benefiting from a "wholly arbitrary and

unconstitutional exercise undertaken" by the telecom department for

granting them the bandwidth.

Under law, the companies can file for a review of the order.

In separate statements, Idea, Telenor and Sistema Shyam said

they will consider all necessary actions to protect their

investments, while NTT DoCoMo said it couldn't comment on a

business decision that Tata Teleservices will take.

Emirates Telecommunications said it wants to study the impact of

the order, while S Tel said it feels "like a victim caught in a

riot." Loop declined to comment and others couldn't be reached.

The development is likely to further deepen the uncertainties in

an industry that has until recently been a showpiece of India's

growth story, but is now facing corruption allegations, policy

hurdles, slowing growth and narrowing margins.

The development will hurt foreign direct investment "because

foreign investors seek certainty in these types of (policy)

matters," said Akil Hirani, managing partner of Majmudar & Co.,

which advises international companies on investments in India and

cross-border mergers. "However, on the flip side, the message that

the Supreme Court has sent out is that corruption will be dealt

with strictly."

Communications Minister Kapil Sibal, however, said the order has

brought clarity on some issues and should actually bring in more

foreign investors to a sector that is "crying for investments."

The order comes even as a special court is trying a former

minister and several others including former government officials

and corporate executives over charges of corruption in the

allotment of the licenses that a federal probe agency says led to a

potential $7 billion revenue loss to the government.

The telecom case has been a major embarrassment for Prime

Minister Manmohan Singh's administration, which is facing flak over

large-scale corruption and, of late, indecision on policy

issues.

But the court ruling could bring a financial windfall for the

government as it could auction the bandwidth currently with the

cancelled licenses, and use that to narrow its budget deficit.

India had raised $22 billion through an auction of bandwidth for

third-generation and broadband internet services in 2010.

While the ruling is a body blow for the new telecom players, it

could benefit existing players such as Bharti Airtel Ltd., Reliance

Communications Ltd. and Vodafone India Ltd. A lower number of

operators could ease the competitive intensity in India's telecom

industry, and see some call tariffs being raised.

"Some of these smaller operators [affected by the court ruling]

will be faced with the choice to either close operations or re-bid

for licenses," ratings agency Fitch said in a report. "It is

unclear whether some players will have the stomach or resources to

invest more to defend businesses which are still in start-up

mode."

-By R Jai Krishna and Romit Guha, Dow Jones Newswires;

+91-9967586928; romit.guha@dowjones.com

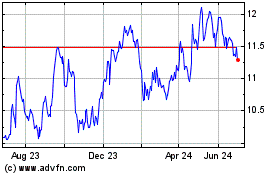

Telenor ASA (QX) (USOTC:TELNY)

Historical Stock Chart

From Oct 2024 to Nov 2024

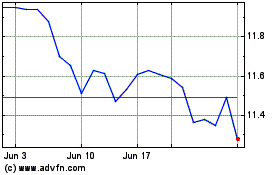

Telenor ASA (QX) (USOTC:TELNY)

Historical Stock Chart

From Nov 2023 to Nov 2024